Analysts’ Viewpoint on Global NAMPT Inhibitors Pipeline Analysis

Nicotinamide phosphoribosyltransferase (NAMPT) inhibitor is considered an effective treatment for various types of cancer. Research studies have shown that these inhibitors exhibit anti-cancer properties in several models of organ-specific cancers. Increase in patient population suffering from various types of cancers is expected to accelerate the market development in the future. Discovery and development of novel NAMPT inhibitors are likely to boost the demand in the next few years. For instance, FK866 NAMPT inhibitor kills gastric cancer cells with an epithelial-to-mesenchymal transition (EMT) gene expression by inhibiting NAMPT in cells with NAPRT deficiency.

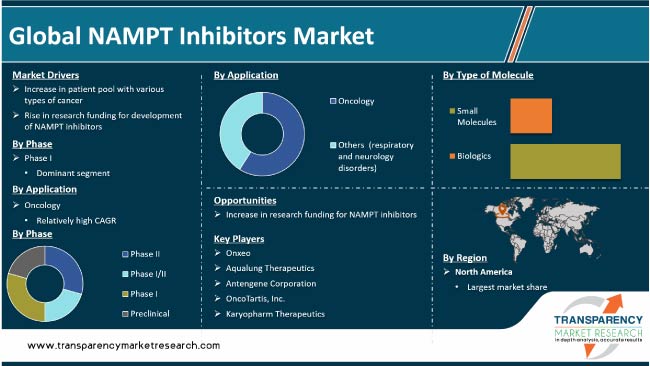

Currently, nicotinamide phosphoribosyltransferase (NAMPT) inhibitors are being evaluated in various types of indications, primarily focusing on cancer disorders. Thus, increase in research & development activities for nicotinamide phosphoribosyltransferase (NAMPT) inhibitors, rise in funding or financial support for drug developers from investors, and promising clinical data NAMPT inhibitors are expected to propel the demand for NAMPT enzyme inhibitors in the near future.

Nicotinamide adenine dinucleotide (NAD) is a metabolite, which is an important second messenger and cofactor for a number of cellular processes such as metabolism and genomic stability, which are necessary for survival. Body cells preserve adequate NAD levels with the help of multiple enzymatic pathways. NAMPT enzyme is the rate-limiting enzyme of the primary pathway for sustaining cellular NAD levels. The regulator function of NAMPT enzyme has made it an essential target for drug discovery efforts intended to interfere with cancer metabolism.

NAMPT inhibitors are characterized not only by cytochrome inhibition, but also by the formation of toxic metabolites and scarce aqueous solubility. Nicotinamide phosphoribosyltransferase is expressed relative to non-cancerous cells in carcinomas, lymphomas and astrocytomas. Furthermore, NAMPT inhibitor activities have shown anti-cancerous properties in several models of organ-specific cancers.

Rise in prevalence and the incidence rate of cancer, including colorectal, ovarian, prostate, breast, lung, and kidney, is driving patient burden. This is likely to augment the demand for NAMPT inhibitors for cancer treatment across the globe.

According to the National Cancer Institute (NIH), around 1,806,590 cancer cases were diagnosed in the U.S. in 2020. Prostate, lung, and colorectal cancers accounted for 43.0% of the total cancer cases in men. The number of people living with cancer stood at around 2.25 million in India in 2018. Every year, around 1,157,294 new cancer patients are diagnosed in the country. Furthermore, cancer-related deaths are projected to be around 784,821 every year.

Around 16,850 children and adolescents were diagnosed with cancer in the U.S. in 2020, while US$ 150.8 Bn is the projected national expenditure on cancer care. Around 628,519 new cancer cases were reported in Germany in 2020, with 344,451 cancer cases diagnosed in men and 284,068 in women. More than 60% of the world’s new cancer cases are recorded in Africa, Asia, and Central and South America; around 70% of the total cancer deaths across the globe occur in these regions.

Each type of cancer entails unique treatment. Hence, rise in prevalence of cancer and increase in need of personalized medicines are likely to provide significant opportunities for players in the business. NAMPT inhibitor is a promising target for anti-cancer drugs. It is considered an effective treatment for various types of cancer. Thus, rise in prevalence and increase in incidence rate of cancer across the globe is expected to drive the market progress in the near future.

In terms of phase, NAMPT inhibitors have been segregated into phase II, phase I/II, phase I, and preclinical. The phase I segment is expected to dominate the global NAMPT inhibitors market in the near future. This can be ascribed to the increase in number of drug candidates in phase I trial. Drugs such as OT-82 are being evaluated under phase I. OT-82 is a novel anti-cancer target for lymphoma or hematological malignancies.

Based on application, the NAMPT inhibitors market has been bifurcated into oncology and others (respiratory and neurology disorders). Oncology was the most promising segment in 2021. Around 4/5th drug candidates are being evaluated for the treatment of cancer. The oncology segment is expected to dominate the market in future, as new drug candidates from preclinical phase are likely to enter into the clinical phase in the next few years.

In terms of type of molecule, NAMPT inhibitors have been split into small molecules and biologics. The small molecules segment is projected to dominate the NAMPT inhibitors market in the near future, as about 4/6th drug candidates are small molecules.

North America is anticipated to account for major market share in the near future owing to large patient population living with cancer in the U.S. According to data published by American Cancer Society, Inc., about 1.9 million new cancer cases were diagnosed and 608,570 cancer deaths occurred in the U.S. in 2021.

The NAMPT inhibitors market is fragmented, with the presence of large number of local as well as international players. Expansion of product portfolio and mergers & acquisitions are the key strategies adopted by the leading players. Prominent players in the NAMPT inhibitors business are Onxeo, Aqualung Therapeutics, Antengene Corporation, OncoTartis, Inc., and Karyopharm Therapeutics.

Leading players have been profiled in the market report based on parameters such as company overview, financial overview, strategies, portfolio, segments, and recent developments.

|

Attribute |

Detail |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The oncology segment held more than 80.0% share in 2021.

Increase in patient pool with various types of cancer and rise in research funding for development of NAMPT inhibitors.

North America is expected to account for major share of the NAMPT inhibitors market in future.

Onxeo, Aqualung Therapeutics, Antengene Corporation, OncoTartis, Inc., and Karyopharm Therapeutics.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global NAMPT Inhibitors Market

4. Market Overview

4.1. Introduction

4.1.1. Phase Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

5. Key Insights

5.1. Overview on Kay players operating in the market space

5.2. Key industry events (mergers, acquisitions, partnerships, etc.)

5.3. COVID-19 pandemic impact on industry

6. North America NAMPT Inhibitors Market Analysis and Forecast

6.1. Introduction

6.1.1. Key Findings

6.2. Market Analysis, by Phase, 2017 - 2031

6.2.1. Phase II

6.2.2. Phase I/II

6.2.3. Phase I

6.2.4. Preclinical

6.3. Market Analysis, by Application, 2017 - 2031

6.3.1. Oncology

6.3.2. Others (respiratory and neurology disorders)

6.4. Market Analysis, by Type of Molecule, 2017 - 2031

6.4.1. Small Molecules

6.4.2. Biologics

7. Europe NAMPT Inhibitors Market Analysis and Forecast

7.1. Introduction

7.1.1. Key Findings

7.2. Market Analysis, by Phase, 2017 - 2031

7.2.1. Phase II

7.2.2. Phase I/II

7.2.3. Phase I

7.2.4. Preclinical

7.3. Market Analysis, by Application, 2017 - 2031

7.3.1. Oncology

7.3.2. Others (Respiratory and Neurology Disorders)

7.4. Market Analysis, by Type of Molecule, 2017 - 2031

7.4.1. Small Molecules

7.4.2. Biologics

8. Rest of the World NAMPT Inhibitors Market Analysis and Forecast

8.1. Introduction

8.1.1. Key Findings

8.2. Market Analysis, by Phase, 2017 - 2031

8.2.1. Phase II

8.2.2. Phase I/II

8.2.3. Phase I

8.2.4. Preclinical

8.3. Market Analysis, by Application, 2017 - 2031

8.3.1. Oncology

8.3.2. Others (Respiratory and Neurology Disorders)

8.4. Market Analysis, by Type of Molecule, 2017 - 2031

8.4.1. Small Molecules

8.4.2. Biologics

9. Competition Landscape

9.1. Market Player - Competition Matrix (by tier and size of companies)

9.2. Company Profiles

9.2.1. Onxeo

9.2.1.1. Company Overview (HQ, Business Segments, Employee Strength)

9.2.1.2. Product Portfolio

9.2.1.3. SWOT Analysis

9.2.1.4. Strategic Overview

9.2.2. Aqualung Therapeutics

9.2.2.1. Company Overview (HQ, Business Segments, Employee Strength)

9.2.2.2. Product Portfolio

9.2.2.3. SWOT Analysis

9.2.2.4. Strategic Overview

9.2.3. Antengene Corporation

9.2.3.1. Company Overview (HQ, Business Segments, Employee Strength)

9.2.3.2. Product Portfolio

9.2.3.3. SWOT Analysis

9.2.3.4. Strategic Overview

9.2.4. OncoTartis, Inc.

9.2.4.1. Company Overview (HQ, Business Segments, Employee Strength)

9.2.4.2. Product Portfolio

9.2.4.3. SWOT Analysis

9.2.4.4. Strategic Overview

9.2.5. Karyopharm Therapeutics

9.2.5.1. Company Overview (HQ, Business Segments, Employee Strength)

9.2.5.2. Product Portfolio

9.2.5.3. SWOT Analysis

9.2.5.4. Strategic Overview