Analysts’ Viewpoint on Market Scenario

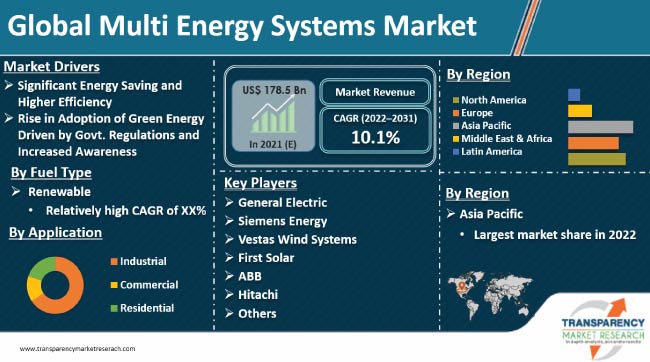

Rise in demand for energy efficiency and increase in awareness about green energy are driving the multi energy systems market size. Multi energy system has the ability to reduce dependency on any one energy source, thereby increasing energy security and resilience. Multi energy systems increase the penetration of renewable energy sources by supplementing them with traditional forms of energy generation, such as natural gas, when renewable sources are not available. This helps to smooth out fluctuations in renewable energy output and improve the overall stability of the energy system.

Moreover, a multi energy system could also provide opportunities to improve energy efficiency by optimizing the use of different energy sources and enabling the integration of distributed energy resources (DERs). It is cost-effective, and diversifying the energy mix helps mitigate the risk of price fluctuations of fuel. This further helps to reduce overall system costs. Multi energy systems also help create more sustainable, resilient, and affordable energy systems.

A multi energy system is a combination of different forms of energy generation, storage, and distribution, which can include a mix of renewable and non-renewable sources. A multi energy system is a type of energy system that combines multiple sources of energy, such as electricity, heat, and fuel, to meet the energy demands of a particular location or region.

Multi energy system is a worthy alternative for energy generated from fossil fuels. The process of energy generation from fossil fuels emits greenhouse gases (GHGs), which can cause serious damage to the environment including global warming, air pollution, and land pollution.

A multi energy system can help save energy in several ways. One of the prominent ways is by allowing for the integration of different energy sources, which can help improve the overall efficiency of the system. For instance, it is possible to generate electricity by using a combination of solar and wind energy even when one of the sources is not producing at full capacity. This can help ensure a steady supply of energy, which can lead to energy savings.

Another way that a multi energy system can help to save energy is by enabling the use of energy storage solutions, such as multi energy batteries or pumped hydro storage. These solutions can help to store excess energy when it is produced and subsequently release it when it is needed, which can help to reduce the need for fossil fuels and increase the use of renewable energy sources. This can help to reduce the cost of energy and also the dependence on fossil fuels. Consequently, these benefits are expected to boost multi energy systems market growth in the near future.

Additionally, a multi energy system can also include demand-side management measures, such as smart grid technology, which can help improve the efficiency of energy usage. For instance, it is possible to monitor energy usage in real-time by using smart meters, which can help identify areas where energy savings can be made.

It's worth noting that, the effectiveness of multi energy system for energy saving depends on the mix of energy sources used; how it is integrated; and how it is coupled with demand side management. The more it is aligned with the energy demand, the more efficient it would be, and the more savings in terms of energy it can generate.

Rise in awareness about green energy and enactment of stringent government rules and regulations on emission of greenhouse gases (GHGs) and carbon dioxide are compelling companies to seek more effective alternative and pollution-free energy generation methods

Using a multi energy system makes it possible to reduce the dependence on fossil fuels, which are a main source of greenhouse gas emissions and increase the usage of clean and sustainable energy sources. This can help mitigate the effects of climate change and improve air quality.

It is conceivable to achieve a minimum net present cost (NPC) in a multi energy system configuration that is 65% less than a traditional energy system, 59% less than a conventional micro-grid, and 54% less than a multi-good micro-grid. Furthermore, a renewable penetration of 93.7% can be reached.

One of the notable market trends is the use of multi energy system to help reduce emissions by enabling the use of renewable energy sources that do not produce greenhouse gases when generating electricity. Therefore, increasing awareness about green energy and stringent government regulations are key factors driving the global multi energy systems market size.

In terms of fuel type, the global multi energy systems market segmentation comprises petroleum, renewables, natural gas, and biomass. The renewables segment accounted for major share of market demand in 2021. Demand of multi energy system is rising, as it can provide a sustainable and clean source of energy to power diverse applications in commercial and industrial sector. This, in turn, is estimated to offer significant opportunities for multi energy system business growth in the next few years.

The renewables segment accounted for 29% of the multi energy systems market share in 2021. Demand for renewables is likely to rise during the forecast period due to an increase in environmental concerns regarding diesel emissions and rise in prices of fossil fuels. Consequently, the worldwide multi energy systems industry is estimated to expand at a steady pace during the forecast period.

In terms of component type, the global market has been segregated into PV panels, battery electric storage system, diesel generator, thermal solar collectors, water heating & storage tank, and LPG boilers. The photovoltaic segment held 22.8% share of the market in 2021. It is estimated to dominate the market during the forecast period, as a PV panel multi energy system can increase the overall efficiency and reliability of the system by utilizing multiple sources of energy. Furthermore, this can help reduce the dependence on a single energy source and increase the system's ability to generate electricity in a variety of weather conditions.

According to the latest multi energy systems market outlook, Asia Pacific accounted for a prominent global market share of 59.3% in 2021. China, holds the major share in the Asia Pacific market. Development of infrastructure, increased construction activities, frequent black-outs, power fluctuations, expansion of the commercial sector, and booming telecom industry in the region are projected to drive the multi energy system business growth in Asia Pacific.

Europe is also a key market for multi energy systems, and the region held the second-largest share of the global market in 2021. A shift in market trend toward the development of renewable technologies for power production in order to cater to an increase in the demand for electricity across Europe is estimated to boost multi energy systems market development in the region.

North America is a larger market for multi energy system as compared to the market in Latin America and Middle East & Africa. The multi energy system industry report forecast for North America is highly promising in the next few years, as regulators in the region have introduced several incentives to boost the penetration of renewable resources in primary energy consumption.

The global multi energy system business is consolidated with a small number of large-scale vendors controlling a majority share. A majority of organizations are spending a significant amount on comprehensive research and development activities. Key players operating in the worldwide multi energy system industry include Siemens Energy, General Electric (GE), Vestas Wind Systems, First Solar, ABB, Hitachi, and Enel Green Power. These companies provide a range of products and services related to multi energy system, including design, installation, and maintenance. They offer solutions that cater to different types of energy sources, which is major multi energy systems market trend.

Key players in the multi energy systems industry report have been profiled based on parameters such as financial overview, business strategies, company overview, business segments, product portfolio, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 178.5 Bn |

|

Market Forecast Value in 2031 |

US$ 467.4 Bn |

|

Growth Rate (CAGR) |

10.1% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2020 |

|

Quantitative Units |

US$ Bn for Value & MW for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global multi energy systems business was valued at US$ 178.5 Bn in 2021.

The global business growth is expected to grow at a CAGR of 10.1% from 2022 to 2031.

Significant energy saving with higher efficiency, rise in adoption of green energy with stringent government regulation and increase in awareness among consumers.

Renewables was the largest fuel type segment that held 29% share in 2021.

Asia Pacific was the most lucrative region which held 59.3% share in 2021.

Siemens Energy, General Electric (GE), Vestas Wind Systems, First Solar, ABB, Hitachi, and Enel Green Power.

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Global Multi Energy Systems Market Analysis and Forecasts, 2022-2031

2.6.1. Global Multi Energy Systems Market Volume (MW)

2.6.2. Global Multi Energy Systems Market Revenue (US$ Bn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Manufacturers

2.9.2. List of Dealer/Distributors

2.9.3. List of Potential Customers

2.10. Product Specification Analysis

2.11. Production Overview

2.12. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on the Supply Chain of the Multi Energy Systems

3.2. Impact on the Demand of Multi Energy Systems – Pre & Post Crisis

4. Impact of Current Geopolitical Scenario on Market

5. Production Output Analysis (MW)

5.1. North America

5.2. Europe

5.3. Asia Pacific

5.4. Latin America

5.5. Middle East and Africa

6. Price Trend Analysis and Forecast (US$/MW), 2022-2031

6.1. Price Comparison Analysis by Fuel Type

6.2. Price Comparison Analysis by Region

7. Global Multi Energy Systems Market Analysis and Forecast, by Fuel Type, 2022–2031

7.1. Introduction and Definitions

7.2. Global Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Fuel Type, 2022–2031

7.2.1. Petroleum

7.2.2. Renewables

7.2.3. Natural gas

7.2.4. Biomass

7.2.5. Others

7.3. Global Multi Energy Systems Market Attractiveness, by Fuel Type

8. Global Multi Energy Systems Market Analysis and Forecast, by Component, 2022–2031

8.1. Introduction and Definitions

8.2. Global Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Component, 2022–2031

8.2.1. PV Panels

8.2.2. Battery Electric Storage System

8.2.3. Diesel Generator

8.2.4. Thermal Solar Collectors

8.2.5. Water Heating & Storage Tank

8.2.6. LPG Boilers

8.3. Global Multi Energy Systems Market Attractiveness, by Component

9. Global Multi Energy Systems Market Analysis and Forecast, by Energy Type, 2022–2031

9.1. Introduction and Definitions

9.2. Global Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Energy Type, 2022–2031

9.2.1. Electricity

9.2.2. Heat

9.2.3. Cooling

9.2.4. Others

9.3. Global Multi Energy Systems Market Attractiveness, by Energy Type

10. Global Multi Energy Systems Market Analysis and Forecast, by Application, 2022–2031

10.1. Introduction and Definitions

10.2. Global Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Application, 2022–2031

10.2.1. Industrial

10.2.2. Commercial

10.2.3. Residential

10.3. Global Multi Energy Systems Market Attractiveness, by Application

11. Global Multi Energy Systems Market Analysis and Forecast, by Region, 2022–2031

11.1. Key Findings

11.2. Global Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Region, 2022–2031

11.2.1. North America

11.2.2. Europe

11.2.3. Asia Pacific

11.2.4. Latin America

11.2.5. Middle East & Africa

11.3. Global Multi Energy Systems Market Attractiveness, by Region

12. North America Multi Energy Systems Market Analysis and Forecast, 2022–2031

12.1. Key Findings

12.2. North America Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Fuel Type, 2022–2031

12.3. North America Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Component, 2022–2031

12.4. North America Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Energy Type, 2022–2031

12.5. North America Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Application, 2022–2031

12.6. North America Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Country, 2022–2031

12.6.1. U.S. Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Fuel Type, 2022–2031

12.6.2. U.S. Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Component, 2022–2031

12.6.3. U.S. Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Energy Type, 2022–2031

12.6.4. U.S. Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, Application, 2022–2031

12.6.5. Canada Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Fuel Type Process, 2022–2031

12.6.6. Canada Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Component, 2022–2031

12.6.7. Canada Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Energy Type, 2022–2031

12.6.8. Canada Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, Application, 2022–2031

12.7. North America Multi Energy Systems Market Attractiveness Analysis

13. Europe Multi Energy Systems Market Analysis and Forecast, 2022–2031

13.1. Key Findings

13.2. Europe Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Fuel Type, 2022–2031

13.3. Europe Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Component, 2022–2031

13.4. Europe Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Energy Type, 2022–2031

13.5. Europe Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Application, 2022–2031

13.6. Europe Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Country and Sub-region, 2022-2031

13.6.1. Germany Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Type, 2022–2031

13.6.2. Germany Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Component, 2022–2031

13.6.3. Germany Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Energy Type, 2022–2031

13.6.4. Germany. Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, Application, 2022–2031

13.6.5. France Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Fuel Type, 2022–2031

13.6.6. France Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Component, 2022–2031

13.6.7. France Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Energy Type, 2022–2031

13.6.8. France. Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, Application, 2022–2031

13.6.9. U.K. Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Fuel Type, 2022–2031

13.6.10. U.K. Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Component, 2022–2031

13.6.11. U.K. Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Energy Type, 2022–2031

13.6.12. U.K. Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, Application, 2022–2031

13.6.13. Italy Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Fuel Type, 2022–2031

13.6.14. Italy. Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Component, 2022–2031

13.6.15. Italy Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Energy Type, 2022–2031

13.6.16. Italy Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, Application, 2022–2031

13.6.17. Russia & CIS Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Fuel Type, 2022–2031

13.6.18. Russia & CIS Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Component, 2022–2031

13.6.19. Russia & CIS Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Energy Type, 2022–2031

13.6.20. Russia & CIS Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, Application, 2022–2031

13.6.21. Rest of Europe Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Fuel Type, 2022–2031

13.6.22. Rest of Europe Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Component, 2022–2031

13.6.23. Rest of Europe Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Energy Type, 2022–2031

13.6.24. Rest of Europe Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, Application, 2022–2031

13.7. Europe Multi Energy Systems Market Attractiveness Analysis

14. Asia Pacific Multi Energy Systems Market Analysis and Forecast, 2022–2031

14.1. Key Findings

14.2. Asia Pacific Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Fuel Type

14.3. Asia Pacific Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Component, 2022–2031

14.4. Asia Pacific Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Energy Type, 2022–2031

14.5. Asia Pacific Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Application, 2022–2031

14.6. Asia Pacific Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Country and Sub-region, 2022-2031

14.6.1. China Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Fuel Type, 2022–2031

14.6.2. China Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Component, 2022–2031

14.6.3. China Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Energy Type, 2022–2031

14.6.4. China Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, Application, 2022–2031

14.6.5. Japan Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Fuel Type, 2022–2031

14.6.6. Japan Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Component, 2022–2031

14.6.7. Japan Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Energy Type, 2022–2031

14.6.8. Japan Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, Application, 2022–2031

14.6.9. India Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Fuel Type, 2022–2031

14.6.10. India Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Component, 2022–2031

14.6.11. India Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Energy Type, 2022–2031

14.6.12. India Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, Application, 2022–2031

14.6.13. ASEAN Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Fuel Type, 2022–2031

14.6.14. ASEAN Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Component, 2022–2031

14.6.15. ASEAN Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Energy Type, 2022–2031

14.6.16. ASEAN Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, Application, 2022–2031

14.6.17. Rest of Asia Pacific Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Fuel Type, 2022–2031

14.6.18. Rest of Asia Pacific Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Component, 2022–2031

14.6.19. Rest of Asia Pacific Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Energy Type, 2022–2031

14.6.20. Rest of Asia Pacific Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, Application, 2022–2031

14.7. Asia Pacific Multi Energy Systems Market Attractiveness Analysis

15. Latin America Multi Energy Systems Market Analysis and Forecast, 2022–2031

15.1. Key Findings

15.2. Latin America Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Fuel Type Process, 2022–2031

15.3. Latin America Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Component, 2022–2031

15.4. Latin America Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Energy Type, 2022–2031

15.5. Latin America Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Application, 2022–2031

15.6. Latin America Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Country and Sub-region, 2022-2031

15.6.1. Brazil Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Fuel Type, 2022–2031

15.6.2. Brazil Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Component, 2022–2031

15.6.3. Brazil Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Energy Type, 2022–2031

15.6.4. Brazil Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, Application, 2022–2031

15.6.5. Mexico Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Fuel Type, 2022–2031

15.6.6. Mexico Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Component, 2022–2031

15.6.7. Mexico Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Energy Type, 2022–2031

15.6.8. Mexico Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, Application, 2022–2031

15.6.9. Rest of Latin America Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Fuel Type, 2022–2031

15.6.10. Rest of Latin America Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Component, 2022–2031

15.6.11. Rest of Latin America Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Energy Type, 2022–2031

15.6.12. Rest of Latin America Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, Application, 2022–2031

15.7. Latin America Multi Energy Systems Market Attractiveness Analysis

16. Middle East & Africa Multi Energy Systems Market Analysis and Forecast, 2022–2031

16.1. Key Findings

16.2. Middle East & Africa Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Fuel Type, 2022–2031

16.3. Middle East & Africa Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Component, 2022–2031

16.4. Middle East & Africa Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Energy Type, 2022–2031

16.5. Middle East & Africa Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Application, 2022–2031

16.6. Middle East & Africa Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Country and Sub-region, 2022-2031

16.6.1. GCC Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Fuel Type, 2022–2031

16.6.2. GCC Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Component, 2022–2031

16.6.3. GCC Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Energy Type, 2022–2031

16.6.4. GCC Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, Application, 2022–2031

16.6.5. South Africa Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Fuel Type, 2022–2031

16.6.6. South Africa Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Component, 2022–2031

16.6.7. South Africa Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Energy Type, 2022–2031

16.6.8. South Africa Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, Application, 2022–2031

16.6.9. Rest of Middle East & Africa Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Fuel Type, 2022–2031

16.6.10. Rest of Middle East & Africa Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Component, 2022–2031

16.6.11. Rest of Middle East & Africa Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, by Energy Type, 2022–2031

16.6.12. Rest of Middle East & Africa Multi Energy Systems Market Volume (MW) and Value (US$ Bn) Forecast, Application, 2022–2031

16.7. Middle East & Africa Multi Energy Systems Market Attractiveness Analysis

17. Competition Landscape

17.1. Market Players - Competition Matrix (by Tier and Size of Companies)

17.2. Market Share Analysis, 2021

17.3. Market Footprint Analysis

17.3.1. By Fuel Type

17.3.2. By Application

17.4. Company Profiles

17.4.1. General Electric

17.4.1.1. Company Revenue

17.4.1.2. Business Overview

17.4.1.3. Product Segments

17.4.1.4. Geographic Footprint

17.4.1.5. Strategic Partnership, Process Expansion, New Product Innovation etc.

17.4.2. Siemens Energy

17.4.2.1. Company Revenue

17.4.2.2. Business Overview

17.4.2.3. Product Segments

17.4.2.4. Geographic Footprint

17.4.2.5. Strategic Partnership, Process Expansion, New Product Innovation etc.

17.4.3. Vestas Wind Systems

17.4.3.1. Company Revenue

17.4.3.2. Business Overview

17.4.3.3. Product Segments

17.4.3.4. Geographic Footprint

17.4.3.5. Strategic Partnership, Process Expansion, New Product Innovation etc.

17.4.4. First Solar

17.4.4.1. Company Revenue

17.4.4.2. Business Overview

17.4.4.3. Product Segments

17.4.4.4. Geographic Footprint

17.4.4.5. Strategic Partnership, Process Expansion, New Product Innovation etc.

17.4.5. ABB

17.4.5.1. Company Revenue

17.4.5.2. Business Overview

17.4.5.3. Product Segments

17.4.5.4. Geographic Footprint

17.4.5.5. Strategic Partnership, Process Expansion, New Product Innovation etc.

17.4.6. Hitachi

17.4.6.1. Company Revenue

17.4.6.2. Business Overview

17.4.6.3. Product Segments

17.4.6.4. Geographic Footprint

17.4.6.5. Strategic Partnership, Process Expansion, New Product Innovation etc.

17.4.7. Enel Green Power

17.4.7.1. Company Revenue

17.4.7.2. Business Overview

17.4.7.3. Product Segments

17.4.7.4. Geographic Footprint

17.4.7.5. Strategic Partnership, Process Expansion, New Product Innovation etc.

18. Primary Research: Key Insights

19. Appendix

List of Tables

Table 1: Global Multi Energy Systems Market Volume (MW) Forecast, by Fuel Type, 2022–2031

Table 2: Global Multi Energy Systems Market Value (US$ Bn) Forecast, by Fuel Type, 2022–2031

Table 3: Global Multi Energy Systems Market Volume (MW) Forecast, by Component, 2022–2031

Table 4: Global Multi Energy Systems Market Value (US$ Bn) Forecast, by Component, 2022–2031

Table 5: Global Multi Energy Systems Market Volume (MW) Forecast, by Energy Type, 2022–2031

Table 6: Global Multi Energy Systems Market Value (US$ Bn) Forecast, by Energy Type, 2022–2031

Table 7: Global Multi Energy Systems Market Volume (MW) Forecast, by Application, 2022–2031

Table 8: Global Multi Energy Systems Market Value (US$ Bn) Forecast, by Application, 2022–2031

Table 9: Global Multi Energy Systems Market Volume (MW) Forecast, by Region, 2022–2031

Table 10: Global Multi Energy Systems Market Value (US$ Bn) Forecast, by Region, 2022–2031

Table 11: North America Multi Energy Systems Market Volume (MW) Forecast, by Fuel Type, 2022–2031

Table 12: North America Multi Energy Systems Market Value (US$ Bn) Forecast, by Fuel Type, 2022–2031

Table 13: North America Multi Energy Systems Market Volume (MW) Forecast, by Component, 2022–2031

Table 14: North America Multi Energy Systems Market Value (US$ Bn) Forecast, by Component, 2022–2031

Table 15: North America Multi Energy Systems Market Volume (MW) Forecast, by Energy Type, 2022–2031

Table 16: North America Multi Energy Systems Market Value (US$ Bn) Forecast, by Energy Type, 2022–2031

Table 17: North America Multi Energy Systems Market Volume (MW) Forecast, by Application, 2022–2031

Table 18: North America Multi Energy Systems Market Value (US$ Bn) Forecast, by Application, 2022–2031

Table 19: North America Multi Energy Systems Market Volume (MW) Forecast, by Country, 2022–2031

Table 20: North America Multi Energy Systems Market Value (US$ Bn) Forecast, by Country, 2022–2031

Table 21: U.S. Multi Energy Systems Market Volume (MW) Forecast, by Fuel Type, 2022–2031

Table 22: U.S. Multi Energy Systems Market Value (US$ Bn) Forecast, by Fuel Type, 2022–2031

Table 23: U.S. Multi Energy Systems Market Volume (MW) Forecast, by Component, 2022–2031

Table 24: U.S. Multi Energy Systems Market Value (US$ Bn) Forecast, by Component, 2022–2031

Table 25: U.S. Multi Energy Systems Market Volume (MW) Forecast, by Energy Type, 2022–2031

Table 26: U.S. Multi Energy Systems Market Value (US$ Bn) Forecast, by Energy Type, 2022–2031

Table 27: U.S. Multi Energy Systems Market Volume (MW) Forecast, by Application, 2022–2031

Table 28: U.S. Multi Energy Systems Market Value (US$ Bn) Forecast, by Application, 2022–2031

Table 29: Canada Multi Energy Systems Market Volume (MW) Forecast, by Fuel Type, 2022–2031

Table 30: Canada Multi Energy Systems Market Value (US$ Bn) Forecast, by Fuel Type, 2022–2031

Table 31: Canada Multi Energy Systems Market Volume (MW) Forecast, by Component, 2022–2031

Table 32: Canada Multi Energy Systems Market Value (US$ Bn) Forecast, by Component, 2022–2031

Table 33: Canada Multi Energy Systems Market Volume (MW) Forecast, by Energy Type, 2022–2031

Table 34: Canada Multi Energy Systems Market Value (US$ Bn) Forecast, by Energy Type, 2022–2031

Table 35: Canada Multi Energy Systems Market Volume (MW) Forecast, by Application, 2022–2031

Table 36: Canada Multi Energy Systems Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 37: Europe Multi Energy Systems Market Volume (MW) Forecast, by Fuel Type, 2022–2031

Table 38: Europe Multi Energy Systems Market Value (US$ Bn) Forecast, by Fuel Type, 2022–2031

Table 39: Europe Multi Energy Systems Market Volume (MW) Forecast, by Component, 2022–2031

Table 40: Europe Multi Energy Systems Market Value (US$ Bn) Forecast, by Component, 2022–2031

Table 41: Europe Multi Energy Systems Market Volume (MW) Forecast, by Energy Type, 2022–2031

Table 42: Europe Multi Energy Systems Market Value (US$ Bn) Forecast, by Energy Type, 2022–2031

Table 43: Europe Multi Energy Systems Market Volume (MW) Forecast, by Application, 2022–2031

Table 44: Europe Multi Energy Systems Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 45: Europe Multi Energy Systems Market Volume (MW) Forecast, by Country and Sub-region, 2022–2031

Table 46: Europe Multi Energy Systems Market Value (US$ Bn) Forecast, by Country and Sub-region, 2022–2031

Table 47: Germany Multi Energy Systems Market Volume (MW) Forecast, by Fuel Type, 2022–2031

Table 48: Germany Multi Energy Systems Market Value (US$ Bn) Forecast, by Fuel Type, 2022–2031

Table 49: Germany Multi Energy Systems Market Volume (MW) Forecast, by Component, 2022–2031

Table 50: Germany Multi Energy Systems Market Value (US$ Bn) Forecast, by Component, 2022–2031

Table 51: Germany Multi Energy Systems Market Volume (MW) Forecast, by Energy Type, 2022–2031

Table 52: Germany Multi Energy Systems Market Value (US$ Bn) Forecast, by Energy Type, 2022–2031

Table 53: Germany Multi Energy Systems Market Volume (MW) Forecast, by Application, 2022–2031

Table 54: Germany Multi Energy Systems Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 55: France Multi Energy Systems Market Volume (MW) Forecast, by Fuel Type, 2022–2031

Table 56: France Multi Energy Systems Market Value (US$ Bn) Forecast, by Fuel Type, 2022–2031

Table 57: France Multi Energy Systems Market Volume (MW) Forecast, by Component, 2022–2031

Table 58: France Multi Energy Systems Market Value (US$ Bn) Forecast, by Component, 2022–2031

Table 59: France Multi Energy Systems Market Volume (MW) Forecast, by Energy Type, 2022–2031

Table 60: France Multi Energy Systems Market Value (US$ Bn) Forecast, by Energy Type, 2022–2031

Table 61: France Multi Energy Systems Market Volume (MW) Forecast, by Application, 2022–2031

Table 62: France Multi Energy Systems Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 63: U.K. Multi Energy Systems Market Volume (MW) Forecast, by Fuel Type, 2022–2031

Table 64: U.K. Multi Energy Systems Market Value (US$ Bn) Forecast, by Fuel Type, 2022–2031

Table 65: U.K. Multi Energy Systems Market Volume (MW) Forecast, by Component, 2022–2031

Table 66: U.K. Multi Energy Systems Market Value (US$ Bn) Forecast, by Component, 2022–2031

Table 67: U.K. Multi Energy Systems Market Volume (MW) Forecast, by Energy Type, 2022–2031

Table 68: U.K. Multi Energy Systems Market Value (US$ Bn) Forecast, by Energy Type, 2022–2031

Table 69: U.K. Multi Energy Systems Market Volume (MW) Forecast, by Application, 2022–2031

Table 70: U.K. Multi Energy Systems Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 71: Italy Multi Energy Systems Market Volume (MW) Forecast, by Fuel Type, 2022–2031

Table 72: Italy Multi Energy Systems Market Value (US$ Bn) Forecast, by Fuel Type, 2022–2031

Table 73: Italy Multi Energy Systems Market Volume (MW) Forecast, by Component, 2022–2031

Table 74: Italy Multi Energy Systems Market Value (US$ Bn) Forecast, by Component, 2022–2031

Table 75: Italy Multi Energy Systems Market Volume (MW) Forecast, by Energy Type, 2022–2031

Table 76: Italy Multi Energy Systems Market Value (US$ Bn) Forecast, by Energy Type, 2022–2031

Table 77: Italy Multi Energy Systems Market Volume (MW) Forecast, by Application, 2022–2031

Table 78: Italy Multi Energy Systems Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 79: Spain Multi Energy Systems Market Volume (MW) Forecast, by Fuel Type, 2022–2031

Table 80: Spain Multi Energy Systems Market Value (US$ Bn) Forecast, by Fuel Type, 2022–2031

Table 81: Spain Multi Energy Systems Market Volume (MW) Forecast, by Component, 2022–2031

Table 82: Spain Multi Energy Systems Market Value (US$ Bn) Forecast, by Component, 2022–2031

Table 83: Spain Multi Energy Systems Market Volume (MW) Forecast, by Energy Type, 2022–2031

Table 84: Spain Multi Energy Systems Market Value (US$ Bn) Forecast, by Energy Type, 2022–2031

Table 85: Spain Multi Energy Systems Market Volume (MW) Forecast, by Application, 2022–2031

Table 86: Spain Multi Energy Systems Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 87: Russia & CIS Multi Energy Systems Market Volume (MW) Forecast, by Fuel Type, 2022–2031

Table 88: Russia & CIS Multi Energy Systems Market Value (US$ Bn) Forecast, by Fuel Type, 2022–2031

Table 89: Russia & CIS Multi Energy Systems Market Volume (MW) Forecast, by Component, 2022–2031

Table 90: Russia & CIS Multi Energy Systems Market Value (US$ Bn) Forecast, by Component, 2022–2031

Table 91: Russia & CIS Multi Energy Systems Market Volume (MW) Forecast, by Energy Type, 2022–2031

Table 92: Russia & CIS Multi Energy Systems Market Value (US$ Bn) Forecast, by Energy Type, 2022–2031

Table 93: Russia & CIS Multi Energy Systems Market Volume (MW) Forecast, by Application, 2022–2031

Table 94: Russia & CIS Multi Energy Systems Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 95: Rest of Europe Multi Energy Systems Market Volume (MW) Forecast, by Fuel Type, 2022–2031

Table 96: Rest of Europe Multi Energy Systems Market Value (US$ Bn) Forecast, by Fuel Type, 2022–2031

Table 97: Rest of Europe Multi Energy Systems Market Volume (MW) Forecast, by Component, 2022–2031

Table 98: Rest of Europe Multi Energy Systems Market Value (US$ Bn) Forecast, by Component, 2022–2031

Table 99: Rest of Europe Multi Energy Systems Market Volume (MW) Forecast, by Energy Type, 2022–2031

Table 100: Rest of Europe Multi Energy Systems Market Value (US$ Bn) Forecast, by Energy Type, 2022–2031

Table 101: Rest of Europe Multi Energy Systems Market Volume (MW) Forecast, by Application, 2022–2031

Table 102: Rest of Europe Multi Energy Systems Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 103: Asia Pacific Multi Energy Systems Market Volume (MW) Forecast, by Fuel Type, 2022–2031

Table 104: Asia Pacific Multi Energy Systems Market Value (US$ Bn) Forecast, by Fuel Type, 2022–2031

Table 105: Asia Pacific Multi Energy Systems Market Volume (MW) Forecast, by Component, 2022–2031

Table 106: Asia Pacific Multi Energy Systems Market Value (US$ Bn) Forecast, by Component, 2022–2031

Table 107: Asia Pacific Multi Energy Systems Market Volume (MW) Forecast, by Energy Type, 2022–2031

Table 108: Asia Pacific Multi Energy Systems Market Value (US$ Bn) Forecast, by Energy Type, 2022–2031

Table 109: Asia Pacific Multi Energy Systems Market Volume (MW) Forecast, by Application, 2022–2031

Table 110: Asia Pacific Multi Energy Systems Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 111: Asia Pacific Multi Energy Systems Market Volume (MW) Forecast, by Country and Sub-region, 2022–2031

Table 112: Asia Pacific Multi Energy Systems Market Value (US$ Bn) Forecast, by Country and Sub-region, 2022–2031

Table 113: China Multi Energy Systems Market Volume (MW) Forecast, by Fuel Type, 2022–2031

Table 114: China Multi Energy Systems Market Value (US$ Bn) Forecast, by Fuel Type 2022–2031

Table 115: China Multi Energy Systems Market Volume (MW) Forecast, by Component, 2022–2031

Table 116: China Multi Energy Systems Market Value (US$ Bn) Forecast, by Component, 2022–2031

Table 117: China Multi Energy Systems Market Volume (MW) Forecast, by Energy Type, 2022–2031

Table 118: China Multi Energy Systems Market Value (US$ Bn) Forecast, by Energy Type, 2022–2031

Table 119: China Multi Energy Systems Market Volume (MW) Forecast, by Application, 2022–2031

Table 120: China Multi Energy Systems Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 121: Japan Multi Energy Systems Market Volume (MW) Forecast, by Fuel Type, 2022–2031

Table 122: Japan Multi Energy Systems Market Value (US$ Bn) Forecast, by Fuel Type, 2022–2031

Table 123: Japan Multi Energy Systems Market Volume (MW) Forecast, by Component, 2022–2031

Table 124: Japan Multi Energy Systems Market Value (US$ Bn) Forecast, by Component, 2022–2031

Table 125: Japan Multi Energy Systems Market Volume (MW) Forecast, by Energy Type, 2022–2031

Table 126: Japan Multi Energy Systems Market Value (US$ Bn) Forecast, by Energy Type, 2022–2031

Table 127: Japan Multi Energy Systems Market Volume (MW) Forecast, by Application, 2022–2031

Table 128: Japan Multi Energy Systems Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 129: India Multi Energy Systems Market Volume (MW) Forecast, by Fuel Type, 2022–2031

Table 130: India Multi Energy Systems Market Value (US$ Bn) Forecast, by Fuel Type, 2022–2031

Table 131: India Multi Energy Systems Market Volume (MW) Forecast, by Component, 2022–2031

Table 132: India Multi Energy Systems Market Value (US$ Bn) Forecast, by Component, 2022–2031

Table 133: India Multi Energy Systems Market Volume (MW) Forecast, by Energy Type, 2022–2031

Table 134: India Multi Energy Systems Market Value (US$ Bn) Forecast, by Energy Type, 2022–2031

Table 135: India Multi Energy Systems Market Volume (MW) Forecast, by Application, 2022–2031

Table 136: India Multi Energy Systems Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 137: ASEAN Multi Energy Systems Market Volume (MW) Forecast, by Fuel Type, 2022–2031

Table 138: ASEAN Multi Energy Systems Market Value (US$ Bn) Forecast, by Fuel Type, 2022–2031

Table 139: ASEAN Multi Energy Systems Market Volume (MW) Forecast, by Component, 2022–2031

Table 140: ASEAN Multi Energy Systems Market Value (US$ Bn) Forecast, by Component, 2022–2031

Table 141: ASEAN Multi Energy Systems Market Volume (MW) Forecast, by Energy Type, 2022–2031

Table 142: ASEAN Multi Energy Systems Market Value (US$ Bn) Forecast, by Energy Type, 2022–2031

Table 143: ASEAN Multi Energy Systems Market Volume (MW) Forecast, by Application, 2022–2031

Table 144: ASEAN Multi Energy Systems Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 145: Rest of Asia Pacific Multi Energy Systems Market Volume (MW) Forecast, by Fuel Type, 2022–2031

Table 146: Rest of Asia Pacific Multi Energy Systems Market Value (US$ Bn) Forecast, by Fuel Type, 2022–2031

Table 147: Rest of Asia Pacific Multi Energy Systems Market Volume (MW) Forecast, by Component, 2022–2031

Table 148: Rest of Asia Pacific Multi Energy Systems Market Value (US$ Bn) Forecast, by Component, 2022–2031

Table 149: Rest of Asia Pacific Multi Energy Systems Market Volume (MW) Forecast, by Energy Type, 2022–2031

Table 150: Rest of Asia Pacific Multi Energy Systems Market Value (US$ Bn) Forecast, by Energy Type, 2022–2031

Table 151: Rest of Asia Pacific Multi Energy Systems Market Volume (MW) Forecast, by Application, 2022–2031

Table 152: Rest of Asia Pacific Multi Energy Systems Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 153: Latin America Multi Energy Systems Market Volume (MW) Forecast, by Fuel Type, 2022–2031

Table 154: Latin America Multi Energy Systems Market Value (US$ Bn) Forecast, by Fuel Type, 2022–2031

Table 155: Latin America Multi Energy Systems Market Volume (MW) Forecast, by Component, 2022–2031

Table 156: Latin America Multi Energy Systems Market Value (US$ Bn) Forecast, by Component, 2022–2031

Table 157: Latin America Multi Energy Systems Market Volume (MW) Forecast, by Energy Type, 2022–2031

Table 158: Latin America Multi Energy Systems Market Value (US$ Bn) Forecast, by Energy Type, 2022–2031

Table 159: Latin America Multi Energy Systems Market Volume (MW) Forecast, by Application, 2022–2031

Table 160: Latin America Multi Energy Systems Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 161: Latin America Multi Energy Systems Market Volume (MW) Forecast, by Country and Sub-region, 2022–2031

Table 162: Latin America Multi Energy Systems Market Value (US$ Bn) Forecast, by Country and Sub-region, 2022–2031

Table 163: Brazil Multi Energy Systems Market Volume (MW) Forecast, by Fuel Type, 2022–2031

Table 164: Brazil Multi Energy Systems Market Value (US$ Bn) Forecast, by Fuel Type, 2022–2031

Table 165: Brazil Multi Energy Systems Market Volume (MW) Forecast, by Component, 2022–2031

Table 166: Brazil Multi Energy Systems Market Value (US$ Bn) Forecast, by Component, 2022–2031

Table 167: Brazil Multi Energy Systems Market Volume (MW) Forecast, by Energy Type, 2022–2031

Table 168: Brazil Multi Energy Systems Market Value (US$ Bn) Forecast, by Energy Type, 2022–2031

Table 169: Brazil Multi Energy Systems Market Volume (MW) Forecast, by Application, 2022–2031

Table 170: Brazil Multi Energy Systems Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 171: Mexico Multi Energy Systems Market Volume (MW) Forecast, by Fuel Type, 2022–2031

Table 172: Mexico Multi Energy Systems Market Value (US$ Bn) Forecast, by Fuel Type, 2022–2031

Table 173: Mexico Multi Energy Systems Market Volume (MW) Forecast, by Component, 2022–2031

Table 174: Mexico Multi Energy Systems Market Value (US$ Bn) Forecast, by Component, 2022–2031

Table 175: Mexico Multi Energy Systems Market Volume (MW) Forecast, by Energy Type, 2022–2031

Table 176: Mexico Multi Energy Systems Market Value (US$ Bn) Forecast, by Energy Type, 2022–2031

Table 177: Mexico Multi Energy Systems Market Volume (MW) Forecast, by Application, 2022–2031

Table 178: Mexico Multi Energy Systems Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 179: Rest of Latin America Multi Energy Systems Market Volume (MW) Forecast, by Fuel Type, 2022–2031

Table 180: Rest of Latin America Multi Energy Systems Market Value (US$ Bn) Forecast, by Fuel Type, 2022–2031

Table 181: Rest of Latin America Multi Energy Systems Market Volume (MW) Forecast, by Component, 2022–2031

Table 182: Rest of Latin America Multi Energy Systems Market Value (US$ Bn) Forecast, by Component, 2022–2031

Table 183: Rest of Latin America Multi Energy Systems Market Volume (MW) Forecast, by Energy Type, 2022–2031

Table 184: Rest of Latin America Multi Energy Systems Market Value (US$ Bn) Forecast, by Energy Type, 2022–2031

Table 185: Rest of Latin America Multi Energy Systems Market Volume (MW) Forecast, by Application, 2022–2031

Table 186: Rest of Latin America Multi Energy Systems Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 187: Middle East & Africa Multi Energy Systems Market Volume (MW) Forecast, by Fuel Type, 2022–2031

Table 188: Middle East & Africa Multi Energy Systems Market Value (US$ Bn) Forecast, by Fuel Type, 2022–2031

Table 189: Middle East & Africa Multi Energy Systems Market Volume (MW) Forecast, by Component, 2022–2031

Table 190: Middle East & Africa Multi Energy Systems Market Value (US$ Bn) Forecast, by Component, 2022–2031

Table 191: Middle East & Africa Multi Energy Systems Market Volume (MW) Forecast, by Energy Type, 2022–2031

Table 192: Middle East & Africa Multi Energy Systems Market Value (US$ Bn) Forecast, by Energy Type, 2022–2031

Table 193: Middle East & Africa Multi Energy Systems Market Volume (MW) Forecast, by Application, 2022–2031

Table 194: Middle East & Africa Multi Energy Systems Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 195: Middle East & Africa Multi Energy Systems Market Volume (MW) Forecast, by Country and Sub-region, 2022–2031

Table 196: Middle East & Africa Multi Energy Systems Market Value (US$ Bn) Forecast, by Country and Sub-region, 2022–2031

Table 197: GCC Multi Energy Systems Market Volume (MW) Forecast, by Fuel Type, 2022–2031

Table 198: GCC Multi Energy Systems Market Value (US$ Bn) Forecast, by Fuel Type, 2022–2031

Table 199: GCC Multi Energy Systems Market Volume (MW) Forecast, by Component, 2022–2031

Table 200: GCC Multi Energy Systems Market Value (US$ Bn) Forecast, by Component, 2022–2031

Table 201: GCC Multi Energy Systems Market Volume (MW) Forecast, by Energy Type, 2022–2031

Table 202: GCC Multi Energy Systems Market Value (US$ Bn) Forecast, by Energy Type, 2022–2031

Table 203: GCC Multi Energy Systems Market Volume (MW) Forecast, by Application, 2022–2031

Table 204: GCC Multi Energy Systems Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 205: South Africa Multi Energy Systems Market Volume (MW) Forecast, by Fuel Type, 2022–2031

Table 206: South Africa Multi Energy Systems Market Value (US$ Bn) Forecast, by Fuel Type, 2022–2031

Table 207: South Africa Multi Energy Systems Market Volume (MW) Forecast, by Component, 2022–2031

Table 208: South Africa Multi Energy Systems Market Value (US$ Bn) Forecast, by Component, 2022–2031

Table 209: South Africa Multi Energy Systems Market Volume (MW) Forecast, by Energy Type, 2022–2031

Table 210: South Africa Multi Energy Systems Market Value (US$ Bn) Forecast, by Energy Type, 2022–2031

Table 211: South Africa Multi Energy Systems Market Volume (MW) Forecast, by Application, 2022–2031

Table 212: South Africa Multi Energy Systems Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 213: Rest of Middle East & Africa Multi Energy Systems Market Volume (MW) Forecast, by Fuel Type, 2022–2031

Table 214: Rest of Middle East & Africa Multi Energy Systems Market Value (US$ Bn) Forecast, by Fuel Type, 2022–2031

Table 215: Rest of Middle East & Africa Multi Energy Systems Market Volume (MW) Forecast, by Component, 2022–2031

Table 216: Rest of Middle East & Africa Multi Energy Systems Market Value (US$ Bn) Forecast, by Component, 2022–2031

Table 217: Rest of Middle East & Africa Multi Energy Systems Market Volume (MW) Forecast, by Energy Type, 2022–2031

Table 218: Rest of Middle East & Africa Multi Energy Systems Market Value (US$ Bn) Forecast, by Energy Type, 2022–2031

Table 219: Rest of Middle East & Africa Multi Energy Systems Market Volume (MW) Forecast, by Application, 2022–2031

Table 220: Rest of Middle East & Africa Multi Energy Systems Market Value (US$ Bn) Forecast, by Application 2022–2031

List of Figures

Figure 1: Global Multi Energy Systems Market Volume Share Analysis, by Fuel Type, 2021, 2027, and 2031

Figure 2: Global Multi Energy Systems Market Attractiveness, by Fuel Type

Figure 3: Global Multi Energy Systems Market Volume Share Analysis, by Component, 2021, 2027, and 2031

Figure 4: Global Multi Energy Systems Market Attractiveness, by Component

Figure 5: Global Multi Energy Systems Market Volume Share Analysis, by Energy Type, 2021, 2027, and 2031

Figure 6: Global Multi Energy Systems Market Attractiveness, by Energy Type

Figure 7: Global Multi Energy Systems Market Volume Share Analysis, by Application, 2021, 2027, and 2031

Figure 8: Global Multi Energy Systems Market Attractiveness, by Application

Figure 9: Global Multi Energy Systems Market Volume Share Analysis, by Region, 2021, 2027, and 2031

Figure 10: Global Multi Energy Systems Market Attractiveness, by Region

Figure 11: North America Multi Energy Systems Market Volume Share Analysis, by Fuel Type, 2021, 2027, and 2031

Figure 12: North America Multi Energy Systems Market Attractiveness, by Fuel Type

Figure 13: North America Multi Energy Systems Market Attractiveness, by Fuel Type

Figure 14: North America Multi Energy Systems Market Volume Share Analysis, by Component, 2021, 2027, and 2031

Figure 15: North America Multi Energy Systems Market Attractiveness, by Component

Figure 16: North America Multi Energy Systems Market Volume Share Analysis, by Energy Type, 2021, 2027, and 2031

Figure 17: North America Multi Energy Systems Market Attractiveness, by Energy Type

Figure 18: North America Multi Energy Systems Market Volume Share Analysis, by Application, 2021, 2027, and 2031

Figure 19: North America Multi Energy Systems Market Attractiveness, by Application

Figure 20: North America Multi Energy Systems Market Attractiveness, by Country and Sub-region

Figure 21: Europe Multi Energy Systems Market Volume Share Analysis, by Fuel Type, 2021, 2027, and 2031

Figure 22: Europe Multi Energy Systems Market Attractiveness, by Fuel Type

Figure 23: Europe Multi Energy Systems Market Volume Share Analysis, by Component, 2021, 2027, and 2031

Figure 24: Europe Multi Energy Systems Market Attractiveness, by Component

Figure 25: Europe Multi Energy Systems Market Volume Share Analysis, by Energy Type, 2021, 2027, and 2031

Figure 26: Europe Multi Energy Systems Market Attractiveness, by Energy Type

Figure 27: Europe Multi Energy Systems Market Volume Share Analysis, by Application, 2021, 2027, and 2031

Figure 28: Europe Multi Energy Systems Market Attractiveness, by Application

Figure 29: Europe Multi Energy Systems Market Volume Share Analysis, by Country and Sub-region, 2021, 2027, and 2031

Figure 30: Europe Multi Energy Systems Market Attractiveness, by Country and Sub-region

Figure 31: Asia Pacific Multi Energy Systems Market Volume Share Analysis, by Fuel Type, 2021, 2027, and 2031

Figure 32: Asia Pacific Multi Energy Systems Market Attractiveness, by Fuel Type

Figure 33: Asia Pacific Multi Energy Systems Market Volume Share Analysis, by Component, 2021, 2027, and 2031

Figure 34: Asia Pacific Multi Energy Systems Market Attractiveness, by Component

Figure 35: Asia Pacific Multi Energy Systems Market Volume Share Analysis, by Energy Type, 2021, 2027, and 2031

Figure 36: Asia Pacific Multi Energy Systems Market Attractiveness, by Energy Type

Figure 33: Asia Pacific Multi Energy Systems Market Volume Share Analysis, by Application, 2021, 2027, and 2031

Figure 34: Asia Pacific Multi Energy Systems Market Attractiveness, by Application

Figure 35: Asia Pacific Multi Energy Systems Market Volume Share Analysis, by Country and Sub-region, 2021, 2027, and 2031

Figure 36: Asia Pacific Multi Energy Systems Market Attractiveness, by Country and Sub-region

Figure 33: Latin America Multi Energy Systems Market Volume Share Analysis, by Fuel Type, 2021, 2027, and 2031

Figure 34: Latin America Multi Energy Systems Market Attractiveness, by Fuel Type

Figure 35: Latin America Multi Energy Systems Market Volume Share Analysis, by Component, 2021, 2027, and 2031

Figure 36: Latin America Multi Energy Systems Market Attractiveness, by Component

Figure 33: Latin America Multi Energy Systems Market Volume Share Analysis, by Energy Type, 2021, 2027, and 2031

Figure 34: Latin America Multi Energy Systems Market Attractiveness, by Energy Type

Figure 35: Latin America Multi Energy Systems Market Volume Share Analysis, by Application, 2021, 2027, and 2031

Figure 36: Latin America Multi Energy Systems Market Attractiveness, by Application

Figure 36: Latin America Multi Energy Systems Market Volume Share Analysis, by Country and Sub-region, 2021, 2027, and 2031

Figure 37: Latin America Multi Energy Systems Market Attractiveness, by Country and Sub-region

Figure 38: Middle East & Africa Multi Energy Systems Market Volume Share Analysis, by Fuel Type, 2021, 2027, and 2031

Figure 39: Middle East & Africa Multi Energy Systems Market Attractiveness, by Fuel Type

Figure 40: Middle East & Africa Multi Energy Systems Market Volume Share Analysis, by Component, 2021, 2027, and 2031

Figure 41: Middle East & Africa Multi Energy Systems Market Attractiveness, by Component

Figure 42: Middle East & Africa Multi Energy Systems Market Volume Share Analysis, by Energy Type, 2021, 2027, and 2031

Figure 43: Middle East & Africa Multi Energy Systems Market Attractiveness, by Energy Type

Figure 44: Middle East & Africa Multi Energy Systems Market Volume Share Analysis, by Application, 2021, 2027, and 2031

Figure 45: Middle East & Africa Multi Energy Systems Market Attractiveness, by Application

Figure 46: Middle East & Africa Multi Energy Systems Market Volume Share Analysis, by Country and Sub-region, 2021, 2027, and 2031

Figure 47: Middle East & Africa Multi Energy Systems Market Attractiveness, by Country and Sub-region