Analysts’ Viewpoint

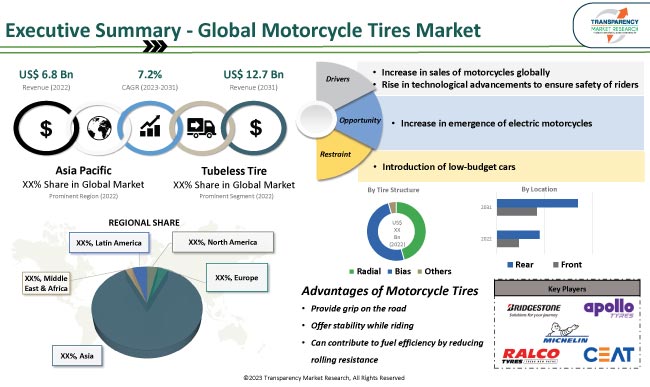

Rise in demand for sustainable and eco-friendly products, as consumers have become more ecologically concerned, is driving the global motorcycle tires market growth. New technologies such as smart tires and AI-based tire monitoring systems are emerging as the market is continuously evolving.

Technological advancements and increase in investment in R&D activities to develop new products, specifically for electric motorcycles, offer lucrative opportunities to market players. Motorcycle tire producers are focusing on enhancing their distribution networks and forging strong alliances with OEMs, distributors, and retailers to make sure their products reach customers. Tire manufacturers are striving to create high-quality tires that adhere to global safety standards and offer outstanding grip, stability, and handling as motorcycle riders place a high value on safety.

Motorcycle tire, which is the outermost component of the wheel and is attached to the rim, is important for traction and stability. The design of a tire tread pattern is crucial in providing the necessary grip and handling characteristics for various riding conditions.

The contact patch between the tire and the ground is where the forces of acceleration, braking, and cornering are transmitted, making it a critical component of the motorcycle's handling and safety. Additionally, the design of a tire is crucial for absorbing shocks and vibrations, enhancing rider comfort, and decreasing tiredness.

Regular maintenance of motorbike tires is important to guarantee the best performance and safety. This includes examining the tires for wear or damage, checking the pressure, and replacing them as needed. Riding on worn out or damaged tires can weaken the motorcycle's handling and stability and greatly increase the danger of accidents.

Different types of motorcycle tire available in the market are tubed motorcycle tire, tubeless motorcycle tire, and solid motorcycle tire. Absence of infrastructure for parking four-wheelers and increase in urbanization are anticipated to augment the global motorcycle tires market dynamics. The need for specialized tires that can fulfil particular requirements of electric motorcycles is high, as their demand is continuously increasing.

Rise in motorcycle sales directly affects the demand for motorcycle tires. Replacement tires are more in demand, as more people purchase motorcycles. Rapid growth of the motorcycle market has increased production of motorcycles, which, in turn, is propelling motorcycle tires market demand.

High performance motorcycles with more horsepower and better handling have also become more popular, necessitating the usage of tires with modern technology and superior materials. Hence, demand for premium and high-performance motorcycle tires has increased in the past few years. These tires are more expensive and bring in more money for tire makers.

Buying tires online has become easy for customers, as e-commerce platforms have expanded. Tire manufacturers are capitalizing on this development by broadening their online sales channels. Consequently, motorcycle tires are now more easily accessible to consumers, which is expected to create significant motorcycle tires market opportunities.

Desire for high-performance and premium tires, rise in motorbike sales, and expansion of e-commerce sales channels are the key factors fueling the demand for motorcycle tires.

New materials and construction methods that enhance tire performance have been introduced owing to technological developments. For instance, using advanced rubber compounds and strengthened carcasses could provide better grip, handling, and durability, which improves the tire's overall performance. These developments have increased the need for high-performance motorcycle tires.

Development of environmentally-friendly motorbike tires that offer better fuel efficiency and reduced carbon emissions has led to the emergence of a new product category that appeals to buyers who are concerned about the environment. This has increased the number of applications of motorcycle tires and given tire makers additional avenues for revenue generation.

Technological advances in tire production could also increase safety by boosting traction, handling, and stability. New building materials and methods can lower the risks of accidents by enhancing the grip on wet or slippery surfaces. These advantages of motorcycle tires are likely to increase the trust of consumers, thereby boosting sales and market revenue.

In terms of tire type, the tubeless tire segment represented a sizable proportion of 75.2% of the global market in 2022. Motorcycle tubed tires are heavier than tubeless tires, which also run cooler and are available in several sizes and forms.

A tubeless tire might close around a nail (or other pointed road debris) and trap the air inside by catching it in the thick main layer of the tire. Most motorcycles now come with tubeless tires owing to the moderate rate of deflation and minimal resistance.

Concerns about safety, convenience, performance, and environmental protection drive the demand for tubeless motorbike tires across the world. Demand for tubeless tires is projected to be high, as these variables continue to affect customer choices.

Based on tire structure, the bias segment accounted for major market share of 49.89% in 2022. Bias tires have strong sidewalls owing to their unique crosshatch design. These tires provide a smooth ride on rough areas and are less expensive than radial tires. Increased traction of bias tires, however, causes the tread to deteriorate quickly.

Radial tires, on the other hand, provide consistent ground contact, which promotes consistent tread wear. Radial tire’s steel belt design, however, has an impact on the ride. Rise in popularity of electric motorcycles is projected to drive the demand for radial tires during the forecast period.

Asia Pacific was a prominent market in 2022, in terms of volume and revenue. This can be ascribed to expanding population and widespread motorcycle usage in Asia Pacific, especially in China and India. These countries are regarded as the major motorcycle producers worldwide.

India produces more than 80% motorcycles of all vehicles, which increases the demand for motorcycle tires in the OEM and aftermarket sectors. Additionally, the adoption rate of IC engine and electric motorcycle is the highest in China, which also boosts the demand for motorcycle tires.

According to the motorcycle tires market forecast, the purchase of two-wheelers is expected to increase in the region. Demand for motorcycle tires is projected to rise due to significant presence of tire suppliers and increase in motorbike sales in China and India.

The motorcycle tires market is highly fragmented. Market participants are creating supply chain networks to increase revenue share. However, major companies are enhancing their market positions through collaboration, merger, acquisition, and expansion of product lines.

As per the motorcycle tires market analysis, tire producers should concentrate on raising brand awareness through efficient marketing, advertising, and customer involvement to attract new customers, and retain existing ones. They should focus on creating sustainable production processes, utilizing renewable materials, and lowering carbon footprints to keep up with changing consumer demands.

Prominent players in the global motorcycle tires market are Anlas, Apollo Tyres Ltd., Bridgestone Corporation, CEAT Limited, Continental Corporation, Deestone, DSI, Dunlop, Giti Tire Pte. Ltd., Goodyear Tires, Hankook Tires, IRC, JK Tyre & Industries Ltd., Kenda Tires, LEVORIN, Metro Tyres limited., Metzelers, Michelin, Mitas, MRF Limited, Pirelli and C. S.p.A, Pyramids, RALCO Tires, Sailun Tires, Timsun Tires, Triangle Tires, TVS Srichakra Limited, Vee Rubber, and Yokohama Tires.

Each of these players has been profile in the motorcycle tires market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Size Value in 2022 |

US$ 6.8 Bn |

|

Market Forecast Value in 2031 |

US$ 12.7 Bn |

|

Growth Rate (CAGR) |

7.2% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

Volume (Mn Units) & Value (US$ Bn) |

|

Market Analysis |

Qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global industry was valued at US$ 6.8 Bn in 2022

It is projected to expand at a CAGR of 7.2% by 2031

It is expected to be US$ 12.7 Bn by 2031

Increase in sales of motorcycles globally and rise in technological advancements to ensure the safety of riders are propelling the global market

The tubeless tire type segment accounted the leading share in 2022

Asia Pacific is a highly lucrative region.

Anlas, Apollo Tyres Ltd., Bridgestone Corporation, CEAT Limited, Continental Corporation, Deestone, DSI, Dunlop, Giti Tire Pte. Ltd., Goodyear Tires, Hankook Tires, IRC, JK Tyre & Industries Ltd., Kenda Tires, LEVORIN, Metro Tyres Limited, Metzelers, Michelin, Mitas, MRF Limited, Pirelli and C. S.p.A, Pyramids, RALCO Tires, Sailun Tires, Timsun Tires, Triangle Tires, TVS Srichakra Limited, Vee Rubber, and Yokohama Tires are the prominent players in the market.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Value (US$ Bn), 2017-2031

1.2. Demand & Supply Side Trends

1.3. TMR Analysis and Recommendations

2. Market Overview

2.1. Market Definition/Scope/Limitations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Opportunity

2.3. Market Factor Analysis

2.3.1. Porter’s Five Force Analysis

2.3.2. SWOT Analysis

2.4. Value Chain Analysis

2.5. Regulatory Scenario

2.6. Key Trend Analysis

2.7. Price Trend Analysis

2.8. Cost Structure Analysis

2.9. Profit Margin, by Country

3. Import/Export Analysis

3.1. Countries with Key Imports of Motorcycle Tires, based on Sales Channel

3.2. Countries with Key Exports of Motorcycle Tires, based on Sales Channel

4. Manufacturer Analysis

4.1. Company Analysis for Each Manufacturer

4.2. Sales Number (Mn Units), and Revenue (US$ Bn)

4.3. Product Category by Each Manufacturer

5. Global Motorcycle Tires Market

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Motorcycle Tires Market Volume (Mn Units), Revenue (US$ Bn) Analysis & Forecast, by Tire Type, 2017-2031

5.2.1. Tube Tire

5.2.2. Tubeless Tire

5.2.3. Others (Solid, PU, etc.)

5.3. Global Motorcycle Tires Market Volume (Mn Units), Revenue (US$ Bn) Analysis & Forecast, by Tire Structure, 2017-2031

5.3.1. Radial

5.3.2. Bias

5.3.3. Others

5.4. Global Motorcycle Tires Market Volume (Mn Units), Revenue (US$ Bn) Analysis & Forecast, by Motorcycle/Tire Category, 2017-2031

5.4.1. Street Tires

5.4.2. Dual Sports or ADV Tires

5.4.3. Touring Tires

5.4.4. Sports/Performance Tires

5.4.5. Sport Touring Tires

5.4.6. Off-road Tires

5.4.7. Racing Tires/Slicks

5.5. Global Motorcycle Tires Market Volume (Mn Units), Revenue (US$ Bn) Analysis & Forecast, by Tire Sizes, 2017-2031

5.5.1. Less than 12”

5.5.2. 12” - 15”

5.5.3. 15” - 17”

5.5.4. More than 17”

5.6. Global Motorcycle Tires Market Volume (Mn Units), Revenue (US$ Bn) Analysis & Forecast, by Sales Channel, 2017-2031

5.6.1. OEM

5.6.2. Aftermarket

5.7. Global Motorcycle Tires Market Volume (Mn Units), Revenue (US$ Bn) Analysis & Forecast, by Location, 2017-2031

5.7.1. Front

5.7.2. Rear

5.8. Global Motorcycle Tires Market Volume (Mn Units), Revenue (US$ Bn) Analysis & Forecast, by Region, 2017-2031

5.8.1. North America

5.8.2. Europe

5.8.3. Asia Pacific

5.8.4. Middle East & Africa

5.8.5. Latin America

6. North America Motorcycle Tires Market

6.1. Market Snapshot

6.2. Motorcycle Tires Market Volume (Mn Units), Revenue (US$ Bn) Analysis & Forecast, by Tire Type, 2017-2031

6.2.1. Tube Tire

6.2.2. Tubeless Tire

6.2.3. Others (Solid, PU, etc.)

6.3. Motorcycle Tires Market Volume (Mn Units), Revenue (US$ Bn) Analysis & Forecast, by Tire Structure, 2017-2031

6.3.1. Radial

6.3.2. Bias

6.3.3. Others

6.4. Motorcycle Tires Market Volume (Mn Units), Revenue (US$ Bn) Analysis & Forecast, by Motorcycle/Tire Category, 2017-2031

6.4.1. Street Tires

6.4.2. Dual Sports or ADV Tires

6.4.3. Touring Tires

6.4.4. Sports/Performance Tires

6.4.5. Sport Touring Tires

6.4.6. Off-road Tires

6.4.7. Racing Tires/Slicks

6.5. Motorcycle Tires Market Volume (Mn Units), Revenue (US$ Bn) Analysis & Forecast, by Tire Sizes, 2017-2031

6.5.1. Less than 12”

6.5.2. 12” - 15”

6.5.3. 15” - 17”

6.5.4. More than 17”

6.6. Motorcycle Tires Market Volume (Mn Units), Revenue (US$ Bn) Analysis & Forecast, by Sales Channel, 2017-2031

6.6.1. OEM

6.6.2. Aftermarket

6.7. Motorcycle Tires Market Volume (Mn Units), Revenue (US$ Bn) Analysis & Forecast, by Location, 2017-2031

6.7.1. Front

6.7.2. Rear

6.8. Key Country Analysis - North America Motorcycle Tires Market Volume (Mn Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031

6.8.1. U.S.

6.8.1.1. By Tire Type

6.8.1.2. By Tire Structure

6.8.2. Canada

6.8.2.1. By Tire Type

6.8.2.2. By Tire Structure

7. Europe Motorcycle Tires Market

7.1. Market Snapshot

7.2. Motorcycle Tires Market Volume (Mn Units), Revenue (US$ Bn) Analysis & Forecast, by Tire Type, 2017-2031

7.2.1. Tube Tire

7.2.2. Tubeless Tire

7.2.3. Others (Solid, PU, etc.)

7.3. Motorcycle Tires Market Volume (Mn Units), Revenue (US$ Bn) Analysis & Forecast, by Tire Structure, 2017-2031

7.3.1. Radial

7.3.2. Bias

7.3.3. Others

7.4. Motorcycle Tires Market Volume (Mn Units), Revenue (US$ Bn) Analysis & Forecast, by Motorcycle/Tire Category, 2017-2031

7.4.1. Street Tires

7.4.2. Dual Sports or ADV Tires

7.4.3. Touring Tires

7.4.4. Sports/Performance Tires

7.4.5. Sport Touring Tires

7.4.6. Off-road Tires

7.4.7. Racing Tires/Slicks

7.5. Motorcycle Tires Market Volume (Mn Units), Revenue (US$ Bn) Analysis & Forecast, by Tire Sizes, 2017-2031

7.5.1. Less than 12”

7.5.2. 12” - 15”

7.5.3. 15” - 17”

7.5.4. More than 17”

7.6. Motorcycle Tires Market Volume (Mn Units), Revenue (US$ Bn) Analysis & Forecast, by Sales Channel, 2017-2031

7.6.1. OEM

7.6.2. Aftermarket

7.7. Motorcycle Tires Market Volume (Mn Units), Revenue (US$ Bn) Analysis & Forecast, by Location, 2017-2031

7.7.1. Front

7.7.2. Rear

7.8. Key Country Analysis - Asia Pacific Motorcycle Tires Market Volume (Mn Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031

7.8.1. Germany

7.8.1.1. By Tire Type

7.8.1.2. By Tire Structure

7.8.2. U.K.

7.8.2.1. By Tire Type

7.8.2.2. By Tire Structure

7.8.3. France

7.8.3.1. By Tire Type

7.8.3.2. By Tire Structure

7.8.4. Italy

7.8.4.1. By Tire Type

7.8.4.2. By Tire Structure

7.8.5. Spain

7.8.5.1. By Tire Type

7.8.5.2. By Tire Structure

7.8.6. Portugal

7.8.6.1. By Tire Type

7.8.6.2. By Tire Structure

7.8.7. Russia & CIS

7.8.7.1. By Tire Type

7.8.7.2. By Tire Structure

7.8.8. Nordic Region

7.8.8.1. By Tire Type

7.8.8.2. By Tire Structure

7.8.9. Rest of Europe

7.8.9.1. By Tire Type

7.8.9.2. By Tire Structure

8. Asia Pacific Motorcycle Tires Market

8.1. Market Snapshot

8.2. Motorcycle Tires Market Volume (Mn Units), Revenue (US$ Bn) Analysis & Forecast, by Tire Type, 2017-2031

8.2.1. Tube Tire

8.2.2. Tubeless Tire

8.2.3. Others (Solid, PU, etc.)

8.3. Motorcycle Tires Market Volume (Mn Units), Revenue (US$ Bn) Analysis & Forecast, by Tire Structure, 2017-2031

8.3.1. Radial

8.3.2. Bias

8.3.3. Others

8.4. Motorcycle Tires Market Volume (Mn Units), Revenue (US$ Bn) Analysis & Forecast, by Motorcycle/Tire Category, 2017-2031

8.4.1. Street Tires

8.4.2. Dual Sports or ADV Tires

8.4.3. Touring Tires

8.4.4. Sports/Performance Tires

8.4.5. Sport Touring Tires

8.4.6. Off-road Tires

8.4.7. Racing Tires/Slicks

8.5. Motorcycle Tires Market Volume (Mn Units), Revenue (US$ Bn) Analysis & Forecast, by Tire Sizes, 2017-2031

8.5.1. Less than 12”

8.5.2. 12” - 15”

8.5.3. 15” - 17”

8.5.4. More than 17”

8.6. Motorcycle Tires Market Volume (Mn Units), Revenue (US$ Bn) Analysis & Forecast, by Sales Channel, 2017-2031

8.6.1. OEM

8.6.2. Aftermarket

8.7. Motorcycle Tires Market Volume (Mn Units), Revenue (US$ Bn) Analysis & Forecast, by Location, 2017-2031

8.7.1. Front

8.7.2. Rear

8.8. Key Country Analysis - Asia Pacific Motorcycle Tires Market Volume (Mn Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031

8.8.1. China

8.8.1.1. By Tire Type

8.8.1.2. By Tire Structure

8.8.2. India

8.8.2.1. By Tire Type

8.8.2.2. By Tire Structure

8.8.3. Japan

8.8.3.1. By Tire Type

8.8.3.2. By Tire Structure

8.8.4. ASEAN

8.8.4.1. By Tire Type

8.8.4.2. By Tire Structure

8.8.5. South Korea

8.8.5.1. By Tire Type

8.8.5.2. By Tire Structure

8.8.6. ANZ

8.8.6.1. By Tire Type

8.8.6.2. By Tire Structure

8.8.7. Rest of Asia Pacific

8.8.7.1. By Tire Type

8.8.7.2. By Tire Structure

9. Middle East & Africa Motorcycle Tires Market

9.1. Market Snapshot

9.2. Motorcycle Tires Market Volume (Mn Units), Revenue (US$ Bn) Analysis & Forecast, by Tire Type, 2017-2031

9.2.1. Tube Tire

9.2.2. Tubeless Tire

9.2.3. Others (Solid, PU, etc.)

9.3. Motorcycle Tires Market Volume (Mn Units), Revenue (US$ Bn) Analysis & Forecast, by Tire Structure, 2017-2031

9.3.1. Radial

9.3.2. Bias

9.3.3. Others

9.4. Motorcycle Tires Market Volume (Mn Units), Revenue (US$ Bn) Analysis & Forecast, by Motorcycle/Tire Category, 2017-2031

9.4.1. Street Tires

9.4.2. Dual Sports or ADV Tires

9.4.3. Touring Tires

9.4.4. Sports/Performance Tires

9.4.5. Sport Touring Tires

9.4.6. Off-road Tires

9.4.7. Racing Tires/Slicks

9.5. Motorcycle Tires Market Volume (Mn Units), Revenue (US$ Bn) Analysis & Forecast, by Tire Sizes, 2017-2031

9.5.1. Less than 12”

9.5.2. 12” - 15”

9.5.3. 15” - 17”

9.5.4. More than 17”

9.6. Motorcycle Tires Market Volume (Mn Units), Revenue (US$ Bn) Analysis & Forecast, by Sales Channel, 2017-2031

9.6.1. OEM

9.6.2. Aftermarket

9.7. Motorcycle Tires Market Volume (Mn Units), Revenue (US$ Bn) Analysis & Forecast, by Location, 2017-2031

9.7.1. Front

9.7.2. Rear

9.8. Key Country Analysis - Latin America Motorcycle Tires Market Volume (Mn Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031

9.8.1. GCC

9.8.1.1. By Tire Type

9.8.1.2. By Tire Structure

9.8.2. South Africa

9.8.2.1. By Tire Type

9.8.2.2. By Tire Structure

9.8.3. Syria

9.8.3.1. By Tire Type

9.8.3.2. By Tire Structure

9.8.4. Iraq

9.8.4.1. By Tire Type

9.8.4.2. By Tire Structure

9.8.5. Nigeria

9.8.5.1. By Tire Type

9.8.5.2. By Tire Structure

9.8.6. Egypt

9.8.6.1. By Tire Type

9.8.6.2. By Tire Structure

9.8.7. Tanzania

9.8.7.1. By Tire Type

9.8.7.2. By Tire Structure

9.8.8. Democratic Republic of Congo

9.8.8.1. By Tire Type

9.8.8.2. By Tire Structure

9.8.9. Kenya

9.8.9.1. By Tire Type

9.8.9.2. By Tire Structure

9.8.10. Morocco

9.8.10.1. By Tire Type

9.8.10.2. By Tire Structure

9.8.11. Sudan

9.8.11.1. By Tire Type

9.8.11.2. By Tire Structure

9.8.12. Ethiopia

9.8.12.1. By Tire Type

9.8.12.2. By Tire Structure

9.8.13. Algeria

9.8.13.1. By Tire Type

9.8.13.2. By Tire Structure

9.8.14. Ghana

9.8.14.1. By Tire Type

9.8.14.2. By Tire Structure

9.8.15. Libya

9.8.15.1. By Tire Type

9.8.15.2. By Tire Structure

9.8.16. Rest of Middle East & Africa

9.8.16.1. By Tire Type

9.8.16.2. By Tire Structure

10. Latin America Motorcycle Tires Market

10.1. Market Snapshot

10.2. Motorcycle Tires Market Volume (Mn Units), Revenue (US$ Bn) Analysis & Forecast, by Tire Type, 2017-2031

10.2.1. Tube Tire

10.2.2. Tubeless Tire

10.2.3. Others (Solid, PU, etc.)

10.3. Motorcycle Tires Market Volume (Mn Units), Revenue (US$ Bn) Analysis & Forecast, by Tire Structure, 2017-2031

10.3.1. Radial

10.3.2. Bias

10.3.3. Others

10.4. Motorcycle Tires Market Volume (Mn Units), Revenue (US$ Bn) Analysis & Forecast, by Motorcycle/Tire Category, 2017-2031

10.4.1. Street Tires

10.4.2. Dual Sports or ADV Tires

10.4.3. Touring Tires

10.4.4. Sports/Performance Tires

10.4.5. Sport Touring Tires

10.4.6. Off-road Tires

10.4.7. Racing Tires/Slicks

10.5. Motorcycle Tires Market Volume (Mn Units), Revenue (US$ Bn) Analysis & Forecast, by Tire Sizes, 2017-2031

10.5.1. Less than 12”

10.5.2. 12” - 15”

10.5.3. 15” - 17”

10.5.4. More than 17”

10.6. Motorcycle Tires Market Volume (Mn Units), Revenue (US$ Bn) Analysis & Forecast, by Sales Channel, 2017-2031

10.6.1. OEM

10.6.2. Aftermarket

10.7. Motorcycle Tires Market Volume (Mn Units), Revenue (US$ Bn) Analysis & Forecast, by Location, 2017-2031

10.7.1. Front

10.7.2. Rear

10.8. Key Country Analysis - Latin America Motorcycle Tires Market Volume (Mn Units), Revenue (US$ Bn) Analysis & Forecast, 2017-2031

10.8.1. Brazil

10.8.1.1. By Tire Type

10.8.1.2. By Tire Structure

10.8.2. Argentina

10.8.2.1. By Tire Type

10.8.2.2. By Tire Structure

10.8.3. Mexico

10.8.3.1. By Tire Type

10.8.3.2. By Tire Structure

10.8.4. Peru

10.8.4.1. By Tire Type

10.8.4.2. By Tire Structure

10.8.5. Colombia

10.8.5.1. By Tire Type

10.8.5.2. By Tire Structure

10.8.6. Rest of Latin America

10.8.6.1. By Tire Type

10.8.6.2. By Tire Structure

11. Competitive Landscape

11.1. Company Share/Brand Share Analysis, 2022

11.2. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Recent Developments, Financial Analysis (Turnover, Exports), Capacity, SWOT Analysis, Strategic Overview)

12. Company Profile/Key Players

12.1. Anlas

12.1.1. Company Overview

12.1.2. Company Footprints

12.1.3. Production Locations

12.1.4. Product Portfolio

12.1.5. Recent Developments

12.1.6. Financial Analysis (Turnover, Exports)

12.1.7. Capacity

12.1.8. SWOT Analysis

12.1.9. Strategic Overview

12.2. Apollo Tyres Ltd.

12.2.1. Company Overview

12.2.2. Company Footprints

12.2.3. Production Locations

12.2.4. Product Portfolio

12.2.5. Recent Developments

12.2.6. Financial Analysis (Turnover, Exports)

12.2.7. Capacity

12.2.8. SWOT Analysis

12.2.9. Strategic Overview

12.3. Bridgestone Corporation

12.3.1. Company Overview

12.3.2. Company Footprints

12.3.3. Production Locations

12.3.4. Product Portfolio

12.3.5. Recent Developments

12.3.6. Financial Analysis (Turnover, Exports)

12.3.7. Capacity

12.3.8. SWOT Analysis

12.3.9. Strategic Overview

12.4. CEAT Limited

12.4.1. Company Overview

12.4.2. Company Footprints

12.4.3. Production Locations

12.4.4. Product Portfolio

12.4.5. Recent Developments

12.4.6. Financial Analysis (Turnover, Exports)

12.4.7. Capacity

12.4.8. SWOT Analysis

12.4.9. Strategic Overview

12.5. Continental Corporation

12.5.1. Company Overview

12.5.2. Company Footprints

12.5.3. Production Locations

12.5.4. Product Portfolio

12.5.5. Recent Developments

12.5.6. Financial Analysis (Turnover, Exports)

12.5.7. Capacity

12.5.8. SWOT Analysis

12.5.9. Strategic Overview

12.6. Deestone

12.6.1. Company Overview

12.6.2. Company Footprints

12.6.3. Production Locations

12.6.4. Product Portfolio

12.6.5. Recent Developments

12.6.6. Financial Analysis (Turnover, Exports)

12.6.7. Capacity

12.6.8. SWOT Analysis

12.6.9. Strategic Overview

12.7. DSI

12.7.1. Company Overview

12.7.2. Company Footprints

12.7.3. Production Locations

12.7.4. Product Portfolio

12.7.5. Recent Developments

12.7.6. Financial Analysis (Turnover, Exports)

12.7.7. Capacity

12.7.8. SWOT Analysis

12.7.9. Strategic Overview

12.8. Dunlop

12.8.1. Company Overview

12.8.2. Company Footprints

12.8.3. Production Locations

12.8.4. Product Portfolio

12.8.5. Recent Developments

12.8.6. Financial Analysis (Turnover, Exports)

12.8.7. Capacity

12.8.8. SWOT Analysis

12.8.9. Strategic Overview

12.9. Giti Tire Pte. Ltd.

12.9.1. Company Overview

12.9.2. Company Footprints

12.9.3. Production Locations

12.9.4. Product Portfolio

12.9.5. Recent Developments

12.9.6. Financial Analysis (Turnover, Exports)

12.9.7. Capacity

12.9.8. SWOT Analysis

12.9.9. Strategic Overview

12.10. Goodyear Tires

12.10.1. Company Overview

12.10.2. Company Footprints

12.10.3. Production Locations

12.10.4. Product Portfolio

12.10.5. Recent Developments

12.10.6. Financial Analysis (Turnover, Exports)

12.10.7. Capacity

12.10.8. SWOT Analysis

12.10.9. Strategic Overview

12.11. Hankook Tires

12.11.1. Company Overview

12.11.2. Company Footprints

12.11.3. Production Locations

12.11.4. Product Portfolio

12.11.5. Recent Developments

12.11.6. Financial Analysis (Turnover, Exports)

12.11.7. Capacity

12.11.8. SWOT Analysis

12.11.9. Strategic Overview

12.12. IRC

12.12.1. Company Overview

12.12.2. Company Footprints

12.12.3. Production Locations

12.12.4. Product Portfolio

12.12.5. Recent Developments

12.12.6. Financial Analysis (Turnover, Exports)

12.12.7. Capacity

12.12.8. SWOT Analysis

12.12.9. Strategic Overview

12.13. JK Tyre & Industries Ltd

12.13.1. Company Overview

12.13.2. Company Footprints

12.13.3. Production Locations

12.13.4. Product Portfolio

12.13.5. Recent Developments

12.13.6. Financial Analysis (Turnover, Exports)

12.13.7. Capacity

12.13.8. SWOT Analysis

12.13.9. Strategic Overview

12.14. Kenda Tires

12.14.1. Company Overview

12.14.2. Company Footprints

12.14.3. Production Locations

12.14.4. Product Portfolio

12.14.5. Recent Developments

12.14.6. Financial Analysis (Turnover, Exports)

12.14.7. Capacity

12.14.8. SWOT Analysis

12.14.9. Strategic Overview

12.15. LEVORIN

12.15.1. Company Overview

12.15.2. Company Footprints

12.15.3. Production Locations

12.15.4. Product Portfolio

12.15.5. Recent Developments

12.15.6. Financial Analysis (Turnover, Exports)

12.15.7. Capacity

12.15.8. SWOT Analysis

12.15.9. Strategic Overview

12.16. Metro Tyres limited

12.16.1. Company Overview

12.16.2. Company Footprints

12.16.3. Production Locations

12.16.4. Product Portfolio

12.16.5. Recent Developments

12.16.6. Financial Analysis (Turnover, Exports)

12.16.7. Capacity

12.16.8. SWOT Analysis

12.16.9. Strategic Overview

12.17. Metzelers

12.17.1. Company Overview

12.17.2. Company Footprints

12.17.3. Production Locations

12.17.4. Product Portfolio

12.17.5. Recent Developments

12.17.6. Financial Analysis (Turnover, Exports)

12.17.7. Capacity

12.17.8. SWOT Analysis

12.17.9. Strategic Overview

12.18. Michelin

12.18.1. Company Overview

12.18.2. Company Footprints

12.18.3. Production Locations

12.18.4. Product Portfolio

12.18.5. Recent Developments

12.18.6. Financial Analysis (Turnover, Exports)

12.18.7. Capacity

12.18.8. SWOT Analysis

12.18.9. Strategic Overview

12.19. Mitas

12.19.1. Company Overview

12.19.2. Company Footprints

12.19.3. Production Locations

12.19.4. Product Portfolio

12.19.5. Recent Developments

12.19.6. Financial Analysis (Turnover, Exports)

12.19.7. Capacity

12.19.8. SWOT Analysis

12.19.9. Strategic Overview

12.20. MRF Limited

12.20.1. Company Overview

12.20.2. Company Footprints

12.20.3. Production Locations

12.20.4. Product Portfolio

12.20.5. Recent Developments

12.20.6. Financial Analysis (Turnover, Exports)

12.20.7. Capacity

12.20.8. SWOT Analysis

12.20.9. Strategic Overview

12.21. Pirelli and C. S.p.A

12.21.1. Company Overview

12.21.2. Company Footprints

12.21.3. Production Locations

12.21.4. Product Portfolio

12.21.5. Recent Developments

12.21.6. Financial Analysis (Turnover, Exports)

12.21.7. Capacity

12.21.8. SWOT Analysis

12.21.9. Strategic Overview

12.22. Pyramids

12.22.1. Company Overview

12.22.2. Company Footprints

12.22.3. Production Locations

12.22.4. Product Portfolio

12.22.5. Recent Developments

12.22.6. Financial Analysis (Turnover, Exports)

12.22.7. Capacity

12.22.8. SWOT Analysis

12.22.9. Strategic Overview

12.23. RALCO Tires

12.23.1. Company Overview

12.23.2. Company Footprints

12.23.3. Production Locations

12.23.4. Product Portfolio

12.23.5. Recent Developments

12.23.6. Financial Analysis (Turnover, Exports)

12.23.7. Capacity

12.23.8. SWOT Analysis

12.23.9. Strategic Overview

12.24. Sailun Tires

12.24.1. Company Overview

12.24.2. Company Footprints

12.24.3. Production Locations

12.24.4. Product Portfolio

12.24.5. Recent Developments

12.24.6. Financial Analysis (Turnover, Exports)

12.24.7. Capacity

12.24.8. SWOT Analysis

12.24.9. Strategic Overview

12.25. Timsun Tires

12.25.1. Company Overview

12.25.2. Company Footprints

12.25.3. Production Locations

12.25.4. Product Portfolio

12.25.5. Recent Developments

12.25.6. Financial Analysis (Turnover, Exports)

12.25.7. Capacity

12.25.8. SWOT Analysis

12.25.9. Strategic Overview

12.26. Triangle Tires

12.26.1. Company Overview

12.26.2. Company Footprints

12.26.3. Production Locations

12.26.4. Product Portfolio

12.26.5. Recent Developments

12.26.6. Financial Analysis (Turnover, Exports)

12.26.7. Capacity

12.26.8. SWOT Analysis

12.26.9. Strategic Overview

12.27. TVS Srichakra Limited

12.27.1. Company Overview

12.27.2. Company Footprints

12.27.3. Production Locations

12.27.4. Product Portfolio

12.27.5. Recent Developments

12.27.6. Financial Analysis (Turnover, Exports)

12.27.7. Capacity

12.27.8. SWOT Analysis

12.27.9. Strategic Overview

12.28. Vee Rubber

12.28.1. Company Overview

12.28.2. Company Footprints

12.28.3. Production Locations

12.28.4. Product Portfolio

12.28.5. Recent Developments

12.28.6. Financial Analysis (Turnover, Exports)

12.28.7. Capacity

12.28.8. SWOT Analysis

12.28.9. Strategic Overview

12.29. Yokohama Tires

12.29.1. Company Overview

12.29.2. Company Footprints

12.29.3. Production Locations

12.29.4. Product Portfolio

12.29.5. Recent Developments

12.29.6. Financial Analysis (Turnover, Exports)

12.29.7. Capacity

12.29.8. SWOT Analysis

12.29.9. Strategic Overview

12.30. Other Key Players

12.30.1. Company Overview

12.30.2. Company Footprints

12.30.3. Production Locations

12.30.4. Product Portfolio

12.30.5. Recent Developments

12.30.6. Financial Analysis (Turnover, Exports)

12.30.7. Capacity

12.30.8. SWOT Analysis

12.30.9. Strategic Overview

List of Tables

Table 1: Global Motorcycle Tires Market Volume (Mn Units) Forecast, by Tire Type, 2017-2031

Table 2: Global Motorcycle Tires Market Value (US$ Bn) Forecast, by Tire Type, 2017‒2031

Table 3: Global Motorcycle Tires Market Volume (Mn Units) Forecast, by Tire Structure, 2017-2031

Table 4: Global Motorcycle Tires Market Value (US$ Bn) Forecast, by Tire Structure, 2017‒2031

Table 5: Global Motorcycle Tires Market Volume (Mn Units) Forecast, by Motorcycle/Tire Category, 2017-2031

Table 6: Global Motorcycle Tires Market Value (US$ Bn) Forecast, by Motorcycle/Tire Category, 2017‒2031

Table 7: Global Motorcycle Tires Market Volume (Mn Units) Forecast, by Tire Size, 2017-2031

Table 8: Global Motorcycle Tires Market Value (US$ Bn) Forecast, by Tire Size, 2017-2031

Table 9: Global Motorcycle Tires Market Volume (Mn Units) Forecast, by Sales Channel, 2017-2031

Table 10: Global Motorcycle Tires Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 11: Global Motorcycle Tires Market Volume (Mn Units) Forecast, by Location, 2017-2031

Table 12: Global Motorcycle Tires Market Value (US$ Bn) Forecast, by Location, 2017-2031

Table 13: Global Motorcycle Tires Market Volume (Mn Units) Forecast, by Region, 2017-2031

Table 14: Global Motorcycle Tires Market Value (US$ Bn) Forecast, by Region, 2017‒2031

Table 15: North America Motorcycle Tires Market Volume (Mn Units) Forecast, by Tire Type, 2017-2031

Table 16: North America Motorcycle Tires Market Value (US$ Bn) Forecast, by Tire Type, 2017‒2031

Table 17: North America Motorcycle Tires Market Volume (Mn Units) Forecast, by Tire Structure, 2017-2031

Table 18: North America Motorcycle Tires Market Value (US$ Bn) Forecast, by Tire Structure, 2017‒2031

Table 19: North America Motorcycle Tires Market Volume (Mn Units) Forecast, by Motorcycle/Tire Category, 2017-2031

Table 20: North America Motorcycle Tires Market Value (US$ Bn) Forecast, by Motorcycle/Tire Category, 2017‒2031

Table 21: North America Motorcycle Tires Market Volume (Mn Units) Forecast, by Tire Size, 2017-2031

Table 22: North America Motorcycle Tires Market Value (US$ Bn) Forecast, by Tire Size, 2017-2031

Table 23: North America Motorcycle Tires Market Volume (Mn Units) Forecast, by Sales Channel, 2017-2031

Table 24: North America Motorcycle Tires Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 25: North America Motorcycle Tires Market Volume (Mn Units) Forecast, by Location, 2017-2031

Table 26: North America Motorcycle Tires Market Value (US$ Bn) Forecast, by Location, 2017-2031

Table 27: North America Motorcycle Tires Market Volume (Mn Units) Forecast, by Country, 2017-2031

Table 28: North America Motorcycle Tires Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 29: Europe Motorcycle Tires Market Volume (Mn Units) Forecast, by Tire Type, 2017-2031

Table 30: Europe Motorcycle Tires Market Value (US$ Bn) Forecast, by Tire Type, 2017‒2031

Table 31: Europe Motorcycle Tires Market Volume (Mn Units) Forecast, by Tire Structure, 2017-2031

Table 32: Europe Motorcycle Tires Market Value (US$ Bn) Forecast, by Tire Structure, 2017‒2031

Table 33: Europe Motorcycle Tires Market Volume (Mn Units) Forecast, by Motorcycle/Tire Category, 2017-2031

Table 34: Europe Motorcycle Tires Market Value (US$ Bn) Forecast, by Motorcycle/Tire Category, 2017‒2031

Table 35: Europe Motorcycle Tires Market Volume (Mn Units) Forecast, by Tire Size, 2017-2031

Table 36: Europe Motorcycle Tires Market Value (US$ Bn) Forecast, by Tire Size, 2017-2031

Table 37: Europe Motorcycle Tires Market Volume (Mn Units) Forecast, by Sales Channel, 2017-2031

Table 38: Europe Motorcycle Tires Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 39: Europe Motorcycle Tires Market Volume (Mn Units) Forecast, by Location, 2017-2031

Table 40: Europe Motorcycle Tires Market Value (US$ Bn) Forecast, by Location, 2017-2031

Table 41: Europe Motorcycle Tires Market Volume (Mn Units) Forecast, by Country, 2017-2031

Table 42: Europe Motorcycle Tires Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 43: Asia Pacific Motorcycle Tires Market Volume (Mn Units) Forecast, by Tire Type, 2017-2031

Table 44: Asia Pacific Motorcycle Tires Market Value (US$ Bn) Forecast, by Tire Type, 2017‒2031

Table 45: Asia Pacific Motorcycle Tires Market Volume (Mn Units) Forecast, by Tire Structure, 2017-2031

Table 46: Asia Pacific Motorcycle Tires Market Value (US$ Bn) Forecast, by Tire Structure, 2017‒2031

Table 47: Asia Pacific Motorcycle Tires Market Volume (Mn Units) Forecast, by Motorcycle/Tire Category, 2017-2031

Table 48: Asia Pacific Motorcycle Tires Market Value (US$ Bn) Forecast, by Motorcycle/Tire Category, 2017‒2031

Table 49: Asia Pacific Motorcycle Tires Market Volume (Mn Units) Forecast, by Tire Size, 2017-2031

Table 50: Asia Pacific Motorcycle Tires Market Value (US$ Bn) Forecast, by Tire Size, 2017-2031

Table 51: Asia Pacific Motorcycle Tires Market Volume (Mn Units) Forecast, by Sales Channel, 2017-2031

Table 52: Asia Pacific Motorcycle Tires Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 53: Asia Pacific Motorcycle Tires Market Volume (Mn Units) Forecast, by Location, 2017-2031

Table 54: Asia Pacific Motorcycle Tires Market Value (US$ Bn) Forecast, by Location, 2017-2031

Table 55: Asia Pacific Motorcycle Tires Market Volume (Mn Units) Forecast, by Country, 2017-2031

Table 56: Asia Pacific Motorcycle Tires Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 57: Middle East & Africa Motorcycle Tires Market Volume (Mn Units) Forecast, by Tire Type, 2017-2031

Table 58: Middle East & Africa Motorcycle Tires Market Value (US$ Bn) Forecast, by Tire Type, 2017‒2031

Table 59: Middle East & Africa Motorcycle Tires Market Volume (Mn Units) Forecast, by Tire Structure, 2017-2031

Table 60: Middle East & Africa Motorcycle Tires Market Value (US$ Bn) Forecast, by Tire Structure, 2017‒2031

Table 61: Middle East & Africa Motorcycle Tires Market Volume (Mn Units) Forecast, by Motorcycle/Tire Category, 2017-2031

Table 62: Middle East & Africa Motorcycle Tires Market Value (US$ Bn) Forecast, by Motorcycle/Tire Category, 2017‒2031

Table 63: Middle East & Africa Motorcycle Tires Market Volume (Mn Units) Forecast, by Tire Size, 2017-2031

Table 64: Middle East & Africa Motorcycle Tires Market Value (US$ Bn) Forecast, by Tire Size, 2017-2031

Table 65: Middle East & Africa Motorcycle Tires Market Volume (Mn Units) Forecast, by Sales Channel, 2017-2031

Table 66: Middle East & Africa Motorcycle Tires Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 67: Middle East & Africa Motorcycle Tires Market Volume (Mn Units) Forecast, by Location, 2017-2031

Table 68: Middle East & Africa Motorcycle Tires Market Value (US$ Bn) Forecast, by Location, 2017-2031

Table 69: Middle East & Africa Motorcycle Tires Market Volume (Mn Units) Forecast, by Country, 2017-2031

Table 70: Middle East & Africa Motorcycle Tires Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 71: Latin America Motorcycle Tires Market Volume (Mn Units) Forecast, by Tire Type, 2017-2031

Table 72: Latin America Motorcycle Tires Market Value (US$ Bn) Forecast, by Tire Type, 2017‒2031

Table 73: Latin America Motorcycle Tires Market Volume (Mn Units) Forecast, by Tire Structure, 2017-2031

Table 74: Latin America Motorcycle Tires Market Value (US$ Bn) Forecast, by Tire Structure, 2017‒2031

Table 75: Latin America Motorcycle Tires Market Volume (Mn Units) Forecast, by Motorcycle/Tire Category, 2017-2031

Table 76: Latin America Motorcycle Tires Market Value (US$ Bn) Forecast, by Motorcycle/Tire Category, 2017‒2031

Table 77: Latin America Motorcycle Tires Market Volume (Mn Units) Forecast, by Tire Size, 2017-2031

Table 78: Latin America Motorcycle Tires Market Value (US$ Bn) Forecast, by Tire Size, 2017-2031

Table 79: Latin America Motorcycle Tires Market Volume (Mn Units) Forecast, by Sales Channel, 2017-2031

Table 80: Latin America Motorcycle Tires Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 81: Latin America Motorcycle Tires Market Volume (Mn Units) Forecast, by Location, 2017-2031

Table 82: Latin America Motorcycle Tires Market Value (US$ Bn) Forecast, by Location, 2017-2031

Table 83: Latin America Motorcycle Tires Market Volume (Mn Units) Forecast, by Country, 2017-2031

Table 84: Latin America Motorcycle Tires Market Value (US$ Bn) Forecast, by Country, 2017‒2031

List of Figures

Figure 1: Global Motorcycle Tires Market Volume (Mn Units) Forecast, by Tire Type, 2017-2031

Figure 2: Global Motorcycle Tires Market Value (US$ Bn) Forecast, by Tire Type, 2017-2031

Figure 3: Global Motorcycle Tires Market, Incremental Opportunity, by Tire Type, Value (US$ Bn), 2023-2031

Figure 4: Global Motorcycle Tires Market Volume (Mn Units) Forecast, by Tire Structure, 2017-2031

Figure 5: Global Motorcycle Tires Market Value (US$ Bn) Forecast, by Tire Structure, 2017-2031

Figure 6: Global Motorcycle Tires Market, Incremental Opportunity, by Tire Structure, Value (US$ Bn), 2023-2031

Figure 7: Global Motorcycle Tires Market Volume (Mn Units) Forecast, by Motorcycle/Tire Category, 2017-2031

Figure 8: Global Motorcycle Tires Market Value (US$ Bn) Forecast, by Motorcycle/Tire Category, 2017-2031

Figure 9: Global Motorcycle Tires Market, Incremental Opportunity, by Motorcycle/Tire Category, Value (US$ Bn), 2023-2031

Figure 10: Global Motorcycle Tires Market Volume (Mn Units) Forecast, by Tire Size, 2017-2031

Figure 11: Global Motorcycle Tires Market Value (US$ Bn) Forecast, by Tire Size, 2017-2031

Figure 12: Global Motorcycle Tires Market, Incremental Opportunity, by Tire Size, Value (US$ Bn), 2023-2031

Figure 13: Global Motorcycle Tires Market Volume (Mn Units) Forecast, by Sales Channel, 2017-2031

Figure 14: Global Motorcycle Tires Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 15: Global Motorcycle Tires Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 16: Global Motorcycle Tires Market Volume (Mn Units) Forecast, by Location, 2017-2031

Figure 17: Global Motorcycle Tires Market Value (US$ Bn) Forecast, by Location, 2017-2031

Figure 18: Global Motorcycle Tires Market, Incremental Opportunity, by Location, Value (US$ Bn), 2023-2031

Figure 19: Global Motorcycle Tires Market Volume (Mn Units) Forecast, by Region, 2017-2031

Figure 20: Global Motorcycle Tires Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 21: Global Motorcycle Tires Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023-2031

Figure 22: North America Motorcycle Tires Market Volume (Mn Units) Forecast, by Tire Type, 2017-2031

Figure 23: North America Motorcycle Tires Market Value (US$ Bn) Forecast, by Tire Type, 2017-2031

Figure 24: North America Motorcycle Tires Market, Incremental Opportunity, by Tire Type, Value (US$ Bn), 2023-2031

Figure 25: North America Motorcycle Tires Market Volume (Mn Units) Forecast, by Tire Structure, 2017-2031

Figure 26: North America Motorcycle Tires Market Value (US$ Bn) Forecast, by Tire Structure, 2017-2031

Figure 27: North America Motorcycle Tires Market, Incremental Opportunity, by Tire Structure, Value (US$ Bn), 2023-2031

Figure 28: North America Motorcycle Tires Market Volume (Mn Units) Forecast, by Motorcycle/Tire Category, 2017-2031

Figure 29: North America Motorcycle Tires Market Value (US$ Bn) Forecast, by Motorcycle/Tire Category, 2017-2031

Figure 30: North America Motorcycle Tires Market, Incremental Opportunity, by Motorcycle/Tire Category, Value (US$ Bn), 2023-2031

Figure 31: North America Motorcycle Tires Market Volume (Mn Units) Forecast, by Tire Size, 2017-2031

Figure 32: North America Motorcycle Tires Market Value (US$ Bn) Forecast, by Tire Size, 2017-2031

Figure 33: North America Motorcycle Tires Market, Incremental Opportunity, by Tire Size, Value (US$ Bn), 2023-2031

Figure 34: North America Motorcycle Tires Market Volume (Mn Units) Forecast, by Sales Channel, 2017-2031

Figure 35: North America Motorcycle Tires Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 36: North America Motorcycle Tires Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 37: North America Motorcycle Tires Market Volume (Mn Units) Forecast, by Location, 2017-2031

Figure 38: North America Motorcycle Tires Market Value (US$ Bn) Forecast, by Location, 2017-2031

Figure 39: North America Motorcycle Tires Market, Incremental Opportunity, by Location, Value (US$ Bn), 2023-2031

Figure 40: North America Motorcycle Tires Market Volume (Mn Units) Forecast, by Country, 2017-2031

Figure 41: North America Motorcycle Tires Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 42: North America Motorcycle Tires Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 43: Europe Motorcycle Tires Market Volume (Mn Units) Forecast, by Tire Type, 2017-2031

Figure 44: Europe Motorcycle Tires Market Value (US$ Bn) Forecast, by Tire Type, 2017-2031

Figure 45: Europe Motorcycle Tires Market, Incremental Opportunity, by Tire Type, Value (US$ Bn), 2023-2031

Figure 46: Europe Motorcycle Tires Market Volume (Mn Units) Forecast, by Tire Structure, 2017-2031

Figure 47: Europe Motorcycle Tires Market Value (US$ Bn) Forecast, by Tire Structure, 2017-2031

Figure 48: Europe Motorcycle Tires Market, Incremental Opportunity, by Tire Structure, Value (US$ Bn), 2023-2031

Figure 49: Europe Motorcycle Tires Market Volume (Mn Units) Forecast, by Motorcycle/Tire Category, 2017-2031

Figure 50: Europe Motorcycle Tires Market Value (US$ Bn) Forecast, by Motorcycle/Tire Category, 2017-2031

Figure 51: Europe Motorcycle Tires Market, Incremental Opportunity, by Motorcycle/Tire Category, Value (US$ Bn), 2023-2031

Figure 52: Europe Motorcycle Tires Market Volume (Mn Units) Forecast, by Tire Size, 2017-2031

Figure 53: Europe Motorcycle Tires Market Value (US$ Bn) Forecast, by Tire Size, 2017-2031

Figure 54: Europe Motorcycle Tires Market, Incremental Opportunity, by Tire Size, Value (US$ Bn), 2023-2031

Figure 55: Europe Motorcycle Tires Market Volume (Mn Units) Forecast, by Sales Channel, 2017-2031

Figure 56: Europe Motorcycle Tires Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 57: Europe Motorcycle Tires Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 58: Europe Motorcycle Tires Market Volume (Mn Units) Forecast, by Location, 2017-2031

Figure 59: Europe Motorcycle Tires Market Value (US$ Bn) Forecast, by Location, 2017-2031

Figure 60: Europe Motorcycle Tires Market, Incremental Opportunity, by Location, Value (US$ Bn), 2023-2031

Figure 61: Europe Motorcycle Tires Market Volume (Mn Units) Forecast, by Country, 2017-2031

Figure 62: Europe Motorcycle Tires Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 63: Europe Motorcycle Tires Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 64: Asia Pacific Motorcycle Tires Market Volume (Mn Units) Forecast, by Tire Type, 2017-2031

Figure 65: Asia Pacific Motorcycle Tires Market Value (US$ Bn) Forecast, by Tire Type, 2017-2031

Figure 66: Asia Pacific Motorcycle Tires Market, Incremental Opportunity, by Tire Type, Value (US$ Bn), 2023-2031

Figure 67: Asia Pacific Motorcycle Tires Market Volume (Mn Units) Forecast, by Tire Structure, 2017-2031

Figure 68: Asia Pacific Motorcycle Tires Market Value (US$ Bn) Forecast, by Tire Structure, 2017-2031

Figure 69: Asia Pacific Motorcycle Tires Market, Incremental Opportunity, by Tire Structure, Value (US$ Bn), 2023-2031

Figure 70: Asia Pacific Motorcycle Tires Market Volume (Mn Units) Forecast, by Motorcycle/Tire Category, 2017-2031

Figure 71: Asia Pacific Motorcycle Tires Market Value (US$ Bn) Forecast, by Motorcycle/Tire Category, 2017-2031

Figure 72: Asia Pacific Motorcycle Tires Market, Incremental Opportunity, by Motorcycle/Tire Category, Value (US$ Bn), 2023-2031

Figure 73: Asia Pacific Motorcycle Tires Market Volume (Mn Units) Forecast, by Tire Size, 2017-2031

Figure 74: Asia Pacific Motorcycle Tires Market Value (US$ Bn) Forecast, by Tire Size, 2017-2031

Figure 75: Asia Pacific Motorcycle Tires Market, Incremental Opportunity, by Tire Size, Value (US$ Bn), 2023-2031

Figure 76: Asia Pacific Motorcycle Tires Market Volume (Mn Units) Forecast, by Sales Channel, 2017-2031

Figure 77: Asia Pacific Motorcycle Tires Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 78: Asia Pacific Motorcycle Tires Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 79: Asia Pacific Motorcycle Tires Market Volume (Mn Units) Forecast, by Location, 2017-2031

Figure 80: Asia Pacific Motorcycle Tires Market Value (US$ Bn) Forecast, by Location, 2017-2031

Figure 81: Asia Pacific Motorcycle Tires Market, Incremental Opportunity, by Location, Value (US$ Bn), 2023-2031

Figure 82: Asia Pacific Motorcycle Tires Market Volume (Mn Units) Forecast, by Country, 2017-2031

Figure 83: Asia Pacific Motorcycle Tires Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 84: Asia Pacific Motorcycle Tires Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 85: Middle East & Africa Motorcycle Tires Market Volume (Mn Units) Forecast, by Tire Type, 2017-2031

Figure 86: Middle East & Africa Motorcycle Tires Market Value (US$ Bn) Forecast, by Tire Type, 2017-2031

Figure 87: Middle East & Africa Motorcycle Tires Market, Incremental Opportunity, by Tire Type, Value (US$ Bn), 2023-2031

Figure 88: Middle East & Africa Motorcycle Tires Market Volume (Mn Units) Forecast, by Tire Structure, 2017-2031

Figure 89: Middle East & Africa Motorcycle Tires Market Value (US$ Bn) Forecast, by Tire Structure, 2017-2031

Figure 90: Middle East & Africa Motorcycle Tires Market, Incremental Opportunity, by Tire Structure, Value (US$ Bn), 2023-2031

Figure 91: Middle East & Africa Motorcycle Tires Market Volume (Mn Units) Forecast, by Motorcycle/Tire Category, 2017-2031

Figure 92: Middle East & Africa Motorcycle Tires Market Value (US$ Bn) Forecast, by Motorcycle/Tire Category, 2017-2031

Figure 93: Middle East & Africa Motorcycle Tires Market, Incremental Opportunity, by Motorcycle/Tire Category, Value (US$ Bn), 2023-2031

Figure 94: Middle East & Africa Motorcycle Tires Market Volume (Mn Units) Forecast, by Tire Size, 2017-2031

Figure 95: Middle East & Africa Motorcycle Tires Market Value (US$ Bn) Forecast, by Tire Size, 2017-2031

Figure 96: Middle East & Africa Motorcycle Tires Market, Incremental Opportunity, by Tire Size, Value (US$ Bn), 2023-2031

Figure 97: Middle East & Africa Motorcycle Tires Market Volume (Mn Units) Forecast, by Sales Channel, 2017-2031

Figure 98: Middle East & Africa Motorcycle Tires Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 99: Middle East & Africa Motorcycle Tires Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 100: Middle East & Africa Motorcycle Tires Market Volume (Mn Units) Forecast, by Location, 2017-2031

Figure 101: Middle East & Africa Motorcycle Tires Market Value (US$ Bn) Forecast, by Location, 2017-2031

Figure 102: Middle East & Africa Motorcycle Tires Market, Incremental Opportunity, by Location, Value (US$ Bn), 2023-2031

Figure 103: Middle East & Africa Motorcycle Tires Market Volume (Mn Units) Forecast, by Country, 2017-2031

Figure 104: Middle East & Africa Motorcycle Tires Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 105: Middle East & Africa Motorcycle Tires Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 106: Latin America Motorcycle Tires Market Volume (Mn Units) Forecast, by Tire Type, 2017-2031

Figure 107: Latin America Motorcycle Tires Market Value (US$ Bn) Forecast, by Tire Type, 2017-2031

Figure 108: Latin America Motorcycle Tires Market, Incremental Opportunity, by Tire Type, Value (US$ Bn), 2023-2031

Figure 109: Latin America Motorcycle Tires Market Volume (Mn Units) Forecast, by Tire Structure, 2017-2031

Figure 110: Latin America Motorcycle Tires Market Value (US$ Bn) Forecast, by Tire Structure, 2017-2031

Figure 111: Latin America Motorcycle Tires Market, Incremental Opportunity, by Tire Structure, Value (US$ Bn), 2023-2031

Figure 112: Latin America Motorcycle Tires Market Volume (Mn Units) Forecast, by Motorcycle/Tire Category, 2017-2031

Figure 113: Latin America Motorcycle Tires Market Value (US$ Bn) Forecast, by Motorcycle/Tire Category, 2017-2031

Figure 114: Latin America Motorcycle Tires Market, Incremental Opportunity, by Motorcycle/Tire Category, Value (US$ Bn), 2023-2031

Figure 115: Latin America Motorcycle Tires Market Volume (Mn Units) Forecast, by Tire Size, 2017-2031

Figure 116: Latin America Motorcycle Tires Market Value (US$ Bn) Forecast, by Tire Size, 2017-2031

Figure 117: Latin America Motorcycle Tires Market, Incremental Opportunity, by Tire Size, Value (US$ Bn), 2023-2031

Figure 118: Latin America Motorcycle Tires Market Volume (Mn Units) Forecast, by Sales Channel, 2017-2031

Figure 119: Latin America Motorcycle Tires Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 120: Latin America Motorcycle Tires Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 121: Latin America Motorcycle Tires Market Volume (Mn Units) Forecast, by Location, 2017-2031

Figure 122: Latin America Motorcycle Tires Market Value (US$ Bn) Forecast, by Location, 2017-2031

Figure 123: Latin America Motorcycle Tires Market, Incremental Opportunity, by Location, Value (US$ Bn), 2023-2031

Figure 124: Latin America Motorcycle Tires Market Volume (Mn Units) Forecast, by Country, 2017-2031

Figure 125: Latin America Motorcycle Tires Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 126: Latin America Motorcycle Tires Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031