The Morocco ceramic and porcelain tiles market is expected to grow in the near future owing to the growing sense of aesthetics among consumers. This is mainly due to wide scale production of low-grade cement tiles in the region. The rise in the market is attributed to the growing tourism sector and improving lifestyle of people in the region. The changing preference of consumers toward modern and elegant porcelain tiles is the primary factor driving the global ceramic and porcelain tile market in the near future.

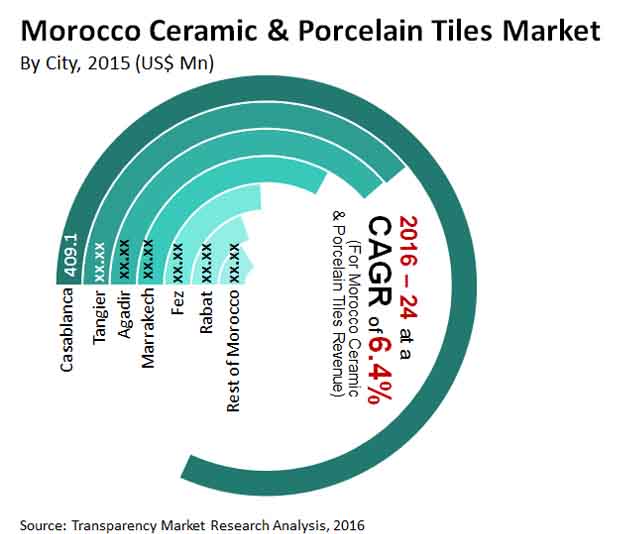

As per a recent report by Transparency Market Research on the ceramic and porcelain tiles market, analysts anticipate the ceramic and porcelain tiles market to achieve a valuation of US$2.7 billion by 2024 end, expanding at an impressive CAGR of 6.4% during the forecast period from 2016 to 2024. In 2015, the ceramic and porcelain tiles market was valued at US$1.5 billion.2015

Rise in Demand for Low Sloped Roofing to Boost Growth

The global commercial roofing materials market is divided on the basis of type, material and bathroom.

On the basis of type, the ceramic and porcelain tiles market is segmented into glazed porcelain, full-body porcelain, ceramic floor tiles, ceramic wall tiles, and thin tiles. Among all of them, full-body porcelain tiles is likely to hold more than 30% the of global market shares in 2015. This is mainly because of the increasing demand for full-body porcelain in the regional market of the Morocco.

On the basis of bathroom material, the ceramic and porcelain tiles market market is segmented into floor and wall. Both the segment jointly hold their dominance in the Morocco ceramic and porcelain tiles market. This is mainly due to the growing inclination of the consumer toward expensive sanitary ware items. International players are taking an advantage of the shifting trend by launching aesthetic and exclusive brands in the region. On the basis bathroom furniture & accessories, ceramic accounted for more than 40.0% in 2015.

The competitive landscape of the Morocco ceramic and porcelain tiles market displays a fierce competition. This is mainly due to the presence of several local and international players in the region. Major players operating in the Morocco ceramic and porcelain tiles market include Roca Sanitario, CERA Sanitaryware Limited, S.A., Jaquar, Kohler Co., HSIL Hindware, Grohe AG, and Hansgrohe Group. These players are adopting innovative strategies like product proliferation, branding and advertisement to tap growth.

In terms of revenue, Casablanca held a share of more than 30.0% in 2015. Casablanca is the economic capital and leading financial hub of Morocco. Major industrial facilities and several Moroccan and international companies are based in Casablanca.

Rising Demand for Affordable Housing boosts growth

A major share of the population of Morocco is economically middle-class. In such situation, numerous segments of ceramic and porcelain tiles offer a cheaper alternate to the population in the region. The Morocco ceramic and porcelain times market is expect to rise in future owing to the increasing efforts by the Ministry of Housing and Urban Policy (MHU) to develop residential housing.

Water Obstruction and Other Properties will Augment Growth of Ceramic and Porcelain Tiles Market

The rise in disposable incomes of people and the growing inclination towards standardized living standard has propelled the growth of the building and construction industry. The beautiful appearance and easy maintenance of tiles and porcelain in homes are likely to aid in expansion of the global ceramic and porcelain tiles market.

The tremendous utilization of PET holders among individuals, particularly in creating areas of Asia Pacific, is complementing the market development. The rising take-up of PET holders, credited to them being viewed as protected and affordable, in the food and drinks industry is boosting the market. The far reaching take-up of polyester in the material business world over has supported the interest for paraxylene. Additionally, the advantages offered by concrete tiles, for example, are many, including water obstruction, strength, and climate agreeableness.

Porcelain was the most quickly extending fragment in the two cases. The restroom furniture and adornments market is overwhelmed by the shower and sterile product section and fixtures are expected to enroll a high development rate in the coming years. A significant portion of the number of inhabitants in Morocco is financially working class. In such circumstance, various sections of artistic and porcelain tiles offer a less expensive substitute to the populace in the area. The Morocco clay and porcelain times market is hope to ascend in future attributable to the expanding endeavors by the Ministry of Housing and Urban Policy (MHU) to create private lodging.

A flood in the inflow of vacationers converts into an ascent in the development of lodgings, consequently driving the interest for ceramic and porcelain tiles, restroom materials, and furniture and frill. Further supporting the structure and development area is the Government of Morocco, with its endeavors in endeavor new development projects under its lodging plan. The ascent in the remodel of old properties is expected to help the market for ceramic and porcelain tiles, washroom materials, and furniture and frill.

In 2015, Morocco ceramic and porcelain tiles market was valued at US$1.5 bn

Morocco ceramic and porcelain tiles market is expected to reach US$2.7 bn by 2024

Morocco ceramic and porcelain tiles market is estimated to rise at a CAGR of 6.4% during forecast period

Increasing demand for full-body porcelain in the regional market of the morocco is expected to drive the Morocco ceramic and porcelain tiles market

Key players of Morocco ceramic and porcelain tiles market are Roca Sanitario, CERA Sanitaryware Limited, S.A., Jaquar, Kohler Co., HSIL Hindware, Grohe AG, and Hansgrohe Group

1 Preface

1.1 Report Scope and Market Segmentation

1.2 Research Highlights

2 Assumptions and Research Methodology

2.1 Assumptions and Acronyms Used

3 Executive Summary

3.1 Morocco Ceramic & Porcelain Tiles Market

3.2 Morocco Bathroom Materials Market

3.3 Morocco Bathroom Furniture & Accessories Market

4 Market Overview

4.1 Product Overview

4.2 Market Indicators

4.3 Drivers

4.3.1 Growth in tourism is likely to fuel the usage of ceramic & porcelain tiles, bathroom materials, and bathroom furniture & accessories in hotels and motels

4.3.2 Rise in new construction projects along with renovation of old constructions is expected to boost the market

4.3.3 Changing consumer preference for imported products over traditional construction materials

4.4 Restraints

4.4.1 Availability of wide range of substitutes

4.4.2 Strong construction growth is limited to few key cities

4.5 Opportunity Analysis

4.6 Porter’s Analysis

4.6.1 Bargaining Power of Suppliers

4.6.2 Bargaining Power of Buyers

4.6.3 Threat of Substitutes

4.6.4 Threat of New Entrants

4.6.5 Degree of Competition

4.7 Value Chain Analysis

4.8 Channel Analysis

4.9 Trade Agreements and Barriers with Turkey

4.10 Product Standards & Inspection Requirements

4.11 Morocco Ceramic & Porcelain Tiles Market: Demand-supply Scenario

4.12 Customer Survey – Brand Awareness

4.13 Product & Price Level Comparison (Ceramic & Porcelain Tiles)

4.14 Morocco Ceramic & Porcelain Tiles Market: Morocco Import Scenario

4.15 Tax Structure

4.16 Freight Rate & Transit Time from Key Countries - Casablanca Port

4.17 Freight Rate & Transit Time from Key Countries - Tangier Port

4.18 Key Decision Makers

5 Morocco Ceramic & Porcelain Tiles Market Analysis by Product Type

5.1 Key Findings

5.2 Introduction

5.3 Morocco Ceramic & Porcelain Tiles Market Value, Share Analysis, by Product Type

5.4 Morocco Ceramic & Porcelain Tiles Market Attractiveness Analysis by Product Type

6 Morocco Bathroom Materials Market Analysis by Product Type

6.1 Key Findings

6.2 Introduction Floor Bathroom Materials

6.3 Introduction Wall Bathroom Materials

6.4 Morocco Bathroom Materials Market Value Share Analysis, by Type

6.5 Morocco Bathroom Materials Attractiveness Analysis, by Type

7 Morocco Bathroom Furniture & Accessories Market Analysis, by Product Type

7.1 Key Findings

7.2 Introduction - Bathroom Furniture & Accessories

7.3 Morocco Bathroom Furniture & Accessories Market Value Share Analysis, by Type

7.4 Morocco Bathroom Materials Attractiveness Analysis, by Type

8 Morocco Ceramic & Porcelain Tiles, Bathroom Materials, Bathroom Furniture & Accessories Market Analysis, by City

8.1 Morocco Ceramic & Porcelain Tiles Market Overview

8.2 Morocco Bathroom Materials Market Overview

8.3 Morocco Bathroom Furniture & Accessories Market Overview

8.4 Morocco Ceramic & Porcelain Tiles Market Value Share Analysis, by City

8.5 Morocco Bathroom Materials Market Value Share Analysis, by City

8.6 Morocco Bathroom Furniture & Accessories Market Value Share Analysis, by City

8.7 Casablanca Ceramic & Porcelain Tiles Market, by Product (US$ Mn), 2015–2024

8.8 Casablanca Bathroom Materials Market, by Product (US$ Thousand), 2015–2024

8.9 Casablanca Bathroom Furniture & Accessories Market, by Product (US$ Thousand), 2015–2024

8.10 Rabat Ceramic & Porcelain Tiles Market, by Product (US$ Mn), 2015–2024

8.11 Rabat Bathroom Materials Market, by Product (US$ Thousand), 2015–2024

8.12 Rabat Bathroom Furniture & Accessories Market, by Product (US$ Thousand), 2015–2024

8.13 Fez Ceramic & Porcelain Tiles Market, by Product (US$ Mn), 2015–2024

8.14 Fez Bathroom Materials Market, by Product (US$ Thousand), 2015–2024

8.15 Fez Bathroom Furniture & Accessories Market, by Product (US$ Thousand), 2015–2024

8.16 Marrakech Ceramic & Porcelain Tiles Market, by Product (US$ Mn), 2015–2024

8.17 Marrakech Bathroom Materials Market, by Product (US$ Thousand), 2015–2024

8.18 Marrakech Bathroom Furniture & Accessories Market, by Product (US$ Thousand), 2015–2024

8.19 Agadir Ceramic & Porcelain Tiles Market, by Product (US$ Mn), 2015–2024

8.20 Agadir Bathroom Materials Market, by Product (US$ Thousand), 2015–2024

8.21 Agadir Bathroom Furniture & Accessories Market, by Product (US$ Thousand), 2015–2024

8.22 Tangier Ceramic & Porcelain Tiles Market, by Product (US$ Mn), 2015–2024

8.23 Tangier Bathroom Materials Market, by Product (US$ Thousand), 2015–2024

8.24 Tangier Bathroom Furniture & Accessories Market, by Product (US$ Thousand), 2015–2024

8.25 Rest of Morocco Ceramic & Porcelain Tiles Market, by Product (US$ Mn), 2015–2024

8.26 Rest of Morocco Bathroom Materials Market, by Product (US$ Thousand), 2015–2024

8.27 Rest of Morocco Bathroom Furniture & Accessories Market, by Product (US$ Thousand), 2015–2024

9 Company Profiles

9.1 Roca Sanitario, S.A.

9.1.1 Company Details

9.1.2 Business Overview

9.1.3 Financial Details

9.1.4 SWOT

9.1.5 Strategic Overview

9.2 Jaquar

9.2.1 Company Details

9.2.2 Business Overview

9.2.3 SWOT

9.2.4 Strategic Overview

9.3 CERA Sanitaryware Limited

9.3.1 Company Details

9.3.2 Business Overview

9.1.3 Financial Details

9.3.4 SWOT

9.3.5 Strategic Overview

9.4 Kohler Co.

9.4.1 Company Details

9.4.2 Business Overview

9.4.3 SWOT

9.4.4 Strategic Overview

9.5 Grohe AG

9.5.1 Company Details

9.5.2 Business Overview

9.5.3 SWOT

9.5.4 Strategic Overview

9.6 HSIL Hindware

9.6.1 Company Details

9.6.2 Business Overview

9.6.3 Financial Details

9.6.4 SWOT

9.6.5 Strategic Overview

9.7 Hansgrohe Group

9.7.1 Company Details

9.7.2 Business Overview

9.7.3 Financial Details

9.7.4 SWOT

9.7.5 Strategic Overview

9.8 Kajaria Ceramics Limited

9.8.1 Company Details

9.8.2 Business Overview

9.8.3 Financial Details

9.8.4 SWOT

9.8.5 Strategic Overview

9.9 H&R Johnson (India) Limited

9.9.1 Company Details

9.9.2 Business Overview

9.9.3 SWOT

9.9.4 Strategic Overview

9.10 Duravit

9.10.1 Company Details

9.10.2 Business Overview

9.11 S.B.S. Porcher

9.11.1 Company Details

9.11.2 Business Overview

9.12 Sahara Designs

9.12.1 Company Details

9.12.2 Business Overview

10 List of Domestic and International Fairs

11 List of Industrial Institutions & Chambers

12 Marketing Media Tools

13 List of Developments by International Players in the Morocco Market

List of Tables

Table 1 Morocco Ceramic & Porcelain Tiles Market Value Share (US$ Mn) Forecast, by Type, 2015–2024

Table 2 Morocco Ceramic & Porcelain Tiles Market Value Share (US$ Mn) Forecast for Glazed Porcelain Tiles, by Size, 2015–2024

Table 3 Morocco Ceramic & Porcelain Tiles Market Value Share (US$ Mn) Forecast for Full Body Porcelain Tiles, by Size, 2015–2024

Table 4 Morocco Ceramic & Porcelain Tiles Market Value Share (US$ Mn) Forecast for Ceramic Wall Tiles, by Size, 2015–2024

Table 5 Morocco Ceramic & Porcelain Tiles Market Value Share (US$ Mn) Forecast for Ceramic Floor Tiles, by Size, 2015–2024

Table 6 Morocco Ceramic & Porcelain Tiles Market Value Share (US$ Mn) Forecast, for Thin Tiles by Size, 2015–2024

Table 7 Morocco Bathroom Materials Market Value Share (US$ Thousand) Forecast, by Type, 2015–2024

Table 8 Morocco Bathroom Materials Market Value Share (US$ Thousand) Forecast, for Floor, by Type, 2015–2024

Table 9 Morocco Bathroom Materials Market Value Share (US$ Thousand) Forecast, for Wall, by Type, 2015–2024

Table 10 Morocco Bathroom Furniture & Accessories Market Value Share (US$ Thousand) Forecast, by Type, 2015–2024

Table 11 Morocco Bathroom Furniture & Accessories Market Value Share (US$ Thousand) Forecast, by Type, 2015–2024

Table 12 Morocco Ceramic & Porcelain Tiles Market Value Share (US$ Mn) Forecast, by City, 2015–2024

Table 13 Morocco Bathroom Materials Market Value Share (US$ Thousand) Forecast, by City, 2015–2024

Table 14 Morocco Bathroom Furniture & Accessories Market Value Share (US$ Thousand) Forecast, by City, 2015–2024

Table 15 Casablanca Ceramic & Porcelain Tiles Market Value Share (US$ Mn) Forecast, by Type, 2015–2024

Table 16 Casablanca Ceramic & Porcelain Tiles Market Value Share (US$ Mn) Forecast, for Glazed Porcelain Tiles, by Size, 2015–2024

Table 17 Casablanca Ceramic & Porcelain Tiles Market Value Share (US$ Mn) Forecast, for Full Body Porcelain Tiles, by Size, 2015–2024

Table 18 Casablanca Ceramic & Porcelain Tiles Market Value Share (US$ Mn) Forecast, for Ceramic Wall Tiles, by Size, 2015–2024

Table 19 Casablanca Ceramic & Porcelain Tiles Market Value Share (US$ Mn) Forecast, for Ceramic Floor Tiles, by Size, 2015–2024

Table 20 Casablanca Ceramic & Porcelain Tiles Market Value Share (US$ Mn) Forecast, for Thin Tiles, by Size, 2015–2024

Table 21 Casablanca Bathroom Materials Market Value Share (US$ Thousand) Forecast, by Type, 2015–2024

Table 22 Casablanca Bathroom Materials Market Value Share (US$ Thousand) Forecast, for Floor, by Type, 2015–2024

Table 23 Casablanca Bathroom Materials Market Value Share (US$ Thousand) Forecast, for Wall, by Type, 2015–2024

Table 24 Casablanca Bathroom Furniture & Accessories Market Value Share (US$ Thousand) Forecast, by Type, 2015–2024

Table 25 Casablanca Bathroom Accessories Market Value Share (US$ Thousand) Forecast, by Type, 2015–2024

Table 26 Rabat Ceramic & Porcelain Tiles Market Value Share (US$ Mn) Forecast, by Type, 2015–2024

Table 27 Rabat Ceramic & Porcelain Tiles Market Value Share (US$ Mn) Forecast, for Glazed Porcelain Tiles, by Size, 2015–2024

Table 28 Rabat Ceramic & Porcelain Tiles Market Value Share (US$ Mn) Forecast, for Full Body Porcelain Tiles by Size, 2015–2024

Table 29 Rabat Ceramic & Porcelain Tiles Market Value Share (US$ Mn) Forecast, for Ceramic Wall Tiles by Size, 2015–2024

Table 30 Rabat Ceramic & Porcelain Tiles Market Value Share (US$ Mn) Forecast, for Ceramic Floor Tiles by Size, 2015–2024

Table 31 Rabat Ceramic & Porcelain Tiles Market Value Share (US$ Mn) Forecast, for Thin Tiles by Size, 2015–2024

Table 32 Rabat Bathroom Materials Market Value Share (US$ Thousand) Forecast, by Type, 2015–2024

Table 33 Rabat Bathroom Materials Market Value Share (US$ Thousand) Forecast, for Floor by Type, 2015–2024

Table 34 Rabat Bathroom Materials Market Value Share (US$ Thousand) Forecast, for Wall by Type, 2015–2024

Table 35 Rabat Bathroom Furniture & Accessories Market Value Share (US$ Thousand) Forecast, by Type, 2015–2024

Table 36 Rabat Bathroom Furniture & Accessories Market Value Share (US$ Thousand) Forecast, by Type, 2015–2024

Table 37 Fez Ceramic & Porcelain Tiles Market Value Share (US$ Mn) Forecast, by Type, 2015–2024

Table 38 Fez Ceramic & Porcelain Tiles Market Value Share (US$ Mn) Forecast, for Glazed Porcelain Tiles, by Size, 2015–2024

Table 39 Fez Ceramic & Porcelain Tiles Market Value Share (US$ Mn) Forecast, for Full Body Porcelain Tiles, by Size, 2015–2024

Table 40 Fez Ceramic & Porcelain Tiles Market Value Share (US$ Mn) Forecast, for Ceramic Wall Tiles, by Size, 2015–2024

Table 41 Fez Ceramic & Porcelain Tiles Market Value Share (US$ Mn) Forecast for Ceramic Floor Tiles, by Size, 2015–2024

Table 42 Fez Ceramic & Porcelain Tiles Market Value Share (US$ Mn) Forecast, for Thin Tiles, by Size, 2015–2024

Table 43 Fez Bathroom Materials Market Value Share (US$ Thousand) Forecast, by Type, 2015–2024

Table 44 Fez Bathroom Materials Market Value Share (US$ Thousand) Forecast, for Floor, by Type, 2015–2024

Table 45 Fez Bathroom Materials Market Value Share (US$ Thousand) Forecast, for Wall, by Type, 2015–2024

Table 46 Fez Bathroom Furniture & Accessories Market Value Share (US$ Thousand) Forecast, by Type, 2015–2024

Table 47 Fez Bathroom Furniture & Accessories Market Value Share (US$ Thousand) Forecast, by Type, 2015–2024

Table 48 Marrakech Ceramic & Porcelain Tiles Market Value Share (US$ Mn) Forecast, by Type, 2015–2024

Table 49 Marrakech Ceramic & Porcelain Tiles Market Value Share (US$ Mn) Forecast, for Glazed Porcelain Tiles, by Size, 2015–2024

Table 50 Marrakech Ceramic & Porcelain Tiles Market Value Share (US$ Mn) Forecast, for Full Body Porcelain Tiles, by Size, 2015–2024

Table 51 Marrakech Ceramic & Porcelain Tiles Market Value Share (US$ Mn) Forecast, for Ceramic Wall Tiles, by Size, 2015–2024

Table 52 Marrakech Ceramic & Porcelain Tiles Market Value Share (US$ Mn) Forecast, for Ceramic Floor Tiles, by Size, 2015–2024

Table 53 Marrakech Ceramic & Porcelain Tiles Market Value Share (US$ Mn) Forecast, for Thin Tiles, by Size, 2015–2024

Table 54 Marrakech Bathroom Materials Market Value Share (US$ Thousand) Forecast, by Type, 2015–2024

Table 55 Marrakech Bathroom Materials Market Value Share (US$ Thousand) Forecast, for Floor, by Type, 2015–2024

Table 56 Marrakech Bathroom Materials Market Value Share (US$ Thousand) Forecast, for Wall, by Type, 2015–2024

Table 57 Marrakech Bathroom Furniture & Accessories Market Value Share (US$ Thousand) Forecast, by Type, 2015–2024

Table 58 Marrakech Bathroom Furniture & Accessories Market Value Share (US$ Thousand) Forecast, by Type, 2015–2024

Table 59 Agadir Ceramic & Porcelain Tiles Market Value Share (US$ Mn) Forecast, by Type, 2015–2024

Table 60 Agadir Ceramic & Porcelain Tiles Market Value Share (US$ Mn) Forecast, for Glazed Porcelain Tiles, by Size, 2015–2024

Table 61 Agadir Ceramic & Porcelain Tiles Market Value Share (US$ Mn) Forecast, for Full Body Porcelain Tiles, by Size, 2015–2024

Table 62 Agadir Ceramic & Porcelain Tiles Market Value Share (US$ Mn) Forecast, for Ceramic Wall Tiles, by Size, 2015–2024

Table 63 Agadir Ceramic & Porcelain Tiles Market Value Share (US$ Mn) Forecast, for Ceramic Floor Tiles, by Size, 2015–2024

Table 64 Agadir Ceramic & Porcelain Tiles Market Value Share (US$ Mn) Forecast, for Thin Tiles, by Size, 2015–2024

Table 65 Agadir Bathroom Materials Market Value Share (US$ Thousand) Forecast, by Type, 2015–2024

Table 66 Agadir Bathroom Materials Market Value Share (US$ Thousand) Forecast, for Floor, by Type, 2015–2024

Table 67 Agadir Bathroom Materials Market Value Share (US$ Thousand) Forecast, for Wall, by Type, 2015–2024

Table 68 Agadir Bathroom Furniture & Accessories Market Value Share (US$ Thousand) Forecast, by Type, 2015–2024

Table 69 Agadir Bathroom Furniture & Accessories Market Value Share (US$ Thousand) Forecast, by Type, 2015–2024

Table 70 Tangier Ceramic & Porcelain Tiles Market Value Share (US$ Mn) Forecast, by Type, 2015–2024

Table 71 Tangier Ceramic & Porcelain Tiles Market Value Share (US$ Mn) Forecast, for Glazed Porcelain Tiles, by Size, 2015–2024

Table 72 Tangier Ceramic & Porcelain Tiles Market Value Share (US$ Mn) Forecast, for Full Body Porcelain Tiles, by Size, 2015–2024

Table 73 Tangier Ceramic & Porcelain Tiles Market Value Share (US$ Mn) Forecast, for Ceramic Wall Tiles, by Size, 2015–2024

Table 74 Tangier Ceramic & Porcelain Tiles Market Value Share (US$ Mn) Forecast, for Ceramic Floor Tiles, by Size, 2015–2024

Table 75 Tangier Ceramic & Porcelain Tiles Market Value Share (US$ Mn) Forecast, for Thin Tiles, by Size, 2015–2024

Table 76 Tangier Bathroom Materials Market Value Share (US$ Thousand) Forecast, by Type, 2015–2024

Table 77 Tangier Bathroom Materials Market Value Share (US$ Thousand) Forecast, for Floor, by Type, 2015–2024

Table 78 Tangier Bathroom Materials Market Value Share (US$ Thousand) Forecast, for Wall, by Type, 2015–2024

Table 79 Tangier Bathroom Furniture & Accessories Market Value Share (US$ Thousand) Forecast, by Type, 2015–2024

Table 80 Tangier Bathroom Furniture & Accessories Market Value Share (US$ Thousand) Forecast, by Type, 2015–2024

Table 81 Rest of Morocco Ceramic & Porcelain Tiles Market Value Share (US$ Mn) Forecast, by Type, 2015–2024

Table 82 Rest of Morocco Ceramic & Porcelain Tiles Market Value Share (US$ Mn) Forecast, for Glazed Porcelain Tiles, by Size, 2015–2024

Table 83 Rest of Morocco Ceramic & Porcelain Tiles Market Value Share (US$ Mn) Forecast, for Full Body Porcelain Tiles, by Size, 2015–2024

Table 84 Rest of Morocco Ceramic & Porcelain Tiles Market Value Share (US$ Mn) Forecast, for Ceramic Wall Tiles, by Size, 2015–2024

Table 85 Rest of Morocco Ceramic & Porcelain Tiles Market Value Share (US$ Mn) Forecast, for Ceramic Floor Tiles, by Size, 2015–2024

Table 86 Rest of Morocco Ceramic & Porcelain Tiles Market Value Share (US$ Mn) Forecast, for Thin Tiles, by Size, 2015–2024

Table 87 Rest of Morocco Bathroom Materials Market Value Share (US$ Thousand) Forecast, by Type, 2015–2024

Table 88 Rest of Morocco Bathroom Materials Market Value Share (US$ Thousand) Forecast, for Floor, by Type, 2015–2024

Table 89 Rest of Morocco Bathroom Materials Market Value Share (US$ Thousand) Forecast, for Wall, by Type, 2015–2024

Table 90 Rest of Morocco Bathroom Furniture & Accessories Market Value Share (US$ Thousand) Forecast, by Type, 2015–2024

Table 91 Rest of Morocco Bathroom Furniture & Accessories Market Value Share (US$ Thousand) Forecast, by Type, 2015–2024

List of Figures

Figure 1 Morocco Ceramic & Porcelain Tiles Market, Value Share Analysis, by Product Type, 2015 and 2024

Figure 2 Ceramic & Porcelain Tiles Market Attractiveness Analysis, by Product Type

Figure 3 Morocco Bathroom Materials Market Value Share Analysis, by Type, 2015 and 2024

Figure 4 Bathroom Materials Market Attractiveness Analysis by Type

Figure 5 Morocco Bathroom Furniture & Accessories Market Value Share Analysis, by Product Type, 2015 and 2024

Figure 6 Bathroom Materials Market Attractiveness Analysis, by Type

Figure 7 Morocco Ceramic & Porcelain Tiles Market Size (US$ Mn) Forecast, 2015–2024

Figure 8 Morocco Ceramic & Porcelain Tiles Market Attractiveness Analysis, by City

Figure 9 Morocco Bathroom Materials Market Size (US$ Thousand) Forecast, 2015–2024

Figure 10 Morocco Bathroom Materials Market Attractiveness Analysis, by City

Figure 11 Morocco Bathroom Furniture & Accessories Market Size (US$ Thousand) Forecast, 2015–2024

Figure 12 Morocco Bathroom Furniture & Accessories Market Attractiveness Analysis, by City

Figure 13 Morocco Ceramic & Porcelain Tiles Market Value Share Analysis, by City, 2015 and 2024

Figure 14 Morocco Bathroom Materials Market Value Share Analysis, by City, 2015 and 2024

Figure 15 Bathroom Furniture & Accessories Market Value Share Analysis, by City, 2015 and 2024