Montan Wax is a mineral wax produced from peat and lignite and can be used as an alternative for carnauba wax and beeswax. Montan wax has a high melting point and is hard and brittle.

The rise in demand for fruit wax is having a positive impact on the montan wax demand. Montan Wax offers edible coatings for fruits. This wax coating makes fruits more long lasting and improves the overall quality.

The montan wax market worldwide is anticipated to grow at a substantial rate mainly because of an increase in demand for wax polishes in furniture and automotive sectors.

The products in the montan wax market have a wide range of applications in industries such as machinery, chemical, electrical, cosmetics, and polish. The market is anticipated to grow rapidly in the upcoming years due to the increasing demand for technical wax in coatings, cosmetics, and paints industries. An increase in demand for the production of high-quality synthetic wax is an important driver for the growth in investments in the montan wax market.

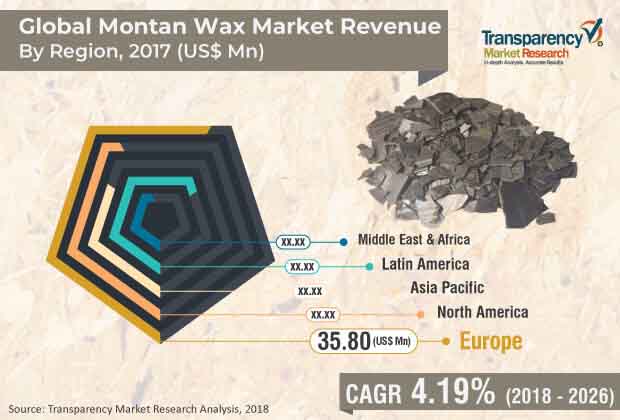

Europe and North America have emerged as the important regions in the global montan wax market. The montan wax market in countries such as Germany is estimated to grow at a swift rate, in turn boosting the overall market in Europe.

China has been a large end user of montan wax products in Asia Pacific. Latin America, Middle East and Africa are developing regions in the global montan wax market.

The important players in the global montan wax market need to emphasize on promoting the advantages of montan wax. Manufacturers in important regional markets are experimenting on environment-friendly extraction technology. Manufacturers are also aiming to make the production process cost effective, which could help in widening the application base

Montana wax market thrives on the wide array of applications in wax polish, cosmetics, chemical, machinery, electrical, and numerous other industries. Economies striving for leveraging the high commercial value of montan wax are leaning on relentlessly adopting advanced extraction technologies. These pertain to pretreatment of raw materials in order to vary resin content to meet the desired end-use industries’ requirements. Producers in the montan wax market are keen on attaining the objective of making production process cost effective in order to broaden the application base. Rise in demand for producing high-quality synthetic wax is a key driver for rise in industry investments in the market. In the wake of still-emerging Covid-19 pandemic and its impact on manufacturing sectors, the supply chain strategies of various producers of montan wax have undergone realignment. Chemical companies in the montan wax market have in recent months adopted raw materials sourcing strategies with the aim of achieving resiliency and keep the growth momentum intact against the Covid-19 disruptions.

The outlook of the montan wax market is expected to shine in coming months, fueled by rising demand for technical wax applications in the paints and coatings and cosmetics industries. Producers in key regional markets are testing environmental-friendly extraction technology. The aim is to attain an optimal percentage of wax content that is extracted. An example of such a technology is solid-liquid extraction. Countries who had sizable shares in the production of montan wax have been continuously expanding research and development. Future research directions aim at studying the pharmacological effects of montan wax, which might spur its prospect in the medical industry. Producers aiming to develop montan wax for meeting the needs of cosmetics industry have already achieved products with good toxicity profile. Also, it is commercially important to explore application of montan wax resin to make the entire process economically profitable for market players.

Montan wax is a hard mineral wax obtained from lignite and peat. It was first produced in northern Bohemia (the Czech Republic) in the late 1800s. The crude wax obtained is dark brown; however, the wax turns light yellow to white in color after purification with solvent extraction. Montan wax has been used as a substitute for carnauba wax and beeswax. It is hard and brittle and has high melting point. Montan wax is also known as lignite wax or OP wax. Commercially viable deposits exist in a few locations. These include Amsdorf, Germany, and the Ione Basin, California. Montan wax is available as crude wax or refined wax. Refined wax is also called bleached wax.

The global montan wax market is anticipated to expand at a significant pace during the forecast period primarily due to the rise in demand for wax polishes in automotive and furniture industries. The montan wax market was valued at US$ 118 thousand in 2017 and is expected to expand at a CAGR of more than 4.0% during the forecast period. Increase in demand for fruit wax is boosting the demand for montan wax. Demand for montan wax in is high, as it provides edible coatings and films for fruits. The wax coating helps improve the shelf-life and the quality of fruits and vegetables.

Key players operating in the global montan wax market need to focus on promoting benefits of montan wax. Major players are engaged in establishing new facilities and entering into acquisitions and mergers to develop and launch new products. These strategies are likely to propel the montan wax market during the forecast period. On February 26, 2018, Clariant launched a family of high-performance waxes based on renewable feedstock. This is a non-food-competing by-product from the production of rice bran oil and is available in large quantities. In August 2017, ALTANA acquired a technology portfolio and R&D platform from NuLabel Technologies, Inc. based in the U.S. It comprises innovative technologies of additive manufacturing of sustainable decoration solutions as well as novel technology for resalable packaging.

Based on end-use industry, the global montan wax market has been divided into cosmetics, pharmaceuticals, rubbers, plastics, electrical, wax polishes, machinery, agriculture & forestry, leather & textiles, and others (including metal, wood, and stone). Montan wax is primarily used for wax polishes. It is used for floors, furniture, leather care polish, and car polish applications. Wax is helps improve feel and appearance of materials and surfaces. Furthermore, montan wax is employed as high performance additive in the plastic industry. It is used as combined external and internal lubricants, nucleating additives, and dispersing agents in various types of plastics and processing methods.

Based on region, the global montan wax market has been segregated into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. North America and Europe are key regions of the global market. In terms of consumption, Europe holds major share of the global montan wax market. The montan wax market in Germany and Russia & CIS is anticipated to expand at a rapid pace during the forecast period. China is a prominent consumer of montan wax in Asia Pacific. Middle East & Africa and Latin America are emerging regions of the global montan wax market.

Key players operating in the global montan wax market include ROMONTA GmbH, Clariant, Mayur Dyes & Chemicals Corporation, S. KATO & CO., Yunphos, Poth Hille, Frank B. Ross Co., Inc., Völpker Special Products GmbH, FIRST SOURCE WORLDWIDE, LLC., AmeriLubes, L.L.C., Carmel Industries, Parchvale Ltd., MÜNZING Corporation, and ALTANA.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Research Highlights

1.4. Key Research Objectives

2. Assumptions and Research Methodology

3. Executive Summary: Global Montan Wax Market, 2017–2026

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Key Market Developments

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Porter's Five Forces Analysis

4.4. Regulatory Landscape

4.5. Value Chain Analysis

4.6. List of Suppliers

4.7. List of Potential Customers

4.8. Montan Wax Import/Export Analysis

4.9. Montan Wax Price Trend Analysis, by Region

4.10. Production Scenario of Crude Montan Wax, by Country, 2017

4.11. Global Montan Wax Market Forecast, 2017–2026

5. Global Montan Wax Market Analysis and Forecast, by Function, 2017–2026

5.1. Key Trends

5.2. Definitions & Introduction

5.3. Global Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by Function, 2017–2026

5.3.1. Emulsions

5.3.2. Lubricants

5.3.3. Thickening Agents

5.3.4. Release Agents

5.3.5. Coating Agents

5.3.6. Nucleating Agents

5.3.7. Dispersants

5.3.8. Others

6. Global Montan Wax Market Analysis and Forecast, by End-use Industry, 2017–2026

6.1. Key Trends

6.2. Definitions & Introduction

6.3. Global Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by End-use Industry, 2017–2026

6.3.1. Cosmetics

6.3.2. Pharmaceuticals

6.3.3. Rubbers

6.3.4. Plastics

6.3.5. Electricals

6.3.6. Wax Polishes

6.3.7. Machinery

6.3.8. Agriculture & Forestry

6.3.9. Leather & Textile

6.3.10. Others

7. Global Montan Wax Market Analysis and Forecast, by Region, 2017–2026

7.1. Key Trends

7.2. Definitions & Introduction

7.3. Global Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by Region, 2017–2026

7.3.1. North America

7.3.2. Europe

7.3.3. Asia Pacific

7.3.4. Middle East & Africa

7.3.5. Latin America

7.4. Global Montan Wax Market Attractiveness Analysis, by Function, End-use Industry, and Region

8. North America Montan Wax Market Analysis and Forecast, 2017–2026

8.1. Key Findings

8.2. North America Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by Function, 2017–2026

8.2.1. Emulsions

8.2.2. Lubricants

8.2.3. Thickening Agents

8.2.4. Release Agents

8.2.5. Coating Agents

8.2.6. Nucleating Agents

8.2.7. Dispersants

8.2.8. Others

8.3. North America Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by End-use Industry, 2017–2026

8.3.1. Cosmetics

8.3.2. Pharmaceuticals

8.3.3. Rubbers

8.3.4. Plastics

8.3.5. Electricals

8.3.6. Wax Polishes

8.3.7. Machinery

8.3.8. Agriculture & Forestry

8.3.9. Leather & Textile

8.3.10. Others

8.4. U.S. Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by Function, 2017–2026

8.4.1. Emulsions

8.4.2. Lubricants

8.4.3. Thickening Agents

8.4.4. Release Agents

8.4.5. Coating Agents

8.4.6. Nucleating Agents

8.4.7. Dispersants

8.4.8. Others

8.5. U.S. Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by End-use Industry, 2017–2026

8.5.1. Cosmetics

8.5.2. Pharmaceuticals

8.5.3. Rubbers

8.5.4. Plastics

8.5.5. Electricals

8.5.6. Wax Polishes

8.5.7. Machinery

8.5.8. Agriculture & Forestry

8.5.9. Leather & Textile

8.5.10. Others

8.6. Canada Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by Function, 2017–2026

8.6.1. Emulsions

8.6.2. Lubricants

8.6.3. Thickening Agents

8.6.4. Release Agents

8.6.5. Coating Agents

8.6.6. Nucleating Agents

8.6.7. Dispersants

8.6.8. Others

8.7. Canada Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by End-use Industry, 2017–2026

8.7.1. Cosmetics

8.7.2. Pharmaceuticals

8.7.3. Rubbers

8.7.4. Plastics

8.7.5. Electricals

8.7.6. Wax Polishes

8.7.7. Machinery

8.7.8. Agriculture & Forestry

8.7.9. Leather & Textile

8.7.10. Others

8.8. North America Montan Wax Market Attractiveness Analysis

9. Europe Montan Wax Market Analysis and Forecast, 2017–2026

9.1. Key Findings

9.2. Europe Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by Function, 2017–2026

9.2.1. Emulsions

9.2.2. Lubricants

9.2.3. Thickening Agents

9.2.4. Release Agents

9.2.5. Coating Agents

9.2.6. Nucleating Agents

9.2.7. Dispersants

9.2.8. Others

9.3. Europe Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by End-use Industry, 2017–2026

9.3.1. Cosmetics

9.3.2. Pharmaceuticals

9.3.3. Rubbers

9.3.4. Plastics

9.3.5. Electricals

9.3.6. Wax Polishes

9.3.7. Machinery

9.3.8. Agriculture & Forestry

9.3.9. Leather & Textile

9.3.10. Others

9.4. Germany Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by Function, 2017–2026

9.4.1. Emulsions

9.4.2. Lubricants

9.4.3. Thickening Agents

9.4.4. Release Agents

9.4.5. Coating Agents

9.4.6. Nucleating Agents

9.4.7. Dispersants

9.4.8. Others

9.5. Germany Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by End-use Industry, 2017–2026

9.5.1. Cosmetics

9.5.2. Pharmaceuticals

9.5.3. Rubbers

9.5.4. Plastics

9.5.5. Electricals

9.5.6. Wax Polishes

9.5.7. Machinery

9.5.8. Agriculture & Forestry

9.5.9. Leather & Textile

9.5.10. Others

9.6. U.K. Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by Function, 2017–2026

9.6.1. Emulsions

9.6.2. Lubricants

9.6.3. Thickening Agents

9.6.4. Release Agents

9.6.5. Coating Agents

9.6.6. Nucleating Agents

9.6.7. Dispersants

9.6.8. Others

9.7. U.K. Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by End-use Industry, 2017–2026

9.7.1. Cosmetics

9.7.2. Pharmaceuticals

9.7.3. Rubbers

9.7.4. Plastics

9.7.5. Electricals

9.7.6. Wax Polishes

9.7.7. Machinery

9.7.8. Agriculture & Forestry

9.7.9. Leather & Textile

9.7.10. Others

9.8. Spain Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by Function, 2017–2026

9.8.1. Emulsions

9.8.2. Lubricants

9.8.3. Thickening Agents

9.8.4. Release Agents

9.8.5. Coating Agents

9.8.6. Nucleating Agents

9.8.7. Dispersants

9.8.8. Others

9.9. Spain Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by End-use Industry, 2017–2026

9.9.1. Cosmetics

9.9.2. Pharmaceuticals

9.9.3. Rubbers

9.9.4. Plastics

9.9.5. Electricals

9.9.6. Wax Polishes

9.9.7. Machinery

9.9.8. Agriculture & Forestry

9.9.9. Leather & Textile

9.9.10. Others

9.10. Italy Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by Function, 2017–2026

9.10.1. Emulsions

9.10.2. Lubricants

9.10.3. Thickening Agents

9.10.4. Release Agents

9.10.5. Coating Agents

9.10.6. Nucleating Agents

9.10.7. Dispersants

9.10.8. Others

9.11. Italy Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by End-use Industry, 2017–2026

9.11.1. Cosmetics

9.11.2. Pharmaceuticals

9.11.3. Rubbers

9.11.4. Plastics

9.11.5. Electricals

9.11.6. Wax Polishes

9.11.7. Machinery

9.11.8. Agriculture & Forestry

9.11.9. Leather & Textile

9.11.10. Others

9.12. France Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by Function, 2017–2026

9.12.1. Emulsions

9.12.2. Lubricants

9.12.3. Thickening Agents

9.12.4. Release Agents

9.12.5. Coating Agents

9.12.6. Nucleating Agents

9.12.7. Dispersants

9.12.8. Others

9.13. France Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by End-use Industry, 2017–2026

9.13.1. Cosmetics

9.13.2. Pharmaceuticals

9.13.3. Rubbers

9.13.4. Plastics

9.13.5. Electricals

9.13.6. Wax Polishes

9.13.7. Machinery

9.13.8. Agriculture & Forestry

9.13.9. Leather & Textile

9.13.10. Others

9.14. Russia & CIS Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by Function, 2017–2026

9.14.1. Emulsions

9.14.2. Lubricants

9.14.3. Thickening Agents

9.14.4. Release Agents

9.14.5. Coating Agents

9.14.6. Nucleating Agents

9.14.7. Dispersants

9.14.8. Others

9.15. Russia & CIS Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by End-use Industry, 2017–2026

9.15.1. Cosmetics

9.15.2. Pharmaceuticals

9.15.3. Rubbers

9.15.4. Plastics

9.15.5. Electricals

9.15.6. Wax Polishes

9.15.7. Machinery

9.15.8. Agriculture & Forestry

9.15.9. Leather & Textile

9.15.10. Others

9.16. Rest of Europe Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by Function, 2017–2026

9.16.1. Emulsions

9.16.2. Lubricants

9.16.3. Thickening Agents

9.16.4. Release Agents

9.16.5. Coating Agents

9.16.6. Nucleating Agents

9.16.7. Dispersants

9.16.8. Others

9.17. Rest of Europe Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by End-use Industry, 2017–2026

9.17.1. Cosmetics

9.17.2. Pharmaceuticals

9.17.3. Rubbers

9.17.4. Plastics

9.17.5. Electricals

9.17.6. Wax Polishes

9.17.7. Machinery

9.17.8. Agriculture & Forestry

9.17.9. Leather & Textile

9.17.10. Others

10. Europe Montan Wax Market Attractiveness Analysis

11. Asia Pacific Montan Wax Market Analysis & Forecast, 2017–2026

11.1. Key Findings

11.2. Asia Pacific Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by Function, 2017–2026

11.2.1. Emulsions

11.2.2. Lubricants

11.2.3. Thickening Agents

11.2.4. Release Agents

11.2.5. Coating Agents

11.2.6. Nucleating Agents

11.2.7. Dispersants

11.2.8. Others

11.3. Asia Pacific Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by End-use Industry, 2017–2026

11.3.1. Cosmetics

11.3.2. Pharmaceuticals

11.3.3. Rubbers

11.3.4. Plastics

11.3.5. Electricals

11.3.6. Wax Polishes

11.3.7. Machinery

11.3.8. Agriculture & Forestry

11.3.9. Leather & Textile

11.3.10. Others

11.4. China Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by Function, 2017–2026

11.4.1. Emulsions

11.4.2. Lubricants

11.4.3. Thickening Agents

11.4.4. Release Agents

11.4.5. Coating Agents

11.4.6. Nucleating Agents

11.4.7. Dispersants

11.4.8. Others

11.5. China Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by End-use Industry, 2017–2026

11.5.1. Cosmetics

11.5.2. Pharmaceuticals

11.5.3. Rubbers

11.5.4. Plastics

11.5.5. Electricals

11.5.6. Wax Polishes

11.5.7. Machinery

11.5.8. Agriculture & Forestry

11.5.9. Leather & Textile

11.5.10. Others

11.6. Japan Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by Function, 2017–2026

11.6.1. Emulsions

11.6.2. Lubricants

11.6.3. Thickening Agents

11.6.4. Release Agents

11.6.5. Coating Agents

11.6.6. Nucleating Agents

11.6.7. Dispersants

11.6.8. Others

11.7. Japan Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by End-use Industry, 2017–2026

11.7.1. Cosmetics

11.7.2. Pharmaceuticals

11.7.3. Rubbers

11.7.4. Plastics

11.7.5. Electricals

11.7.6. Wax Polishes

11.7.7. Machinery

11.7.8. Agriculture & Forestry

11.7.9. Leather & Textile

11.7.10. Others

11.8. India Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by Function, 2017–2026

11.8.1. Emulsions

11.8.2. Lubricants

11.8.3. Thickening Agents

11.8.4. Release Agents

11.8.5. Coating Agents

11.8.6. Nucleating Agents

11.8.7. Dispersants

11.8.8. Others

11.9. India Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by End-use Industry, 2017–2026

11.9.1. Cosmetics

11.9.2. Pharmaceuticals

11.9.3. Rubbers

11.9.4. Plastics

11.9.5. Electricals

11.9.6. Wax Polishes

11.9.7. Machinery

11.9.8. Agriculture & Forestry

11.9.9. Leather & Textile

11.9.10. Others

11.10. ASEAN Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by Function, 2017–2026

11.10.1. Emulsions

11.10.2. Lubricants

11.10.3. Thickening Agents

11.10.4. Release Agents

11.10.5. Coating Agents

11.10.6. Nucleating Agents

11.10.7. Dispersants

11.10.8. Others

11.11. ASEAN Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by End-use Industry, 2017–2026

11.11.1. Cosmetics

11.11.2. Pharmaceuticals

11.11.3. Rubbers

11.11.4. Plastics

11.11.5. Electricals

11.11.6. Wax Polishes

11.11.7. Machinery

11.11.8. Agriculture & Forestry

11.11.9. Leather & Textile

11.11.10. Others

11.12. Rest of Asia Pacific Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by Function, 2017–2026

11.12.1. Emulsions

11.12.2. Lubricants

11.12.3. Thickening Agents

11.12.4. Release Agents

11.12.5. Coating Agents

11.12.6. Nucleating Agents

11.12.7. Dispersants

11.12.8. Others

11.13. Rest of Asia Pacific Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by End-use Industry, 2017–2026

11.13.1. Cosmetics

11.13.2. Pharmaceuticals

11.13.3. Rubbers

11.13.4. Plastics

11.13.5. Electricals

11.13.6. Wax Polishes

11.13.7. Machinery

11.13.8. Agriculture & Forestry

11.13.9. Leather & Textile

11.13.10. Others

11.14. Asia Pacific Montan Wax Market Attractiveness Analysis

12. Latin America Montan Wax Market Analysis & Forecast, 2017–2026

12.1. Key Findings

12.2. Latin America Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by Function, 2017–2026

12.2.1. Emulsions

12.2.2. Lubricants

12.2.3. Thickening Agents

12.2.4. Release Agents

12.2.5. Coating Agents

12.2.6. Nucleating Agents

12.2.7. Dispersants

12.2.8. Others

12.3. Latin America Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by End-use Industry, 2017–2026

12.3.1. Cosmetics

12.3.2. Pharmaceuticals

12.3.3. Rubbers

12.3.4. Plastics

12.3.5. Electricals

12.3.6. Wax Polishes

12.3.7. Machinery

12.3.8. Agriculture & Forestry

12.3.9. Leather & Textile

12.3.10. Others

12.4. Brazil Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by Function, 2017–2026

12.4.1. Emulsions

12.4.2. Lubricants

12.4.3. Thickening Agents

12.4.4. Release Agents

12.4.5. Coating Agents

12.4.6. Nucleating Agents

12.4.7. Dispersants

12.4.8. Others

12.5. Brazil Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by End-use Industry, 2017–2026

12.5.1. Cosmetics

12.5.2. Pharmaceuticals

12.5.3. Rubbers

12.5.4. Plastics

12.5.5. Electricals

12.5.6. Wax Polishes

12.5.7. Machinery

12.5.8. Agriculture & Forestry

12.5.9. Leather & Textile

12.5.10. Others

12.6. Mexico Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by Function, 2017–2026

12.6.1. Emulsions

12.6.2. Lubricants

12.6.3. Thickening Agents

12.6.4. Release Agents

12.6.5. Coating Agents

12.6.6. Nucleating Agents

12.6.7. Dispersants

12.6.8. Others

12.7. Mexico Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by End-use Industry, 2017–2026

12.7.1. Cosmetics

12.7.2. Pharmaceuticals

12.7.3. Rubbers

12.7.4. Plastics

12.7.5. Electricals

12.7.6. Wax Polishes

12.7.7. Machinery

12.7.8. Agriculture & Forestry

12.7.9. Leather & Textile

12.7.10. Others

12.8. Rest of Latin America Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by Function, 2017–2026

12.8.1. Emulsions

12.8.2. Lubricants

12.8.3. Thickening Agents

12.8.4. Release Agents

12.8.5. Coating Agents

12.8.6. Nucleating Agents

12.8.7. Dispersants

12.8.8. Others

12.9. Rest of Latin America Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by End-use Industry, 2017–2026

12.9.1. Cosmetics

12.9.2. Pharmaceuticals

12.9.3. Rubbers

12.9.4. Plastics

12.9.5. Electricals

12.9.6. Wax Polishes

12.9.7. Machinery

12.9.8. Agriculture & Forestry

12.9.9. Leather & Textile

12.9.10. Others

12.10. Latin America Montan Wax Market Attractiveness Analysis

13. Middle East & Africa Montan Wax Market Analysis & Forecast, 2017–2026

13.1. Key Findings

13.2. Middle East & Africa Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by Function, 2017–2026

13.2.1. Emulsions

13.2.2. Lubricants

13.2.3. Thickening Agents

13.2.4. Release Agents

13.2.5. Coating Agents

13.2.6. Nucleating Agents

13.2.7. Dispersants

13.2.8. Others

13.2.9. Middle East & Africa Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by End-use Industry, 2017–2026 Cosmetics

13.2.10. Pharmaceuticals

13.2.11. Rubbers

13.2.12. Plastics

13.2.13. Electricals

13.2.14. Wax Polishes

13.2.15. Machinery

13.2.16. Agriculture & Forestry

13.2.17. Leather & Textile

13.2.18. Others

13.3. GCC Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by Function, 2017–2026

13.3.1. Emulsions

13.3.2. Lubricants

13.3.3. Thickening Agents

13.3.4. Release Agents

13.3.5. Coating Agents

13.3.6. Nucleating Agents

13.3.7. Dispersants

13.3.8. Others

13.4. GCC Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by End-use Industry, 2017–2026

13.4.1. Cosmetics

13.4.2. Pharmaceuticals

13.4.3. Rubbers

13.4.4. Plastics

13.4.5. Electricals

13.4.6. Wax Polishes

13.4.7. Machinery

13.4.8. Agriculture & Forestry

13.4.9. Leather & Textile

13.4.10. Others

13.5. South Africa Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by Function, 2017–2026

13.5.1. Emulsions

13.5.2. Lubricants

13.5.3. Thickening Agents

13.5.4. Release Agents

13.5.5. Coating Agents

13.5.6. Nucleating Agents

13.5.7. Dispersants

13.5.8. Others

13.6. South Africa Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by End-use Industry, 2017–2026

13.6.1. Cosmetics

13.6.2. Pharmaceuticals

13.6.3. Rubbers

13.6.4. Plastics

13.6.5. Electricals

13.6.6. Wax Polishes

13.6.7. Machinery

13.6.8. Agriculture & Forestry

13.6.9. Leather & Textile

13.6.10. Others

13.7. Rest of Middle East & Africa Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by Function, 2017–2026

13.7.1. Emulsions

13.7.2. Lubricants

13.7.3. Thickening Agents

13.7.4. Release Agents

13.7.5. Coating Agents

13.7.6. Nucleating Agents

13.7.7. Dispersants

13.7.8. Others

13.8. Rest of Middle East & Africa Montan Wax Market Volume (Tons) and Value (US$ Thousand) Analysis, by End-use Industry, 2017–2026

13.8.1. Cosmetics

13.8.2. Pharmaceuticals

13.8.3. Rubbers

13.8.4. Plastics

13.8.5. Electricals

13.8.6. Wax Polishes

13.8.7. Machinery

13.8.8. Agriculture & Forestry

13.8.9. Leather & Textile

13.8.10. Others

13.9. Middle East & Africa Montan Wax Market Attractiveness Analysis

14. Competition Landscape

14.1. Competition Matrix

14.2. Crude Montan wax Market Share Analysis, by Company (2017)

14.3. Refined Montan wax Market Share Analysis, by Company (2017)

14.4. Market Footprint Analysis, by End-use Industry

14.5. Competitive Business Strategies

14.5.1. ROMONTA GmbH

14.5.1.1. Headquarters, Year of Establishment, Revenue, Key Management, Number of Employees

14.5.1.2. Business Segments

14.5.1.3. Product Segments

14.5.2. Clariant

14.5.2.1. Headquarters, Year of Establishment, Revenue, Key Management, Number of Employees

14.5.2.2. Business Segments

14.5.2.3. Product Segments

14.5.2.4. Financial Overview

14.5.2.5. Strategic Overview

14.5.3. Mayur Dyes & Chemicals Corporation

14.5.3.1. Headquarters, Year of Establishment, Revenue, Key Management, Number of Employees

14.5.3.2. Business Segments

14.5.3.3. Product Segments

14.5.4. S. KATO & CO.

14.5.4.1. Headquarters, Year of Establishment, Revenue, Key Management, Number of Employees

14.5.4.2. Business Segments

14.5.4.3. Product Segments

14.5.5. Yunphos

14.5.5.1. Headquarters, Year of Establishment, Revenue, Key Management, Number of Employees

14.5.5.2. Business Segments

14.5.5.3. Product Segments

14.5.6. Poth Hille

14.5.6.1. Headquarters, Year of Establishment, Revenue, Key Management, Number of Employees

14.5.6.2. Business Segments

14.5.6.3. Product Segments

14.5.7. Frank B. Ross Co., Inc.

14.5.7.1. Headquarters, Year of Establishment, Revenue, Key Management, Number of Employees

14.5.7.2. Business Segments

14.5.7.3. Product Segments

14.5.8. Völpker Special Products GmbH

14.5.8.1. Headquarters, Year of Establishment, Revenue, Key Management, Number of Employees

14.5.8.2. Business Segments

14.5.8.3. Product Segments

14.5.9. FIRST SOURCE WORLDWIDE, LLC.

14.5.9.1. Headquarters, Year of Establishment, Revenue, Key Management, Number of Employees

14.5.9.2. Business Segments

14.5.9.3. Product Segments

14.5.10. AmeriLubes, L.L.C.

14.5.10.1. Headquarters, Year of Establishment, Revenue, Key Management, Number of Employees

14.5.10.2. Business Segments

14.5.10.3. Product Segments

14.5.11. Carmel Industries

14.5.11.1. Headquarters, Year of Establishment, Revenue, Key Management, Number of Employees

14.5.11.2. Business Segments

14.5.11.3. Product Segments

14.5.12. Parchvale Ltd.

14.5.12.1. Headquarters, Year of Establishment, Revenue, Key Management, Number of Employees

14.5.12.2. Business Segments

14.5.12.3. Product Segments

14.5.13. MÜNZING Corporation

14.5.13.1. Headquarters, Year of Establishment, Revenue, Key Management, Number of Employees

14.5.13.2. Business Segments

14.5.13.3. Product Segments

14.5.14. ALTANA

14.5.14.1. Headquarters, Year of Establishment, Revenue, Key Management, Number of Employees

14.5.14.2. Business Segments

14.5.14.3. Product Segments

14.5.14.4. Financial Overview

14.5.14.5. Strategic Overview

Table 1 Average Price Range of Montan Wax in US$, 2017

Table 2 Global Montan Wax Market Value (US$ Thousand) Forecast, by Function, 2017–2026

Table 3 Global Montan Wax Market Volume (Tons) Forecast, by Function, 2017–2026

Table 4 Global Montan Wax Market Value (US$ Thousand) Forecast, by End-use Industry, 2017–2026

Table 5 Global Montan Wax Market Volume (Tons) Forecast, by End-use Industry, 2017–2026

Table 6 Global Montan Wax Market Value (US$ Thousand) Forecast, by Region, 2017–2026

Table 7 Global Montan Wax Market Volume (Tons) Forecast, by Region, 2017–2026

Table 8 North America Montan Wax Market Value (US$ Thousand) Forecast, by Function, 2017–2026

Table 9 North America Montan Wax Market Volume (Tons) Forecast, by Function, 2017–2026

Table 10 North America Montan Wax Market Value (US$ Thousand) Forecast, by End-use Industry, 2017–2026

Table 11 North America Montan Wax Market Volume (Tons) Forecast, by End-use Industry, 2017–2026

Table 12 North America Montan Wax Market Value (US$ Thousand) Forecast, by Country, 2017–2026

Table 13 North America Montan Wax Market Volume (Tons) Forecast, by Country, 2017–2026

Table 14 U.S. Montan Wax Market Value (US$ Thousand) Forecast, by Function, 2017–2026

Table 15 U.S. Montan Wax Market Volume (Tons) Forecast, by Function, 2017–2026

Table 16 U.S. Montan Wax Market Value (US$ Thousand) Forecast, by End-use Industry, 2017–2026

Table 17 U.S. Montan Wax Market Volume (Tons) Forecast, by End-use Industry, 2017–2026

Table 18 Canada Montan Wax Market Value (US$ Thousand) Forecast, by Function, 2017–2026

Table 19 Canada Montan Wax Market Volume (Tons) Forecast, by Function, 2017–2026

Table 20 Canada Montan Wax Market Value (US$ Thousand) Forecast, by End-use Industry, 2017–2026

Table 21 Canada Montan Wax Market Volume (Tons) Forecast, by End-use Industry, 2017–2026

Table 22 Europe Montan Wax Market Value (US$ Thousand) Forecast, by Function, 2017–2026

Table 23 Europe Montan Wax Market Volume (Tons) Forecast, by Function, 2017–2026

Table 24 Europe Montan Wax Market Value (US$ Thousand) Forecast, by End-use Industry, 2017–2026

Table 25 Europe Montan Wax Market Volume (Tons) Forecast, by End-use Industry, 2017–2026

Table 26 Europe Montan Wax Market Value (US$ Thousand) Forecast, by Country and Sub-region, 2017–2026

Table 27 Europe Montan Wax Market Volume (Tons) Forecast, by Country and Sub-region, 2017–2026

Table 28 Germany Montan Wax Market Value (US$ Thousand) Forecast, by Function, 2017–2026

Table 29 Germany Montan Wax Market Volume (Tons) Forecast, by Function, 2017–2026

Table 30 Germany Montan Wax Market Value (US$ Thousand) Forecast, by End-use Industry, 2017–2026

Table 31 Germany Montan Wax Market Volume (Tons) Forecast, by End-use Industry, 2017–2026

Table 32 U.K. Montan Wax Market Value (US$ Thousand) Forecast, by Function, 2017–2026

Table 33 U.K. Montan Wax Market Volume (Tons) Forecast, by Function, 2017–2026

Table 34 U.K. Montan Wax Market Value (US$ Thousand) Forecast, by End-use Industry, 2017–2026

Table 35 U.K. Montan Wax Market Volume (Tons) Forecast, by End-use Industry, 2017–2026

Table 36 France Montan Wax Market Value (US$ Thousand) Forecast, by Function, 2017–2026

Table 37 France Montan Wax Market Volume (Tons) Forecast, by Function, 2017–2026

Table 38 France Montan Wax Market Value (US$ Thousand) Forecast, by End-use Industry, 2017–2026

Table 39 France Montan Wax Market Volume (Tons) Forecast, by End-use Industry, 2017–2026

Table 40 Italy Montan Wax Market Value (US$ Thousand) Forecast, by Function, 2017–2026

Table 41 Italy Montan Wax Market Volume (Tons) Forecast, by Function, 2017–2026

Table 42 Italy Montan Wax Market Value (US$ Thousand) Forecast, by End-use Industry, 2017–2026

Table 43 Italy Montan Wax Market Volume (Tons) Forecast, by End-use Industry, 2017–2026

Table 44 Spain Montan Wax Market Value (US$ Thousand) Forecast, by Function, 2017–2026

Table 45 Spain Montan Wax Market Volume (Tons) Forecast, by Function, 2017–2026

Table 46 Spain Montan Wax Market Value (US$ Thousand) Forecast, by End-use Industry, 2017–2026

Table 47 Spain Montan Wax Market Volume (Tons) Forecast, by End-use Industry, 2017–2026

Table 48 Russia & CIS Montan Wax Market Value (US$ Thousand) Forecast, by Function, 2017–2026

Table 49 Russia & CIS Montan Wax Market Volume (Tons) Forecast, by Function, 2017–2026

Table 50 Russia & CIS Montan Wax Market Value (US$ Thousand) Forecast, by End-use Industry, 2017–2026

Table 51 Russia & CIS Montan Wax Market Volume (Tons) Forecast, by End-use Industry, 2017–2026

Table 52 Rest of Europe Montan Wax Market Value (US$ Thousand) Forecast, by Function, 2017– 2026

Table 53 Rest of Europe Montan Wax Market Volume (Tons) Forecast, by Function, 2017–2026

Table 54 Rest of Europe Montan Wax Market Value (US$ Thousand) Forecast, by End-use Industry, 2017–2026

Table 55 Rest of Europe Montan Wax Market Volume (Tons) Forecast, by End-use Industry, 2017–2026

Table 56 Asia Pacific Montan Wax Market Value (US$ Thousand) Forecast, by Function, 2017–2026

Table 57 Asia Pacific Montan Wax Market Volume (Tons) Forecast, by Function, 2017–2026

Table 58 Asia Pacific Montan Wax Market Value (US$ Thousand) Forecast, by End-use Industry, 2017–2026

Table 59 Asia Pacific Montan Wax Market Volume (Tons) Forecast, by End-use Industry, 2017–2026

Table 60 Asia Pacific Montan Wax Market Value (US$ Thousand) Forecast, by Country and Sub-region, 2017–2026

Table 61 Asia Pacific Montan Wax Market Volume (Tons) Forecast, by Country and Sub-region, 2017–2026

Table 62 China Montan Wax Market Value (US$ Thousand) Forecast, by Function, 2017–2026

Table 63 China Montan Wax Market Volume (Tons) Forecast, by Function, 2017–2026

Table 64 China Montan Wax Market Value (US$ Thousand) Forecast, by End-use Industry, 2017–2026

Table 65 China Montan Wax Market Volume (Tons) Forecast, by End-use Industry, 2017–2026

Table 66 Japan Montan Wax Market Value (US$ Thousand) Forecast, by Function, 2017–2026

Table 67 Japan Montan Wax Market Volume (Tons) Forecast, by Function, 2017–2026

Table 68 Japan Montan Wax Market Value (US$ Thousand) Forecast, by End-use Industry, 2017–2026

Table 69 Japan Montan Wax Market Volume (Tons) Forecast, by End-use Industry, 2017–2026

Table 70 India Montan Wax Market Value (US$ Thousand) Forecast, by Function, 2017–2026

Table 71 India Montan Wax Market Volume (Tons) Forecast, by Function, 2017–2026

Table 72 India Montan Wax Market Value (US$ Thousand) Forecast, by End-use Industry, 2017–2026

Table 73 India Montan Wax Market Volume (Tons) Forecast, by End-use Industry, 2017–2026

Table 74 ASEAN Montan Wax Market Value (US$ Thousand) Forecast, by Function, 2017–2026

Table 75 ASEAN Montan Wax Market Volume (Tons) Forecast, by Function, 2017–2026

Table 76 ASEAN Montan Wax Market Value (US$ Thousand) Forecast, by End-use Industry, 2017–2026

Table 77 ASEAN Montan Wax Market Volume (Tons) Forecast, by End-use Industry, 2017–2026

Table 78 Rest of Asia Pacific Montan Wax Market Value (US$ Thousand) Forecast, by Function, 2017–2026

Table 79 Rest of Asia Pacific Montan Wax Market Volume (Tons) Forecast, by Function, 2017–2026

Table 80 Rest of Asia Pacific Montan Wax Market Value (US$ Thousand) Forecast, by End-use Industry, 2017–2026

Table 81 Rest of Asia Pacific Montan Wax Market Volume (Tons) Forecast, by End-use Industry, 2017–2026

Table 82 Latin America Montan Wax Market Value (US$ Thousand) Forecast, by Function, 2017–2026

Table 83 Latin America Montan Wax Market Volume (Tons) Forecast, by Function, 2017–2026

Table 84 Latin America Montan Wax Market Value (US$ Thousand) Forecast, by End-use Industry, 2017–2026

Table 85 Latin America Montan Wax Market Volume (Tons) Forecast, by End-use Industry, 2017–2026

Table 86 Latin America Montan Wax Market Value (US$ Thousand) Forecast, by Country and Sub-region, 2017–2026

Table 87 Latin America Montan Wax Market Volume (Tons) Forecast, by Country and Sub-region, 2017–2026

Table 88 Brazil Montan Wax Market Value (US$ Thousand) Forecast, by Function, 2017–2026

Table 89 Brazil Montan Wax Market Volume (Tons) Forecast, by Function, 2017–2026

Table 90 Brazil Montan Wax Market Value (US$ Thousand) Forecast, by End-use Industry, 2017–2026

Table 91 Brazil Montan Wax Market Volume (Tons) Forecast, by End-use Industry, 2017–2026

Table 92 Mexico Montan Wax Market Value (US$ Thousand) Forecast, by Function, 2017–2026

Table 93 Mexico Montan Wax Market Volume (Tons) Forecast, by Function, 2017–2026

Table 94 Mexico Montan Wax Market Value (US$ Thousand) Forecast, by End-use Industry, 2017–2026

Table 95 Mexico Montan Wax Market Volume (Tons) Forecast, by End-use Industry, 2017–2026

Table 96 Rest of Latin America Montan Wax Market Value (US$ Thousand) Forecast, by Function, 2017–2026

Table 97 Rest of Latin America Montan Wax Market Volume (Tons) Forecast, by Function, 2017–2026

Table 98 Rest of Latin America Montan Wax Market Value (US$ Thousand) Forecast, by End-use Industry, 2017– 2026

Table 99 Rest of Latin America Montan Wax Market Volume (Tons) Forecast, by End-use Industry, 2017–2026

Table 100 Middle East & Africa Montan Wax Market Value (US$ Thousand) Forecast, by Function, 2017–2026

Table 101 Middle East & Africa Montan Wax Market Volume (Tons) Forecast, by Function, 2017–2026

Table 102 Middle East & Africa Montan Wax Market Value (US$ Thousand) Forecast, by End-use Industry, 2017–2026

Table 103 Middle East & Africa Montan Wax Market Volume (Tons) Forecast, by End-use Industry, 2017–2026

Table 104 Middle East & Africa Montan Wax Market Value (US$ Thousand) Forecast, by Country and Sub-region, 2017–2026

Table 105 Middle East & Africa Montan Wax Market Volume (Tons) Forecast, by Country and Sub-region, 2017–2026

Table 106 GCC Montan Wax Market Value (US$ Thousand) Forecast, by Function, 2017–2026

Table 107 GCC Montan Wax Market Volume (Tons) Forecast, by Function, 2017–2026

Table 108 GCC Montan Wax Market Value (US$ Thousand) Forecast, by End-use Industry, 2017–2026

Table 109 GCC Montan Wax Market Volume (Tons) Forecast, by End-use Industry, 2017–2026

Table 110 South Africa Montan Wax Market Value (US$ Thousand) Forecast, by Function, 2017–2026

Table 111 South Africa Montan Wax Market Volume (Tons) Forecast, by Function, 2017–2026

Table 112 South Africa Montan Wax Market Value (US$ Thousand) Forecast, by End-use Industry, 2017–2026

Table 113 South Africa Montan Wax Market Volume (Tons) Forecast, by End-use Industry, 2017–2026

Table 114 Rest of Middle East & Africa Montan Wax Market Value (US$ Thousand) Forecast, by Function, 2017–2026

Table 115 Rest of Middle East & Africa Montan Wax Market Volume (Tons) Forecast, by Function, 2017–2026

Table 116 Rest of Middle East & Africa Montan Wax Market Value (US$ Thousand) Forecast, by End-use Industry, 2017–2026

Table 117 Rest of Middle East & Africa Montan Wax Market Volume (Tons) Forecast, by End-use Industry, 2017–2026

Figure 1 Global Montan Wax Market Value Share, by Function, 2017

Figure 2 Global Montan Wax Market Value Share, by End-use Industry, 2017

Figure 3 Global Montan Wax Market Value Share, by Region, 2017

Figure 4 Key Countries Importing Wax (HS Codes: 2712), 2017

Figure 5 Key Countries Exporting Wax (HS Codes: 2712), 2017

Figure 6 Global Montan wax Market Volume (Tons) and Value (US$ Thousand), by Emulsions, 2017–2026

Figure 7 Global Montan Wax Market Volume (Tons) and Value (US$ Thousand), by Lubricants, 2017–2026

Figure 8 Global Montan Wax Market Volume (Tons) and Value (US$ Thousand), by Thickening Agents, 2017–2026

Figure 9 Global Montan Wax Market Volume (Tons) and Value (US$ Thousand), by Release Agents, 2017–2026

Figure 10 Global Montan Wax Market Volume (Tons) and Value (US$ Thousand), by Coating Agents, 2017–2026

Figure 11 Global Montan Wax Market Volume (Tons) and Value (US$ Thousand), by Nucleating Agents, 2017–2026

Figure 12 Global Montan Wax Market Volume (Tons) and Value (US$ Thousand), by Dispersants, 2017–2026

Figure 13 Global Montan Wax Market Volume (Tons) and Value (US$ Thousand), by Others, 2017–2026

Figure 14 Global Montan Wax Market Value Share, by Function, 2017 and 2026

Figure 15 Global Montan wax Market Volume (Tons) and Value (US$ Thousand), by Cosmetics, 2017–2026

Figure 16 Global Montan Wax Market Volume (Tons) and Value (US$ Thousand), by Pharmaceuticals, 2017–2026

Figure 17 Global Montan Wax Market Volume (Tons) and Value (US$ Thousand), by Rubbers, 2017–2026

Figure 18 Global Montan Wax Market Volume (Tons) and Value (US$ Thousand), by Plastic, 2017–2026

Figure 19 Global Montan Wax Market Volume (Tons) and Value (US$ Thousand), by Papers, 2017–2026

Figure 20 Global Montan Wax Market Volume (Tons) and Value (US$ Thousand), by Electricals, 2017–2026

Figure 21 Global Montan Wax Market Volume (Tons) and Value (US$ Thousand), by Wax Polishes, 2017–2026

Figure 22 Global Montan Wax Market Volume (Tons) and Value (US$ Thousand), by Machinery, 2017–2026

Figure 23 Global Montan Wax Market Volume (Tons) and Value (US$ Thousand), by Agriculture & Forestry, 2017–2026

Figure 24 Global Montan Wax Market Volume (Tons) and Value (US$ Thousand), by Leather & Textile, 2017–2026

Figure 25 Global Montan Wax Market Volume (Tons) and Value (US$ Thousand), by Others, 2017–2026

Figure 26 Global Montan Wax Market Value Share, by End-use Industry, 2017 and 2026

Figure 27 Global Montan Wax Market Value Share, by Region, 2017–2026

Figure 28 Global Montan Wax Market Attractiveness, by Function, 2017

Figure 29 Global Montan Wax Market Attractiveness, by End-use Industry, 2017

Figure 30 Global Montan Wax Market Attractiveness, by Region, 2017

Figure 31 North America Montan Wax Market Volume (Tons), and Value (US$ Thousand), Forecast, 2017–2026

Figure 32 North America Market Attractiveness Analysis, by Country, 2017

Figure 33 North America Montan Wax Market Value Share, by Function, 2017 and 2026

Figure 34 North America Montan Wax Market Value Share, by End-use Industry, 2017 and 2026

Figure 35 North America Montan Wax Market Value Share, by Country, 2017 and 2026

Figure 36 North America Montan Wax Market Attractiveness, by Function, 2017

Figure 37 North America Montan Wax Market Attractiveness, by End-use Industry, 2017

Figure 38 Europe Montan Wax Market Volume (Tons), and Value (US$ Thousand), Forecast, 2017–2026

Figure 39 Europe Market Attractiveness Analysis, by Country and Sub-region

Figure 40 Europe Montan Wax Market Value Share, by Function, 2017 and 2026

Figure 41 Europe Montan Wax Market Value Share, by End-use Industry, 2017 and 2026

Figure 42 Europe Montan Wax Market Value Share, by Country and Sub-region, 2017 and 2026

Figure 43 Europe Montan Wax Market Attractiveness, by Function, 2017

Figure 44 Europe Montan Wax Market Attractiveness, by End-use Industry, 2017

Figure 45 Asia Pacific Montan Wax Market Volume (Tons) and Value (Thousand), Forecast, 2017–2026

Figure 46 Asia Pacific Market Attractiveness Analysis, by Country and Sub-region

Figure 47 Asia Pacific Montan Wax Market Value Share, by Function, 2017 and 2026

Figure 48 Asia Pacific Montan Wax Market Value Share, by End-use Industry, 2017 and 2026

Figure 49 Asia Pacific Montan Wax Market Value Share, by Country and Sub-region, 2017 and 2026

Figure 50 Asia Pacific Montan Wax Market Attractiveness, by Function, 2017

Figure 51 Asia Pacific Montan Wax Market Attractiveness, by End-use Industry, 2017

Figure 52 Latin America Montan Wax Market Volume (Tons) and Value (US$ Thousand), Forecast, 2017–2026

Figure 53 Latin America Market Attractiveness Analysis, by Country and Sub-region

Figure 54 Latin America Montan Wax Market Value Share, by Function, 2017 and 2026

Figure 55 Latin America Montan Wax Market Value Share, by End-use Industry, 2017 and 2026

Figure 56 Latin America Montan Wax Market Value Share, by Country and Sub-region, 2017 and 2026

Figure 57 Latin America Montan Wax Market Attractiveness, by Function, 2017

Figure 58 Latin America Montan Wax Market Attractiveness, by End-use Industry, 2017

Figure 59 Middle East & Africa Montan Wax Market Volume (Tons) and Value (US$ Thousand), Forecast, 2017–2026

Figure 60 Middle East & Africa Market Attractiveness Analysis, by Country and Sub-region

Figure 61 Middle East & Africa Montan Wax Market Value Share by Function, 2017 and 2026

Figure 62 Middle East & Africa Montan Wax Market Value Share, by End-use Industry, 2017 and 2026

Figure 63 Middle East & Africa Montan Wax Market Value Share, by Country and Sub-region, 2017 and 2026

Figure 64 Middle East & Africa Montan Wax Market Attractiveness, by Function, 2017

Figure 65 Middle East & Africa Montan Wax Market Attractiveness, by End-use Industry, 2017

Figure 66 Crude Montan wax Market Share Analysis, by Company in % (2017)

Figure 67 Refined Montan wax Market Share Analysis, by Company in % (2017)