Analysts’ Viewpoint

Rise in demand for small-size refineries to process crude oil in emerging countries is primarily driving the global modular refinery market. These refineries are established by adhering to international modular refinery safety regulations and monitored by private and national oil companies.

Key EPC contractors, refinery consultants, and installers have set up several modular refinery projects. This can be ascribed to the minimal capital expenditure required for procuring and setting up refinery components. Growth in popularity of modular refineries for processing specific kinds of crude oil in different capacities is boosting market dynamics.

Rise in investment by private operators and national oil companies is projected to increase the number of modular refineries being set up in the next few years, especially in the capacity range of 20,000-30,000 BPD.

A modular refinery is a small-scale refinery or micro refinery that requires minimal capital investment for installation as compared to conventional or traditional full-scale refinery facilities. Modular refineries are usually installed below 50,000 bpd and therefore have a lower output capacity than the large-size conventional crude oil refineries. These refineries are widely used for processing a diverse range of petrochemicals in crude oil reserve belts.

Key developed economies are collaborating with emerging nations that have high stock of crude oil reserves, leading to more investment in smaller refinery projects. Recent modular refinery market trends include new modular refinery technology such as mobile refineries or portable refineries.

Modular refinery cost analysis indicate that compared to conventional refineries, modular refineries have nominal investment. They can be quickly installed and take up minimal space, thus making them a viable choice and fueling market progress.

A modular refinery can be installed in phases, is assembled on skid-mounted structures, and tested prior to transportation to the location. Modules can be installed much more quickly compared to a traditional stick-building approach. Modular refinery market analysis reveal that they provide substantial benefits such as sizing for lower local demand, off-site modular fabrication for better quality, and the potential for future relocation. Modular refineries require relatively fewer resources and specialized labor to operate, maintain, and upgrade when compared to conventional refineries.

Thus, modular refineries are a financially viable option for investors and provide operational advantages vis-à-vis the conventional oil production business model.

The modular refinery market research report highlights the fact that developing countries across the globe are likely to witness increase in demand for energy. Furthermore, significant rise in demand for energy is anticipated to originate from the aviation sector and road transportation industries.

As per the OPEC 2021 World Oil Outlook 2045 report, about US$ 1.5 Trn is projected to be invested in downstream activities between 2021 and 2045. Of this, around US$ 450 Bn is planned for investments in new refinery projects and expansion of current facilities, primarily in developing nations. Market catalysts for this potential investment include growth in population and expanding economies of Asia, Africa, and the Middle East.

Maximum refinery installations are seen in the Middle East, Africa, and Asia Pacific. This is supported by the expanding crude and condensate supplies in the Middle East and rise in oil demand in Asia Pacific. Additionally, West Africa has a number of smaller modular refinery projects in countries such as Ghana, Nigeria, and Angola.

Governments in various countries are supporting the construction of modular refineries to increase local refining capacities by providing financial aid and tax incentives. For instance, the issuance of twenty-five refining licenses to domestic companies in Nigeria is likely to drive growth within the sector in the long term.

The oil and gas sector has experienced significant innovation over the years and is now adopting environmental and sustainability planning. Manufacturers are focusing on the use of carbon capture, utilisation and storage (CCUS) technology to decarbonize refineries and generate new modular refinery market opportunities.

The refinery industry is striving to optimize, recycle, or reduce CO2 emissions through financial incentives such as carbon taxes or credits. A noticeable shift in policy to support the demand for alternative fuels, including biofuels, synthetic fuels, and hydrogen, and the growing trend of using renewable energy sources such as solar and wind is likely to encourage the usage of renewable energy to run modular refinery operations. Additionally, increase in digitalization and use of Big Data is expected to improve refinery optimization. Rise in demand for refined petroleum products in several developing nations presents lucrative opportunities for modular refinery market development to meet the local demand and lessen the reliance on imported fuels.

Refineries are likely to face increasing pressure to reduce their carbon footprint due to environmental concerns and to meet the climate goals of several nations. Refiners are required to abide by stringent air and water quality laws to lessen the environmental impact of refining processes. The US Environmental Protection Agency (EPA) established new air quality regulations in 2015 with the goal of reducing hazardous air emissions from oil refineries.

Significant modifications need to be made to the refining process to comply with these standards, which include managing sulfur concentrations in finished fuels, lowering the level of toxicity in effluent discharge, and controlling air emissions. This requires operational reconfigurations that entail high capital investments, which may be a market limitation.

In terms of component, the crude distillation unit (CDU) segment is estimated to account for high modular refinery market share. CDU is extensively used in oil refinery fields to convert crude oil into gasoline, diesel, and kerosene. Furthermore, CDU plays an important role in the primary stage of the refining process. Thus, CDU is a preferred choice among companies.

According to the modular refinery market forecast, Middle East & Africa is the most prominent region in the global landscape. Key developing economies of the region such as Nigeria, Guyana, and Congo, are continuously installing refineries. State-owned oil companies and private investor support to enhance the capacity of crude oil reserves and minimize overall imports of crude oil, showcases the positive growth of the market in Middle East & Africa. Strong presence of crude oil reserves and increase in dependence on modular refineries for a diverse range of refinery petroleum products is likely to augment the modular refinery market size in the region during the forecast period.

Detailed profiles of modular refinery equipment suppliers have been provided in the report to evaluate their financials, key installation service offerings, recent developments, and strategies. Majority of firms are spending significantly on comprehensive R&D activities, primarily to develop innovative products.

Expansion of product portfolios and mergers and acquisitions are the key strategies adopted by prominent players to improve market statistics.

McDermott International, Ltd, Peiyang Chemical Equipment Co., Ltd., Waltersmith Refining & Petrochemicals Company, and Brahms Group SA are the prominent companies operating in the modular refinery industry.

Key players have been profiled in the modular refinery market report based on parameters such as business segments, financial overview, business strategies, company overview, recent developments, and product portfolio.

|

Attribute |

Detail |

|

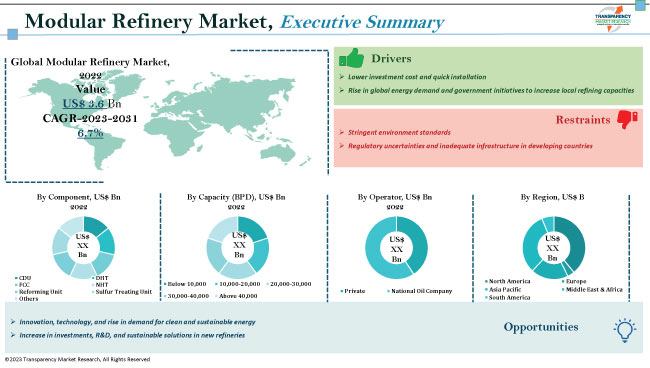

Market Value in 2022 (Base Year) |

USD 3.6 Bn |

|

Market Forecast Value in 2031 |

USD 5.4 Bn |

|

Growth Rate (CAGR) |

6.7% |

|

Forecast Period |

2023-2031 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

Regional qualitative analysis includes drivers, restraints, opportunities, key trends, upcoming key trends, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, and regulatory analysis. Furthermore, at the regional level, qualitative analysis includes key trends, and key refinery installation services analysis. |

|

Competition Landscape |

|

|

Region Covered |

|

|

Market Segmentation |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

It was valued at US$ 3.6 Bn in 2022

It would be worth US$ 5.4 Bn by 2031

It is estimated to grow at a CAGR of 6.7% during 2023 to 2031

Lower investment cost and quick installation process compared to conventional refineries, rise in global energy demand, and government initiatives to increase local refining capacities

The Crude Distillation Unit (CDU) segment accounted for approximately 34.6% share in 2022

Middle East & Africa is a more attractive region for vendors in the market

Peiyang Chemical Equipment Co., Ltd., McDermott International, Ltd., Waltersmith Refining & Petrochemicals Company, Chemex Global, and Brahms Group SA.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trend Analysis

5.3.1. Supplier Side

5.3.2. Demand Side

5.4. Key Market Indicators

5.4.1. Oil & Gas Industry Overview

5.4.2. Overall Oil Refinery Market

5.5. Industry SWOT Analysis

5.6. Porter’s Five Forces Analysis

5.7. Covid-19 Impact Analysis

5.8. Value Chain Analysis

5.9. Standards and Regulations

5.10. Global Modular Refinery Market Analysis and Forecast, 2017 - 2031

5.10.1. Market Value Projections (US$ Mn)

6. Global Modular Refinery Market Analysis and Forecast, by Component

6.1. Modular Refinery Market Size (US$ Mn) by Component, 2017 - 2031

6.1.1. Crude Distillation Unit (CDU)

6.1.2. Diesel Hydro Treating (DHT)

6.1.3. Fluid Catalytic Cracking (FCC)

6.1.4. Naphtha Hydro Treating (NHT)

6.1.5. Reforming Unit

6.1.6. Sulfur Treating Unit

6.1.7. Others

6.2. Incremental Opportunity, by Component

7. Global Modular Refinery Market Analysis and Forecast, by Capacity (BPD)

7.1. Modular Refinery Market Size (US$ Mn) by Capacity (BPD), 2017 - 2031

7.1.1. Below 10,000

7.1.2. 10,000-20,000

7.1.3. 20,000-30,000

7.1.4. 30,000-40,000

7.1.5. Above 40,000

7.2. Incremental Opportunity, by Capacity (BPD)

8. Global Modular Refinery Market Analysis and Forecast, by Operator

8.1. Modular Refinery Market Size (US$ Mn) by Operator, 2017 - 2031

8.1.1. National Oil Company

8.1.2. Private

8.2. Incremental Opportunity, by Operator

9. Global Modular Refinery Market Analysis and Forecast, by Region

9.1. Modular Refinery Market Size (US$ Mn) by Region, 2017 - 2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Incremental Opportunity, by Region

10. North America Modular Refinery Market Analysis and Forecast

10.1. Regional Snapshot

10.2. Key Trends Analysis

10.2.1. Supply Side

10.2.2. Demand Side

10.3. Key Suppliers Analysis

10.4. Modular Refinery Market Size (US$ Mn) by Component, 2017 - 2031

10.4.1. Crude Distillation Unit (CDU)

10.4.2. Diesel Hydro Treating (DHT)

10.4.3. Fluid Catalytic Cracking (FCC)

10.4.4. Naphtha Hydro Treating (NHT)

10.4.5. Reforming Unit

10.4.6. Sulfur Treating Unit

10.4.7. Others

10.5. Modular Refinery Market Size (US$ Mn) by Capacity (BPD), 2017 - 2031

10.5.1. Below 10,000

10.5.2. 10,000-20,000

10.5.3. 20,000-30,000

10.5.4. 30,000-40,000

10.5.5. Above 40,000

10.6. Modular Refinery Market Size (US$ Mn) by Operator, 2017 - 2031

10.6.1. National Oil Company

10.6.2. Private

10.7. Modular Refinery Market Size (US$ Mn) (Thousand Units) Forecast, by Country/Sub-region, 2017 - 2031

10.7.1. U.S.

10.7.2. Canada

10.7.3. Rest of North America

10.8. Incremental Opportunity Analysis

11. Europe Modular Refinery Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Key Trends Analysis

11.2.1. Supply Side

11.2.2. Demand Side

11.3. Key Suppliers Analysis

11.4. Modular Refinery Market Size (US$ Mn) by Component, 2017 - 2031

11.4.1. Crude Distillation Unit (CDU)

11.4.2. Diesel Hydro Treating (DHT)

11.4.3. Fluid Catalytic Cracking (FCC)

11.4.4. Naphtha Hydro Treating (NHT)

11.4.5. Reforming Unit

11.4.6. Sulfur Treating Unit

11.4.7. Others

11.5. Modular Refinery Market Size (US$ Mn) by Capacity (BPD), 2017 - 2031

11.5.1. Below 10,000

11.5.2. 10,000-20,000

11.5.3. 20,000-30,000

11.5.4. 30,000-40,000

11.5.5. Above 40,000

11.6. Modular Refinery Market Size (US$ Mn) by Operator, 2017 - 2031

11.6.1. National Oil Company

11.6.2. Private

11.7. Modular Refinery Market Size (US$ Mn) (Thousand Units) Forecast, by Country/Sub-region, 2017 - 2031

11.7.1. Poland

11.7.2. Croatia

11.7.3. Romania

11.7.4. Turkey

11.7.5. Russia

11.7.6. Rest of Europe

11.8. Incremental Opportunity Analysis

12. Asia Pacific Modular Refinery Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Trends Analysis

12.2.1. Supply Side

12.2.2. Demand Side

12.3. Key Suppliers Analysis

12.4. Modular Refinery Market Size (US$ Mn) by Component, 2017 - 2031

12.4.1. Crude Distillation Unit (CDU)

12.4.2. Diesel Hydro Treating (DHT)

12.4.3. Fluid Catalytic Cracking (FCC)

12.4.4. Naphtha Hydro Treating (NHT)

12.4.5. Reforming Unit

12.4.6. Sulfur Treating Unit

12.4.7. Others

12.5. Modular Refinery Market Size (US$ Mn) by Capacity (BPD), 2017 - 2031

12.5.1. Below 10,000

12.5.2. 10,000-20,000

12.5.3. 20,000-30,000

12.5.4. 30,000-40,000

12.5.5. Above 40,000

12.6. Modular Refinery Market Size (US$ Mn) by Operator, 2017 - 2031

12.6.1. National Oil Company

12.6.2. Private

12.7. Modular Refinery Market Size (US$ Mn) (Thousand Units) Forecast, by Country/Sub-region, 2017 - 2031

12.7.1. China

12.7.2. Southeast Asia

12.7.3. Rest of Asia Pacific

12.8. Incremental Opportunity Analysis

13. Middle East & Africa Modular Refinery Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Trends Analysis

13.2.1. Supply Side

13.2.2. Demand Side

13.3. Key Suppliers Analysis

13.4. Modular Refinery Market Size (US$ Mn) by Component, 2017 - 2031

13.4.1. Crude Distillation Unit (CDU)

13.4.2. Diesel Hydro Treating (DHT)

13.4.3. Fluid Catalytic Cracking (FCC)

13.4.4. Naphtha Hydro Treating (NHT)

13.4.5. Reforming Unit

13.4.6. Sulfur Treating Unit

13.4.7. Others

13.5. Modular Refinery Market Size (US$ Mn) by Capacity (BPD), 2017 - 2031

13.5.1. Below 10,000

13.5.2. 10,000-20,000

13.5.3. 20,000-30,000

13.5.4. 30,000-40,000

13.5.5. Above 40,000

13.6. Modular Refinery Market Size (US$ Mn) by Operator, 2017 - 2031

13.6.1. National Oil Company

13.6.2. Private

13.7. Modular Refinery Market Size (US$ Mn) (Thousand Units) Forecast, by Country/Sub-region, 2017 - 2031

13.7.1. Nigeria

13.7.2. Guyana

13.7.3. Kenya

13.7.4. Liberia

13.7.5. Equatorial Guinea

13.7.6. Iraq

13.7.7. UAE

13.7.8. South Sudan

13.7.9. Rest of Middle East & Africa

13.8. Incremental Opportunity Analysis

14. South America Modular Refinery Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Trends Analysis

14.2.1. Supply Side

14.2.2. Demand Side

14.3. Key Suppliers Analysis

14.4. Modular Refinery Market Size (US$ Mn) by Component, 2017 - 2031

14.4.1. Crude Distillation Unit (CDU)

14.4.2. Diesel Hydro Treating (DHT)

14.4.3. Fluid Catalytic Cracking (FCC)

14.4.4. Naphtha Hydro Treating (NHT)

14.4.5. Reforming Unit

14.4.6. Sulfur Treating Unit

14.4.7. Others

14.5. Modular Refinery Market Size (US$ Mn) by Capacity (BPD), 2017 - 2031

14.5.1. Below 10,000

14.5.2. 10,000-20,000

14.5.3. 20,000-30,000

14.5.4. 30,000-40,000

14.5.5. Above 40,000

14.6. Modular Refinery Market Size (US$ Mn) by Operator, 2017 - 2031

14.6.1. National Oil Company

14.6.2. Private

14.7. Modular Refinery Market Size (US$ Mn) (Thousand Units) Forecast, by Country/Sub-region, 2017 - 2031

14.7.1. Brazil

14.7.2. Rest of South America

14.8. Incremental Opportunity Analysis

15. Competition Landscape

15.1. Competition Dashboard

15.2. Market Share % (2022)

15.3. Company Profiles [Company Overview, Product Portfolio, Financial Information, (Subject to Data Availability), Business Strategies / Recent Developments]

15.3.1. Peiyang Chemical Equipment Co., Ltd.

15.3.1.1. Company Overview

15.3.1.2. Product Portfolio

15.3.1.3. Financial Information, (Subject to Data Availability)

15.3.1.4. Business Strategies / Recent Developments

15.3.2. Almoner Petroleum & Gas Limited

15.3.2.1. Company Overview

15.3.2.2. Product Portfolio

15.3.2.3. Financial Information, (Subject to Data Availability)

15.3.2.4. Business Strategies / Recent Developments

15.3.3. Amerisource Energy

15.3.3.1. Company Overview

15.3.3.2. Product Portfolio

15.3.3.3. Financial Information, (Subject to Data Availability)

15.3.3.4. Business Strategies / Recent Developments

15.3.4. Brahms Group SA

15.3.4.1. Company Overview

15.3.4.2. Product Portfolio

15.3.4.3. Financial Information, (Subject to Data Availability)

15.3.4.4. Business Strategies / Recent Developments

15.3.5. Chemex Global

15.3.5.1. Company Overview

15.3.5.2. Product Portfolio

15.3.5.3. Financial Information, (Subject to Data Availability)

15.3.5.4. Business Strategies / Recent Developments

15.3.6. Honeywell International Inc.

15.3.6.1. Company Overview

15.3.6.2. Product Portfolio

15.3.6.3. Financial Information, (Subject to Data Availability)

15.3.6.4. Business Strategies / Recent Developments

15.3.7. Pyramid E & C

15.3.7.1. Company Overview

15.3.7.2. Product Portfolio

15.3.7.3. Financial Information, (Subject to Data Availability)

15.3.7.4. Business Strategies / Recent Developments

15.3.8. Waltersmith Refining & Petrochemicals Company

15.3.8.1. Company Overview

15.3.8.2. Product Portfolio

15.3.8.3. Financial Information, (Subject to Data Availability)

15.3.8.4. Business Strategies / Recent Developments

15.3.9. KP Engineering, Inc.

15.3.9.1. Company Overview

15.3.9.2. Product Portfolio

15.3.9.3. Financial Information, (Subject to Data Availability)

15.3.9.4. Business Strategies / Recent Developments

15.3.10. VFuels, LLC

15.3.10.1. Company Overview

15.3.10.2. Product Portfolio

15.3.10.3. Financial Information, (Subject to Data Availability)

15.3.10.4. Business Strategies / Recent Developments

15.3.11. McDermott International, Ltd

15.3.11.1. Company Overview

15.3.11.2. Product Portfolio

15.3.11.3. Financial Information, (Subject to Data Availability)

15.3.11.4. Business Strategies / Recent Developments

16. Key Takeaways

16.1. Identification of Potential Market Spaces

16.2. Prevailing Market Risk

List of Tables

Table 1: Global Modular Refinery Market Value Size & Forecast – By Component (US$ Mn)

Table 2: Global Modular Refinery Market Value Size & Forecast – By Capacity (US$ Mn)

Table 3: Global Modular Refinery Market Value Size & Forecast – By Operator (US$ Mn)

Table 4: Global Modular Refinery Market Value Size & Forecast – By Region (US$ Mn)

Table 5: North America Modular Refinery Market Value Size & Forecast – By Component (US$ Mn)

Table 6: North America Modular Refinery Market Value Size & Forecast – By Capacity (US$ Mn)

Table 7: North America Modular Refinery Market Value Size & Forecast – By Operator (US$ Mn)

Table 8: North America Modular Refinery Market Value Size & Forecast – By Country (US$ Mn)

Table 9: Europe Modular Refinery Market Value Size & Forecast – By Component (US$ Mn)

Table 10: Europe Modular Refinery Market Value Size & Forecast – By Capacity (US$ Mn)

Table 11: Europe Modular Refinery Market Value Size & Forecast – By Operator (US$ Mn)

Table 12: Europe Modular Refinery Market Value Size & Forecast – By Country (US$ Mn)

Table 13: Asia Pacific Modular Refinery Market Value Size & Forecast – By Component (US$ Mn)

Table 14: Asia Pacific Modular Refinery Market Value Size & Forecast – By Capacity (US$ Mn)

Table 15: Asia Pacific Modular Refinery Market Value Size & Forecast – By Operator (US$ Mn)

Table 16: Asia Pacific Modular Refinery Market Value Size & Forecast – By Country (US$ Mn)

Table 17: Middle East & Africa Modular Refinery Market Value Size & Forecast – By Component (US$ Mn)

Table 18: Middle East & Africa Modular Refinery Market Value Size & Forecast – By Capacity (US$ Mn)

Table 19: Middle East & Africa Modular Refinery Market Value Size & Forecast – By Operator (US$ Mn)

Table 20: Middle East & Africa Modular Refinery Market Value Size & Forecast – By Country (US$ Mn)

Table 21: South America Modular Refinery Market Value Size & Forecast – By Component (US$ Mn)

Table 22: South America Modular Refinery Market Value Size & Forecast – By Capacity (US$ Mn)

Table 23: South America Modular Refinery Market Value Size & Forecast – By Operator (US$ Mn)

Table 24: South America Modular Refinery Market Value Size & Forecast – By Country (US$ Mn)

List of Figures

Figure 1: Global Modular Refinery Market Projections, By Component, US$ Mn, 2017-2031

Figure 2: Global Modular Refinery Market, Incremental Opportunity, By Component, US$ Mn

Figure 3: Global By Modular Refinery, 2022 & 2031, By Component, US$ Mn

Figure 4: Global Modular Refinery Market Projections, By Capacity, US$ Mn, 2017-2031

Figure 5: Global Modular Refinery Market, Incremental Opportunity, By Capacity, US$ Mn

Figure 6: Global By Modular Refinery, 2022 & 2031, By Capacity, US$ Mn

Figure 7: Global Modular Refinery Market Projections, By Operator, US$ Mn, 2017-2031

Figure 8: Global Modular Refinery Market, Incremental Opportunity, By Operator, US$ Mn

Figure 9: Global By Modular Refinery, 2022 & 2031, By Operator, US$ Mn

Figure 10: Global Modular Refinery Market Projections, By Region, US$ Mn, 2017-2031

Figure 11: Global Modular Refinery Market, Incremental Opportunity, By Region, US$ Mn

Figure 12: Global By Modular Refinery Market, 2023 & 2031, By Region, US$ Mn

Figure 13: North America Modular Refinery Market Projections, By Component, US$ Mn, 2017-2031

Figure 14: North America Modular Refinery Market, Incremental Opportunity, By Component, US$ Mn

Figure 15: North America Modular Refinery, 2022 & 2031, By Component, US$ Mn

Figure 16: North America Modular Refinery Market Projections, By Capacity, US$ Mn, 2017-2031

Figure 17: North America Modular Refinery Market, Incremental Opportunity, By Capacity, US$ Mn

Figure 18: North America Modular Refinery, 2022 & 2031, By Capacity, US$ Mn

Figure 19: North America Modular Refinery Market Projections, By Operator, US$ Mn, 2017-2031

Figure 20: North America Modular Refinery Market, Incremental Opportunity, By Operator, US$ Mn

Figure 21: North America Modular Refinery, 2022 & 2031, By Operator, US$ Mn

Figure 22: North America Modular Refinery Market Projections, By Country, US$ Mn, 2017-2031

Figure 23: North America Modular Refinery Market, Incremental Opportunity, By Country, US$ Mn

Figure 24: North America Modular Refinery Market, 2023 & 2031, By Country, US$ Mn

Figure 25: Europe Modular Refinery Market Projections, By Component, US$ Mn, 2017-2031

Figure 26: Europe Modular Refinery Market, Incremental Opportunity, By Component, US$ Mn

Figure 27: Europe Modular Refinery, 2022 & 2031, By Component, US$ Mn

Figure 28: Europe Modular Refinery Market Projections, By Capacity, US$ Mn, 2017-2031

Figure 29: Europe Modular Refinery Market, Incremental Opportunity, By Capacity, US$ Mn

Figure 30: Europe Modular Refinery, 2022 & 2031, By Capacity, US$ Mn

Figure 31: Europe Modular Refinery Market Projections, By Operator, US$ Mn, 2017-2031

Figure 32: Europe Modular Refinery Market, Incremental Opportunity, By Operator, US$ Mn

Figure 33: Europe Modular Refinery, 2022 & 2031, By Operator, US$ Mn

Figure 34: Europe Modular Refinery Market Projections, By Country, US$ Mn, 2017-2031

Figure 35: Europe Modular Refinery Market, Incremental Opportunity, By Country, US$ Mn

Figure 36: Europe Modular Refinery Market, 2023 & 2031, By Country, US$ Mn

Figure 37: Asia Pacific Modular Refinery Market Projections, By Component, US$ Mn, 2017-2031

Figure 38: Asia Pacific Modular Refinery Market, Incremental Opportunity, By Component, US$ Mn

Figure 39: Asia Pacific Modular Refinery, 2022 & 2031, By Component, US$ Mn

Figure 40: Asia Pacific Modular Refinery Market Projections, By Capacity, US$ Mn, 2017-2031

Figure 41: Asia Pacific Modular Refinery Market, Incremental Opportunity, By Capacity, US$ Mn

Figure 42: Asia Pacific Modular Refinery, 2022 & 2031, By Capacity, US$ Mn

Figure 43: Asia Pacific Modular Refinery Market Projections, By Operator, US$ Mn, 2017-2031

Figure 44: Asia Pacific Modular Refinery Market, Incremental Opportunity, By Operator, US$ Mn

Figure 45: Asia Pacific Modular Refinery, 2022 & 2031, By Operator, US$ Mn

Figure 46: Asia Pacific Modular Refinery Market Projections, By Country, US$ Mn, 2017-2031

Figure 47: Asia Pacific Modular Refinery Market, Incremental Opportunity, By Country, US$ Mn

Figure 48: Asia Pacific Modular Refinery Market, 2023 & 2031, By Country, US$ Mn

Figure 49: Middle East & Africa Modular Refinery Market Projections, By Component, US$ Mn, 2017-2031

Figure 50: Middle East & Africa Modular Refinery Market, Incremental Opportunity, By Component, US$ Mn

Figure 51: Middle East & Africa Modular Refinery, 2022 & 2031, By Component, US$ Mn

Figure 52: Middle East & Africa Modular Refinery Market Projections, By Capacity, US$ Mn, 2017-2031

Figure 53: Middle East & Africa Modular Refinery Market, Incremental Opportunity, By Capacity, US$ Mn

Figure 54: Middle East & Africa Modular Refinery, 2022 & 2031, By Capacity, US$ Mn

Figure 55: Middle East & Africa Modular Refinery Market Projections, By Operator, US$ Mn, 2017-2031

Figure 56: Middle East & Africa Modular Refinery Market, Incremental Opportunity, By Operator, US$ Mn

Figure 57: Middle East & Africa Modular Refinery, 2022 & 2031, By Operator, US$ Mn

Figure 58: Middle East & Africa Modular Refinery Market Projections, By Country, US$ Mn, 2017-2031

Figure 59: Middle East & Africa Modular Refinery Market, Incremental Opportunity, By Country, US$ Mn

Figure 60: Middle East & Africa Modular Refinery Market, 2023 & 2031, By Country, US$ Mn

Figure 61: South America Modular Refinery Market Projections, By Component, US$ Mn, 2017-2031

Figure 62: South America Modular Refinery Market, Incremental Opportunity, By Component, US$ Mn

Figure 63: South America Modular Refinery, 2022 & 2031, By Component, US$ Mn

Figure 64: South America Modular Refinery Market Projections, By Capacity, US$ Mn, 2017-2031

Figure 65: South America Modular Refinery Market, Incremental Opportunity, By Capacity, US$ Mn

Figure 66: South America Modular Refinery, 2022 & 2031, By Capacity, US$ Mn

Figure 67: South America Modular Refinery Market Projections, By Operator, US$ Mn, 2017-2031

Figure 68: South America Modular Refinery Market, Incremental Opportunity, By Operator, US$ Mn

Figure 69: South America Modular Refinery, 2022 & 2031, By Operator, US$ Mn

Figure 70: South America Modular Refinery Market Projections, By Country, US$ Mn, 2017-2031

Figure 71: South America Modular Refinery Market, Incremental Opportunity, By Country, US$ Mn

Figure 72: South America Modular Refinery Market, 2023 & 2031, By Country, US$ Mn