Analysts’ Viewpoint on Mobility Aid Devices Market Scenario

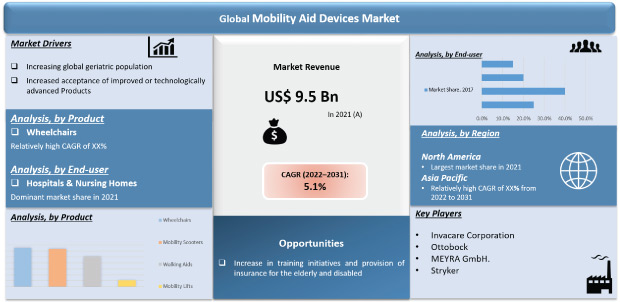

The usage of mobility aid devices is increasing among the geriatric population globally due to the high prevalence of health-compromising conditions, as personal mobility equipment facilitates the movement of people with disabilities and improves independent living. Rise in the global disabled population and increase in acceptance of improved or technologically advanced products are estimated to propel the mobility aid devices market. Consequently, the market is estimated to register a steady growth rate during the forecast period due to innovations in powered wheelchairs and mobility lifts. Companies operating in the mobility aid devices market are focusing on technological advancements of the devices to keep their businesses growing post the COVID-19 pandemic.

Mobility disorders are the most common type of illness, and mobility aid devices used by patients can facilitate independence, autonomy, and social participation. The higher prevalence of these illnesses among the geriatric population is resulting in increased use of mobility aids.

The evolution and development of human mobile devices have been taking place over the centuries. Manufacturers of wheelchairs and other mobility device models are emphasizing on reducing the weight of the device, enhancing flexibility, and boosting efficiency.

An increase in the geriatric population is fueling growth of the global mobility aid devices market. The population aged 65 years and above is anticipated to increase rapidly in the next few years.

According to the Journal of Aging Research, the number of adults in the U.S. is expected to reach 87 million by 2050. Moreover, according to the Bureau of Transportation Statistics 2020, the US Department of Transportation, an estimated 25.5 million people in the U.S. have a disability.

Assistive technology reduces the difficulty of performing daily tasks. Understanding the size and demographics of the people who use these assistive technologies is highly important.

The field of mobility devices has witnessed several developments such as smart wheelchairs that can stay on a sidewalk and avoid rough patches, scooters for the elderly and disabled, and assistive technologies for the visually impaired. Another development includes marker-free smart highways, smart robots in warehouses that can precisely position themselves next to shelves, and even domestic assistants that can handle day-to-day chores inside a home. Novel developments have been driven due to an increasing need for mobility devices.

An increase in investments in research and development (R&D) by leading players in the market is resulting in the introduction of technologically superior products. Moreover, rising awareness, increasing convenience due to the availability of technologically advanced products, and favorable reimbursements are anticipated to drive the adoption rate of high-value devices across the globe.

Life expectancy is increasing with the use of advanced medical technologies, and a significant percentage of the elderly population requires the support of assistive technologies to perform their daily activities. Thus, the demand for mobility aid devices is potentially increasing among the geriatric population. Such findings are contributing to growth in the assisted living industry.

For instance, as per United Nations, the older population of over 60 years of age is expected to double by 2050, and triple by 2100; rising from 962 million in 2017 to 2.1 billion in 2050 and 3.1 billion in 2100. Globally, the geriatric population is increasing at a faster pace than the young age population group.

Presently, Europe is home to the largest old-age population of aged 60 years and above globally. Aging is associated with declining support for long-term caregiving from families and highly expensive formal long-term caregiving services. Hence, these structural changes in society are likely to also fuel the demand for mobility aid devices such as wheelchairs. These trends are fueling innovations in personal mobility devices and mobility scooters.

Increasing research and development activities is boosting the approvals of technologically advanced products that are able to improve the quality of life of people with disability. This has led to a rise in acceptance and the demand for these products. As such, med-tech companies are investing in R&D to innovate in assistive devices and mobility aids.

Increasing awareness about the available mobility aid devices, such as innovative powered wheelchairs, power assists, standing wheelchairs, walkers, and patient lifts, over the last few years is also boosting the market.

Developments in software have widened the application areas of powered wheelchairs and target patient segments. For instance, Gecko Systems introduced the SafePath wheelchair technology solution in order to provide safety, mobility, and ease of access to the patients.

The healthcare sector in emerging economies is moving toward privatization. Hence, the infrastructure in these regions is developing rapidly. A collaborative partnership between the WHO and the United States Agency for International Development (USAID) has led to the development of the ‘Wheelchair Service Training Package-Intermediate Level following the release of the Basic level earlier.

The main purpose of this training package is to increase the number of wheelchair users to meet their needs, push the growth of intermediate wheelchair service, and achieve the integration of wheelchair service delivery in the rehabilitation centers.

Various public and private insurance players provide insurance coverage for mobility aid devices including wheelchairs so that the customers can reimburse them. But the Powered wheelchairs are highly expensive and are not reimbursed by insurance systems.

In some countries, it becomes tedious for an individual to get access to the usage of mobility aid devices. An increase in the number of both private and government insurance players is likely to provide significant opportunities for the global mobility aid devices market.

The global geriatric population is likely to increase at a significant pace in the next few years. This is likely to drive the demand for wheelchairs. The wheelchairs segment is expected to outperform the comfortable chairs, stable chairs, and custom & lightweight chairs segments due to their mobility feature.

The wheelchairs segment dominated the mobility aid devices market and held around 50% share in 2021. The high prevalence of Alzheimer's disease and Parkinson's disease, which affects personal mobility, is likely to drive the wheelchairs segment during the forecast period.

North America accounted for a prominent share of around 50% of the global mobility aid devices market in 2021. The market in the region is projected to advance at a CAGR of over 4% from 2022 to 2031.

The Asia Pacific was a rapidly growing market for mobility aid devices in 2021, and the market in the region is slated to clock a CAGR of around 5% during the forecast period.

The mobility aid devices market is fragmented, with a large number of key players accounting for the market share. Most companies are making significant investments in comprehensive research and development.

Diversification of product portfolios and mergers & acquisitions are the key strategies adopted by the players. The Mobility devices market is fragmented due to the presence of a large number of players. Key players operating in the market include Invacare Corporation, Sunrise Medical (US) LLC, Ottobock, Permobil, MEYRA GmbH., Besco Medical, Stryker, and Medline Industries, LP.

Each of these players has been profiled in the mobility devices market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 9.5 Bn |

|

Market Forecast Value in 2031 |

US$ 15.6 Bn |

|

Growth Rate (CAGR) |

5.1% from Year-to-Year |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis as well as at regional level. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

Mobility aid devices market is expected to reach value of US$ 15.6 Bn by the end of 2031

Mobility aid devices market is estimated to advance at a CAGR of 5.1% from 2022 to 2031

Mobility aid devices market is driven by rise in the global disabled population and increase in acceptance of improved or technologically advanced products

North America accounted for a major share of the global mobility aid devices market

Key players in the mobility aid devices market include Invacare Corporation, Sunrise Medical (US) LLC, Ottobock, Permobil, MEYRA GmbH.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Mobility Aid Devices Market

4. Market Overview

4.1. Introduction

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Mobility Aid Devices Market Analysis and Forecasts, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

4.5. Porter’s Five Force Analysis

5. Key Insightsa

5.1. Pricing Analysis by Product, by Region

5.2. Regulatory Scenario by Region/globally

5.3. Key Industry Events (Mergers, Acquisitions, Partnerships, etc.)

5.4. COVID-19 Pandemic Impact on Industry (Value Chain and Short-/ Mid-/ Long-Term Impact)

6. Global Mobility Aid Devices Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product, 2017–2031

6.3.1. Wheelchairs

6.3.1.1. Manual

6.3.1.2. Power

6.3.2. Mobility Scooters

6.3.2.1. Boot Scooter

6.3.2.2. Midsize Scooter

6.3.2.3. Road Scooter

6.3.3. Walking Aids

6.3.3.1. Canes

6.3.3.2. Crutches

6.3.3.3. Walkers

6.3.4. Mobility Lifts

6.4. Market Attractiveness, by Product

7. Global Mobility Aid Devices Market Analysis and Forecast, by End-user

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by End-user, 2017–2031

7.3.1. Home Care Settings

7.3.2. Hospitals & Nursing Homes

7.3.3. Assisted Living Facilities

7.3.4. Others

7.4. Market Attractiveness, by End-user

8. Global Mobility Aid Devices Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness, by Region

9. North America Mobility Aid Devices Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Product, 2017–2031

9.2.1. Wheelchairs

9.2.1.1. Manual

9.2.1.2. Power

9.2.2. Mobility Scooters

9.2.2.1. Boot Scooter

9.2.2.2. Midsize Scooter

9.2.2.3. Road Scooter

9.2.3. Walking Aids

9.2.3.1. Canes

9.2.3.2. Crutches

9.2.3.3. Walkers

9.2.4. Mobility Lifts

9.3. Market Value Forecast, by End-user, 2017–2031

9.3.1. Home Care Settings

9.3.2. Hospitals & Nursing Homes

9.3.3. Assisted Living Facilities

9.3.4. Others

9.4. Market Value Forecast, by Country, 2017–2031

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Product

9.5.2. By End-user

9.5.3. By Country

10. Europe Mobility Aid Devices Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product, 2017–2031

10.2.1. Wheelchairs

10.2.1.1. Manual

10.2.1.2. Power

10.2.2. Mobility Scooters

10.2.2.1. Boot Scooter

10.2.2.2. Midsize Scooter

10.2.2.3. Road Scooter

10.2.3. Walking Aids

10.2.3.1. Canes

10.2.3.2. Crutches

10.2.3.3. Walkers

10.2.4. Mobility Lifts

10.3. Market Value Forecast, by End-user, 2017–2031

10.3.1. Home Care Settings

10.3.2. Hospitals & Nursing Homes

10.3.3. Assisted Living Facilities

10.3.4. Others

10.4. Market Value Forecast, by Country/Sub-region, 2017–2031

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Spain

10.4.5. Italy

10.4.6. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Product

10.5.2. By End-user

10.5.3. By Country/Sub-region

11. Asia Pacific Mobility Aid Devices Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2017–2031

11.2.1. Wheelchairs

11.2.1.1. Manual

11.2.1.2. Power

11.2.2. Mobility Scooters

11.2.2.1. Boot Scooter

11.2.2.2. Midsize Scooter

11.2.2.3. Road Scooter

11.2.3. Walking Aids

11.2.3.1. Canes

11.2.3.2. Crutches

11.2.3.3. Walkers

11.2.4. Mobility Lifts

11.3. Market Value Forecast, by End-user, 2017–2031

11.3.1. Home Care Settings

11.3.2. Hospitals & Nursing Homes

11.3.3. Assisted Living Facilities

11.3.4. Others

11.4. Market Value Forecast, by Country/Sub-region, 2017–2031

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Product

11.5.2. By End-user

11.5.3. By Country/Sub-region

12. Latin America Mobility Aid Devices Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2017–2031

12.2.1. Wheelchairs

12.2.1.1. Manual

12.2.1.2. Power

12.2.2. Mobility Scooters

12.2.2.1. Boot Scooter

12.2.2.2. Midsize Scooter

12.2.2.3. Road Scooter

12.2.3. Walking Aids

12.2.3.1. Canes

12.2.3.2. Crutches

12.2.3.3. Walkers

12.2.4. 12.2.2. Mobility Lifts

12.3. Market Value Forecast, by End-user, 2017–2031

12.3.1. Home Care Settings

12.3.2. Hospitals & Nursing Homes

12.3.3. Assisted Living Facilities

12.3.4. Others

12.4. Market Value Forecast, by Country/Sub-region, 2017–2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Product

12.5.2. By End-user

12.5.3. By Country/Sub-region

13. Middle East & Africa Mobility Aid Devices Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2017–2031

13.2.1. Wheelchairs

13.2.1.1. Manual

13.2.1.2. Power

13.2.2. Mobility Scooters

13.2.2.1. Boot Scooter

13.2.2.2. Midsize Scooter

13.2.2.3. Road Scooter

13.2.3. Walking Aids

13.2.3.1. Canes

13.2.3.2. Crutches

13.2.3.3. Walkers

13.2.4. Mobility Lifts

13.3. Market Value Forecast, by End-user, 2017–2031

13.3.1. Home Care Settings

13.3.2. Hospitals & Nursing Homes

13.3.3. Assisted Living Facilities

13.3.4. Others

13.4. Market Value Forecast, by Country/Sub-region, 2017–2031

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Product

13.5.2. By End-user

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player - Competition Matrix (by tier and size of companies)

14.2. Company Profiles

14.2.1. Invacare Corporation

14.2.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.1.2. Product Portfolio

14.2.1.3. Financial Overview

14.2.1.4. SWOT Analysis

14.2.1.5. Strategic Overview

14.2.2. Sunrise Medical LLC

14.2.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.2.2. Product Portfolio

14.2.2.3. Financial Overview

14.2.2.4. SWOT Analysis

14.2.2.5. Strategic Overview

14.2.3. Ottobock

14.2.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.3.2. Product Portfolio

14.2.3.3. Financial Overview

14.2.3.4. SWOT Analysis

14.2.3.5. Strategic Overview

14.2.4. Permobil

14.2.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.4.2. Product Portfolio

14.2.4.3. Financial Overview

14.2.4.4. SWOT Analysis

14.2.4.5. Strategic Overview

14.2.5. MEYRA GmbH.

14.2.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.5.2. Product Portfolio

14.2.5.3. Financial Overview

14.2.5.4. SWOT Analysis

14.2.5.5. Strategic Overview

14.2.6. Besco Medical

14.2.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.6.2. Product Portfolio

14.2.6.3. Financial Overview

14.2.6.4. SWOT Analysis

14.2.6.5. Strategic Overview

14.2.7. Stryker

14.2.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.7.2. Product Portfolio

14.2.7.3. Financial Overview

14.2.7.4. SWOT Analysis

14.2.7.5. Strategic Overview

14.2.8. Medline Industries LP.

14.2.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.8.2. Product Portfolio

14.2.8.3. Financial Overview

14.2.8.4. SWOT Analysis

14.2.8.5. Strategic Overview

List of Table

Table 01: Global Mobility Aid Devices Market Value (US$ Mn) Forecast, by Product, 2017‒2031

Table 02: Global Mobility Aid Devices Market Value (US$ Mn) Forecast, by Wheelchairs, 2017‒2031

Table 03: Global Mobility Aid Devices Market Value (US$ Mn) Forecast, by Mobility Scooters, 2017‒2031

Table 03: Global Mobility Aid Devices Market Value (US$ Mn) Forecast, by Walking Aids, 2017‒2031

Table 04: Global Mobility Aid Devices Market Value (US$ Mn) Forecast, by End-user, 2017‒2031

Table 05: Global Mobility Aid Devices Market Value (US$ Mn) Forecast, by Region, 2017‒2031

Table 06: North America Mobility Aid Devices Market Value (US$ Mn) Forecast, by Product, 2017‒2031

Table 07: North America Mobility Aid Devices Market Value (US$ Mn) Forecast, by Wheelchairs, 2017‒2031

Table 08: North America Mobility Aid Devices Market Value (US$ Mn) Forecast, by Mobility Scooters, 2017‒2031

Table 09: North America Mobility Aid Devices Market Value (US$ Mn) Forecast, by Walking Aids, 2017‒2031

Table 10: North America Mobility Aid Devices Market Value (US$ Mn) Forecast, by End-user, 2017‒2031

Table 11: North America Mobility Aid Devices Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 12: Europe Mobility Aid Devices Market Value (US$ Mn) Forecast, by Product, 2017‒2031

Table 13: Europe Mobility Aid Devices Market Value (US$ Mn) Forecast, by Wheelchairs, 2017‒2031

Table 14: Europe Mobility Aid Devices Market Value (US$ Mn) Forecast, by Mobility Scooters, 2017‒2031

Table 15: Europe Mobility Aid Devices Market Value (US$ Mn) Forecast, by Walking Aids, 2017‒2031

Table 16: Europe Mobility Aid Devices Market Value (US$ Mn) Forecast, by End-user, 2017‒2031

Table 17: Europe Mobility Aid Devices Market Value (US$ Mn) Forecast, by Country/Region, 2017‒2031

Table 18: Asia Pacific Mobility Aid Devices Market Value (US$ Mn) Forecast, by Product, 2017‒2031

Table 19: Asia Pacific Mobility Aid Devices Market Value (US$ Mn) Forecast, by Wheelchairs, 2017‒2031

Table 20: Asia Pacific Mobility Aid Devices Market Value (US$ Mn) Forecast, by Mobility Scooters, 2017‒2031

Table 21: Asia Pacific Mobility Aid Devices Market Value (US$ Mn) Forecast, by Walking Aids, 2017‒2031

Table 22: Asia Pacific Mobility Aid Devices Market Value (US$ Mn) Forecast, by End-user, 2017‒2031

Table 23: Asia Pacific Mobility Aid Devices Market Value (US$ Mn) Forecast, by Country/Region, 2017‒2031

Table 24: Latin America Mobility Aid Devices Market Value (US$ Mn) Forecast, by Product, 2017‒2031

Table 25: Latin America Mobility Aid Devices Market Value (US$ Mn) Forecast, by Wheelchairs, 2017‒2031

Table 26: Latin America Mobility Aid Devices Market Value (US$ Mn) Forecast, by Mobility Scooters, 2017‒2031

Table 27: Latin America Mobility Aid Devices Market Value (US$ Mn) Forecast, by Walking Aids, 2017‒2031

Table 28: Latin America Mobility Aid Devices Market Value (US$ Mn) Forecast, by End-user, 2017‒2031

Table 29: Latin America Mobility Aid Devices Market Value (US$ Mn) Forecast, by Country/Region, 2017‒2031

Table 30: Middle East & Africa Mobility Aid Devices Market Value (US$ Mn) Forecast, by Product, 2017‒2031

Table 31: Middle East & Africa Mobility Aid Devices Market Value (US$ Mn) Forecast, by Wheelchairs, 2017‒2031

Table 32: Middle East & Africa Mobility Aid Devices Market Value (US$ Mn) Forecast, by Mobility Scooters, 2017‒2031

Table 33: Middle East & Africa Mobility Aid Devices Market Value (US$ Mn) Forecast, by Walking Aids, 2017‒2031

Table 34: Middle East & Africa Mobility Aid Devices Market Value (US$ Mn) Forecast, by End-user, 2017‒2031

Table 35: Middle East & Africa Mobility Aid Devices Market Value (US$ Mn) Forecast, by Country/Region, 2017‒2031

List of Figures

Figure 01: Global Mobility Aid Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Mobility Aid Devices Market Value Share, by Product, 2021

Figure 03: Global Mobility Aid Devices Market Value Share, by End-user, 2021

Figure 04: Global Mobility Aid Devices Market Value Share Analysis, by Product, 2021 and 2031

Figure 05: Global Mobility Aid Devices Market Attractiveness Analysis, by Product, 2017–2031

Figure 06: Global Mobility Aid Devices Market Value (US$ Mn), by Wheelchairs, 2017–2031

Figure 07: Global Mobility Aid Devices Market Value (US$ Mn), by Mobility Scooters, 2017–2031

Figure 08: Global Mobility Aid Devices Market Value (US$ Mn), by Walking Aids, 2017–2031

Figure 09: Global Mobility Aid Devices Market Value (US$ Mn), by Mobility Lifts, 2017–2031

Figure 10: Global Mobility Aid Devices Market Value Share Analysis, by End-user, 2021 and 2031

Figure 11: Global Mobility Aid Devices Market Attractiveness Analysis, by End-user, 2017–2031

Figure 12: Global Mobility Aid Devices Market Value (US$ Mn), by Home Care Settings, 2017–2031

Figure 13: Global Mobility Aid Devices Market Value (US$ Mn), by Hospitals & Nursing Homes, 2017–2031

Figure 14: Global Mobility Aid Devices Market Value (US$ Mn), by Assisted Living Facilities, 2017–2031

Figure 15: Global Mobility Aid Devices Market Value (US$ Mn), by Others, 2017–2031

Figure 16: Global Mobility Aid Devices Market Value Share Analysis, by Region, 2021 and 2031

Figure 17: Global Mobility Aid Devices Market Attractiveness Analysis, by Region, 2017–2031

Figure 18: North America Mobility Aid Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 19: North America Mobility Aid Devices Market Value Share Analysis, by Product type, 2021 and 2031

Figure 20: North America Mobility Aid Devices Market Attractiveness Analysis, by Product type, 2017–2031

Figure 21: North America Mobility Aid Devices Market Value Share Analysis, by End-user, 2021 and 2031

Figure 22: North America Mobility Aid Devices Market Attractiveness Analysis, by End-user, 2017–2031

Figure 23: North America Mobility Aid Devices Market Value Share Analysis, by Country, 2021 and 2031

Figure 24: North America Mobility Aid Devices Market Attractiveness Analysis, by Country, 2017–2031

Figure 25: Europe Mobility Aid Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 26: Europe Mobility Aid Devices Market Value Share Analysis, by Product type, 2021 and 2031

Figure 27: Europe Mobility Aid Devices Market Attractiveness Analysis, by Product type, 2017–2031

Figure 28: Europe Mobility Aid Devices Market Value Share Analysis, by End-user, 2021 and 2031

Figure 29: Europe Mobility Aid Devices Market Attractiveness Analysis, by End-user, 2017–2031

Figure 30: Europe Mobility Aid Devices Market Value Share Analysis, by Country/region, 2021 and 2031

Figure 31: Europe Mobility Aid Devices Market Attractiveness Analysis, by Country/region, 2017–2031

Figure 31: Asia Pacific Mobility Aid Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 32: Asia Pacific Mobility Aid Devices Market Value Share Analysis, by Product type, 2021 and 2031

Figure 33: Asia Pacific Mobility Aid Devices Market Attractiveness Analysis, by Product type, 2017–2031

Figure 34: Asia Pacific Mobility Aid Devices Market Value Share Analysis, by End-user, 2021 and 2031

Figure 35: Asia Pacific Mobility Aid Devices Market Attractiveness Analysis, by End-user, 2017–2031

Figure 36: Asia Pacific Mobility Aid Devices Market Value Share Analysis, by Country/region, 2021 and 2031

Figure 37: Asia Pacific Mobility Aid Devices Market Attractiveness Analysis, by Country/region, 2017–2031

Figure 38: Latin America Mobility Aid Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 39: Latin America Mobility Aid Devices Market Value Share Analysis, by Product type, 2021 and 2031

Figure 40: Latin America Mobility Aid Devices Market Attractiveness Analysis, by Product type, 2017–2031

Figure 41: Latin America Mobility Aid Devices Market Value Share Analysis, by End-user, 2021 and 2031

Figure 42: Latin America Mobility Aid Devices Market Attractiveness Analysis, by End-user, 2017–2031

Figure 43: Latin America Mobility Aid Devices Market Value Share Analysis, by Country/region, 2021 and 2031

Figure 44: Latin America Mobility Aid Devices Market Attractiveness Analysis, by Country/region, 2017–2031

Figure 45: Middle East & Africa Mobility Aid Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 46: Middle East & Africa Mobility Aid Devices Market Value Share Analysis, by Product type, 2021 and 2031

Figure 47: Middle East & Africa Mobility Aid Devices Market Attractiveness Analysis, by Product type, 2017–2031

Figure 48: Middle East & Africa Mobility Aid Devices Market Value Share Analysis, by End-user, 2021 and 2031

Figure 49: Middle East & Africa Mobility Aid Devices Market Attractiveness Analysis, by End-user, 2017–2031

Figure 50: Middle East & Africa Mobility Aid Devices Market Value Share Analysis, by Country/region, 2021 and 2031

Figure 51: Middle East & Africa Mobility Aid Devices Market Attractiveness Analysis, by Country/region, 2017–2031