Analysts’ Viewpoint

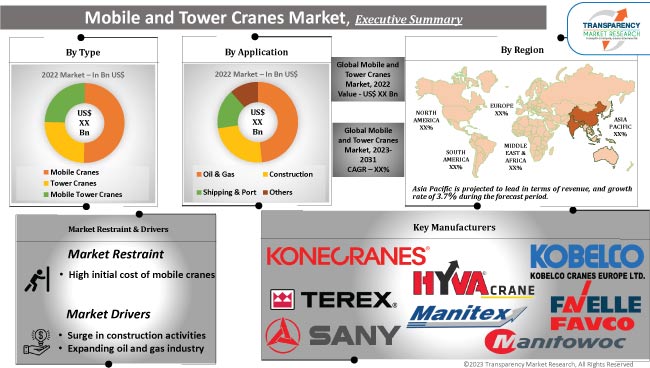

Increase in government investment in infrastructure and construction activities globally and an expanding oil and gas industry are primarily driving the mobile and tower cranes market size. Numerous ongoing development projects such as metros, railways, bridges, and flyovers lead to significant demand for medium and heavy duty mobile cranes.

The current landscape of investment and development in different regions creates lucrative mobile and tower cranes market opportunities for all original equipment manufacturers in construction. Mobile and tower cranes market development is also influenced by FDIs and growth in mining, oil, and gas sector revenues.

Mobile and tower cranes are used in several application segments. The most promising government projects, which are likely to drive demand for the equipment in the future, include railway projects, flyover projects, and metro projects.

A crane is a machine that can lift heavy objects to great heights with little assistance from humans. Cranes can be fixed or mobile, depending on the nature of the project.

Mobile cranes are typically affixed to movable platforms that can be manually or automatically controlled. They frequently have booms that telescopically extend their reach. In both domestic and commercial settings, mobile cranes are used to move heavy or large objects horizontally to a new location and to raise and lower them.

Hydraulic mobile cranes, which increase lifting range; pick and carry hybrid cranes, which move and erect material; truck-mounted mobile cranes with precise load configurations; and electric mobile cranes, are the different mobile crane types. Self-erecting tower cranes and climbing cranes are also fairly popular.

Construction is expected to drive the global economy during the course of this decade. The construction industry displayed remarkable resilience during the worst of the Coronavirus pandemic at a time when the global economy was significantly disrupted.

A tower crane is used in most construction projects. A tower crane is a structure shaped like an inverted L that can lift several tons of weight to incredible heights. The tower crane's ability to self-build and enable the construction of a building adjacent to or even around it is its most striking feature. Tower cranes are an essential tool for tall buildings because of their height, ability to lift heavy materials, and other features.

Safety by design is the most important aspect of 360 degree slew mobile cranes. Mobile crane manufacturers focus on safety systems to prevent accidents and allow effortless and safer operations at sites.

With the surge in construction and infrastructure activities across countries, mobile cranes, which hold the largest share of the crane market, are experiencing strong recovery. Furthermore, capital expenditure by governments for infrastructure development is positively propelling mobile and tower cranes market value. Additionally, the rental sector is significantly contributing to the acceleration of mobile and tower cranes market demand.

The oil and natural gas sector contributes 7% of the gross domestic product to the United States and supports nine million jobs, according to the American Petroleum Institute. Petroleum and natural gas industries in the United States accounted for 8% of GDP in 2021. With a favourable regulatory framework, gas production in Europe can be maintained or even increased. These gas reserves can be utilized in support of the EU's climate neutrality goal by complementing the deployment of renewable energy and much-needed energy savings. As the Asia Pacific region experiences rapid urbanization and industrialization, its demand for oil and gas continues to rise.

In the oil and gas industry, cranes are perhaps of the most used and crucial equipment. Cranes are used for drilling, lifting, and hauling in the oil and gas field. A common heavy equipment that is used in the oil and gas industry is rough terrain cranes. The oil and gas industry uses all terrain cranes for installing and maintaining drilling rigs, pipelines, and other equipment in challenging environments.

Tower crane use has increased in tandem with the increase in high-rise construction in North America. Hospitality construction accounts for 24% in the U.S., in terms of mobile and tower cranes market share. In North America, Toronto accounts for 43% of active tower cranes, followed by Seattle, Los Angles, and Washington D.C., which all account for 9% each of the total count.

Steady growth is anticipated in Asia Pacific throughout the forecast period as per the mobile and tower cranes market analysis. The regional market is expected to grow significantly with noteworthy contributions from China, India, and Japan. The primary driver for the growth of the mobile and tower cranes market in Asia Pacific is surge in construction activities due to the establishment of smart cities and initiatives for infrastructure development by governments.

Middle East & Africa is anticipated to witness promising growth in the global mobile and tower cranes industry during the forecast period as per the mobile and tower cranes market forecast, attributed to the conspicuous presence of oil and gas processing plants which require a large number of versatile tower cranes.

Significant investment in R&D activities, product expansions, and mergers and acquisitions are the business model followed by prominent manufacturers of mobile and tower cranes. The market is highly competitive, with the presence of various global and regional players.

FAVCO BERHAD, Hyva Cranes, Kobelco Cranes Global Ltd, Konecranes, Manitex International, Manitowoc, Sany Heavy Industry Co. Ltd., Tadano Faun, Terex Corporation, and WOLFFKRAN International AG are the prominent entities profiled in the mobile and tower cranes market.

Each of these players has been profiled in the mobile and tower cranes industry research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 28.9 Bn |

|

Market Forecast Value in 2031 |

US$ 40.1 Bn |

|

Growth Rate (CAGR) |

3.7% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value & Thousand Units for Volume |

|

Market Analysis |

Includes cross segment analysis at regional as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Region Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 28.9 Bn in 2022

It is projected to be 3.7% from 2023 to 2031

Rise in construction activities and expansion of the oil and gas industry

The all terrain segment accounted for significant share in 2022

Asia Pacific is likely to be one of the lucrative markets in the next few years

FAVCO BERHAD, Hyva Cranes, Kobelco Cranes Global Ltd, Konecranes, Manitex International, Manitowoc, Sany Heavy Industry Co. Ltd., Tadano Faun, Terex Corporation, and WOLFFKRAN International AG

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Standards & Regulations

5.5. Technological Overview Analysis

5.6. Key Market Indicators

5.7. Raw Material Analysis

5.8. Porter’s Five Forces Analysis

5.9. Industry SWOT Analysis

5.10. Value Chain Analysis

5.11. Regulatory Framework

5.12. Global Mobile and Tower Cranes Market Analysis and Forecast, 2017 - 2031

5.12.1. Market Value Projections (US$ Bn)

5.12.2. Market Volume Projections (Thousand Units)

6. Global Mobile and Tower Cranes Market Analysis and Forecast, By Type

6.1. Mobile and Tower Cranes Market Size (US$ Bn and Thousand Units) Forecast, By Type, 2017 – 2031

6.1.1. Mobile Cranes

6.1.1.1. All Terrain

6.1.1.2. Rough Terrain

6.1.1.3. Truck Crane

6.1.1.4. Crawler Crane

6.1.1.5. Telescopic Truck Mounted Crane

6.1.2. Tower Cranes

6.1.2.1. Self-Erecting Crane

6.1.2.2. Flat top

6.1.2.3. Luffing Jib Tower Crane

6.1.2.4. Hammerhead Crane

6.1.3. Mobile Tower Cranes

6.2. Incremental Opportunity, By Type

7. Global Mobile and Tower Cranes Market Analysis and Forecast, By Application

7.1. Mobile and Tower Cranes Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

7.1.1. Oil & Gas

7.1.2. Construction

7.1.3. Shipping & Port

7.1.4. Others

7.2. Incremental Opportunity, By Application

8. Global Mobile and Tower Cranes Market Analysis and Forecast, By Region

8.1. Mobile and Tower Cranes Market Size (US$ Bn and Thousand Units) Forecast, By Region, 2017 - 2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. South America

8.2. Incremental Opportunity, By Region

9. North America Mobile and Tower Cranes Market Analysis and Forecast

9.1. Regional Snapshot

9.2. Macroeconomic Overview

9.3. Brand Analysis

9.4. Price Trend Analysis

9.4.1. Weighted Average Price

9.5. Key Trends Analysis

9.5.1. Demand Side

9.5.2. Supplier Side

9.6. Mobile and Tower Cranes Market Size (US$ Bn and Thousand Units) Forecast, By Type, 2017 – 2031

9.6.1. Mobile Cranes

9.6.1.1. All Terrain

9.6.1.2. Rough Terrain

9.6.1.3. Truck Crane

9.6.1.4. Crawler Crane

9.6.1.5. Telescopic Truck Mounted Crane

9.6.2. Tower Cranes

9.6.2.1. Self-Erecting Crane

9.6.2.2. Flat top

9.6.2.3. Luffing Jib Tower Crane

9.6.2.4. Hammerhead Crane

9.6.3. Mobile Tower Cranes

9.7. Mobile and Tower Cranes Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

9.7.1. Oil & Gas

9.7.2. Construction

9.7.3. Shipping & Port

9.7.4. Others

9.8. Mobile and Tower Cranes Market Size (US$ Bn and Thousand Units) Forecast, By Country/Sub-region, 2017 - 2031

9.8.1. U.S

9.8.2. Canada

9.8.3. Rest of North America

9.9. Incremental Opportunity Analysis

10. Europe Mobile and Tower Cranes Market Analysis and Forecast

10.1. Regional Snapshot

10.2. Macroeconomic Overview

10.3. Brand Analysis

10.4. Price Trend Analysis

10.4.1. Weighted Average Price

10.5. Key Trends Analysis

10.5.1. Demand Side

10.5.2. Supplier Side

10.6. Mobile and Tower Cranes Market Size (US$ Bn and Thousand Units) Forecast, By Type, 2017 – 2031

10.6.1. Mobile Cranes

10.6.1.1. All Terrain

10.6.1.2. Rough Terrain

10.6.1.3. Truck Crane

10.6.1.4. Crawler Crane

10.6.1.5. Telescopic Truck Mounted Crane

10.6.2. Tower Cranes

10.6.2.1. Self-Erecting Crane

10.6.2.2. Flat top

10.6.2.3. Luffing Jib Tower Crane

10.6.2.4. Hammerhead Crane

10.6.3. Mobile Tower Cranes

10.7. Mobile and Tower Cranes Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

10.7.1. Oil & Gas

10.7.2. Construction

10.7.3. Shipping & Port

10.7.4. Others

10.8. Mobile and Tower Cranes Market Size (US$ Bn and Thousand Units) Forecast, By Country/Sub-region, 2017 - 2031

10.8.1. U.K

10.8.2. Germany

10.8.3. France

10.8.4. Rest of Europe

10.9. Incremental Opportunity Analysis

11. Asia Pacific Mobile and Tower Cranes Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Macroeconomic Overview

11.3. Brand Analysis

11.4. Key Trends Analysis

11.4.1. Demand Side

11.4.2. Supplier Side

11.5. Mobile and Tower Cranes Market Size (US$ Bn and Thousand Units) Forecast, By Type, 2017 – 2031

11.5.1. Mobile Cranes

11.5.1.1. All Terrain

11.5.1.2. Rough Terrain

11.5.1.3. Truck Crane

11.5.1.4. Crawler Crane

11.5.1.5. Telescopic Truck Mounted Crane

11.5.2. Tower Cranes

11.5.2.1. Self-Erecting Crane

11.5.2.2. Flat top

11.5.2.3. Luffing Jib Tower Crane

11.5.2.4. Hammerhead Crane

11.5.3. Mobile Tower Cranes

11.6. Mobile and Tower Cranes Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

11.6.1. Oil & Gas

11.6.2. Construction

11.6.3. Shipping & Port

11.6.4. Others

11.7. Mobile and Tower Cranes Market Size (US$ Bn and Thousand Units) Forecast, By Country/Sub-region, 2017 - 2031

11.7.1. India

11.7.2. China

11.7.3. Japan

11.7.4. Rest of Asia Pacific

11.8. Incremental Opportunity Analysis

12. Middle East & South Africa Mobile and Tower Cranes Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Macroeconomic Overview

12.3. Brand Analysis

12.4. Price Trend Analysis

12.4.1. Weighted Average Price

12.5. Key Trends Analysis

12.5.1. Demand Side

12.5.2. Supplier Side

12.6. Mobile and Tower Cranes Market Size (US$ Bn and Thousand Units) Forecast, By Type, 2017 – 2031

12.6.1. Mobile Cranes

12.6.1.1. All Terrain

12.6.1.2. Rough Terrain

12.6.1.3. Truck Crane

12.6.1.4. Crawler Crane

12.6.1.5. Telescopic Truck Mounted Crane

12.6.2. Tower Cranes

12.6.2.1. Self-Erecting Crane

12.6.2.2. Flat top

12.6.2.3. Luffing Jib Tower Crane

12.6.2.4. Hammerhead Crane

12.6.3. Mobile Tower Cranes

12.7. Mobile and Tower Cranes Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

12.7.1. Oil & Gas

12.7.2. Construction

12.7.3. Shipping & Port

12.7.4. Others

12.8. Mobile and Tower Cranes Market Size (US$ Bn and Thousand Units) Forecast, By Country/Sub-region, 2017 - 2031

12.8.1. GCC

12.8.2. Rest of MEA

12.9. Incremental Opportunity Analysis

13. South America Mobile and Tower Cranes Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Macroeconomic Overview

13.3. Brand Analysis

13.4. Price Trend Analysis

13.4.1. Weighted Average Price

13.5. Key Trends Analysis

13.5.1. Demand Side

13.5.2. Supplier Side

13.6. Mobile and Tower Cranes Market Size (US$ Bn and Thousand Units) Forecast, By Type, 2017 – 2031

13.6.1. Mobile Cranes

13.6.1.1. All Terrain

13.6.1.2. Rough Terrain

13.6.1.3. Truck Crane

13.6.1.4. Crawler Crane

13.6.1.5. Telescopic Truck Mounted Crane

13.6.2. Tower Cranes

13.6.2.1. Self-Erecting Crane

13.6.2.2. Flat top

13.6.2.3. Luffing Jib Tower Crane

13.6.2.4. Hammerhead Crane

13.6.3. Mobile Tower Cranes

13.7. Mobile and Tower Cranes Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

13.7.1. Oil & Gas

13.7.2. Construction

13.7.3. Shipping & Port

13.7.4. Others

13.8. Mobile and Tower Cranes Market Size (US$ Bn and Thousand Units) Forecast, By Country/Sub-region, 2017 - 2031

13.8.1. Brazil

13.8.2. Rest of South America

13.9. Incremental Opportunity Analysis

14. Competition Landscape

14.1. Market Player – Competition Dashboard

14.2. Market Share Analysis (%), by Company, (2022)

14.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

14.3.1. FAVCO BERHAD

14.3.1.1. Company Overview

14.3.1.2. Sales Area/Geographical Presence

14.3.1.3. Revenue

14.3.1.4. Strategy & Business Overview

14.3.2. Hyva Cranes

14.3.2.1. Company Overview

14.3.2.2. Sales Area/Geographical Presence

14.3.2.3. Revenue

14.3.2.4. Strategy & Business Overview

14.3.3. Kobelco Cranes Global Ltd

14.3.3.1. Company Overview

14.3.3.2. Sales Area/Geographical Presence

14.3.3.3. Revenue

14.3.3.4. Strategy & Business Overview

14.3.4. Konecranes

14.3.4.1. Company Overview

14.3.4.2. Sales Area/Geographical Presence

14.3.4.3. Revenue

14.3.4.4. Strategy & Business Overview

14.3.5. Manitex International

14.3.5.1. Company Overview

14.3.5.2. Sales Area/Geographical Presence

14.3.5.3. Revenue

14.3.5.4. Strategy & Business Overview

14.3.6. Manitowoc

14.3.6.1. Company Overview

14.3.6.2. Sales Area/Geographical Presence

14.3.6.3. Revenue

14.3.6.4. Strategy & Business Overview

14.3.7. Sany Heavy Industry Co. Ltd.

14.3.7.1. Company Overview

14.3.7.2. Sales Area/Geographical Presence

14.3.7.3. Revenue

14.3.7.4. Strategy & Business Overview

14.3.8. Tadano Faun

14.3.8.1. Company Overview

14.3.8.2. Sales Area/Geographical Presence

14.3.8.3. Revenue

14.3.8.4. Strategy & Business Overview

14.3.9. Terex Corporation

14.3.9.1. Company Overview

14.3.9.2. Sales Area/Geographical Presence

14.3.9.3. Revenue

14.3.9.4. Strategy & Business Overview

14.3.10. WOLFFKRAN International AG.

14.3.10.1. Company Overview

14.3.10.2. Sales Area/Geographical Presence

14.3.10.3. Revenue

14.3.10.4. Strategy & Business Overview

15. Key Takeaways

15.1. Identification of Potential Market Spaces

15.1.1. By Type

15.1.2. By Application

15.1.3. By Region

15.2. Prevailing Market Risks

15.3. Understanding the Buying Process of Customers

15.4. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Mobile and Tower Cranes Market Value (US$ Bn), by Type, 2017-2031

Table 2: Global Mobile and Tower Cranes Market Volume (Thousand Units), by Type 2017-2031

Table 3: Global Mobile and Tower Cranes Market Value (US$ Bn), by Application, 2017-2031

Table 4: Global Mobile and Tower Cranes Market Volume (Thousand Units), by Application 2017-2031

Table 5: Global Mobile and Tower Cranes Market Value (US$ Bn), by Region, 2017-2031

Table 6: Global Mobile and Tower Cranes Market Volume (Thousand Units), by Region 2017-2031

Table 7: North America Mobile and Tower Cranes Market Value (US$ Bn), by Type, 2017-2031

Table 8: North America Mobile and Tower Cranes Market Volume (Thousand Units), by Type 2017-2031

Table 9: North America Mobile and Tower Cranes Market Value (US$ Bn), by Application, 2017-2031

Table 10: North America Mobile and Tower Cranes Market Volume (Thousand Units), by Application 2017-2031

Table 11: North America Mobile and Tower Cranes Market Value (US$ Bn), by Region, 2017-2031

Table 12: North America Mobile and Tower Cranes Market Volume (Thousand Units), by Region 2017-2031

Table 13: Europe Mobile and Tower Cranes Market Value (US$ Bn), by Type, 2017-2031

Table 14: Europe Mobile and Tower Cranes Market Volume (Thousand Units), by Type 2017-2031

Table 15: Europe Mobile and Tower Cranes Market Value (US$ Bn), by Application, 2017-2031

Table 16: Europe Mobile and Tower Cranes Market Volume (Thousand Units), by Application 2017-2031

Table 17: Europe Mobile and Tower Cranes Market Value (US$ Bn), by Region, 2017-2031

Table 18: Europe Mobile and Tower Cranes Market Volume (Thousand Units), by Region 2017-2031

Table 19: Asia Pacific Mobile and Tower Cranes Market Value (US$ Bn), by Type, 2017-2031

Table 20: Asia Pacific Mobile and Tower Cranes Market Volume (Thousand Units), by Type 2017-2031

Table 21: Asia Pacific Mobile and Tower Cranes Market Value (US$ Bn), by Application, 2017-2031

Table 22: Asia Pacific Mobile and Tower Cranes Market Volume (Thousand Units), by Application 2017-2031

Table 23: Asia Pacific Mobile and Tower Cranes Market Value (US$ Bn), by Region, 2017-2031

Table 24: Asia Pacific Mobile and Tower Cranes Market Volume (Thousand Units), by Region 2017-2031

Table 25: Middle East & Africa Mobile and Tower Cranes Market Value (US$ Bn), by Type, 2017-2031

Table 26: Middle East & Africa Mobile and Tower Cranes Market Volume (Thousand Units), by Type 2017-2031

Table 27: Middle East & Africa Mobile and Tower Cranes Market Value (US$ Bn), by Application, 2017-2031

Table 28: Middle East & Africa Mobile and Tower Cranes Market Volume (Thousand Units), by Application 2017-2031

Table 29: Middle East & Africa Mobile and Tower Cranes Market Value (US$ Bn), by Region, 2017-2031

Table 30: Middle East & Africa Mobile and Tower Cranes Market Volume (Thousand Units), by Region 2017-2031

Table 31: South America Mobile and Tower Cranes Market Value (US$ Bn), by Type, 2017-2031

Table 32: South America Mobile and Tower Cranes Market Volume (Thousand Units), by Type 2017-2031

Table 33: South America Mobile and Tower Cranes Market Value (US$ Bn), by Application, 2017-2031

Table 34: South America Mobile and Tower Cranes Market Volume (Thousand Units), by Application 2017-2031

Table 35: South America Mobile and Tower Cranes Market Value (US$ Bn), by Region, 2017-2031

Table 36: South America Mobile and Tower Cranes Market Volume (Thousand Units), by Region 2017-2031

List of Figures

Figure 1: Global Mobile and Tower Cranes Market Value (US$ Bn), by Type, 2017-2031

Figure 2: Global Mobile and Tower Cranes Market Volume (Thousand Units), by Type 2017-2031

Figure 3: Global Mobile and Tower Cranes Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 4: Global Mobile and Tower Cranes Market Value (US$ Bn), by Application, 2017-2031

Figure 5: Global Mobile and Tower Cranes Market Volume (Thousand Units), by Application 2017-2031

Figure 6: Global Mobile and Tower Cranes Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 7: Global Mobile and Tower Cranes Market Value (US$ Bn), by Region, 2017-2031

Figure 8: Global Mobile and Tower Cranes Market Volume (Thousand Units), by Region 2017-2031

Figure 9: Global Mobile and Tower Cranes Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 10: North America Mobile and Tower Cranes Market Value (US$ Bn), by Type, 2017-2031

Figure 11: North America Mobile and Tower Cranes Market Volume (Thousand Units), by Type 2017-2031

Figure 12: North America Mobile and Tower Cranes Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 13: North America Mobile and Tower Cranes Market Value (US$ Bn), by Application, 2017-2031

Figure 14: North America Mobile and Tower Cranes Market Volume (Thousand Units), by Application 2017-2031

Figure 15: North America Mobile and Tower Cranes Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 16: North America Mobile and Tower Cranes Market Value (US$ Bn), by Region, 2017-2031

Figure 17: North America Mobile and Tower Cranes Market Volume (Thousand Units), by Region 2017-2031

Figure 18: North America Mobile and Tower Cranes Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 19: Europe Mobile and Tower Cranes Market Value (US$ Bn), by Type, 2017-2031

Figure 20: Europe Mobile and Tower Cranes Market Volume (Thousand Units), by Type 2017-2031

Figure 21: Europe Mobile and Tower Cranes Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 22: Europe Mobile and Tower Cranes Market Value (US$ Bn), by Application, 2017-2031

Figure 23: Europe Mobile and Tower Cranes Market Volume (Thousand Units), by Application 2017-2031

Figure 24: Europe Mobile and Tower Cranes Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 25: Europe Mobile and Tower Cranes Market Value (US$ Bn), by Region, 2017-2031

Figure 26: Europe Mobile and Tower Cranes Market Volume (Thousand Units), by Region 2017-2031

Figure 27: Europe Mobile and Tower Cranes Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 28: Asia Pacific Mobile and Tower Cranes Market Value (US$ Bn), by Type, 2017-2031

Figure 29: Asia Pacific Mobile and Tower Cranes Market Volume (Thousand Units), by Type 2017-2031

Figure 30: Asia Pacific Mobile and Tower Cranes Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 31: Asia Pacific Mobile and Tower Cranes Market Value (US$ Bn), by Application, 2017-2031

Figure 32: Asia Pacific Mobile and Tower Cranes Market Volume (Thousand Units), by Application 2017-2031

Figure 33: Asia Pacific Mobile and Tower Cranes Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 34: Asia Pacific Mobile and Tower Cranes Market Value (US$ Bn), by Region, 2017-2031

Figure 35: Asia Pacific Mobile and Tower Cranes Market Volume (Thousand Units), by Region 2017-2031

Figure 36: Asia Pacific Mobile and Tower Cranes Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 37: Middle East & Africa Mobile and Tower Cranes Market Value (US$ Bn), by Type, 2017-2031

Figure 38: Middle East & Africa Mobile and Tower Cranes Market Volume (Thousand Units), by Type 2017-2031

Figure 39: Middle East & Africa Mobile and Tower Cranes Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 40: Middle East & Africa Mobile and Tower Cranes Market Value (US$ Bn), by Application, 2017-2031

Figure 41: Middle East & Africa Mobile and Tower Cranes Market Volume (Thousand Units), by Application 2017-2031

Figure 42: Middle East & Africa Mobile and Tower Cranes Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 43: Middle East & Africa Mobile and Tower Cranes Market Value (US$ Bn), by Region, 2017-2031

Figure 44: Middle East & Africa Mobile and Tower Cranes Market Volume (Thousand Units), by Region 2017-2031

Figure 45: Middle East & Africa Mobile and Tower Cranes Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 46: North America Mobile and Tower Cranes Market Value (US$ Bn), by Type, 2017-2031

Figure 47: North America Mobile and Tower Cranes Market Volume (Thousand Units), by Type 2017-2031

Figure 48: North America Mobile and Tower Cranes Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 49: North America Mobile and Tower Cranes Market Value (US$ Bn), by Application, 2017-2031

Figure 50: North America Mobile and Tower Cranes Market Volume (Thousand Units), by Application 2017-2031

Figure 51: North America Mobile and Tower Cranes Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 52: North America Mobile and Tower Cranes Market Value (US$ Bn), by Region, 2017-2031

Figure 53: North America Mobile and Tower Cranes Market Volume (Thousand Units), by Region 2017-2031

Figure 54: North America Mobile and Tower Cranes Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031