Mobile satellite service (MSS) is a telecommunication service beyond the terrestrial range that serves mobile users by using the satellites. MSS is an appropriate communication channel for remote areas that lack wired networks. MSS systems are categorized based on their orbital altitudes such as low earth orbit (LEO), medium earth orbit (MEO) and geostationary orbit (GEO). MSS find its application in the key market segments such as the government sector, aviation sector and maritime sector. It allows remote communication of voice, and data between the terminals. Distinguishing benefits of MSS are access diversity, global connectivity, priority access and terrain independence. These capabilities of MSS enhance remote communications and terrestrial-based wireless systems.

MSS operators use lower frequency S- and L-band frequencies of radio spectrum connecting to non-directional earth station antennas with terminals in space or on ground for mobile communications, maritime and other transport-related services. Deployment of MSS stations is rapid and provide secure and scalable communications to the end-users. Increasing demand for mobility is one of the key factor which is anticipated to drive the market’s growth trajectories. In-flight connectivity, maritime communication and autonomous vehicles are few of the prime factors responsible for growing users demand for mobility. Furthermore, oil and gas sector is increasing its use of video streaming for operations monitoring and crew welfare. With the rise in oil & gas and mining activities in remote areas, demand for MSS is increasing.

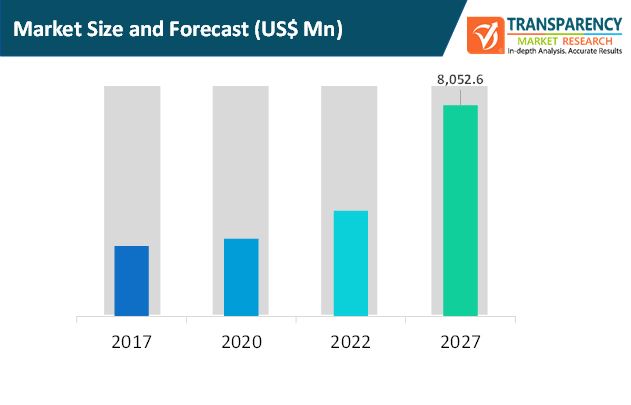

Deployment of MSS stations is rapid and provide secure and scalable communications to the end-users. Increasing demand for mobility is one of the key factor which is anticipated to drive the market’s growth trajectories. In-flight connectivity, maritime communication and autonomous vehicles are few of the prime factors responsible for growing users demand for mobility. Furthermore, oil and gas sector is increasing its use of video streaming for operations monitoring and crew welfare. With the rise in oil & gas and mining activities in remote areas, demand for MSS is increasing. Considering these positive factors, the demand for high Mobile Satellite Services (MSS) market set to rise during the forecast period from 2017 – 2027.

Mobile satellite services (MSS) market is segmented on the basis of access type, service type and end-use verticals. Based on access type, the market is further segmented into aeronautical MSS, land MSS, maritime MSS, personal MSS and broadband MSS. Based on service type, the market is segmented into voice service and data service. Data Service segment is anticipated to contribute major share in the global MSS market. End-use vertical is segmented into oil & gas, media & entertainment, mining, military & defense, aviation, government, transportations, automotive and others. The military & defense segment is anticipated to contribute major share in the global mobile satellite services (MSS) market followed by government over the forecast period.

By geography, the MSS market has been segregated into North America, Europe, Asia Pacific, Middle East and Africa and Latin America. In 2019, North America held the largest market of the Internet of Thing in terms of revenue. On the other hand, growing consumer’s preference towards smart devices especially in countries such as china and India is expected to drive the market of Asia Pacific region at the fastest pace. The Internet of Thing market of North America is followed by Europe in terms of revenue and these two regions collectively held more than 60% of the market in terms of revenue in 2018.

The global Mobile Satellite Services (MSS) market is characterized by the presence of numerous players in the market. The key market players majorly compete on the basis of price, performance, quality, support, services and innovations of product. Some of the major players in IoT market include

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Mobile Satellite Services (MSS) Market

4. Market Overview

4.1. Introduction

4.1.1. Definition: Mobile Satellite Services (MSS) Market

4.1.2. Industry Developments

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunity

4.3. Key Trends

4.4. Global Mobile Satellite Services (MSS) Market Analysis and Forecasts, 2017 - 2027

4.4.1. Global Mobile Satellite Services (MSS) Market Revenue Projections (US$ Mn), 2017 - 2027

4.5. Porter’s Five Forces Analysis

4.6. Policy and Regulations

4.7. Ecosystem Analysis

4.8. Market Outlook

5. Global Mobile Satellite Services (MSS) Market Analysis and Forecasts, By Access Type

5.1. Introduction & Definitions

5.2. Market Size (US$ Mn) Forecast By Access Type, 2017 - 2027

5.2.1. Aeronautical MSS

5.2.2. Land MSS

5.2.3. Maritime MSS

5.2.4. Personal MSS

5.2.5. Broadcast MSS

5.3. Access Type Comparison Matrix

5.4. Market Attractiveness By Access Type

6. Global Mobile Satellite Services (MSS) Market Analysis and Forecasts, By Service Type

6.1. Introduction & Definitions

6.2. Market Size Forecast By Service Type, 2017 - 2027

6.2.1. Data Services

6.2.2. Voice Services

6.3. Service Type Comparison Matrix

6.4. Market Attractiveness By Service Type

7. Global Mobile Satellite Services (MSS) Market Analysis and Forecasts, By End-use Industry

7.1. Introduction & Definitions

7.2. Market Size (US$ Mn) Forecast By End-use Industry, 2017 - 2027

7.2.1. Oil & Gas

7.2.2. Media & Entertainment

7.2.3. Mining

7.2.4. Military & Defense

7.2.5. Aviation

7.2.6. Government (Disaster Management)

7.2.7. Transportation

7.2.7.1. Land

7.2.7.2. Rail

7.2.7.3. Marine

7.2.8. Automotive

7.2.9. Others

7.3. End-use Industry Comparison Matrix

7.4. Market Attractiveness Analysis, By End-use Industry

8. Global Mobile Satellite Services (MSS) Market Analysis and Forecasts, By Country

8.1. Key Findings

8.2. Market Size (US$ Mn) Forecast, By Country/Region, 2017 - 2027

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Arica

8.2.5. South America

8.3. Market Attractiveness Analysis By Country/Region

9. North America Mobile Satellite Services (MSS) Market Analysis and Forecast

9.1. Key Findings

9.2. Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast, By Access Type, 2017 - 2027

9.2.1. Aeronautical MSS

9.2.2. Land MSS

9.2.3. Maritime MSS

9.2.4. Personal MSS

9.2.5. Broadcast MSS

9.3. Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast, By Service Type, 2017 - 2027

9.3.1. Data Services

9.3.2. Voice Services

9.4. Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast, By End-Use Industry, 2017 - 2027

9.4.1. Oil & Gas

9.4.2. Media & Entertainment

9.4.3. Mining

9.4.4. Military & Defense

9.4.5. Aviation

9.4.6. Government (Disaster Management)

9.4.7. Transportation

9.4.7.1. Land

9.4.7.2. Rail

9.4.7.3. Marine

9.4.8. Automotive

9.4.9. Others

9.5. Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast, By Country, 2017 - 2027

9.5.1. The U.S.

9.5.2. Canada

9.5.3. Rest of North America

9.6. Market Attractiveness Analysis

9.6.1. By Access Type

9.6.2. By Service Type

9.6.3. By End-Use Industry

9.6.4. By Country

10. Europe Mobile Satellite Services (MSS) Market Analysis and Forecast

10.1. Key Findings

10.2. Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast, By Access Type, 2017 - 2027

10.2.1. Aeronautical MSS

10.2.2. Land MSS

10.2.3. Maritime MSS

10.2.4. Personal MSS

10.2.5. Broadcast MSS

10.3. Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast, By Service Type, 2017 - 2027

10.3.1. Data Services

10.3.2. Voice Services

10.4. Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast, By End-Use Industry, 2017 - 2027

10.4.1. Oil & Gas

10.4.2. Media & Entertainment

10.4.3. Mining

10.4.4. Military & Defense

10.4.5. Aviation

10.4.6. Government (Disaster Management)

10.4.7. Transportation

10.4.7.1. Land

10.4.7.2. Rail

10.4.7.3. Marine

10.4.8. Automotive

10.4.9. Others

10.4.10.

10.5. Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast, By Country, 2017 - 2027

10.5.1. Germany

10.5.2. France

10.5.3. UK

10.5.4. Rest of Europe

10.6. Market Attractiveness Analysis

10.6.1. By Access Type

10.6.2. By Service Type

10.6.3. By End-Use Industry

10.6.4. By Country

11. Asia Pacific Mobile Satellite Services (MSS) Market Analysis and Forecast

11.1. Key Findings

11.2. Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast, By Access Type, 2017 - 2027

11.2.1. Aeronautical MSS

11.2.2. Land MSS

11.2.3. Maritime MSS

11.2.4. Personal MSS

11.2.5. Broadcast MSS

11.3. Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast, By Service Type, 2017 - 2027

11.3.1. Data Services

11.3.2. Voice Services

11.4. Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast, By End-Use Industry, 2017 - 2027

11.4.1. Oil & Gas

11.4.2. Media & Entertainment

11.4.3. Mining

11.4.4. Military & Defense

11.4.5. Aviation

11.4.6. Government (Disaster Management)

11.4.7. Transportation

11.4.7.1. Land

11.4.7.2. Rail

11.4.7.3. Marine

11.4.8. Automotive

11.4.9. Others

11.5. Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast, By Country, 2017 - 2027

11.5.1. China

11.5.2. Japan

11.5.3. India

11.5.4. Rest of Asia Pacific

11.6. Market Attractiveness Analysis

11.6.1. By Access Type

11.6.2. By Service Type

11.6.3. By End-Use Industry

11.6.4. By Country

12. Middle East and Africa (MEA) Mobile Satellite Services (MSS) Market Analysis and Forecast

12.1. Key Findings

12.2. Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast, By Access Type, 2017 - 2027

12.2.1. Aeronautical MSS

12.2.2. Land MSS

12.2.3. Maritime MSS

12.2.4. Personal MSS

12.2.5. Broadcast MSS

12.3. Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast, By Service Type, 2017 - 2027

12.3.1. Data Services

12.3.2. Voice Services

12.4. Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast, By End-Use Industry, 2017 - 2027

12.4.1. Oil & Gas

12.4.2. Media & Entertainment

12.4.3. Mining

12.4.4. Military & Defense

12.4.5. Aviation

12.4.6. Government (Disaster Management)

12.4.7. Transportation

12.4.7.1. Land

12.4.7.2. Rail

12.4.7.3. Marine

12.4.8. Automotive

12.4.9. Others

12.5. Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast, By Country, 2017 - 2027

12.5.1. GCC Countries

12.5.2. South Africa

12.5.3. Rest of Middle East & Africa

12.6. Market Attractiveness Analysis

12.6.1. By Access Type

12.6.2. By Service Type

12.6.3. By End-Use Industry

12.6.4. By Country

13. South America Global Mobile Satellite Services (MSS) Market Analysis and Forecast

13.1. Key Findings

13.2. Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast, By Access Type, 2017 - 2027

13.2.1. Aeronautical MSS

13.2.2. Land MSS

13.2.3. Maritime MSS

13.2.4. Personal MSS

13.2.5. Broadcast MSS

13.3. Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast, By Service Type, 2017 - 2027

13.3.1. Data Services

13.3.2. Voice Services

13.4. Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast, By End-Use Industry, 2017 - 2027

13.4.1. Oil & Gas

13.4.2. Media & Entertainment

13.4.3. Mining

13.4.4. Military & Defense

13.4.5. Aviation

13.4.6. Government (Disaster Management)

13.4.7. Transportation

13.4.7.1. Land

13.4.7.2. Rail

13.4.7.3. Marine

13.4.8. Automotive

13.4.9. Others

13.5. Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast, By Country, 2017 - 2027

13.5.1. Brazil

13.5.2. Rest of South America

13.6. Market Attractiveness Analysis

13.6.1. By Access Type

13.6.2. By Service Type

13.6.3. By End-Use Industry

13.6.4. By Country

14. Competition Landscape

14.1. Market Player – Competition Matrix

14.2. Market Share Analysis By Company (2017)

14.3. Company Profiles (Details – Overview, Financials, SWOT Analysis, Strategy)

14.3.1. Echostar Corporation

14.3.1.1. Product Portfolio

14.3.1.2. Geographical Presence

14.3.1.3. SWOT

14.3.1.4. Financial Overview

14.3.1.5. Strategy

14.3.2. Ericsson AB

14.3.2.1. Product Portfolio

14.3.2.2. Geographical Presence

14.3.2.3. SWOT

14.3.2.4. Financial Overview

14.3.2.5. Strategy

14.3.3. GlobalStar

14.3.3.1. Product Portfolio

14.3.3.2. Geographical Presence

14.3.3.3. SWOT

14.3.3.4. Financial Overview

14.3.3.5. Strategy

14.3.4. Inmarsat Inc.

14.3.4.1. Product Portfolio

14.3.4.2. Geographical Presence

14.3.4.3. SWOT

14.3.4.4. Financial Overview

14.3.4.5. Strategy

14.3.5. Intelsat, S.A.

14.3.5.1. Product Portfolio

14.3.5.2. Geographical Presence

14.3.5.3. SWOT

14.3.5.4. Financial Overview

14.3.5.5. Strategy

14.3.6. Iridium Communications Inc.

14.3.6.1. Product Portfolio

14.3.6.2. Geographical Presence

14.3.6.3. SWOT

14.3.6.4. Financial Overview

14.3.6.5. Strategy

14.3.7. ORBCOMM, Inc.

14.3.7.1. Product Portfolio

14.3.7.2. Geographical Presence

14.3.7.3. SWOT

14.3.7.4. Financial Overview

14.3.7.5. Strategy

14.3.8. Singtel Satellite

14.3.8.1. Product Portfolio

14.3.8.2. Geographical Presence

14.3.8.3. SWOT

14.3.8.4. Financial Overview

14.3.8.5. Strategy

14.3.9. Telstra Corporation Limited

14.3.9.1. Product Portfolio

14.3.9.2. Geographical Presence

14.3.9.3. SWOT

14.3.9.4. Financial Overview

14.3.9.5. Strategy

14.3.10. Tesacom

14.3.10.1. Product Portfolio

14.3.10.2. Geographical Presence

14.3.10.3. SWOT

14.3.10.4. Financial Overview

14.3.10.5. Strategy

14.3.11. Thuraya Telecommunications Company

14.3.11.1. Product Portfolio

14.3.11.2. Geographical Presence

14.3.11.3. SWOT

14.3.11.4. Financial Overview

14.3.11.5. Strategy

14.3.12. ViaSat Inc.

14.3.12.1. Product Portfolio

14.3.12.2. Geographical Presence

14.3.12.3. SWOT

14.3.12.4. Financial Overview

14.3.12.5. Strategy

15. Key Takeaways

List of Tables

Table 1: Global Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast, by Access Type, 2017 - 2027

Table 2: Global Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast, by Service Type, 2017 - 2027

Table 3: Global Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast, by End-use Industry, 2017 - 2027

Table 4: Global Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast, By End-Use Industry, By Transportation, 2017 - 2027

Table 5: Global Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast, by Region , 2017 - 2027

Table 6: North America Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast, by Access Type, 2017 - 2027

Table 7: North America Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast, by Service Type, 2017 - 2027

Table 8: North America Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast, by End-use Industry, 2017 - 2027

Table 9: North America Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast, by End-Use Industry, By Transportation, 2017 - 2027

Table 10: North America Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast, by Country, 2017 - 2027

Table 11: Europe Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast, by Access Type, 2017 - 2027

Table 12: Europe Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast, by Service Type, 2017 - 2027

Table 13: Europe Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast, by End-use Industry, 2017 - 2027

Table 14: Europe Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast, by End-Use Industry, By Transportation, 2017 - 2027

Table 15: Europe Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast, by Country, 2017 - 2027

Table 16: Asia Pacific Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast, by Access Type, 2017 - 2027

Table 17: Asia Pacific Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast, by Service Type, 2017 - 2027

Table 18: Asia Pacific Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast, by End-use Industry, 2017 - 2027

Table 19: Asia Pacific Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast, by End-Use Industry, By Transportation, 2017 - 2027

Table 20: Asia Pacific Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast, by Country, 2017 - 2027

Table 21: Middle East & Africa Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast, by Access Type, 2017 - 2027

Table 22: Middle East & Africa Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast, by Service Type, 2017 - 2027

Table 23: Middle East & Africa Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast, by End-use Industry, 2017 - 2027

Table 24: Middle East & Africa Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast, by End-Use Industry, By Transportation, 2017 - 2027

Table 25: Middle East & Africa Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast, by Country, 2017 - 2027

Table 26: South America Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast, by Access Type, 2017 - 2027

Table 27: South America Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast, by Service Type, 2017 - 2027

Table 28: South America Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast, by End-use Industry, 2017 - 2027

Table 29: South America Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast, by End-Use Industry, By Transportation, 2017 - 2027

Table 30: Middle East & Africa Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast, by Country, 2017 - 2027

Table 31: Key Financial Indicators, 2015- 2017, EchoStar Corporation

Table 32: Key Financial Indicators, 2015- 2017, Ericsson AB

Table 33: Key Financial Indicators, 2015- 2017, Globalstar, Inc.

Table 34: Key Financial Indicators, 2015- 2017, Inmarsat plc.

Table 35: Key Financial Indicators, 2015- 2017, INTELSAT

Table 36: Key Financial Indicators, 2015- 2017, Iridium Communications Inc.

Table 37: Key Financial Indicators, 2015- 2017, ORBCOMM

Table 38: Key Financial Indicators, 2017- 2017, Telstra Corporation Limited

Table 39: Key Financial Indicators, 2017- 2017, Viasat Inc.

List of Figures

Figure 1: Global Mobile Satellite Services (MSS) Market CAGR by Access Type (2017 - 2027)

Figure 2: Global Mobile Satellite Services (MSS) Market CAGR by Service Type (2017 - 2027)

Figure 3: Global Mobile Satellite Services (MSS) Market CAGR by End-Use Industry (2017 - 2027)

Figure 5: Global Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast by Access Type, Land MSS

Figure 7: Global Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast by Access Type, Personal MSS

Figure 4: Global Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast by Access Type, Aeronautical MSS

Figure 6: Global Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast by Access Type, Maritime MSS

Figure 8: Global Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast by Access Type, Broadcast MSS

Figure 9: Global Mobile Satellite Services (MSS) Market Attractiveness, by Access Type (2017)

Figure 10: Global Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast by Service Type, Data Service

Figure 11: Global Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast by Service Type, Voice Service

Figure 12: Global Mobile Satellite Services (MSS) Market Attractiveness, by Service Type (2017)

Figure 12: Global Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast by End-use Industry, Oil & Gas

Figure 13: Global Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast by End-use Industry, Media & Entertainment

Figure 14: Global Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast by End-use Industry, Mining

Figure 15: Global Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast by End-use Industry, Military & Defense

Figure 16: Global Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast by End-use Industry, Aviation

Figure 17: Global Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast by End-use Industry, Government (Disaster Management)

Figure 18: Global Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast by End-use Industry, Transportation

Figure 19: Global Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast by End-use Industry, Automotive

Figure 20: Global Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast by End-use Industry, Others

Figure 21: Global Mobile Satellite Services (MSS) Market Attractiveness, by End-use Industry (2017)

Figure 22: Global Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast by Region, North America

Figure 23: Global Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast by Region, Europe

Figure 24: Global Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast by Region, Asia Pacific

Figure 25: Global Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast by Region, Middle East & Africa

Figure 26: Global Mobile Satellite Services (MSS) Market Size (US$ Mn) Forecast by Region, South America

Figure 27: Global Mobile Satellite Services (MSS) Market Attractiveness, by Region (2017)

Figure 28: North America Mobile Satellite Services (MSS) Market Value Share Analysis, by Access Type, 2019 and 2027

Figure 29: North America Mobile Satellite Services (MSS) Market Value Share Analysis, by Service Type, 2019 and 2027

Figure 30: North America Mobile Satellite Services (MSS) Market Value Share Analysis, by End-Use Industry, 2019 and 2027

Figure 32: North America Mobile Satellite Services (MSS) Market Attractiveness Analysis, by Service Type(2017)

Figure 31: North America Mobile Satellite Services (MSS) Market Attractiveness Analysis, by Access Type (2017)

Figure 33: North America Mobile Satellite Services (MSS) Market Attractiveness Analysis, by End-Use Industry(2017)

Figure 34: Europe Mobile Satellite Services (MSS) Market Value Share Analysis, by Access Type, 2019 and 2027

Figure 35: Europe Mobile Satellite Services (MSS) Market Value Share Analysis, by Service Type, 2019 and 2027

Figure 36: Europe Mobile Satellite Services (MSS) Market Value Share Analysis, by End-Use Industry, 2019 and 2027

Figure 38: Europe Mobile Satellite Services (MSS) Market Attractiveness Analysis, by Service Type(2017)

Figure 37: Europe Mobile Satellite Services (MSS) Market Attractiveness Analysis, by Access Type (2017)

Figure 39: Europe Mobile Satellite Services (MSS) Market Attractiveness Analysis, by End-Use Industry(2017)

Figure 40: Asia Pacific Mobile Satellite Services (MSS) Market Value Share Analysis, by Access Type, 2019 and 2027

Figure 41: Asia Pacific Mobile Satellite Services (MSS) Market Value Share Analysis, by Service Type, 2019 and 2027

Figure 42: Asia Pacific Mobile Satellite Services (MSS) Market Value Share Analysis, by End-Use Industry, 2019 and 2027

Figure 44: Asia Pacific Mobile Satellite Services (MSS) Market Attractiveness Analysis, by Service Type(2017)

Figure 43: Asia Pacific Mobile Satellite Services (MSS) Market Attractiveness Analysis, by Access Type (2017)

Figure 45: Asia Pacific Mobile Satellite Services (MSS) Market Attractiveness Analysis, by End-Use Industry(2017)

Figure 46: Middle East & Africa Mobile Satellite Services (MSS) Market Value Share Analysis, by Access Type, 2019 and 2027

Figure 47: Middle East & Africa Mobile Satellite Services (MSS) Market Value Share Analysis, by Service Type, 2019 and 2027

Figure 48: Middle East & Africa Mobile Satellite Services (MSS) Market Value Share Analysis, by End-Use Industry, 2019 and 2027

Figure 50: Middle East & Africa Mobile Satellite Services (MSS) Market Attractiveness Analysis, by Service Type(2017)

Figure 49: Middle East & Africa Mobile Satellite Services (MSS) Market Attractiveness Analysis, by Access Type (2017)

Figure 51: Middle East & Africa Mobile Satellite Services (MSS) Market Attractiveness Analysis, by End-Use Industry(2017)

Figure 52: South America Mobile Satellite Services (MSS) Market Value Share Analysis, by Access Type, 2019 and 2027

Figure 53: South America Mobile Satellite Services (MSS) Market Value Share Analysis, by Service Type, 2019 and 2027

Figure 54: South America Mobile Satellite Services (MSS) Market Value Share Analysis, by End-Use Industry, 2019 and 2027

Figure 56: South America Mobile Satellite Services (MSS) Market Attractiveness Analysis, by Service Type(2017)

Figure 55: South America Mobile Satellite Services (MSS) Market Attractiveness Analysis, by Access Type (2017)

Figure 57: South America Mobile Satellite Services (MSS) Market Attractiveness Analysis, by End-Use Industry(2017)

Figure 58: Revenue (US$ Mn) & Y-o-Y Growth (%), 2017-2019, EchoStar Corporation

Figure 59: Breakdown of Net Sales, by Geography, 2017 (%), EchoStar Corporation

Figure 60: Revenue (US$ Mn) & Y-o-Y Growth (%), 2017-2019, Ericsson AB

Figure 61: Breakdown of Net Sales, by Geography, 2017 (%), Ericsson AB

Figure 62: Revenue (US$ Mn) & Y-o-Y Growth (%), 2017-2019, Globalstar, Inc.

Figure 63: Breakdown of Net Sales, by Geography, 2017 (%), Globalstar, Inc.

Figure 64: Revenue (US$ Mn) & Y-o-Y Growth (%), 2017-2019, Inmarsat plc.

Figure 65: Breakdown of Net Sales, by Geography, 2017 (%), Inmarsat plc.

Figure 66: Revenue (US$ Mn) & Y-o-Y Growth (%), 2017-2019, INTELSAT

Figure 67: Breakdown of Net Sales, by Geography, 2017 (%), INTELSAT

Figure 68: Revenue (US$ Mn) & Y-o-Y Growth (%), 2017-2019, Iridium Communications Inc.

Figure 69: Breakdown of Net Sales, by Geography, 2017 (%), Iridium Communications Inc.

Figure 70: Revenue (US$ Mn) & Y-o-Y Growth (%), 2017-2019, ORBCOMM

Figure 71: Breakdown of Net Sales, by Geography, 2017 (%), ORBCOMM

Figure 72: Revenue (US$ Mn) & Y-o-Y Growth (%), 2017-2019, Telstra Corporation Limited

Figure 73: Breakdown of Net Sales, by Geography, 2017 (%), Telstra Corporation Limited

Figure 74: Revenue (US$ Mn) & Y-o-Y Growth (%), 2017-2019, Viasat Inc.

Figure 75: Breakdown of Net Sales, by Geography, 2017 (%), Viasat Inc.