Analysts’ Viewpoint on Mobile Cobots Market Scenario

Mobile cobot solutions are currently being gaining popularity in various applications, thereby boosting safety and efficiency in hazardous industrial situations. Smaller platforms, as well as systems capable of handling significantly bigger payloads, are being added to the collaborative robotics sector. Mobile collaborative robots, or cobots, are becoming mainstream. Small payload mobile cobots have been gaining traction for the last few years, accounting for more than one-third of the industry. Current innovations in the mobile cobots industry are led by firms with mobile chassis (AMR) and collaborative robot arms, while integrators also play an important role in the technology's end-use penetration. Collaborative mobile robotics technologies, such as computer vision and mechanical sensing, continue to evolve in order to cater to specialized fields. Consequently, the numerous advantages of mobile cobots promise a growing market.

Mobile cobots are the integration of mobile robots and mobile manipulators or end effectors having collaborative nature. The combination of collaborative and mobile robots provides companies more flexibility by enabling them to rapidly and cost-effectively adapt their production lines to new requirements and changing business needs.

The idea of Industry 4.0 has spread all over the world and currently, it is being implemented on a large-scale worldwide. Principles of the ‘Industry 4.0’ design include interoperability, information transparency, technical assistance, and decentralized decisions. Collaborative robots are fully compatible with the principles of ‘Industry 4.0’. Cobots are designed to be equipped with powerful onboard computers. They are interoperable and they can be easily integrated to IoT in any factory environment. Additionally, they offer information transparency and technical assistance. They can facilitate decentralized decisions.

Cobots are a perfect choice for situations where flexibility is more important than speed, thanks to user-friendly software tools and built-in sensor capabilities. Businesses require clever user-friendly camera and image processing systems; machine vision systems with localization capabilities are one example, which recognize patterns, perform quality control, arrange things, and read bar codes.

The primary objective of mobile cobots is to conduct repetitive assembly cycles and tasks step-by-step with high accuracy and reliable execution. They boost productivity and safety at work while providing high levels of precision. Therefore, the market for mobile cobots is anticipated to grow during the forecast period owing to their high accuracy and falling price.

The potential of the collaborative robot rests on its basic definition ‒ collaboration. Collaborative robots are made to work alongside people, unlike fixed systems that need to be crated and fenced off to protect worker safety. When people are around, cobots can detect them and can prevent their arms from swinging or hurting them.

Analysis of the mobile collaborative robots market trends indicate that cobots as being employed for palleting, inspection tasks, machine tending and maintenance, loading and unloading materials, and various other manufacturing tasks. They can be valuable partners for delicate or dangerous tasks associated with machine tending, because they can be implemented near workers. Improvements in sensors, computer vision, and connectivity are helping cobots become safer, which is especially important for emerging mobile manipulation.

The mobile collaborative robots market research report states that the presence of robots across every major industry, ranging from automotive and electrical & electronics industries to pharmaceutical & cosmetics and food & beverage industries, is expected to boost the market at a notable CAGR between 2022 and 2031.

Traditional industrial robots are built and programmed to do a single task at a distance from workers on the manufacturing or assembly floor and they seem to have favored larger industries first. Smaller manufacturing businesses have had a more challenging time reaping the benefits of automation delivered by robots. Cobots, however, are promising to be a game-changer for all large and small manufacturing. Mobile tablets and devices on the production floor serve as an essential conduit in getting the most out of these sturdy workhorses.

Small business have a low threshold for capital investment, unlike large-scale sectors such as automobile or electronics manufacture. They also have a poor tolerance for risk and a short window of opportunity before seeing a return on their investment. The mobile cobot industry may be hampered by the very specialized and case-by-case nature of the applications.

Mobile cobots are lightweight, space-saving, and easy to re-deploy to multiple applications without changing the production layout. They can easily be transported around the factory floor or facility because they are compact and lightweight. Once at their new location, operators can move between duties fast due to simple and clear GUIs. Several versions, such as autonomous mobile cobots, can also be programmed for new operations. Small and medium-sized manufacturers, particularly those operating in high-mix/low-volume and just-in-time (JIT) environments, benefit from this flexibility.

Cobots are hugely flexible by picking the right gripper, vision component, software modules or sensors; every cobot can be optimized for a large variety of workflows or tasks.

In terms of component, the global mobile cobots market has been classified into hardware, software, and services, where the hardware segment has been further divided into collaborative arm, AMR, vision systems, and other accessories. The hardware segment held a prominent share of the global market in 2021. Furthermore, the mobile cobots market share held by the hardware segment expected to expand at a notable pace during the forecast period. A wide range of tasks can be accomplished owing to the versatility and flexibility of the end effectors, thereby maximizing return on investment.

The robot arm is the most crucial element of a cobot application, which distinguishes it from others. Without a robotic arm, businesses would be forced to deploy big, space-consuming industrial robots. Some people may find that traditional robotics solutions are simply too expensive or too large for their floorspace. Automation and robotics are now available to a completely new group of smaller firms thanks to collaborative robot arms.

Europe dominated the global mobile cobots market and held around 32.5% share in 2021. The market is expanding owing to the numerous industry participants operating in the region and significant amount of research and development activities being carried out on mobile cobots. North America and Asia Pacific are also major markets of mobile cobots, and they held value shares of 28.2% and 26.7% respectively, in 2021.

Several market players are investing in the market for mobile cobots attracted by the rapidly expanding market and underlying latent demand. Manufacturers of products ranging from sensors to accessories and companies across various industries are striving to strengthen their foothold in the mobile cobots market. Some of the prominent players operating in the mobile cobots market and profiled in the study are Universal Robots, ABB Ltd, Aubo Robotics, Fanuc Corporation, Kawasaki Heavy Industries, Ltd., KUKA AG, Precise Automation, Inc., Rethink Robotics, Robert Bosch, TECHMAN Robots, Universal Robots, and Yasakawa Electric Corporation. These companies are focused on expansion of their business through strategic acquisitions and partnerships.

Each of these players has been profiled in the Mobile Cobots market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments

|

Attribute |

Detail |

|

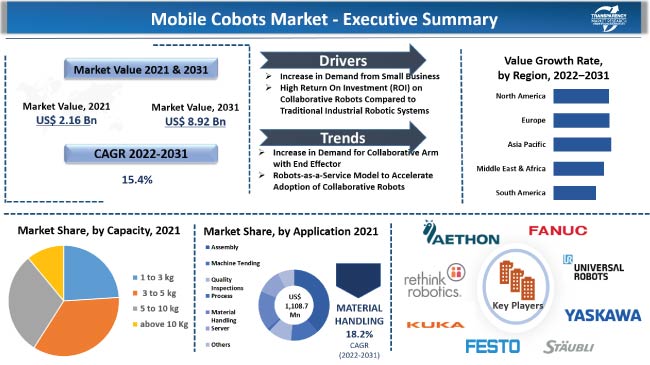

Market Size Value in 2021 |

US$ 2.1 Bn |

|

Market Forecast Value in 2031 |

US$ 8.9 Bn |

|

Growth Rate (CAGR) |

15.4% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The mobile cobots market stood at US$ 2.1 Bn in 2021

The mobile cobots market is estimated to advance at a CAGR of 15.4% during the forecast period

The mobile cobots market is expected to reach US$ 8.9 Bn by 2031

KUKA AG, Locus Robotics, Mobile Industrial Robots A/S, OMRON Corporation, Precise Automation, Inc., Rethink Robotics, Robotnik, SICK, Stäubli International AG, TECHMAN ROBOT INC, Universal Robots.

Europe accounted for 32.5% share of the global mobile cobots market in 2021

Increase in demand for small payload cobots from smaller business and rise in demand for collaborative arm with end effector

Asia Pacific is a highly lucrative region of the global mobile cobots market

1. Preface

1.1. Research Scope.

1.2. Mobile Cobots Market Overview

1.3. Market and Segments Definition

1.4. Market Taxonomy

1.5. Research Methodology

1.6. Assumption and Acronyms

2. Executive Summary

2.1. Global Mobile Cobots Market Analysis and Forecast

2.2. Regional Outline

2.3. Market Dynamics Snapshot

2.4. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Key Market Indicator

3.3. Drivers

3.4. Restraints

3.5. Opportunities

3.6. Trends

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Global Robotics Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Industry SWOT Analysis

4.5. Porter Five Forces Analysis

4.6. COVID-19 Impact Analysis

5. Global Mobile Cobots Market Analysis, by Component

5.1. Global Mobile Cobots Market Size (US$ Bn) Analysis & Forecast, by Component, 2017‒2031

5.1.1. Hardware

5.1.1.1. Arm/End Effector

5.1.1.2. AMR

5.1.1.3. Controller

5.1.1.4. Vision System

5.1.1.5. Accessories

5.1.2. Software

5.1.3. Services

5.2. Global Mobile Cobots Market Attractiveness Analysis, by Component

6. Global Mobile Cobots Market Analysis, by Capacity

6.1. Global Mobile Cobots Market Size (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, by Capacity, 2017‒2031

6.1.1. 1 to 3 kg

6.1.2. 3 to 5 kg

6.1.3. 5 to 10 kg

6.1.4. Above 10 Kg

6.2. Global Mobile Cobots Market Attractiveness Analysis, by Capacity

7. Global Mobile Cobots Market Analysis, by Application

7.1. Global Mobile Cobots Market Size (US$ Bn) Analysis & Forecast, by Application, 2017‒2031

7.1.1. Assembly

7.1.2. Machine Tending

7.1.3. Quality Inspections

7.1.4. Process (Material Removal/gluing/dispensing/welding/finishing)

7.1.5. Material Handling

7.1.6. Others (Maintenances Activities, Packaging, Inventory, etc.)

7.2. Global Mobile Cobots Market Attractiveness Analysis, by Application

8. Global Mobile Cobots Market Analysis, by End-use Industry

8.1. Global Mobile Cobots Market Size (US$ Bn) Analysis & Forecast, by End-use Industry, 2017‒2031

8.1.1. Automotive

8.1.2. Retail

8.1.3. Healthcare

8.1.4. Electronics & Semiconductor

8.1.5. Food and Beverage

8.1.6. Aerospace and Defense

8.1.7. Others (Metal & Machining, Agriculture, etc.)

8.2. Global Mobile Cobots Market Attractiveness Analysis, by End-use Industry

9. Global Mobile Cobots Market Analysis and Forecast, by Region

9.1. Global Mobile Cobots Market Size (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, by Region, 2017 – 2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Global Mobile Cobots Market Attractiveness Analysis, by Region

10. North America Mobile Cobots Market Analysis and Forecast

10.1. Market Snapshot

10.2. North America Mobile Cobots Market Size (US$ Bn) Analysis & Forecast, by Component, 2017‒2031

10.2.1. Hardware

10.2.1.1. Arm/End Effector

10.2.1.2. AMR

10.2.1.3. Controller

10.2.1.4. Vision System

10.2.1.5. Accessories

10.2.2. Software

10.2.3. Services

10.3. North America Mobile Cobots Market Size (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, by Capacity, 2017‒2031

10.3.1. 1 to 3 kg

10.3.2. 3 to 5 kg

10.3.3. 5 to 10 kg

10.3.4. Above 10 Kg

10.4. North America Mobile Cobots Market Size (US$ Bn) Analysis & Forecast, by Application, 2017‒2031

10.4.1. Assembly

10.4.2. Machine Tending

10.4.3. Quality Inspections

10.4.4. Process (Material Removal/gluing/dispensing/welding/finishing)

10.4.5. Material Handling

10.4.6. Others (Maintenances Activities, Packaging, Inventory, etc.)

10.5. North America Mobile Cobots Market Size (US$ Bn) Analysis & Forecast, by End-use Industry, 2017‒2031

10.5.1. Automotive

10.5.2. Retail

10.5.3. Healthcare

10.5.4. Electronics & Semiconductor

10.5.5. Food and Beverage

10.5.6. Aerospace and Defense

10.5.7. Others (Metal & Machining, Agriculture, etc.)

10.6. North America Mobile Cobots Market Size (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, by Country & Sub-region, 2017 – 2031

10.6.1. U.S.

10.6.2. Canada

10.6.3. Mexico

10.7. North America Mobile Cobots Market Attractiveness Analysis

10.7.1. By Component

10.7.2. By Capacity

10.7.3. By Application

10.7.4. By End-use Industry

10.7.5. By Country & Sub-region

11. Europe Mobile Cobots Market Analysis and Forecast

11.1. Market Snapshot

11.2. Europe Mobile Cobots Market Size (US$ Bn) Analysis & Forecast, by Component, 2017‒2031

11.2.1. Hardware

11.2.1.1. Arm/End Effector

11.2.1.2. AMR

11.2.1.3. Controller

11.2.1.4. Vision System

11.2.1.5. Accessories

11.2.2. Software

11.2.3. Services

11.3. Europe Mobile Cobots Market Size (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, by Capacity, 2017‒2031

11.3.1. 1 to 3 kg

11.3.2. 3 to 5 kg

11.3.3. 5 to 10 kg

11.3.4. Above 10 Kg

11.4. Europe Mobile Cobots Market Size (US$ Bn) Analysis & Forecast, by Application, 2017‒2031

11.4.1. Assembly

11.4.2. Machine Tending

11.4.3. Quality Inspections

11.4.4. Process(Material Removal/gluing/dispensing/welding/finishing)

11.4.5. Material Handling

11.4.6. Others (Maintenances Activities, Packaging, Inventory, etc.)

11.5. Europe Mobile Cobots Market Size (US$ Bn) Analysis & Forecast, by End-use Industry, 2017‒2031

11.5.1. Automotive

11.5.2. Retail

11.5.3. Healthcare

11.5.4. Electronics & Semiconductor

11.5.5. Food and Beverage

11.5.6. Aerospace and Defense

11.5.7. Others (Metal & Machining, Agriculture, etc.)

11.6. Europe Mobile Cobots Market Size (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, by Country & Sub-region, 2017 – 2031

11.6.1. U.K.

11.6.2. Germany

11.6.3. France

11.6.4. Rest of Europe

11.7. Europe Mobile Cobots Market Attractiveness Analysis

11.7.1. By Component

11.7.2. By Capacity

11.7.3. By Application

11.7.4. By End-use Industry

11.7.5. By Country & Sub-region

12. Asia Pacific Mobile Cobots Market Analysis and Forecast

12.1. Market Snapshot

12.2. Asia Pacific Mobile Cobots Market Size (US$ Bn) Analysis & Forecast, by Component, 2017‒2031

12.2.1. Hardware

12.2.1.1. Arm/End Effector

12.2.1.2. AMR

12.2.1.3. Controller

12.2.1.4. Vision System

12.2.1.5. Accessories

12.2.2. Software

12.2.3. Services

12.3. Asia Pacific Mobile Cobots Market Size (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, by Capacity, 2017‒2031

12.3.1. 1 to 3 kg

12.3.2. 3 to 5 kg

12.3.3. 5 to 10 kg

12.3.4. Above 10 Kg

12.4. Asia Pacific Mobile Cobots Market Size (US$ Bn) Analysis & Forecast, by Application, 2017‒2031

12.4.1. Assembly

12.4.2. Machine Tending

12.4.3. Quality Inspections

12.4.4. Process(Material Removal/gluing/dispensing/welding/finishing)

12.4.5. Material Handling

12.4.6. Others (Maintenances Activities, Packaging, Inventory, etc.)

12.5. Asia Pacific Mobile Cobots Market Size (US$ Bn) Analysis & Forecast, by End-use Industry, 2017‒2031

12.5.1. Automotive

12.5.2. Retail

12.5.3. Healthcare

12.5.4. Electronics & Semiconductor

12.5.5. Food and Beverage

12.5.6. Aerospace and Defense

12.5.7. Others (Metal & Machining, Agriculture, etc.)

12.6. Asia Pacific Mobile Cobots Market Size (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, by Country & Sub-region, 2017 – 2031

12.6.1. China

12.6.2. India

12.6.3. Japan

12.6.4. South Korea

12.6.5. ASEAN

12.6.6. Rest of Asia Pacific

12.7. Asia Pacific Mobile Cobots Market Attractiveness Analysis

12.7.1. By Component

12.7.2. By Capacity

12.7.3. By Application

12.7.4. By End-use Industry

12.7.5. By Country & Sub-region

13. Middle East & Africa (MEA) Mobile Cobots Market Analysis and Forecast

13.1. Market Snapshot

13.2. MEA Mobile Cobots Market Size (US$ Bn) Analysis & Forecast, by Component, 2017‒2031

13.2.1. Hardware

13.2.1.1. Arm/End Effector

13.2.1.2. AMR

13.2.1.3. Controller

13.2.1.4. Vision System

13.2.1.5. Accessories

13.2.2. Software

13.2.3. Services

13.3. MEA Mobile Cobots Market Size (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, by Capacity, 2017‒2031

13.3.1. 1 to 3 kg

13.3.2. 3 to 5 kg

13.3.3. 5 to 10 kg

13.3.4. Above 10 Kg

13.4. MEA Mobile Cobots Market Size (US$ Bn) Analysis & Forecast, by Application, 2017‒2031

13.4.1. Assembly

13.4.2. Machine Tending

13.4.3. Quality Inspections

13.4.4. Process(Material Removal/gluing/dispensing/welding/finishing)

13.4.5. Material Handling

13.4.6. Others (Maintenances Activities, Packaging, Inventory, etc.)

13.5. MEA Mobile Cobots Market Size (US$ Bn) Analysis & Forecast, by End-use Industry, 2017‒2031

13.5.1. Automotive

13.5.2. Retail

13.5.3. Healthcare

13.5.4. Electronics & Semiconductor

13.5.5. Food and Beverage

13.5.6. Aerospace and Defense

13.5.7. Others (Metal & Machining, Agriculture, etc.)

13.6. MEA Mobile Cobots Market Size (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, by Country & Sub-region, 2017 – 2031

13.6.1. GCC

13.6.2. South Africa

13.6.3. North Africa

13.6.4. Rest of Middle East & Africa

13.7. MEA Mobile Cobots Market Attractiveness Analysis

13.7.1. By Component

13.7.2. By Capacity

13.7.3. By Application

13.7.4. By End-use Industry

13.7.5. By Country & Sub-region

14. South America Mobile Cobots Market Analysis and Forecast

14.1. Market Snapshot

14.2. South America Mobile Cobots Market Size (US$ Bn) Analysis & Forecast, by Component, 2017‒2031

14.2.1. Hardware

14.2.1.1. Arm/End Effector

14.2.1.2. AMR

14.2.1.3. Controller

14.2.1.4. Vision System

14.2.1.5. Accessories

14.2.2. Software

14.2.3. Services

14.3. South America Mobile Cobots Market Size (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, by Capacity, 2017‒2031

14.3.1. 1 to 3 kg

14.3.2. 3 to 5 kg

14.3.3. 5 to 10 kg

14.3.4. Above 10 Kg

14.4. South America Mobile Cobots Market Size (US$ Bn) Analysis & Forecast, by Application, 2017‒2031

14.4.1. Assembly

14.4.2. Machine Tending

14.4.3. Quality Inspections

14.4.4. Process (Material Removal/gluing/dispensing/welding/finishing)

14.4.5. Material Handling

14.4.6. Others (Maintenances Activities, Packaging, Inventory, etc.)

14.5. South America Mobile Cobots Market Size (US$ Bn) Analysis & Forecast, by End-use Industry, 2017‒2031

14.5.1. Automotive

14.5.2. Retail

14.5.3. Healthcare

14.5.4. Electronics & Semiconductor

14.5.5. Food and Beverage

14.5.6. Aerospace and Defense

14.5.7. Others (Metal & Machining, Agriculture, etc.)

14.6. South America Mobile Cobots Market Size (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, by Country & Sub-region, 2017 – 2031

14.6.1. Brazil

14.6.2. Rest of South America

14.7. South America Mobile Cobots Market Attractiveness Analysis

14.7.1. By Component

14.7.2. By Capacity

14.7.3. By Application

14.7.4. By End-use Industry

14.7.5. By Country & Sub-region

15. Competition Assessment

15.1. Global Mobile Cobots Market Competition Matrix - a Dashboard View

15.2. Global Mobile Cobots Market Company Share Analysis, by Value (2020)

15.3. Technological Differentiator

16. Company Profiles (Manufacturers/Suppliers)

16.1. ABB

16.1.1. Overview

16.1.2. Product Portfolio

16.1.3. Sales Footprint

16.1.4. Key Subsidiaries or Distributors

16.1.5. Strategy and Recent Developments

16.1.6. Key Financials

16.2. Addverb Technologies Private Limited

16.2.1. Overview

16.2.2. Product Portfolio

16.2.3. Sales Footprint

16.2.4. Key Subsidiaries or Distributors

16.2.5. Strategy and Recent Developments

16.2.6. Key Financials

16.3. Aethon Inc.

16.3.1. Overview

16.3.2. Product Portfolio

16.3.3. Sales Footprint

16.3.4. Key Subsidiaries or Distributors

16.3.5. Strategy and Recent Developments

16.3.6. Key Financials

16.4. Aubo Robotics

16.4.1. Overview

16.4.2. Product Portfolio

16.4.3. Sales Footprint

16.4.4. Key Subsidiaries or Distributors

16.4.5. Strategy and Recent Developments

16.4.6. Key Financials

16.5. Denso Wave Incorporated.

16.5.1. Overview

16.5.2. Product Portfolio

16.5.3. Sales Footprint

16.5.4. Key Subsidiaries or Distributors

16.5.5. Strategy and Recent Developments

16.5.6. Key Financials

16.6. Doosan Robotics Inc.

16.6.1. Overview

16.6.2. Product Portfolio

16.6.3. Sales Footprint

16.6.4. Key Subsidiaries or Distributors

16.6.5. Strategy and Recent Developments

16.6.6. Key Financials

16.7. Fanuc Corporation

16.7.1. Overview

16.7.2. Product Portfolio

16.7.3. Sales Footprint

16.7.4. Key Subsidiaries or Distributors

16.7.5. Strategy and Recent Developments

16.7.6. Key Financials

16.8. HTE Technologies.

16.8.1. Overview

16.8.2. Product Portfolio

16.8.3. Sales Footprint

16.8.4. Key Subsidiaries or Distributors

16.8.5. Strategy and Recent Developments

16.8.6. Key Financials

16.9. Kawasaki Heavy Industries, Ltd.

16.9.1. Overview

16.9.2. Product Portfolio

16.9.3. Sales Footprint

16.9.4. Key Subsidiaries or Distributors

16.9.5. Strategy and Recent Developments

16.9.6. Key Financials

16.10. KUKA AG

16.10.1. Overview

16.10.2. Product Portfolio

16.10.3. Sales Footprint

16.10.4. Key Subsidiaries or Distributors

16.10.5. Strategy and Recent Developments

16.10.6. Key Financials

16.11. Locus Robotics.

16.11.1. Overview

16.11.2. Product Portfolio

16.11.3. Sales Footprint

16.11.4. Key Subsidiaries or Distributors

16.11.5. Strategy and Recent Developments

16.11.6. Key Financials

16.12. Mobile Industrial Robots A/S.

16.12.1. Overview

16.12.2. Product Portfolio

16.12.3. Sales Footprint

16.12.4. Key Subsidiaries or Distributors

16.12.5. Strategy and Recent Developments

16.12.6. Key Financials

16.13. OMRON Corporation

16.13.1. Overview

16.13.2. Product Portfolio

16.13.3. Sales Footprint

16.13.4. Key Subsidiaries or Distributors

16.13.5. Strategy and Recent Developments

16.13.6. Key Financials

16.14. Precise Automation, Inc.

16.14.1. Overview

16.14.2. Product Portfolio

16.14.3. Sales Footprint

16.14.4. Key Subsidiaries or Distributors

16.14.5. Strategy and Recent Developments

16.14.6. Key Financials

16.15. Rethink Robotics

16.15.1. Overview

16.15.2. Product Portfolio

16.15.3. Sales Footprint

16.15.4. Key Subsidiaries or Distributors

16.15.5. Strategy and Recent Developments

16.15.6. Key Financials

16.16. Robotnik

16.16.1. Overview

16.16.2. Product Portfolio

16.16.3. Sales Footprint

16.16.4. Key Subsidiaries or Distributors

16.16.5. Strategy and Recent Developments

16.16.6. Key Financials

16.17. SICK

16.17.1. Overview

16.17.2. Product Portfolio

16.17.3. Sales Footprint

16.17.4. Key Subsidiaries or Distributors

16.17.5. Strategy and Recent Developments

16.17.6. Key Financials

16.18. Stäubli International AG

16.18.1. Overview

16.18.2. Product Portfolio

16.18.3. Sales Footprint

16.18.4. Key Subsidiaries or Distributors

16.18.5. Strategy and Recent Developments

16.18.6. Key Financials

16.19. TECHMAN ROBOT INC

16.19.1. Overview

16.19.2. Product Portfolio

16.19.3. Sales Footprint

16.19.4. Key Subsidiaries or Distributors

16.19.5. Strategy and Recent Developments

16.19.6. Key Financials

16.20. Universal Robots

16.20.1. Overview

16.20.2. Product Portfolio

16.20.3. Sales Footprint

16.20.4. Key Subsidiaries or Distributors

16.20.5. Strategy and Recent Developments

16.20.6. Key Financials

16.21. Wyzo

16.21.1. Overview

16.21.2. Product Portfolio

16.21.3. Sales Footprint

16.21.4. Key Subsidiaries or Distributors

16.21.5. Strategy and Recent Developments

16.21.6. Key Financials

16.22. Yasakawa Electric Corporation

16.22.1. Overview

16.22.2. Product Portfolio

16.22.3. Sales Footprint

16.22.4. Key Subsidiaries or Distributors

16.22.5. Strategy and Recent Developments

16.22.6. Key Financials

17. Recommendation

17.1. Opportunity Assessment

17.1.1. By Component.

17.1.2. By Capacity

17.1.3. By Application

17.1.4. By End-use Industry

17.1.5. By Region

List of Tables

Table 1: Global Mobile Cobots Market Value (US$ Bn) & Forecast, by Component, 2017‒2031

Table 2: Global Mobile Cobots Market Value (US$ Bn) & Forecast, by Capacity, 2017‒2031

Table 3: Global Mobile Cobots Market Volume (Thousand Units) & Forecast, by Capacity, 2017‒2031

Table 4: Global Mobile Cobots Market Value (US$ Bn) & Forecast, by Application, 2017‒2031

Table 5: Global Mobile Cobots Market Value (US$ Bn) & Forecast, by End-use Industry, 2017‒2033

Table 6: Global Mobile Cobots Market Value (US$ Bn) & Forecast, by Region, 2017‒2031

Table 7: Global Mobile Cobots Market Volume (Thousand Units) & Forecast, by Region, 2017‒2031

Table 8: North America Mobile Cobots Market Value (US$ Bn) & Forecast, by Component, 2017‒2031

Table 9: North America Mobile Cobots Market Value (US$ Bn) & Forecast, by Capacity 2017‒2031

Table 10: North America Mobile Cobots Market Volume (Thousand Units) & Forecast, by Capacity 2017‒2031

Table 11: North America Mobile Cobots Market Value (US$ Bn) & Forecast, by Application 2017‒2031

Table 12: North America Mobile Cobots Market Value (US$ Bn) & Forecast, by End-use Industry, 2017‒2033

Table 13: North America Mobile Cobots Market Value (US$ Bn) & Forecast, by Country & Sub-region, 2017‒2031

Table 14: North America Mobile Cobots Market Volume (Thousand Units) & Forecast, by Country & Sub-region, 2017‒2031

Table 15: Europe Mobile Cobots Market Value (US$ Bn) & Forecast, by Component, 2017‒2031

Table 16: Europe Mobile Cobots Market Value (US$ Bn) & Forecast, by Capacity 2017‒2031

Table 17: Europe Mobile Cobots Market Volume (Thousand Units) & Forecast, by Capacity 2017‒2031

Table 18: Europe Mobile Cobots Market Value (US$ Bn) & Forecast, by Application 2017‒2031

Table 19: Europe Mobile Cobots Market Value (US$ Bn) & Forecast, by End-use Industry, 2017‒2033

Table 20: Europe Mobile Cobots Market Value (US$ Bn) & Forecast, by Country & Sub-region, 2017‒2031

Table 21: Europe Mobile Cobots Market Volume (Thousand Units) & Forecast, by Country & Sub-region, 2017‒2031

Table 22: Asia Pacific Mobile Cobots Market Value (US$ Bn) & Forecast, by Component, 2017‒2031

Table 23: Asia Pacific Mobile Cobots Market Value (US$ Bn) & Forecast, by Capacity 2017‒2031

Table 24: Asia Pacific Mobile Cobots Market Volume (Thousand Units) & Forecast, by Capacity 2017‒2031

Table 25: Asia Pacific Mobile Cobots Market Value (US$ Bn) & Forecast, by Application 2017‒2031

Table 26: Asia Pacific Mobile Cobots Market Value (US$ Bn) & Forecast, by End-use Industry, 2017‒2033

Table 27: Asia Pacific Mobile Cobots Market Value (US$ Bn) & Forecast, by Country & Sub-region, 2017‒2031

Table 28: Asia Pacific Mobile Cobots Market Volume (Thousand Units) & Forecast, by Country & Sub-region, 2017‒2031

Table 29: MEA Mobile Cobots Market Value (US$ Bn) & Forecast, by Component, 2017‒2031

Table 30: MEA Mobile Cobots Market Value (US$ Bn) & Forecast, by Capacity 2017‒2031

Table 31: MEA Mobile Cobots Market Volume (Thousand Units) & Forecast, by Capacity 2017‒2031

Table 32: MEA Mobile Cobots Market Value (US$ Bn) & Forecast, by Application 2017‒2031

Table 33: MEA Mobile Cobots Market Value (US$ Bn) & Forecast, by End-use Industry, 2017‒2033

Table 34: MEA Mobile Cobots Market Value (US$ Bn) & Forecast, by Country & Sub-region, 2017‒2031

Table 35: MEA Mobile Cobots Market Volume (Thousand Units) & Forecast, by Country & Sub-region, 2017‒2031

Table 36: South America Mobile Cobots Market Value (US$ Bn) & Forecast, by Component, 2017‒2031

Table 37: South America Mobile Cobots Market Value (US$ Bn) & Forecast, by Capacity 2017‒2031

Table 38: South America Mobile Cobots Market Volume (Thousand Units) & Forecast, by Capacity 2017‒2031

Table 39: South America Mobile Cobots Market Value (US$ Bn) & Forecast, by Application 2017‒2031

Table 40: South America Mobile Cobots Market Value (US$ Bn) & Forecast, by End-use Industry, 2017‒2033

Table 41: South America Mobile Cobots Market Value (US$ Bn) & Forecast, by Country & Sub-region, 2017‒2031

Table 42: South America Mobile Cobots Market Volume (Thousand Units) & Forecast, by Country & Sub-region, 2017‒2031

List of Figures

Figure 01: Global Mobile Cobots Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 02: Global Mobile Cobots Market Size & Forecast, Volume (Thousand Units), 2017‒2031

Figure 03: Global Mobile Cobots Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 04: Global Mobile Cobots Market Projections by Component, Value (US$ Bn), 2017‒2031

Figure 05: Global Mobile Cobots Market Share Analysis, by Component, 2021 and 2031

Figure 06: Global Mobile Cobots Market, Incremental Opportunity, by Component, 2021‒2031

Figure 07: Global Mobile Cobots Market Projections by Capacity, Value (US$ Bn), 2017‒2031

Figure 08: Global Mobile Cobots Market Share Analysis, by Capacity, 2021 and 2031

Figure 09: Global Mobile Cobots Market, Incremental Opportunity, by Capacity, 2021‒2031

Figure 10: Global Mobile Cobots Market Projections by Application, Value (US$ Bn), 2017‒2031

Figure 11: Global Mobile Cobots Market Share Analysis, by Application, 2021 and 2031

Figure 12: Global Mobile Cobots Market, Incremental Opportunity, by Application, 2021‒2031

Figure 13: Global Mobile Cobots Market Projections by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 14: Global Mobile Cobots Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 15: Global Mobile Cobots Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 16: Global Mobile Cobots Market Projections by Region, Value (US$ Bn), 2017‒2031

Figure 17: Global Mobile Cobots Market Share Analysis, by Region 2021 and 2031

Figure 18: Global Mobile Cobots Market, Incremental Opportunity, by Region, 2021‒2031

Figure 19: North America Mobile Cobots Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 20: North America Mobile Cobots Market Size & Forecast, Volume (Thousand Units), 2017‒2031

Figure 21: North America Mobile Cobots Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 22: North America Mobile Cobots Market Projections by Component, Value (US$ Bn), 2017‒2031

Figure 23: North America Mobile Cobots Market Share Analysis, by Component, 2021 and 2031

Figure 24: North America Mobile Cobots Market, Incremental Opportunity, by Component, 2021‒2031

Figure 25: North America Mobile Cobots Market Projections by Capacity, Value (US$ Bn), 2017‒2031

Figure 26: North America Mobile Cobots Market Share Analysis, by Capacity, 2021 and 2031

Figure 27: North America Mobile Cobots Market, Incremental Opportunity, by Capacity, 2021‒2031

Figure 28: North America Mobile Cobots Market Projections by Application, Value (US$ Bn), 2017‒2031

Figure 29: North America Mobile Cobots Market Share Analysis, by Application, 2021 and 2031

Figure 30: North America Mobile Cobots Market, Incremental Opportunity, by Application, 2021‒2031

Figure 31: North America Mobile Cobots Market Projections by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 32: North America Mobile Cobots Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 33: North America Mobile Cobots Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 34: North America Mobile Cobots Market Projections by Country & Sub-region, Value (US$ Bn), 2017‒2031

Figure 35: North America Mobile Cobots Market Share Analysis, by Country & Sub-region, 2021 and 2031

Figure 36: North America Mobile Cobots Market, Incremental Opportunity, by Country & Sub-region, 2021‒2031

Figure 37: Europe Mobile Cobots Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 38: Europe Mobile Cobots Market Size & Forecast, Volume (Thousand Units), 2017‒2031

Figure 39: Europe Mobile Cobots Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 40: Europe Mobile Cobots Market Projections by Component, Value (US$ Bn), 2017‒2031

Figure 41: Europe Mobile Cobots Market Share Analysis, by Component, 2021 and 2031

Figure 42: Europe Mobile Cobots Market, Incremental Opportunity, by Component, 2021‒2031

Figure 43: Europe Mobile Cobots Market Projections by Capacity, Value (US$ Bn), 2017‒2031

Figure 44: Europe Mobile Cobots Market Share Analysis, by Capacity, 2021 and 2031

Figure 45: Europe Mobile Cobots Market, Incremental Opportunity, by Capacity, 2021‒2031

Figure 46: Europe Mobile Cobots Market Projections by Application, Value (US$ Bn), 2017‒2031

Figure 47: Europe Mobile Cobots Market Share Analysis, by Application, 2021 and 2031

Figure 48: Europe Mobile Cobots Market, Incremental Opportunity, by Application, 2021‒2031

Figure 49: Europe Mobile Cobots Market Projections by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 50: Europe Mobile Cobots Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 51: Europe Mobile Cobots Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 52: Europe Mobile Cobots Market Projections by Country & Sub-region, Value (US$ Bn), 2017‒2031

Figure 53: Europe Mobile Cobots Market Share Analysis, by Country & Sub-region, 2021 and 2031

Figure 54: Europe Mobile Cobots Market, Incremental Opportunity, by Country & Sub-region, 2021‒2031

Figure 55: Asia Pacific Mobile Cobots Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 56: Asia Pacific Mobile Cobots Market Size & Forecast, Volume (Thousand Units), 2017‒2031

Figure 57: Asia Pacific Mobile Cobots Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 58: Asia Pacific Mobile Cobots Market Projections by Component, Value (US$ Bn), 2017‒2031

Figure 59: Asia Pacific Mobile Cobots Market Share Analysis, by Component, 2021 and 2031

Figure 60: Asia Pacific Mobile Cobots Market, Incremental Opportunity, by Component, 2021‒2031

Figure 61: Asia Pacific Mobile Cobots Market Projections by Capacity, Value (US$ Bn), 2017‒2031

Figure 62: Asia Pacific Mobile Cobots Market Share Analysis, by Capacity, 2021 and 2031

Figure 63: Asia Pacific Mobile Cobots Market, Incremental Opportunity, by Capacity, 2021‒2031

Figure 64: Asia Pacific Mobile Cobots Market Projections by Application, Value (US$ Bn), 2017‒2031

Figure 65: Asia Pacific Mobile Cobots Market Share Analysis, by Application, 2021 and 2031

Figure 66: Asia Pacific Mobile Cobots Market, Incremental Opportunity, by Application, 2021‒2031

Figure 67: Asia Pacific Mobile Cobots Market Projections by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 68: Asia Pacific Mobile Cobots Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 69: Asia Pacific Mobile Cobots Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 70: Asia Pacific Mobile Cobots Market Projections by Country & Sub-region, Value (US$ Bn), 2017‒2031

Figure 71: Asia Pacific Mobile Cobots Market Share Analysis, by Country & Sub-region, 2021 and 2031

Figure 72: Asia Pacific Mobile Cobots Market, Incremental Opportunity, by Country & Sub-region, 2021‒2031

Figure 73: Middle East & Africa Mobile Cobots Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 74: Middle East & Africa Mobile Cobots Market Size & Forecast, Volume (Thousand Units), 2017‒2031

Figure 75: Middle East & Africa Mobile Cobots Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 76: Middle East & Africa Mobile Cobots Market Projections by Component, Value (US$ Bn), 2017‒2031

Figure 77: Middle East & Africa Mobile Cobots Market Share Analysis, by Component, 2021 and 2031

Figure 78: Middle East & Africa Mobile Cobots Market, Incremental Opportunity, by Component, 2021‒2031

Figure 79: Middle East & Africa Mobile Cobots Market Projections by Capacity, Value (US$ Bn), 2017‒2031

Figure 80: Middle East & Africa Mobile Cobots Market Share Analysis, by Capacity, 2021 and 2031

Figure 81: Middle East & Africa Mobile Cobots Market, Incremental Opportunity, by Capacity, 2021‒2031

Figure 82: Middle East & Africa Mobile Cobots Market Projections by Application, Value (US$ Bn), 2017‒2031

Figure 83: Middle East & Africa Mobile Cobots Market Share Analysis, by Application, 2021 and 2031

Figure 84: Middle East & Africa Mobile Cobots Market, Incremental Opportunity, by Application, 2021‒2031

Figure 85: Middle East & Africa Mobile Cobots Market Projections by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 86: Middle East & Africa Mobile Cobots Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 87: Middle East & Africa Mobile Cobots Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 88: Middle East & Africa Mobile Cobots Market Projections by Country & Sub-region, Value (US$ Bn), 2017‒2031

Figure 89: Middle East & Africa Mobile Cobots Market Share Analysis, by Country & Sub-region, 2021 and 2031

Figure 90: Middle East & Africa Mobile Cobots Market, Incremental Opportunity, by Country & Sub-region, 2021‒2031

Figure 91: South America Mobile Cobots Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 92: South America Mobile Cobots Market Size & Forecast, Volume (Thousand Units), 2017‒2031

Figure 93: South America Mobile Cobots Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 94: South America Mobile Cobots Market Projections by Component, Value (US$ Bn), 2017‒2031

Figure 95: South America Mobile Cobots Market Share Analysis, by Component, 2021 and 2031

Figure 96: South America Mobile Cobots Market, Incremental Opportunity, by Component, 2021‒2031

Figure 97: South America Mobile Cobots Market Projections by Capacity, Value (US$ Bn), 2017‒2031

Figure 98: South America Mobile Cobots Market Share Analysis, by Capacity, 2021 and 2031

Figure 99: South America Mobile Cobots Market, Incremental Opportunity, by Capacity, 2021‒2031

Figure 100: South America Mobile Cobots Market Projections by Application, Value (US$ Bn), 2017‒2031

Figure 101: South America Mobile Cobots Market Share Analysis, by Application, 2021 and 2031

Figure 102: South America Mobile Cobots Market, Incremental Opportunity, by Application, 2021‒2031

Figure 103: South America Mobile Cobots Market Projections by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 104: South America Mobile Cobots Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 105: South America Mobile Cobots Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 106: South America Mobile Cobots Market Projections by Country & Sub-region, Value (US$ Bn), 2017‒2031

Figure 107: South America Mobile Cobots Market Share Analysis, by Country & Sub-region, 2021 and 2031

Figure 108: South America Mobile Cobots Market, Incremental Opportunity, by Country & Sub-region, 2021‒2031

Figure 109: Company Share Analysis (2020)