Analysts’ Viewpoint on Market Scenario

Currently, laser designators are fabricated by using legacy design and manufacturing procedures, which make them expensive, heavy, and bulky. Consequently, this has created a need to improve manufacturing techniques in order to produce lightweight and cost-effective laser designators. The efficiency, technical performance, size, weight, and power of these lasers have all played a role in driving new manufacturing designs. Key players in the market are focusing on the introduction of compact laser designators with reduced weight, which can be deployed on small unmanned aerial vehicles (UAVs).

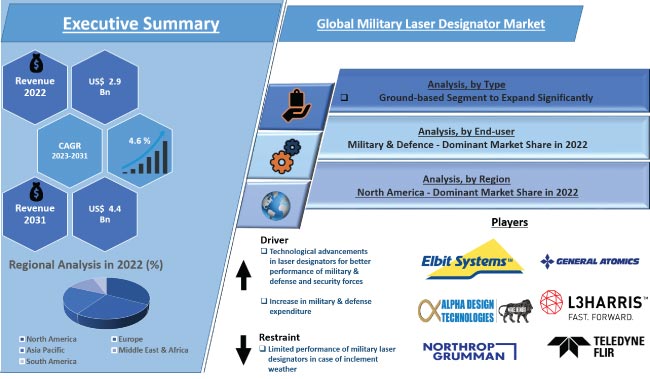

Various manufacturers of military laser designators are emphasizing on growth strategies such as patents, mergers and acquisitions, partnerships and collaborations, and product launches in order to boost their share in the military laser designator industry. North America held a dominant global military laser designators market share due to the early adoption of technologies and increased need for military laser systems to equip aircraft and unmanned aerial vehicles (UAVs) in the region. Furthermore, rise in R&D expenditure in the U.S. for next-generation technology to preserve the US military’s technological edge over strategic competitors is expected to fuel military laser designator market growth in North America.

A military laser designator is used to identify objects such as bombs, artillery munition, missiles, and other objects. It helps detect and mark the target for an accurate strike. Military laser designators are used inside an airborne or ground-based laser target designation system. They require a relatively high pulse energy, a programmable pulse repetition rate, low beam divergence, and high pointing accuracy. Advancements in laser designators, in terms of efficient interface, to plan, transmit, and coordinate the target data are likely to create significant opportunities for the military laser designator market in the next few years.

Technological advancements in optics and optoelectronics are leading to the development of more durable and efficient laser devices, which in turn makes laser designators crucial in modern warfare. Laser designators are rapidly becoming standard inventory in defense forces across the globe. These devices have shown strong potential to transform modern-day military battlefield scenarios through various supporting, defensive, and offensive/destructive uses.

Laser technology has been making rapid advances for the last few decades. This technology is being employed in diverse fields, including medical sciences, military, industrial production, electronics, holography, spectroscopy, and astronomy.

The latest military laser designators are lightweight and emit a very narrow beam of infrared light energy. This provides identification and exact location of a target. Military laser designators use laser illumination to identify targets for laser spot trackers (LST) and laser guided weapons (LGW). According to the paper published by the Federation of American Scientists Organization, presently, LGWs can effectively engage a wider range of targets to include mobile targets.

Latest technological advances have enabled the usage of these devices for 3-dimensional (3D) vision control, positioning or level control and with three color display. For instance, one such advanced designation system is the JETS (Joint Effects Targeting System). Leonardo DRS, formerly DRS Technologies, is manufacturing JETS under a five-year contract with the U.S. Army.

Therefore, advances in laser technology are projected to boost military laser designator market demand in military and defense sectors.

Majority of countries across the globe are emphasizing on enhancing their military and defense capabilities. Moreover, national armed forces and defense forces worldwide are increasingly adopting laser designators for target designation and ranging on both ground and air vehicles. This is expected to propel the military laser designator market size in the near future,

Countries with the highest military expenditure are U.S., China, Saudi Arabia, Russia, and India, followed by France, U.K., Japan, and Germany. The top 15 countries account for a dominant market share in terms of military & defense expenditure. This shows that governments across the globe are firmly focused on the security and surveillance of their countries.

In terms of type, the global military laser designator market segmentation comprises ground-based and airborne. The ground-based segment accounted for 64.2% share of the global market in 2022. It is likely to maintain its share and expand at a growth rate of 4.6% during the forecast period. Demand for ground-based military laser designator is significantly high, because soldiers engaged in homeland security need laser designators to find range and locate potential targets.

Ground-based laser designators help identify targets for Naval Surface Fire Support (NSFS), artillery, and aircraft delivered munitions. Additionally, remote-controlled laser designator rangefinder telescoping system with an automatic tracking device enables troops to mark moving and stationary targets from armored vehicles.

Analysis of the regional military laser designator market insights reveal that North America held 32.8% share of the total global demand for laser designators in 2022. This was primarily due to numerous aircraft manufacturers in the region integrating military laser designators into their new aircraft. Furthermore, a prominent military laser designator market trend witnessed was the increase in investment from the U.S. government in aviation and security sectors.

Europe held 26.5% of the global military laser designator market share in 2022. The Europe market is expected to expand in the next few years due to increasing technological advancements in military laser designators. According to Stockholm International Peace Research Institute (SIPRI), in 2021, Russia increased its military expenditure by 2.9% to US$ 65.9 Bn from US$ 61.7 Bn in 2020. Consequently, consistent rise in military spending is anticipated to boost the military laser designator industry in Europe during the forecast period.

The global military laser designator business is consolidated with a small number of large-scale vendors controlling the majority of market share. Expansion of product portfolios and mergers and acquisitions are major strategies adopted by leading manufacturers to develop different types of military laser designators. Alpha Design Technologies Pvt Ltd, Elbit Systems Ltd, General Atomics, L3 Technologies, Inc, Leonardo S.p.A, Northrop Grumman Corporation, RPMC LASERS, Teledyne FLIR LLC, Thales Group, UTC Aerospace Systems, are among the prominent companies in military laser designator market.

The military laser designator market report also comprises profiles of key players who have been analyzed based on parameters such as company overview, financial overview, product portfolio, business segments, business strategies, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 2.9 Bn |

|

Market Forecast Value in 2031 |

US$ 4.4 Bn |

|

Growth Rate (CAGR) |

4.6% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 2.9 Bn in 2022

It is expected to expand at a CAGR of 4.6% from 2023 to 2031

Technological advancements in laser designators for better performance of military & defense and security forces and increase in military & defense expenditure.

The ground-based segment accounted for major share of 64.2% in 2022

North America is highly attractive region and it accounted for 32.8% share in 2022

The U.S. market was valued at US$ 687.9 Mn in 2022

Alpha Design Technologies Pvt Ltd, Elbit Systems Ltd, General Atomics, L3 Technologies, Inc., Leonardo S.p.A, Northrop Grumman Corporation, RPMC LASERS, Teledyne FLIR LLC, Thales Group, UTC Aerospace Systems

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Military Laser Designator Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Global Laser Target Acquisition Systems Industry Overview

4.2. Supply Chain Analysis

4.3. Technology Roadmap Analysis

4.4. Industry SWOT Analysis

4.5. Porter’s Five Forces Analysis

4.6. COVID-19 Impact and Recovery Analysis

5. Global Military Laser Designator Market Analysis, by Standard

5.1. Military Laser Designator Market Value (US$ Mn) Analysis & Forecast, by Standard, 2017–2031

5.1.1. Eyesafe

5.1.2. Non-Eyesafe

5.2. Market Attractiveness Analysis, by Standard

6. Global Military Laser Designator Market Analysis, by Type

6.1. Military Laser Designator Market Value (US$ Mn) Analysis & Forecast, by Type, 2017–2031

6.1.1. Ground-based

6.1.1.1. Man-portable

6.1.1.2. Vehicle-mounted

6.1.2. Airborne

6.1.2.1. Rockets & Missiles

6.1.2.2. Aircraft

6.1.2.3. Unmanned Aerial Vehicles

6.1.2.4. Maritime

6.2. Market Attractiveness Analysis, by Type

7. Global Military Laser Designator Market Analysis, by End-user

7.1. Military Laser Designator Market Value (US$ Mn) Analysis & Forecast, by End-user, 2017–2031

7.1.1. Military & Defense

7.1.2. Homeland Security

7.2. Market Attractiveness Analysis, by End-user

8. Global Military Laser Designator Market Analysis and Forecast, by Region

8.1. Military Laser Designator Market Value (US$ Mn) Analysis & Forecast, by Region, 2017–2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. South America

8.2. Market Attractiveness Analysis, by Region

9. North America Military Laser Designator Market Analysis and Forecast

9.1. Market Snapshot

9.2. Drivers and Restraints: Impact Analysis

9.3. Military Laser Designator Market Value (US$ Mn) Analysis & Forecast, by Standard, 2017–2031

9.3.1. Eyesafe

9.3.2. Non-Eyesafe

9.4. Military Laser Designator Market Value (US$ Mn) Analysis & Forecast, by Type, 2017–2031

9.4.1. Ground-based

9.4.1.1. Man-portable

9.4.1.2. Vehicle-mounted

9.4.2. Airborne

9.4.2.1. Rockets & Missiles

9.4.2.2. Aircraft

9.4.2.3. Unmanned Aerial Vehicles

9.4.2.4. Maritime

9.5. Military Laser Designator Market Value (US$ Mn) Analysis & Forecast, by End-user, 2017–2031

9.5.1. Military & Defense

9.5.2. Homeland Security

9.6. Military Laser Designator Value (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2017–2031

9.6.1. U.S.

9.6.2. Canada

9.6.3. Rest of North America

9.7. Market Attractiveness Analysis

9.7.1. By Standard

9.7.2. By Type

9.7.3. By End-user

9.7.4. By Country/Sub-region

10. Europe Military Laser Designator Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. Military Laser Designator Market Value (US$ Mn) Analysis & Forecast, by Standard, 2017–2031

10.3.1. Eyesafe

10.3.2. Non-Eyesafe

10.4. Military Laser Designator Market Value (US$ Mn) Analysis & Forecast, by Type, 2017–2031

10.4.1. Ground-based

10.4.1.1. Man-portable

10.4.1.2. Vehicle-mounted

10.4.2. Airborne

10.4.2.1. Rockets & Missiles

10.4.2.2. Aircraft

10.4.2.3. Unmanned Aerial Vehicles

10.4.2.4. Maritime

10.5. Military Laser Designator Market Value (US$ Mn) Analysis & Forecast, by End-user, 2017–2031

10.5.1. Military & Defense

10.5.2. Homeland Security

10.6. Military Laser Designator Value (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2017–2031

10.6.1. The U.K.

10.6.2. Germany

10.6.3. France

10.6.4. Rest of Europe

10.7. Market Attractiveness Analysis

10.7.1. By Standard

10.7.2. By Type

10.7.3. By End-user

10.7.4. By Country/Sub-region

11. Asia Pacific Military Laser Designator Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Military Laser Designator Market Value (US$ Mn) Analysis & Forecast, by Standard, 2017–2031

11.3.1. Eyesafe

11.3.2. Non-Eyesafe

11.4. Military Laser Designator Market Value (US$ Mn) Analysis & Forecast, by Type, 2017–2031

11.4.1. Ground-based

11.4.1.1. Man-portable

11.4.1.2. Vehicle-mounted

11.4.2. Airborne

11.4.2.1. Rockets & Missiles

11.4.2.2. Aircraft

11.4.2.3. Unmanned Aerial Vehicles

11.4.2.4. Maritime

11.5. Military Laser Designator Market Value (US$ Mn) Analysis & Forecast, by End-user, 2017–2031

11.5.1. Military & Defense

11.5.2. Homeland Security

11.6. Military Laser Designator Value (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2017–2031

11.6.1. China

11.6.2. India

11.6.3. Japan

11.6.4. South Korea

11.6.5. ASEAN

11.6.6. Rest of Asia Pacific

11.7. Market Attractiveness Analysis

11.7.1. By Standard

11.7.2. By Type

11.7.3. By End-user

11.7.4. By Country/Sub-region

12. Middle East & Africa Military Laser Designator Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Military Laser Designator Market Value (US$ Mn) Analysis & Forecast, by Standard, 2017–2031

12.3.1. Eyesafe

12.3.2. Non-Eyesafe

12.4. Military Laser Designator Market Value (US$ Mn) Analysis & Forecast, by Type, 2017–2031

12.4.1. Ground-based

12.4.1.1. Man-portable

12.4.1.2. Vehicle-mounted

12.4.2. Airborne

12.4.2.1. Rockets & Missiles

12.4.2.2. Aircraft

12.4.2.3. Unmanned Aerial Vehicles

12.4.2.4. Maritime

12.5. Military Laser Designator Market Value (US$ Mn) Analysis & Forecast, by End-user, 2017–2031

12.5.1. Military & Defense

12.5.2. Homeland Security

12.6. Military Laser Designator Value (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2017–2031

12.6.1. GCC

12.6.2. South Africa

12.6.3. Rest of the Middle East & Africa

12.7. Market Attractiveness Analysis

12.7.1. By Standard

12.7.2. By Type

12.7.3. By End-user

12.7.4. By Country/Sub-region

13. South America Military Laser Designator Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Military Laser Designator Market Value (US$ Mn) Analysis & Forecast, by Standard, 2017–2031

13.3.1. Eyesafe

13.3.2. Non-Eyesafe

13.4. Military Laser Designator Market Value (US$ Mn) Analysis & Forecast, by Type, 2017–2031

13.4.1. Ground-based

13.4.1.1. Man-portable

13.4.1.2. Vehicle-mounted

13.4.2. Airborne

13.4.2.1. Rockets & Missiles

13.4.2.2. Aircraft

13.4.2.3. Unmanned Aerial Vehicles

13.4.2.4. Maritime

13.5. Military Laser Designator Market Value (US$ Mn) Analysis & Forecast, by End-user, 2017–2031

13.5.1. Military & Defense

13.5.2. Homeland Security

13.6. Military Laser Designator Value (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2017–2031

13.6.1. Brazil

13.6.2. Rest of South America

13.7. Market Attractiveness Analysis

13.7.1. By Standard

13.7.2. By Type

13.7.3. By End-user

13.7.4. By Country/Sub-region

14. Competition Assessment

14.1. Global Military Laser Designator Market Competition Matrix - a Dashboard View

14.1.1. Global Military Laser Designator Market Company Share Analysis, by Value (2022)

14.1.2. Technological Differentiator

15. Company Profiles (Global Manufacturers/Suppliers)

15.1. Alpha Design Technologies Pvt Ltd.

15.1.1. Overview

15.1.2. Product Portfolio

15.1.3. Sales Footprint

15.1.4. Key Subsidiaries or Distributors

15.1.5. Strategy and Recent Developments

15.1.6. Key Financials

15.2. Elbit Systems Ltd.

15.2.1. Overview

15.2.2. Product Portfolio

15.2.3. Sales Footprint

15.2.4. Key Subsidiaries or Distributors

15.2.5. Strategy and Recent Developments

15.2.6. Key Financials

15.3. General Atomics

15.3.1. Overview

15.3.2. Product Portfolio

15.3.3. Sales Footprint

15.3.4. Key Subsidiaries or Distributors

15.3.5. Strategy and Recent Developments

15.3.6. Key Financials

15.4. L3 Technologies, Inc

15.4.1. Overview

15.4.2. Product Portfolio

15.4.3. Sales Footprint

15.4.4. Key Subsidiaries or Distributors

15.4.5. Strategy and Recent Developments

15.4.6. Key Financials

15.5. Leonardo S.p.A.

15.5.1. Overview

15.5.2. Product Portfolio

15.5.3. Sales Footprint

15.5.4. Key Subsidiaries or Distributors

15.5.5. Strategy and Recent Developments

15.5.6. Key Financials

15.6. Northrop Grumman Corporation

15.6.1. Overview

15.6.2. Product Portfolio

15.6.3. Sales Footprint

15.6.4. Key Subsidiaries or Distributors

15.6.5. Strategy and Recent Developments

15.6.6. Key Financials

15.7. RPMC LASERS

15.7.1. Overview

15.7.2. Product Portfolio

15.7.3. Sales Footprint

15.7.4. Key Subsidiaries or Distributors

15.7.5. Strategy and Recent Developments

15.7.6. Key Financials

15.8. Teledyne FLIR LLC

15.8.1. Overview

15.8.2. Product Portfolio

15.8.3. Sales Footprint

15.8.4. Key Subsidiaries or Distributors

15.8.5. Strategy and Recent Developments

15.8.6. Key Financials

15.9. Thales Group

15.9.1. Overview

15.9.2. Product Portfolio

15.9.3. Sales Footprint

15.9.4. Key Subsidiaries or Distributors

15.9.5. Strategy and Recent Developments

15.9.6. Key Financials

15.10. UTC Aerospace Systems

15.10.1. Overview

15.10.2. Product Portfolio

15.10.3. Sales Footprint

15.10.4. Key Subsidiaries or Distributors

15.10.5. Strategy and Recent Developments

15.10.6. Key Financials

16. Recommendation

16.1. Opportunity Assessment

16.1.1. By Standard

16.1.2. By Type

16.1.3. By End-user

16.1.4. By Region

List of Tables

Table 1: Global Military Laser Designator Market Value (US$ Mn) & Forecast, by Standard, 2017‒2031

Table 2: Global Military Laser Designator Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 3: Global Military Laser Designator Market Value (US$ Mn) & Forecast, by End-user, 2017‒2031

Table 4: Global Military Laser Designator Market Value (US$ Mn) & Forecast, by Region, 2017‒2031

Table 5: North America Military Laser Designator Market Value (US$ Mn) & Forecast, by Standard, 2017‒2031

Table 6: North America Military Laser Designator Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 7: North America Military Laser Designator Market Value (US$ Mn) & Forecast, by End-user, 2017‒2031

Table 8: North America Military Laser Designator Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 9: Europe Military Laser Designator Market Value (US$ Mn) & Forecast, by Standard, 2017‒2031

Table 10: Europe Military Laser Designator Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 11: Europe Military Laser Designator Market Value (US$ Mn) & Forecast, by End-user, 2017‒2031

Table 12: Europe Military Laser Designator Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 13: Asia Pacific Military Laser Designator Market Value (US$ Mn) & Forecast, by Standard, 2017‒2031

Table 14: Asia Pacific Military Laser Designator Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 15: Asia Pacific Military Laser Designator Market Value (US$ Mn) & Forecast, by End-user, 2017‒2031

Table 16: Asia Pacific Military Laser Designator Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 17: Middle East & Africa Military Laser Designator Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 18: Middle East & Africa Military Laser Designator Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 19: Middle East & Africa Military Laser Designator Market Value (US$ Mn) & Forecast, by End-user, 2017‒2031

Table 20: Middle East & Africa Military Laser Designator Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 21: South America Military Laser Designator Market Value (US$ Mn) & Forecast, by Standard, 2017‒2031

Table 22: South America Military Laser Designator Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 23: South America Military Laser Designator Market Value (US$ Mn) & Forecast, by End-user, 2017‒2031

Table 24: South America Military Laser Designator Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

List of Figures

Figure 01: Supply Chain Analysis - Global Military Laser Designator

Figure 02: Porter Five Forces Analysis - Global Military Laser Designator

Figure 03: Technology Road Map - Global Military Laser Designator

Figure 04: Global Military Laser Designator Market, Value (US$ Mn), 2017-2031

Figure 05: Global Military Laser Designator Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 06: Global Military Laser Designator Market Projections by Standard, Value (US$ Mn), 2017‒2031

Figure 07: Global Military Laser Designator Market, Incremental Opportunity, by Standard, 2023‒2031

Figure 08: Global Military Laser Designator Market Share Analysis, by Standard, 2022 and 2031

Figure 09: Global Military Laser Designator Market Projections by Type, Value (US$ Mn), 2017‒2031

Figure 10: Global Military Laser Designator Market, Incremental Opportunity, by Type, 2023‒2031

Figure 11: Global Military Laser Designator Market Share Analysis, by Type, 2022 and 2031

Figure 12: Global Military Laser Designator Market Projections by End-user, Value (US$ Mn), 2017‒2031

Figure 13: Global Military Laser Designator Market, Incremental Opportunity, by End-user, 2023‒2031

Figure 14: Global Military Laser Designator Market Share Analysis, by End-user, 2022 and 2031

Figure 15: Global Military Laser Designator Market Projections by Region, Value (US$ Mn), 2017‒2031

Figure 16: Global Military Laser Designator Market, Incremental Opportunity, by Region, 2023‒2031

Figure 17: Global Military Laser Designator Market Share Analysis, by Region, 2022 and 2031

Figure 18: North America Military Laser Designator Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 19: North America Military Laser Designator Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 20: North America Military Laser Designator Market Projections by Standard, Value (US$ Mn), 2017‒2031

Figure 21: North America Military Laser Designator Market, Incremental Opportunity, by Standard, 2023‒2031

Figure 22: North America Military Laser Designator Market Share Analysis, by Standard, 2022 and 2031

Figure 23: North America Military Laser Designator Market Projections by Type Value (US$ Mn), 2017‒2031

Figure 24: North America Military Laser Designator Market, Incremental Opportunity, by Type, 2023‒2031

Figure 25: North America Military Laser Designator Market Share Analysis, by Type, 2022 and 2031

Figure 26: North America Military Laser Designator Market Projections by End-user, Value (US$ Mn), 2017‒2031

Figure 27: North America Military Laser Designator Market, Incremental Opportunity, by End-user, 2023‒2031

Figure 28: North America Military Laser Designator Market Share Analysis, by End-user, 2022 and 2031

Figure 29: North America Military Laser Designator Market Projections by Country and sub-region, Value (US$ Mn), 2017‒2031

Figure 30: North America Military Laser Designator Market, Incremental Opportunity, by Country and sub-region, 2022‒2031

Figure 31: North America Military Laser Designator Market Share Analysis, by Country and sub-region 2022 and 2031

Figure 32: Europe Military Laser Designator Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 33: Europe Military Laser Designator Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 34: Europe Military Laser Designator Market Projections by Standard, Value (US$ Mn), 2017‒2031

Figure 35: Europe Military Laser Designator Market, Incremental Opportunity, by Standard, 2023‒2031

Figure 36: Europe Military Laser Designator Market Share Analysis, by Standard, 2022 and 2031

Figure 37: Europe Military Laser Designator Market Projections by Type Value (US$ Mn), 2017‒2031

Figure 38: Europe Military Laser Designator Market, Incremental Opportunity, by Type, 2023‒2031

Figure 39: Europe Military Laser Designator Market Share Analysis, by Type, 2022 and 2031

Figure 40: Europe Military Laser Designator Market Projections by End-user, Value (US$ Mn), 2017‒2031

Figure 41: Europe Military Laser Designator Market, Incremental Opportunity, by End-user, 2023‒2031

Figure 42: Europe Military Laser Designator Market Share Analysis, by End-user, 2022 and 2031

Figure 43: Europe Military Laser Designator Market Projections by Country and sub-region, Value (US$ Mn), 2017‒2031

Figure 44: Europe Military Laser Designator Market, Incremental Opportunity, by Country and sub-region, 2022‒2031

Figure 45: Europe Military Laser Designator Market Share Analysis, by Country and sub-region 2022 and 2031

Figure 46: Asia Pacific Military Laser Designator Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 47: Asia Pacific Military Laser Designator Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 48: Asia Pacific Military Laser Designator Market Projections by Standard, Value (US$ Mn), 2017‒2031

Figure 49: Asia Pacific Military Laser Designator Market, Incremental Opportunity, by Standard, 2023‒2031

Figure 50: Asia Pacific Military Laser Designator Market Share Analysis, by Standard, 2022 and 2031

Figure 51: Asia Pacific Military Laser Designator Market Projections by Type Value (US$ Mn), 2017‒2031

Figure 52: Asia Pacific Military Laser Designator Market, Incremental Opportunity, by Type, 2023‒2031

Figure 53: Asia Pacific Military Laser Designator Market Share Analysis, by Type, 2022 and 2031

Figure 54: Asia Pacific Military Laser Designator Market Projections by End-user, Value (US$ Mn), 2017‒2031

Figure 55: Asia Pacific Military Laser Designator Market, Incremental Opportunity, by End-user, 2023‒2031

Figure 56: Asia Pacific Military Laser Designator Market Share Analysis, by End-user, 2022 and 2031

Figure 57: Asia Pacific Military Laser Designator Market Projections by Country and sub-region, Value (US$ Mn), 2017‒2031

Figure 58: Asia Pacific Military Laser Designator Market, Incremental Opportunity, by Country and sub-region, 2022‒2031

Figure 59: Asia Pacific Military Laser Designator Market Share Analysis, by Country and sub-region 2022 and 2031

Figure 60: MEA Military Laser Designator Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 61: MEA Military Laser Designator Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 62: MEA Military Laser Designator Market Projections by Standard, Value (US$ Mn), 2017‒2031

Figure 63: MEA Military Laser Designator Market, Incremental Opportunity, by Standard, 2023‒2031

Figure 64: MEA Military Laser Designator Market Share Analysis, by Standard, 2022 and 2031

Figure 65: MEA Military Laser Designator Market Projections by Type Value (US$ Mn), 2017‒2031

Figure 66: MEA Military Laser Designator Market, Incremental Opportunity, by Type, 2023‒2031

Figure 67: MEA Military Laser Designator Market Share Analysis, by Type, 2022 and 2031

Figure 68: MEA Military Laser Designator Market Projections by End-user, Value (US$ Mn), 2017‒2031

Figure 69: MEA Military Laser Designator Market, Incremental Opportunity, by End-user, 2023‒2031

Figure 70: MEA Military Laser Designator Market Share Analysis, by End-user, 2022 and 2031

Figure 71: MEA Military Laser Designator Market Projections by Country and sub-region, Value (US$ Mn), 2017‒2031

Figure 72: MEA Military Laser Designator Market, Incremental Opportunity, by Country and sub-region, 2022‒2031

Figure 73: MEA Military Laser Designator Market Share Analysis, by Country and sub-region 2022 and 2031

Figure 74: South America Military Laser Designator Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 75: South America Military Laser Designator Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 76: South America Military Laser Designator Market Projections by Standard, Value (US$ Mn), 2017‒2031

Figure 77: South America Military Laser Designator Market, Incremental Opportunity, by Standard, 2023‒2031

Figure 78: South America Military Laser Designator Market Share Analysis, by Standard, 2022 and 2031

Figure 79: South America Military Laser Designator Market Projections by Type Value (US$ Mn), 2017‒2031

Figure 80: South America Military Laser Designator Market, Incremental Opportunity, by Type, 2023‒2031

Figure 81: South America Military Laser Designator Market Share Analysis, by Type, 2022 and 2031

Figure 82: South America Military Laser Designator Market Projections by End-user, Value (US$ Mn), 2017‒2031

Figure 83: South America Military Laser Designator Market, Incremental Opportunity, by End-user, 2023‒2031

Figure 84: South America Military Laser Designator Market Share Analysis, by End-user, 2022 and 2031

Figure 85: South America Military Laser Designator Market Projections by Country and sub-region, Value (US$ Mn), 2017‒2031

Figure 86: South America Military Laser Designator Market, Incremental Opportunity, by Country and sub-region, 2022‒2031

Figure 87: South America Military Laser Designator Market Share Analysis, by Country and sub-region 2022 and 2031

Figure 88: Global Military Laser Designator Market Competition

Figure 89: Global Military Laser Designator Market Company Share Analysis