The overall hardware costs associated with embedded systems have decreased due to advancements in integrated circuits and processor technology, which is expected to bolster growth of the global military embedded systems market in the years to come. Modern blade servers are becoming more popular, particularly in network-centric military applications. Over the last few years, military electronic technology has advanced dramatically. High efficiency, reliability and small size are some of the major criteria for electronic devices and systems utilized in military applications. As a result of these demands, market participants devote significant resources to creating technologically superior embedded systems.

It is now feasible to use a single network to transfer data from numerous separate systems via a single cable, thanks to technical improvements in embedded systems. Ethernet for these systems can transmit a wide range of data in industries like aerospace and military, and it can do so in a variety of forms, such as a combination of speech, video, and data from various sensors and applications. Multiple single-purpose connections are being replaced by a converged network, which provides significant SWaP (size, weight, and power) advantages as well as enhanced flexibility when introducing new abilities to a platform. The latest generation OpenVPX GbE switch module was launched by Curtiss-Wright Corporation in 2018, offering a secure integrated convergent network.

The complexity of electronic systems utilized by the military sector has expanded, resulting in greater embedded system difficulties. The demand for embedded system components that allow parallel operations with reduced power consumption. In addition, demand for reduction in weight and size, has raised the level of complexity of embedded system design in the defense sector. In order to satisfy the design requirements of these electronic systems and equipment, however, the constant update of military electronics necessitates the development of embedded systems as well. Vendors face a significant problem in keeping up with the changing system upgrade process and technical improvements, as well as staying on top of technological inventions, in order to build modern and complex architectures suited for military systems and equipment makers. Technological developments are likely to foster growth of the global military embedded systems market.

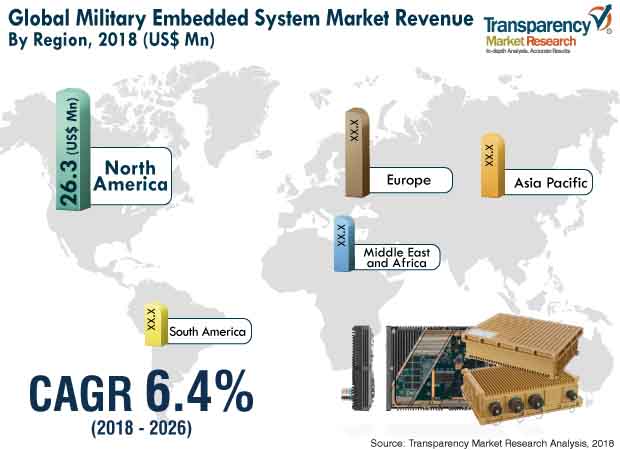

An embedded system is a computer hardware system that has software embedded in it. An embedded system can operate independently or as a part of another larger system. When used in military and defense applications, it is termed as military embedded system. An embedded system consists of various components such as multifunction I/O boards, rugged systems, single-board computers, and general-purpose graphical processing units. An embedded system is a microprocessor- or microcontroller-based system that is designed to perform real-time analysis and other specific tasks. Military embedded systems are used in various applications such as intelligence, surveillance and reconnaissance, communication equipment, command and control systems, computers, data storage devices, and data acquisition equipment. The global military embedded system market is anticipated to reach value of US$ 128.81 Bn by 2026 from US$ 74.18 Bn in 2017, expanding at a CAGR of 6.4% during the forecast period.

The global military embedded system market has been broadly segmented based on product, platform, application, and region. Based on product, the market has been classified into multifunction I/O boards, rugged systems, single-board computers, and general-purpose graphic processing units (GPGPUs). Furthermore, the multifunction I/O boards segment has been sub-divided into communication, analog/digital I/O, networking, and position/motion control. The rugged systems segment has been sub-segregated into safety critical and non-safety critical. The single-board computers segment has been sub-classified into ARM, Power PC, Intel (X86), and others. Based on platform, the military embedded system market has been classified into air, land, and naval. Furthermore, in terms of application, the market has been categorized into intelligence, surveillance and reconnaissance, communication equipment, command & control systems, computers, data storage, and data acquisition. In terms of region, the global military embedded system market has been segmented into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The general-purpose graphic processing units segment holds a major share of the global military embedded system market and it is expected to continue its dominance throughout the forecast period. Increasing demand for mobile command systems in the military & defense sector is driving the market. However, the market faces challenges led by high costs of military embedded systems. Increasing demand for rugged embedded systems is expected to provide significant opportunities to the global military embedded system market in the near future.

Considering rapid growth of the global military embedded system market, several players are investing in the market. In May 2017, Aitech Defense System launched upgraded A176, a rugged GPGPU system, with the use of NVIDIA Jetson TX2. It provides two times higher performance and more than double power efficiency than its predecessor systems.

Some of the prominent players operating in the global military embedded system market and profiled in the study are Abaco Systems, ADLINK Technology Inc., Aitech Defense Systems, Inc., Artesyn Embedded Technologies, Astronics Corporation, Curtiss-Wright Corporation, ECRIN Systems, Elma Electronic Inc., Excalibur Systems, Extreme Engineering Solutions, Inc., Kontron AG, Mercury Systems Inc., National Instruments, North Atlantic Industries Inc., SDK Embedded Systems Ltd., TEK Microsystems, Inc., and United Electronic Industries.

Growing Government Focus toward Modernization Fuels Expansion of Military Embedded System Market

The military embedded system finds application in various activities such as intelligence, surveillance, reconnaissance, and communication equipment, data storage, computers, and data acquisitions. The main motive of this system is to offer real-time analysis and other defined tasks. Rugged systems, multifunction I/O boards, general-purpose graphic processing units, and single-board computers are some of the products available in the global military embedded system market.

The military embedded system is designed for military utilization and made up of two parts, namely, software and hardware. The recent technological developments have resulted into the integration of cloud computing and wireless activities in the military including electronic warfare and network-centric operations. This scenario is projected to fuel the expansion of the global military embedded system market in the forthcoming years.

The government bodies across the globe are growing focus toward modernization of their militaries and defense systems. Owing to this scenario, there remarkable growth in demand for unmanned application from all across the globe. This factor is working in favor of the global military embedded system market. This aside, the extensive applicability of wireless technologies and multi-core processors together with the introduction of modern warfare system is likely to further help in the expansion of the market for military embedded system in the years ahead.

The recent COVID-19 pandemic has adversely impacted on the growth of majority of industries worldwide. The lockdown imposed by the government bodies of many countries from all across the globe has resulted into halting of all operational activities in almost all industrial sectors including the global military embedded system market. As a result, the companies engaged in the market for military embedded system are facing remarkable drop in sales. Thus, they are focused on strategizing their moves to recover from the losses occurred due to COVID-19 pandemic.

The global Military Embedded System Market is projected to reach a value of US$ 128.81 Bn by the end of 2026

Key players in the global Military Embedded System Market include Abaco Systems, ADLINK Technology Inc., Aitech Defense Systems, Inc., Artesyn Embedded Technologies, Astronics Corporation, Curtiss-Wright Corporation, ECRIN Systems, Elma Electronic Inc., Excalibur Systems, Extreme Engineering Solutions, Inc., Kontron AG, Mercury Systems Inc., National Instruments, North Atlantic Industries Inc., SDK Embedded Systems Ltd., TEK Microsystems, Inc., and United Electronic Industries.

The global military embedded system market has been broadly segmented based on product, platform, application, and region.

The forecast period considered for the Military Embedded System Market is 2018 - 2026

Asia Pacific is more attractive region for vendors in the Military Embedded System Market

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Military Embedded System Market

4. Market Overview

4.1. Introduction

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Regulations and Policies

4.4. Key Trends Analysis

4.5. Global Military Embedded System Market Analysis and Forecast, 2016–2026

4.5.1. Market Revenue Projection (US$ Bn)

4.6. Porter’s Five Forces Analysis - Global Military Embedded System Market

4.7. Value Chain Analysis - Global Military Embedded System Market

4.8. Global Military Embedded System Market Share Analysis (%), by Product

4.8.1. Multifunction I/O Boards

4.8.1.1. Standard

4.8.1.2. Custom-built

4.8.2. Rugged Systems

4.8.2.1. Standard

4.8.2.2. Custom-built

4.8.3. Single-board Computers

4.8.3.1. Standard

4.8.3.2. Custom-built

4.8.4. General-purpose Graphic Processing Units (GPGPUs)

4.8.4.1. Standard

4.8.4.2. Custom-built

4.9. Market Outlook

5. Global Military Embedded System Market Analysis and Forecast, by Product

5.1. Overview & Definitions

5.2. Global Military Embedded System Market Value (US$ Bn) Forecast, by Product, 2016–202

5.2.1. Multifunction I/O Boards

5.2.1.1. Communication

5.2.1.2. Analog/Digital I/O

5.2.1.3. Networking

5.2.1.4. Position/Motion Control

5.2.2. Rugged Systems

5.2.2.1. Safety Critical

5.2.2.2. Non-safety Critical

5.2.3. Single-board Computers

5.2.3.1. ARM

5.2.3.2. Power PC

5.2.3.3. Intel (X86)

5.2.3.4. Others

5.2.4. General-purpose Graphic Processing Units (GPGPUs)

5.3. Product Comparison Matrix

5.4. Global Military Embedded System Market Attractiveness, by Product

6. Global Military Embedded System Market Analysis and Forecast, by Platform

6.1. Overview & Definitions

6.2. Global Military Embedded System Market Value (US$ Bn) Forecast, by Platform, 2016–2026

6.2.1. Air

6.2.2. Land

6.2.3. Naval

6.3. Platform Comparison Matrix

6.4. Global Military Embedded System Market Attractiveness, by Platform

7. Global Military Embedded System Market Analysis and Forecast, by Application

7.1. Overview & Definitions

7.2. Global Military Embedded System Market Value (US$ Bn) Forecast, by Application, 2016–2026

7.2.1. Intelligence, Surveillance and Reconnaissance

7.2.2. Communication Equipment

7.2.3. Command & Control Systems

7.2.4. Computers

7.2.5. Data Storage

7.2.6. Data Acquisition

7.3. Application Comparison Matrix

7.4. Global Military Embedded System Market Attractiveness, by Application

8. Global Military Embedded System Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Global Military Embedded System Market Value (US$ Bn) Forecast, by Region, 2016–2026

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. South America

8.3. Global Military Embedded System Market Attractiveness, by Region

9. North America Military Embedded System Market Analysis and Forecast

9.1. Key Findings

9.2. Key Trends

9.3. North America Military Embedded System Market Value (US$ Bn) Forecast, by Product, 2016–2026

9.3.1. Multifunction I/O Boards

9.3.1.1. Communication

9.3.1.2. Analog/Digital I/O

9.3.1.3. Networking

9.3.1.4. Position/Motion Control

9.3.2. Rugged Systems

9.3.2.1. Safety Critical

9.3.2.2. Non-safety Critical

9.3.3. Single-board Computers

9.3.3.1. ARM

9.3.3.2. Power PC

9.3.3.3. Intel (X86)

9.3.3.4. Others

9.3.4. General-purpose Graphic Processing Units (GPGPUs)

9.4. North America Military Embedded System Market Value (US$ Bn) Forecast, by Platform, 2016–2026

9.4.1. Air

9.4.2. Land

9.4.3. Naval

9.5. North America Military Embedded System Market Value (US$ Bn) Forecast, by Application, 2016–2026

9.5.1. Intelligence, Surveillance and Reconnaissance

9.5.2. Communication Equipment

9.5.3. Command & Control Systems

9.5.4. Computers

9.5.5. Data Storage

9.5.6. Data Acquisition

9.6. North America Military Embedded System Market Value (US$ Bn) Forecast, by Country/Sub-region, 2016–2026

9.6.1. U.S.

9.6.2. Canada

9.6.3. Rest of North America

9.7. North America Military Embedded System Market Attractiveness Analysis

9.7.1. by Product

9.7.2. by Platform

9.7.3. by Application

9.7.4. by Country/Sub-region

10. Europe Military Embedded System Market Analysis and Forecast

10.1. Key Findings

10.2. Key Trends

10.3. Europe Military Embedded System Market Value (US$ Bn) Forecast, by Product, 2016–2026

10.3.1. Multifunction I/O Boards

10.3.1.1. Communication

10.3.1.2. Analog/Digital I/O

10.3.1.3. Networking

10.3.1.4. Position/Motion Control

10.3.2. Rugged Systems

10.3.2.1. Safety Critical

10.3.2.2. Non-safety Critical

10.3.3. Single-board Computers

10.3.3.1. ARM

10.3.3.2. Power PC

10.3.3.3. Intel (X86)

10.3.3.4. Others

10.3.4. General-purpose Graphic Processing Units (GPGPUs)

10.4. Europe Military Embedded System Market Value (US$ Bn) Forecast, by Platform, 2016–2026

10.4.1. Air

10.4.2. Land

10.4.3. Naval

10.5. Europe Military Embedded System Market Value (US$ Bn) Forecast, by Application, 2016–2026

10.5.1. Intelligence, Surveillance and Reconnaissance

10.5.2. Communication Equipment

10.5.3. Command & Control Systems

10.5.4. Computers

10.5.5. Data Storage

10.5.6. Data Acquisition

10.6. Europe Military Embedded System Market Value (US$ Bn) Forecast, by Country/Sub-region, 2016–2026

10.6.1. Germany

10.6.2. U.K.

10.6.3. France

10.6.4. Rest of Europe

10.7. Europe Military Embedded System Market Attractiveness Analysis

10.7.1. by Product

10.7.2. by Platform

10.7.3. by Application

10.7.4. by Country/Sub-region

11. Asia Pacific Military Embedded System Market Analysis and Forecast

11.1. Key Findings

11.2. Key Trends

11.3. Asia Pacific Military Embedded System Market Value (US$ Bn) Forecast, by Product, 2016–2026

11.3.1. Multifunction I/O Boards

11.3.1.1. Communication

11.3.1.2. Analog/Digital I/O

11.3.1.3. Networking

11.3.1.4. Position/Motion Control

11.3.2. Rugged Systems

11.3.2.1. Safety Critical

11.3.2.2. Non-safety Critical

11.3.3. Single-board Computers

11.3.3.1. ARM

11.3.3.2. Power PC

11.3.3.3. Intel (X86)

11.3.3.4. Others

11.3.4. General-purpose Graphic Processing Units (GPGPUs)

11.4. Asia Pacific Military Embedded System Market Value (US$ Bn) Forecast, by Platform, 2016–2026

11.4.1. Air

11.4.2. Land

11.4.3. Naval

11.5. Asia Pacific Military Embedded System Market Value (US$ Bn) Forecast, by Application, 2016–2026

11.5.1. Intelligence, Surveillance and Reconnaissance

11.5.2. Communication Equipment

11.5.3. Command & Control Systems

11.5.4. Computers

11.5.5. Data Storage

11.5.6. Data Acquisition

11.6. Asia Pacific Military Embedded System Market Value (US$ Bn) Forecast, by Country/Sub-region, 2016–2026

11.6.1. China

11.6.2. Japan

11.6.3. India

11.6.4. Australia

11.6.5. Rest of Asia Pacific

11.7. Asia Pacific Military Embedded System Market Attractiveness Analysis

11.7.1. by Product

11.7.2. by Platform

11.7.3. by Application

11.7.4. by Country/Sub-region

12. Middle East & Africa Military Embedded System Market Analysis and Forecast

12.1. Key Findings

12.2. Key Trends

12.3. Middle East & Africa Military Embedded System Market Value (US$ Bn) Forecast, by Product, 2016–2026

12.3.1. Multifunction I/O Boards

12.3.1.1. Communication

12.3.1.2. Analog/Digital I/O

12.3.1.3. Networking

12.3.1.4. Position/Motion Control

12.3.2. Rugged Systems

12.3.2.1. Safety Critical

12.3.2.2. Non-safety Critical

12.3.3. Single-board Computers

12.3.3.1. ARM

12.3.3.2. Power PC

12.3.3.3. Intel (X86)

12.3.3.4. Others

12.3.4. General-purpose Graphic Processing Units (GPGPUs)

12.4. Middle East & Africa Military Embedded System Market Value (US$ Bn) Forecast, by Platform, 2016–2026

12.4.1. Air

12.4.2. Land

12.4.3. Naval

12.5. Middle East & Africa Military Embedded System Market Value (US$ Bn) Forecast, by Application, 2016–2026

12.5.1. Intelligence, Surveillance and Reconnaissance

12.5.2. Communication Equipment

12.5.3. Command & Control Systems

12.5.4. Computers

12.5.5. Data Storage

12.5.6. Data Acquisition

12.6. Middle East & Africa Military Embedded System Market Value (US$ Bn) Forecast, by Country/Sub-region, 2016–2026

12.6.1. GCC

12.6.2. South Africa

12.6.3. Rest of Middle East & Africa

12.7. Middle East & Africa Military Embedded System Market Attractiveness Analysis

12.7.1. by Product

12.7.2. by Platform

12.7.3. by Application

12.7.4. by Country/Sub-region

13. South America Military Embedded System Market Analysis and Forecast

13.1. Key Findings

13.2. Key Trends

13.3. South America Military Embedded System Market Value (US$ Bn) Forecast, by Product, 2016–2026

13.3.1. Multifunction I/O Boards

13.3.1.1. Communication

13.3.1.2. Analog/Digital I/O

13.3.1.3. Networking

13.3.1.4. Position/Motion Control

13.3.2. Rugged Systems

13.3.2.1. Safety Critical

13.3.2.2. Non-safety Critical

13.3.3. Single-board Computers

13.3.3.1. ARM

13.3.3.2. Power PC

13.3.3.3. Intel (X86)

13.3.3.4. Others

13.3.4. General-purpose Graphic Processing Units (GPGPUs)

13.4. South America Military Embedded System Market Value (US$ Bn) Forecast, by Platform, 2016–2026

13.4.1. Air

13.4.2. Land

13.4.3. Naval

13.5. South America Military Embedded System Market Value (US$ Bn) Forecast, by Application, 2016–2026

13.5.1. Intelligence, Surveillance and Reconnaissance

13.5.2. Communication Equipment

13.5.3. Command & Control Systems

13.5.4. Computers

13.5.5. Data Storage

13.5.6. Data Acquisition

13.6. South America Military Embedded System Market Value (US$ Bn) Forecast, by Country/Sub-region, 2016–2026

13.6.1. Brazil

13.6.2. Rest of South America

13.7. South America Military Embedded System Market Attractiveness Analysis

13.7.1. by Product

13.7.2. by Platform

13.7.3. by Application

13.7.4. by Country/Sub-region

14. Competition Landscape

14.1. Market Players – Competition Matrix

14.2. Global Military Embedded System Market Share (%), by Company (2017)

14.3. Company Profiles (Details – Overview, Financials, SWOT Analysis, Strategy)

14.3.1. Abaco Systems

14.3.1.1. Company Details

14.3.1.2. Company Description

14.3.1.3. Business Overview

14.3.1.4. Financials

14.3.1.5. SWOT Analysis

14.3.1.6. Strategic Overview

14.3.2. ADLINK Technology Inc.

14.3.2.1. Company Details

14.3.2.2. Company Description

14.3.2.3. Business Overview

14.3.2.4. Financials

14.3.2.5. SWOT Analysis

14.3.2.6. Strategic Overview

14.3.3. Aitech Defense Systems, Inc.

14.3.3.1. Company Details

14.3.3.2. Company Description

14.3.3.3. Business Overview

14.3.3.4. Financials

14.3.3.5. SWOT Analysis

14.3.3.6. Strategic Overview

14.3.4. Artesyn Embedded Technologies

14.3.4.1. Company Details

14.3.4.2. Company Description

14.3.4.3. Business Overview

14.3.4.4. Financials

14.3.4.5. SWOT Analysis

14.3.4.6. Strategic Overview

14.3.5. Astronics Corporation

14.3.5.1. Company Details

14.3.5.2. Company Description

14.3.5.3. Business Overview

14.3.5.4. Financials

14.3.5.5. SWOT Analysis

14.3.5.6. Strategic Overview

14.3.6. Curtiss-Wright Corporation

14.3.6.1. Company Details

14.3.6.2. Company Description

14.3.6.3. Business Overview

14.3.6.4. Financials

14.3.6.5. SWOT Analysis

14.3.6.6. Strategic Overview

14.3.7. ECRIN Systems

14.3.7.1. Company Details

14.3.7.2. Company Description

14.3.7.3. Business Overview

14.3.7.4. Financials

14.3.7.5. SWOT Analysis

14.3.7.6. Strategic Overview

14.3.8. Elma Electronic Inc.

14.3.8.1. Company Details

14.3.8.2. Company Description

14.3.8.3. Business Overview

14.3.8.4. Financials

14.3.8.5. SWOT Analysis

14.3.8.6. Strategic Overview

14.3.9. Excalibur Systems

14.3.9.1. Company Details

14.3.9.2. Company Description

14.3.9.3. Business Overview

14.3.9.4. Financials

14.3.9.5. SWOT Analysis

14.3.9.6. Strategic Overview

14.3.10. Extreme Engineering Solutions, Inc.

14.3.10.1. Company Details

14.3.10.2. Company Description

14.3.10.3. Business Overview

14.3.10.4. Financials

14.3.10.5. SWOT Analysis

14.3.10.6. Strategic Overview

14.3.11. Kontron AG

14.3.11.1. Company Details

14.3.11.2. Company Description

14.3.11.3. Business Overview

14.3.11.4. Financials

14.3.11.5. SWOT Analysis

14.3.11.6. Strategic Overview

14.3.12. Mercury Systems Inc.

14.3.12.1. Company Details

14.3.12.2. Company Description

14.3.12.3. Business Overview

14.3.12.4. Financials

14.3.12.5. SWOT Analysis

14.3.12.6. Strategic Overview

14.3.13. National Instruments

14.3.13.1. Company Details

14.3.13.2. Company Description

14.3.13.3. Business Overview

14.3.13.4. Financials

14.3.13.5. SWOT Analysis

14.3.13.6. Strategic Overview

14.3.14. North Atlantic Industries Inc.

14.3.14.1. Company Details

14.3.14.2. Company Description

14.3.14.3. Business Overview

14.3.14.4. Financials

14.3.14.5. SWOT Analysis

14.3.14.6. Strategic Overview

14.3.15. SDK Embedded Systems Ltd.

14.3.15.1. Company Details

14.3.15.2. Company Description

14.3.15.3. Business Overview

14.3.15.4. Financials

14.3.15.5. SWOT Analysis

14.3.15.6. Strategic Overview

14.3.16. TEK Microsystems, Inc.

14.3.16.1. Company Details

14.3.16.2. Company Description

14.3.16.3. Business Overview

14.3.16.4. Financials

14.3.16.5. SWOT Analysis

14.3.16.6. Strategic Overview

14.3.17. United Electronic Industries

15. Key Takeaways

List of Tables

Table 01: Global Military Embedded System Market Value Share Analysis (%), by Product

Table 02: Global Military Embedded System Market Value (US$ Bn) Forecast, by Product, 2016–2026

Table 03: Global Military Embedded System Market Value (US$ Bn) Forecast, by Product – Multifunction I/O Boards, 2016–2026

Table 04: Global Military Embedded System Market Value (US$ Bn) Forecast, by Product – Rugged Systems, 2016–2026

Table 05: Global Military Embedded System Market Value (US$ Bn) Forecast, by Product – Single-board Computers, 2016–2026

Table 06: Global Military Embedded System Market Value (US$ Bn) Forecast, by Platform, 2016–2026

Table 07: Global Military Embedded System Market Value (US$ Bn) Forecast, by Application, 2016–2026

Table 08: Global Military Embedded System Market Value (US$ Bn) Forecast, by Region, 2016–2026

Table 09: North America Military Embedded System Market Value (US$ Bn) Forecast, by Product, 2016–2026

Table 10: North America Military Embedded System Market Value (US$ Bn) Forecast, by Product – Multifunction I/O Boards, 2016–2026

Table 11: North America Military Embedded System Market Value (US$ Bn) Forecast, by Product – Rugged Systems, 2016–2026

Table 12: North America Military Embedded System Market Value (US$ Bn) Forecast, by Product – Single-board Computers, 2016–2026

Table 13: North America Military Embedded System Market Value (US$ Bn) Forecast, by Platform, 2016–2026

Table 14: North America Military Embedded System Market Value (US$ Bn) Forecast, by Application, 2016–2026

Table 15: North America Military Embedded System Market Value (US$ Bn) Forecast, by Country/Sub-region, 2016–2026

Table 16: Europe Military Embedded System Market Value (US$ Bn) Forecast, by Product, 2016–2026

Table 17: Europe Military Embedded System Market Value (US$ Bn) Forecast, by Product – Multifunction I/O Boards, 2016–2026

Table 18: Europe Military Embedded System Market Value (US$ Bn) Forecast, by Product – Rugged Systems, 2016–2026

Table 19: Europe Military Embedded System Market Value (US$ Bn) Forecast, by Product – Single-board Computers, 2016–2026

Table 20: Europe Military Embedded System Market Value (US$ Bn) Forecast, by Platform, 2016–2026

Table 21: Europe Military Embedded System Market Value (US$ Bn) Forecast, by Application, 2016–2026

Table 22: Europe Military Embedded System Market Value (US$ Bn) Forecast, by Country/Sub-region, 2016–2026

Table 23: Asia Pacific Military Embedded System Market Value (US$ Bn) Forecast, by Product, 2016–2026

Table 24: Asia Pacific Military Embedded System Market Value (US$ Bn) Forecast, by Product – Multifunction I/O Boards, 2016–2026

Table 25: Asia Pacific Military Embedded System Market Value (US$ Bn) Forecast, by Product – Rugged Systems, 2016–2026

Table 26: Asia Pacific Military Embedded System Market Value (US$ Bn) Forecast, by Product – Single-board Computers, 2016–2026

Table 27: Asia Pacific Military Embedded System Market Value (US$ Bn) Forecast, by Platform, 2016–2026

Table 28: Asia Pacific Military Embedded System Market Value (US$ Bn) Forecast, by Application, 2016–2026

Table 29: Asia Pacific Military Embedded System Market Revenue Forecast, by Country/Sub-region, 2016–2026

Table 30: Middle East & Africa Military Embedded System Market Value (US$ Bn) Forecast, by Product, 2016–2026

Table 31: Middle East & Africa Military Embedded System Market Value (US$ Bn) Forecast, by Product – Multifunction I/O Boards, 2016–2026

Table 32: Middle East & Africa Military Embedded System Market Value (US$ Bn) Forecast, by Product – Rugged Systems, 2016–2026

Table 33: Middle East & Africa Military Embedded System Market Value (US$ Bn) Forecast, by Product – Single-board Computers, 2016–2026

Table 34: Middle East & Africa Military Embedded System Market Value (US$ Bn) Forecast, by Platform, 2016–2026

Table 35: Middle East & Africa Military Embedded System Market Value (US$ Bn) Forecast, by Application, 2016–2026

Table 36: Middle East & Africa Military Embedded System Market Value (US$ Bn) Forecast, by Country/Sub-region, 2016–2026

Table 37: South America Military Embedded System Market Value (US$ Bn) Forecast, by Product, 2016–2026

Table 38: South America Military Embedded System Market Value (US$ Bn) Forecast, by Product – Multifunction I/O Boards, 2016–2026

Table 39: South America Military Embedded System Market Value (US$ Bn) Forecast, by Product – Rugged Systems, 2016–2026

Table 40: South America Military Embedded System Market Value (US$ Bn) Forecast, by Product – Single-board Computers, 2016–2026

Table 41: South America Military Embedded System Market Value (US$ Bn) Forecast, by Platform, 2016–2026

Table 42: South America Military Embedded System Market Value (US$ Bn) Forecast, by Application, 2016–2026

Table 43: South America Military Embedded System Market Value (US$ Bn) Forecast, by Country/Sub-region, 2016–2026

Table 44: Competition Matrix

List of Figures

Figure 01: Global Military Embedded System Market Size – Historical and Forecast, 2016–2026

Figure 02: Global Military Embedded System Market Size – Historical and Forecast, 2016–2026

Figure 03: North America Military Embedded System Market CAGR

Figure 04: Europe Military Embedded System Market CAGR

Figure 05: Asia Pacific Military Embedded System Market CAGR

Figure 06: Middle East & Africa Military Embedded System Market CAGR

Figure 07: South America Military Embedded System Market CAGR

Figure 08: Global Military Embedded System Market Value Share, by Region, 2017

Figure 09: Global Military Embedded System Market Revenue (US$ Bn) Projection and Y-o-Y Growth, 2016–2026

Figure 10: Porter’s Five Forces Analysis

Figure 11: Global Military Embedded System Market Overview

Figure 12: Global Military Embedded System Market, by Product (2018)

Figure 13: Global Military Embedded System Market, by Platform (2018)

Figure 14: Global Military Embedded System Market, by Application (2018)

Figure 15: Global Military Embedded System Market Share Analysis, by Product, 2018 and 2026

Figure 16: Global Military Embedded System Market, by Product – Multifunction I/O Boards

Figure 17: Global Military Embedded System Market, by Product – Rugged Systems

Figure 18: Global Military Embedded System Market, by Product – Single-board Computers

Figure 19: Global Military Embedded System Market, by Product – General-purpose Graphic Processing Units (GPGPUs)

Figure 20: Segment Growth Matrix, 2018–2026 (%)

Figure 21: Segment Revenue Contribution, 2018–2026 (%)

Figure 22: Segment Compounded Growth Matrix (CAGR %)

Figure 23: Global Military Embedded System Market Attractiveness Analysis, by Product

Figure 24: Global Military Embedded System Market Share Analysis, by Platform, 2018 and 2026

Figure 25: Global Military Embedded System Market, by Platform – Air

Figure 26: Global Military Embedded System Market, by Platform – Land

Figure 27: Global Military Embedded System Market, by Platform – Naval

Figure 28: Segment Growth Matrix, 2018–2026 (%)

Figure 29: Segment Revenue Contribution, 2018–2026 (%)

Figure 30: Segment Compounded Growth Matrix (CAGR %)

Figure 31: Global Military Embedded System Market Attractiveness Analysis, by Platform

Figure 32: Global Military Embedded System Market Share Analysis, by Application, 2018 and 2026

Figure 33: Global Military Embedded System Market, by Application – Intelligence, Surveillance and Reconnaissance

Figure 34: Global Military Embedded System Market, by Application – Communication Equipment

Figure 35: Global Military Embedded System Market, by Application – Command & Control Systems

Figure 36: Global Military Embedded System Market, by Application – Computers

Figure 37: Global Military Embedded System Market, by Application – Data Storage

Figure 38: Global Military Embedded System Market, by Application – Data Acquisition

Figure 39: Segment Growth Matrix, 2018–2026 (%)

Figure 40: Segment Revenue Contribution, 2018–2026 (%)

Figure 41: Segment Compounded Growth Matrix (CAGR %)

Figure 42: Global Military Embedded System Market Attractiveness Analysis, by Application

Figure 43: Global Military Embedded System Market, by Region – North America

Figure 44: Global Military Embedded System Market, by Region – Europe

Figure 45: Global Military Embedded System Market, by Region – Asia Pacific

Figure 46: Global Military Embedded System Market, by Region – Middle East & Africa

Figure 47: Global Military Embedded System Market, by Region – South America

Figure 48: Global Military Embedded System Market Attractiveness Analysis, by Region

Figure 49: North America Military Embedded System Market Value (US$ Bn) Forecast, 2016–2026

Figure 50: North America Military Embedded System Market Y-o-Y Growth Forecast, 2016–2026

Figure 51: North America Military Embedded System Market Value Share Analysis, by Product, 2018 and 2026

Figure 52: North America Military Embedded System Market Value Share Analysis, by Platform, 2018 and 2026

Figure 53: North America Military Embedded System Market Value Share Analysis, by Application, 2018 and 2026

Figure 54: North America Military Embedded System Market Value Share Analysis, by Country/Sub-region, 2018 and 2026

Figure 55: North America Military Embedded System Market Attractiveness Analysis, by Product

Figure 56: North America Military Embedded System Market Attractiveness Analysis, by Platform

Figure 57: North America Military Embedded System Market Attractiveness Analysis, by Application

Figure 58: North America Military Embedded System Market Attractiveness Analysis, by Country/Sub-region

Figure 59: Europe Military Embedded System Market Value (US$ Bn) Forecast, 2016–2026

Figure 60: Europe Military Embedded System Market Y-o-Y Growth Forecast, 2016–2026

Figure 61: Europe Military Embedded System Market Value Share Analysis, by Product, 2018 and 2026

Figure 62: Europe Military Embedded System Market Value Share Analysis, by Platform, 2018 and 2026

Figure 63: Europe Military Embedded System Market Value Share Analysis, by Application, 2018 and 2026

Figure 64: Europe Military Embedded System Market Value Share Analysis, by Country/Sub-region, 2018 and 2026

Figure 65: Europe Military Embedded System Market Attractiveness Analysis, by Product

Figure 66: Europe Military Embedded System Market Attractiveness Analysis, by Platform

Figure 67: Europe Military Embedded System Market Attractiveness Analysis, by Application

Figure 68: Europe Military Embedded System Market Attractiveness Analysis, by Country/Sub-region

Figure 69: Asia Pacific Military Embedded System Market Value (US$ Bn) Forecast, 2016–2026

Figure 70: Asia Pacific Military Embedded System Market Y-o-Y Growth Forecast, 2016–2026

Figure 71: Asia Pacific Military Embedded System Market Value Share Analysis, by Product, 2018 and 2026

Figure 72: Asia Pacific Military Embedded System Market Value Share Analysis, by Platform, 2018 and 2026

Figure 73: Asia Pacific Military Embedded System Market Value Share Analysis, by Application, 2018 and 2026

Figure 74: Asia Pacific Military Embedded System Market Value Share Analysis, by Country/Sub-region, 2018 and 2026

Figure 75: Asia Pacific Military Embedded System Market Attractiveness Analysis, by Product

Figure 76: Asia Pacific Military Embedded System Market Attractiveness Analysis, by Platform

Figure 77: Asia Pacific Military Embedded System Market Attractiveness Analysis, by Application

Figure 78: Asia Pacific Military Embedded System Market Attractiveness Analysis, by Country/Sub-region

Figure 79: Middle East & Africa Military Embedded System Market Value (US$ Bn) Forecast, 2016–2026

Figure 80: Middle East & Africa Military Embedded System Market Y-o-Y Growth Forecast, 2016–2026

Figure 81: Middle East & Africa Military Embedded System Market Value Share Analysis, by Product, 2018 and 2026

Figure 82: Middle East & Africa Military Embedded System Market Value Share Analysis, by Platform, 2018 and 2026

Figure 83: Middle East & Africa Military Embedded System Market Value Share Analysis, by Application, 2018 and 2026

Figure 84: Middle East & Africa Military Embedded System Market Value Share Analysis, by Country/Sub-region, 2018 and 2026

Figure 85: Middle East & Africa Military Embedded System Market Attractiveness Analysis, by Product

Figure 86: Middle East & Africa Military Embedded System Market Attractiveness Analysis, by Platform

Figure 87: Middle East & Africa Military Embedded System Market Attractiveness Analysis, by Application

Figure 88: Middle East & Africa Military Embedded System Market Attractiveness Analysis, by Country/Sub-region

Figure 89: South America Military Embedded System Market Value (US$ Bn) Forecast, 2016–2026

Figure 90: South America Military Embedded System Market Y-o-Y Growth Forecast, 2016–2026

Figure 91: South America Military Embedded System Market Value Share Analysis, by Product, 2018 and 2026

Figure 92: South America Military Embedded System Market Value Share Analysis, by Platform, 2018 and 2026

Figure 93: South America Military Embedded System Market Value Share Analysis, by Application, 2018 and 2026

Figure 94: South America Military Embedded System Market Value Share Analysis, by Country/Sub-region, 2018 and 2026

Figure 95: South America Military Embedded System Market Attractiveness Analysis, by Product

Figure 96: South America Military Embedded System Market Attractiveness Analysis, by Platform

Figure 97: South America Military Embedded System Market Attractiveness Analysis, by Application

Figure 98: South America Military Embedded System Market Attractiveness Analysis, by Country/Sub-region

Figure 99: Global Military Embedded System Market Share Analysis, by Company