The growing threat of national security due to rise in number of illegal migration, is one of the primary drivers aiding to the growth of the global military biometrics market. The increase in the number of illegal migration affects the growth in economy as the people residing illegally are not liable to pay any form of taxes to the government. This is one of the primary concerns for restricting illegal migrations. Furthermore, another issue that can be linked with illegal migration is the fear of terrorism. According to the U.S. department of defense, 30,000 illegal migrations were reported in 2015 which belonged from countries linked with terrorist activities. The use of biometric authentication helps in identifying individuals entering the country. Hence the demand for biometrics in defense applications is expected to grow significantly during the forecast period.

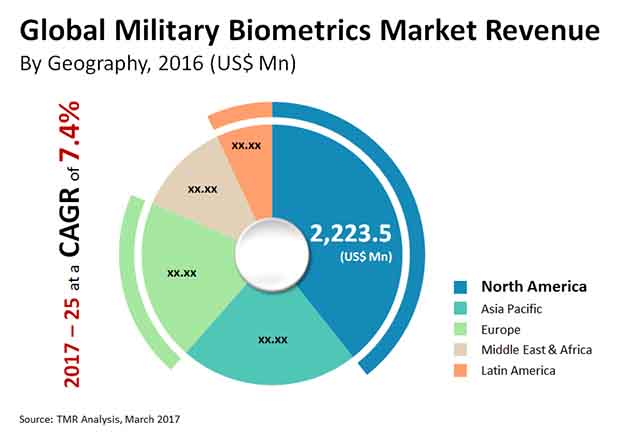

The global market for military biometrics accounted for US$ 5,650.5 mn in 2016. The market is expected to grow steadily at a CAGR of 7.4% from 2017 to 2025, to reach US$ 10,620.6 mn.

By geography, the global military biometrics market has been segmented into North America, Europe, Asia Pacific, Middle East & Africa and Latin America. North America and Europe together held more than 55% of the global market in 2016 and expected to remain dominant during the forecast period. North America has been anticipated to be the largest market in global military biometrics market. The growing concern for illegal migration in the U.S. is expected to drive the demand for military biometrics in this region. Asia Pacific held the second largest market for military biometrics. The region has also been analyzed to be the fastest growing owing to the presence of developing nations such as India and China who are increasingly adopting the biometric authentication in defense to upgrade their security measures.

Europe held the third largest market during the forecast period. The leading countries in Europe include Germany, France and the U.K. who are focusing on upgrading their defense capabilities by upgrading their authentication systems. Furthermore, the countries are also trying to restrict the entry of illegal migrations from under developed nations. Middle East and Africa region is also expected to witness steady demand for military biometrics owing to the presence of countries such as Saudi Arabia and U.A.E. which invest significantly to upgrade their defense and security. Furthermore, this region also includes countries like Iraq and Syria which are witnessing constant terrorist activities. Latin America holds the smallest market share and is expected to witness sluggish growth owing to the weak economic conditions of the countries present in this region.

The global military biometrics market has been segmented by types in fingerprint recognition, facial recognition and iris recognition among others. The fingerprint recognition segment has been analyzed to be the largest market during the forecast period. The fingerprint recognition is most commonly used authentication system in most of the defense agencies across the globe. However, the accuracy of iris recognition is expected to drive the demand for this segment strongly in future. Furthermore, facial recognition is also witnessing steady growth due to their wide use in border security and surveillance.

3M Cogent, Inc. (United States), Crossmatch (United States), M2SYS Technology (United States), NEC Corporation (Japan), Safran Identity and Security (France), Aware, Inc. ( United States), BIO-Key International, Inc. (United States), Fulcrum Biometrics LLC (United States) and HID Global Corporation (United States) among others are some of the major players in global military biometrics market.

Rising Need for Authentication to Drive Military Biometrics Market

The increasing demand for combating terrorism have propelled various nations to adopt the latst and most advanced form of biometrics for use in military applications. This is expected to promote the growth of the global military biometrics market in the coming years. With developing requirement for tending to penetration and comparative security issues, it has gotten most extreme critical to embrace military biometrics. The developing number of countries battling with manufactured characters, personality burglaries, and unlawful settlements will prod an uplifted interest for military biometrics. An ever increasing number of air terminals and lines across nations are utilizing biometrics confirmation frameworks in an offer to diminish illegal intimidation and fear assaults.

On the contrary, the intricacy of military biometrics frameworks could be a test. The significant expense may likewise be a hindering variable for enormous scope reception. Moreover, the establishment of these frameworks is confounded and requires gifted faculty. The way that it includes security of exceptionally private information, requires for the framework to never be undermined and as this framework can't be reset effectively, it is a major factor for diminished appropriation. Nonetheless, the persistent innovative progressions in this field are assessed to diminish the effect of this limitation.

Some of the key players of the global military biometrics market include HID Global Corporation, Fulcrum Biometrics LLC, BIO-Key International, Inc., Aware, Inc., Safran Identity and Security, NEC Corporation, M2SYS Technology, Crossmatch, 3M Cogent, Inc., and others. The key strategies adopted by players include merger and acquisition, collaborative agreement, joint ventures, and others. Apart from this, major investments in research and development, and quality testing will help players gain a competitive edge in the coming years. Regionwise, the market is dominated by Europe and North America on account of the increasing emphasis on illegal migration in the developed nations such as the United States. However, the market in Asia Pacific is prognosticated to witness notable growth rate in the coming years owing to the increasing adoption of biometric authentication in emerging nations such as China and India.

Section 1 Preface

1.1 Report Scope & Market Segmentation

1.2 Research Highlights

Section 2 Research Methodology

2.1 Secondary Research

2.2 Primary Research

2.3 Models

Section 3 Executive Summary

Section 4 Military Biometrics Market: Dynamics

4.1 Market Introduction

4.2 Market Trend

4.3 Market Drivers

4.3.1 The growing demand for facial and iris recognition in defense

4.4 Market Restraints

4.4.1 Integration, complexity and risk of breach

4.5 Market Opportunities

4.5.1 The concept of behavioral biometrics to drive the market in future

4.6 Porter's Five Forces Analysis

4.7 Market Attractiveness Analysis

4.8 Market Share of Key Players, 2016

4.9 Global Military Biometrics Market Outlook, 2015

Section 5 Global Military Biometrics Market: By Types

5.1 Introduction

5.2 Global Military Biometrics Market Value Share Analysis, By Types

5.3 Global Military Biometrics Market Forecast By Types

5.4 Global Military Biometrics Market Analysis By Types

Section 6 North America Military Biometrics Market Analysis

6.1 Introduction

6.2 North America Military Biometrics Market Value Share Analysis, By Types

6.3 North America Military Biometrics Market Forecast, By Types

6.4 North America Military Biometrics Market Value Share Analysis, By Country

6.5 North America Military Biometrics Market Analysis, By Country

6.5.1 U.S. Military Biometrics Market, 2016 – 2025, USD Mn

6.5.2 Canada Military Biometrics Market, 2016 – 2025, USD Mn

6.5.3 Mexico Military Biometrics Market, 2016 – 2025, USD Mn

Section 7 Europe Military Biometrics Market

7.1 Introduction

7.2 Europe Military Biometrics Market Value Share Analysis, By Types

7.3 Europe Military Biometrics Market Forecast By Types

7.4 Europe Military Biometrics Market Value Share Analysis,By Country

7.5 Europe Military Biometrics Market Analysis By Country

7.5.1 U.K. Military Biometrics Market, 2016 – 2025, USD Mn

7.5.2 Germany Military Biometrics Market, 2016 – 2025, USD Mn

7.5.3 France Military Biometrics Market, 2016 – 2025, USD Mn

7.5.4 Italy Military Biometrics Market, 2016 – 2025, USD Mn

7.5.5 Rest of EuropeMilitary Biometrics Market, 2016 – 2025, USD Mn

Section 8 Asia Pacific Military Biometrics Market

8.1 Introduction

8.2 Asia PacificMilitary Biometrics Market Value Share Analysis, By Types

8.3 Asia PacificMilitary Biometrics Market Forecast By Types

8.4 Asia PacificMilitary Biometrics Market Value Share Analysis, By Country

8.5 Asia Pacific Military Biometrics Market Analysis By Country

8.5.1 China Military Biometrics Market, 2016 – 2025, USD Mn

8.5.2 Japan Military Biometrics Market, 2016 – 2025, USD Mn

8.5.3 India Military Biometrics Market, 2016 – 2025, USD Mn

8.5.4 South Korea Military Biometrics Market, 2016 – 2025, USD Mn

8.5.5 Rest of Asia Pacific Military Biometrics Market, 2016 – 2025, USD Mn

Section 9 Middle East and Africa Market

9.1 Introduction

9.2 Middle East and Africa Pacific Military Biometrics Market Value Share Analysis, By Types

9.3 Middle East and Africa Pacific Military Biometrics Market Forecast By Types

9.4 Middle East and Africa Pacific Military Biometrics Market Value Share Analysis, By Country

9.5 Middle East and Africa Pacific Military Biometrics Market Forecast By Country

9.5.1 Saudi Arabia Military Biometrics Market, 2016 – 2025, USD Mn

9.5.2 UAE Military Biometrics Market, 2016 – 2025, USD Mn

9.5.3 South Africa Military Biometrics Market, 2016 – 2025, USD Mn

9.5.4 Rest of Middle East & Africa Military Biometrics Market, 2016 – 2025, USD Mn

Section 10 Latin America Market

10.1 Introduction

10.2 Latin America Pacific Military Biometrics Market Value Share Analysis, By Types

10.3 Latin America Pacific Military Biometrics Market Forecast By Types

10.4 Latin America Pacific Military Biometrics Market Value Share Analysis,By Country

10.5 Latin America Pacific Military Biometrics Market Forecast By Country

10.5.1 Brazil Military Biometrics Market, 2016 – 2025, USD Mn

10.5.2 Rest of Latin America Military Biometrics Market, 2016 – 2025, USD Mn

Section 11 Military Biometrics Market: Company Profiles

11.1 3M Cogent, Inc.

11.1.1. Company Details

11.1.2. Market Presence

11.1.3. SWOT Analysis

11.1.4. Financial

11.1.5. Strategic Overview

11.2 Crossmatch

11.2.1. Company Details

11.2.2. Market Presence

11.2.3. SWOT Analysis

11.2.4. Financial

11.2.5. Strategic Overview

11.3 M2SYS Technology

11.3.1. Company Details

11.3.2. Market Presence

11.3.3. SWOT Analysis

11.3.4. Financial

11.3.5. Strategic Overview

11.4 NEC Corporation

11.4.1. Company Details

11.4.2. Market Presence

11.4.3. SWOT Analysis

11.4.4. Financial

11.4.5. Strategic Overview

11.5 Safran Identity and Security

11.5.1. Company Details

11.5.2. Market Presence

11.5.3. SWOT Analysis

11.5.4. Financial

11.5.5. Strategic Overview

11.6 Aware, Inc.

11.6.1. Company Details

11.6.2. Market Presence

11.6.3. SWOT Analysis

11.6.4. Financial

11.6.5. Strategic Overview

11.7 BIO-Key International, Inc.

11.7.1. Company Details

11.7.2. Market Presence

11.7.3. SWOT Analysis

11.7.4. Financial

11.7.5. Strategic Overview

11.8 Fulcrum Biometrics LLC

11.8.1. Company Details

11.8.2. Market Presence

11.8.3. SWOT Analysis

11.8.4. Financial

11.8.5. Strategic Overview

11.9 HID Global Corporation

11.9.1. Company Details

11.9.2. Market Presence

11.9.3. SWOT Analysis

11.9.4. Financial

11.9.5. Strategic Overview

11.10 Corvus Integration, Inc.

11.10.1. Company Details

11.10.2. Market Presence

11.10.3. SWOT Analysis

11.10.4. Financial

11.10.5. Strategic Overview

List of Tables

TABLE 1 Global Market Size (USD Mn) Forecast, By Types, 2016 – 2025

TABLE 2 North America Military Biometrics Market, Revenue (USDMn) and Forecast, By Types, 2016–2025

TABLE 3 North America Military Biometrics Market, Revenue (USDMn) and Forecast, By Country, 2016–2025

TABLE 4 Europe Military Biometrics Market Revenue (USDMn) and Forecast, By Types, 2016–2025

TABLE 5 Europe Military Biometrics Market Revenue (USDMn) and Forecast, By Country, 2016–2025

TABLE 6 Asia Pacific Military Biometrics Market Revenue (USDMn) and Forecast, By Types, 2016–2025

TABLE 7 Asia Pacific Military Biometrics Market Revenue (USDMn) and Forecast, By Country, 2016–2025

TABLE 8 Middle East and Africa Military Biometrics Market Revenue (USD Mn) and Forecast, By Types, 2016–2025

TABLE 9 Middle East and Africa Military Biometrics Market Revenue (USD Mn) and Forecast, By Country Type, 2016–2025

TABLE 10 Latin America Military Biometrics Market Revenue (USD Mn) and Forecast, By Types, 2016–2025

TABLE 11 Latin America Military Biometrics Market Revenue (USD Mn) and Forecast, By Country, 2016–2025

List of Figures

FIG. 1 Report Scope

FIG. 2 Market Size, Indicative (USD Million)

FIG. 3 Market Size, By Types, 2025 (USD Million)

FIG. 4 Market Share, By Regions, 2016 & 2025

FIG. 5 Key Trends

FIG. 6 Market Attractiveness Analysis by Types, 2016

FIG. 7 Market Share of Key Players, 2016

FIG. 8 Military Biometrics: Global Market Value Share Analysis By Types, 2016 and 2025

FIG. 9 Fingerprint Recognition Market, 2016 – 2025, USD Mn

FIG. 10 Facial Recognition Market, 2016 – 2025

FIG. 11 Iris Recognition Market, 2016 – 2025, USD Mn

FIG. 12 Others, 2016 – 2025, USD Mn

FIG. 13 North America Military Biometrics Market, 2016 – 2025, USD Mn

FIG. 14 North America Military Biometrics Market, Value Share Analysis, By Types, 2016 and 2025

FIG. 15 North America Military Biometrics Market, Value Share Analysis, By Country, 2016 and 2025

FIG. 16 U.S. Military Biometrics Market, 2016 – 2025, USD Mn

FIG. 17 Canada Military Biometrics Market, 2016 – 2025, USD Mn

FIG. 18 Mexico Military Biometrics Market, 2016 – 2025, USD Mn

FIG. 19 Europe Military Biometrics Market, 2016 – 2025, USD Mn

FIG. 20 Europe Military Biometrics Market Value Share Analysis, By Types, 2016 and 2025

FIG. 21 Europe Military Biometrics Market, Value Share Analysis, By Country, 2016 and 2025

FIG. 22 U.K. Military Biometrics Market, 2016 – 2025, USD Mn

FIG. 23 Germany Military Biometrics Market, 2016 – 2025, USD Mn

FIG. 24 France Military Biometrics Market, 2016 – 2025, USD Mn

FIG. 25 Italy Military Biometrics Market, 2016 – 2025, USD Mn

FIG. 26 Rest of Europe Military Biometrics Market, 2016 – 2025, USD Mn

FIG. 27 Asia Pacific Military Biometrics Market, Value Share Analysis, By Type, 2016 and 2025

FIG. 28 Asia Pacific Military Biometrics Market, Value Share Analysis, By Country, 2016 and 2025

FIG. 29 China Military Biometrics Market, 2016 – 2025, USD Mn

FIG. 30 Japan Military Biometrics Market, 2016 – 2025, USD Mn

FIG. 31 India Military Biometrics Market, 2016 – 2025, USD Mn

FIG. 32 South Korea Military Biometrics Market, 2016 – 2025, USD Mn

FIG. 33 Rest of Asia Pacific Military Biometrics Market, 2016 – 2025, USD Mn

FIG. 34 Middle East & Africa Military Biometrics Market, 2016 – 2025, USD Mn

FIG. 35 Middle East and Africa Military Biometrics Market, Value Share Analysis, By Types, 2016 and 2025

FIG. 36 Middle East and Africa Military Biometrics Market, Value Share Analysis, By Country, 2016 and 2025

FIG. 37 Saudi Arabia Military Biometrics Market, 2016 – 2025, USD Mn

FIG. 38 UAE Military Biometrics Market, 2016 – 2025, USD Mn

FIG. 39 South Africa Military Biometrics Market, 2016 – 2025, USD Mn

FIG. 40 Rest of Middle East & Africa Military Biometrics Market, 2016 – 2025, USD Mn

FIG. 41 Latin America Military Biometrics Market, 2016 – 2025, USD Mn

FIG. 42 Latin America Military Biometrics Market Value Share Analysis, By Types, 2016 and 2025

FIG. 43 Latin America Military Biometrics Market Value Share Analysis, By Country, 2016 and 2025

FIG. 44 Brazil Military Biometrics Market, 2016 – 2025, USD Mn

FIG. 45 Rest of Latin America Military Biometrics Market, 2016 – 2025, USD Mn