The prevailing unhealthy food habits and hectic lifestyle of consumers across the world are the primary drivers of the global migraine drugs market. Further, the growing population and increasing awareness among consumers regarding the availability of the migraine treatment drugs are prominent factors fueling the growth in the global migraine drugs market. Furthermore, development of advanced drugs by the migraine drugs manufacturers is some other factor influencing growth in the market.

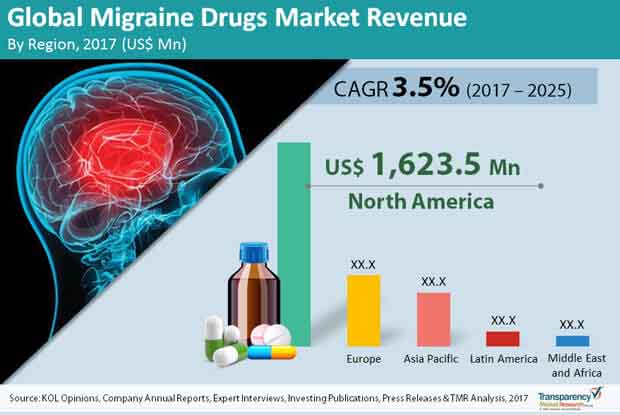

As per the Transparency Market Research, the global migraine drugs market reached a value of US$2.72 bn in 2016 and is expected to reach a value of US$3.72 bn by 2025. The global migraine drugs market is expected to register a steady CAGR 3.50% between 2017 and 2025. The market is mainly segmented into three segments namely Treatment, Route of Administration, and Distribution Channel.

Development of Advanced Migraine Drugs to Boost Growth of Migraine Drugs Market

From the perspective of treatment, the global migraine drugs market is divided into- Abortive, and Prophylactic segments. Further, Abortive segment is classified into triptans, alkoids, ergot and others based on the drug class. While prophylactic treatment is segmented into botulinum toxin, topiramate and others. Among these treatment segments, abortive procedure is likely to dominant market share in the global migraine drugs market whereas prophylactic treatment segment is projected to register a healthy growth during the forecast period that is from 2017 to 2025.

On the basis of route of administration segment, the global migraine drugs market is mainly segmented into oral, injectable and others. The other segment of route of administration includes nasal, spray, transdermal, patches and likewise. Among all of them, orally administrable drugs is likely to holds maximum potential for the global migraine market. And this is projected to continue in the upcoming years as well. This is mainly due to the low cost associated with the usage of oral drugs and vast availability of the oral drugs as compared to the other form across the globe. While on the basis of distribution channel the global migraine drugs market is segmented into hospital pharmacy and retail pharmacy.

North America Holds Immense Potential in Migraine Drugs Market

Based on Geography the global migraine drugs market segment is classified into five prime regions: North America, Asia Pacific, Europe, Latin America, and the Middle East and Africa. Among all these five region, North America is expected to account highest share in the global migraine drugs market during the upcoming years. This is mainly because of the increasing healthcare investment by the private and government bodies. Apart from this, increasing cases of migraine and easy avaiblity of the specialized migraine treatment are the some other headwinds propelling growth in the market. The region is anticipated to register a healthy 3.40% CAGR between 2017 and 2025.

The global migraine drug market depicts a fragmented competitive landscape owing to the presence of several players in the market. Some of the predominant players in the global migraine drugs market are Novartis AG, GlaxoSmithKline plc., Allergan Plc.,Avanir Pharmaceuticals, Inc., Janssen Pharmaceutical Company and ., Eisai Co.,

Migraine Drugs Market - Snapshot

The migraine drugs market features a fragmented and intensely competitive vendor landscape with the presence of several large players in the fray. To stay competitive, several large players are considering to launch revised version of their existing patent drugs and at the same launch new drugs. Besides this, large players in the migraine drugs market are striving for mergers and collaborations with regional players to consolidate their position in the global migraine drugs market.

North America is a prominent region in the global migraine drugs market. The presence of a well-established pharmaceutical industry in the region is a key factor for strong position of North America in the overall migraine drugs market. Moreover, high awareness for the risks of migraine, and the way it impacts quality of life accounts for substantial demand for migraine drugs in the region.

Meanwhile, the demand for migraine drugs is rising steadily in other key regions too. Firstly, the prevalence of migraine among individuals of all age groups that needs to be subsided with drugs fuels the migraine drugs market. Migraine is related to several factors, including food triggers, environment, hormones, or genetics. Nonetheless, so far, there has not been any line of treatment apart from prescription drugs to subside the pain. This creates massive opportunities in the migraine drugs market. In the coming years too, the migraine drugs market is anticipated to witness outstanding growth to be worth close to four billion dollars in the near future.

Key segments of the migraine drugs market based on treatment type are abortive and prophylactic. The abortive segment is further divided into alkoids, triptans, ergot, and others. On the other hand, prophylactic treatment segment is divided into topiramate, botulinum toxin, and others. The migraine drugs market is studied on the basis of route of administration as well. Oral, injectable, and others (transdermal, nasal spray, patches) are key segments of the migraine drugs market on the basis of route of administration.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Migraine Drugs Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution / Developments

4.2. Market Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.1.1. High prevalence of migraine and increasing transition from episodic to chronic migraine

4.3.1.2. Increasing investment in R&D and promising pipeline of novel drugs

4.3.1.3. Aging population and increasing proportion of female population

4.3.1.4. Increasing awareness among patients and high promotional investment by key players

4.3.2. Restraints

4.3.2.1. Fragmented Market with vast availability of generic drugs

4.3.2.2. Ongoing investment in alternative therapies

4.3.3. Opportunities

4.3.4. Trends

4.4. Migraine Drugs Market Analysis and Forecast, 2017 – 2025

4.4.1. Market Revenue Projections (US$ Mn)

4.5. Porter’s five forces analysis

4.6. Value Chain Analysis

4.7. Global Prevalence of Migraine

4.8. Pipeline Analysis

4.8.1. Pipeline Analysis: Migraine Treatment Drugs

4.8.2. Pipeline Analysis: Migraine Treatment Devices

4.9. Market Outlook

5. Global Migraine Drugs Market Analysis and Forecasts, By Treatment

5.1. Introduction & Definition

5.2. Key Findings

5.3. Market Size (US$ Mn) Forecast, By Treatment

5.3.1. Abortive

5.3.1.1. Triptans

5.3.1.2. Ergot Alkaloids

5.3.1.3. Others

5.3.2. Prophylactic

5.3.2.1. Botulinum Toxin

5.3.2.2. Topiramate

5.3.2.3. Others

5.4. New (Pipeline) Migraine Drugs Market Revenue (US$) Forecast, 2017-2025

5.5. Market Attractiveness, By Treatment

5.6. Key Trends

6. Global Migraine Drugs Market Analysis and Forecasts, By Route of Administration

6.1. Introduction & Definition

6.2. Key Findings

6.3. Market Size (US$ Mn) Forecast, By Route of Administration

6.3.1. Oral

6.3.2. Injectable

6.3.3. Other

6.4. Market Attractiveness, By Route of Administration

6.5. Key Trends

7. Global Migraine Drugs Market Analysis and Forecasts, By Distribution Channel

7.1. Introduction & Definition

7.2. Key Findings

7.3. Market Size (US$ Mn) Forecast, By Distribution Chanel

7.3.1. Retail Pharmacies

7.3.2. Hospital Pharmacies

7.3.3. Others

7.4. Market Attractiveness, By Distribution Channel

7.5. Key Trends

8. Global Migraine Drugs Market Analysis and Forecasts, By Region

8.1. Key Findings

8.2. Global Market Scenario

8.3. Market Size (US$ Mn) Forecast, By Region

8.3.1. North America

8.3.2. Europe

8.3.3. Asia Pacific

8.3.4. Latin America

8.3.5. Middle East & Africa

8.4. Market Attractiveness, By Region

8.5. Key Trends, By Region

9. North America Migraine Drugs Market Analysis and Forecast

9.1. Key Findings

9.2. Market Size (US$ Mn) Forecast, By Treatment

9.2.1. Abortive

9.2.1.1. Triptans

9.2.1.2. Ergot Alkaloids

9.2.1.3. Others

9.2.2. Prophylactic

9.2.2.1. Botulinum Toxin

9.2.2.2. Topiramate

9.2.2.3. Others

9.3. Market Size (US$ Mn) Forecast, By Route of Administration

9.3.1. Oral

9.3.2. Injectable

9.3.3. Others

9.4. Market Size (US$ Mn) Forecast, By Distribution Chanel

9.4.1. Retail Pharmacies

9.4.2. Hospital Pharmacies

9.4.3. Others

9.5. Market Size by Value (US$ Mn) Forecast, By Country

9.5.1. U.S.

9.5.2. Canada

9.6. Market Attractiveness Analysis

9.6.1. By Treatment

9.6.2. By Route of Administration

9.6.3. By Distribution Channel

9.6.4. By Country

10. Europe Migraine Drugs Market Analysis and Forecast

10.1. Key Findings

10.2. Market Size (US$ Mn) Forecast, By Treatment

10.2.1. Abortive

10.2.1.1. Triptans

10.2.1.2. Ergot Alkaloids

10.2.1.3. Others

10.2.2. Prophylactic

10.2.2.1. Botulinum Toxin

10.2.2.2. Topiramate

10.2.2.3. Others

10.3. Market Size (US$ Mn) Forecast, By Route of Administration

10.3.1. Oral

10.3.2. Injectable

10.3.3. Others

10.4. Market Size (US$ Mn) Forecast, By Distribution Chanel

10.4.1. Retail Pharmacies

10.4.2. Hospital Pharmacies

10.4.3. Others

10.5. Market Size by Value (US$ Mn) Forecast, By Country

10.5.1. Germany

10.5.2. France

10.5.3. U.K.

10.5.4. Spain

10.5.5. Italy

10.5.6. Rest of Europe

10.6. Market Attractiveness Analysis

10.6.1. By Treatment

10.6.2. By Route of Administration

10.6.3. By Distribution Channel

10.6.4. By Country

11. Asia Pacific Anti-migraine Drugs Market Analysis and Forecast

11.1. Key Findings

11.2. Market Size (US$ Mn) Forecast, By Treatment

11.2.1. Abortive

11.2.1.1. Triptans

11.2.1.2. Ergot Alkaloids

11.2.1.3. Others

11.2.2. Prophylactic

11.2.2.1. Botulinum Toxin

11.2.2.2. Topiramate

11.2.2.3. Others

11.3. Market Size (US$ Mn) Forecast, By Route of Administration

11.3.1. Oral

11.3.2. Injectable

11.3.3. Others

11.4. Market Size (US$ Mn) Forecast, By Distribution Chanel

11.4.1. Retail Pharmacies

11.4.2. Hospital Pharmacies

11.4.3. Others

11.5. Market Size by Value (US$ Mn) Forecast, By Country

11.5.1. India

11.5.2. China

11.5.3. Japan

11.5.4. Australia & New Zealand

11.5.5. Rest of Asia Pacific

11.6. Market Attractiveness Analysis

11.6.1. By Treatment

11.6.2. By Route of Administration

11.6.3. By Distribution Channel

11.6.4. By Country

12. Latin America Anti-migraine Drugs Market Analysis and Forecast

12.1. Key Findings

12.2. Market Size (US$ Mn) Forecast, By Treatment

12.2.1. Abortive

12.2.1.1. Triptans

12.2.1.2. Ergot Alkaloids

12.2.1.3. Others

12.2.2. Prophylactic

12.2.2.1. Botulinum Toxin

12.2.2.2. Topiramate

12.2.2.3. Others

12.3. Market Size (US$ Mn) Forecast, By Route of Administration

12.3.1. Oral

12.3.2. Injectable

12.3.3. Others

12.4. Market Size (US$ Mn) Forecast, By Distribution Chanel

12.4.1. Retail Pharmacies

12.4.2. Hospital Pharmacies

12.4.3. Others

12.5. Market Size by Value (US$ Mn) Forecast, By Country

12.5.1. Brazil

12.5.2. Mexico

12.5.3. Rest of Latin America

12.6. Market Attractiveness Analysis

12.6.1. By Treatment

12.6.2. By Route of Administration

12.6.3. By Distribution Channel

12.6.4. By Country

13. Middle East and Africa Anti-migraine Drugs Market Analysis and Forecast

13.1. Key Findings

13.2. Market Size (US$ Mn) Forecast, By Treatment

13.2.1. Abortive

13.2.1.1. Triptans

13.2.1.2. Ergot Alkaloids

13.2.1.3. Others

13.2.2. Prophylactic

13.2.2.1. Botulinum Toxin

13.2.2.2. Topiramate

13.2.2.3. Others

13.3. Market Size (US$ Mn) Forecast, By Route of Administration

13.3.1. Oral

13.3.2. Injectable

13.3.3. Others

13.4. Market Size (US$ Mn) Forecast, By Distribution Chanel

13.4.1. Retail Pharmacies

13.4.2. Hospital Pharmacies

13.4.3. Others

13.5. Market Size by Value (US$ Mn) Forecast, By Country

13.5.1. Saudi Arabia

13.5.2. South Africa

13.5.3. Israel

13.5.4. Rest of Middle East and Africa

13.6. Market Attractiveness Analysis

13.6.1. By Treatment

13.6.2. By Route of Administration

13.6.3. By Distribution Channel

13.6.4. By Country

14. Competition Landscape

14.1. Market Player – Competition Matrix (By Tier and Size of companies)

14.2. Company Profiles (Details – Overview, Financials, Recent Developments, Strategy)

14.2.1. AstraZeneca Plc.

14.2.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.1.2. Product Portfolio

14.2.1.3. SWOT Analysis

14.2.1.4. Financial Overview

14.2.1.5. Strategic Overview

14.2.2. Allergan Plc.

14.2.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.2.2. Product Portfolio

14.2.2.3. SWOT Analysis

14.2.2.4. Financial Overview

14.2.2.5. Strategic Overview

14.2.3. GlaxoSmithKline Plc.

14.2.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.3.2. Product Portfolio

14.2.3.3. SWOT Analysis

14.2.3.4. Financial Overview

14.2.3.5. Strategic Overview

14.2.4. Novartis AG

14.2.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.4.2. Product Portfolio

14.2.4.3. SWOT Analysis

14.2.4.4. Financial Overview

14.2.4.5. Strategic Overview

14.2.5. Pfizer, Inc.

14.2.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.5.2. Product Portfolio

14.2.5.3. SWOT Analysis

14.2.5.4. Financial Overview

14.2.5.5. Strategic Overview

14.2.6. Valeant Pharmaceuticals International, Inc.

14.2.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.6.2. Product Portfolio

14.2.6.3. SWOT Analysis

14.2.6.4. Financial Overview

14.2.6.5. Strategic Overview

14.2.7. Teva Pharmaceutical Industries, Ltd.

14.2.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.7.2. Product Portfolio

14.2.7.3. SWOT Analysis

14.2.7.4. Financial Overview

14.2.7.5. Strategic Overview

14.2.8. Eli Lilly & Company

14.2.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.8.2. Product Portfolio

14.2.8.3. SWOT Analysis

14.2.8.4. Financial Overview

14.2.8.5. Strategic Overview

14.2.9. Merck & Co., Inc.

14.2.9.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.9.2. Product Portfolio

14.2.9.3. SWOT Analysis

14.2.9.4. Financial Overview

14.2.9.5. Strategic Overview

14.2.10. Janssen Pharmaceutical Company (Johnson & Johnson)

14.2.10.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.10.2. Product Portfolio

14.2.10.3. SWOT Analysis

14.2.10.4. Financial Overview

14.2.10.5. Strategic Overview

14.2.11. Endo Pharmaceutical Inc.

14.2.11.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.11.2. Product Portfolio

14.2.11.3. SWOT Analysis

14.2.11.4. Financial Overview

14.2.11.5. Strategic Overview

14.2.12. Zosano Pharma Corporation

14.2.12.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.12.2. Product Portfolio

14.2.12.3. SWOT Analysis

14.2.12.4. Financial Overview

14.2.12.5. Strategic Overview

14.2.13. Alder BioPharmaceutical, Inc.

14.2.13.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.13.2. Product Portfolio

14.2.13.3. SWOT Analysis

14.2.13.4. Financial Overview

14.2.13.5. Strategic Overview

14.2.14. Avanir Pharmaceuticals, Inc.

14.2.14.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.14.2. Product Portfolio

14.2.14.3. SWOT Analysis

14.2.14.4. Financial Overview

14.2.14.5. Strategic Overview

14.2.15. Eisai Co., Ltd.

14.2.15.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.15.2. Product Portfolio

14.2.15.3. SWOT Analysis

14.2.15.4. Financial Overview

14.2.15.5. Strategic Overview

List of Tables

Table 01: Pipeline Analysis, Migraine Therapy Drugs (1/3)

Table 02: Pipeline Analysis, Migraine Therapy Drugs (2/3)

Table 03: Pipeline Analysis, Migraine Therapy Drugs (3/3)

Table 04: Pipeline Analysis, Migraine Therapy Devices

Table 05: Global Migraine Drugs Market Size (US$ Mn) Forecast, by Treatment, 2015–2025

Table 06: Global Migraine Drugs Market Size (US$ Mn) Forecast, by Abortive Treatment, 2015–2025

Table 07: Global Migraine Drugs Market Size (US$ Mn) Forecast, by Prophylactic Treatment, 2015–2025

Table 08: Global New Chronic Constipation Therapies Market Size (US$) Forecast, 2017-2025

Table 09: Global Migraine Drugs Market Size (US$ Mn) Forecast, by Route of Administration, 2015–2025

Table 10: Global Migraine Drugs Market Size (US$ Mn) Forecast, by Distribution Channel, 2015–2025

Table 11: Global Migraine Drugs Market Size (US$ Mn) Forecast, by Region, 2015–2025

Table 12: North America Migraine Drugs Market Size (US$ Mn) Forecast, by Treatment, 2015–2025

Table 13: North America Migraine Drugs Market Size (US$ Mn) Forecast, by Abortive Treatment, 2015–2025

Table 14: North America Migraine Drugs Market Size (US$ Mn) Forecast, by Prophylactic Treatment, 2015–2025

Table 15: North America Migraine Drugs Market Value (US$ Mn) Forecast, by Route of Administration, 2015–2025

Table 16: North America Migraine Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2015–2025

Table 17: North America Migraine Drugs Market Value (US$ Mn) Forecast, by Country, 2015–2025

Table 18: Europe Migraine Drugs Market Size (US$ Mn) Forecast, by Treatment, 2015–2025

Table 19: Europe Migraine Drugs Market Size (US$ Mn) Forecast, by Abortive Treatment, 2015–2025

Table 20: Europe Migraine Drugs Market Size (US$ Mn) Forecast, by Prophylactic Treatment, 2015–2025

Table 21: Europe Migraine Drugs Market Value (US$ Mn) Forecast, by Route of Administration, 2015–2025

Table 22: Europe Migraine Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2015–2025

Table 23: Europe Migraine Drugs Market Value (US$ Mn) Forecast, by Country/Sub-region, 2015–2025

Table 24: Asia Pacific Migraine Drugs Market Size (US$ Mn) Forecast, by Treatment, 2015–2025

Table 25: Asia Pacific Migraine Drugs Market Size (US$ Mn) Forecast, by Abortive Treatment, 2015–2025

Table 26: Asia Pacific Migraine Drugs Market Size (US$ Mn) Forecast, by Prophylactic Treatment, 2015–2025

Table 27: Asia Pacific Migraine Drugs Market Value (US$ Mn) Forecast, by Route of Administration, 2015–2025

Table 28: Asia Pacific Migraine Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2015–2025

Table 29: Asia Pacific Migraine Drugs Market Value (US$ Mn) Forecast, by Country/Sub-region, 2015–2025

Table 30: Latin America Migraine Drugs Market Size (US$ Mn) Forecast, by Treatment, 2015–2025

Table 31: Latin America Migraine Drugs Market Size (US$ Mn) Forecast, by Abortive Treatment, 2015–2025

Table 32: Latin America Migraine Drugs Market Size (US$ Mn) Forecast, by Prophylactic Treatment, 2015–2025

Table 33: Latin America Migraine Drugs Market Value (US$ Mn) Forecast, by Route of Administration, 2015–2025

Table 34: Latin America Migraine Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2015–2025

Table 35: Latin America Migraine Drugs Market Value (US$ Mn) Forecast, by Country/Sub-region, 2015–2025

Table 36: Middle East & Africa Migraine Drugs Market Size (US$ Mn) Forecast, by Treatment, 2015–2025

Table 37: Middle East & Africa Migraine Drugs Market Size (US$ Mn) Forecast, by Abortive Treatment, 2015–2025

Table 38: Middle East & Africa Migraine Drugs Market Size (US$ Mn) Forecast, by Prophylactic Treatment, 2015–2025

Table 39: Middle East & Africa Migraine Drugs Market Value (US$ Mn) Forecast, by Route of Administration, 2015–2025

Table 40: Middle East & Africa Migraine Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2015–2025

Table 41: Middle East & Africa Migraine Drugs Market Value (US$ Mn) Forecast, by Country/Sub-region, 2015–2025

List of Figures

Figure 01: Migraine Drugs Market, by Treatment, Market Size (US$ Mn), 2016 (A)

Figure 02: Migraine Drugs Market Revenue (%), by Route of Administration, 2016 (A)

Figure 03: Migraine Drugs Market Revenue (%), by Rigion, 2016 (A)

Figure 04: Treatment Revenue (%), 2016

Figure 05: Route of Administration Revenue (%), 2016

Figure 06: Distribution Channel Revenue (%), 2016

Figure 07: Global Migraine Drugs Market Size (US$ Mn) Forecast, 2015–2025

Figure 08 : Global Prevalence of Migraine

Figure 09: Market Value Share, by Treatment (2016)

Figure 10: Market Value Share, by Route of Administration (2016)

Figure 11: Market Value Share, by Distribution Channel (2016)

Figure 12: Global Migraine Drugs Market Value Share, by Treatment, 2016 and 2025

Figure 13: Global Migraine Drugs Market Attractiveness, by Treatment, 2017–2025

Figure 14: Global Migraine Drugs Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Abortive Treatment, 2015–2025

Figure 15: Global Migraine Drugs Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Prophylactic Treatment, 2015–2025

Figure 16: Global Migraine Drugs Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Triptans, 2015–2025

Figure 17: Global Migraine Drugs Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Ergot Alkoids, 2015–2025

Figure 18: Global Migraine Drugs Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Abortive Treatment - Others, 2015–2025

Figure 19: Global Migraine Drugs Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Botulinum Toxin, 2015–2025

Figure 20: Global Migraine Drugs Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Topiramate, 2015–2025

Figure 21: Global Migraine Drugs Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Prophylactic Treatment - Others, 2015–2025

Figure 22: Global Migraine Drugs Market Value Share, by Route of Administration, 2016 and 2025

Figure 23: Global Migraine Drugs Market Attractiveness, by Route of Administration, 2017–2025

Figure 24: Global Migraine Drugs Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Oral, 2015–2025

Figure 25: Global Migraine Drugs Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Injectable, 2015–2025

Figure 26: Global Migraine Drugs Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Others, 2015–2025

Figure 27: Global Migraine Drugs Market Value Share, by Distribution Channel, 2016 and 2025

Figure 28: Global Migraine Drugs Market Attractiveness, by Distribution Channel, 2017–2025

Figure 29: Global Migraine Drugs Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Retail Pharmacies, 2015–2025

Figure 30: Global Migraine Drugs Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Hospital Pharmacies, 2015–2025

Figure 31: Global Migraine Drugs Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Others, 2015–2025

Figure 32: Global Migraine Drugs Market Value Share, by Region, 2016 and 2025

Figure 33: Global Migraine Drugs Market Attractiveness, by Region, 2017–2025

Figure 34: North America Migraine Drugs Market Size (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2025

Figure 35: North America Migraine Drugs Market Value Share Analysis, by Treatment, 2016 and 2025

Figure 36: North America Migraine Drugs Market Value Share Analysis, by Route of Administration, 2016 and 2025

Figure 37: North America Migraine Drugs Market Value Share Analysis, by Distribution Channel, 2016 and 2025

Figure 38: North America Migraine Drugs Market Value Share Analysis, by Country, 2016 and 2025

Figure 39: North America Migraine Drugs Market Attractiveness Analysis, by Treatment

Figure 40: North America Migraine Drugs Market Attractiveness Analysis, by Route of Administration

Figure 41: North America Migraine Drugs Market Attractiveness Analysis, by Distribution Channel

Figure 42: North America Migraine Drugs Market Attractiveness Analysis, by Country

Figure 43: Europe Migraine Drugs Market Size (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2025

Figure 44: Europe Migraine Drugs Market Value Share Analysis, by Treatment, 2016 and 2025

Figure 45: Europe Migraine Drugs Market Value Share Analysis, by Route of Administration, 2016 and 2025

Figure 46: Europe Migraine Drugs Market Value Share Analysis, by Distribution Channel, 2016 and 2025

Figure 47: Europe Migraine Drugs Market Value Share Analysis, by Country/Sub-region, 2016 and 2025

Figure 48: Europe Migraine Drugs Market Attractiveness Analysis, by Treatment

Figure 49: Europe Migraine Drugs Market Attractiveness Analysis, by Route of Administration

Figure 50: Europe Migraine Drugs Market Attractiveness Analysis, by Distribution Channel

Figure 51: Europe Migraine Drugs Market Attractiveness Analysis, by Country / Sub-region

Figure 52: Asia Pacific Migraine Drugs Market Size (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2025

Figure 53: Asia Pacific Migraine Drugs Market Value Share Analysis, by Treatment, 2016 and 2025

Figure 54: Asia Pacific Migraine Drugs Market Value Share Analysis, by Route of Administration, 2016 and 2025

Figure 55: Asia Pacific Migraine Drugs Market Value Share Analysis, by Distribution Channel, 2016 and 2025

Figure 56: Asia Pacific Migraine Drugs Market Value Share Analysis, by Country/Sub-region, 2016 and 2025

Figure 57: Asia Pacific Migraine Drugs Market Attractiveness Analysis, by Treatment

Figure 58: Asia Pacific Migraine Drugs Market Attractiveness Analysis, by Route of Administration

Figure 59: Asia Pacific Migraine Drugs Market Attractiveness Analysis, by Distribution Channel

Figure 60: Asia Pacific Migraine Drugs Market Attractiveness Analysis, by Country

Figure 61: Latin America Migraine Drugs Market Size (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2025

Figure 62: Latin America Migraine Drugs Market Value Share Analysis, by Treatment, 2016 and 2025

Figure 63: Latin America Migraine Drugs Market Value Share Analysis, by Route of Administration, 2016 and 2025

Figure 64: Latin America Migraine Drugs Market Value Share Analysis, by Distribution Channel, 2016 and 2025

Figure 65: Latin America Migraine Drugs Market Value Share Analysis, by Country/Sub-region, 2016 and 2025

Figure 66: Latin America Migraine Drugs Market Attractiveness Analysis, by Treatment

Figure 67: Latin America Migraine Drugs Market Attractiveness Analysis, by Route of Administration

Figure 68: Latin America Migraine Drugs Market Attractiveness Analysis, by Distribution Channel

Figure 69: Latin America Migraine Drugs Market Attractiveness Analysis, by Country / Sub-region

Figure 70: Middle East & Africa Migraine Drugs Market Size (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2025

Figure 71: Middle East & Africa Migraine Drugs Market Value Share Analysis, by Treatment, 2016 and 2025

Figure 72: Middle East & Africa Migraine Drugs Market Value Share Analysis, by Route of Administration, 2016 and 2025

Figure 73: Middle East & Africa Migraine Drugs Market Value Share Analysis, by Distribution Channel, 2016 and 2025

Figure 74: Middle East & Africa Migraine Drugs Market Value Share Analysis, by Country/Sub-region, 2016 and 2025

Figure 75: Middle East & Africa Migraine Drugs Market Attractiveness Analysis, by Treatment

Figure 76: Middle East & Africa Migraine Drugs Market Attractiveness Analysis, by Route of Administration

Figure 77: Middle East & Africa Migraine Drugs Market Attractiveness Analysis, by Distribution Channel

Figure 78: Middle East & Africa Migraine Drugs Market Attractiveness Analysis, by Country