COVID-19 Test Home Collection Kits Gain Popularity in Middle East and Africa

Since the U.S. Food and Drug Administration (FDA) authorized LabCorp’s Pixel COVID-19 Test Home Collection Kit, companies in the MEA direct-to-consumer laboratory testing market are taking cues from the same. Manufacturers are developing COVID-19 test home collection kits that can be used by individuals of 18 years and above without the need for a prescription. Such kits are allowing users to self-collect a nasal swab sample at home and then send that sample for testing to labs.

Companies in the MEA direct-to-consumer laboratory testing market are innovating in COVID-19 test home collection kits that enable positive or invalid results that are delivered to the user by phone call from a healthcare provider or a lab.

Lack of Regulations for Genetic DTC Testing Affects Market Growth

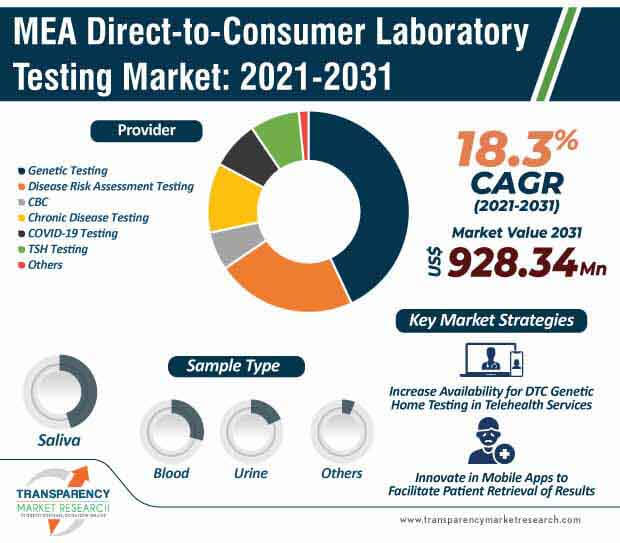

The MEA direct-to-consumer laboratory testing market is expected to expand at a CAGR of 18.3% during the forecast period. The cost of gene sequencing is decreasing due to advancements in next gen sequencing (NGS) and increasing availability of direct-to-consumer (DTC) laboratory testing. However, it has been found that in many cases, DTC tests are not regulated by the government healthcare organizations. Hence, healthcare companies and healthcare authorities should collaborate to implement regulations regarding DTC, and create awareness about the key differences and limitations between clinical & DTC genetic tests.

Manufacturers are increasing R&D in low cost and automated tests with automated analysis and reporting.

Companies Pursuing Opportunities in DTC Testing Due to Growth in Telehealth

The surge in the demand for DTC testing is part of a broader shift toward telehealth and eCommerce as a result of the ongoing coronavirus pandemic. Virtual care is likely to surge in the upcoming years, since weekly visits are growing at a substantial rate. Market stakeholders are setting their collaboration wheels in motion to sell new COVID-19 home sample collection kits.

Stakeholders in the MEA direct-to-consumer laboratory testing market are scaling up testing and telehealth services due to the ongoing pandemic. They have been working at break-neck speed to meet the unprecedented demand for COVID-19 home sample collection kits. Healthcare companies are expanding their marketing strategy spanning from podcosts to news channels to increase acceptance of DTC operations.

DTC Genetic Testing Enabling Access to Information on Risks of Cancer

Personalized, precision, and genomic medicines based on DNA sequencing hold potentials to offer opportunities for improving the overall public health. The MEA direct-to-consumer laboratory testing market is undergoing a significant change with DNA sequencing being applied for disease prevention such as heart diseases, cancers, and metabolic diseases.

The identification of patients’ risk profile is becoming necessary in the MEA direct-to-consumer laboratory testing market. This is explains why the market is anticipated to reach US$ 928.34 Mn by 2031. DTC genetic testing (DTCGT) is allowing access to information on their risks of suffering from a wide range of chronic diseases.

Patient-centered Patient Care Creating Revenue Opportunities for Stakeholders

Telehealth is making it possible for increasing the availability of direct-to-consumer laboratory testing. Patient-centered laboratory stewardship is acting as a key driver for the MEA direct-to-consumer laboratory testing market. There is a growing need for patient care that is respectful of and responsive to individual patient preferences, values, and needs. These trends are ensuring that patient values guide all clinical decisions.

The concept of patient centered capitalism is storming the MEA direct-to-consumer laboratory testing market. Stakeholders are prioritizing the interests of patients over those of financial and other stakeholders within both the healthcare system & its suppliers. Patient-centered laboratory stewardship is proving beneficial to improve important areas of lab testing and DTC testing such as test ordering, result retrieval, result interpretation, and financial fairness for patients and other stakeholders.

Analysts’ Viewpoint

With the COVID-19 pandemic accelerating interest in telehealth and consumer-initiated testing, companies in the MEA direct-to-consumer laboratory testing market are aiming to expand their DTC operations. DTC genetic testing aimed at guiding a patient’s diet or exercise remains largely unproven in producing better outcomes. Hence, market stakeholders should collaborate and implement laboratory stewardship programs that put in safeguards to improve patient-centered care.

Genetic counseling sessions are being conducted to explain details and options at appropriate education levels. Mobile apps are being developed to facilitate patient retrieval of results. Healthcare providers in the MEA direct-to-consumer laboratory testing market are increasing patient access to their electronic medical records. Moreover, educational materials are being written in patient’s language of choice. Enhanced communication between patients and physicians through text, phone, and electronic medical record is helping to improve patient quality of life.

Middle East & Africa Direct-to-Consumer Laboratory Testing Market: Overview

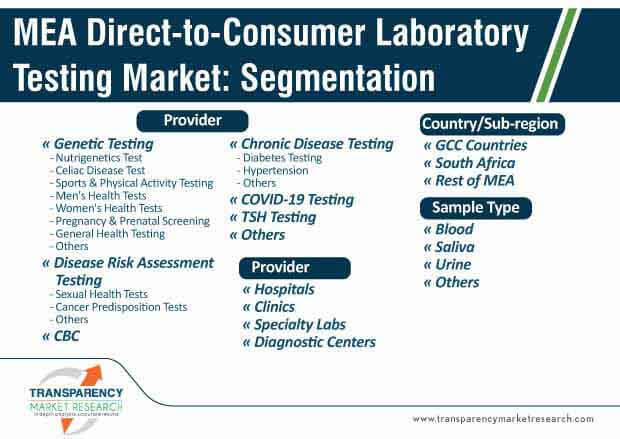

Middle East & Africa Direct-to-Consumer Laboratory Testing Market: Key Segments

Middle East & Africa Direct-to-Consumer Laboratory Testing Market: Regional Outlook

Companies Covered in Middle East & Africa Direct-to-Consumer Laboratory Testing Market Report

Middle East & Africa Direct-to-Consumer Laboratory Testing Market Snapshot

|

Attribute |

Detail |

|

Market Size Value in 2020 (Base Year) |

US$ 124.40 Mn |

|

Market Forecast Value in 2031 |

US$ 928.34 Mn |

|

Growth Rate (CAGR) |

18.3% |

|

Forecast Period |

2021–2031 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes segment analysis at MEA as well as sub-region level. Moreover, qualitative analysis includes drivers, restraints, opportunities, key industry events, etc. |

|

Competition Landscape |

Market share analysis by company (2020) |

|

Company profiles section includes overview, product portfolio, sales footprint, key subsidiaries or distributors, strategy & recent developments, key financials, etc. |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Regions Covered |

MEA |

|

GCC Countries |

|

|

South Africa |

|

|

Rest of MEA |

|

|

Companies Profiled |

23andMe, Inc. |

|

Ancestry |

|

|

CircleDNA |

|

|

Eurofins Scientific |

|

|

Family Tree DNA (Gene by Gene) |

|

|

Laboratory Corporation of America Holdings |

|

|

Living DNA Ltd. |

|

|

Medichecks.com Ltd. |

|

|

MyHeritage Ltd. |

|

|

MyMedLab, Inc. |

|

|

Quest Diagnostics Incorporated |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: MEA Direct-to-Consumer Laboratory Testing Market

4. Market Overview

4.1. Introduction

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. MEA Direct-to-Consumer Laboratory Testing Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Key Industrial Events (licensing partnerships/mergers & acquisitions)

5.2. Disease Prevalence & Incidence Rate

5.3. COVID-19 Pandemic Impact on Industry (value chain and short / mid / long term impact)

6. MEA Direct-to-Consumer Laboratory Testing Market Analysis and Forecast, by Sample Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Sample Type, 2017–2031

6.3.1. Blood

6.3.2. Urine

6.3.3. Saliva

6.3.4. Others

6.4. Market Attractiveness Analysis, by Sample Type

7. MEA Direct-to-Consumer Laboratory Testing Market Analysis and Forecast, by Test Type

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Test Type, 2017–2031

7.3.1. Genetic Testing

7.3.1.1. Nutrigenetics Test

7.3.1.1.1. Weight Control

7.3.1.1.2. Lactose Intolerance

7.3.1.1.3. Others

7.3.1.2. Celiac Disease Test

7.3.1.3. Sports & Physical Activity Testing

7.3.1.4. Men's Health Tests

7.3.1.5. Women's Health Tests

7.3.1.6. Pregnancy & Prenatal Screening Test

7.3.1.7. General Health Testing

7.3.1.8. Others

7.3.2. Disease Risk Assessment Testing

7.3.2.1. Sexual Health Tests

7.3.2.1.1. HIV

7.3.2.1.2. Chlamydia

7.3.2.1.3. Others

7.3.2.2. Cancer Predisposition Tests

7.3.2.3. Others

7.3.3. CBC

7.3.4. Chronic Disease Testing

7.3.4.1. Diabetes Testing

7.3.4.2. Hypertension

7.3.4.3. Others

7.3.5. COVID-19 Testing

7.3.6. TSH Testing

7.3.7. Others

7.4. Market Attractiveness Analysis, by Test Type

8. MEA Direct-to-Consumer Laboratory Testing Market Analysis and Forecast, by Provider

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Provider, 2017–2031

8.3.1. Hospitals

8.3.2. Clinics

8.3.3. Specialty Labs

8.3.4. Diagnostic Centers

8.4. Market Attractiveness Analysis, by Provider

9. GCC Countries Direct-to-Consumer Laboratory Testing Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Sample Type, 2017–2031

9.2.1. Blood

9.2.2. Urine

9.2.3. Saliva

9.2.4. Others

9.3. Market Value Forecast, by Test Type, 2017–2031

9.3.1. Genetic Testing

9.3.1.1. Nutrigenetics Test

9.3.1.1.1. Weight Control

9.3.1.1.2. Lactose Intolerance

9.3.1.1.3. Others

9.3.1.2. Celiac Disease Test

9.3.1.3. Sports & Physical Activity Testing

9.3.1.4. Men's Health Tests

9.3.1.5. Women's Health Tests

9.3.1.6. Pregnancy & Prenatal Screening Test

9.3.1.7. General Health Testing

9.3.1.8. Others

9.3.2. Disease Risk Assessment Testing

9.3.2.1. Sexual Health Tests

9.3.2.1.1. HIV

9.3.2.1.2. Chlamydia

9.3.2.1.3. Others

9.3.2.2. Cancer Predisposition Tests

9.3.2.3. Others

9.3.3. CBC

9.3.4. Chronic Disease Testing

9.3.4.1. Diabetes Testing

9.3.4.2. Hypertension

9.3.4.3. Others

9.3.5. COVID-19 Testing

9.3.6. TSH Testing

9.3.7. Others

9.4. Market Value Forecast, by Provider, 2017–2031

9.4.1. Hospitals

9.4.2. Clinics

9.4.3. Specialty Labs

9.4.4. Diagnostic Centers

10. South Africa Direct-to-Consumer Laboratory Testing Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Sample Type, 2017–2031

10.2.1. Blood

10.2.2. Urine

10.2.3. Saliva

10.2.4. Others

10.3. Market Value Forecast, by Test Type, 2017–2031

10.3.1. Genetic Testing

10.3.1.1. Nutrigenetics Test

10.3.1.1.1. Weight Control

10.3.1.1.2. Lactose Intolerance

10.3.1.1.3. Others

10.3.1.2. Celiac Disease Test

10.3.1.3. Sports & Physical Activity Testing

10.3.1.4. Men's Health Tests

10.3.1.5. Women's Health Tests

10.3.1.6. Pregnancy & Prenatal Screening Test

10.3.1.7. General Health Testing

10.3.1.8. Others

10.3.2. Disease Risk Assessment Testing

10.3.2.1. Sexual Health Tests

10.3.2.1.1. HIV

10.3.2.1.2. Chlamydia

10.3.2.1.3. Others

10.3.2.2. Cancer Predisposition Tests

10.3.2.3. Others

10.3.3. CBC

10.3.4. Chronic Disease Testing

10.3.4.1. Diabetes Testing

10.3.4.2. Hypertension

10.3.4.3. Others

10.3.5. COVID-110 Testing

10.3.6. TSH Testing

10.3.7. Others

10.4. Market Value Forecast, by Provider, 2017–2031

10.4.1. Hospitals

10.4.2. Clinics

10.4.3. Specialty Labs

10.4.4. Diagnostic Centers

11. Rest of MEA Direct-to-Consumer Laboratory Testing Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Sample Type, 2017–2031

11.2.1. Blood

11.2.2. Urine

11.2.3. Saliva

11.2.4. Others

11.3. Market Value Forecast, by Test Type, 2017–2031

11.3.1. Genetic Testing

11.3.1.1. Nutrigenetics Test

11.3.1.1.1. Weight Control

11.3.1.1.2. Lactose Intolerance

11.3.1.1.3. Others

11.3.1.2. Celiac Disease Test

11.3.1.3. Sports & Physical Activity Testing

11.3.1.4. Men's Health Tests

11.3.1.5. Women's Health Tests

11.3.1.6. Pregnancy & Prenatal Screening Test

11.3.1.7. General Health Testing

11.3.1.8. Others

11.3.2. Disease Risk Assessment Testing

11.3.2.1. Sexual Health Tests

11.3.2.1.1. HIV

11.3.2.1.2. Chlamydia

11.3.2.1.3. Others

11.3.2.2. Cancer Predisposition Tests

11.3.2.3. Others

11.3.3. CBC

11.3.4. Chronic Disease Testing

11.3.4.1. Diabetes Testing

11.3.4.2. Hypertension

11.3.4.3. Others

11.3.5. COVID-19 Testing

11.3.6. TSH Testing

11.3.7. Others

11.4. Market Value Forecast, by Provider, 2017–2031

11.4.1. Hospitals

11.4.2. Clinics

11.4.3. Specialty Labs

11.4.4. Diagnostic Centers

12. Competition Landscape

12.1. Market Player - Competition Matrix (by tier and size of companies)

12.2. Company Profiles

12.2.1. 23andMe, Inc.

12.2.1.1. Company Description

12.2.1.2. Business Overview

12.2.1.3. Strategic Overview

12.2.1.4. SWOT Analysis

12.2.2. Ancestry

12.2.2.1. Company Description

12.2.2.2. Business Overview

12.2.2.3. SWOT Analysis

12.2.3. CircleDNA

12.2.3.1. Company Description

12.2.3.2. Business Overview

12.2.3.3. SWOT Analysis

12.2.4. Eurofins Scientific

12.2.4.1. Company Description

12.2.4.2. Business Overview

12.2.4.3. Financial Overview

12.2.4.4. SWOT Analysis

12.2.5. Family Tree DNA (Gene by Gene)

12.2.5.1. Company Description

12.2.5.2. Business Overview

12.2.5.3. SWOT Analysis

12.2.6. Laboratory Corporation of America Holdings

12.2.6.1. Company Description

12.2.6.2. Business Overview

12.2.6.3. Financial Overview

12.2.6.4. Strategic Overview

12.2.6.5. SWOT Analysis

12.2.7. Living DNA Ltd.

12.2.7.1. Company Description

12.2.7.2. Business Overview

12.2.7.3. SWOT Analysis

12.2.8. Medichecks.com Ltd.

12.2.8.1. Company Description

12.2.8.2. Business Overview

12.2.8.3. SWOT Analysis

12.2.9. MyHeritage Ltd.

12.2.9.1. Company Description

12.2.9.2. Business Overview

12.2.9.3. SWOT Analysis

12.2.10. MyMedLab, Inc.

12.2.10.1. Company Description

12.2.10.2. Business Overview

12.2.10.3. SWOT Analysis

12.2.11. Quest Diagnostics Incorporated

12.2.11.1. Company Description

12.2.11.2. Business Overview

12.2.11.3. Financial Overview

12.2.11.4. Strategic Overview

12.2.11.5. SWOT Analysis

List of Tables

Table 01: MEA Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Sample Type, 2017–2031

Table 02: MEA Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 03: MEA Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Genetic Testing, 2017–2031

Table 04: MEA Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Nutrigenetics Test, 2017–2031

Table 05: MEA Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Disease Risk Assessment Testing, 2017–2031

Table 06: MEA Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Sexual Health Tests, 2017–2031

Table 07: MEA Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Chronic Disease Testing, 2017–2031

Table 08: MEA Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Provider, 2017–2031

Table 09: GCC Countries Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Sample Type, 2017–2031

Table 10: GCC Countries Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 11: GCC Countries Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Genetic Testing, 2017–2031

Table 12: GCC Countries Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Nutrigenetics Test, 2017–2031

Table 13: GCC Countries Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Disease Risk Assessment Testing, 2017–2031

Table 14: GCC Countries Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Sexual Health Tests, 2017–2031

Table 15: GCC Countries Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Chronic Disease Testing, 2017–2031

Table 16: GCC Countries Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Provider, 2017–2031

Table 17: SOUTH AFRICA Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Sample Type, 2017–2031

Table 18: SOUTH AFRICA Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 19: SOUTH AFRICA Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Genetic Testing, 2017–2031

Table 20: SOUTH AFRICA Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Nutrigenetics Test, 2017–2031

Table 21: SOUTH AFRICA Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Disease Risk Assessment Testing, 2017–2031

Table 22: SOUTH AFRICA Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Sexual Health Tests, 2017–2031

Table 23: SOUTH AFRICA Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Chronic Disease Testing, 2017–2031

Table 24: SOUTH AFRICA Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Provider, 2017–2031

Table 25: Rest of MEA Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Sample Type, 2017–2031

Table 26: Rest of MEA Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 27: Rest of MEA Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Genetic Testing, 2017–2031

Table 28: Rest of MEA Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Nutrigenetics Test, 2017–2031

Table 29: Rest of MEA Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Disease Risk Assessment Testing, 2017–2031

Table 30: Rest of MEA Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Sexual Health Tests, 2017–2031

Table 31: Rest of MEA Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Chronic Disease Testing, 2017–2031

Table 32: Rest of MEA Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Provider, 2017–2031

List of Figures

Figure 01: MEA Direct-to-Consumer Laboratory Testing Market Value Share Analysis, by Sample Type, 2020 and 2031

Figure 02: MEA Direct-to-Consumer Laboratory Testing Market Attractiveness Analysis, by Sample Type, 2021–2031

Figure 03: MEA Direct-to-Consumer Laboratory Testing Market Value (US$ Mn), by Blood, 2017–2031

Figure 04: MEA Direct-to-Consumer Laboratory Testing Market Value (US$ Mn), by Urine, 2017–2031

Figure 05: MEA Direct-to-Consumer Laboratory Testing Market Value (US$ Mn), by Urine, 2017–2031

Figure 06: MEA Direct-to-Consumer Laboratory Testing Market Value (US$ Mn), by Others, 2017–2031

Figure 07: MEA Direct-to-Consumer Laboratory Testing Market Value Share Analysis, by Test Type, 2020 and 2031

Figure 08: MEA Direct-to-Consumer Laboratory Testing Market Attractiveness Analysis, by Test Type, 2021–2031

Figure 09: MEA Direct-to-Consumer Laboratory Testing Market Value (US$ Mn), by Genetic Testing, 2017–2031

Figure 10: MEA Direct-to-Consumer Laboratory Testing Market Value (US$ Mn), by Disease Risk Assessment Testing, 2017–2031

Figure 11: MEA Direct-to-Consumer Laboratory Testing Market Value (US$ Mn), by CBC, 2017–2031

Figure 12: MEA Direct-to-Consumer Laboratory Testing Market Value (US$ Mn), by Chronic Disease Testing, 2017–2031

Figure 13: MEA Direct-to-Consumer Laboratory Testing Market Value (US$ Mn), by COVID-19 Testing, 2017–2031

Figure 14: MEA Direct-to-Consumer Laboratory Testing Market Value (US$ Mn), by TSH Testing, 2017–2031

Figure 15: MEA Direct-to-Consumer Laboratory Testing Market Value (US$ Mn), by Others, 2017–2031

Figure 16: MEA Direct-to-Consumer Laboratory Testing Market Value Share Analysis, by Provider, 2020 and 2031

Figure 17: MEA Direct-to-Consumer Laboratory Testing Market Attractiveness Analysis, by Provider, 2021–2031

Figure 18: MEA Direct-to-Consumer Laboratory Testing Market Value (US$ Mn), by Hospitals, 2017–2031

Figure 19: MEA Direct-to-Consumer Laboratory Testing Market Value (US$ Mn), by Clinics, 2017–2031

Figure 20: MEA Direct-to-Consumer Laboratory Testing Market Value (US$ Mn), by Specialty Labs, 2017–2031

Figure 21: MEA Direct-to-Consumer Laboratory Testing Market Value (US$ Mn), by Diagnostic Centers, 2017–2031

Figure 22: GCC Countries Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, 2017–2031

Figure 23: GCC Countries Direct-to-Consumer Laboratory Testing Market Value Share Analysis, by Sample Type, 2020 and 2031

Figure 24: GCC Countries Direct-to-Consumer Laboratory Testing Market Attractiveness Analysis, by Sample Type, 2021–2031

Figure 25: GCC Countries Direct-to-Consumer Laboratory Testing Market Value Share Analysis, by Test Type, 2020 and 2031

Figure 26: GCC Countries Direct-to-Consumer Laboratory Testing Market Attractiveness Analysis, by Test Type, 2021–2031

Figure 27: GCC Countries Direct-to-Consumer Laboratory Testing Market Value Share Analysis, by Provider, 2020 and 2031

Figure 28: GCC Countries Direct-to-Consumer Laboratory Testing Market Attractiveness Analysis, by Provider, 2021–2031

Figure 29: SOUTH AFRICA Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, 2017–2031

Figure 30: SOUTH AFRICA Direct-to-Consumer Laboratory Testing Market Value Share Analysis, by Sample Type, 2020 and 2031

Figure 31: SOUTH AFRICA Direct-to-Consumer Laboratory Testing Market Attractiveness Analysis, by Sample Type, 2021–2031

Figure 32: SOUTH AFRICA Direct-to-Consumer Laboratory Testing Market Value Share Analysis, by Test Type, 2020 and 2031

Figure 33: SOUTH AFRICA Direct-to-Consumer Laboratory Testing Market Attractiveness Analysis, by Test Type, 2021–2031

Figure 34: SOUTH AFRICA Direct-to-Consumer Laboratory Testing Market Value Share Analysis, by Provider, 2020 and 2031

Figure 35: SOUTH AFRICA Direct-to-Consumer Laboratory Testing Market Attractiveness Analysis, by Provider, 2021–2031