Analyst Viewpoint

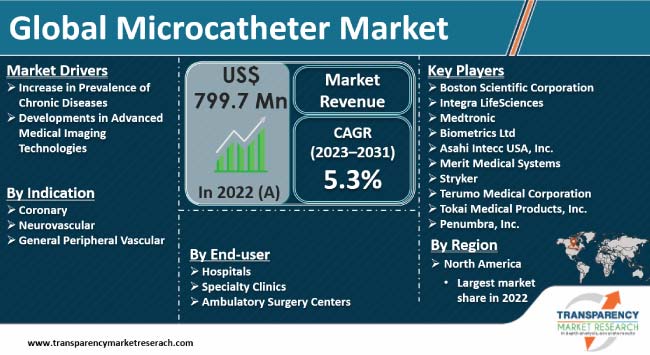

Increase in prevalence of chronic diseases and developments in advanced medical imaging technologies are fostering the microcatheter market value. Microcatheters are extensively used in minimally invasive surgeries to perform complex procedures with minimum incisions and less blood flow. Rise in popularity of minimally invasive surgeries among the geriatric population is boosting market progress.

Technological developments in oncology and neurology are likely to offer lucrative microcatheter business opportunities for companies. Leading players in the market are launching new microcatheters to cater to the specific treatment requirements of healthcare professionals. They are investing in research and development activities to obtain approval for these products from government organizations, thereby diversifying their product portfolio.

Microcatheters are small diameter catheters used for guidewire support, exchanges, to access distal anatomy, cross lesions, deliver therapeutic embolic, inject contrast media, and perform other procedures in complex endovascular procedures. Microcatheters are extensively utilized with minimally invasive procedures, such as percutaneous coronary intervention, angioplasty, minimal interventional radiology, angiography, ablation, and embolization.

Intravascular microcatheter, neurovascular microcatheter, and cardiovascular microcatheter are some of the major types of microcatheters employed in disease diagnosis and therapeutic procedures. Minimal invasion, reduced recovery time, and precise drug delivery to the arteries are some of the crucial advantages of microcatheter in cardiovascular treatments. Microcatheters simplify medical imaging by identifying the exact area to be diagnosed according to the procedure.

Cancer, cardiovascular diseases, and chronic diseases are on the rise due to changing lifestyles and food consumption habits among people. Increase in adoption of a sedentary lifestyle, lack of physical activity, and improper diet are some of the major causes of these diseases. Microcatheters are used to diagnose and treat these diseases by conducting minimally invasive surgeries. Increase in availability of advanced treatments for cancer, cardiovascular, and chronic diseases is driving the demand for microcatheters. Thus, rise in prevalence of chronic diseases is fostering the microcatheter market size.

Growth in geriatric population is significantly fueling microcatheter market statistics, as elder people are more susceptible to cardiovascular and chronic diseases. Fewer incisions during diagnosis and treatment reduce patient trauma and ensure faster recovery. Healthcare professionals prefer minimal invasive surgeries for elderly patients to improve recovery rate and reduce possibilities of potential complexities during procedures.

According to the National Institutes of Health, multiple facets of conventional surgical methods have been replaced by minimally invasive surgeries, while gaining interest due to improved survival, fewer complications, and rapid recoveries in the last few years.

Intravascular ultrasound, fluoroscopy, and optical coherence tomography are some of the advanced technologies utilized in medical imaging techniques. Microcatheters are employed to get real-time visualization and guidance during procedures. Therefore, rapid developments in advanced medical imaging technologies are fostering the microcatheter market growth.

Microcatheters are widely used in oncology and neurology to precisely deliver the drugs to targeted areas. Direct drug delivery to affected areas reduces the risk of side-effects and increases treatment efficiency. Thus, increase in availability of targeted therapies in several medical specialties are boosting microcatheter market expansion.

As per the microcatheter market analysis, North America dominated the global market in 2022. Increase in prevalence of cardiovascular diseases and availability of advanced treatments are likely to propel the microcatheter industry share during the forecast period. Moreover, well-established healthcare facilities and easy accessibility to advanced therapeutic products enable healthcare professionals to conduct minimally invasive surgeries to ensure faster recoveries.

Rise in number of neurovascular and percutaneous coronary intervention procedures is bolstering market revenue. Increase in investments by governments to develop effective diagnosis and therapeutic procedures enable companies to launch advanced microcatheters.

Leading manufacturers of microcatheter are investing heavily on research and development activities to implement advanced technologies and improve their product portfolio. They are launching new microcatheters for precise drug delivery and accurate medical imaging techniques. Key players in the industry are obtaining approvals from government organizations, which in turn would enable them to grab lucrative microcatheter market opportunities.

Some of the prominent players operating in the industry are Boston Scientific Corporation, Integra LifeSciences, Medtronic, Biometrics Ltd., Asahi Intecc USA, Inc., Merit Medical Systems, Stryker, Terumo Medical Corporation, Tokai Medical Products, Inc., and Penumbra, Inc.

These companies have been profiled in the microcatheter market report based on various parameters including company overview, business segments, product portfolio, recent developments, business strategies, and financial overview.

| Attribute | Detail |

|---|---|

| Market Size in 2022 | US$ 799.7 Mn |

| Market Forecast (Value) in 2031 | US$ 1.3 Bn |

| Growth Rate (CAGR) | 5.3% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Tons | US$ Mn/Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces Analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 799.7 Mn in 2022

It is projected to expand at a CAGR of 5.3% from 2023 to 2031

Increase in prevalence of chronic diseases and developments in advanced medical imaging technologies

North America was the most lucrative region in 2022

Boston Scientific Corporation, Integra LifeSciences, Medtronic, Biometrics Ltd, Asahi Intecc USA, Inc., Merit Medical Systems, Stryker, Terumo Medical Corporation, Tokai Medical Products, Inc., and Penumbra, Inc.

1. Executive Summary

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Microcatheter Market

4. Market Overview

4.1. Market Segmentation

4.1.1. Segment Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Microcatheter Market Analysis and Forecast, 2017-2031

5. Key Insights

5.1. Pipeline Analysis

5.2. Disease Prevalence & Incidence Rate Globally With Key Countries

5.3. COVID-19 Pandemic Impact on Industry

6. Microcatheter Market Analysis and Forecast, by Indication

6.1. Introduction and Definitions

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Indication, 2017–2031

6.3.1. Coronary

6.3.2. Neurovascular

6.3.3. General Peripheral Vascular

6.4. Market Attractiveness, by Indication

7. Global Microcatheter Market Analysis and Forecast, by End-user

7.1. Introduction and Definitions

7.2. Key Findings/Developments

7.3. Market Value Forecast, by End-user, 2017–2031

7.3.1. Hospitals

7.3.2. Specialty Clinics

7.3.3. Ambulatory Surgery Centers

7.4. Market Attractiveness, by End-user

8. Global Microcatheter Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region, 2017–2031

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness, by Region

9. North America Microcatheter Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Indication, 2017–2031

9.2.1. Coronary

9.2.2. Neurovascular

9.2.3. General Peripheral Vascular

9.3. Market Value Forecast, by End-user, 2017–2031

9.3.1. Hospitals

9.3.2. Specialty Clinics

9.3.3. Ambulatory Surgery Centers

9.4. Market Value Forecast, by Country, 2017–2031

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Indication

9.5.2. By End-user

9.5.3. By Country

10. Europe Microcatheter Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Indication, 2017–2031

10.2.1. Coronary

10.2.2. Neurovascular

10.2.3. General Peripheral Vascular

10.3. Market Value Forecast, by End-user, 2017–2031

10.3.1. Hospitals

10.3.2. Specialty Clinics

10.3.3. Ambulatory Surgery Centers

10.4. Market Value Forecast, by Country/Sub-region, 2017–2031

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Italy

10.4.5. Spain

10.4.6. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Indication

10.5.2. By End-user

10.5.3. By Country/Sub-region

11. Asia Pacific Microcatheter Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Indication, 2017–2031

11.2.1. Coronary

11.2.2. Neurovascular

11.2.3. General Peripheral Vascular

11.3. Market Value Forecast, by End-user, 2017–2031

11.3.1. Hospitals

11.3.2. Specialty Clinics

11.3.3. Ambulatory Surgery Centers

11.4. Market Value Forecast, by Country/Sub-region, 2017–2031

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Indication

11.5.2. By End-user

11.5.3. By Country/Sub-region

12. Latin America Microcatheter Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Indication, 2017–2031

12.2.1. Coronary

12.2.2. Neurovascular

12.2.3. General Peripheral Vascular

12.3. Market Value Forecast, by End-user, 2017–2031

12.3.1. Hospitals

12.3.2. Specialty Clinics

12.3.3. Ambulatory Surgery Centers

12.4. Market Value Forecast, by Country/Sub-region, 2017–2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Indication

12.5.2. By End-user

12.5.3. By Country/Sub-region

13. Middle East & Africa Microcatheter Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Indication, 2017–2031

13.2.1. Coronary

13.2.2. Neurovascular

13.2.3. General Peripheral Vascular

13.3. Market Value Forecast, by End-user, 2017–2031

13.3.1. Hospitals

13.3.2. Specialty Clinics

13.3.3. Ambulatory Surgery Centers

13.4. Market Value Forecast, by Country/Sub-region, 2017–2031

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Indication

13.5.2. By End-user

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player – Competition Matrix (By Tier and Size of Companies)

14.2. Market Share Analysis, by Company (2022)

14.3. Company Profiles

14.3.1. Boston Scientific Corporation

14.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.1.2. Product Portfolio

14.3.1.3. Financial Overview

14.3.1.4. SWOT Analysis

14.3.1.5. Strategic Overview

14.3.2. Integra LifeSciences

14.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.2.2. Product Portfolio

14.3.2.3. Financial Overview

14.3.2.4. SWOT Analysis

14.3.2.5. Strategic Overview

14.3.3. Medtronic

14.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.3.2. Product Portfolio

14.3.3.3. Financial Overview

14.3.3.4. SWOT Analysis

14.3.3.5. Strategic Overview

14.3.4. Biometrics Ltd.

14.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.4.2. Product Portfolio

14.3.4.3. Financial Overview

14.3.4.4. SWOT Analysis

14.3.4.5. Strategic Overview

14.3.5. Asahi Intecc USA, Inc.

14.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.5.2. Product Portfolio

14.3.5.3. Financial Overview

14.3.5.4. SWOT Analysis

14.3.5.5. Strategic Overview

14.3.6. Merit Medical Systems

14.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.6.2. Product Portfolio

14.3.6.3. Financial Overview

14.3.6.4. SWOT Analysis

14.3.6.5. Strategic Overview

14.3.7. Stryker

14.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.7.2. Product Portfolio

14.3.7.3. Financial Overview

14.3.7.4. SWOT Analysis

14.3.7.5. Strategic Overview

14.3.8. Terumo Medical Corporation

14.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.8.2. Product Portfolio

14.3.8.3. Financial Overview

14.3.8.4. SWOT Analysis

14.3.8.5. Strategic Overview

14.3.9. Tokai Medical Products, Inc.

14.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.9.2. Product Portfolio

14.3.9.3. Financial Overview

14.3.9.4. SWOT Analysis

14.3.9.5. Strategic Overview

14.3.10. Penumbra, Inc.

14.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.10.2. Product Portfolio

14.3.10.3. Financial Overview

14.3.10.4. SWOT Analysis

14.3.10.5. Strategic Overview

List of Tables

Table 01: Global Microcatheter Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 02: Global Microcatheter Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 03: Global Microcatheter Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 04: North America Microcatheter Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 05: North America Microcatheter Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 06: North America Microcatheter Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 07: Europe Microcatheter Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 08: Europe Microcatheter Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 09: Europe Microcatheter Market Value (US$ Mn) Forecast, by End-user 2017–2031

Table 10: Asia Pacific Microcatheter Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 11: Asia Pacific Microcatheter Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 12: Asia Pacific Microcatheter Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 13: Latin America Microcatheter Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Latin America Microcatheter Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 15: Latin America Microcatheter Market Value (US$ Mn) Forecast, by End-user 2017–2031

Table 16: Middle East & Africa Microcatheter Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 17: Middle East & Africa Microcatheter Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 18: Middle East & Africa Microcatheter Market Value (US$ Mn) Forecast, by End-user 2017–2031

List of Figures

Figure 01: Global Microcatheter Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Microcatheter Market Value Share, by Indication, 2022

Figure 03: Global Microcatheter Market Value Share, by End-user, 2022

Figure 04: Global Microcatheter Market Value Share Analysis, by Indication, 2022 and 2031

Figure 05: Global Microcatheter Market Attractiveness Analysis, by Indication, 2023–2031

Figure 06: Global Microcatheter Market Value Share Analysis, by End-user, 2022 and 2031

Figure 07: Global Microcatheter Market Attractiveness Analysis, by End-user 2023–2031

Figure 08: Global Microcatheter Market Value Share Analysis, by Region, 2022 and 2031

Figure 09: Global Microcatheter Market Attractiveness Analysis, by Region, 2023–2031

Figure 10: North America Microcatheter Market Value (US$ Mn) Forecast, 2017–2031

Figure 11: North America Microcatheter Market Value Share Analysis, by Country, 2022 and 2031

Figure 12: North America Microcatheter Market Attractiveness Analysis, by Country, 2023–2031

Figure 13: North America Microcatheter Market Value Share Analysis, by Indication, 2022 and 2031

Figure 14: North America Microcatheter Market Attractiveness Analysis, by Indication, 2023–2031

Figure 15: North America Microcatheter Market Value Share Analysis, by End-user, 2022 and 2031

Figure 16: North America Microcatheter Market Attractiveness Analysis, by End-user 2023–2031

Figure 17: Europe Microcatheter Market Value (US$ Mn) Forecast, 2017–2031

Figure 18: Europe Microcatheter Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 19: Europe Microcatheter Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 20: Europe Microcatheter Market Value Share Analysis, by Indication, 2022 and 2031

Figure 21: Europe Microcatheter Market Attractiveness Analysis, by Indication, 2023–2031

Figure 22: Europe Microcatheter Market Value Share Analysis, by End-user, 2022 and 2031

Figure 23: Europe Microcatheter Market Attractiveness Analysis, by End-user 2023–2031

Figure 24: Asia Pacific Microcatheter Market Value (US$ Mn) Forecast, 2017–2031

Figure 25: Asia Pacific Microcatheter Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 26: Asia Pacific Microcatheter Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 27: Asia Pacific Microcatheter Market Value Share Analysis, by Indication, 2022 and 2031

Figure 28: Asia Pacific Microcatheter Market Attractiveness Analysis, by Indication, 2023–2031

Figure 29: Asia Pacific Microcatheter Market Value Share Analysis, by End-user, 2022 and 2031

Figure 30: Asia Pacific Microcatheter Market Attractiveness Analysis, by End-user 2023–2031

Figure 31: Latin America Microcatheter Market Value (US$ Mn) Forecast, 2017–2031

Figure 32: Latin America Microcatheter Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 33: Latin America Microcatheter Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 34: Latin America Microcatheter Market Value Share Analysis, by Indication, 2022 and 2031

Figure 35: Latin America Microcatheter Market Attractiveness Analysis, by Indication, 2023–2031

Figure 36: Middle East & Africa Microcatheter Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 37: Middle East & Africa Microcatheter Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 38: Middle East & Africa Microcatheter Market Value Share Analysis, by Indication, 2022 and 2031

Figure 39: Middle East & Africa Microcatheter Market Attractiveness Analysis, by Indication, 2023–2031

Figure 40: Middle East & Africa Microcatheter Market Value Share Analysis, by End-user, 2022 and 2031

Figure 41: Middle East & Africa Microcatheter Market Attractiveness Analysis, by End-user 2023–2031

Figure 42: Global Microcatheter Market Share Analysis, by Company (2022)