Analyst Viewpoint

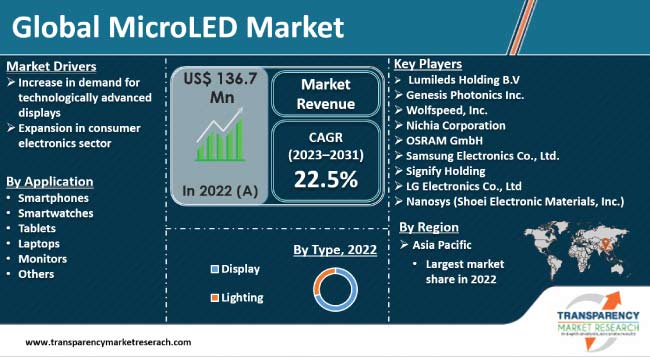

Increase in demand for high-end and technologically advanced audio and visual products is propelling the microLED market size. Expansion in consumer electronics sector is also boosting the demand for microLEDs and microLED panels.

Rise in adoption of smartphones, tablets, and other gadgets is likely to offer lucrative opportunities to players in the global microLED industry. MicroLED displays with high resolution and color accuracy are gaining traction among end-users. Vendors are developing compact, lightweight, and energy-efficient microLEDs for use in smartwatches, fitness trackers, and other wearable technologies. They are investing in the R&D of new products to expand their product portfolio and increase their microLED market share.

Micro-light emitting diode (LED) display is an array of tiny, multicolored LEDs. The red, green, and blue (RGB) MicroLED lights disperse and shine brighter for longer periods due to gallium nitride used in its manufacturing. These lights boast improved color saturation, ultra-high definition (UHD) picture quality, brightness, and wavelength uniformity.

MicroLEDs consume less energy than other conventional technologies. They also offer a longer lifespan and enhanced contrast and reaction time. Micro-LED displays provide several advantages compared to traditional LED and OLED displays. They can produce brighter images with less electricity usage. Micro-LED displays are thin and flexible, facilitating their use in wearable technologies and other applications where there is a shortage of space.

Growth in demand for high-end, technologically advanced audio and visual products, energy-saving displays, and portable electronic gadgets are boosting the production of microLEDs. An individual pixel element in a micro-LED display is made up of several tiny LEDs. MicroLEDs deliver improved contrast than conventional OLEDs and LED display technologies.

Rise in adoption of next-generation displays is projected to fuel the microLED market trajectory in the next few years. Manufacturers of microLEDs are employing porous GaN materials to develop products for augmented reality (AR) applications. Ultra-high-density and energy-efficient microLED micro-displays are gaining traction in AR applications, wearable, and smart devices. This, in turn, is expected to spur the microLED industry growth in the near future.

The demand for consumer electronics is increasing significantly, particularly in developing countries such as China and India. Surge in disposable income and growth in middle-class population are driving the demand for consumer electronics. MicroLED displays are employed in various consumer electronics products such as laptops, smartwatches, microLED TVs, and smartphones.

According to the Ministry of Electronics & Information Technology, Government of India, the electronics manufacturing sector in the country is expected to grow from the current US$ 75.0 Bn in 2020-21 to US$ 300.0 Bn by 2025-26.

According to the latest microLED market analysis, the display type segment held largest share in 2022. Growth of the segment can be ascribed to increase in demand for smartwatches, smartphones, near-to-eye gadgets, and other electronic devices.

MicroLED devices are smaller in size than other LEDs, allowing their use in small devices such as tablets and smartphones. MicroLEDs respond quickly-just a few milliseconds-and are suitable for wearables and AR/VR applications. Growth in adoption of smart display systems is also driving the segment. Smart display systems offer high clarity and contrast which allow users to fully engage with the information/data displayed on devices.

According to the latest microLED market trends, Asia Pacific held largest share in 2022. Rise in adoption of smartphones is fueling the market dynamics of the region. Presence of major microLED manufacturers is also boosting the market statistics in Asia Pacific.

Panasonic, LG, and Samsung are some of the major vendors in the region. China is a major market for microLEDs due to the presence of a high number of display manufacturers such as Konka Group Co., Ltd. and Refond Optoelectronics.

The global microLED market landscape is highly competitive, with several opportunities for expansion and innovation. Companies operating in the sector are adopting various strategies such as mergers and acquisitions and new product development to maintain their leading position and extend their market presence. The majority of companies are pooling their resources and putting forth plans to develop micro-LED display solutions to give prospective clients an extra genuine viewing experience.

Lumileds Holding B.V, Genesis Photonics Inc., Wolfspeed, Inc., Nichia Corporation, OSRAM GmbH, Samsung Electronics Co., Ltd., Signify Holding, LG Electronics Co., Ltd., Nanosys (Shoei Electronic Materials, Inc.), JBD, Apple Inc., and Sony Corporation are key players operating in this market.

Each of these companies has been profiled in the microLED market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size in 2022 | US$ 136.7 Mn |

| Market Forecast (Value) in 2031 | US$ 843.6 Mn |

| Growth Rate (CAGR) | 22.5% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Mn for Value and Million Units for Volume |

| Market Analysis | It includes segment analysis as well as regional-level analysis. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces Analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 136.7 Mn in 2022

It is anticipated to advance at a CAGR of 22.5% from 2023 to 2031

Increase in demand for technologically advanced displays and expansion in consumer electronics sector

The display segment held the largest share in 2022

Asia Pacific recorded the highest demand in 2022

Lumileds Holding B.V, Genesis Photonics Inc., Wolfspeed, Inc., Nichia Corporation, OSRAM GmbH, Samsung Electronics Co., Ltd., Signify Holding, LG Electronics Co., Ltd., Nanosys (Shoei Electronic Materials, Inc.), JBD, Apple Inc., and Sony Corporation

1. Preface

1.1. Market and Segment Definitions

1.2. Market Taxonomy

1.3. Research Methodology

1.4. Assumption and Acronyms

2. Executive Summary

2.1. Global MicroLED Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview - Industry Automation Overview

4.2. Ecosystem Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap Analysis

4.5. Industry SWOT Analysis

4.6. Porter Five Forces Analysis

5. Global MicroLED Market Analysis, by Type

5.1. MicroLED Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

5.1.1. Display

5.1.2. Lighting

5.2. Market Attractiveness Analysis, by Type

6. Global MicroLED Market Analysis, by Application

6.1. MicroLED Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

6.1.1. Smartphones

6.1.2. Smartwatches

6.1.3. Tablets

6.1.4. Laptops

6.1.5. Monitors

6.1.6. Others

6.2. Market Attractiveness Analysis, by Application

7. Global MicroLED Market Analysis and Forecast, by Region

7.1. MicroLED Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Region, 2017–2031

7.1.1. North America

7.1.2. Europe

7.1.3. Asia Pacific

7.1.4. Middle East & Africa

7.1.5. South America

7.2. Market Attractiveness Analysis, by Region

8. North America MicroLED Market Analysis and Forecast

8.1. Market Snapshot

8.2. MicroLED Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

8.2.1. Display

8.2.2. Lighting

8.3. MicroLED Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

8.3.1. Smartphones

8.3.2. Smartwatches

8.3.3. Tablets

8.3.4. Laptops

8.3.5. Monitors

8.3.6. Others

8.4. MicroLED Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country, 2017–2031

8.4.1. U.S.

8.4.2. Canada

8.4.3. Rest of North America

8.5. Market Attractiveness Analysis

8.5.1. By Type

8.5.2. By Application

8.5.3. By Country/Sub-region

9. Europe MicroLED Market Analysis and Forecast

9.1. Market Snapshot

9.2. MicroLED Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

9.2.1. Display

9.2.2. Lighting

9.3. MicroLED Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

9.3.1. Smartphones

9.3.2. Smartwatches

9.3.3. Tablets

9.3.4. Laptops

9.3.5. Monitors

9.3.6. Others

9.4. MicroLED Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

9.4.1. U.K.

9.4.2. Germany

9.4.3. France

9.4.4. Rest of Europe

9.5. Market Attractiveness Analysis

9.5.1. By Type

9.5.2. By Application

9.5.3. By Country/Sub-region

10. Asia Pacific MicroLED Market Analysis and Forecast

10.1. Market Snapshot

10.2. MicroLED Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

10.2.1. Display

10.2.2. Lighting

10.3. MicroLED Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

10.3.1. Smartphones

10.3.2. Smartwatches

10.3.3. Tablets

10.3.4. Laptops

10.3.5. Monitors

10.3.6. Others

10.4. MicroLED Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

10.4.1. China

10.4.2. Japan

10.4.3. India

10.4.4. South Korea

10.4.5. ASEAN

10.4.6. Rest of Asia Pacific

10.5. Market Attractiveness Analysis

10.5.1. By Type

10.5.2. By Application

10.5.3. By Country/Sub-region

11. Middle East & Africa MicroLED Market Analysis and Forecast

11.1. Market Snapshot

11.2. MicroLED Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

11.2.1. Display

11.2.2. Lighting

11.3. MicroLED Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

11.3.1. Smartphones

11.3.2. Smartwatches

11.3.3. Tablets

11.3.4. Laptops

11.3.5. Monitors

11.3.6. Others

11.4. MicroLED Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

11.4.1. GCC

11.4.2. South Africa

11.4.3. Rest of Middle East & Africa

11.5. Market Attractiveness Analysis

11.5.1. By Type

11.5.2. By Application

11.5.3. By Country/Sub-region

12. South America MicroLED Market Analysis and Forecast

12.1. Market Snapshot

12.2. MicroLED Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

12.2.1. Display

12.2.2. Lighting

12.3. MicroLED Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

12.3.1. Smartphones

12.3.2. Smartwatches

12.3.3. Tablets

12.3.4. Laptops

12.3.5. Monitors

12.3.6. Others

12.4. MicroLED Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

12.4.1. Brazil

12.4.2. Rest of South America

12.5. Market Attractiveness Analysis

12.5.1. By Type

12.5.2. By Application

12.5.3. By Country/Sub-region

13. Competition Assessment

13.1. Global MicroLED Market Competition Matrix - a Dashboard View

13.1.1. Global MicroLED Market Company Share Analysis, by Value (2022)

13.1.2. Technological Differentiator

14. Company Profiles (Global Manufacturers/Suppliers)

14.1. Lumileds Holding B.V

14.1.1. Overview

14.1.2. Product Portfolio

14.1.3. Sales Footprint

14.1.4. Key Subsidiaries or Distributors

14.1.5. Strategy and Recent Developments

14.1.6. Key Financials

14.2. Genesis Photonics Inc.

14.2.1. Overview

14.2.2. Product Portfolio

14.2.3. Sales Footprint

14.2.4. Key Subsidiaries or Distributors

14.2.5. Strategy and Recent Developments

14.2.6. Key Financials

14.3. Wolfspeed, Inc.

14.3.1. Overview

14.3.2. Product Portfolio

14.3.3. Sales Footprint

14.3.4. Key Subsidiaries or Distributors

14.3.5. Strategy and Recent Developments

14.3.6. Key Financials

14.4. Nichia Corporation

14.4.1. Overview

14.4.2. Product Portfolio

14.4.3. Sales Footprint

14.4.4. Key Subsidiaries or Distributors

14.4.5. Strategy and Recent Developments

14.4.6. Key Financials

14.5. OSRAM GmbH

14.5.1. Overview

14.5.2. Product Portfolio

14.5.3. Sales Footprint

14.5.4. Key Subsidiaries or Distributors

14.5.5. Strategy and Recent Developments

14.5.6. Key Financials

14.6. Samsung Electronics Co., Ltd.

14.6.1. Overview

14.6.2. Product Portfolio

14.6.3. Sales Footprint

14.6.4. Key Subsidiaries or Distributors

14.6.5. Strategy and Recent Developments

14.6.6. Key Financials

14.7. Signify Holding

14.7.1. Overview

14.7.2. Product Portfolio

14.7.3. Sales Footprint

14.7.4. Key Subsidiaries or Distributors

14.7.5. Strategy and Recent Developments

14.7.6. Key Financials

14.8. LG Electronics Co., Ltd.

14.8.1. Overview

14.8.2. Product Portfolio

14.8.3. Sales Footprint

14.8.4. Key Subsidiaries or Distributors

14.8.5. Strategy and Recent Developments

14.8.6. Key Financials

14.9. Nanosys (Shoei Electronic Materials, Inc.)

14.9.1. Overview

14.9.2. Product Portfolio

14.9.3. Sales Footprint

14.9.4. Key Subsidiaries or Distributors

14.9.5. Strategy and Recent Developments

14.9.6. Key Financials

14.10. JBD

14.10.1. Overview

14.10.2. Product Portfolio

14.10.3. Sales Footprint

14.10.4. Key Subsidiaries or Distributors

14.10.5. Strategy and Recent Developments

14.10.6. Key Financials

14.11. Apple Inc.

14.11.1. Overview

14.11.2. Product Portfolio

14.11.3. Sales Footprint

14.11.4. Key Subsidiaries or Distributors

14.11.5. Strategy and Recent Developments

14.11.6. Key Financials

14.12. Sony Corporation

14.12.1. Overview

14.12.2. Product Portfolio

14.12.3. Sales Footprint

14.12.4. Key Subsidiaries or Distributors

14.12.5. Strategy and Recent Developments

14.12.6. Key Financials

15. Go to Market Strategy

15.1. Identification of Potential Market Spaces

15.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global MicroLED Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 2: Global MicroLED Market Volume (Million Units) & Forecast, by Type, 2017‒2031

Table 3: Global MicroLED Market Value (US$ Mn) & Forecast, by Application, 2017‒2031

Table 4: Global MicroLED Market Value (US$ Mn) & Forecast, by Region, 2017‒2031

Table 5: Global MicroLED Market Volume (Million Units) & Forecast, by Region, 2017‒2031

Table 6: North America MicroLED Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 7: North America MicroLED Market Volume (Million Units) & Forecast, by Type, 2017‒2031

Table 8: North America MicroLED Market Value (US$ Mn) & Forecast, by Application, 2017‒2031

Table 9: North America MicroLED Market Value (US$ Mn) & Forecast, by Country, 2017‒2031

Table 10: North America MicroLED Market Volume (Million Units) & Forecast, by Country, 2017‒2031

Table 11: Europe MicroLED Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 12: Europe MicroLED Market Volume (Million Units) & Forecast, by Type, 2017‒2031

Table 13: Europe MicroLED Market Value (US$ Mn) & Forecast, by Application, 2017‒2031

Table 14: Europe MicroLED Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 15: Europe MicroLED Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017‒2031

Table 16: Asia Pacific MicroLED Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 17: Asia Pacific MicroLED Market Volume (Million Units) & Forecast, by Type, 2017‒2031

Table 18: Asia Pacific MicroLED Market Value (US$ Mn) & Forecast, by Application, 2017‒2031

Table 19: Asia Pacific MicroLED Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 20: Asia Pacific MicroLED Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017‒2031

Table 21: Middle East & Africa MicroLED Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 22: Middle East & Africa MicroLED Market Volume (Million Units) & Forecast, by Type, 2017‒2031

Table 23: Middle East & Africa MicroLED Market Value (US$ Mn) & Forecast, by Application, 2017‒2031

Table 24: Middle East & Africa MicroLED Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 25: Middle East & Africa MicroLED Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017‒2031

Table 26: South America MicroLED Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 27: South America MicroLED Market Volume (Million Units) & Forecast, by Type, 2017‒2031

Table 28: South America MicroLED Market Value (US$ Mn) & Forecast, by Application, 2017‒2031

Table 29: South America MicroLED Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 30: South America MicroLED Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017‒2031

List of Figures

Figure 01: Supply Chain Analysis - Global MicroLED Market

Figure 02: Porter Five Forces Analysis – Global MicroLED Market

Figure 03: Technology Road Map - Global MicroLED Market

Figure 04: Global MicroLED Market, Value (US$ Mn), 2017-2017

Figure 05: Global MicroLED Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017-2031

Figure 06: Global MicroLED Market Projections, by Type, Value (US$ Mn), 2017-2017

Figure 07: Global MicroLED Market, Incremental Opportunity, by Type, 2023‒2031

Figure 08: Global MicroLED Market Share Analysis, by Type, 2023 and 2031

Figure 09: Global MicroLED Market Projections, by Application, Value (US$ Mn), 2017‒2031

Figure 10: Global MicroLED Market, Incremental Opportunity, by Application, 2023‒2031

Figure 11: Global MicroLED Market Share Analysis, by Application, 2023 and 2031

Figure 12: Global MicroLED Market Projections, by Region, Value (US$ Mn), 2017‒2031

Figure 13: Global MicroLED Market, Incremental Opportunity, by Region, 2023‒2031

Figure 14: Global MicroLED Market Share Forecast, Y-O-Y, Value (US$ Mn), 2017-2031

Figure 15: North America MicroLED Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 16: North America MicroLED Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017-2031

Figure 17: North America MicroLED Market Projections, by Type Value (US$ Mn), 2017‒2031

Figure 18: North America MicroLED Market, Incremental Opportunity, by Type, 2023‒2031

Figure 19: North America MicroLED Market Share Analysis, by Type, 2023 and 2031

Figure 20: North America MicroLED Market Projections, by Application (US$ Mn), 2017‒2031

Figure 21: North America MicroLED Market, Incremental Opportunity, by Application, 2023‒2031

Figure 22: North America MicroLED Market Share Analysis, by Application, 2023 and 2031

Figure 23: North America MicroLED Market Projections, by Country, Value (US$ Mn), 2017‒2031

Figure 24: North America MicroLED Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 25: North America MicroLED Market Share Analysis, by Country, 2023 and 2031

Figure 26: Europe MicroLED Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 27: Europe MicroLED Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017-2031

Figure 28: Europe MicroLED Market Projections, by Type Value (US$ Mn), 2017‒2031

Figure 29: Europe MicroLED Market, Incremental Opportunity, by Type, 2023‒2031

Figure 30: Europe MicroLED Market Share Analysis, by Type, 2023 and 2031

Figure 31: Europe MicroLED Market Projections, by Application, Value (US$ Mn), 2017‒2031

Figure 32: Europe MicroLED Market, Incremental Opportunity, by Application, 2023‒2031

Figure 33: Europe MicroLED Market Share Analysis, by Application, 2023 and 2031

Figure 34: Europe MicroLED Market Projections, by Country and Sub-region, Value (US$ Mn), 2017‒2031

Figure 35: Europe MicroLED Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 36: Europe MicroLED Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 37: Asia Pacific MicroLED Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 38: Asia Pacific MicroLED Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017-2031

Figure 39: Asia Pacific MicroLED Market Projections, by Type Value (US$ Mn), 2017‒2031

Figure 40: Asia Pacific MicroLED Market, Incremental Opportunity, by Type, 2023‒2031

Figure 41: Asia Pacific MicroLED Market Share Analysis, by Type, 2023 and 2031

Figure 42: Asia Pacific MicroLED Market Projections, by Application, Value (US$ Mn), 2017‒2031

Figure 43: Asia Pacific MicroLED Market, Incremental Opportunity, by Application, 2023‒2031

Figure 44: Asia Pacific MicroLED Market Share Analysis, by Application, 2023 and 2031

Figure 45: Asia Pacific MicroLED Market Projections, by Country and Sub-region, Value (US$ Mn), 2017‒2031

Figure 46: Asia Pacific MicroLED Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 47: Asia Pacific MicroLED Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 48: Middle East & Africa MicroLED Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 49: Middle East & Africa MicroLED Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017-2031

Figure 50: Middle East & Africa MicroLED Market Projections, by Type Value (US$ Mn), 2017‒2031

Figure 51: Middle East & Africa MicroLED Market, Incremental Opportunity, by Type, 2023‒2031

Figure 52: Middle East & Africa MicroLED Market Share Analysis, by Type, 2023 and 2031

Figure 53: Middle East & Africa MicroLED Market Projections, by Application, Value (US$ Mn), 2017‒2031

Figure 54: Middle East & Africa MicroLED Market, Incremental Opportunity, by Application, 2023‒2031

Figure 55: Middle East & Africa MicroLED Market Share Analysis, by Application, 2023 and 2031

Figure 56: Middle East & Africa MicroLED Market Projections, by Country and Sub-region, Value (US$ Mn), 2017‒2031

Figure 57: Middle East & Africa MicroLED Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 58: Middle East & Africa MicroLED Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 59: South America MicroLED Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 60: South America MicroLED Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017-2031

Figure 61: South America MicroLED Market Projections, by Type Value (US$ Mn), 2017‒2031

Figure 62: South America MicroLED Market, Incremental Opportunity, by Type, 2023‒2031

Figure 63: South America MicroLED Market Share Analysis, by Type, 2023 and 2031

Figure 64: South America MicroLED Market Projections, by Application, Value (US$ Mn), 2017‒2031

Figure 65: South America MicroLED Market, Incremental Opportunity, by Application, 2023‒2031

Figure 66: South America MicroLED Market Share Analysis, by Application, 2023 and 2031

Figure 67: South America MicroLED Market Projections, by Country and Sub-region, Value (US$ Mn), 2017‒2031

Figure 68: South America MicroLED Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 69: South America MicroLED Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 70: Global MicroLED Market Competition

Figure 71: Global MicroLED Market Company Share Analysis