Analysts’ Viewpoint on Mice Model Technologies Market Scenario

High incidence of genetic disorders worldwide has led to significant R&D investment in genetic testing and rise in adoption of the CRISPR technology in the healthcare industry. CRISPR/Cas9 gene editing, an emerging technology, is extensively used to make mutations in all kinds of organisms. There is also an eminent need for accurate and speedy treatment with the rise in cases of various contagious diseases. Such scenarios have led to an increase in focus on NOD SCID gamma mouse (NSG mice), the model of choice for humanized mice, cell biology, cancer xenograft modeling, and infectious disease research. The global mice model technologies market is expected to grow at a substantial pace, owing to R&D in vaccines and drugs to curb the spread of COVID-19. Furthermore, increase in demand for personalized medicines and rise in prevalence of chronic diseases are also expected to drive the global mice model technologies market size.

Animal model is a non-human species, which can mimic characteristics of a biological process or a disease found in humans. Animal models are used in biomedical research. Genetic engineering is used to develop different types of mice models to target specific human diseases. Mice model technologies are often adopted in biomedical research, as mice share mammalian features with humans and suffer from many similar diseases.

Investment in biomedical research is considered one of the most important indicators of any country’s research landscape. In the last decade, biomedical research expenditure has increased manifold across the globe, with developed countries such as the U.S. and the U.K. dominating the landscape. Majority of these investments are made for R&D of animal models.

The National Institutes of Health (NIH), the largest advocate of biomedical research in the world, had a budget of around US$ 31 Bn in 2019, followed by the Bill & Melinda Gates Foundation (BMGF) and the Wellcome Trust (each with approximately US$ 1.08 Bn; 3.1%). Overall, around 89.6% (approximately US$ 32 Bn) of all the grants awarded for biomedical research were allocated to recipient organizations in the U.S. More than 60% of NIH extramural funding involves animal-related research; most of this is allocated to mice-related studies. Thus, increase in biomedical research funding is expected to drive the global mice model technologies market during the forecast period.

Various techniques and methodologies have been developed in the past few years to create genetically modified mice models of human diseases. Homologous recombination in embryonic stem cells is the conventional way of gene targeting. The advent of new molecular genome-altering technologies such as CRISPR/Cas9 allows for genetic mutations to be introduced into the germ line of a mouse faster and cheaper than previous methods.

Development of mice models is significantly easier than before with the use of CRISPR-based techniques. These techniques can be employed to effectively and quickly (within two to three months) produce frequently used mice models (simple knockout mouse, CRISPR Knockin mouse, point mutation knock-in mouse, cKOs, and reporter/Cre knock-ins). One or two guide RNAs and Cas9 protein can be injected to generate knockout mice. Development of large knock-ins (approximately 5 to 10 kb long) is generally achieved using plasmid DNAs as donors. CRISPR editing or ESC-mediated gene targeting can be used to create humanized knock-in (KI) mice models; each technique has its advantages for model development.

Cyagen TurboKnockout gene targeting service combines benefits of each approach to enable sophisticated gene modeling in C57BL/6 or BALB/c mouse models on an accelerated timeframe, including LFKIs up to 300 kb. In as little as six months, TurboKnockout can provide research-ready mouse models for humanization.

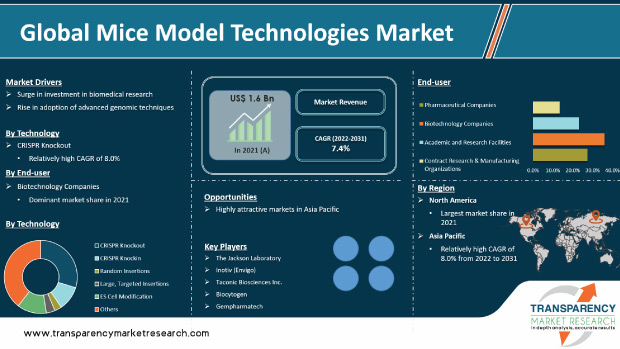

In terms of technology, the global mice model technologies market has been segregated into CRISPR Knockout; CRISPR Knockin; random insertions, large, targeted insertions; ES cell modification (homologous recombination); and others. The CRISPR Knockout segment held dominant share of the market in 2021. It is expected to maintain its dominance during the forecast period. Growth of the segment can be ascribed to high efficiency of CRISPR gene editing technology and increase in adoption of CRISPR technology for the development of CRISPR Knockout mice.

Based on end-user, the global mice model technologies market has been classified into pharmaceutical companies, biotechnology companies, academic and research facilities, and contract research and manufacturing organizations.

The biotechnology companies segment is projected to account for dominant share of the global mice model technologies market during the forecast period. Increase in adoption of CRISPR technology in biotechnology companies and research laboratories is driving the segment. For instance, in October 2016, Caribou Biosciences granted The Jackson Laboratory non-exclusive worldwide rights to use its CRISPR-Cas9 intellectual property to create genetically-engineered mice for research purposes.

The academic and research facilities segment is expected to grow at a higher rate during the forecast period. Growth of the segment can be ascribed to the rise in funding for academic and research facilities for R&D in mice model technologies.

North America dominated the global mice model technologies market, with more than 40% share in 2021. According to the mice model technologies market research study, rise in research and development activities in CRISPR to provide modified products for prevention and treatment of various chronic and rare diseases, such as sickle cell anemia and Alzheimer’s diseases, is expected to fuel the market in North America in the near future.

Asia Pacific is also poised to witness significant growth during the forecast period, owing to the increase in adoption of mice models for R&D in COVID-19 prevention and treatment.

The global mice model technologies market is fragmented, with the presence of international as well as local players. Manufacturers in the market are striving to build a strong network of vendors to enable seamless distribution of products. Players are also focused on adopting strategies such as collaboration, partnership, joint venture, and merger and acquisition to enhance their mice model technologies market share.

Key players operating in the global mice model technologies market include Biocytogen, Charles River Laboratories, Cyagen Biosciences, Gempharmatech, GenOway, Ingenious Targeting Laboratory, Merck KGaA, Ozgene Pty Ltd., Taconic Biosciences, Inc., PolyGene AG, The Jackson Laboratory, Yale School of Medicine, University of North Carolina, University of Nebraska Medical Center, Monash University, UMass Chan Medical School, University of Bonn, Columbia University, and The University of Arizona.

Each of these players has been profiled in the mice model technologies market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 1.6 Bn |

|

Market Forecast Value in 2031 |

US$ 3.2 Bn |

|

Growth Rate (CAGR) |

7.4% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Example: Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global mice model technologies market was valued at US$ 1.6 Bn in 2021

The global mice model technologies market is projected to reach US$ 3.2 Bn by 2031

The global mice model technologies market grew at a CAGR of 6.7% from 2017 to 2021

The global mice model technologies market is anticipated to grow at a CAGR of 7.4% from 2022 to 2031

Increase in R&D in gene technology due to the need for accurate and speedy treatment of various diseases and rise in adoption of advanced genomic techniques

The CRISPR knockout segment accounted for more than 25% share of the global mice model technologies market in 2021

North America is expected to account for major share of the global market during the forecast period

Biocytogen, Charles River Laboratories, Cyagen Biosciences, Gempharmatech, GenOway, Ingenious Targeting Laboratory, Merck KGaA, Ozgene Pty Ltd., Taconic Biosciences, Inc., PolyGene AG, The Jackson Laboratory, Yale School of Medicine, University of North Carolina, University of Nebraska Medical Center, Monash University, UMass Chan Medical School, University of Bonn, Columbia University, and The University of Arizona

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Mice Model Technologies Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Mice Model Technologies Market Analysis and Forecasts, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Global Genetically Engineered Mouse Model Overview

5.2. Regulatory Scenario by Region/globally

5.3. Technological Advancements

5.4. Key Industry Events (Mergers, Acquisitions, Partnerships, Collaborations, etc.)

5.5. COVID-19 Pandemic Impact on Industry (Value Chain and Short / Mid / Long Term Impact)

6. Global Mice Model Technologies Market Analysis and Forecasts, By Technology

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast By Technology, 2017–2031

6.3.1. CRISPR Knockout

6.3.2. CRISPR Knockin

6.3.3. Random Insertions

6.3.4. Large, Targeted Insertions

6.3.5. ES Cell Modification (Homologous Recombination)

6.3.6. Others

6.4. Market Attractiveness By Technology

7. Global Mice Model Technologies Market Analysis and Forecasts, By End-user

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast By End-user, 2017–2031

7.3.1. Pharmaceutical Companies

7.3.2. Biotechnology Companies

7.3.3. Academic and Research Facilities

7.3.4. Contract Research and Manufacturing Organizations

7.4. Market Attractiveness By End-user

8. Global Mice Model Technologies Market Analysis and Forecasts, By Region

8.1. Key Findings

8.2. Market Value Forecast By Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness By Country/Region

9. North America Mice Model Technologies Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast By Technology, 2017–2031

9.2.1. CRISPR Knockout

9.2.2. CRISPR Knockin

9.2.3. Random Insertions

9.2.4. Large, Targeted Insertions

9.2.5. ES Cell Modification (Homologous Recombination)

9.2.6. Others

9.3. Market Value Forecast By End-user, 2017–2031

9.3.1. Pharmaceutical Companies

9.3.2. Biotechnology Companies

9.3.3. Academic and Research Facilities

9.3.4. Contract Research and Manufacturing Organizations

9.4. Market Value Forecast By End-user by Technology, 2017–2031

9.4.1. Pharmaceutical Companies

9.4.1.1. CRISPR Knockout

9.4.1.2. CRISPR Knockin

9.4.1.3. Random Insertions

9.4.1.4. Large, Targeted Insertions

9.4.1.5. ES Cell Modification (Homologous Recombination)

9.4.1.6. Others

9.4.2. Biotechnology Companies

9.4.2.1. CRISPR Knockout

9.4.2.2. CRISPR Knockin

9.4.2.3. Random Insertions

9.4.2.4. Large, Targeted Insertions

9.4.2.5. ES Cell Modification (Homologous Recombination)

9.4.2.6. Others

9.4.3. Academic and Research Facilities

9.4.3.1. CRISPR Knockout

9.4.3.2. CRISPR Knockin

9.4.3.3. Random Insertions

9.4.3.4. Large, Targeted Insertions

9.4.3.5. ES Cell Modification (Homologous Recombination)

9.4.3.6. Others

9.4.4. Contract Research and Manufacturing Organizations

9.4.4.1. CRISPR Knockout

9.4.4.2. CRISPR Knockin

9.4.4.3. Random Insertions

9.4.4.4. Large, Targeted Insertions

9.4.4.5. ES Cell Modification (Homologous Recombination)

9.4.4.6. Others

9.5. Market Value Forecast By Country, 2017–2031

9.5.1. U.S.

9.5.2. Canada

9.6. Market Attractiveness Analysis

9.6.1. By Technology

9.6.2. By End-user

9.6.3. By End-user by Technology

9.6.4. By Country

10. Europe Mice Model Technologies Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast By Technology, 2017–2031

10.2.1. CRISPR Knockout

10.2.2. CRISPR Knockin

10.2.3. Random Insertions

10.2.4. Large, Targeted Insertions

10.2.5. ES Cell Modification (Homologous Recombination)

10.2.6. Others

10.3. Market Value Forecast By End-user, 2017–2031

10.3.1. Pharmaceutical Companies

10.3.2. Biotechnology Companies

10.3.3. Academic and Research Facilities

10.3.4. Contract Research and Manufacturing Organizations

10.4. Market Value Forecast By End-user by Technology, 2017–2031

10.4.1. Pharmaceutical Companies

10.4.1.1. CRISPR Knockout

10.4.1.2. CRISPR Knockin

10.4.1.3. Random Insertions

10.4.1.4. Large, Targeted Insertions

10.4.1.5. ES Cell Modification (Homologous Recombination)

10.4.1.6. Others

10.4.2. Biotechnology Companies

10.4.2.1. CRISPR Knockout

10.4.2.2. CRISPR Knockin

10.4.2.3. Random Insertions

10.4.2.4. Large, Targeted Insertions

10.4.2.5. ES Cell Modification (Homologous Recombination)

10.4.2.6. Others

10.4.3. Academic and Research Facilities

10.4.3.1. CRISPR Knockout

10.4.3.2. CRISPR Knockin

10.4.3.3. Random Insertions

10.4.3.4. Large, Targeted Insertions

10.4.3.5. ES Cell Modification (Homologous Recombination)

10.4.3.6. Others

10.4.4. Contract Research and Manufacturing Organizations

10.4.4.1. CRISPR Knockout

10.4.4.2. CRISPR Knockin

10.4.4.3. Random Insertions

10.4.4.4. Large, Targeted Insertions

10.4.4.5. ES Cell Modification (Homologous Recombination)

10.4.4.6. Others

10.5. Market Value Forecast By Country/Sub-Region, 2017–2031

10.5.1. Germany

10.5.2. U.K.

10.5.3. France

10.5.4. Spain

10.5.5. Italy

10.5.6. Rest of Europe

10.6. Market Attractiveness Analysis

10.6.1. By Technology

10.6.2. By End-user

10.6.3. By End-user by Technology

10.6.4. By Country/Sub-Region

11. Asia Pacific Mice Model Technologies Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast By Technology, 2017–2031

11.2.1. CRISPR Knockout

11.2.2. CRISPR Knockin

11.2.3. Random Insertions

11.2.4. Large, Targeted Insertions

11.2.5. ES Cell Modification (Homologous Recombination)

11.2.6. Others

11.3. Market Value Forecast By End-user, 2017–2031

11.3.1. Pharmaceutical Companies

11.3.2. Biotechnology Companies

11.3.3. Academic and Research Facilities

11.3.4. Contract Research and Manufacturing Organizations

11.4. Market Value Forecast By End-user by Technology, 2017–2031

11.4.1. Pharmaceutical Companies

11.4.1.1. CRISPR Knockout

11.4.1.2. CRISPR Knockin

11.4.1.3. Random Insertions

11.4.1.4. Large, Targeted Insertions

11.4.1.5. ES Cell Modification (Homologous Recombination)

11.4.1.6. Others

11.4.2. Biotechnology Companies

11.4.2.1. CRISPR Knockout

11.4.2.2. CRISPR Knockin

11.4.2.3. Random Insertions

11.4.2.4. Large, Targeted Insertions

11.4.2.5. ES Cell Modification (Homologous Recombination)

11.4.2.6. Others

11.4.3. Academic and Research Facilities

11.4.3.1. CRISPR Knockout

11.4.3.2. CRISPR Knockin

11.4.3.3. Random Insertions

11.4.3.4. Large, Targeted Insertions

11.4.3.5. ES Cell Modification (Homologous Recombination)

11.4.3.6. Others

11.4.4. Contract Research and Manufacturing Organizations

11.4.4.1. CRISPR Knockout

11.4.4.2. CRISPR Knockin

11.4.4.3. Random Insertions

11.4.4.4. Large, Targeted Insertions

11.4.4.5. ES Cell Modification (Homologous Recombination)

11.4.4.6. Others

11.5. Market Value Forecast By Country/Sub-Region, 2017–2031

11.5.1. China

11.5.2. Japan

11.5.3. India

11.5.4. Australia & New Zealand

11.5.5. Rest of Asia Pacific

11.6. Market Attractiveness Analysis

11.6.1. By Technology

11.6.2. By End-user

11.6.3. By End-user by Technology

11.6.4. By Country/Sub-Region

12. Latin America Mice Model Technologies Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast By Technology, 2017–2031

12.2.1. CRISPR Knockout

12.2.2. CRISPR Knockin

12.2.3. Random Insertions

12.2.4. Large, Targeted Insertions

12.2.5. ES Cell Modification (Homologous Recombination)

12.2.6. Others

12.3. Market Value Forecast By End-user, 2017–2031

12.3.1. Pharmaceutical Companies

12.3.2. Biotechnology Companies

12.3.3. Academic and Research Facilities

12.3.4. Contract Research and Manufacturing Organizations

12.4. Market Value Forecast By End-user by Technology, 2017–2031

12.4.1. Pharmaceutical Companies

12.4.1.1. CRISPR Knockout

12.4.1.2. CRISPR Knockin

12.4.1.3. Random Insertions

12.4.1.4. Large, Targeted Insertions

12.4.1.5. ES Cell Modification (Homologous Recombination)

12.4.1.6. Others

12.4.2. Biotechnology Companies

12.4.2.1. CRISPR Knockout

12.4.2.2. CRISPR Knockin

12.4.2.3. Random Insertions

12.4.2.4. Large, Targeted Insertions

12.4.2.5. ES Cell Modification (Homologous Recombination)

12.4.2.6. Others

12.4.3. Academic and Research Facilities

12.4.3.1. CRISPR Knockout

12.4.3.2. CRISPR Knockin

12.4.3.3. Random Insertions

12.4.3.4. Large, Targeted Insertions

12.4.3.5. ES Cell Modification (Homologous Recombination)

12.4.3.6. Others

12.4.4. Contract Research and Manufacturing Organizations

12.4.4.1. CRISPR Knockout

12.4.4.2. CRISPR Knockin

12.4.4.3. Random Insertions

12.4.4.4. Large, Targeted Insertions

12.4.4.5. ES Cell Modification (Homologous Recombination)

12.4.4.6. Others

12.5. Market Value Forecast By Country/Sub-Region, 2017–2031

12.5.1. Brazil

12.5.2. Mexico

12.5.3. Rest of Latin America

12.6. Market Attractiveness Analysis

12.6.1. By Technology

12.6.2. By End-user

12.6.3. By End-user by Technology

12.6.4. By Country/Sub-Region

13. Middle East & Africa Mice Model Technologies Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast By Technology, 2017–2031

13.2.1. CRISPR Knockout

13.2.2. CRISPR Knockin

13.2.3. Random Insertions

13.2.4. Large, Targeted Insertions

13.2.5. ES Cell Modification (Homologous Recombination)

13.2.6. Others

13.3. Market Value Forecast By End-user, 2017–2031

13.3.1. Pharmaceutical Companies

13.3.2. Biotechnology Companies

13.3.3. Academic and Research Facilities

13.3.4. Contract Research and Manufacturing Organizations

13.4. Market Value Forecast By End-user by Technology, 2017–2031

13.4.1. Pharmaceutical Companies

13.4.1.1. CRISPR Knockout

13.4.1.2. CRISPR Knockin

13.4.1.3. Random Insertions

13.4.1.4. Large, Targeted Insertions

13.4.1.5. ES Cell Modification (Homologous Recombination)

13.4.1.6. Others

13.4.2. Biotechnology Companies

13.4.2.1. CRISPR Knockout

13.4.2.2. CRISPR Knockin

13.4.2.3. Random Insertions

13.4.2.4. Large, Targeted Insertions

13.4.2.5. ES Cell Modification (Homologous Recombination)

13.4.2.6. Others

13.4.3. Academic and Research Facilities

13.4.3.1. CRISPR Knockout

13.4.3.2. CRISPR Knockin

13.4.3.3. Random Insertions

13.4.3.4. Large, Targeted Insertions

13.4.3.5. ES Cell Modification (Homologous Recombination)

13.4.3.6. Others

13.4.4. Contract Research and Manufacturing Organizations

13.4.4.1. CRISPR Knockout

13.4.4.2. CRISPR Knockin

13.4.4.3. Random Insertions

13.4.4.4. Large, Targeted Insertions

13.4.4.5. ES Cell Modification (Homologous Recombination)

13.4.4.6. Others

13.5. Market Value Forecast By Country/Sub-Region, 2017–2031

13.5.1. GCC Countries

13.5.2. South Africa

13.5.3. Rest of Middle East & Africa

13.6. Market Attractiveness Analysis

13.6.1. By Technology

13.6.2. By End-user

13.6.3. By End-user by Technology

13.6.4. By Country/Sub-Region

14. Competition Landscape

14.1. Market Player – Competition Matrix (By Tier and Size of companies)

14.2. Market Share Analysis By Company (2021)

14.2.1. Global

14.2.2. North America

14.2.3. Europe

14.2.4. By Asia-Pacific

14.2.5. By Latin America

14.2.6. By Middle East & Africa

14.3. Company Profiles

14.3.1. BIOCYTOGEN

14.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.1.2. Product Portfolio

14.3.1.3. SWOT Analysis

14.3.1.4. Strategic Overview

14.3.2. Charles River Laboratories

14.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.2.2. Product Portfolio

14.3.2.3. SWOT Analysis

14.3.2.4. Strategic Overview

14.3.3. Cyagen Biosciences

14.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.3.2. Product Portfolio

14.3.3.3. SWOT Analysis

14.3.3.4. Strategic Overview

14.3.4. Gempharmatech

14.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.4.2. Product Portfolio

14.3.4.3. SWOT Analysis

14.3.4.4. Strategic Overview

14.3.5. genOway

14.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.5.2. Product Portfolio

14.3.5.3. SWOT Analysis

14.3.5.4. Strategic Overview

14.3.6. ingenious targeting laboratory

14.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.6.2. Product Portfolio

14.3.6.3. SWOT Analysis

14.3.6.4. Strategic Overview

14.3.7. Merck KGaA

14.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.7.2. Product Portfolio

14.3.7.3. SWOT Analysis

14.3.7.4. Strategic Overview

14.3.8. Ozgene Pty Ltd.

14.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.8.2. Product Portfolio

14.3.8.3. SWOT Analysis

14.3.8.4. Strategic Overview

14.3.9. Taconic Biosciences, Inc.

14.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.9.2. Product Portfolio

14.3.9.3. SWOT Analysis

14.3.9.4. Strategic Overview

14.3.10. PolyGene AG

14.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.10.2. Product Portfolio

14.3.10.3. SWOT Analysis

14.3.10.4. Strategic Overview

14.3.11. THE JACKSON LABORATORY

14.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.11.2. Product Portfolio

14.3.11.3. SWOT Analysis

14.3.11.4. Strategic Overview

14.3.12. Yale School of Medicine

14.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.12.2. Product Portfolio

14.3.12.3. SWOT Analysis

14.3.12.4. Strategic Overview

14.3.13. University of North Carolina

14.3.13.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.13.2. Product Portfolio

14.3.13.3. SWOT Analysis

14.3.13.4. Strategic Overview

14.3.14. University of Nebraska Medical Center

14.3.14.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.14.2. Product Portfolio

14.3.14.3. SWOT Analysis

14.3.14.4. Strategic Overview

14.3.15. Monash University

14.3.15.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.15.2. Product Portfolio

14.3.15.3. SWOT Analysis

14.3.15.4. Strategic Overview

14.3.16. UMass Chan Medical School

14.3.16.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.16.2. Product Portfolio

14.3.16.3. SWOT Analysis

14.3.16.4. Strategic Overview

14.3.17. University of Bonn

14.3.17.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.17.2. Product Portfolio

14.3.17.3. SWOT Analysis

14.3.17.4. Strategic Overview

14.3.18. Columbia University

14.3.18.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.18.2. Product Portfolio

14.3.18.3. SWOT Analysis

14.3.18.4. Strategic Overview

14.3.19. The University of Arizona

14.3.19.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.19.2. Product Portfolio

14.3.19.3. SWOT Analysis

14.3.19.4. Strategic Overview

List of Tables

Table 01: Price/Cost Analysis of Mice Models, by Region

Table 02: Global Mice Model Technologies Market Value (US$ Mn) Forecast, by Technology, 2017‒2031

Table 03: Global Mice Model Technologies Market Value (US$ Mn) Forecast, by End-user, 2017‒2031

Table 04: Global Mice Model Technologies Market Value (US$ Mn) Forecast, Pharmaceutical Companies by Technology, 2017‒2031

Table 05: Global Mice Model Technologies Market Value (US$ Mn) Forecast, Biotechnology Companies by Technology, 2017‒2031

Table 06: Global Mice Model Technologies Market Value (US$ Mn) Forecast, Academic and Research Facilities by Technology, 2017‒2031

Table 07: Global Mice Model Technologies Market Value (US$ Mn) Forecast, Contract Research and Manufacturing Organizations by Technology, 2017‒2031

Table 08: Global Mice Model Technologies Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 09: North America Mice Model Technologies Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 10: North America Mice Model Technologies Market Value (US$ Mn) Forecast, by Technology, 2017‒2031

Table 11: North America Mice Model Technologies Market Value (US$ Mn) Forecast, by End-user, 2017‒2031

Table 12: North America Mice Model Technologies Market Value (US$ Mn) Forecast, Pharmaceutical Companies by Technology, 2017‒2031

Table 13: North America Mice Model Technologies Market Value (US$ Mn) Forecast, Biotechnology Companies by Technology, 2017‒2031

Table 14: North America Mice Model Technologies Market Value (US$ Mn) Forecast, Academic and Research Facilities by Technology, 2017‒2031

Table 15: North America Mice Model Technologies Market Value (US$ Mn) Forecast, Contract Research and Manufacturing Organizations by Technology, 2017‒2031

Table 16: Europe Mice Model Technologies Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017–2031

Table 17: Europe Mice Model Technologies Market Value (US$ Mn) Forecast, by Technology, 2017‒2031

Table 18: Europe Mice Model Technologies Market Value (US$ Mn) Forecast, by End-user, 2017‒2031

Table 19: Europe Mice Model Technologies Market Value (US$ Mn) Forecast, Pharmaceutical Companies by Technology, 2017‒2031

Table 20: Europe Mice Model Technologies Market Value (US$ Mn) Forecast, Biotechnology Companies by Technology, 2017‒2031

Table 21: Europe Mice Model Technologies Market Value (US$ Mn) Forecast, Academic and Research Facilities by Technology, 2017‒2031

Table 22: Europe Mice Model Technologies Market Value (US$ Mn) Forecast, Contract Research and Manufacturing Organizations by Technology, 2017‒2031

Table 23: Asia Pacific Mice Model Technologies Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 24: Asia Pacific Mice Model Technologies Market Value (US$ Mn) Forecast, by Technology, 2017‒2031

Table 25: Asia Pacific Mice Model Technologies Market Value (US$ Mn) Forecast, by End-user, 2017‒2031

Table 26: Asia Pacific Mice Model Technologies Market Value (US$ Mn) Forecast, Pharmaceutical Companies by Technology, 2017‒2031

Table 27: Asia Pacific Mice Model Technologies Market Value (US$ Mn) Forecast, Biotechnology Companies by Technology, 2017‒2031

Table 28: Asia Pacific Mice Model Technologies Market Value (US$ Mn) Forecast, Academic and Research Facilities by Technology, 2017‒2031

Table 29: Asia Pacific Mice Model Technologies Market Value (US$ Mn) Forecast, Contract Research and Manufacturing Organizations by Technology, 2017‒2031

Table 30: Latin America Mice Model Technologies Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 31: Latin America Mice Model Technologies Market Value (US$ Mn) Forecast, by Technology, 2017‒2031

Table 32: Latin America Mice Model Technologies Market Value (US$ Mn) Forecast, by End-user, 2017‒2031

Table 33: Latin America Mice Model Technologies Market Value (US$ Mn) Forecast, Pharmaceutical Companies by Technology, 2017‒2031

Table 34: Latin America Mice Model Technologies Market Value (US$ Mn) Forecast, Biotechnology Companies by Technology, 2017‒2031

Table 35: Latin America Mice Model Technologies Market Value (US$ Mn) Forecast, Academic & Research Facilities by Technology, 2017‒2031

Table 36: Latin America Mice Model Technologies Market Value (US$ Mn) Forecast, Contract Research and Manufacturing Organizations by Technology, 2017‒2031

Table 37: Middle East & Africa Mice Model Technologies Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 38: Middle East & Africa Mice Model Technologies Market Value (US$ Mn) Forecast, by Technology, 2017‒2031

Table 39: Middle East & Africa Mice Model Technologies Market Value (US$ Mn) Forecast, by End-user, 2017‒2031

Table 40: Middle East & Africa Mice Model Technologies Market Value (US$ Mn) Forecast, Pharmaceutical Companies by Technology, 2017‒2031

Table 41: Middle East & Africa Mice Model Technologies Market Value (US$ Mn) Forecast, Biotechnology Companies by Technology, 2017‒2031

Table 42: Middle East & Africa Mice Model Technologies Market Value (US$ Mn) Forecast, Academic and Research Facilities by Technology, 2017‒2031

Table 43: Middle East & Africa Mice Model Technologies Market Value (US$ Mn) Forecast, Contract Research and Manufacturing Organizations by Technology, 2017‒2031

List of Figures

Figure 01: Global Mice Model Technologies Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Mice Model Technologies Market Value Share, by Technology, 2021

Figure 03: Mice Model Technologies Market Value Share, by End-user, 2021

Figure 04: Mice Model Technologies Market Value Share, by Region, 2021

Figure 05: Global Mice Model Technologies Market Value Share Analysis, by Technology, 2021 and 2031

Figure 06: Global Mice Model Technologies Market Attractiveness Analysis, by Technology, 2022–2031

Figure 07: Global Mice Model Technologies Market Value (US$ Mn), by CRISPR Knockout, 2017‒2031

Figure 08: Global Mice Model Technologies Market Value (US$ Mn), by CRISPR Knockin Mice, 2017‒2031

Figure 09: Global Mice Model Technologies Market Value (US$ Mn), by Random Insertions, 2017‒2031

Figure 10: Global Mice Model Technologies Market Value (US$ Mn), by Large, Targeted Insertions, 2017‒2031

Figure 11: Global Mice Model Technologies Market Value (US$ Mn), by ES Cell Modification (Homologous Recombination), 2017‒2031

Figure 12: Global Mice Model Technologies Market Value (US$ Mn), by Others, 2017‒2031

Figure 13: Global Mice Model Technologies Market Value Share Analysis, by End-user, 2021 and 2031

Figure 14: Global Mice Model Technologies Market Attractiveness Analysis, by End-user, 2022–2031

Figure 15: Global Mice Model Technologies Market Value (US$ Mn), by Pharmaceutical Companies, 2017‒2031

Figure 16: Global Mice Model Technologies Market Value (US$ Mn), by Biotechnology Companies, 2017‒2031

Figure 17: Global Mice Model Technologies Market Value (US$ Mn), by Academic and Research Facilities, 2017‒2031

Figure 18: Global Mice Model Technologies Market Value (US$ Mn), by Contract Research and Manufacturing Organizations, 2017‒2031

Figure 19: Global Mice Model Technologies Market Value Share Analysis, by Region, 2021 and 2031

Figure 20: Global Mice Model Technologies Market Attractiveness Analysis, by Region, 2022–2031

Figure 21: North America Mice Model Technologies Market Value (US$ Mn) Forecast, 2017–2031

Figure 22: North America Mice Model Technologies Market Attractiveness Analysis, by Country, 2022–2031

Figure 23: North America Mice Model Technologies Market Value Share Analysis, by Country, 2021 and 2031

Figure 24: North America Mice Model Technologies Market Value Share Analysis, by Technology, 2021 and 2031

Figure 25: North America Mice Model Technologies Market Attractiveness Analysis, by Technology, 2022–2031

Figure 26: North America Mice Model Technologies Market Value Share Analysis, by End-user, 2021 and 2031

Figure 27: North America Mice Model Technologies Market Attractiveness Analysis, by End-user, 2022–2031

Figure 28: Europe Mice Model Technologies Market Value (US$ Mn) Forecast, 2017–2031

Figure 29: Europe Mice Model Technologies Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 30: Europe Mice Model Technologies Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 31: Europe Mice Model Technologies Market Value Share Analysis, by Technology, 2021 and 2031

Figure 32: Europe Mice Model Technologies Market Attractiveness Analysis, by Technology, 2022–2031

Figure 33: Europe Mice Model Technologies Market Value Share Analysis, by End-user, 2021 and 2031

Figure 34: Europe Mice Model Technologies Market Attractiveness Analysis, by End-user, 2022–2031

Figure 35: Asia Pacific Mice Model Technologies Market Value (US$ Mn) Forecast, 2017–2031

Figure 36: Asia Pacific Mice Model Technologies Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 37: Asia Pacific Mice Model Technologies Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 38: Asia Pacific Mice Model Technologies Market Value Share Analysis, by Technology, 2021 and 2031

Figure 39: Asia Pacific Mice Model Technologies Market Attractiveness Index, by Technology, 2022–2031

Figure 40: Asia Pacific Mice Model Technologies Market Value Share Analysis, by End-user, 2021 and 2031

Figure 41: Asia Pacific Mice Model Technologies Market Attractiveness Analysis, by End-user, 2022–2031

Figure 42: Latin America Mice Model Technologies Market Value (US$ Mn) Forecast, 2017–2031

Figure 43: Latin America Mice Model Technologies Market Attractiveness Analysis, by Country/Sub-Region, 2021-2031

Figure 44: Latin America Mice Model Technologies Market Value Share Analysis, by Country/Sub-Region, 2021 and 2031

Figure 45: Latin America Mice Model Technologies Market Value Share Analysis, by Technology, 2021 and 2031

Figure 46: Latin America Mice Model Technologies Market Attractiveness Analysis, by Technology, 2022–2031

Figure 47: Latin America Mice Model Technologies Market Value Share Analysis, by End-user, 2021 and 2031

Figure 48: Latin America Mice Model Technologies Market Attractiveness Analysis, by End-user, 2022–2031

Figure 49: Middle East & Africa Mice Model Technologies Market Value (US$ Mn) Forecast, 2017–2031

Figure 50: Middle East & Africa Mice Model Technologies Market Attractiveness Analysis, by Country/Sub-Region, 2021-2031

Figure 51: Middle East & Africa Mice Model Technologies Market Value Share Analysis, by Country/Sub-Region, 2021 and 2031

Figure 52: Middle East & Africa Mice Model Technologies Market Value Share Analysis, by Technology, 2021 and 2031

Figure 53: Middle East & Africa Mice Model Technologies Market Attractiveness Analysis, by Technology, 2022–2031

Figure 54: Middle East & Africa Mice Model Technologies Market Value Share Analysis, by End-user, 2021 and 2031

Figure 55: Middle East & Africa Mice Model Technologies Market Attractiveness Analysis, by End-user, 2022–2031