Analysts’ Viewpoint on Market Scenario

Mice are small and relatively easy to handle and transport. They can also be reproduced quickly. This is expected to result in the global mice model generation industry growth during the forecast period.

Rise in usage of genetically engineered mouse model (GEMM) for drug discovery purposes is expected to drive the mice model generation market demand from 2022 to 2031.

Rapid technological advancements have been taking place in mouse model generation, resulting in transgenic mice generation, knock-in mouse generation, and knock-out mouse generation. Need for effective COVID-19 vaccines to control the pandemic and eradicate the virus is augmenting the global market.

Governments of various countries are taking initiatives to discover effective vaccines and medications for several types of chronic diseases. This is likely to provide lucrative opportunities to players operating in the global market.

Mice are efficient and cost-effective research tools. Mice model inception began in the early 1900s on a farm in Granby, Massachusetts. Mice models are more advantageous than other animal models, as 99% of their genome is similar to the human genome.

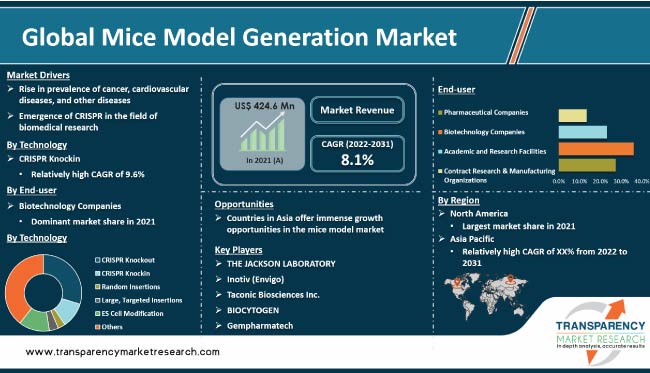

Rise in prevalence of cancer, cardiovascular diseases, diabetes, autism, schizophrenia, and rare diseases; increase in the burden of obesity; and growth of genetic disorders are propelling the global mice model generation market. Emergence of CRISPR as a powerful tool in the field of biomedical research and surge in applications of CRISPR technology in several industry segments are augmenting the global mice model market.

Advancement in gene technology, fueled by the need for fast and accurate treatment, in the ever-evolving medical industry is driving the mice model market. Identification of genomic differences to predict drug resistance or drug response by the patients could offer scope to design a customized therapy according to specific characteristics of a particular cancer.

Study of cancer in mouse models has gained popularity over the last few decades. Sophisticated genetic manipulation technologies and commercialization of these murine systems have made it possible to generate mice models to study human disease.

Given the large socio-economic burden of cancer, both on academic research and the healthcare industry, there is a need for in vivo animal cancer models that can provide a rationale that is translatable to the clinic. Such a bench-to-bedside transition is likely to facilitate long-term growth of the global mice model generation market. The Mouse Avatar and Co-clinical Trial concepts have the potential to revolutionize the drug development and healthcare process.

In terms of technology, the global market has been segmented into CRISPR knockout, CRISPR knockin, random insertions, large & targeted insertions, ES cell modification (homologous recombination), and others. The CRISPR knockout segment held dominant share of the market in 2021. The segment is likely to lead the global market during the forecast period by registering the highest CAGR.

High efficiency and flexibility of the CRISPR gene editing technology is expected to drive the CRISPR knockout segment during the forecast period. As per the global mice model generation market trends, usage of CRISPR technology for the development of CRISPR knockout mice is likely to increase in the next few years.

Based on end-user, the global market has been classified into pharmaceutical companies, biotechnology companies, academic & research facilities, and contract research & manufacturing organizations.

The biotechnology companies segment is projected to account for significant share of the global mice model generation market from 2022 to 2031. The segment is anticipated to exhibit the highest CAGR during the forecast period.

High adoption of CRISPR technology by biotechnology companies and research laboratories is driving the segment. For instance, in October 2016, Caribou Biosciences granted The Jackson Laboratory non-exclusive worldwide rights to use its CRISPR-Cas9 intellectual property to create genetically engineered mice for research purposes.

However, the academic & research facilities segment is expected to register the highest growth rate during the forecast period. Increase in funding for academic research institutes for mice model research is augmenting the segment.

North America dominated the global market, with more than 40% share in 2021. Well-established pharmaceutical & biopharmaceutical research industry and presence of some of the world’s leading pharmaceutical and biopharmaceutical companies in the region make it highly promising for various products employed in research activities. This is projected to drive the mice model generation market in North America during the forecast period.

The market in Asia Pacific is expected to grow at the fastest CAGR during the forecast period. Increase in the usage of mice models for research purposes due to the COVID-19 outbreak is anticipated to drive the market in the region during the forecast period.

The global mice model generation market is consolidated, with the presence of international as well as local players. Top five or six players account for the major share of the market. Manufacturers strive to build a strong network of vendors to enable seamless distribution of products among the consumers.

Leading vendors in the global market are striving to increase their presence across the globe and build a distribution network through collaborations and partnerships. Mergers, acquisitions, joint ventures, collaborations, and partnerships are important expansion strategies adopted by key players in the mice model generation industry.

Prominent players operating in the global market are Biocytogen, Charles River Laboratories, Cyagen Biosciences, Gempharmatech, genOway, Ingenious Targeting Laboratory, Ozgene Pty Ltd., Taconic Biosciences, Inc., PolyGene AG, The Jackson Laboratory, Yale School of Medicine, University of North Carolina, University of Nebraska Medical Center, Monash University, UMass Chan Medical School, University of Bonn, Columbia University, The University of Arizona, The Weizmann Institute of Science, The Hebrew University of Jerusalem, The Technion – Israel Institute of Technology, and Hadassah BrainLabs.

Each of these players has been profiled in the mice model generation market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 424.6 Mn |

|

Market Forecast Value in 2031 |

More than US$ 918.4 Mn |

|

Growth Rate (CAGR) |

8.1% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 424.6 Mn in 2021

It is projected to reach more than US$ 918.4 Mn by 2031

The global market grew at a CAGR of 7.4% from 2017 to 2021

It is anticipated to grow at a CAGR of 8.1% from 2022 to 2031

Rise in prevalence of cancer, cardiovascular diseases, diabetes, autism, schizophrenia, and rare diseases; increase in burden of obesity; emergence of CRISPR as a powerful tool in the field of biomedical research; surge in application of CRISPR technology in various industry segments; and growth in incidence of genetic disorders

The CRISPR knockout segment accounted for more than 35% share of the global mice model generation market in 2021

North America is expected to account for major share of the global market during the forecast period.

Biocytogen, Charles River Laboratories, Cyagen Biosciences, Gempharmatech, genOway, Ingenious Targeting Laboratory, Ozgene Pty Ltd., Taconic Biosciences, Inc., PolyGene AG, The Jackson Laboratory, Yale School of Medicine, University of North Carolina, University of Nebraska Medical Center, Monash University, UMass Chan Medical School, University of Bonn, Columbia University, The University of Arizona, The Weizmann Institute of Science, The Hebrew University of Jerusalem, The Technion – Israel In

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Mice Model Generation Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Mice Model Generation Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Global Genetically Engineered Mouse Model Overview

5.2. Regulatory Scenario by Region/globally

5.3. Technological Advancements

5.4. Key Industry Events (mergers, acquisitions, partnerships, collaborations, etc.)

5.5. COVID-19 Pandemic Impact on Industry (value chain and short / mid / long term impact)

6. Global Mice Model Generation Market Analysis and Forecast, by Technology

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Technology, 2017–2031

6.3.1. CRISPR Knockout

6.3.2. CRISPR Knockin

6.3.3. Random Insertions

6.3.4. Large, Targeted Insertions

6.3.5. ES Cell Modification (homologous recombination)

6.3.6. Others

6.4. Market Attractiveness Analysis, by Technology

7. Global Mice Model Generation Market Analysis and Forecast, by End-user

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by End-user, 2017–2031

7.3.1. Pharmaceutical Companies

7.3.2. Biotechnology Companies

7.3.3. Academic & Research Facilities

7.3.4. Contract Research & Manufacturing Organizations

7.4. Market Attractiveness Analysis, by End-user

8. Global Mice Model Generation Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness Analysis, by Region

9. North America Mice Model Generation Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Technology, 2017–2031

9.2.1. CRISPR Knockout

9.2.2. CRISPR Knockin

9.2.3. Random Insertions

9.2.4. Large, Targeted Insertions

9.2.5. ES Cell Modification (homologous recombination)

9.2.6. Others

9.3. Market Value Forecast, by End-user, 2017–2031

9.3.1. Pharmaceutical Companies

9.3.2. Biotechnology Companies

9.3.3. Academic & Research Facilities

9.3.4. Contract Research & Manufacturing Organizations

9.4. Market Value Forecast, by End-user by Technology, 2017–2031

9.4.1. Pharmaceutical Companies

9.4.1.1. CRISPR Knockout

9.4.1.2. CRISPR Knockin

9.4.1.3. Random Insertions

9.4.1.4. Large, Targeted Insertions

9.4.1.5. ES Cell Modification (homologous recombination)

9.4.1.6. Others

9.4.2. Biotechnology Companies

9.4.2.1. CRISPR Knockout

9.4.2.2. CRISPR Knockin

9.4.2.3. Random Insertions

9.4.2.4. Large, Targeted Insertions

9.4.2.5. ES Cell Modification (homologous recombination)

9.4.2.6. Others

9.4.3. Academic & Research Facilities

9.4.3.1. CRISPR Knockout

9.4.3.2. CRISPR Knockin

9.4.3.3. Random Insertions

9.4.3.4. Large, Targeted Insertions

9.4.3.5. ES Cell Modification (homologous recombination)

9.4.3.6. Others

9.4.4. Contract Research & Manufacturing Organizations

9.4.4.1. CRISPR Knockout

9.4.4.2. CRISPR Knockin

9.4.4.3. Random Insertions

9.4.4.4. Large, Targeted Insertions

9.4.4.5. ES Cell Modification (homologous recombination)

9.4.4.6. Others

9.5. Market Value Forecast, by Country, 2017–2031

9.5.1. U.S.

9.5.2. Canada

9.6. Market Attractiveness Analysis

9.6.1. By Technology

9.6.2. By End-user

9.6.3. By End-user by Technology

9.6.4. By Country

10. Europe Mice Model Generation Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Technology, 2017–2031

10.2.1. CRISPR Knockout

10.2.2. CRISPR Knockin

10.2.3. Random Insertions

10.2.4. Large, Targeted Insertions

10.2.5. ES Cell Modification (homologous recombination)

10.2.6. Others

10.3. Market Value Forecast, by End-user, 2017–2031

10.3.1. Pharmaceutical Companies

10.3.2. Biotechnology Companies

10.3.3. Academic & Research Facilities

10.3.4. Contract Research & Manufacturing Organizations

10.4. Market Value Forecast, by End-user by Technology, 2017–2031

10.4.1. Pharmaceutical Companies

10.4.1.1. CRISPR Knockout

10.4.1.2. CRISPR Knockin

10.4.1.3. Random Insertions

10.4.1.4. Large, Targeted Insertions

10.4.1.5. ES Cell Modification (homologous recombination)

10.4.1.6. Others

10.4.2. Biotechnology Companies

10.4.2.1. CRISPR Knockout

10.4.2.2. CRISPR Knockin

10.4.2.3. Random Insertions

10.4.2.4. Large, Targeted Insertions

10.4.2.5. ES Cell Modification (homologous recombination)

10.4.2.6. Others

10.4.3. Academic & Research Facilities

10.4.3.1. CRISPR Knockout

10.4.3.2. CRISPR Knockin

10.4.3.3. Random Insertions

10.4.3.4. Large, Targeted Insertions

10.4.3.5. ES Cell Modification (homologous recombination)

10.4.3.6. Others

10.4.4. Contract Research & Manufacturing Organizations

10.4.4.1. CRISPR Knockout

10.4.4.2. CRISPR Knockin

10.4.4.3. Random Insertions

10.4.4.4. Large, Targeted Insertions

10.4.4.5. ES Cell Modification (homologous recombination)

10.4.4.6. Others

10.5. Market Value Forecast, by Country/Sub-region, 2017–2031

10.5.1. Germany

10.5.2. U.K.

10.5.3. France

10.5.4. Spain

10.5.5. Italy

10.5.6. Rest of Europe

10.6. Market Attractiveness Analysis

10.6.1. By Technology

10.6.2. By End-user

10.6.3. By End-user by Technology

10.6.4. By Country/Sub-region

11. Asia Pacific Mice Model Generation Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Technology, 2017–2031

11.2.1. CRISPR Knockout

11.2.2. CRISPR Knockin

11.2.3. Random Insertions

11.2.4. Large, Targeted Insertions

11.2.5. ES Cell Modification (homologous recombination)

11.2.6. Others

11.3. Market Value Forecast, by End-user, 2017–2031

11.3.1. Pharmaceutical Companies

11.3.2. Biotechnology Companies

11.3.3. Academic & Research Facilities

11.3.4. Contract Research & Manufacturing Organizations

11.4. Market Value Forecast, by End-user by Technology, 2017–2031

11.4.1. Pharmaceutical Companies

11.4.1.1. CRISPR Knockout

11.4.1.2. CRISPR Knockin

11.4.1.3. Random Insertions

11.4.1.4. Large, Targeted Insertions

11.4.1.5. ES Cell Modification (homologous recombination)

11.4.1.6. Others

11.4.2. Biotechnology Companies

11.4.2.1. CRISPR Knockout

11.4.2.2. CRISPR Knockin

11.4.2.3. Random Insertions

11.4.2.4. Large, Targeted Insertions

11.4.2.5. ES Cell Modification (homologous recombination)

11.4.2.6. Others

11.4.3. Academic & Research Facilities

11.4.3.1. CRISPR Knockout

11.4.3.2. CRISPR Knockin

11.4.3.3. Random Insertions

11.4.3.4. Large, Targeted Insertions

11.4.3.5. ES Cell Modification (homologous recombination)

11.4.3.6. Others

11.4.4. Contract Research & Manufacturing Organizations

11.4.4.1. CRISPR Knockout

11.4.4.2. CRISPR Knockin

11.4.4.3. Random Insertions

11.4.4.4. Large, Targeted Insertions

11.4.4.5. ES Cell Modification (homologous recombination)

11.4.4.6. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. China

11.5.2. Japan

11.5.3. India

11.5.4. Australia & New Zealand

11.5.5. Rest of Asia Pacific

11.6. Market Attractiveness Analysis

11.6.1. By Technology

11.6.2. By End-user

11.6.3. By End-user by Technology

11.6.4. By Country/Sub-region

12. Latin America Mice Model Generation Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Technology, 2017–2031

12.2.1. CRISPR Knockout

12.2.2. CRISPR Knockin

12.2.3. Random Insertions

12.2.4. Large, Targeted Insertions

12.2.5. ES Cell Modification (homologous recombination)

12.2.6. Others

12.3. Market Value Forecast, by End-user, 2017–2031

12.3.1. Pharmaceutical Companies

12.3.2. Biotechnology Companies

12.3.3. Academic & Research Facilities

12.3.4. Contract Research & Manufacturing Organizations

12.4. Market Value Forecast, by End-user by Technology, 2017–2031

12.4.1. Pharmaceutical Companies

12.4.1.1. CRISPR Knockout

12.4.1.2. CRISPR Knockin

12.4.1.3. Random Insertions

12.4.1.4. Large, Targeted Insertions

12.4.1.5. ES Cell Modification (homologous recombination)

12.4.1.6. Others

12.4.2. Biotechnology Companies

12.4.2.1. CRISPR Knockout

12.4.2.2. CRISPR Knockin

12.4.2.3. Random Insertions

12.4.2.4. Large, Targeted Insertions

12.4.2.5. ES Cell Modification (homologous recombination)

12.4.2.6. Others

12.4.3. Academic & Research Facilities

12.4.3.1. CRISPR Knockout

12.4.3.2. CRISPR Knockin

12.4.3.3. Random Insertions

12.4.3.4. Large, Targeted Insertions

12.4.3.5. ES Cell Modification (homologous recombination)

12.4.3.6. Others

12.4.4. Contract Research & Manufacturing Organizations

12.4.4.1. CRISPR Knockout

12.4.4.2. CRISPR Knockin

12.4.4.3. Random Insertions

12.4.4.4. Large, Targeted Insertions

12.4.4.5. ES Cell Modification (homologous recombination)

12.4.4.6. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. Brazil

12.5.2. Mexico

12.5.3. Rest of Latin America

12.6. Market Attractiveness Analysis

12.6.1. By Technology

12.6.2. By End-user

12.6.3. By End-user by Technology

12.6.4. By Country/Sub-region

13. Middle East & Africa Mice Model Generation Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Technology, 2017–2031

13.2.1. CRISPR Knockout

13.2.2. CRISPR Knockin

13.2.3. Random Insertions

13.2.4. Large, Targeted Insertions

13.2.5. ES Cell Modification (homologous recombination)

13.2.6. Others

13.3. Market Value Forecast, by End-user, 2017–2031

13.3.1. Pharmaceutical Companies

13.3.2. Biotechnology Companies

13.3.3. Academic & Research Facilities

13.3.4. Contract Research & Manufacturing Organizations

13.4. Market Value Forecast, by End-user by Technology, 2017–2031

13.4.1. Pharmaceutical Companies

13.4.1.1. CRISPR Knockout

13.4.1.2. CRISPR Knockin

13.4.1.3. Random Insertions

13.4.1.4. Large, Targeted Insertions

13.4.1.5. ES Cell Modification (homologous recombination)

13.4.1.6. Others

13.4.2. Biotechnology Companies

13.4.2.1. CRISPR Knockout

13.4.2.2. CRISPR Knockin

13.4.2.3. Random Insertions

13.4.2.4. Large, Targeted Insertions

13.4.2.5. ES Cell Modification (homologous recombination)

13.4.2.6. Others

13.4.3. Academic & Research Facilities

13.4.3.1. CRISPR Knockout

13.4.3.2. CRISPR Knockin

13.4.3.3. Random Insertions

13.4.3.4. Large, Targeted Insertions

13.4.3.5. ES Cell Modification (homologous recombination)

13.4.3.6. Others

13.4.4. Contract Research & Manufacturing Organizations

13.4.4.1. CRISPR Knockout

13.4.4.2. CRISPR Knockin

13.4.4.3. Random Insertions

13.4.4.4. Large, Targeted Insertions

13.4.4.5. ES Cell Modification (homologous recombination)

13.4.4.6. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. GCC Countries

13.5.2. South Africa

13.5.3. Rest of Middle East & Africa

13.6. Market Attractiveness Analysis

13.6.1. By Technology

13.6.2. By End-user

13.6.3. By End-user by Technology

13.6.4. By Country/Sub-region

14. Competition Landscape

14.1. Market Player - Competition Matrix (by tier and size of companies)

14.2. Market Share Analysis, by Company, 2021

14.2.1. Global

14.2.2. North America

14.2.3. Europe

14.2.4. By Asia Pacific

14.2.5. By Latin America

14.2.6. By Middle East & Africa

14.3. Company Profiles

14.3.1. Biocytogen

14.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.1.2. Product Portfolio

14.3.1.3. SWOT Analysis

14.3.1.4. Strategic Overview

14.3.2. Charles River Laboratories

14.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.2.2. Product Portfolio

14.3.2.3. SWOT Analysis

14.3.2.4. Strategic Overview

14.3.3. Cyagen Biosciences

14.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.3.2. Product Portfolio

14.3.3.3. SWOT Analysis

14.3.3.4. Strategic Overview

14.3.4. Gempharmatech

14.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.4.2. Product Portfolio

14.3.4.3. SWOT Analysis

14.3.4.4. Strategic Overview

14.3.5. genOway

14.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.5.2. Product Portfolio

14.3.5.3. SWOT Analysis

14.3.5.4. Strategic Overview

14.3.6. ingenious targeting laboratory

14.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.6.2. Product Portfolio

14.3.6.3. SWOT Analysis

14.3.6.4. Strategic Overview

14.3.7. Merck KGaA

14.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.7.2. Product Portfolio

14.3.7.3. SWOT Analysis

14.3.7.4. Strategic Overview

14.3.8. Ozgene Pty Ltd.

14.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.8.2. Product Portfolio

14.3.8.3. SWOT Analysis

14.3.8.4. Strategic Overview

14.3.9. Taconic Biosciences, Inc.

14.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.9.2. Product Portfolio

14.3.9.3. SWOT Analysis

14.3.9.4. Strategic Overview

14.3.10. PolyGene AG

14.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.10.2. Product Portfolio

14.3.10.3. SWOT Analysis

14.3.10.4. Strategic Overview

14.3.11. The Jackson Laboratory

14.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.11.2. Product Portfolio

14.3.11.3. SWOT Analysis

14.3.11.4. Strategic Overview

14.3.12. Yale School of Medicine

14.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.12.2. Product Portfolio

14.3.12.3. SWOT Analysis

14.3.12.4. Strategic Overview

14.3.13. University of North Carolina

14.3.13.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.13.2. Product Portfolio

14.3.13.3. SWOT Analysis

14.3.13.4. Strategic Overview

14.3.14. University of Nebraska Medical Center

14.3.14.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.14.2. Product Portfolio

14.3.14.3. SWOT Analysis

14.3.14.4. Strategic Overview

14.3.15. Monash University

14.3.15.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.15.2. Product Portfolio

14.3.15.3. SWOT Analysis

14.3.15.4. Strategic Overview

14.3.16. UMass Chan Medical School

14.3.16.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.16.2. Product Portfolio

14.3.16.3. SWOT Analysis

14.3.16.4. Strategic Overview

14.3.17. University of Bonn

14.3.17.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.17.2. Product Portfolio

14.3.17.3. SWOT Analysis

14.3.17.4. Strategic Overview

14.3.18. Columbia University

14.3.18.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.18.2. Product Portfolio

14.3.18.3. SWOT Analysis

14.3.18.4. Strategic Overview

14.3.19. The University of Arizona

14.3.19.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.19.2. Product Portfolio

14.3.19.3. SWOT Analysis

14.3.19.4. Strategic Overview

14.3.20. Hadassah BrainLabs

14.3.20.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.20.2. Product Portfolio

14.3.20.3. SWOT Analysis

14.3.20.4. Strategic Overview

14.3.21. The Weizmann Institute of Science

14.3.21.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.21.2. Product Portfolio

14.3.21.3. SWOT Analysis

14.3.21.4. Strategic Overview

14.3.22. The Hebrew University of Jerusalem

14.3.22.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.22.2. Product Portfolio

14.3.22.3. SWOT Analysis

14.3.22.4. Strategic Overview

14.3.23. The Technion – Israel Institute of Technology

14.3.23.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.23.2. Product Portfolio

14.3.23.3. SWOT Analysis

14.3.23.4. Strategic Overview

List of Tables

Table 01: Price/Cost Analysis of Mice Models, by Region

Table 02: Global Mice Model Generation Market Value (US$ Mn) Forecast, by Technology, 2017‒2031

Table 03: Global Mice Model Generation Market Value (US$ Mn) Forecast, by End-user, 2017‒2031

Table 04: Global Mice Model Generation Market Value (US$ Mn) Forecast, Pharmaceutical Companies by Technology, 2017‒2031

Table 05: Global Mice Model Generation Market Value (US$ Mn) Forecast, Biotechnology Companies by Technology, 2017‒2031

Table 06: Global Mice Model Generation Market Value (US$ Mn) Forecast, Academic & Research Facilities by Technology, 2017‒2031

Table 07: Global Mice Model Generation Market Value (US$ Mn) Forecast, Contract Research & Manufacturing Organizations by Technology, 2017‒2031

Table 08: Global Mice Model Generation Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 09: North America Mice Model Generation Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 10: North America Mice Model Generation Market Value (US$ Mn) Forecast, by Technology, 2017‒2031

Table 11: North America Mice Model Generation Market Value (US$ Mn) Forecast, by End-user, 2017‒2031

Table 12: North America Mice Model Generation Market Value (US$ Mn) Forecast, Pharmaceutical Companies by Technology, 2017‒2031

Table 13: North America Mice Model Generation Market Value (US$ Mn) Forecast, Biotechnology Companies by Technology, 2017‒2031

Table 14: North America Mice Model Generation Market Value (US$ Mn) Forecast, Academic & Research Facilities by Technology, 2017‒2031

Table 15: North America Mice Model Generation Market Value (US$ Mn) Forecast, Contract Research & Manufacturing Organizations by Technology, 2017‒2031

Table 16: Europe Mice Model Generation Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 17: Europe Mice Model Generation Market Value (US$ Mn) Forecast, by Technology, 2017‒2031

Table 18: Europe Mice Model Generation Market Value (US$ Mn) Forecast, by End-user, 2017‒2031

Table 19: Europe Mice Model Generation Market Value (US$ Mn) Forecast, Pharmaceutical Companies by Technology, 2017‒2031

Table 20: Europe Mice Model Generation Market Value (US$ Mn) Forecast, Biotechnology Companies by Technology, 2017‒2031

Table 21: Europe Mice Model Generation Market Value (US$ Mn) Forecast, Academic & Research Facilities by Technology, 2017‒2031

Table 22: Europe Mice Model Generation Market Value (US$ Mn) Forecast, Contract Research & Manufacturing Organizations by Technology, 2017‒2031

Table 23: Asia Pacific Mice Model Generation Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 24: Asia Pacific Mice Model Generation Market Value (US$ Mn) Forecast, by Technology, 2017‒2031

Table 25: Asia Pacific Mice Model Generation Market Value (US$ Mn) Forecast, by End-user, 2017‒2031

Table 26: Asia Pacific Mice Model Generation Market Value (US$ Mn) Forecast, Pharmaceutical Companies by Technology, 2017‒2031

Table 27: Asia Pacific Mice Model Generation Market Value (US$ Mn) Forecast, Biotechnology Companies by Technology, 2017‒2031

Table 28: Asia Pacific Mice Model Generation Market Value (US$ Mn) Forecast, Academic & Research Facilities by Technology, 2017‒2031

Table 29: Asia Pacific Mice Model Generation Market Value (US$ Mn) Forecast, Contract Research & Manufacturing Organizations by Technology, 2017‒2031

Table 30: Latin America Mice Model Generation Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 31: Latin America Mice Model Generation Market Value (US$ Mn) Forecast, by Technology, 2017‒2031

Table 32: Latin America Mice Model Generation Market Value (US$ Mn) Forecast, by End-user, 2017‒2031

Table 33: Latin America Mice Model Generation Market Value (US$ Mn) Forecast, Pharmaceutical Companies by Technology, 2017‒2031

Table 34: Latin America Mice Model Generation Market Value (US$ Mn) Forecast, Biotechnology Companies by Technology, 2017‒2031

Table 35: Latin America Mice Model Generation Market Value (US$ Mn) Forecast, Academic & Research Facilities by Technology, 2017‒2031

Table 36: Latin America Mice Model Generation Market Value (US$ Mn) Forecast, Contract Research & Manufacturing Organizations by Technology, 2017‒2031

Table 37: Middle East & Africa Mice Model Generation Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 38: Middle East & Africa Mice Model Generation Market Value (US$ Mn) Forecast, by Technology, 2017‒2031

Table 39: Middle East & Africa Mice Model Generation Market Value (US$ Mn) Forecast, by End-user, 2017‒2031

Table 40: Middle East & Africa Mice Model Generation Market Value (US$ Mn) Forecast, Pharmaceutical Companies by Technology, 2017‒2031

Table 41: Middle East & Africa Mice Model Generation Market Value (US$ Mn) Forecast, Biotechnology Companies by Technology, 2017‒2031

Table 42: Middle East & Africa Mice Model Generation Market Value (US$ Mn) Forecast, Academic & Research Facilities by Technology, 2017‒2031

Table 43: Middle East & Africa Mice Model Generation Market Value (US$ Mn) Forecast, Contract Research & Manufacturing Organizations by Technology, 2017‒2031

List of Figures

Figure 01: Global Mice Model Generation Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Mice Model Generation Market Value Share, by Technology, 2021

Figure 03: Global Mice Model Generation Market Value Share, by End-user, 2021

Figure 04: Global Mice Model Generation Market Value Share, by Region, 2021

Figure 05: Global Mice Model Generation Market Value Share Analysis, by Technology, 2021 and 2031

Figure 06: Global Mice Model Generation Market Attractiveness Analysis, by Technology, 2022–2031

Figure 07: Global Mice Model Generation Market Value (US$ Mn), by CRISPR Knockout, 2017‒2031

Figure 08: Global Mice Model Generation Market Value (US$ Mn), by CRISPR Knockin Mice, 2017‒2031

Figure 09: Global Mice Model Generation Market Value (US$ Mn), by Random Insertions, 2017‒2031

Figure 10: Global Mice Model Generation Market Value (US$ Mn), by Large, Targeted Insertions, 2017‒2031

Figure 11: Global Mice Model Generation Market Value (US$ Mn), by ES Cell Modification (homologous recombination), 2017‒2031

Figure 12: Global Mice Model Generation Market Value (US$ Mn), by Others, 2017‒2031

Figure 13: Global Mice Model Generation Market Value Share Analysis, by End-user, 2021 and 2031

Figure 14: Global Mice Model Generation Market Attractiveness Analysis, by End-user, 2022–2031

Figure 15: Global Mice Model Generation Market Value (US$ Mn), by Pharmaceutical Companies, 2017‒2031

Figure 16: Global Mice Model Generation Market Value (US$ Mn), by Biotechnology Companies, 2017‒2031

Figure 17: Global Mice Model Generation Market Value (US$ Mn), by Academic & Research Facilities, 2017‒2031

Figure 18: Global Mice Model Generation Market Value (US$ Mn), by Contract Research & Manufacturing Organizations, 2017‒2031

Figure 19: Global Mice Model Generation Market Value Share Analysis, by Region, 2021 and 2031

Figure 20: Global Mice Model Generation Market Attractiveness Analysis, by Region, 2022–2031

Figure 21: North America Mice Model Generation Market Value (US$ Mn) Forecast, 2017–2031

Figure 23: North America Mice Model Generation Market Attractiveness Analysis, by Country, 2022–2031

Figure 22: North America Mice Model Generation Market Value Share Analysis, by Country, 2021 and 2031

Figure 24: North America Mice Model Generation Market Value Share Analysis, by Technology, 2021 and 2031

Figure 25: North America Mice Model Generation Market Attractiveness Analysis, by Technology, 2022–2031

Figure 26: North America Mice Model Generation Market Value Share Analysis, by End-user, 2021 and 2031

Figure 27: North America Mice Model Generation Market Attractiveness Analysis, by End-user, 2022–2031

Figure 28: Europe Mice Model Generation Market Value (US$ Mn) Forecast, 2017–2031

Figure 30: Europe Mice Model Generation Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 29: Europe Mice Model Generation Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 31: Europe Mice Model Generation Market Value Share Analysis, by Technology, 2021 and 2031

Figure 32: Europe Mice Model Generation Market Attractiveness Analysis, by Technology, 2022–2031

Figure 33: Europe Mice Model Generation Market Value Share Analysis, by End-user, 2021 and 2031

Figure 34: Europe Mice Model Generation Market Attractiveness Analysis, by End-user, 2022–2031

Figure 35: Asia Pacific Mice Model Generation Market Value (US$ Mn) Forecast, 2017–2031

Figure 37: Asia Pacific Mice Model Generation Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 36: Asia Pacific Mice Model Generation Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 38: Asia Pacific Mice Model Generation Market Value Share Analysis, by Technology, 2021 and 2031

Figure 39: Asia Pacific Mice Model Generation Market Attractiveness Index, by Technology, 2022–2031

Figure 40: Asia Pacific Mice Model Generation Market Value Share Analysis, by End-user, 2021 and 2031

Figure 41: Asia Pacific Mice Model Generation Market Attractiveness Analysis, by End-user, 2022–2031

Figure 42: Latin America Mice Model Generation Market Value (US$ Mn) Forecast, 2017–2031

Figure 44: Latin America Mice Model Generation Market Attractiveness Analysis, by Country/Sub-region, 2021-2031

Figure 43: Latin America Mice Model Generation Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 45: Latin America Mice Model Generation Market Value Share Analysis, by Technology, 2021 and 2031

Figure 46: Latin America Mice Model Generation Market Attractiveness Analysis, by Technology, 2022–2031

Figure 47: Latin America Mice Model Generation Market Value Share Analysis, by End-user, 2021 and 2031

Figure 48: Latin America Mice Model Generation Market Attractiveness Analysis, by End-user, 2022–2031

Figure 49: Middle East & Africa Mice Model Generation Market Value (US$ Mn) Forecast, 2017–2031

Figure 51: Middle East & Africa Mice Model Generation Market Attractiveness Analysis, by Country/Sub-region, 2021-2031

Figure 50: Middle East & Africa Mice Model Generation Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 52: Middle East & Africa Mice Model Generation Market Value Share Analysis, by Technology, 2021 and 2031

Figure 53: Middle East & Africa Mice Model Generation Market Attractiveness Analysis, by Technology, 2022–2031

Figure 54: Middle East & Africa Mice Model Generation Market Value Share Analysis, by End-user, 2021 and 2031

Figure 55: Middle East & Africa Mice Model Generation Market Attractiveness Analysis, by End-user, 2022–2031