Analysts’ Viewpoint

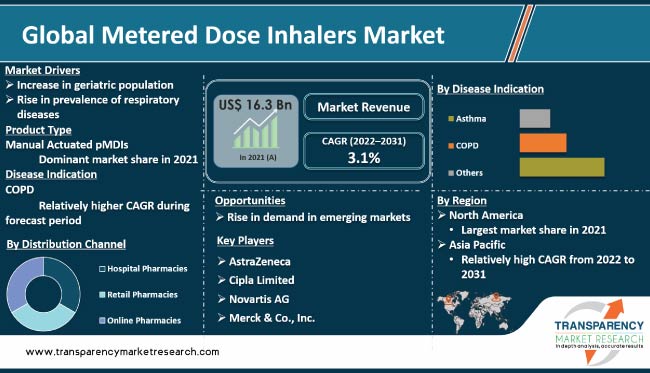

The global metered dose inhalers market is expected to expand significantly in the next few years due to increase in respiratory diseases, introduction of new & advanced products, and surge in the geriatric population. Rise in prevalence of respiratory diseases such as asthma and chronic obstructive pulmonary disease (COPD) globally is driving the demand for metered dose inhalers.

Introduction of new and advanced products, such as breath-actuated metered dose inhalers, which offer improved ease of use and patient compliance, present significant opportunities for manufacturers in the market. Companies are focusing on the introduction of new and advanced products in the industry. However, increase in competition from alternative drug delivery systems, such as dry powder inhalers, nebulizers, and soft mist inhalers, is likely to restrain the market. Furthermore, increasing regulation of metered dose inhalers could pose a challenge for market expansion.

Metered dose inhaler (MDI) is a device used to deliver medication directly to the lungs. The device is also known as MDI inhaler or pressurized metered dose inhaler. It is a small, handheld device that contains a pressurized canister of medication, such as a bronchodilator or steroid, and a mouthpiece through which a metered dose inhaler medication is inhaled.

MDIs are commonly used to treat conditions such as asthma, chronic obstructive pulmonary disease (COPD), and bronchospasm. These devices are convenient and easy to use, making them a popular choice for people who need to take medication regularly.

MDIs should be used correctly, as improper technique could result in less medication reaching the lungs and could be less effective. Overall, the metered dose inhaler is a widely used and an effective method of delivering medication directly to the lungs. With proper technique, it could help improve symptoms and manage respiratory conditions. However, these devices might not be suitable for all patients and alternative inhalation methods should be considered.

The COVID-19 pandemic had a significant impact on the MDIs market size. The business witnessed steady growth before the pandemic due to rise in prevalence of respiratory diseases such as asthma and COPD. However, the pandemic led to a shift in focus toward the treatment and management of COVID-19, which has affected the metered dose inhalers market demand. Need for MDIs was high during the initial stages of the pandemic, as patients with respiratory conditions sought to manage their symptoms at home.

Nevertheless, as the pandemic progressed and lockdowns were imposed, several hospitals and clinics temporarily closed or cut down their operations, leading to a decrease in demand. Additionally, supply chain disruptions and raw material shortages affected the production and availability of MDIs. Currently, the market for MDIs is showing signs of recovery, as economies begin to reopen and healthcare services return to normal operations. However, growth of the market is expected to decline due to the ongoing economic downturn and effects of the pandemic.

The MDI market is expected to grow in the next few years driven by rise in prevalence of respiratory diseases and development of new & innovative MDIs. However, the market is likely to be affected by the ongoing pandemic, including supply chain disruptions, economic downturns, and changes in healthcare service delivery. Companies in the business are adapting to these changes in order to be competitive.

Rise in prevalence of respiratory diseases is driving the demand for metered dose inhalers, as these are widely used and effective treatment option for these conditions. Inhalers are convenient and easy-to-use to deliver medication to the lungs, making them a popular choice among patients. MDIs deliver a precise dose of medication with each puff, helping to control symptoms and improve quality of life for patients.

According to the World Health Organization (WHO), 235 million people globally suffer from asthma, and 64 million people suffer from COPD. These numbers are expected to rise in the next few years, with asthma projected to affect around 400 million people by 2025 and COPD projected to be the third leading cause of death worldwide by 2030.

Respiratory diseases are becoming more prevalent due to increase in pollution and environmental changes. This is expected to drive the demand for metered dose inhalers. Studies have shown a direct correlation between air pollution and respiratory diseases, such as asthma and COPD, with exposure to air pollution being a significant risk factor for the development of these conditions.

Rise in prevalence of respiratory diseases, such as asthma and COPD, is a key driver of the metered dose inhalers market. Increase in the number of people affected by these conditions is likely to propel the demand for effective treatment options such as metered dose inhalers.

Introduction of new and advanced products, such as breath actuated metered dose inhalers, is propelling metered dose inhalers market progress. These types of inhaler are designed to release medication automatically when the patient inhales, eliminating the need for manual coordination between inhaling and pressing the inhaler. This improves patient compliance, as patients are less likely to make mistakes when using the inhaler.

According to a study published in the Journal of Asthma and Allergy, usage of breath actuated MDIs has improved patient compliance and reduced the number of inhaler-related errors compared to manual metered dose inhalers. Moreover, patients using breath-actuated metered dose inhalers had a higher rate of correct inhaler technique and were more likely to adhere to the treatment regimen.

Several companies have launched new and advanced breath-actuated metered dose inhalers in the past few years. In 2021, Vectura Group plc launched the VR647 breath-actuated metered-dose inhaler for the treatment of asthma and chronic obstructive pulmonary disease (COPD).

In terms of disease indication, the asthma segment accounted for the largest market share in 2021. This is ascribed to the high prevalence of asthma across the world. According to the World Health Organization (WHO), around 334 million people suffer from asthma globally. High prevalence of asthma leads to increase in demand for MDIs as a treatment option.

Asthma is a lifelong condition that requires ongoing management. However, there are significant unmet medical needs for effective and convenient treatment options. Advancement in technology is ascribed to the asthma segment's large market share. Technological advancements have led to development of more sophisticated and efficient MDIs, which has led to better treatment outcomes for asthma patients. This has increased demand for MDIs in the asthma segment.

Based on distribution channel, the retail pharmacies held largest global metered dose inhalers market share. Retail pharmacies are available in most neighborhoods, cities and towns, and are easily accessible to consumers. This makes it easy for consumers to purchase MDIs. Additionally, retail pharmacies are open for longer hours, even on weekends, which makes it easy for consumers to purchase MDIs at their convenience. These factors contribute to the segment's large market share.

North America is expected to dominate the global market during the forecast period. This is ascribed to presence of a large number of metered dose inhaler manufacturers and high rate of adoption of metered dose inhalers in the region. The U.S. is the largest market for metered dose inhalers in the region, followed by Canada. Rise in prevalence of respiratory diseases such as asthma and COPD and increase in geriatric population in the region are the major factors driving market development in North America.

Europe is expected to account for significant share of the industry during the forecast period. The region has a large patient population suffering from respiratory diseases. Increase in adoption of metered dose inhalers in combination with other drug delivery systems, such as dry powder inhalers, is expected to drive market progress in Europe.

The metered dose inhalers market in Asia Pacific is expected to grow at a rapid pace during the forecast period. Rise in prevalence of respiratory diseases and increase in the geriatric population are major factors propelling the market in the region. China, India, and Japan are major markets for metered dose inhalers in Asia Pacific.

The metered dose inhalers market report includes vital information about the key manufacturers operating globally. Companies focus on strategies such as product launches, divestiture, merger & acquisition (M&A), and partnerships to strengthen their position in the market. AstraZeneca, GlaxoSmithKline, Novartis AG, Merck & Co., Inc., Sanofi, Boehringer Ingelheim, Teva Pharmaceutical Industries Ltd., Mylan N.V., Hikma Pharmaceuticals plc, and Cipla Limited are the prominent players operating in the market.

Key players in the market have been profiled in the report on the basis of company overview, financial overview, strategies, portfolio, segments, and recent developments.

|

Attribute |

Detail |

|

Size in 2021 |

US$ 16.3 Bn |

|

Forecast (Value) in 2031 |

More than US$ 22.1 Bn |

|

Compound Annual Growth Rate (CAGR) |

3.1% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 16.3 Bn in 2021.

It is projected to reach a value of more than US$ 22.1 Bn by 2031.

The CAGR is anticipated to be 3.1% from 2022 to 2031.

Increase in geriatric population, rise in prevalence of respiratory diseases such as asthma & chronic obstructive pulmonary disease (COPD), and introduction of new and advanced products.

The asthma segment held the largest share of more than 56.0% in 2021.

North America is expected to account for significant share during the forecast period.

AstraZeneca, Cipla Limited, GlaxoSmithKline, Novartis AG, Merck & Co., Inc., Sanofi, Boehringer Ingelheim, Teva Pharmaceutical Industries Ltd., Mylan N.V., and Hikma Pharmaceuticals plc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Metered Dose Inhalers Market

4. Market Overview

4.1. Introduction

4.1.1. Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Metered Dose Inhalers Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

4.5. Porter’s Five Forces Analysis

5. Key Insights

5.1. Respiratory Disease Epidemiology

5.2. Technological Advancements

5.3. Key Mergers & Acquisitions

5.4. COVID-19 Pandemic Impact on Industry (value chain and short/mid/long term impact)

6. Global Metered Dose Inhalers Market Analysis and Forecast, by Product Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product Type, 2017–2031

6.3.1. Manual Actuated pMDIs

6.3.2. Breath Actuated pMDIs

6.4. Market Attractiveness Analysis, by Product Type

7. Global Metered Dose Inhalers Market Analysis and Forecast, by Disease Indication

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Disease Indication, 2017–2031

7.3.1. Asthma

7.3.2. COPD

7.3.3. Others

7.4. Market Attractiveness Analysis, by Disease Indication

8. Global Metered Dose Inhalers Market Analysis and Forecast, by Distribution Channel

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by Distribution Channel, 2017–2031

8.3.1. Hospital Pharmacies

8.3.2. Retail Pharmacies

8.3.3. Online Pharmacies

8.4. Market Attractiveness Analysis, by Distribution Channel

9. Global Metered Dose Inhalers Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region, 2017–2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Metered Dose Inhalers Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product Type, 2017–2031

10.2.1. Manual Actuated pMDIs

10.2.2. Breath Actuated pMDIs

10.3. Market Value Forecast, by Disease Indication, 2017–2031

10.3.1. Asthma

10.3.2. COPD

10.3.3. Others

10.4. Market Value Forecast, by Distribution Channel, 2017–2031

10.4.1. Hospital Pharmacies

10.4.2. Retail Pharmacies

10.4.3. Online Pharmacies

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product Type

10.6.2. By Disease Indication

10.6.3. By Distribution Channel

10.6.4. By Country

11. Europe Metered Dose Inhalers Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product Type, 2017–2031

11.2.1. Manual Actuated pMDIs

11.2.2. Breath Actuated pMDIs

11.3. Market Value Forecast, by Disease Indication, 2017–2031

11.3.1. Asthma

11.3.2. COPD

11.3.3. Others

11.4. Market Value Forecast, by Distribution Channel, 2017–2031

11.4.1. Hospital Pharmacies

11.4.2. Retail Pharmacies

11.4.3. Online Pharmacies

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product Type

11.6.2. By Disease Indication

11.6.3. By Distribution Channel

11.6.4. By Country/Sub-region

12. Asia Pacific Metered Dose Inhalers Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product Type, 2017–2031

12.2.1. Manual Actuated pMDIs

12.2.2. Breath Actuated pMDIs

12.3. Market Value Forecast, by Disease Indication, 2017–2031

12.3.1. Asthma

12.3.2. COPD

12.3.3. Others

12.4. Market Value Forecast, by Distribution Channel, 2017–2031

12.4.1. Hospital Pharmacies

12.4.2. Retail Pharmacies

12.4.3. Online Pharmacies

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product Type

12.6.2. By Disease Indication

12.6.3. By Distribution Channel

12.6.4. By Country/Sub-region

13. Latin America Metered Dose Inhalers Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product Type, 2017–2031

13.2.1. Manual Actuated pMDIs

13.2.2. Breath Actuated pMDIs

13.3. Market Value Forecast, by Disease Indication, 2017–2031

13.3.1. Asthma

13.3.2. COPD

13.3.3. Others

13.4. Market Value Forecast, by Distribution Channel, 2017–2031

13.4.1. Hospital Pharmacies

13.4.2. Retail Pharmacies

13.4.3. Online Pharmacies

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product Type

13.6.2. By Disease Indication

13.6.3. By Distribution Channel

13.6.4. By Country/Sub-region

14. Middle East & Africa Metered Dose Inhalers Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product Type, 2017–2031

14.2.1. Manual Actuated pMDIs

14.2.2. Breath Actuated pMDIs

14.3. Market Value Forecast, by Disease Indication, 2017–2031

14.3.1. Asthma

14.3.2. COPD

14.3.3. Others

14.4. Market Value Forecast, by Distribution Channel, 2017–2031

14.4.1. Hospital Pharmacies

14.4.2. Retail Pharmacies

14.4.3. Online Pharmacies

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Product Type

14.6.2. By Disease Indication

14.6.3. By Distribution Channel

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company (2021)

15.3. Company Profiles

15.3.1. AstraZeneca

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Product Type Portfolio

15.3.1.3. Financial Overview

15.3.1.4. SWOT Analysis

15.3.1.5. Strategic Overview

15.3.2. Cipla Limited

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Product Type Portfolio

15.3.2.3. Financial Overview

15.3.2.4. SWOT Analysis

15.3.2.5. Strategic Overview

15.3.3. Novartis AG

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Product Type Portfolio

15.3.3.3. Financial Overview

15.3.3.4. SWOT Analysis

15.3.3.5. Strategic Overview

15.3.4. Merck & Co., Inc.

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Product Type Portfolio

15.3.4.3. Financial Overview

15.3.4.4. SWOT Analysis

15.3.4.5. Strategic Overview

15.3.5. Sanofi

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Product Type Portfolio

15.3.5.3. Financial Overview

15.3.5.4. SWOT Analysis

15.3.6. Boehringer Ingelheim

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Product Type Portfolio

15.3.6.3. Financial Overview

15.3.6.4. SWOT Analysis

15.3.7. Teva Pharmaceutical Industries Ltd.

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Product Type Portfolio

15.3.7.3. Financial Overview

15.3.7.4. SWOT Analysis

15.3.8. Mylan N.V.

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Product Type Portfolio

15.3.8.3. Financial Overview

15.3.8.4. SWOT Analysis

15.3.9. Hikma Pharmaceuticals plc

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Product Type Portfolio

15.3.9.3. Financial Overview

15.3.10. GlaxoSmithKline

15.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.2. Product Type Portfolio

15.3.10.3. Financial Overview

List of Tables

Table 01: Global Metered Dose Inhalers Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 02: Global Metered Dose Inhalers Market Value (US$ Mn) Forecast, by Disease Indication, 2017–2031

Table 03: Global Metered Dose Inhalers Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 04: Global Metered Dose Inhalers Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Metered Dose Inhalers Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 06: North America Metered Dose Inhalers Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 07: North America Metered Dose Inhalers Market Value (US$ Mn) Forecast, by Disease Indication, 2017–2031

Table 08: North America Metered Dose Inhalers Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 09: Europe Metered Dose Inhalers Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 10: Europe Metered Dose Inhalers Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 11: Europe Metered Dose Inhalers Market Value (US$ Mn) Forecast, by Disease Indication, 2017–2031

Table 12: Europe Metered Dose Inhalers Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 13: Asia Pacific Metered Dose Inhalers Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Asia Pacific Metered Dose Inhalers Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 15: Asia Pacific Metered Dose Inhalers Market Value (US$ Mn) Forecast, by Disease Indication, 2017–2031

Table 16: Asia Pacific Metered Dose Inhalers Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 17: Latin America Metered Dose Inhalers Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 18: Latin America Metered Dose Inhalers Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 19: Latin America Metered Dose Inhalers Market Value (US$ Mn) Forecast, by Disease Indication, 2017–2031

Table 20: Latin America Metered Dose Inhalers Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 21: Middle East & Africa Metered Dose Inhalers Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 22: Middle East & Africa Metered Dose Inhalers Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 23: Middle East & Africa Metered Dose Inhalers Market Value (US$ Mn) Forecast, by Disease Indication, 2017–2031

Table 24: Middle East & Africa Metered Dose Inhalers Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

List of Figures

Figure 01: Global Metered Dose Inhalers Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Metered Dose Inhalers Market Value Share, by Product Type, 2021

Figure 03: Global Metered Dose Inhalers Market Value Share, by Distribution Channel, 2021

Figure 04: Global Metered Dose Inhalers Market Value Share, by Disease Indication, 2021

Figure 05: Global Metered Dose Inhalers Market Value Share, by Region, 2021

Figure 06: Global Metered Dose Inhalers Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 07: Global Metered Dose Inhalers Market Value (US$ Mn), by Manual Actuated pMDIs, 2017–2031

Figure 08: Global Metered Dose Inhalers Market Value (US$ Mn), by Breath Actuated pMDIs, 2017–2031

Figure 09: Global Metered Dose Inhalers Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 10: Global Metered Dose Inhalers Market Value Share Analysis, by Disease Indication, 2021 and 2031

Figure 11: Global Metered Dose Inhalers Market Value (US$ Mn), by Asthma, 2017–2031

Figure 12: Global Metered Dose Inhalers Market Value (US$ Mn), by COPD, 2017–2031

Figure 13: Global Metered Dose Inhalers Market Value (US$ Mn), by Others, 2017–2031

Figure 14: Global Metered Dose Inhalers Market Attractiveness Analysis, by Disease Indication, 2022–2031

Figure 15: Global Metered Dose Inhalers Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 16: Global Metered Dose Inhalers Market Value (US$ Mn), by Hospital Pharmacies, 2017–2031

Figure 17: Global Metered Dose Inhalers Market Value (US$ Mn), by Retail Pharmacies, 2017–2031

Figure 18: Global Metered Dose Inhalers Market Value (US$ Mn), by Online Pharmacies, 2017–2031

Figure 19: Global Metered Dose Inhalers Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 20: Global Metered Dose Inhalers Market Value Share Analysis, by Region, 2021 and 2031

Figure 21: Global Metered Dose Inhalers Market Attractiveness Analysis, by Region, 2022-2031

Figure 22: North America Metered Dose Inhalers Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 23: North America Metered Dose Inhalers Market Value Share (%), by Country, 2021 and 2031

Figure 24: North America Metered Dose Inhalers Market Attractiveness Analysis, by Country, 2022–2031

Figure 25: North America Metered Dose Inhalers Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 26: North America Metered Dose Inhalers Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 27: North America Metered Dose Inhalers Market Value Share Analysis, by Disease Indication, 2021 and 2031

Figure 28: North America Metered Dose Inhalers Market Attractiveness Analysis, by Disease Indication, 2022–2031

Figure 29: North America Metered Dose Inhalers Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 30: North America Metered Dose Inhalers Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 31: Europe Metered Dose Inhalers Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 32: Europe Metered Dose Inhalers Market Value Share (%), by Country/Sub-region, 2021 and 2031

Figure 33: Europe Metered Dose Inhalers Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 34: Europe Metered Dose Inhalers Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 35: Europe Metered Dose Inhalers Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 36: Europe Metered Dose Inhalers Market Value Share Analysis, by Disease Indication, 2021 and 2031

Figure 37: Europe Metered Dose Inhalers Market Attractiveness Analysis, by Disease Indication, 2022–2031

Figure 38: Europe Metered Dose Inhalers Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 39: Europe Metered Dose Inhalers Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 40: Asia Pacific Metered Dose Inhalers Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 41: Asia Pacific Metered Dose Inhalers Market Value Share (%), by Country/Sub-region, 2021 and 2031

Figure 42: Asia Pacific Metered Dose Inhalers Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 43: Asia Pacific Metered Dose Inhalers Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 44: Asia Pacific Metered Dose Inhalers Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 45: Asia Pacific Metered Dose Inhalers Market Value Share Analysis, by Disease Indication, 2021 and 2031

Figure 46: Asia Pacific Metered Dose Inhalers Market Attractiveness Analysis, by Disease Indication, 2022–2031

Figure 47: Asia Pacific Metered Dose Inhalers Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 48: Asia Pacific Metered Dose Inhalers Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 49: Latin America Metered Dose Inhalers Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 50: Latin America Metered Dose Inhalers Market Value Share (%), by Country/Sub-region, 2021 and 2031

Figure 51: Latin America Metered Dose Inhalers Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 52: Latin America Metered Dose Inhalers Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 53: Latin America Metered Dose Inhalers Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 54: Latin America Metered Dose Inhalers Market Value Share Analysis, by Disease Indication, 2021 and 2031

Figure 55: Latin America Metered Dose Inhalers Market Attractiveness Analysis, by Disease Indication, 2022–2031

Figure 56: Latin America Metered Dose Inhalers Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 57: Latin America Metered Dose Inhalers Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 58: Middle East & Africa Metered Dose Inhalers Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 59: Middle East & Africa Metered Dose Inhalers Market Value Share (%), by Country/Sub-region, 2021 and 2031

Figure 60: Middle East & Africa Metered Dose Inhalers Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 61: Middle East & Africa Metered Dose Inhalers Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 62: Middle East & Africa Metered Dose Inhalers Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 63: Middle East & Africa Metered Dose Inhalers Market Value Share Analysis, by Disease Indication, 2021 and 2031

Figure 64: Middle East & Africa Metered Dose Inhalers Market Attractiveness Analysis, by Disease Indication, 2022–2031

Figure 65: Middle East & Africa Metered Dose Inhalers Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 66: Middle East & Africa Metered Dose Inhalers Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 67: Global Metered Dose Inhalers Market Share Analysis, by Company, 2021