Metal IBCs are made up of stainless steel or carbon steel and are used for cross border bulk transportation. Metal IBCs have emerged as a crucial element of growth of cross border trade practices especially for end users such as industrial chemicals. Metal IBC have led to significant minimization of snapping and spillage cases of the bulk liquids due to which they have gained immense strategic significance. Additionally, the global metal IBC market is driven by the increasing manufacturing sector output and trade activities that requires the need of containers for exports and imports.

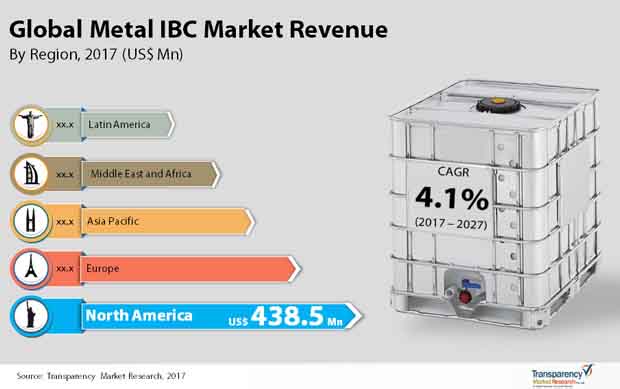

The global metal IBC market is envisaged to witness growth at a CAGR of 4.1% for the forecast period 2017-2027. In 2017, the market had secured a valuation of US$ 1,334.4 Mn. However, by 2027, it is envisioned to reach US$ 1,995.0 Mn. Containerization has led to significant low costs for the shipping industry which has further propelled the demand of the global metal IBC market.

A key trend prevailing among the multinational players operating in the global metal IBC market is the use of RFID technology to track and trace the IBCs to save cost as well as enhance customer service.

On the basis of material type, the global metal IBC market is segmented into stainless steel and carbon steel. Stainless steel has high market share and growth rate as compared to carbon steel due to its better wear and tear properties as compared to the carbon steel IBCs.

On the basis of design type, the global metal IBC market is segmented into cubical and cylindrical wherein both the segments are further sub segmented into flat bottom and conical bottom. Cubical flat bottom segment is expected to account for a major market share as compared to the cylindrical segment.

Among the various capacity types, the 500-1000 liters and 1000-1500 liters segment is expected to lead the global market together accounting for a market share of more than 50% by the end of 2027

On the basis of content type, the global metal IBC market is segmented into liquids and solids and semi solids segment. Liquid segment accounts for a major revenue share as the intermediate bulk containers are mainly employed for the liquid transportation. Liquid segment is expected to account for a market revenue share of more than 85% by the end of 2027.

On the basis of technology, the metal IBC market is segmented into aseptic and non-aseptic technology. Aseptic technology is forecasted to continue its dominance during 2017-2027 expanding at a CAGR of 4.2%.

Global metal IBC market on the basis of end use is segmented into industrial chemicals, paints, inks, and dyes, food and beverages, petroleum and lubricants, waste disposal/recycling and silage, building and construction, and pharmaceutical and others. Industrial chemicals segment accounts for a major chunk in the global metal IBC market. Among the industrial chemicals sub segment, metal IBC are mainly used for the transportation of hazardous chemicals. The hazardous chemicals segment is expected to expand at a CAGR of 4.5% during the forecast period.

Lastly, on the basis of region, the Global Metal IBCs market has been segmented into North America, Latin America, Middle East & Africa, Europe, and Asia Pacific. North America Metal IBCs market is estimated to constitute the highest market share in the global region followed by Europe. Metal IBCs market in Asia Pacific is expected to witness comparatively higher CAGR over the forecast period, 2017-2027. However, the rising demand for advanced transportation options for emerging end users such as the food and beverage industry and waste disposal is likely to enable steady dominance of North America in the global metal IBC market in the coming years.

Leading players in the global metal IBC market include Thielmann US LLC, Hoover Ferguson Group, Precision IBC, Inc., Snyder Industries Inc., Custom Metalcraft Inc., Time Technoplast Ltd., Metano IBC Services Inc., Sharpsville Container Corporation, Automationstechnik GmbH, Yenchen Machinery Co. Ltd., Transtainer, Pensteel Ltd., Titan IBC, Plymouth Industries, Hawman Container Services, CLA Containers Ltd., SYSPAL Inc., La Garde, and Acura Group. The global metal IBC market is likely to be intensely competitive over the coming years due to growing commercial prospects of the sector and the rising number of players carving out sizable shares in the global market.

Flourishing Cross Border Businesses to Boost Metal IBC Market

Metal IBCs consist of carbon steel or stainless steel and they are utilized for bulk transportation across borders. Metal IBCs have come up as a key component in the flourishing cross-border trade activities, particularly for various end-users like industrial chemicals. Metal IBC has made significant contributions toward considerable minimization of incidences of bulk liquid snapping and spillage. This has helped them acquire tremendous strategic value. In addition to that, the global metal IBC market is primarily driven by augmented trade activities and rising production in the manufacturing sector. These activities involve the need for vessels for the purpose of exports and imports activities.

For the shipping sector, containerization has resulted in considerable low costs, which is further likely to drive the growth of the global metal IBC market. The utilization of RFID technology for the purpose of tracing and tracking IBCs has given a boost to customer service and save costs. This factor has come up as a popular trend amongst the players operating in the global metal IBC industry.

Strategic Collaborations are Likely to Widen Scope of Growth of the Market

Numerous large-scale businesses have teamed up with transport and agencies for the purpose of transportation of their goods, which includes liquids as well. Major vendors to cement their footprint in the global IBC metal industry are embracing different strategic alliances. Collaboration with transport networks comprise a few of the innovative tactics embraced by vendors in the global metal IBC market. Such moves are taken to gain an edge over competitors in the industry. Given the arrival of several local players who emphasize on offering high-quality products, the competition between players is intensifying. These companies are also focusing hard on bringing in new clients to their companies to snatch a lead over their rivals. Such high competition in the market is likely to foster growth of the global metal IBC market in the near future.

1. Executive Summary

2. Market Introduction

2.1. Market Definition

2.2. Market Taxonomy

3. Global Metal IBCs Market Analysis

3.1. Parent Market Overview

3.1.1. Global Bulk Packaging Market Outlook

3.1.2. Global Industrial Packaging Market Outlook

3.2. Macro-Economic Overview

3.2.1. Global Steel Production Outlook

3.2.2. Manufacturing Sector Value Added

3.3. Market Size (US$ Mn) and Forecast

3.3.1. Market Size and Y-o-Y Growth

3.3.2. Absolute $ Opportunity

3.4. Market Overview

3.4.1. Value Chain

3.4.2. List of Active Participants

3.4.2.1. Material Suppliers

3.4.2.2. Manufacturers

3.4.2.3. End User Companies

4. Market Dynamics

4.1. Drivers

4.1.1. Supply Side

4.1.2. Demand Side

4.2. Restraints

4.3. Opportunity

4.4. Trends

4.4.1. Business Level Trends

4.4.2. Technology Level Trends

5. Global Metal IBCs Market Analysis and Forecast, By Material Type

5.1. Introduction

5.1.1. Basis Point Share (BPS) Analysis by Material Type

5.1.2. Y-o-Y Growth Projections by Material Type

5.2. Market Size (US$ Mn) and Volume (Units) Forecast By Material Type

5.2.1. Carbon Steel

5.2.2. Stainless Steel

5.3. Market Attractiveness Analysis by Material Type

5.4. Prominent Trends

6. Global Metal IBCs Market Analysis and Forecast, By Capacity Type

6.1. Introduction

6.1.1. Basis Point Share (BPS) Analysis by Capacity

6.1.2. Y-o-Y Growth Projections by Capacity

6.2. Market Size (US$ Mn) and Volume (Units) Forecast By Capacity

6.2.1. Up to 500 Liters

6.2.2. 500 to 1000 Liters

6.2.3. 1000 to 1500 Liters

6.2.4. 1500 to 2000 Liters

6.2.5. Above 2000 Liters

6.3. Market Attractiveness Analysis by Capacity

6.4. Prominent Trends

7. Global Metal IBCs Market Analysis and Forecast, By Design Type

7.1. Introduction

7.1.1. Basis Point Share (BPS) Analysis by Design Type

7.1.2. Y-o-Y Growth Projections by Design Type

7.2. Market Size (US$ Mn) and Volume (Units) Forecast By Design Type

7.2.1. Cubic

7.2.1.1. Flat Bottom

7.2.1.2. Conical Bottom

7.2.2. Cylindrical

7.2.2.1. Flat Bottom

7.2.2.2. Conical Bottom

7.3. Market Attractiveness Analysis by Design Type

7.4. Prominent Trends

8. Global Metal IBCs Market Analysis and Forecast, By Content

8.1. Introduction

8.1.1. Basis Point Share (BPS) Analysis by Content

8.1.2. Y-o-Y Growth Projections by Content

8.2. Market Size (US$ Mn) and Volume (Units) Forecast By Content

8.2.1. Liquid

8.2.2. Solids & Semi solids

8.3. Market Attractiveness Analysis by Content

8.4. Prominent Trends

9. Global Metal IBCs Market Analysis and Forecast, By Technology Type

9.1. Introduction

9.1.1. Basis Point Share (BPS) Analysis by Technology Type

9.1.2. Y-o-Y Growth Projections by Technology Type

9.2. Market Size (US$ Mn) and Volume (Units) Forecast By Technology Type

9.2.1. Aseptic

9.2.2. Non Aseptic

9.3. Market Attractiveness Analysis by Technology Type

9.4. Prominent Trends

10. Global Metal IBCs Market Analysis and Forecast, By End Use

10.1. Introduction

10.1.1. Basis Point Share (BPS) Analysis by End Use

10.1.2. Y-o-Y Growth Projections by End Use

10.2. Market Size (US$ Mn) and Volume (Units) Forecast By End Use

10.2.1. Industrial Chemicals

10.2.1.1. Hazardous

10.2.1.2. Non Hazardous

10.2.2. Petroleum and Lubricants

10.2.3. Paints, Inks and Dyes

10.2.4. Food and Food Ingredients

10.2.5. Waste Disposal/Recycling and Silage

10.2.6. Building and Construction

10.2.7. Pharmaceuticals & Others

10.3. Market Attractiveness Analysis by End Use

10.4. Prominent Trends

11. Global Metal IBCs Market Analysis and Forecast, By Region

11.1. Introduction

11.1.1. Basis Point Share (BPS) Analysis by Region

11.1.2. Y-o-Y Growth Projections by Region

11.2. Market Size (US$ Mn) and Volume (Units) Forecast By Region

11.2.1. North America

11.2.2. Latin America

11.2.3. Europe

11.2.4. Asia Pacific (APAC)

11.2.5. Middle East & Africa (MEA)

11.3. Market Attractiveness Analysis by Region

12. North America Metal IBCs Market Analysis and Forecast

12.1. Introduction

12.1.1. Basis Point Share (BPS) Analysis by Country

12.1.2. Y-o-Y Growth Projections by Country

12.2. Market Size (US$ Mn) and Volume (Units) Forecast By Country

12.2.1. U.S.

12.2.2. Canada

12.3. Market Size (US$ Mn) and Volume (Units) Forecast By Material Type

12.3.1. Carbon Steel

12.3.2. Stainless Steel

12.4. Market Size (US$ Mn) and Volume (Units) Forecast By Capacity

12.4.1. Up to 500 Liters

12.4.2. 500 to 1000 Liters

12.4.3. 1000 to 1500 Liters

12.4.4. 1500 to 2000 Liters

12.4.5. Above 2000 Liters

12.5. Market Size (US$ Mn) and Volume (Units) Forecast By Product Type

12.5.1. Cubic

12.5.1.1. Flat Bottom

12.5.1.2. Conical Bottom

12.5.2. Cylindrical

12.5.2.1. Flat Bottom

12.5.2.2. Conical Bottom

12.6. Market Size (US$ Mn) and Volume (Units) Forecast By Content

12.6.1. Liquid

12.6.2. Solids & Semi solids

12.7. Market Size (US$ Mn) and Volume (Units) Forecast By Technology Type

12.7.1. Aseptic

12.7.2. Non Aseptic

12.8. Market Size (US$ Mn) and Volume (Units) Forecast By End Use

12.8.1. Industrial Chemicals

12.8.1.1. Hazardous

12.8.1.2. Non Hazardous

12.8.2. Petroleum and Lubricants

12.8.3. Paints, Inks and Dyes

12.8.4. Food and Food Ingredients

12.8.5. Waste Disposal/Recycling and Silage

12.8.6. Building and Construction

12.8.7. Pharmaceuticals & Others

12.9. Market Attractiveness Analysis

12.9.1. By Country

12.9.2. By Material Type

12.9.3. By Capacity Type

12.9.4. By Design Type

12.9.5. By Content Type

12.9.6. By Technology Type

12.9.7. By End Use

12.10. Prominent Trends

12.11. Drivers and Restraints: Impact Analysis

13. Europe Metal IBCs Market Analysis and Forecast

13.1. Introduction

13.1.1. Basis Point Share (BPS) Analysis by Country

13.1.2. Y-o-Y Growth Projections by Country

13.2. Market Size (US$ Mn) and Volume (Units) Forecast By Country

13.2.1. Germany

13.2.2. Spain

13.2.3. Italy

13.2.4. France

13.2.5. U.K.

13.2.6. BENELUX

13.2.7. Russia

13.2.8. Rest of Europe

13.3. Market Size (US$ Mn) and Volume (Units) Forecast By Material Type

13.3.1. Carbon Steel

13.3.2. Stainless Steel

13.4. Market Size (US$ Mn) and Volume (Units) Forecast By Capacity

13.4.1. Up to 500 Liters

13.4.2. 500 to 1000 Liters

13.4.3. 1000 to 1500 Liters

13.4.4. 1500 to 2000 Liters

13.4.5. Above 2000 Liters

13.5. Market Size (US$ Mn) and Volume (Units) Forecast By Product Type

13.5.1. Cubic

13.5.1.1. Flat Bottom

13.5.1.2. Conical Bottom

13.5.2. Cylindrical

13.5.2.1. Flat Bottom

13.5.2.2. Conical Bottom

13.6. Market Size (US$ Mn) and Volume (Units) Forecast By Content

13.6.1. Liquid

13.6.2. Solids & Semi solids

13.7. Market Size (US$ Mn) and Volume (Units) Forecast By Technology Type

13.7.1. Aseptic

13.7.2. Non Aseptic

13.8. Market Size (US$ Mn) and Volume (Units) Forecast By End Use

13.8.1. Industrial Chemicals

13.8.1.1. Hazardous

13.8.1.2. Non Hazardous

13.8.2. Petroleum and Lubricants

13.8.3. Paints, Inks and Dyes

13.8.4. Food and Food Ingredients

13.8.5. Waste Disposal/Recycling and Silage

13.8.6. Building and Construction

13.8.7. Pharmaceuticals & Others

13.9. Market Attractiveness Analysis

13.9.1. By Country

13.9.2. By Material Type

13.9.3. By Capacity Type

13.9.4. By Design Type

13.9.5. By Content Type

13.9.6. By Technology Type

13.9.7. By End Use

13.10. Prominent Trends

14. Asia Pacific Metal IBCs Market Analysis and Forecast

14.1. Introduction

14.1.1. Basis Point Share (BPS) Analysis by Country

14.1.2. Y-o-Y Growth Projections by Country

14.2. Market Size (US$ Mn) and Volume (Units) Forecast By Country

14.2.1. China

14.2.2. India

14.2.3. Japan

14.2.4. ASEAN

14.2.5. Australia and New Zealand

14.2.6. Rest of APAC

14.3. Market Size (US$ Mn) and Volume (Units) Forecast By Material Type

14.3.1. Carbon Steel

14.3.2. Stainless Steel

14.4. Market Size (US$ Mn) and Volume (Units) Forecast By Capacity

14.4.1. Up to 500 Liters

14.4.2. 500 to 1000 Liters

14.4.3. 1000 to 1500 Liters

14.4.4. 1500 to 2000 Liters

14.4.5. Above 2000 Liters

14.5. Market Size (US$ Mn) and Volume (Units) Forecast By Product Type

14.5.1. Cubic

14.5.1.1. Flat Bottom

14.5.1.2. Conical Bottom

14.5.2. Cylindrical

14.5.2.1. Flat Bottom

14.5.2.2. Conical Bottom

14.6. Market Size (US$ Mn) and Volume (Units) Forecast By Content

14.6.1. Liquid

14.6.2. Solids & Semi solids

14.7. Market Size (US$ Mn) and Volume (Units) Forecast By Technology Type

14.7.1. Aseptic

14.7.2. Non Aseptic

14.8. Market Size (US$ Mn) and Volume (Units) Forecast By End Use

14.8.1. Industrial Chemicals

14.8.1.1. Hazardous

14.8.1.2. Non Hazardous

14.8.2. Petroleum and Lubricants

14.8.3. Paints, Inks and Dyes

14.8.4. Food and Food Ingredients

14.8.5. Waste Disposal/Recycling and Silage

14.8.6. Building and Construction

14.8.7. Pharmaceuticals & Others

14.9. Market Attractiveness Analysis

14.9.1. By Country

14.9.2. By Material Type

14.9.3. By Capacity Type

14.9.4. By Design Type

14.9.5. By Content Type

14.9.6. By Technology Type

14.9.7. By End Use

14.10. Prominent Trends

15. Latin America Metal IBCs Market Analysis and Forecast

15.1. Introduction

15.1.1. Basis Point Share (BPS) Analysis by Country

15.1.2. Y-o-Y Growth Projections by Country

15.2. Market Size (US$ Mn) and Volume (Units) Forecast By Country

15.2.1. Brazil

15.2.2. Mexico

15.2.3. Rest of Latin America

15.3. Market Size (US$ Mn) and Volume (Units) Forecast By Material Type

15.3.1. Carbon Steel

15.3.2. Stainless Steel

15.4. Market Size (US$ Mn) and Volume (Units) Forecast By Capacity

15.4.1. Up to 500 Liters

15.4.2. 500 to 1000 Liters

15.4.3. 1000 to 1500 Liters

15.4.4. 1500 to 2000 Liters

15.4.5. Above 2000 Liters

15.5. Market Size (US$ Mn) and Volume (Units) Forecast By Product Type

15.5.1. Cubic

15.5.1.1. Flat Bottom

15.5.1.2. Conical Bottom

15.5.2. Cylindrical

15.5.2.1. Flat Bottom

15.5.2.2. Conical Bottom

15.6. Market Size (US$ Mn) and Volume (Units) Forecast By Content

15.6.1. Liquid

15.6.2. Solids & Semi solids

15.7. Market Size (US$ Mn) and Volume (Units) Forecast By Technology Type

15.7.1. Aseptic

15.7.2. Non Aseptic

15.8. Market Size (US$ Mn) and Volume (Units) Forecast By End Use

15.8.1. Industrial Chemicals

15.8.1.1. Hazardous

15.8.1.2. Non Hazardous

15.8.2. Petroleum and Lubricants

15.8.3. Paints, Inks and Dyes

15.8.4. Food and Food Ingredients

15.8.5. Waste Disposal/Recycling and Silage

15.8.6. Building and Construction

15.8.7. Pharmaceuticals & Others

15.9. Market Attractiveness Analysis

15.9.1. By Country

15.9.2. By Material Type

15.9.3. By Capacity Type

15.9.4. By Design Type

15.9.5. By Content Type

15.9.6. By Technology Type

15.9.7. By End Use

15.10. Prominent Trends

16. Middle East and Africa (MEA) Metal IBCs Market Analysis and Forecast

16.1. Introduction

16.1.1. Basis Point Share (BPS) Analysis by Country

16.1.2. Y-o-Y Growth Projections by Country

16.2. Market Size (US$ Mn) and Volume (Units) Forecast By Country

16.2.1. North Africa

16.2.2. South Africa

16.2.3. GCC countries

16.2.4. Rest of MEA

16.3. Market Size (US$ Mn) and Volume (Units) Forecast By Material Type

16.3.1. Carbon Steel

16.3.2. Stainless Steel

16.4. Market Size (US$ Mn) and Volume (Units) Forecast By Capacity

16.4.1. Up to 500 Liters

16.4.2. 500 to 1000 Liters

16.4.3. 1000 to 1500 Liters

16.4.4. 1500 to 2000 Liters

16.4.5. Above 2000 Liters

16.5. Market Size (US$ Mn) and Volume (Units) Forecast By Product Type

16.5.1. Cubic

16.5.1.1. Flat Bottom

16.5.1.2. Conical Bottom

16.5.2. Cylindrical

16.5.2.1. Flat Bottom

16.5.2.2. Conical Bottom

16.6. Market Size (US$ Mn) and Volume (Units) Forecast By Content

16.6.1. Liquid

16.6.2. Solids & Semi solids

16.7. Market Size (US$ Mn) and Volume (Units) Forecast By Technology Type

16.7.1. Aseptic

16.7.2. Non Aseptic

16.8. Market Size (US$ Mn) and Volume (Units) Forecast By End Use

16.8.1. Industrial Chemicals

16.8.1.1. Hazardous

16.8.1.2. Non Hazardous

16.8.2. Petroleum and Lubricants

16.8.3. Paints, Inks and Dyes

16.8.4. Food and Food Ingredients

16.8.5. Waste Disposal/Recycling and Silage

16.8.6. Building and Construction

16.8.7. Pharmaceuticals & Others

16.9. Market Attractiveness Analysis

16.9.1. By Country

16.9.2. By Material Type

16.9.3. By Capacity Type

16.9.4. By Design Type

16.9.5. By Content Type

16.9.6. By Technology Type

16.9.7. By End Use

16.10. Prominent Trends

17. Competitive Landscape

17.1. Competition Dashboard

17.2. Company Profiles (Overview, Financials, Strategy, Recent, Developments)

17.3. Players

17.3.1. Thielmann US LLC

17.3.1.1. Overview

17.3.1.2. Financials

17.3.1.3. Strategy

17.3.1.4. Recent Developments

17.3.1.5. SWOT analysis

17.3.2. Hoover Ferguson Group

17.3.2.1. Overview

17.3.2.2. Financials

17.3.2.3. Strategy

17.3.2.4. Recent Developments

17.3.2.5. SWOT analysis

17.3.3. Snyder Industries, Inc.

17.3.3.1. Overview

17.3.3.2. Financials

17.3.3.3. Strategy

17.3.3.4. Recent Developments

17.3.3.5. SWOT analysis

17.3.4. Precision IBC, Inc.

17.3.4.1. Overview

17.3.4.2. Financials

17.3.4.3. Strategy

17.3.4.4. Recent Developments

17.3.4.5. SWOT analysis

17.3.5. Time Technoplast Ltd.

17.3.5.1. Overview

17.3.5.2. Financials

17.3.5.3. Strategy

17.3.5.4. Recent Developments

17.3.5.5. SWOT analysis

17.3.6. Custom Metalcraft, Inc.

17.3.6.1. Overview

17.3.6.2. Financials

17.3.6.3. Strategy

17.3.6.4. Recent Developments

17.3.6.5. SWOT analysis

17.3.7. Metano IBC Services, Inc.

17.3.7.1. Overview

17.3.7.2. Financials

17.3.7.3. Strategy

17.3.7.4. Recent Developments

17.3.7.5. SWOT analysis

17.3.8. Automationstechnik GmbH

17.3.8.1. Overview

17.3.8.2. Financials

17.3.8.3. Strategy

17.3.8.4. Recent Developments

17.3.8.5. SWOT analysis

17.3.9. Yenchen Machinery Co., Ltd.

17.3.9.1. Overview

17.3.9.2. Financials

17.3.9.3. Strategy

17.3.9.4. Recent Developments

17.3.9.5. SWOT analysis

17.3.10. Sharpsville Container Corporation

17.3.10.1. Overview

17.3.10.2. Financials

17.3.10.3. Strategy

17.3.10.4. Recent Developments

17.3.10.5. SWOT analysis

17.3.11. Pensteel Ltd.

17.3.11.1. Overview

17.3.11.2. Financials

17.3.11.3. Strategy

17.3.11.4. Recent Developments

17.3.11.5. SWOT analysis

17.3.12. Titan IBC

17.3.12.1. Overview

17.3.12.2. Financials

17.3.12.3. Strategy

17.3.12.4. Recent Developments

17.3.12.5. SWOT analysis

17.3.13. Transtainer

17.3.13.1. Overview

17.3.13.2. Financials

17.3.13.3. Strategy

17.3.13.4. Recent Developments

17.3.13.5. SWOT analysis

17.3.14. CLA CONTAINERS LTD

17.3.14.1. Overview

17.3.14.2. Financials

17.3.14.3. Strategy

17.3.14.4. Recent Developments

17.3.14.5. SWOT analysis

17.3.15. Hawman Container Services

17.3.15.1. Overview

17.3.15.2. Financials

17.3.15.3. Strategy

17.3.15.4. Recent Developments

17.3.15.5. SWOT analysis

17.3.16. SCHÄFER WERKE GmbH

17.3.16.1. Overview

17.3.16.2. Financials

17.3.16.3. Strategy

17.3.16.4. Recent Developments

17.3.16.5. SWOT analysis

17.3.17. Brookeson Material Handling Ltd.

17.3.17.1. Overview

17.3.17.2. Financials

17.3.17.3. Strategy

17.3.17.4. Recent Developments

17.3.17.5. SWOT analysis

17.3.18. Plymouth Industries

17.3.18.1. Overview

17.3.18.2. Financials

17.3.18.3. Strategy

17.3.18.4. Recent Developments

17.3.18.5. SWOT analysis

17.3.19. SYSPAL Ltd

17.3.19.1. Overview

17.3.19.2. Financials

17.3.19.3. Strategy

17.3.19.4. Recent Developments

17.3.19.5. SWOT analysis

17.3.20. Obal Centrum s.r.o.

17.3.20.1. Overview

17.3.20.2. Financials

17.3.20.3. Strategy

17.3.20.4. Recent Developments

17.3.20.5. SWOT analysis

17.3.21. La Garde

17.3.21.1. Overview

17.3.21.2. Financials

17.3.21.3. Strategy

17.3.21.4. Recent Developments

17.3.21.5. SWOT analysis

17.3.22. Acura Group

17.3.22.1. Overview

17.3.22.2. Financials

17.3.22.3. Strategy

17.3.22.4. Recent Developments

17.3.22.5. SWOT analysis

18. Assumptions and Acronyms Used

19. Research Methodology

List of Tables

Table 01: Global Metal IBC Market Value (US$ Mn) and Volume (Units) 2016-2027, by Material Type

Table 02: Global Metal IBC Market Value (US$ Mn) and Volume (Units) 2016-2027, by Capacity Type

Table 03: Global Metal IBC Market Value (US$ Mn) and Volume (Units) 2016-2027, by Design Type

Table 04: Global Metal IBC Market Value (US$ Mn) and Volume (Units) 2016-2027, by Content Type

Table 05: Global Metal IBC Market Value (US$ Mn) and Volume (Units) 2016-2027, by Technology Type

Table 06: Global Metal IBC Market Value (US$ Mn) and Volume (Units) 2016-2027, by End-use

Table 07: Global Metal IBC Market Value (US$ Mn) and Volume (Units) 2016-2027, by Region

Table 08: North America Metal IBC Market Value (US$ Mn) and Volume (Units) 2016-2027, by Country

Table 09: North America Metal IBC Market Value (US$ Mn) and Volume (Units) 2016-2027, by Material Type

Table 10: North America Metal IBC Market Value (US$ Mn) and Volume (Units) 2016-2027, by Capacity Type

Table 11: North America Metal IBC Market Value (US$ Mn) and Volume (Units) 2016-2027, by Design Type

Table 12: North America Metal IBC Market Value (US$ Mn) and Volume (Units) 2016-2027, by Content Type

Table 13: North America Metal IBC Market Value (US$ Mn) and Volume (Units) 2016-2027, by Technology Type

Table 14: North America Metal IBC Market Value (US$ Mn) and Volume (Units) 2016-2027, by End-use

Table 15: Europe Metal IBC Market Value (US$ Mn) and Volume (Units) 2016-2027, By Country

Table 16: Europe Metal IBC Market Value (US$ Mn) and Volume (Units) 2016-2027, by Material Type

Table 17: Europe Metal IBC Market Value (US$ Mn) and Volume (Units) 2016-2027, By Capacity Type

Table 18: Europe Metal IBC Market Value (US$ Mn) and Volume (Units) 2016-2027, By Design Type

Table 19: Europe Metal IBC Market Value (US$ Mn) and Volume (Units) 2016-2027, By Content Type

Table 20: Europe Metal IBC Market Value (US$ Mn) and Volume (Units) 2016-2027, By Technology Type

Table 21: Europe Metal IBC Market Value (US$ Mn) and Volume (Units) 2016-2027, By End Use

Table 22: APAC Metal IBC Market Value (US$ Mn) and Volume (Units) 2016-2027, By Country

Table 23: APAC Metal IBC Market Value (US$ Mn) and Volume (Units) 2016-2027, by Material Type

Table 24: APAC Metal IBC Market Value (US$ Mn) and Volume (Units) 2016-2027, By Capacity Type

Table 25: APAC Metal IBC Market Value (US$ Mn) and Volume (Units) 2016-2027, By Design Type

Table 26: APAC Metal IBC Market Value (US$ Mn) and Volume (Units) 2016-2027, By Content Type

Table 27: APAC Metal IBC Market Value (US$ Mn) and Volume (Units) 2016-2027, By Technology Type

Table 28: APAC Metal IBC Market Value (US$ Mn) and Volume (Units) 2016-2027, By End Use

Table 29: Latin America Metal IBC Market Value (US$ Mn) and Volume (Units) 2016-2027, By Country

Table 30: Latin America Metal IBC Market Value (US$ Mn) and Volume (Units) 2016-2027, by Material Type

Table 31: Latin America Metal IBC Market Value (US$ Mn) and Volume (Units) 2016-2027, By Capacity Type

Table 32: Latin America Metal IBC Market Value (US$ Mn) and Volume (Units) 2016-2027, By Design Type

Table 33: Latin America Metal IBC Market Value (US$ Mn) and Volume (Units) 2016-2027, By Content Type

Table 34: Latin America Metal IBC Market Value (US$ Mn) and Volume (Units) 2016-2027, By Technology Type

Table 35: Latin America Metal IBC Market Value (US$ Mn) and Volume (Units) 2016-2027, By End Use

Table 36: MEA Metal IBC Market Value (US$ Mn) and Volume (Units) 2016-2027, By Country

Table 37: MEA Metal IBC Market Value (US$ Mn) and Volume (Units) 2016-2027, by Material Type

Table 38: MEA Metal IBC Market Value (US$ Mn) and Volume (Units) 2016-2027, By Capacity Type

Table 39: MEA Metal IBC Market Value (US$ Mn) and Volume (Units) 2016-2027, By Design Type

Table 40: MEA Metal IBC Market Value (US$ Mn) and Volume (Units) 2016-2027, By Content Type

Table 41: MEA Metal IBC Market Value (US$ Mn) and Volume (Units) 2016-2027, By Technology Type

Table 42: MEA Metal IBC Market Value (US$ Mn) and Volume (Units) 2016-2027, By End Use

List of Figures

Figure 01: Global Metal IBC Market Value (US$ Mn), and volume (Units) analysis, 2016-2027

Figure 02: Global Metal IBC Market Absolute $ Opportunity, 2017-2027

Figure 03: Global Metal IBC Market Value Share and BPS Analysis, by Material Type, 2017 & 2027

Figure 04: Global Metal IBC Market Attractiveness Analysis, by Material Type, (2017)

Figure 05: Global Metal IBC Market Value (US$ Mn), and Volume (Units) Analysis, by Stainless Steel Segment, 2016-2027

Figure 06: Global Metal IBC Market Value (US$ Mn), and Volume (Units) Analysis, by Carbon Steel Segment, 2016-2027

Figure 07: Global Metal IBC Market Absolute $ Opportunity, by Stainless Steel Segment, 2017-2027

Figure 08: Global Metal IBC Market Absolute $ Opportunity, by Carbon Steel Segment, 2017-2027

Figure 09: Global Metal IBC Market Value Share and BPS Analysis, by Capacity Type, 2017 & 2027

Figure 10: Global Metal IBC Market Attractive Analysis, by Capacity Type, 2017-2027

Figure 11: Global Metal IBC Market Value (US$ Mn) Analysis, by Capacity Type, 2016-2027

Figure 12: Global Metal IBC Market Volume (Units) Analysis, by Capacity Type, 2016-2027

Figure 13: Global Metal IBC Market Absolute $ Opportunity, by up to 500 Liters Segment, 2017-2027

Figure 14: Global Metal IBC Market Absolute $ Opportunity, by 500-1000 Liters Segment, 2017-2027

Figure 15: Global Metal IBC Market Absolute $ Opportunity, by 1000-1500 Liters Segment, 2017-2027

Figure 16: Global Metal IBC Market Absolute $ Opportunity, by 1500-2000 Liters Segment, 2017-2027

Figure 17: Global Metal IBC Market Absolute $ Opportunity, by above 2000 Liters Segment, 2017-2027

Figure 18: Global Metal IBC Market Value Share and BPS Analysis, by Design Type, 2017 & 2027

Figure 19: Global Metal IBC Market Attractiveness Analysis, by Design Type, 2017-2027

Figure 20: Global Metal IBC Market Value (US$ Mn) and Volume (Units) Analysis, by Cubical Design Segment, 2016-2027

Figure 21: Global Metal IBC Market Value (US$ Mn) and Volume (Units) Analysis, by Cylindrical Design Segment, 2016-2027

Figure 22: Global Metal IBC Market Absolute $ Opportunity, by Cubical Design Segment, 2017-2027

Figure 23: Global Metal IBC Market Absolute $ Opportunity, by Cylindrical Design Segment, 2017-2027

Figure 24: Global Metal IBC Market Value Share Analysis, by Cubical Design Sub-segment, 2017 & 2027

Figure 25: Global Metal IBC Market Value Share Analysis, by Cylindrical Design Sub-segment, 2017 & 2027

Figure 26: Global Metal IBC Market Value Share and BPS Analysis, by Content Type, 2017 & 2027

Figure 27: Global Metal IBC Market Attractiveness analysis, by Content Type, 2017-2027

Figure 28: Global Metal IBC Market Value (US$ Mn) and Volume (Units) Analysis, by Liquid Segment, 2016-2027

Figure 29: Global Metal IBC Market Value (US$ Mn) and Volume (Units) Analysis, by Solids & Semi-solids Segment, 2016-2027

Figure 30: Global Metal IBC Market Absolute $ Opportunity, by Liquid Segment, 2017-2027

Figure 31: Global Metal IBC Market Absolute $ Opportunity, by Solids & Semi-solids Segment, 2017-2027

Figure 32: Global Metal IBC Market Value Share and BPS Analysis, by Technology Type, 2017 & 2027

Figure 33: Global Metal IBC Market Attractiveness Analysis, by Technology Type, 2017-2027

Figure 34: Global Metal IBC Market Value (US$ Mn) and Volume (Units) analysis, by Aseptic Segment, 2016-2027

Figure 35: Global Metal IBC Market Value (US$ Mn) and Volume (Units) Analysis, by Non-aseptic Segment, 2016-2027

Figure 36: Global Metal IBC Market Absolute $ Opportunity, by Aseptic Segment, 2017-2027

Figure 37: Global Metal IBC Market Absolute $ Opportunity, by Non-aseptic Segment, 2017-2027

Figure 38: Global Metal IBC Market Value Share and BPS Analysis, by End-use, 2017 & 2027

Figure 39: Global Metal IBC Market Attractiveness Analysis, By End-use, 2017-2027

Figure 40: Global Metal IBC Market Value (US$ Mn) Analysis, by End-use, 2016-2027

Figure 41: Global Metal IBC Market Volume (Units) Analysis, by End-use, 2016-2027

Figure 42: Global Metal IBC Market Absolute $ Opportunity, by Industrial Chemicals Segment, 2017-2027

Figure 43: Global Metal IBC Market Absolute $ Opportunity, by Petroleum & Lubricants Segment, 2017-2027

Figure 44: Global Metal IBC Market Absolute $ Opportunity, by Paints, Inks, & Dyes Segment, 2017-2027

Figure 45: Global Metal IBC Market Absolute $ Opportunity, by Food & Beverages Segment, 2017-2027

Figure 46: Global Metal IBC Market Absolute $ Opportunity, by Waste Disposal/Recycling & Silage Segment, 2017-2027

Figure 47: Global Metal IBC Market Absolute $ Opportunity, by Building & Construction Segment, 2017-2027

Figure 48: Global Metal IBC Market Absolute $ Opportunity, by Pharmaceutical & Others Segment, 2017-2027

Figure 49: Global Metal IBC Market Value Share and BPS Analysis, by Region, 2017 & 2027

Figure 50: Global Metal IBC Market Attractiveness Analysis, by Region, 2017-2027

Figure 51: Global Metal IBC Market Y-o-Y Growth, by Region, 2017-2027

Figure 52: North America Metal IBC Market Value Share, by Material Type (2017)

Figure 53: North America Metal IBC Market Value Share, by Design Type (2017)

Figure 54: North America Metal IBC Market Value Share, by Capacity Type (2017)

Figure 55: North America Metal IBC Market Value Share, by Content Type (2017)

Figure 56: North America Metal IBC Market Value Share, by Technology Type (2017)

Figure 57: North America Metal IBC Market Value Share, by End-use (2017)

Figure 58: North America Metal IBC Market Value Share, by Country (2017)

Figure 59: North America Metal IBC Market Value (US$ Mn), and Volume (Units) Analysis, 2016-2027

Figure 60: North America Metal IBC Market Absolute $ Opportunity, 2017?2027

Figure 61: North America Metal IBC Market Value Share and BPS Analysis, by Country, 2017 & 2027

Figure 62: North America Metal IBC Market Attractiveness Analysis, by Country (2017)

Figure 63: North America Metal IBC Market Y-o-Y Growth, by Country 2017 & 2027

Figure 64: North America Metal IBC Market Value Share and BPS Analysis, by Material Type, 2017 & 2027

Figure 65: North America Metal IBC Market Attractiveness Analysis, by Material Type (2017)

Figure 66: North America Metal IBC Market Value Share and BPS Analysis, by Capacity Type, 2017 & 2027

Figure 67: North America Metal IBC Market Attractive Analysis, by Capacity Type, 2017-2027

Figure 68: North America Metal IBC Market Value Share and BPS Analysis, by Design Type, 2017 & 2027

Figure 69: North America Metal IBC Market Attractiveness Analysis, by Design Type, 2017-2027

Figure 70: North America Metal IBC Market Value Share Analysis, by Cubical Design Sub-segment, 2017 & 2027

Figure 71: North America Metal IBC Market Value Share Analysis, by Cylindrical Design Sub-segment, 2017 & 2027

Figure 72: North America Metal IBC Market Value Share and BPS Analysis, by Content Type, 2017 & 2027

Figure 73: North America Metal IBC Market Attractiveness analysis, by Content Type, 2017-2027

Figure 74: North America Metal IBC Market Value Share and BPS Analysis, by Technology Type, 2017 & 2027

Figure 75: North America Metal IBC Market Attractiveness Analysis, by Technology Type, 2017-2027

Figure 76: North America Metal IBC Market Value Share and BPS Analysis, by End-use, 2017 & 2027

Figure 77: North America Metal IBC Market Attractiveness Analysis, by End-use, 2017-2027

Figure 78: North America Metal IBC Market Value (US$ Mn) Analysis, by Industrial Chemicals Sub-segment, 2016-2027

Figure 79: North America Metal IBC Market Volume (Units) Analysis, by Industrial Chemicals Sub-segment, 2016-2027

Figure 80: Europe Metal IBC market value share by material type (2017)

Figure 81: Europe Metal IBC market value share by design type (2017)

Figure 82: Europe Metal IBC market value share by capacity type (2017)

Figure 83: Europe Metal IBC market value share by content type (2017)

Figure 84: Europe Metal IBC market value share by technology type (2017)

Figure 85: Europe Metal IBC market value share by end use (2017)

Figure 86: Europe Metal IBC market value share by Country (2017)

Figure 87: Europe Metal IBC Market Value (US$ Mn), and Volume (Units) analysis, 2016-2027

Figure 88: Europe Metal IBC Market Absolute $ Opportunity, 2017?2027

Figure 89: Europe Metal IBC Market Value Share and BPS Analysis, By Country 2017 & 2027

Figure 90: Europe Metal IBC Market Attractiveness analysis, By Country 2017-2027

Figure 91: Europe Metal IBC Market Y-o-Y growth, By Country 2017-2027

Figure 92: Europe Metal IBC Market Value Share and BPS Analysis, by Material Type, 2017 & 2027

Figure 93: Europe Metal IBC Market Attractiveness analysis, by Material Type, 2017-2027

Figure 94: Europe Metal IBC Market Value Share and BPS Analysis, By Capacity Type, 2017 & 2027

Figure 95: Europe Metal IBC Market Attractive Analysis, By Capacity Type, 2017-2027

Figure 96: Europe Metal IBC Market Value Share and BPS Analysis, By Design Type, 2017 & 2027

Figure 97: Europe Metal IBC Market Attractiveness analysis, By Design Type, 2017-2027

Figure 98: Europe Metal IBC Market Value Share Analysis, By Cubical Design Sub Segment, 2017 & 2027

Figure 99: Europe Metal IBC Market Value Share Analysis, By Cylindrical Design Sub Segment, 2017 & 2027

Figure 100: Europe Metal IBC Market Value Share and BPS Analysis, By Content Type, 2017 & 2027

Figure 101: Europe Metal IBC Market Attractiveness analysis, By Content Type, 2017-2027

Figure 102: Europe Metal IBC Market Value Share and BPS Analysis, By Technology Type, 2017 & 2027

Figure 103: Europe Metal IBC Market Attractiveness analysis, By Technology Type, 2017-2027

Figure 104: Europe Metal IBC Market Value Share and BPS Analysis, By End Use, 2017 & 2027

Figure 105: Europe Metal IBC Market Attractiveness analysis, By End Use, 2017-2027

Figure 106: Europe Metal IBC Market Value (US$ Mn) analysis, by Industrial Chemicals sub segment, 2016-2027

Figure 107: Europe Metal IBC Market Volume (Units) analysis, by Industrial Chemicals sub segment, 2016-2027

Figure 108: APAC Metal IBC market value share by material type (2017)

Figure 109: APAC Metal IBC market value share by design type (2017)

Figure 110: APAC Metal IBC market value share by capacity type (2017)

Figure 111: APAC Metal IBC market value share by content type (2017)

Figure 112: APAC Metal IBC market value share by technology type (2017)

Figure 113: APAC Metal IBC market value share by end use (2017)

Figure 114: APAC Metal IBC market value share by Country (2017)

Figure 115: APAC Metal IBC Market Value (US$ Mn), and Volume (Units) analysis, 2016-2027

Figure 116: APAC Metal IBC Market Absolute $ Opportunity, 2017?2027

Figure 117: APAC Metal IBC Market Value Share and BPS Analysis, By Country 2017 & 2027

Figure 118: APAC Metal IBC Market Attractiveness analysis, By Country 2017-2027

Figure 119: APAC Metal IBC Market Y-o-Y growth, By Country 2017 -2027

Figure 120: APAC Metal IBC Market Value Share and BPS Analysis, by Material Type, 2017 & 2027

Figure 121: APAC Metal IBC Market Attractiveness analysis, by Material Type, 2017-2027

Figure 122: APAC Metal IBC Market Value Share and BPS Analysis, By Capacity Type, 2017 & 2027

Figure 123: APAC Metal IBC Market Attractive Analysis, By Capacity Type, 2017-2027

Figure 124: APAC Metal IBC Market Value Share and BPS Analysis, By Design Type, 2017 & 2027

Figure 125: APAC Metal IBC Market Attractiveness analysis, By Design Type, 2017-2027

Figure 126: APAC Metal IBC Market Value Share Analysis, By Cubical Design Sub Segment, 2017 & 2027

Figure 127: APAC Metal IBC Market Value Share Analysis, By Cylindrical Design Sub Segment, 2017 & 2027

Figure 128: APAC Metal IBC Market Value Share and BPS Analysis, By Content Type, 2017 & 2027

Figure 129: APAC Metal IBC Market Attractiveness analysis, By Content Type, 2017-2027

Figure 130: APAC Metal IBC Market Value Share and BPS Analysis, By Technology Type, 2017 & 2027

Figure 131: APAC Metal IBC Market Attractiveness analysis, By Technology Type, 2017-2027

Figure 132: APAC Metal IBC Market Value Share and BPS Analysis, By End Use, 2017 & 2027

Figure 133: APAC Metal IBC Market Attractiveness analysis, By End Use, 2017-2027

Figure 134: APAC Metal IBC Market Value (US$ Mn) analysis, by Industrial Chemicals sub segment, 2016-2027

Figure 135: APAC Metal IBC Market Volume (Units) analysis, by Industrial Chemicals sub segment, 2016-2027

Figure 136: Latin America Metal IBC market value share by material type (2017)

Figure 137: Latin America Metal IBC market value share by design type (2017)

Figure 138: Latin America Metal IBC market value share by capacity type (2017)

Figure 139: Latin America Metal IBC market value share by content type (2017)

Figure 140: Latin America Metal IBC market value share by technology type (2017)

Figure 141: Latin America Metal IBC market value share by end use (2017)

Figure 142: Latin America Metal IBC market value share by Country (2017)

Figure 143: Latin America Metal IBC Market Value (US$ Mn), and Volume (Units) analysis, 2016-2027

Figure 144: Latin America Metal IBC Market Absolute $ Opportunity, 2017?2027

Figure 145: Latin America Metal IBC Market Value Share and BPS Analysis, By Country 2017 & 2027

Figure 146: Latin America Metal IBC Market Attractiveness analysis, By Country 2017-2027

Figure 147: Latin America Metal IBC Market Y-o-Y growth, By Country 2017-2027

Figure 148: Latin America Metal IBC Market Value Share and BPS Analysis, by Material Type, 2017 & 2027

Figure 149: Latin America Metal IBC Market Attractiveness analysis, by Material Type, 2017-2027

Figure 150: Latin America Metal IBC Market Value Share and BPS Analysis, By Capacity Type, 2017 & 2027

Figure 151: Latin America Metal IBC Market Attractive Analysis, By Capacity Type, 2017-2027

Figure 152: Latin America Metal IBC Market Value Share and BPS Analysis, By Design Type, 2017 & 2027

Figure 153: Latin America Metal IBC Market Attractiveness analysis, By Design Type, 2017-2027

Figure 154: Latin America Metal IBC Market Value Share Analysis, By Cubical Design Sub Segment, 2017 & 2027

Figure 155: Latin America Metal IBC Market Value Share Analysis, By Cylindrical Design Sub Segment, 2017 & 2027

Figure 156: Latin America Metal IBC Market Value Share and BPS Analysis, By Content Type, 2017 & 2027

Figure 157: Latin America Metal IBC Market Attractiveness analysis, By Content Type, 2017-2027

Figure 158: Latin America Metal IBC Market Value Share and BPS Analysis, By Technology Type, 2017 & 2027

Figure 159: Latin America Metal IBC Market Attractiveness analysis, By Technology Type, 2017-2027

Figure 160: Latin America Metal IBC Market Value Share and BPS Analysis, By End Use, 2017 & 2027

Figure 161: Latin America Metal IBC Market Attractiveness analysis, By End Use, 2017-2027

Figure 162: Latin America Metal IBC Market Value (US$ Mn) analysis, by Industrial Chemicals sub segment, 2016-2027

Figure 163: Latin America Metal IBC Market Volume (Units) analysis, by Industrial Chemicals sub segment, 2016-2027

Figure 164: MEA Metal IBC market value share by material type (2017)

Figure 165: MEA Metal IBC market value share by design type (2017)

Figure 166: MEA Metal IBC market value share by capacity type (2017)

Figure 167: MEA Metal IBC market value share by content type (2017)

Figure 168: MEA Metal IBC market value share by technology type (2017)

Figure 169: MEA Metal IBC market value share by end use (2017)

Figure 170: MEA Metal IBC market value share by Country (2017)

Figure 171: MEA Metal IBC Market Value (US$ Mn), and Volume (Units) analysis, 2016-2027

Figure 172: MEA Metal IBC Market Absolute $ Opportunity, 2017?2027

Figure 173: MEA Metal IBC Market Value Share and BPS Analysis, By Country 2017 & 2027

Figure 174: MEA Metal IBC Market Attractiveness analysis, By Country 2017-2027

Figure 175: MEA Metal IBC Market Y-o-Y growth, By Country 2017-2027

Figure 176: MEA Metal IBC Market Value Share and BPS Analysis, by Material Type, 2017 & 2027

Figure 177: MEA Metal IBC Market Attractiveness analysis, by Material Type, 2017-2027

Figure 178: MEA Metal IBC Market Value Share and BPS Analysis, By Capacity Type, 2017 & 2027

Figure 179: MEA Metal IBC Market Attractive Analysis, By Capacity Type, 2017-2027

Figure 180: MEA Metal IBC Market Value Share and BPS Analysis, By Design Type, 2017 & 2027

Figure 181: MEA Metal IBC Market Attractiveness analysis, By Design Type, 2017-2027

Figure 182: MEA Metal IBC Market Value Share Analysis, By Cubical Design Sub Segment, 2017 & 2027

Figure 183: MEA Metal IBC Market Value Share Analysis, By Cylindrical Design Sub Segment, 2017 & 2027

Figure 184: MEA Metal IBC Market Value Share and BPS Analysis, By Content Type, 2017 & 2027

Figure 185: MEA Metal IBC Market Attractiveness analysis, By Content Type, 2017-2027

Figure 186: MEA Metal IBC Market Value Share and BPS Analysis, By Technology Type, 2017 & 2027

Figure 187: MEA Metal IBC Market Attractiveness analysis, By Technology Type, 2017-2027

Figure 188: MEA Metal IBC Market Value Share and BPS Analysis, By End Use, 2017 & 2027

Figure 189: MEA Metal IBC Market Attractiveness analysis, By End Use, 2017-2027

Figure 190: MEA Metal IBC Market Value (US$ Mn) analysis, by Industrial Chemicals sub segment, 2016-2027

Figure 191: MEA Metal IBC Market Volume (Units) analysis, by Industrial Chemicals sub segment, 2016-2027