Analysts’ Viewpoint

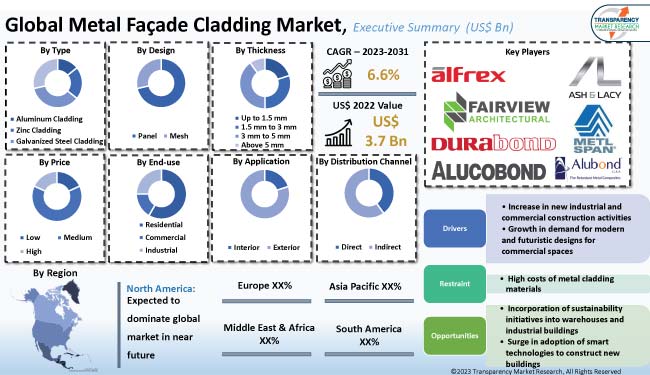

Increase in new industrial and commercial construction activities and growth in demand for modern and futuristic designs for commercial spaces are the key factors fueling metal facade cladding market demand. Incorporation of sustainability initiatives in warehouses and industrial buildings and surge in adoption of smart technologies to construct new buildings are also creating value-grab metal facade cladding market opportunities for manufacturers.

Metal facade cladding suppliers are offering new and innovative materials such as exterior grade laminates, glass fiber reinforced concrete, and zinc, copper, and steel metal cladding. Manufacturers are increasingly offering eco-friendly cladding for green buildings in a variety of finishes and innovative colors. Technology is transforming the way buildings are designed, constructed, and operated. However, high cost of metal cladding materials is expected to hamper market statistics during the forecast period.

Metal facade cladding is a defensive layer that safeguards and decorates the outside part of a building or structure. Metal facade cladding installation protects or shields a building from rain, wind, pollution, and extreme temperatures.

Metal panels can be purchased in a wide range of colors to give a building a distinctive appearance and complement a brand's identity. Metal wall cladding is an ideal choice for commercial construction, as it is stylish, long-lasting, and effective.

Metal facade cladding is often utilized for architectural and design purposes. It offers numerous esthetic advantages, including the ability to alter a building's overall appearance. Metal facade cladding reduces the carbon footprint of a building, as it can easily be recycled at the end of its lifespan.

Expansion in the construction sector is estimated to drive market dynamics during the forecast period. Increase in construction activities in developing as well as developed regions is contributing to the growth of the global market for metal facade cladding.

Rapid urban development and population growth is resulting in construction of new houses and commercial spaces in various regions across the globe. Thus, demand for new buildings with metal cladding is expected to rise steadily during the forecast period.

According to the Associated General Contractors of America, metal facade cladding designs worth US$ 1.8 Trn are made every year in the U.S.

As per the Global Exchange Organization, China is anticipated to invest approximately Yuan 27 Trn (US$ 4.2 Trn) in new infrastructure over the 14th Five-Year Plan period (2021-2025). Nine important aspects of energy efficiency and green building development were emphasized in the new plan. Additionally, the plan calls for retrofitting of more than 350 million square meters of buildings and construction of over 50 million square meters of buildings that do not consume any energy.

The construction sector in India is anticipated to reach US$ 1.4 Trn by 2025, according to government reports. Increase in technology-driven urban planning programs, including the revolutionary Smart Cities Mission that targets 100 cities, is contributing to market expansion in the country.

Metal facade cladding is increasingly being used in commercial spaces for a variety of reasons, including beautification and identity enhancement. Metal facade cladding market demand is anticipated to rise at a steady pace in the next few years owing to the increase in spending on esthetic improvements in buildings.

Metal facade cladding offers a modern and futuristic look to buildings. It is strong and can easily withstand harsh weather conditions due to the presence of metal.

The usage of metal exterior cladding makes construction steady. It helps shield a building's structural integrity and architecture. Metal exterior cladding is gaining popularity across the globe, as it offers exceptional benefits without sacrificing appearance or beauty.

As per the latest metal facade cladding market analysis, aluminum cladding type segment is likely to account for major share of the global industry in the near future.

Sheets of aluminum facade cladding are lightweight, flexible, and simple to mold into the desired design. They are suitable for different weather patterns. Additionally, aluminum facade provides residential and commercial buildings with a structured, glistening, and ultramodern appearance.

Aluminum cladding outperforms all other metals when it comes to architectural facade for roofs and walls due to its extreme flexibility, ease of installation, and superior resistance to corrosive elements.

North America is anticipated to dominate the global landscape during the forecast period. Rapid urbanization and increase in commercial construction are key factors contributing to metal facade cladding market development in the region.

The metal facade cladding market size in Asia Pacific is projected to increase at a steady pace during the forecast period, owing to the rise in urban population and growth in demand for residential and commercial spaces in the region. Surge in construction activities in emerging economies such as China and India is also fueling metal facade cladding market growth in Asia Pacific.

The global landscape is highly competitive, with the presence of various regional and international players that control majority of the metal facade cladding market share. Product development is a key marketing strategy adopted by the leading companies. Other strategies include investments in R&D, product expansion, and mergers & acquisitions.

Alfrex, LLC, Alubond USA, ALUCOBOND, Ash & Lacy Holdings Pvt. Ltd, Durabond Products Limited, Fairview Architectural North America, Fundermax GmbH, Metl-Span, Qora Cladding, and ROCKWOOL Group are the prominent players profiled in the metal facade cladding market report.

Each of these players has been profiled in the metal facade cladding industry research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 3.7 Bn |

|

Market Forecast Value in 2031 |

US$ 5.2 Bn |

|

Growth Rate (CAGR) |

6.6% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value and Million Square Meters for Volume |

|

Market Analysis |

Includes cross-segment analysis at regional as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Region Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 3.7 Bn in 2022

The CAGR is estimated to be 6.6% from 2023 to 2031

Rise in new industrial and commercial construction activities in developed and developing regions and increase in adoption of modern and futuristic designs for commercial spaces

The aluminum cladding type segment held significant share in 2022

Asia Pacific is likely to be one of the most lucrative regions in the next few years

Alfrex, LLC, Alubond USA, ALUCOBOND, Ash & Lacy Holdings Pvt. Ltd, Durabond Products Limited, Fairview Architectural North America, Fundermax GmbH, Metl-Span, Qora Cladding, and ROCKWOOL Group

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.5. Technological Overview Analysis

5.6. Porter’s Five Forces Analysis

5.7. Industry SWOT Analysis

5.8. Value Chain Analysis

5.9. Regulatory Framework

5.10. Global Metal Facade Cladding Market Analysis and Forecast, 2017 - 2031

5.10.1. Market Value Projections (US$ Mn)

5.10.2. Market Volume Projections (Million Square Meters)

6. Global Metal Facade Cladding Market Analysis and Forecast, By Type

6.1. Metal Facade Cladding Market Size (US$ Mn and Million Square Meters) Forecast, By Type, 2017 - 2031

6.1.1. Aluminum Cladding

6.1.2. Zinc Cladding

6.1.3. Galvanized Steel Cladding

6.1.4. Others

6.2. Incremental Opportunity, By Type

7. Global Metal Facade Cladding Market Analysis and Forecast, By Design

7.1. Metal Facade Cladding Market Size (US$ Mn and Million Square Meters) Forecast, Design, 2017 - 2031

7.1.1. Panel

7.1.2. Mesh

7.2. Incremental Opportunity, By Design

8. Global Metal Facade Cladding Market Analysis and Forecast, By Thickness

8.1. Metal Facade Cladding Market Size (US$ Mn and Million Square Meters) Forecast, Thickness, 2017 - 2031

8.1.1. Up to 1.5 mm

8.1.2. 1.5 mm to 3 mm

8.1.3. 3 mm to 5 mm

8.1.4. Above 5 mm

8.2. Incremental Opportunity, By Thickness

9. Global Metal Facade Cladding Market Analysis and Forecast, By Price

9.1. Metal Facade Cladding Market Size (US$ Mn and Million Square Meters) Forecast, Price, 2017 - 2031

9.1.1. Low

9.1.2. Medium

9.1.3. High

9.2. Incremental Opportunity, By Price

10. Global Metal Facade Cladding Market Analysis and Forecast, By End-use

10.1. Metal Facade Cladding Market Size (US$ Mn and Million Square Meters) Forecast, End-use, 2017 - 2031

10.1.1. Residential

10.1.2. Commercial

10.1.3. Industrial

10.2. Incremental Opportunity, By End-use

11. Global Metal Facade Cladding Market Analysis and Forecast, By Application

11.1. Metal Facade Cladding Market Size (US$ Mn and Million Square Meters) Forecast, Application, 2017 - 2031

11.1.1. Interior

11.1.2. Exterior

11.2. Incremental Opportunity, By Application

12. Global Metal Facade Cladding Market Analysis and Forecast, By Distribution Channel

12.1. Metal Facade Cladding Market Size (US$ Mn and Million Square Meters) Forecast, By Distribution Channel, 2017 - 2031

12.1.1. Direct

12.1.2. Indirect

12.2. Incremental Opportunity, By Distribution Channel

13. Global Metal Facade Cladding Market Analysis and Forecast, By Region

13.1. Metal Facade Cladding Market Size (US$ Mn and Million Square Meters) Forecast, By Region, 2017 - 2031

13.1.1. North America

13.1.2. Europe

13.1.3. Asia Pacific

13.1.4. Middle East & Africa

13.1.5. South America

13.2. Incremental Opportunity, By Region

14. North America Metal Facade Cladding Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Brand Analysis

14.3. Price Trend Analysis

14.3.1. Weighted Average Price

14.4. Key Trends Analysis

14.4.1. Demand Side

14.4.2. Supplier Side

14.5. Metal Facade Cladding Market Size (US$ Mn and Million Square Meters) Forecast, By Type, 2017 - 2031

14.5.1. Aluminum Cladding

14.5.2. Zinc Cladding

14.5.3. Galvanized Steel Cladding

14.5.4. Others

14.6. Metal Facade Cladding Market Size (US$ Mn and Million Square Meters) Forecast, Design, 2017 - 2031

14.6.1. Panel

14.6.2. Mesh

14.7. Metal Facade Cladding Market Size (US$ Mn and Million Square Meters) Forecast, Thickness, 2017 - 2031

14.7.1. Up to 1.5 mm

14.7.2. 1.5 mm to 3 mm

14.7.3. 3 mm to 5 mm

14.7.4. Above 5 mm

14.8. Metal Facade Cladding Market Size (US$ Mn and Million Square Meters) Forecast, Price, 2017 - 2031

14.8.1. Low

14.8.2. Medium

14.8.3. High

14.9. Metal Facade Cladding Market Size (US$ Mn and Million Square Meters) Forecast, End-use, 2017 - 2031

14.9.1. Residential

14.9.2. Commercial

14.9.3. Industrial

14.10. Metal Facade Cladding Market Size (US$ Mn and Million Square Meters) Forecast, Application, 2017 - 2031

14.10.1. Interior

14.10.2. Exterior

14.11. Metal Facade Cladding Market Size (US$ Mn and Million Square Meters) Forecast, By Distribution Channel, 2017 - 2031

14.11.1. Direct

14.11.2. Indirect

14.12. Metal Facade Cladding Market Size (US$ Mn and Million Square Meters) Forecast, By Country, 2017 - 2031

14.12.1. U.S

14.12.2. Canada

14.12.3. Rest of North America

14.13. Incremental Opportunity Analysis

15. Europe Metal Facade Cladding Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Brand Analysis

15.3. Price Trend Analysis

15.3.1. Weighted Average Price

15.4. Key Trends Analysis

15.4.1. Demand Side

15.4.2. Supplier Side

15.5. Metal Facade Cladding Market Size (US$ Mn and Million Square Meters) Forecast, By Type, 2017 - 2031

15.5.1. Aluminum Cladding

15.5.2. Zinc Cladding

15.5.3. Galvanized Steel Cladding

15.5.4. Others

15.6. Metal Facade Cladding Market Size (US$ Mn and Million Square Meters) Forecast, Design, 2017 - 2031

15.6.1. Panel

15.6.2. Mesh

15.7. Metal Facade Cladding Market Size (US$ Mn and Million Square Meters) Forecast, Thickness, 2017 - 2031

15.7.1. Up to 1.5 mm

15.7.2. 1.5 mm to 3 mm

15.7.3. 3 mm to 5 mm

15.7.4. Above 5 mm

15.8. Metal Facade Cladding Market Size (US$ Mn and Million Square Meters) Forecast, Price, 2017 - 2031

15.8.1. Low

15.8.2. Medium

15.8.3. High

15.9. Metal Facade Cladding Market Size (US$ Mn and Million Square Meters) Forecast, End-use, 2017 - 2031

15.9.1. Residential

15.9.2. Commercial

15.9.3. Industrial

15.10. Metal Facade Cladding Market Size (US$ Mn and Million Square Meters) Forecast, Application, 2017 - 2031

15.10.1. Interior

15.10.2. Exterior

15.11. Metal Facade Cladding Market Size (US$ Mn and Million Square Meters) Forecast, By Distribution Channel, 2017 - 2031

15.11.1. Direct

15.11.2. Indirect

15.12. Metal Facade Cladding Market Size (US$ Mn and Million Square Meters) Forecast, By Country, 2017 - 2031

15.12.1. U.K

15.12.2. Germany

15.12.3. France

15.12.4. Rest of Europe

15.13. Incremental Opportunity Analysis

16. Asia Pacific Metal Facade Cladding Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Brand Analysis

16.3. Key Trends Analysis

16.3.1. Demand Side

16.3.2. Supplier Side

16.4. Metal Facade Cladding Market Size (US$ Mn and Million Square Meters) Forecast, By Type, 2017 - 2031

16.4.1. Aluminum Cladding

16.4.2. Zinc Cladding

16.4.3. Galvanized Steel Cladding

16.4.4. Others

16.5. Metal Facade Cladding Market Size (US$ Mn and Million Square Meters) Forecast, Design, 2017 - 2031

16.5.1. Panel

16.5.2. Mesh

16.6. Metal Facade Cladding Market Size (US$ Mn and Million Square Meters) Forecast, Thickness, 2017 - 2031

16.6.1. Up to 1.5 mm

16.6.2. 1.5 mm to 3 mm

16.6.3. 3 mm to 5 mm

16.6.4. Above 5 mm

16.7. Metal Facade Cladding Market Size (US$ Mn and Million Square Meters) Forecast, Price, 2017 - 2031

16.7.1. Low

16.7.2. Medium

16.7.3. High

16.8. Metal Facade Cladding Market Size (US$ Mn and Million Square Meters) Forecast, End-use, 2017 - 2031

16.8.1. Residential

16.8.2. Commercial

16.8.3. Industrial

16.9. Metal Facade Cladding Market Size (US$ Mn and Million Square Meters) Forecast, Application, 2017 - 2031

16.9.1. Interior

16.9.2. Exterior

16.10. Metal Facade Cladding Market Size (US$ Mn and Million Square Meters) Forecast, By Distribution Channel, 2017 - 2031

16.10.1. Direct

16.10.2. Indirect

16.11. Metal Facade Cladding Market Size (US$ Mn and Million Square Meters) Forecast, By Country, 2017 - 2031

16.11.1. India

16.11.2. China

16.11.3. Japan

16.11.4. Rest of Asia Pacific

16.12. Incremental Opportunity Analysis

17. Middle East & South Africa Metal Facade Cladding Market Analysis and Forecast

17.1. Regional Snapshot

17.2. Brand Analysis

17.3. Price Trend Analysis

17.3.1. Weighted Average Price

17.4. Key Trends Analysis

17.4.1. Demand Side

17.4.2. Supplier Side

17.5. Metal Facade Cladding Market Size (US$ Mn and Million Square Meters) Forecast, By Type, 2017 - 2031

17.5.1. Aluminum Cladding

17.5.2. Zinc Cladding

17.5.3. Galvanized Steel Cladding

17.5.4. Others

17.6. Metal Facade Cladding Market Size (US$ Mn and Million Square Meters) Forecast, Design, 2017 - 2031

17.6.1. Panel

17.6.2. Mesh

17.7. Metal Facade Cladding Market Size (US$ Mn and Million Square Meters) Forecast, Thickness, 2017 - 2031

17.7.1. Up to 1.5 mm

17.7.2. 1.5 mm to 3 mm

17.7.3. 3 mm to 5 mm

17.7.4. Above 5 mm

17.8. Metal Facade Cladding Market Size (US$ Mn and Million Square Meters) Forecast, Price, 2017 - 2031

17.8.1. Low

17.8.2. Medium

17.8.3. High

17.9. Metal Facade Cladding Market Size (US$ Mn and Million Square Meters) Forecast, End-use, 2017 - 2031

17.9.1. Residential

17.9.2. Commercial

17.9.3. Industrial

17.10. Metal Facade Cladding Market Size (US$ Mn and Million Square Meters) Forecast, Application, 2017 - 2031

17.10.1. Interior

17.10.2. Exterior

17.11. Metal Facade Cladding Market Size (US$ Mn and Million Square Meters) Forecast, By Distribution Channel, 2017 - 2031

17.11.1. Direct

17.11.2. Indirect

17.12. Metal Facade Cladding Market Size (US$ Mn and Million Square Meters) Forecast, By Country, 2017 - 2031

17.12.1. GCC

17.12.2. Rest of MEA

17.13. Incremental Opportunity Analysis

18. South America Metal Facade Cladding Market Analysis and Forecast

18.1. Regional Snapshot

18.2. Brand Analysis

18.3. Price Trend Analysis

18.3.1. Weighted Average Price

18.4. Key Trends Analysis

18.4.1. Demand Side

18.4.2. Supplier Side

18.5. Metal Facade Cladding Market Size (US$ Mn and Million Square Meters) Forecast, By Type, 2017 - 2031

18.5.1. Aluminum Cladding

18.5.2. Zinc Cladding

18.5.3. Galvanized Steel Cladding

18.5.4. Others

18.6. Metal Facade Cladding Market Size (US$ Mn and Million Square Meters) Forecast, Design, 2017 - 2031

18.6.1. Panel

18.6.2. Mesh

18.7. Metal Facade Cladding Market Size (US$ Mn and Million Square Meters) Forecast, Thickness, 2017 - 2031

18.7.1. Up to 1.5 mm

18.7.2. 1.5 mm to 3 mm

18.7.3. 3 mm to 5 mm

18.7.4. Above 5 mm

18.8. Metal Facade Cladding Market Size (US$ Mn and Million Square Meters) Forecast, Price, 2017 - 2031

18.8.1. Low

18.8.2. Medium

18.8.3. High

18.9. Metal Facade Cladding Market Size (US$ Mn and Million Square Meters) Forecast, End-use, 2017 - 2031

18.9.1. Residential

18.9.2. Commercial

18.9.3. Industrial

18.10. Metal Facade Cladding Market Size (US$ Mn and Million Square Meters) Forecast, Application, 2017 - 2031

18.10.1. Interior

18.10.2. Exterior

18.11. Metal Facade Cladding Market Size (US$ Mn and Million Square Meters) Forecast, By Distribution Channel, 2017 - 2031

18.11.1. Direct

18.11.2. Indirect

18.12. Metal Facade Cladding Market Size (US$ Mn and Million Square Meters) Forecast, By Country, 2017 - 2031

18.12.1. Brazil

18.12.2. Rest of South America

18.13. Incremental Opportunity Analysis

19. Competition Landscape

19.1. Market Player - Competition Dashboard

19.2. Market Share Analysis (%), by Company, (2022)

19.3. Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

19.3.1. Alfrex, LLC

19.3.1.1. Company Overview

19.3.1.2. Sales Area/Geographical Presence

19.3.1.3. Revenue

19.3.1.4. Strategy & Business Overview

19.3.2. Alubond USA

19.3.2.1. Company Overview

19.3.2.2. Sales Area/Geographical Presence

19.3.2.3. Revenue

19.3.2.4. Strategy & Business Overview

19.3.3. ALUCOBOND

19.3.3.1. Company Overview

19.3.3.2. Sales Area/Geographical Presence

19.3.3.3. Revenue

19.3.3.4. Strategy & Business Overview

19.3.4. Ash & Lacy Holdings Pvt. Ltd

19.3.4.1. Company Overview

19.3.4.2. Sales Area/Geographical Presence

19.3.4.3. Revenue

19.3.4.4. Strategy & Business Overview

19.3.5. Durabond Products Limited

19.3.5.1. Company Overview

19.3.5.2. Sales Area/Geographical Presence

19.3.5.3. Revenue

19.3.5.4. Strategy & Business Overview

19.3.6. Fairview Architectural North America

19.3.6.1. Company Overview

19.3.6.2. Sales Area/Geographical Presence

19.3.6.3. Revenue

19.3.6.4. Strategy & Business Overview

19.3.7. Fundermax GmbH

19.3.7.1. Company Overview

19.3.7.2. Sales Area/Geographical Presence

19.3.7.3. Revenue

19.3.7.4. Strategy & Business Overview

19.3.8. Metl-Span

19.3.8.1. Company Overview

19.3.8.2. Sales Area/Geographical Presence

19.3.8.3. Revenue

19.3.8.4. Strategy & Business Overview

19.3.9. Qora Cladding

19.3.9.1. Company Overview

19.3.9.2. Sales Area/Geographical Presence

19.3.9.3. Revenue

19.3.9.4. Strategy & Business Overview

19.3.10. ROCKWOOL Group

19.3.10.1. Company Overview

19.3.10.2. Sales Area/Geographical Presence

19.3.10.3. Revenue

19.3.10.4. Strategy & Business Overview

19.3.11. Other Key Players

19.3.11.1. Company Overview

19.3.11.2. Sales Area/Geographical Presence

19.3.11.3. Revenue

19.3.11.4. Strategy & Business Overview

20. Go to Market Strategy

20.1. Identification of Potential Market Spaces

20.1.1. By Type

20.1.2. By Design

20.1.3. By Thickness

20.1.4. By Price

20.1.5. By End-use

20.1.6. By Application

20.1.7. By Distribution Channel

20.1.8. By Region

20.2. Prevailing Market Risks

20.3. Understanding the Buying Process of the Customers

20.4. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Metal Facade Cladding Market Value (US$ Mn), by Type, 2017-2031

Table 2: Global Metal Facade Cladding Market Volume (Million Square Meters), by Type 2017-2031

Table 3: Global Metal Facade Cladding Market Value (US$ Mn), by Design, 2017-2031

Table 4: Global Metal Facade Cladding Market Volume (Million Square Meters), by Design 2017-2031

Table 5: Global Metal Facade Cladding Market Value (US$ Mn), by Thickness, 2017-2031

Table 6: Global Metal Facade Cladding Market Volume (Million Square Meters), by Thickness 2017-2031

Table 7: Global Metal Facade Cladding Market Value (US$ Mn), by Price , 2017-2031

Table 8: Global Metal Facade Cladding Market Volume (Million Square Meters), by Price 2017-2031

Table 9: Global Metal Facade Cladding Market Value (US$ Mn), by End-use, 2017-2031

Table 10: Global Metal Facade Cladding Market Volume (Million Square Meters), by End-use 2017-2031

Table 11: Global Metal Facade Cladding Market Value (US$ Mn), by Application, 2017-2031

Table 12: Global Metal Facade Cladding Market Volume (Million Square Meters), by Application 2017-2031

Table 13: Global Metal Facade Cladding Market Value (US$ Mn), by Distribution Channel, 2017-2031

Table 14: Global Metal Facade Cladding Market Volume (Million Square Meters), by Distribution Channel 2017-2031

Table 15: Global Metal Facade Cladding Market Value (US$ Mn), by Region, 2017-2031

Table 16: Global Metal Facade Cladding Market Volume (Million Square Meters), by Region 2017-2031

Table 17: North America Metal Facade Cladding Market Value (US$ Mn), by Type, 2017-2031

Table 18: North America Metal Facade Cladding Market Volume (Million Square Meters), by Type 2017-2031

Table 19: North America Metal Facade Cladding Market Value (US$ Mn), by Design, 2017-2031

Table 20: North America Metal Facade Cladding Market Volume (Million Square Meters), by Design 2017-2031

Table 21: North America Metal Facade Cladding Market Value (US$ Mn), by Thickness, 2017-2031

Table 22: North America Metal Facade Cladding Market Volume (Million Square Meters), by Thickness 2017-2031

Table 23: North America Metal Facade Cladding Market Value (US$ Mn), by Price , 2017-2031

Table 24: North America Metal Facade Cladding Market Volume (Million Square Meters), by Price 2017-2031

Table 25: North America Metal Facade Cladding Market Value (US$ Mn), by End-use, 2017-2031

Table 26: North America Metal Facade Cladding Market Volume (Million Square Meters), by End-use 2017-2031

Table 27: North America Metal Facade Cladding Market Value (US$ Mn), by Application, 2017-2031

Table 28: North America Metal Facade Cladding Market Volume (Million Square Meters), by Application 2017-2031

Table 29: North America Metal Facade Cladding Market Value (US$ Mn), by Distribution Channel, 2017-2031

Table 30: North America Metal Facade Cladding Market Volume (Million Square Meters), by Distribution Channel 2017-2031

Table 31: North America Metal Facade Cladding Market Value (US$ Mn), by Region, 2017-2031

Table 32: North America Metal Facade Cladding Market Volume (Million Square Meters), by Region 2017-2031

Table 33: Europe Metal Facade Cladding Market Value (US$ Mn), by Type, 2017-2031

Table 34: Europe Metal Facade Cladding Market Volume (Million Square Meters), by Type 2017-2031

Table 35: Europe Metal Facade Cladding Market Value (US$ Mn), by Design, 2017-2031

Table 36: Europe Metal Facade Cladding Market Volume (Million Square Meters), by Design 2017-2031

Table 37: Europe Metal Facade Cladding Market Value (US$ Mn), by Thickness, 2017-2031

Table 38: Europe Metal Facade Cladding Market Volume (Million Square Meters), by Thickness 2017-2031

Table 39: Europe Metal Facade Cladding Market Value (US$ Mn), by Price , 2017-2031

Table 40: Europe Metal Facade Cladding Market Volume (Million Square Meters), by Price 2017-2031

Table 41: Europe Metal Facade Cladding Market Value (US$ Mn), by End-use, 2017-2031

Table 42: Europe Metal Facade Cladding Market Volume (Million Square Meters), by End-use 2017-2031

Table 43: Europe Metal Facade Cladding Market Value (US$ Mn), by Application, 2017-2031

Table 44: Europe Metal Facade Cladding Market Volume (Million Square Meters), by Application 2017-2031

Table 45: Europe Metal Facade Cladding Market Value (US$ Mn), by Distribution Channel, 2017-2031

Table 46: Europe Metal Facade Cladding Market Volume (Million Square Meters), by Distribution Channel 2017-2031

Table 47: Europe Metal Facade Cladding Market Value (US$ Mn), by Region, 2017-2031

Table 48: Europe Metal Facade Cladding Market Volume (Million Square Meters), by Region 2017-2031

Table 49: Asia Pacific Metal Facade Cladding Market Value (US$ Mn), by Type, 2017-2031

Table 50: Asia Pacific Metal Facade Cladding Market Volume (Million Square Meters), by Type 2017-2031

Table 51: Asia Pacific Metal Facade Cladding Market Value (US$ Mn), by Design, 2017-2031

Table 52: Asia Pacific Metal Facade Cladding Market Volume (Million Square Meters), by Design 2017-2031

Table 53: Asia Pacific Metal Facade Cladding Market Value (US$ Mn), by Thickness, 2017-2031

Table 54: Asia Pacific Metal Facade Cladding Market Volume (Million Square Meters), by Thickness 2017-2031

Table 55: Asia Pacific Metal Facade Cladding Market Value (US$ Mn), by Price , 2017-2031

Table 56: Asia Pacific Metal Facade Cladding Market Volume (Million Square Meters), by Price 2017-2031

Table 57: Asia Pacific Metal Facade Cladding Market Value (US$ Mn), by End-use, 2017-2031

Table 58: Asia Pacific Metal Facade Cladding Market Volume (Million Square Meters), by End-use 2017-2031

Table 59: Asia Pacific Metal Facade Cladding Market Value (US$ Mn), by Application, 2017-2031

Table 60: Asia Pacific Metal Facade Cladding Market Volume (Million Square Meters), by Application 2017-2031

Table 61: Asia Pacific Metal Facade Cladding Market Value (US$ Mn), by Distribution Channel, 2017-2031

Table 62: Asia Pacific Metal Facade Cladding Market Volume (Million Square Meters), by Distribution Channel 2017-2031

Table 63: Asia Pacific Metal Facade Cladding Market Value (US$ Mn), by Region, 2017-2031

Table 64: Asia Pacific Metal Facade Cladding Market Volume (Million Square Meters), by Region 2017-2031

Table 65: Middle East & Africa Metal Facade Cladding Market Value (US$ Mn), by Type, 2017-2031

Table 66: Middle East & Africa Metal Facade Cladding Market Volume (Million Square Meters), by Type 2017-2031

Table 67: Middle East & Africa Metal Facade Cladding Market Value (US$ Mn), by Design, 2017-2031

Table 68: Middle East & Africa Metal Facade Cladding Market Volume (Million Square Meters), by Design 2017-2031

Table 69: Middle East & Africa Metal Facade Cladding Market Value (US$ Mn), by Thickness, 2017-2031

Table 70: Middle East & Africa Metal Facade Cladding Market Volume (Million Square Meters), by Thickness 2017-2031

Table 71: Middle East & Africa Metal Facade Cladding Market Value (US$ Mn), by Price , 2017-2031

Table 72: Middle East & Africa Metal Facade Cladding Market Volume (Million Square Meters), by Price 2017-2031

Table 73: Middle East & Africa Metal Facade Cladding Market Value (US$ Mn), by End-use, 2017-2031

Table 74: Middle East & Africa Metal Facade Cladding Market Volume (Million Square Meters), by End-use 2017-2031

Table 75: Middle East & Africa Metal Facade Cladding Market Value (US$ Mn), by Application, 2017-2031

Table 76: Middle East & Africa Metal Facade Cladding Market Volume (Million Square Meters), by Application 2017-2031

Table 77: Middle East & Africa Metal Facade Cladding Market Value (US$ Mn), by Distribution Channel, 2017-2031

Table 78: Middle East & Africa Metal Facade Cladding Market Volume (Million Square Meters), by Distribution Channel 2017-2031

Table 79: Middle East & Africa Metal Facade Cladding Market Value (US$ Mn), by Region, 2017-2031

Table 80: Middle East & Africa Metal Facade Cladding Market Volume (Million Square Meters), by Region 2017-2031

Table 81: South America Metal Facade Cladding Market Value (US$ Mn), by Type, 2017-2031

Table 82: South America Metal Facade Cladding Market Volume (Million Square Meters), by Type 2017-2031

Table 83: South America Metal Facade Cladding Market Value (US$ Mn), by Design, 2017-2031

Table 84: South America Metal Facade Cladding Market Volume (Million Square Meters), by Design 2017-2031

Table 85: South America Metal Facade Cladding Market Value (US$ Mn), by Thickness, 2017-2031

Table 86: South America Metal Facade Cladding Market Volume (Million Square Meters), by Thickness 2017-2031

Table 87: South America Metal Facade Cladding Market Value (US$ Mn), by Price , 2017-2031

Table 88: South America Metal Facade Cladding Market Volume (Million Square Meters), by Price 2017-2031

Table 89: South America Metal Facade Cladding Market Value (US$ Mn), by End-use, 2017-2031

Table 90: South America Metal Facade Cladding Market Volume (Million Square Meters), by End-use 2017-2031

Table 91: South America Metal Facade Cladding Market Value (US$ Mn), by Application, 2017-2031

Table 92: South America Metal Facade Cladding Market Volume (Million Square Meters), by Application 2017-2031

Table 93: South America Metal Facade Cladding Market Value (US$ Mn), by Distribution Channel, 2017-2031

Table 94: South America Metal Facade Cladding Market Volume (Million Square Meters), by Distribution Channel 2017-2031

Table 95: South America Metal Facade Cladding Market Value (US$ Mn), by Region, 2017-2031

Table 96: South America Metal Facade Cladding Market Volume (Million Square Meters), by Region 2017-2031

List of Figures

Figure 1: Global Metal Facade Cladding Market Value (US$ Mn), by Type, 2017-2031

Figure 2: Global Metal Facade Cladding Market Volume (Million Square Meters), by Type 2017-2031

Figure 3: Global Metal Facade Cladding Market Incremental Opportunity (US$ Mn), Forecast, by Type, 2023-2031

Figure 4: Global Metal Facade Cladding Market Value (US$ Mn), by Design, 2017-2031

Figure 5: Global Metal Facade Cladding Market Volume (Million Square Meters), by Design 2017-2031

Figure 6: Global Metal Facade Cladding Market Incremental Opportunity (US$ Mn), Forecast, by Design, 2023-2031

Figure 7: Global Metal Facade Cladding Market Value (US$ Mn), by Thickness, 2017-2031

Figure 8: Global Metal Facade Cladding Market Volume (Million Square Meters), by Thickness 2017-2031

Figure 9: Global Metal Facade Cladding Market Incremental Opportunity (US$ Mn), Forecast, by Thickness, 2023-2031

Figure 10: Global Metal Facade Cladding Market Value (US$ Mn), by Price, 2017-2031

Figure 11: Global Metal Facade Cladding Market Volume (Million Square Meters), by Price 2017-2031

Figure 12: Global Metal Facade Cladding Market Incremental Opportunity (US$ Mn), Forecast, by Price, 2023-2031

Figure 13: Global Metal Facade Cladding Market Value (US$ Mn), by End-use, 2017-2031

Figure 14: Global Metal Facade Cladding Market Volume (Million Square Meters), by End-use 2017-2031

Figure 15: Global Metal Facade Cladding Market Incremental Opportunity (US$ Mn), Forecast, by End-use, 2023-2031

Figure 16: Global Metal Facade Cladding Market Value (US$ Mn), by Application, 2017-2031

Figure 17: Global Metal Facade Cladding Market Volume (Million Square Meters), by Application 2017-2031

Figure 18: Global Metal Facade Cladding Market Incremental Opportunity (US$ Mn), Forecast, by Application, 2023-2031

Figure 19: Global Metal Facade Cladding Market Value (US$ Mn), by Distribution Channel, 2017-2031

Figure 20: Global Metal Facade Cladding Market Volume (Million Square Meters), by Distribution Channel 2017-2031

Figure 21: Global Metal Facade Cladding Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 22: Global Metal Facade Cladding Market Value (US$ Mn), by Region, 2017-2031

Figure 23: Global Metal Facade Cladding Market Volume (Million Square Meters), by Region 2017-2031

Figure 24: Global Metal Facade Cladding Market Incremental Opportunity (US$ Mn), Forecast, by Region, 2023-2031

Figure 25: North America Metal Facade Cladding Market Value (US$ Mn), by Type, 2017-2031

Figure 26: North America Metal Facade Cladding Market Volume (Million Square Meters), by Type 2017-2031

Figure 27: North America Metal Facade Cladding Market Incremental Opportunity (US$ Mn), Forecast, by Type, 2023-2031

Figure 28: North America Metal Facade Cladding Market Value (US$ Mn), by Design, 2017-2031

Figure 29: North America Metal Facade Cladding Market Volume (Million Square Meters), by Design 2017-2031

Figure 30: North America Metal Facade Cladding Market Incremental Opportunity (US$ Mn), Forecast, by Design, 2023-2031

Figure 31: North America Metal Facade Cladding Market Value (US$ Mn), by Thickness, 2017-2031

Figure 32: North America Metal Facade Cladding Market Volume (Million Square Meters), by Thickness 2017-2031

Figure 33: North America Metal Facade Cladding Market Incremental Opportunity (US$ Mn), Forecast, by Thickness, 2023-2031

Figure 34: North America Metal Facade Cladding Market Value (US$ Mn), by Price, 2017-2031

Figure 35: North America Metal Facade Cladding Market Volume (Million Square Meters), by Price 2017-2031

Figure 36: North America Metal Facade Cladding Market Incremental Opportunity (US$ Mn), Forecast, by Price, 2023-2031

Figure 37: North America Metal Facade Cladding Market Value (US$ Mn), by End-use, 2017-2031

Figure 38: North America Metal Facade Cladding Market Volume (Million Square Meters), by End-use 2017-2031

Figure 39: North America Metal Facade Cladding Market Incremental Opportunity (US$ Mn), Forecast, by End-use, 2023-2031

Figure 40: North America Metal Facade Cladding Market Value (US$ Mn), by Application, 2017-2031

Figure 41: North America Metal Facade Cladding Market Volume (Million Square Meters), by Application 2017-2031

Figure 42: North America Metal Facade Cladding Market Incremental Opportunity (US$ Mn), Forecast, by Application, 2023-2031

Figure 43: North America Metal Facade Cladding Market Value (US$ Mn), by Distribution Channel, 2017-2031

Figure 44: North America Metal Facade Cladding Market Volume (Million Square Meters), by Distribution Channel 2017-2031

Figure 45: North America Metal Facade Cladding Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 46: North America Metal Facade Cladding Market Value (US$ Mn), by Region, 2017-2031

Figure 47: North America Metal Facade Cladding Market Volume (Million Square Meters), by Region 2017-2031

Figure 48: North America Metal Facade Cladding Market Incremental Opportunity (US$ Mn), Forecast, by Region, 2023-2031

Figure 49: Europe Metal Facade Cladding Market Value (US$ Mn), by Type, 2017-2031

Figure 50: Europe Metal Facade Cladding Market Volume (Million Square Meters), by Type 2017-2031

Figure 51: Europe Metal Facade Cladding Market Incremental Opportunity (US$ Mn), Forecast, by Type, 2023-2031

Figure 52: Europe Metal Facade Cladding Market Value (US$ Mn), by Design, 2017-2031

Figure 53: Europe Metal Facade Cladding Market Volume (Million Square Meters), by Design 2017-2031

Figure 54: Europe Metal Facade Cladding Market Incremental Opportunity (US$ Mn), Forecast, by Design, 2023-2031

Figure 55: Europe Metal Facade Cladding Market Value (US$ Mn), by Thickness, 2017-2031

Figure 56: Europe Metal Facade Cladding Market Volume (Million Square Meters), by Thickness 2017-2031

Figure 57: Europe Metal Facade Cladding Market Incremental Opportunity (US$ Mn), Forecast, by Thickness, 2023-2031

Figure 58: Europe Metal Facade Cladding Market Value (US$ Mn), by Price, 2017-2031

Figure 59: Europe Metal Facade Cladding Market Volume (Million Square Meters), by Price 2017-2031

Figure 60: Europe Metal Facade Cladding Market Incremental Opportunity (US$ Mn), Forecast, by Price, 2023-2031

Figure 61: Europe Metal Facade Cladding Market Value (US$ Mn), by End-use, 2017-2031

Figure 62: Europe Metal Facade Cladding Market Volume (Million Square Meters), by End-use 2017-2031

Figure 63: Europe Metal Facade Cladding Market Incremental Opportunity (US$ Mn), Forecast, by End-use, 2023-2031

Figure 64: Europe Metal Facade Cladding Market Value (US$ Mn), by Application, 2017-2031

Figure 65: Europe Metal Facade Cladding Market Volume (Million Square Meters), by Application 2017-2031

Figure 66: Europe Metal Facade Cladding Market Incremental Opportunity (US$ Mn), Forecast, by Application, 2023-2031

Figure 67: Europe Metal Facade Cladding Market Value (US$ Mn), by Distribution Channel, 2017-2031

Figure 68: Europe Metal Facade Cladding Market Volume (Million Square Meters), by Distribution Channel 2017-2031

Figure 69: Europe Metal Facade Cladding Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 70: Europe Metal Facade Cladding Market Value (US$ Mn), by Region, 2017-2031

Figure 71: Europe Metal Facade Cladding Market Volume (Million Square Meters), by Region 2017-2031

Figure 72: Europe Metal Facade Cladding Market Incremental Opportunity (US$ Mn), Forecast, by Region, 2023-2031

Figure 73: Asia Pacific Metal Facade Cladding Market Value (US$ Mn), by Type, 2017-2031

Figure 74: Asia Pacific Metal Facade Cladding Market Volume (Million Square Meters), by Type 2017-2031

Figure 75: Asia Pacific Metal Facade Cladding Market Incremental Opportunity (US$ Mn), Forecast, by Type, 2023-2031

Figure 76: Asia Pacific Metal Facade Cladding Market Value (US$ Mn), by Design, 2017-2031

Figure 77: Asia Pacific Metal Facade Cladding Market Volume (Million Square Meters), by Design 2017-2031

Figure 78: Asia Pacific Metal Facade Cladding Market Incremental Opportunity (US$ Mn), Forecast, by Design, 2023-2031

Figure 79: Asia Pacific Metal Facade Cladding Market Value (US$ Mn), by Thickness, 2017-2031

Figure 80: Asia Pacific Metal Facade Cladding Market Volume (Million Square Meters), by Thickness 2017-2031

Figure 81: Asia Pacific Metal Facade Cladding Market Incremental Opportunity (US$ Mn), Forecast, by Thickness, 2023-2031

Figure 82: Asia Pacific Metal Facade Cladding Market Value (US$ Mn), by Price, 2017-2031

Figure 83: Asia Pacific Metal Facade Cladding Market Volume (Million Square Meters), by Price 2017-2031

Figure 84: Asia Pacific Metal Facade Cladding Market Incremental Opportunity (US$ Mn), Forecast, by Price, 2023-2031

Figure 85: Asia Pacific Metal Facade Cladding Market Value (US$ Mn), by End-use, 2017-2031

Figure 86: Asia Pacific Metal Facade Cladding Market Volume (Million Square Meters), by End-use 2017-2031

Figure 87: Asia Pacific Metal Facade Cladding Market Incremental Opportunity (US$ Mn), Forecast, by End-use, 2023-2031

Figure 88: Asia Pacific Metal Facade Cladding Market Value (US$ Mn), by Application, 2017-2031

Figure 89: Asia Pacific Metal Facade Cladding Market Volume (Million Square Meters), by Application 2017-2031

Figure 90: Asia Pacific Metal Facade Cladding Market Incremental Opportunity (US$ Mn), Forecast, by Application, 2023-2031

Figure 91: Asia Pacific Metal Facade Cladding Market Value (US$ Mn), by Distribution Channel, 2017-2031

Figure 92: Asia Pacific Metal Facade Cladding Market Volume (Million Square Meters), by Distribution Channel 2017-2031

Figure 93: Asia Pacific Metal Facade Cladding Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 94: Asia Pacific Metal Facade Cladding Market Value (US$ Mn), by Region, 2017-2031

Figure 95: Asia Pacific Metal Facade Cladding Market Volume (Million Square Meters), by Region 2017-2031

Figure 96: Asia Pacific Metal Facade Cladding Market Incremental Opportunity (US$ Mn), Forecast, by Region, 2023-2031

Figure 97: Middle East & Africa Metal Facade Cladding Market Value (US$ Mn), by Type, 2017-2031

Figure 98: Middle East & Africa Metal Facade Cladding Market Volume (Million Square Meters), by Type 2017-2031

Figure 99: Middle East & Africa Metal Facade Cladding Market Incremental Opportunity (US$ Mn), Forecast, by Type, 2023-2031

Figure 100: Middle East & Africa Metal Facade Cladding Market Value (US$ Mn), by Design, 2017-2031

Figure 101: Middle East & Africa Metal Facade Cladding Market Volume (Million Square Meters), by Design 2017-2031

Figure 102: Middle East & Africa Metal Facade Cladding Market Incremental Opportunity (US$ Mn), Forecast, by Design, 2023-2031

Figure 103: Middle East & Africa Metal Facade Cladding Market Value (US$ Mn), by Thickness, 2017-2031

Figure 104: Middle East & Africa Metal Facade Cladding Market Volume (Million Square Meters), by Thickness 2017-2031

Figure 105: Middle East & Africa Metal Facade Cladding Market Incremental Opportunity (US$ Mn), Forecast, by Thickness, 2023-2031

Figure 106: Middle East & Africa Metal Facade Cladding Market Value (US$ Mn), by Price, 2017-2031

Figure 107: Middle East & Africa Metal Facade Cladding Market Volume (Million Square Meters), by Price 2017-2031

Figure 108: Middle East & Africa Metal Facade Cladding Market Incremental Opportunity (US$ Mn), Forecast, by Price, 2023-2031

Figure 109: Middle East & Africa Metal Facade Cladding Market Value (US$ Mn), by End-use, 2017-2031

Figure 110: Middle East & Africa Metal Facade Cladding Market Volume (Million Square Meters), by End-use 2017-2031

Figure 111: Middle East & Africa Metal Facade Cladding Market Incremental Opportunity (US$ Mn), Forecast, by End Use, 2023-2031

Figure 112: Middle East & Africa Metal Facade Cladding Market Value (US$ Mn), by Application, 2017-2031

Figure 113: Middle East & Africa Metal Facade Cladding Market Volume (Million Square Meters), by Application 2017-2031

Figure 114: Middle East & Africa Metal Facade Cladding Market Incremental Opportunity (US$ Mn), Forecast, by Application, 2023-2031

Figure 115: Middle East & Africa Metal Facade Cladding Market Value (US$ Mn), by Distribution Channel, 2017-2031

Figure 116: Middle East & Africa Metal Facade Cladding Market Volume (Million Square Meters), by Distribution Channel 2017-2031

Figure 117: Middle East & Africa Metal Facade Cladding Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 118: Middle East & Africa Metal Facade Cladding Market Value (US$ Mn), by Region, 2017-2031

Figure 119: Middle East & Africa Metal Facade Cladding Market Volume (Million Square Meters), by Region 2017-2031

Figure 120: Middle East & Africa Metal Facade Cladding Market Incremental Opportunity (US$ Mn), Forecast, by Region, 2023-2031

Figure 121: South America Metal Facade Cladding Market Value (US$ Mn), by Type, 2017-2031

Figure 122: South America Metal Facade Cladding Market Volume (Million Square Meters), by Type 2017-2031

Figure 123: South America Metal Facade Cladding Market Incremental Opportunity (US$ Mn), Forecast, by Type, 2023-2031

Figure 124: South America Metal Facade Cladding Market Value (US$ Mn), by Design, 2017-2031

Figure 125: South America Metal Facade Cladding Market Volume (Million Square Meters), by Design 2017-2031

Figure 126: South America Metal Facade Cladding Market Incremental Opportunity (US$ Mn), Forecast, by Design, 2023-2031

Figure 127: South America Metal Facade Cladding Market Value (US$ Mn), by Thickness, 2017-2031

Figure 128: South America Metal Facade Cladding Market Volume (Million Square Meters), by Thickness 2017-2031

Figure 129: South America Metal Facade Cladding Market Incremental Opportunity (US$ Mn), Forecast, by Thickness, 2023-2031

Figure 130: South America Metal Facade Cladding Market Value (US$ Mn), by Price, 2017-2031

Figure 131: South America Metal Facade Cladding Market Volume (Million Square Meters), by Price 2017-2031

Figure 132: South America Metal Facade Cladding Market Incremental Opportunity (US$ Mn), Forecast, by Price, 2023-2031

Figure 133: South America Metal Facade Cladding Market Value (US$ Mn), by End-use, 2017-2031

Figure 134: South America Metal Facade Cladding Market Volume (Million Square Meters), by End-use 2017-2031

Figure 135: South America Metal Facade Cladding Market Incremental Opportunity (US$ Mn), Forecast, by End-use, 2023-2031

Figure 136: South America Metal Facade Cladding Market Value (US$ Mn), by Application, 2017-2031

Figure 137: South America Metal Facade Cladding Market Volume (Million Square Meters), by Application 2017-2031

Figure 138: South America Metal Facade Cladding Market Incremental Opportunity (US$ Mn), Forecast, by Application, 2023-2031

Figure 139: South America Metal Facade Cladding Market Value (US$ Mn), by Distribution Channel, 2017-2031

Figure 140: South America Metal Facade Cladding Market Volume (Million Square Meters), by Distribution Channel 2017-2031

Figure 141: South America Metal Facade Cladding Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 142: South America Metal Facade Cladding Market Value (US$ Mn), by Region, 2017-2031

Figure 143: South America Metal Facade Cladding Market Volume (Million Square Meters), by Region 2017-2031

Figure 144: South America Metal Facade Cladding Market Incremental Opportunity (US$ Mn), Forecast, by Region, 2023-2031