Analysts’ Viewpoint

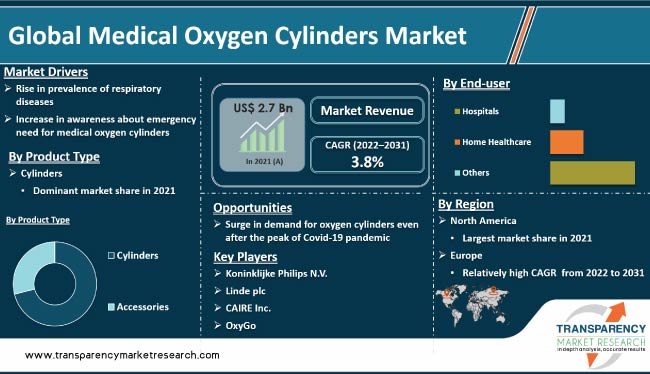

Increase in global geriatric population, rise in prevalence of chronic respiratory diseases, and growth in number of emergency departments and hospitals across the globe are some of the major market drivers. Additionally, the ongoing COVID-19 pandemic has also led to a significant increase in the demand for medical oxygen, which is expected to continue in the next few years. This factor is also contributing to market expansion.

Leading players in the global market for medical oxygen cylinders are increasing their production capacity and expanding their distribution networks to cater to the needs of customers. Moreover, the medical oxygen cylinders market size is anticipated to increase during the forecast period, owing to the rise in awareness about the emergency need for medical oxygen tanks and increase in government initiatives to improve healthcare facilities.

The medical oxygen cylinders business refers to the industry that produces and supplies pressurized oxygen tanks and other related equipment for medical use. These oxygen cylinders are used in hospitals, clinics, and emergency settings to provide oxygen therapy to patients with respiratory conditions such as COPD, asthma, and pneumonia. Medical oxygen cylinders are available in different sizes, from small portable cylinders to large ones. They are typically made of aluminum or steel and are equipped with valves that can be adjusted to control the flow of oxygen.

Several advanced-featured medical oxygen cylinders available in the market including portable oxygen tanks, which are lightweight, user-friendly, durable, have compact designs, and intelligent monitoring features. Other features of medical oxygen tanks include advanced valves, enhanced safety features, and corrosion resistance.

People with respiratory diseases often require continuous oxygen therapy, which can only be provided with medical oxygen cylinders. Rise in prevalence of chronic obstructive pulmonary disease (COPD), asthma, and other respiratory diseases is driving the demand for efficient and safe medical oxygen cylinders. This is expected to increase the medical oxygen cylinders market value in the near future.

Increase in incidence of respiratory diseases as well as lung cancer is likely to fuel the demand for oxygen therapy. This can lead to a greater demand for medical oxygen cylinders, as more patients require higher concentrations of oxygen for longer periods.

The COVID-19 pandemic has led to a significant increase in demand for medical oxygen, as several infected people used oxygen therapy to improve their breathing capacity. The pandemic is subsiding; however, awareness about the emergency need for medical oxygen cylinders is rising across the globe. It has highlighted the importance of emergency medical preparedness, especially the availability and accessibility of medical oxygen, oxygen tank refilling, and portable oxygen tanks for breathing, in the event of another outbreak or pandemic.

This increased awareness is likely to fuel the demand for medical oxygen cylinders in the future, as healthcare facilities and hospitals seek to maintain an adequate supply of oxygen to meet potential demand. Furthermore, the use of oxygen in non-invasive ventilation (NIV) has become more frequent, which is another factor contributing to the medical oxygen cylinders market revenue. Governments in various countries, most notably India and the U.S., have been actively recalibrating production, distribution, and storage norms and have implemented policies to bridge the supply-demand gap of medical oxygen cylinders post the peak of the COVID-19 pandemic.

According to the global medical oxygen cylinders market analysis report, based on product type, the global market has been divided into cylinders and accessories. The cylinders segment has been further divided into portable and fixed. The cylinders segment accounted for the largest market share of the global market in 2021.

Cylinders are a highly popular choice for storage and transportation of medical oxygen because they are relatively inexpensive, easy to handle, and can be refilled or replaced as needed. Additionally, cylinders are durable and can withstand the pressure and wear & tear associated with regular use. They are also widely available and can be easily transported, making them a convenient option for patients and healthcare providers.

Furthermore, several users of medical oxygen prefer cylinders over other accessories because they can be used in various settings, both in and out of the home. This factor is positively impacting the medical oxygen cylinders market share, creating lucrative opportunities for manufacturers.

Based on end-user, the global market segmentation comprises hospitals, home healthcare, and others. The hospitals segment held major share of the global market in 2021.

Hospitals across the globe require large amounts of oxygen stored in operating rooms as well as in intensive care units. Additionally, hospitals typically have the infrastructure and personnel in place to safely store and distribute large quantities of oxygen. Therefore, the hospitals segment is anticipated to account for major share of the global market during the forecast period.

North America is projected to dominate the global business during the forecast period, owing to the well-established healthcare infrastructure in the region. Additionally, increase in geriatric population along with rise in prevalence of chronic respiratory diseases in the region is expected to drive the medical oxygen cylinders market demand in the near future.

Increase in geriatric population in Europe is one of the major factors driving the demand for medical oxygen systems, as these people are more susceptible to respiratory diseases such as COPD and pneumonia. Furthermore, rise in awareness about the importance of home healthcare along with the convenience of having medical oxygen cylinders at home is anticipated to increase the medical oxygen cylinders market opportunities during the forecast period, in Europe.

Rise in number of hospitals and healthcare facilities in Asia Pacific is contributing to the medical oxygen cylinder market development in the region. Several governments in the region are also taking initiatives to increase access to oxygen therapy for home-based patients, which further supports the medical oxygen cylinders market growth. Surge in demand for oxygen therapy treatments in rural areas, increase in investment in healthcare sector, and lucrative presence of market players in the region are some of the factors that are expected to drive the market in the near future.

The global industry is fragmented, with the presence of a large number of leading companies controlling majority of the share. Air Liquide Healthcare, Koninklijke Philips N.V., Invacare Corporation, Linde plc, Nidek Medical Products, Inc., CAIRE Inc., Inogen, Inc., OxyGo, and Drive DeVilbiss Healthcare, Inc. are some of the prominent players operating in the global market.

Key players have been profiled in the global medical oxygen cylinders market forecast report based on parameters such as company overview, financial overview, product portfolio, business strategies, business segments, and recent developments.

|

Attribute |

Detail |

|

Size in 2021 |

US$ 2.7 Bn |

|

Forecast Value in 2031 |

More than US$ 4.2 Bn |

|

CAGR - 2022–2031 |

3.8% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

.Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

The global market was valued at US$ 2.7 Bn in 2021

It is projected to reach a value of more than US$ 4.2 Bn by 2031

It is anticipated to be 3.8% from 2022 to 2031

The cylinder product type segment held more than 70.0% share in 2021

North America is expected to account for major share during the forecast period

Air Liquide Healthcare, Koninklijke Philips N.V., Invacare Corporation, Linde plc, Nidek Medical Products, Inc., CAIRE Inc., Inogen, Inc., OxyGo, and Drive DeVilbiss Healthcare, Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Medical Oxygen Cylinders Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Medical Oxygen Cylinders Market Analysis and Forecasts, 2017 - 2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Technological Advancements

5.2. Disease Prevalence & Incidence Rate

5.3. Covid-19 Impact Analysis

6. Global Medical Oxygen Cylinders Market Analysis and Forecast, by Product Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product Type, 2017 - 2031

6.3.1. Cylinders

6.3.1.1. Portable

6.3.1.2. Fixed

6.3.2. Accessories

6.4. Market Attractiveness, by Product Type

7. Global Medical Oxygen Cylinders Market Analysis and Forecast, by End-user

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by End-user, 2017 - 2031

7.3.1. Hospital

7.3.2. Home Healthcare

7.3.3. Others

7.4. Market Attractiveness, by End-user

8. Global Medical Oxygen Cylinders Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness, by Country/Region

9. North America Medical Oxygen Cylinders Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Product Type, 2017 - 2031

9.2.1. Cylinders

9.2.1.1. Portable

9.2.1.2. Fixed

9.2.2. Accessories

9.3. Market Value Forecast, by End-user, 2017 - 2031

9.3.1. Hospital

9.3.2. Home Healthcare

9.3.3. Others

9.4. Market Value Forecast, by Country, 2017 - 2031

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Product Type

9.5.2. By End-user

9.5.3. By Country

10. Europe Medical Oxygen Cylinders Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product Type, 2017 - 2031

10.2.1. Cylinders

10.2.1.1. Portable

10.2.1.2. Fixed

10.2.2. Accessories

10.3. Market Value Forecast, by End-user, 2017 - 2031

10.3.1. Hospital

10.3.2. Home Healthcare

10.3.3. Others

10.4. Market Value Forecast, by Country/Sub-region, 2017 - 2031

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Italy

10.4.5. Spain

10.4.6. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Product Type

10.5.2. By End-user

10.5.3. By Country/Sub-region

11. Asia Pacific Medical Oxygen Cylinders Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product Type, 2017 - 2031

11.2.1. Cylinders

11.2.1.1. Portable

11.2.1.2. Fixed

11.2.2. Accessories

11.3. Market Value Forecast, by End-user, 2017 - 2031

11.3.1. Hospital

11.3.2. Home Healthcare

11.3.3. Others

11.4. Market Value Forecast, by Country, 2017 - 2031

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Product Type

11.5.2. By End-user

11.5.3. By Country/Sub-region

12. Latin America Medical Oxygen Cylinders Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product Type, 2017 - 2031

12.2.1. Cylinders

12.2.1.1. Portable

12.2.1.2. Fixed

12.2.2. Accessories

12.3. Market Value Forecast, by End-user, 2017 - 2031

12.3.1. Hospital

12.3.2. Home Healthcare

12.3.3. Others

12.4. Market Value Forecast, by Country/Sub-region, 2017 - 2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Product Type

12.5.2. By End-user

12.5.3. By Country/Sub-region

13. Middle East & Africa Medical Oxygen Cylinders Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product Type, 2017 - 2031

13.2.1. Cylinders

13.2.1.1. Portable

13.2.1.2. Fixed

13.2.2. Accessories

13.3. Market Value Forecast, by End-user, 2017 - 2031

13.3.1. Hospital

13.3.2. Home Healthcare

13.3.3. Others

13.4. Market Value Forecast, by Country/Sub-region, 2017 - 2031

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & South Africa

13.5. Market Attractiveness Analysis

13.5.1. By Product Type

13.5.2. By End-user

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player – Competition Matrix (By Tier and Size of companies)

14.2. Market Share Analysis By Company (2021)

14.3. Company Profiles

14.3.1. Air Liquide Healthcare

14.3.1.1. Company Overview

14.3.1.2. Financial Overview

14.3.1.3. Product Portfolio

14.3.1.4. Business Strategies

14.3.1.5. Recent Developments

14.3.2. Koninklijke Philips N.V

14.3.2.1. Company Overview

14.3.2.2. Financial Overview

14.3.2.3. Product Portfolio

14.3.2.4. Business Strategies

14.3.2.5. Recent Developments

14.3.3. Invacare Corporation

14.3.3.1. Company Overview

14.3.3.2. Financial Overview

14.3.3.3. Product Portfolio

14.3.3.4. Business Strategies

14.3.3.5. Recent Developments

14.3.4. Linde plc

14.3.4.1. Company Overview

14.3.4.2. Financial Overview

14.3.4.3. Product Portfolio

14.3.4.4. Business Strategies

14.3.4.5. Recent Developments

14.3.5. Nidek Medical Products, Inc.

14.3.5.1. Company Overview

14.3.5.2. Financial Overview

14.3.5.3. Product Portfolio

14.3.5.4. Business Strategies

14.3.5.5. Recent Developments

14.3.6. CAIRE Inc.

14.3.6.1. Company Overview

14.3.6.2. Financial Overview

14.3.6.3. Product Portfolio

14.3.6.4. Business Strategies

14.3.6.5. Recent Developments

14.3.7. Inogen, Inc.

14.3.7.1. Company Overview

14.3.7.2. Financial Overview

14.3.7.3. Product Portfolio

14.3.7.4. Business Strategies

14.3.7.5. Recent Developments

14.3.8. OxyGo

14.3.8.1. Company Overview

14.3.8.2. Financial Overview

14.3.8.3. Product Portfolio

14.3.8.4. Business Strategies

14.3.8.5. Recent Developments

14.3.9. Drive DeVilbiss Healthcare, Inc.

14.3.9.1. Company Overview

14.3.9.2. Financial Overview

14.3.9.3. Product Portfolio

14.3.9.4. Business Strategies

14.3.9.5. Recent Developments

14.3.10. Other Prominent Players

List of Tables

Table 01: Global Medical Oxygen Cylinders Market Value (US$ Mn) Forecast, by Product Type, 2017‒2031

Table 02: Global Medical Oxygen Cylinders Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 03: Global Medical Oxygen Cylinders Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 04: North America Medical Oxygen Cylinders Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 05: North America Medical Oxygen Cylinders Market Value (US$ Mn) Forecast, by Product Type, 2017‒2031

Table 06: North America Medical Oxygen Cylinders Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 07: Europe Medical Oxygen Cylinders Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017–2031

Table 08: Europe Medical Oxygen Cylinders Market Value (US$ Mn) Forecast, by Product Type, 2017‒2031

Table 09: Europe Medical Oxygen Cylinders Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 10: Asia Pacific Medical Oxygen Cylinders Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 11: Asia Pacific Medical Oxygen Cylinders Market Value (US$ Mn) Forecast, by Product Type, 2017‒2031

Table 12: Asia Pacific Medical Oxygen Cylinders Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 13: Latin America Medical Oxygen Cylinders Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Latin America Medical Oxygen Cylinders Market Value (US$ Mn) Forecast, by Product Type, 2017‒2031

Table 15: Latin America Medical Oxygen Cylinders Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 16: Middle East & Africa Medical Oxygen Cylinders Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 17: Middle East & Africa Medical Oxygen Cylinders Market Value (US$ Mn) Forecast, by Product Type, 2017‒2031

Table 18: Middle East & Africa Medical Oxygen Cylinders Market Value (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Medical Oxygen Cylinders Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Medical Oxygen Cylinders Market Value Share, by Product Type, 2021

Figure 03: Medical Oxygen Cylinders Market Value Share, by End-user, 2021

Figure 04: Medical Oxygen Cylinders Market Value Share, by Region, 2021

Figure 05: Global Medical Oxygen Cylinders Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 06: Global Medical Oxygen Cylinders Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 07: Global Medical Oxygen Cylinders Market Value (US$ Mn), by Cylinders, 2017‒2031

Figure 08: Global Medical Oxygen Cylinders Market Value (US$ Mn), by Portable, 2017‒2031

Figure 09: Global Medical Oxygen Cylinders Market Value (US$ Mn), by Fixed, 2017‒2031

Figure 10: Global Medical Oxygen Cylinders Market Value (US$ Mn), by Accessories, 2017‒2031

Figure 11: Global Medical Oxygen Cylinders Market Value Share Analysis, by End-user 2021 and 2031

Figure 12: Global Medical Oxygen Cylinders Market Attractiveness Analysis, by End-user 2022–2031

Figure 13: Global Medical Oxygen Cylinders Market Revenue (US$ Mn), by Hospitals, 2017–2031

Figure 14: Global Medical Oxygen Cylinders Market Revenue (US$ Mn), by Home Healthcare, 2017–2031

Figure 15: Global Medical Oxygen Cylinders Market Revenue (US$ Mn), by Others, 2017–2031

Figure 16: Global Medical Oxygen Cylinders Market Value Share Analysis, by Region, 2021 and 2031

Figure 17: Global Medical Oxygen Cylinders Market Attractiveness Analysis, by Region, 2022–2031

Figure 18: North America Medical Oxygen Cylinders Market Value (US$ Mn) Forecast, 2017–2031

Figure 19: North America Medical Oxygen Cylinders Market Value Share Analysis, by Country, 2021 and 2031

Figure 20: North America Medical Oxygen Cylinders Market Attractiveness Analysis, by Country, 2022–2031

Figure 21: North America Medical Oxygen Cylinders Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 22: North America Medical Oxygen Cylinders Market Attractiveness Analysis, by Product Type 2022–2031

Figure 23: North America Medical Oxygen Cylinders Market Value Share Analysis, by End-user, 2021 and 2031

Figure 24: North America Medical Oxygen Cylinders Market Attractiveness Analysis, by End-user, 2022–2031

Figure 25: Europe Medical Oxygen Cylinders Market Value (US$ Mn) Forecast, 2017–2031

Figure 26: Europe Medical Oxygen Cylinders Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 27: Europe Medical Oxygen Cylinders Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 28: Europe Medical Oxygen Cylinders Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 29: Europe Medical Oxygen Cylinders Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 30: Europe Medical Oxygen Cylinders Market Value Share Analysis, by End-user, 2021 and 2031

Figure 31: Europe Medical Oxygen Cylinders Market Attractiveness Analysis, by End-user, 2022–2031

Figure 32: Asia Pacific Medical Oxygen Cylinders Market Value (US$ Mn) Forecast, 2017–2031

Figure 33: Asia Pacific Medical Oxygen Cylinders Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 34: Asia Pacific Medical Oxygen Cylinders Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 35: Asia Pacific Medical Oxygen Cylinders Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 36: Asia Pacific Medical Oxygen Cylinders Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 37: Asia Pacific Medical Oxygen Cylinders Market Value Share Analysis, by End-user, 2021 and 2031

Figure 38: Asia Pacific Medical Oxygen Cylinders Market Attractiveness Analysis, by End-user, 2022–2031

Figure 39: Latin America Medical Oxygen Cylinders Market Value (US$ Mn) Forecast, 2017–2031

Figure 40: Latin America Medical Oxygen Cylinders Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 41: Latin America Medical Oxygen Cylinders Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 42: Latin America Medical Oxygen Cylinders Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 43: Latin America Medical Oxygen Cylinders Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 44: Latin America Medical Oxygen Cylinders Market Value Share Analysis, by End-user, 2021 and 2031

Figure 45: Latin America Medical Oxygen Cylinders Market Attractiveness Analysis, by End-user, 2022–2031

Figure 46: Middle East & Africa Medical Oxygen Cylinders Market Value (US$ Mn) Forecast, 2017–2031

Figure 47: Middle East & Africa Medical Oxygen Cylinders Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 48: Middle East & Africa Medical Oxygen Cylinders Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 49: Middle East & Africa Medical Oxygen Cylinders Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 50: Middle East & Africa Medical Oxygen Cylinders Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 51: Middle East & Africa Medical Oxygen Cylinders Market Value Share Analysis, by End-user, 2021 and 2031

Figure 52: Middle East & Africa Medical Oxygen Cylinders Market Attractiveness Analysis, by End-user, 2022–2031

Figure 53: Company Share Analysis