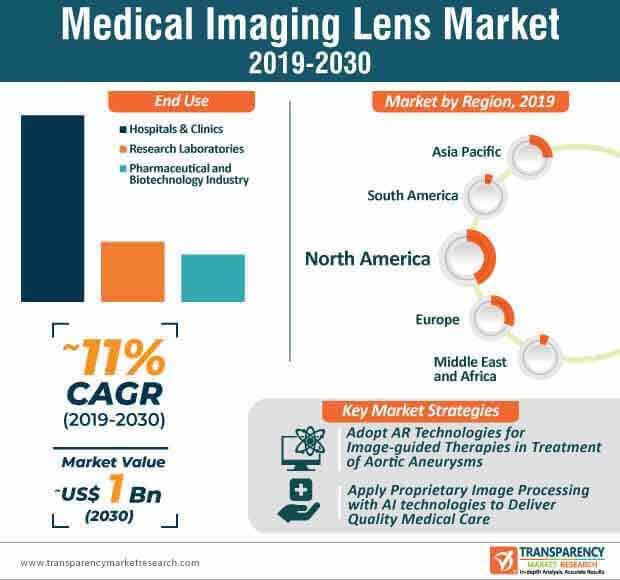

Augmented Reality (AR) is revolutionizing the medical imaging lens market. AR is expected to play a pivotal role in challenging applications in the field of image-guided therapy. For instance, leading U.S. multinational technology company Microsoft is using its AR technology in HoloLens 2 holographic computing platform, along with Philips Azurion-a next-gen image-guided therapy platform to address challenges faced by clinicians in interventional procedures.

The AR involved image-guided therapy is anticipated to create incremental opportunities for companies in the medical imaging lens market, since the technology helps to increase flexibility during interventional procedures. With the help of AR, clinicians are able to move around the patient during a procedure while receiving relevant patient information. AR techniques are gaining popularity in procedures involving endovascular repair of aortic aneurysms.

Ultrasound is a popular technique used for imaging of soft tissues as well as developing fetus. Hence, researchers in the medical imaging lens market are harnessing the advantages of ultrasound to better brain imaging practices. For instance, researchers at the Polytechnic University of Valencia in Spain introduced a 3D (3 Dimensional) printing holographic lens that deploy ultrasonic sound waves in the brain. As such, holographic lens also hold promising potentials in assessing drug delivery for the brain.

The medical imaging lens market is estimated to expand at an astonishing CAGR of ~11% during the forecast period. However, ultrasound is subject to distortion in the brain due to the skull, thus preventing it from focusing on the brain tissues. Hence, companies should collaborate with researchers to innovate in 3D printed holographic lens that are capable of generating complex patterns in beams that reach target brain regions.

AI is predicted to transform the medical imaging lens market and has been dominating titles at imaging conferences. However, limited FDA (Food & Drug Association)-cleared applications associated with AI in delivery rooms (DR) poses a restraint for market growth. As such, AI holds promising potential as supplemental lens for medical imaging that has an advantage of reducing treatment planning time, since the technology analyzes vast amounts of data.

AI helps to improve operational efficiency, as it frees healthcare professionals from mundane tasks associated with data management. Companies in the medical imaging lens market are increasing their R&D efforts to combine the use of AI with 3D imaging and improve operational efficiency for radiologists. On the other hand, the ultrasound technique is being highly publicized as a virtual medical imaging lens, which is playing an instrumental role in assessing difficult-to-access images.

The cornea dome lens is gaining increased popularity in precision imaging for ophthalmology. An alarmingly high number of individuals are suffering from severe diseases of the eyeball surface. This problem is prominent among individuals of western countries who suffer from dryness-related complaints of the ocular surface. Hence, companies in the medical imaging lens market are capitalizing in incremental opportunities with the help of cornea dome lens to document their lens fit photographically on a regular basis.

Companies in the medical imaging lens market are scaling growth opportunities with the help of cornea dome lens, since regular ophthalmological examinations are important for patients. High-resolution color photographic documentation, with the help of medical imaging lens plays a key role in detecting pathological abnormalities.

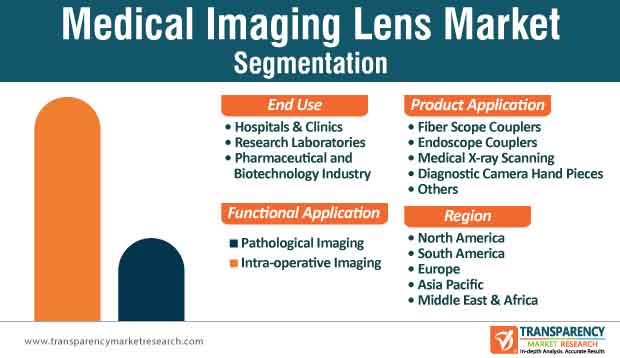

Inorganic strategies such as mergers and acquisitions are bolstering the growth of the medical imaging lens market, which is estimated to reach a value of ~US$ 1 Bn by 2030. For instance, in December 2019, leading Japanese multinational photography and biotechnology company, Fujifilm Holdings Corporation, announced to acquire Hitachi in order to increase their product portfolio in the company’s diagnostic imaging business. Companies in the medical imaging lens market are entering into strategic collaborations to combine proprietary image processing techniques with AI technologies to improve the quality of medical care.

Company acquisitions help leverage global sales networks. In order to enhance the procedures of diagnostic imaging systems, companies are tapping into opportunities in Information Technology (IT) and electronic health records to improve patient outcomes. As such, the market for medical imaging lens is moderately consolidated with leading players accounting for ~45%-50% share of the market. Hence, emerging companies should enter into agreements with leading market players to acquire a strong global presence.

Since healthcare systems in the U.S. are lagging other countries in the distribution of COVID-19 (coronavirus) testing kits, companies in the medical imaging lens market are manufacturing AI (Artificial Intelligence) cameras to detect individuals with fever possibility. For instance, Austin-based company Athena Security is gaining global recognition for its security cameras integrated with the AI technology that helps detect potential COVID-19 patients. The demand for security cameras with thermal imaging and computer vision tech is surging amidst the ongoing coronavirus era.

Lockdown relaxations have increased the stress of staffs at airports, hospitals, grocery stores, and voting locations. This is another key driver, which is generating value-grab opportunities for medical imaging lens manufacturers who should increase their production capacities in security cameras. Security camera detection systems are in high demand for the scanning of larger crowd at various locations.

Analysts’ Viewpoint

Medical imaging lens manufacturers are focusing in photonics equipment that are being pervasively used in laboratory settings to innovate in rapid testing kits for detecting COVID-19. Holographic lenses are playing an instrumental role in brain imaging. However, lens-free imaging solutions involving the use of holographic reconstruction algorithms poses a threat to medical imaging lens manufacturers. Hence, manufacturers should broaden their product portfolio in lens-free imaging solutions and target conventional medical imaging lens to budget-strapped healthcare systems in developing economies of the world. As such, the volume growth of Asia Pacific is predicted for aggressive growth in the medical imaging lens market, whereas the global output is estimated to cross ~39 million units by the end of 2030.

1. Global Medical Imaging Lens Market - Executive Summary

1.1. Global Medical Imaging Lens Market Country Analysis

1.2. Vertical Specific Market Penetration

1.3. Users – Product Mapping

1.4. Competition Blueprint

1.5. Product Application Time Line Mapping

1.6. TMR Analysis and Recommendations

2. Market Overview

2.1. Market Introduction

2.2. Market Definition

2.3. Market Taxonomy

3. Market Dynamics

3.1. Macroeconomic Factors

3.2. Drivers

3.2.1. Economic Drivers

3.2.2. Supply Side Drivers

3.2.3. Demand Side Drivers

3.3. Market Restraints

3.4. Market Trends

3.5. Trend Analysis- Impact on Time Line (2020-2030)

3.6. Forecast Factors – Relevance and Impact

3.7. Key Regulations By Regions

4. COVID-19 Impact Analysis

4.1. Impact on the Supply Chain

4.1.1. Orders

4.1.2. Production

4.1.3. Deliveries

4.2. Impact Analysis:

4.2.1. Impact on Q1, 2020 vs 2020

4.2.2. Impact Analysis, By Company

4.2.3. Impact Analysis, By Geography/Country

4.3. Planning for Recovery and Regrowth

5. Associated Industry and Key Indicator Assessment

5.1. Parent Industry Overview

5.2. Supply Chain Analysis

5.2.1. Profitability and Gross Margin Analysis By Competition

5.2.2. List of Active Participants- By Region

5.2.3. Raw Material Suppliers

5.2.4. Key Manufacturers

5.2.5. Integrators

5.2.6. Key Distributor/Retailers

5.3. Product Application Roadmap

5.4. Porter’s Five Forces Analysis

6. Global Medical Imaging Lens Market Pricing Analysis

6.1. Price Point Assessment by Product Application

6.2. Regional Average Pricing Analysis

6.2.1. North America

6.2.2. South America

6.2.3. Europe

6.2.4. Asia Pacific

6.2.5. Middle East & Africa

6.3. Price Forecast till 2030

6.4. Factors Influencing Pricing

7. Global Medical Imaging Lens Market Analysis and Forecast

7.1. Market Size Analysis (2018-2019) and Forecast (2020-2030)

7.1.1. Market Value (US$ Mn) and Volume (Million Units) and Y-o-Y Growth

7.2. Global Medical Imaging Lens Market Scenario Forecast (Optimistic, Likely, and Conservative Market Conditions)

7.2.1. Forecast Factors and Relevance of Impact

7.2.2. Regional Medical Imaging Lens Market Business Performance Summary

8. Global Medical Imaging Lens Market Analysis By Product Application

8.1. Introduction

8.1.1. Y-o-Y Growth Comparison By Product Application

8.2. Medical Imaging Lens Market Size (US$ Mn) and Analysis & Forecast, By Product Application, 2018 - 2030

8.2.1. Fiber Scope Couplers

8.2.2. Endoscope Couplers

8.2.3. Medical X-ray Scanning

8.2.4. Diagnostic Camera Hand Pieces

8.2.5. Others

8.3. Market Attractiveness Analysis By Product Application

9. Global Medical Imaging Lens Market Analysis By Functional Application

9.1. Introduction

9.1.1. Y-o-Y Growth Comparison By Functional Application

9.2. Medical Imaging Lens Market Size (US$ Mn) Analysis & Forecast, By Functional Application, 2018 - 2030

9.2.1. Pathological Imaging

9.2.2. Intra-operative Imaging

9.3. Market Attractiveness Analysis By Application

10. Global Medical Imaging Lens Market Analysis By End-use

10.1. Introduction

10.1.1. Y-o-Y Growth Comparison By End-use

10.2. Medical Imaging Lens Market Size (US$ Mn) Analysis & Forecast, By End-use, 2018 - 2030

10.2.1. Hospitals & Clinics

10.2.2. Research Laboratories

10.2.3. Pharmaceutical and Biotechnology Industry

10.3. Market Attractiveness Analysis By End-use

11. Global Medical Imaging Lens Market Analysis and Forecast, By Region

11.1. Introduction

11.1.1. Basis Point Share (BPS) Analysis By Region

11.2. Medical Imaging Lens Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Region, 2018 - 2030

11.2.1. North America

11.2.2. Europe

11.2.3. APAC

11.2.4. South America

11.2.5. Middle East & Africa

11.3. Market Attractiveness Analysis By Region

12. North America Medical Imaging Lens Market Analysis and Forecast

12.1. Introduction

12.2. Drivers and Restraints: Impact Analysis

12.3. Medical Imaging Lens Market Size (US$ Mn) and Analysis & Forecast, By Product Application, 2018 - 2030

12.3.1. Fiber Scope Couplers

12.3.2. Endoscope Couplers

12.3.3. Medical X-ray Scanning

12.3.4. Diagnostic Camera Hand Pieces

12.3.5. Others

12.4. Medical Imaging Lens Market Size (US$ Mn) Analysis & Forecast, By Functional Application, 2018 - 2030

12.4.1. Pathological Imaging

12.4.2. Intra-operative Imaging

12.5. Medical Imaging Lens Market Size (US$ Mn) Analysis & Forecast, By End-use, 2018 - 2030

12.5.1. Hospitals & Clinics

12.5.2. Research Laboratories

12.5.3. Pharmaceutical and Biotechnology Industry

12.6. Medical Imaging Lens Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country, 2018 - 2030

12.6.1. U.S.

12.6.2. Canada

12.6.3. Mexico

12.7. Market Attractiveness Analysis

12.7.1. Product Application

12.7.2. Application

12.7.3. End-use

12.7.4. Country

13. South America Medical Imaging Lens Market Analysis and Forecast

13.1. Introduction

13.2. Drivers and Restraints: Impact Analysis

13.3. Medical Imaging Lens Market Size (US$ Mn) and Analysis & Forecast, By Product Application, 2018 - 2030

13.3.1. Fiber Scope Couplers

13.3.2. Endoscope Couplers

13.3.3. Medical X-ray Scanning

13.3.4. Diagnostic Camera Hand Pieces

13.3.5. Others

13.4. Medical Imaging Lens Market Size (US$ Mn) Analysis & Forecast, By Functional Application, 2018 - 2030

13.4.1. Pathological Imaging

13.4.2. Intra-operative Imaging

13.5. Medical Imaging Lens Market Size (US$ Mn) Analysis & Forecast, By End-use, 2018 - 2030

13.5.1. Hospitals & Clinics

13.5.2. Research Laboratories

13.5.3. Pharmaceutical and Biotechnology Industry

13.6. Medical Imaging Lens Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country & Sub-region, 2018 - 2030

13.6.1. Brazil

13.6.2. Argentina

13.6.3. Rest of South America

13.7. Market Attractiveness Analysis

13.7.1. Product Application

13.7.2. Application

13.7.3. End-use

13.7.4. Country

14. Europe Medical Imaging Lens Market Analysis and Forecast

14.1. Introduction

14.2. Drivers and Restraints: Impact Analysis

14.3. Medical Imaging Lens Market Size (US$ Mn) and Analysis & Forecast, By Product Application, 2018 - 2030

14.3.1. Fiber Scope Couplers

14.3.2. Endoscope Couplers

14.3.3. Medical X-ray Scanning

14.3.4. Diagnostic Camera Hand Pieces

14.3.5. Others

14.4. Medical Imaging Lens Market Size (US$ Mn) Analysis & Forecast, By Functional Application, 2018 - 2030

14.4.1. Pathological Imaging

14.4.2. Intra-operative Imaging

14.5. Medical Imaging Lens Market Size (US$ Mn) Analysis & Forecast, By End-use, 2018 - 2030

14.5.1. Hospitals & Clinics

14.5.2. Research Laboratories

14.5.3. Pharmaceutical and Biotechnology Industry

14.6. Medical Imaging Lens Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country & Sub-region, 2018 - 2030

14.6.1. U.K.

14.6.2. Germany

14.6.3. France

14.6.4. Italy

14.6.5. Russia

14.6.6. Rest of Europe

14.7. Market Attractiveness Analysis

14.7.1. Product Application

14.7.2. Application

14.7.3. End-use

14.7.4. Country

15. APAC Medical Imaging Lens Market Analysis and Forecast

15.1. Introduction

15.2. Drivers and Restraints: Impact Analysis

15.3. Medical Imaging Lens Market Size (US$ Mn) and Analysis & Forecast, By Product Application, 2018 - 2030

15.3.1. Fiber Scope Couplers

15.3.2. Endoscope Couplers

15.3.3. Medical X-ray Scanning

15.3.4. Diagnostic Camera Hand Pieces

15.3.5. Others

15.4. Medical Imaging Lens Market Size (US$ Mn) Analysis & Forecast, By Functional Application, 2018 - 2030

15.4.1. Pathological Imaging

15.4.2. Intra-operative Imaging

15.5. Medical Imaging Lens Market Size (US$ Mn) Analysis & Forecast, By End-use, 2018 - 2030

15.5.1. Hospitals & Clinics

15.5.2. Research Laboratories

15.5.3. Pharmaceutical and Biotechnology Industry

15.6. Medical Imaging Lens Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country & Sub-region, 2018 - 2030

15.6.1. China

15.6.2. India

15.6.3. Japan

15.6.4. South Korea

15.6.5. ASEAN

15.6.6. Rest of APAC

15.7. Market Attractiveness Analysis

15.7.1. Product Application

15.7.2. Application

15.7.3. End-use

15.7.4. Country

16. China Medical Imaging Lens Market Analysis and Forecast

16.1. Introduction

16.2. Drivers and Restraints: Impact Analysis

16.3. Medical Imaging Lens Market Size (US$ Mn) and Analysis & Forecast, By Product Application, 2018 - 2030

16.3.1. Fiber Scope Couplers

16.3.2. Endoscope Couplers

16.3.3. Medical X-ray Scanning

16.3.4. Diagnostic Camera Hand Pieces

16.3.5. Others

16.4. Medical Imaging Lens Market Size (US$ Mn) Analysis & Forecast, By Functional Application, 2018 - 2030

16.4.1. Pathological Imaging

16.4.2. Intra-operative Imaging

16.5. Medical Imaging Lens Market Size (US$ Mn) Analysis & Forecast, By End-use, 2018 - 2030

16.5.1. Hospitals & Clinics

16.5.2. Research Laboratories

16.5.3. Pharmaceutical and Biotechnology Industry

16.6. Market Attractiveness Analysis

16.6.1. Product Application

16.6.2. Application

16.6.3. End-use

17. Middle East & Africa (MEA) Medical Imaging Lens Market Analysis and Forecast

17.1. Introduction

17.2. Drivers and Restraints: Impact Analysis

17.3. Medical Imaging Lens Market Size (US$ Mn) and Analysis & Forecast, By Product Application, 2018 - 2030

17.3.1. Fiber Scope Couplers

17.3.2. Endoscope Couplers

17.3.3. Medical X-ray Scanning

17.3.4. Diagnostic Camera Hand Pieces

17.3.5. Others

17.4. Medical Imaging Lens Market Size (US$ Mn) Analysis & Forecast, By Functional Application, 2018 - 2030

17.4.1. Pathological Imaging

17.4.2. Intra-operative Imaging

17.5. Medical Imaging Lens Market Size (US$ Mn) Analysis & Forecast, By End-use, 2018 - 2030

17.5.1. Hospitals & Clinics

17.5.2. Research Laboratories

17.5.3. Pharmaceutical and Biotechnology Industry

17.6. Medical Imaging Lens Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country & Sub-region, 2018 - 2030

17.6.1. GCC Countries

17.6.2. South Africa

17.6.3. North Africa

17.6.4. Rest of MEA

17.7. Market Attractiveness Analysis

17.7.1. Product Application

17.7.2. Application

17.7.3. End-use

17.7.4. Country

18. Competition Assessment

18.1. Global Medical Imaging Lens Market Competition - a Dashboard View

18.2. Global Medical Imaging Lens Market Structure Analysis

18.3. Global Medical Imaging Lens Market Company Share Analysis, by Value and Volume (2019)

18.4. Key Participants Market Presence (Intensity Mapping) by Region

19. Competition Deep-dive (Manufacturers/Suppliers)

19.1. Nikon Instruments, Inc.

19.1.1. Overview

19.1.2. Product Portfolio

19.1.3. Sales Footprint

19.1.4. Channel Footprint

19.1.4.1. Distributors List

19.1.5. Strategy Overview

19.1.5.1. Marketing Strategy

19.1.5.2. Culture Strategy

19.1.5.3. Channel Strategy

19.1.6. SWOT Analysis

19.1.7. Financial Analysis

19.1.8. Revenue Share

19.1.8.1. By Region

19.1.9. Key Clients

19.1.10. Analyst Comments

19.2. Canon, Inc.

19.2.1. Overview

19.2.2. Product Portfolio

19.2.3. Sales Footprint

19.2.4. Channel Footprint

19.2.4.1. Distributors List

19.2.5. Strategy Overview

19.2.5.1. Marketing Strategy

19.2.5.2. Culture Strategy

19.2.5.3. Channel Strategy

19.2.6. SWOT Analysis

19.2.7. Financial Analysis

19.2.8. Revenue Share

19.2.8.1. By Region

19.2.9. Key Clients

19.2.10. Analyst Comments

19.3. National Instruments

19.3.1. Overview

19.3.2. Product Portfolio

19.3.3. Sales Footprint

19.3.4. Channel Footprint

19.3.4.1. Distributors List

19.3.5. Strategy Overview

19.3.5.1. Marketing Strategy

19.3.5.2. Culture Strategy

19.3.5.3. Channel Strategy

19.3.6. SWOT Analysis

19.3.7. Financial Analysis

19.3.8. Revenue Share

19.3.8.1. By Region

19.3.9. Key Clients

19.3.10. Analyst Comments

19.4. Edmund Optics

19.4.1. Overview

19.4.2. Product Portfolio

19.4.3. Sales Footprint

19.4.4. Channel Footprint

19.4.4.1. Distributors List

19.4.5. Strategy Overview

19.4.5.1. Marketing Strategy

19.4.5.2. Culture Strategy

19.4.5.3. Channel Strategy

19.4.6. SWOT Analysis

19.4.7. Financial Analysis

19.4.8. Revenue Share

19.4.8.1. By Region

19.4.9. Key Clients

19.4.10. Analyst Comments

19.5. Navitar

19.5.1. Overview

19.5.2. Product Portfolio

19.5.3. Sales Footprint

19.5.4. Channel Footprint

19.5.4.1. Distributors List

19.5.5. Strategy Overview

19.5.5.1. Marketing Strategy

19.5.5.2. Culture Strategy

19.5.5.3. Channel Strategy

19.5.6. SWOT Analysis

19.5.7. Financial Analysis

19.5.8. Revenue Share

19.5.8.1. By Region

19.5.9. Key Clients

19.5.10. Analyst Comments

19.6. Fujifilm Holdings Corporation

19.6.1. Overview

19.6.2. Product Portfolio

19.6.3. Sales Footprint

19.6.4. Channel Footprint

19.6.4.1. Distributors List

19.6.5. Strategy Overview

19.6.5.1. Marketing Strategy

19.6.5.2. Culture Strategy

19.6.5.3. Channel Strategy

19.6.6. SWOT Analysis

19.6.7. Financial Analysis

19.6.8. Revenue Share

19.6.8.1. By Region

19.6.9. Key Clients

19.6.10. Analyst Comments

19.7. Leica Microsystems

19.7.1. Overview

19.7.2. Product Portfolio

19.7.3. Sales Footprint

19.7.4. Channel Footprint

19.7.4.1. Distributors List

19.7.5. Strategy Overview

19.7.5.1. Marketing Strategy

19.7.5.2. Culture Strategy

19.7.5.3. Channel Strategy

19.7.6. SWOT Analysis

19.7.7. Financial Analysis

19.7.8. Revenue Share

19.7.8.1. By Region

19.7.9. Key Clients

19.7.10. Analyst Comments

19.8. Eastman Kodak Company

19.8.1. Overview

19.8.2. Product Portfolio

19.8.3. Sales Footprint

19.8.4. Channel Footprint

19.8.4.1. Distributors List

19.8.5. Strategy Overview

19.8.5.1. Marketing Strategy

19.8.5.2. Culture Strategy

19.8.5.3. Channel Strategy

19.8.6. SWOT Analysis

19.8.7. Financial Analysis

19.8.8. Revenue Share

19.8.8.1. By Region

19.8.9. Key Clients

19.8.10. Analyst Comments

19.9. Panasonic Corporation

19.9.1. Overview

19.9.2. Product Portfolio

19.9.3. Sales Footprint

19.9.4. Channel Footprint

19.9.4.1. Distributors List

19.9.5. Strategy Overview

19.9.5.1. Marketing Strategy

19.9.5.2. Culture Strategy

19.9.5.3. Channel Strategy

19.9.6. SWOT Analysis

19.9.7. Financial Analysis

19.9.8. Revenue Share

19.9.8.1. By Region

19.9.9. Key Clients

19.9.10. Analyst Comments

19.10. Olympus Corporation

19.10.1. Overview

19.10.2. Product Portfolio

19.10.3. Sales Footprint

19.10.4. Channel Footprint

19.10.4.1. Distributors List

19.10.5. Strategy Overview

19.10.5.1. Marketing Strategy

19.10.5.2. Culture Strategy

19.10.5.3. Channel Strategy

19.10.6. SWOT Analysis

19.10.7. Financial Analysis

19.10.8. Revenue Share

19.10.8.1. By Region

19.10.9. Key Clients

19.10.10. Analyst Comments

20. Recommendation- Critical Success Factors

21. Research Methodology

22. Assumptions & Acronyms Used

List of Tables

Table 01: Global Medical Imaging Lens Market Revenue (US$ Mn), by Product Application, 2014–2030

Table 02: Global Medical Imaging Lens Market Revenue (US$ Mn), by Functional Application, 2014–2030

Table 03: Global Medical Imaging Lens Market Revenue (US$ Mn), by End-use, 2014–2030

Table 04: Global Medical Imaging Lens Market Revenue (US$ Mn), by Region, 2014–2030

Table 05: Global Medical Imaging Lens Market Volume (Million Units), by Region, 2014–2030

Table 06: North America Medical Imaging Lens Market Revenue (US$ Mn), by Product Application, 2014–2030

Table 07: North America Medical Imaging Lens Market Revenue (US$ Mn), by Functional Application, 2014–2030

Table 08: North America Medical Imaging Lens Market Revenue (US$ Mn), by End-use, 2014–2030

Table 09: North America Medical Imaging Lens Market Revenue (US$ Mn), by Country, 2014–2030

Table 10: North America Medical Imaging Lens Market Volume (Million Units), by Country, 2014–2030

Table 11: South America Medical Imaging Lens Market Revenue (US$ Mn), by Product Application, 2014–2030

Table 12: South America Medical Imaging Lens Market Revenue (US$ Mn), by Functional Application, 2014–2030

Table 13: South America Medical Imaging Lens Market Revenue (US$ Mn), by End-use, 2014–2030

Table 14: South America Medical Imaging Lens Market Revenue (US$ Mn), by Country, 2014–2030

Table 15: South America Medical Imaging Lens Market Volume (Million Units), by Country, 2014–2030

Table 16: Europe Medical Imaging Lens Market Revenue (US$ Mn), by Product Application, 2014–2030

Table 17: Europe Medical Imaging Lens Market Revenue (US$ Mn), by Functional Application, 2014–2030

Table 18: Europe Medical Imaging Lens Market Revenue (US$ Mn), by End-use, 2014–2030

Table 19: Europe Medical Imaging Lens Market Revenue (US$ Mn), by Country, 2014–2030

Table 20: Europe Medical Imaging Lens Market Volume (Million Units), by Country, 2014–2030

Table 21: Asia Pacific Medical Imaging Lens Market Revenue (US$ Mn), by Product Application, 2014–2030

Table 22: Asia Pacific Medical Imaging Lens Market Revenue (US$ Mn), by Functional Application, 2014–2030

Table 23: Asia Pacific Medical Imaging Lens Market Revenue (US$ Mn), by End-use, 2014–2030

Table 24: Asia Pacific Medical Imaging Lens Market Revenue (US$ Mn), by Country, 2014–2030

Table 25: Asia Pacific Medical Imaging Lens Market Volume (Million Units), by Country, 2014–2030

Table 26: China Medical Imaging Lens Market Revenue (US$ Mn), by Product Application, 2014–2030

Table 27: China Medical Imaging Lens Market Revenue (US$ Mn), by Functional Application, 2014–2030

Table 28: China Medical Imaging Lens Market Revenue (US$ Mn), by End-use, 2014–2030

Table 29: Middle East & Africa Medical Imaging Lens Market Revenue (US$ Mn), by Product Application, 2014–2030

Table 30: Middle East & Africa Medical Imaging Lens Market Revenue (US$ Mn), by Functional Application, 2014–2030

Table 31: Middle East & Africa Medical Imaging Lens Market Revenue (US$ Mn), by End-use, 2014–2030

Table 32: Middle East & Africa Medical Imaging Lens Market Revenue (US$ Mn), by Country, 2014–2030

Table 33: Middle East & Africa Medical Imaging Lens Market Volume (Million Units), by Country, 2014–2030

List of Figures

Figure 01: Global Medical Imaging Lens Market Revenue (US$ Mn) Forecast, 2014–2030

Figure 02: United States: Real GDP Growth by Each Quarter (2019 – 2021)

Figure 03: United Kingdom: Real GDP Growth by Each Quarter (2019 – 2021)

Figure 04: Japan: Real GDP Growth by Each Quarter (2019 – 2021)

Figure 05: Germany: Real GDP Growth by Each Quarter (2019 – 2021)

Figure 06: Global Medical Imaging Lenses Market – Impact of COVID-19 Sales Revenue, 2019 v/s 2020

Figure 07: Global Medical Imaging Lenses Market – Impact of COVID-19 on Revenue, quarter wise

Figure 08: Global Medical Imaging Lens Market Revenue Projection and Y-o-Y Growth, 2014–2030 (US$ Mn and %)

Figure 09: Global Medical Imaging Lens Market, by Fiber Scope Couplers

Figure 10: Global Medical Imaging Lens Market, by Endoscope Couplers

Figure 11: Global Medical Imaging Lens Market, by Medical X-ray Scanning

Figure 12: Global Medical Imaging Lens Market, by Telephoto (>135 mm)

Figure 13: Global Medical Imaging Lens Market, by Others

Figure 14: Global Medical Imaging Lens Market Comparison Matrix, by Product Application

Figure 15: Global Medical Imaging Lens Market Attractiveness Analysis, by Product Application

Figure 16: Global Medical Imaging Lens Market, by Pathological Imaging

Figure 17: Global Medical Imaging Lens Market, by Intra-operative Imaging

Figure 18: Global Medical Imaging Lens Market Comparison Matrix, by Functional Application

Figure 19: Global Medical Imaging Lens Market Attractiveness Analysis, by Function Application

Figure 20: Global Medical Imaging Lens Market, by Hospitals & Clinics

Figure 21: Global Medical Imaging Lens Market, by Research Laboratories

Figure 22: Global Medical Imaging Lens Market, by Pharmaceutical and Biotechnology Industry

Figure 23: Global Medical Imaging Lens Market Comparison Matrix, by End-use

Figure 24: Global Medical Imaging Lens Market Attractiveness Analysis, by End-use

Figure 25: Global Medical Imaging Lens Market Value Share Analysis, by Region (2020E)

Figure 26: Global Medical Imaging Lens Market Value Share Analysis, by Region (2030F)

Figure 27: Global Medical Imaging Lens Market Volume Share Analysis, by Region (2020E)

Figure 28: Global Medical Imaging Lens Market Volume Share Analysis, by Region (2030F)

Figure 29: Asia Pacific Battery Free RFID Sensor Market Attractiveness Analysis, By End-user Industry

Figure 30: North America Medical Imaging Lens Market Revenue Projection and Y-o-Y Growth, 2014–2030 (US$ Mn and %)

Figure 31: North America Medical Imaging Lens Market Value Share Analysis, by Product Application (2020)

Figure 32: North America Medical Imaging Lens Market Value Share Analysis, by Product Application (2030)

Figure 33: North America Medical Imaging Lens Market Value Share Analysis, by Functional Application (2020)

Figure 34: North America Medical Imaging Lens Market Value Share Analysis, by Functional Application (2030)

Figure 35: North America Medical Imaging Lens Market Value Share Analysis, by End-use (2020)

Figure 36: North America Medical Imaging Lens Market Value Share Analysis, by End-use (2030)

Figure 37: North America Medical Imaging Lens Market Value Share Analysis, by Country (2020)

Figure 38: North America Medical Imaging Lens Market Value Share Analysis, by Country (2030)

Figure 39: North America Medical Imaging Lens Market Volume Share Analysis, by Country (2020)

Figure 40: North America Medical Imaging Lens Market Volume Share Analysis, by Country (2030)

Figure 41: North America Medical Imaging Lens Market Attractiveness Analysis, by Product Application

Figure 42: North America Medical Imaging Lens Market Attractiveness Analysis, by Functional Application

Figure 43: North America Medical Imaging Lens Market Attractiveness Analysis, by End-use

Figure 44: North America Medical Imaging Lens Market Attractiveness Analysis, by Country

Figure 45: South America Medical Imaging Lens Market Revenue Projection and Y-o-Y Growth, 2014–2030 (US$ Mn and %)

Figure 46: South America Medical Imaging Lens Market Value Share Analysis, by Product Application (2020)

Figure 47: South America Medical Imaging Lens Market Value Share Analysis, by Product Application (2030)

Figure 48: South America Medical Imaging Lens Market Value Share Analysis, by Functional Application (2020)

Figure 49: South America Medical Imaging Lens Market Value Share Analysis, by Functional Application (2030)

Figure 50: South America Medical Imaging Lens Market Value Share Analysis, by End-use (2020)

Figure 51: South America Medical Imaging Lens Market Value Share Analysis, by End-use (2030)

Figure 52: South America Medical Imaging Lens Market Value Share Analysis, by Country (2020)

Figure 53: South America Medical Imaging Lens Market Value Share Analysis, by Country (2030)

Figure 54: South America Medical Imaging Lens Market Volume Share Analysis, by Country (2020)

Figure 55: South America Medical Imaging Lens Market Volume Share Analysis, by Country (2030)

Figure 56: South America Medical Imaging Lens Market Attractiveness Analysis, by Product Application

Figure 57: South America Medical Imaging Lens Market Attractiveness Analysis, by Functional Application

Figure 58: South America Medical Imaging Lens Market Attractiveness Analysis, by End-use

Figure 59: South America Medical Imaging Lens Market Attractiveness Analysis, by Country

Figure 60: Europe Medical Imaging Lens Market Revenue Projection and Y-o-Y Growth, 2014–2030 (US$ Mn and %)

Figure 61: Europe Medical Imaging Lens Market Value Share Analysis, by Product Application (2020)

Figure 62: Europe Medical Imaging Lens Market Value Share Analysis, by Product Application (2030)

Figure 63: Europe Medical Imaging Lens Market Value Share Analysis, by Functional Application (2020)

Figure 64: Europe Medical Imaging Lens Market Value Share Analysis, by Functional Application (2030)

Figure 65: Europe Medical Imaging Lens Market Value Share Analysis, by End-use (2020)

Figure 66: Europe Medical Imaging Lens Market Value Share Analysis, by End-use (2030)

Figure 67: Europe Medical Imaging Lens Market Value Share Analysis, by Country (2020)

Figure 68: Europe Medical Imaging Lens Market Value Share Analysis, by Country (2030)

Figure 69: Europe Medical Imaging Lens Market Volume Share Analysis, by Country (2020)

Figure 70: Europe Medical Imaging Lens Market Volume Share Analysis, by Country (2030)

Figure 71: Europe Medical Imaging Lens Market Attractiveness Analysis, by Product Application

Figure 72: Europe Medical Imaging Lens Market Attractiveness Analysis, by Functional Application

Figure 73: Europe Medical Imaging Lens Market Attractiveness Analysis, by End-use

Figure 74: Europe Medical Imaging Lens Market Attractiveness Analysis, by Country

Figure 75: Asia Pacific Medical Imaging Lens Market Revenue Projection and Y-o-Y Growth, 2014–2030 (US$ Mn and %)

Figure 76: Asia Pacific Medical Imaging Lens Market Value Share Analysis, by Product Application (2020)

Figure 77: Asia Pacific Medical Imaging Lens Market Value Share Analysis, by Product Application (2030)

Figure 78: Asia Pacific Medical Imaging Lens Market Value Share Analysis, by Functional Application (2020)

Figure 79: Asia Pacific Medical Imaging Lens Market Value Share Analysis, by Functional Application (2030)

Figure 80: Asia Pacific Medical Imaging Lens Market Value Share Analysis, by End-use (2020)

Figure 81: Asia Pacific Medical Imaging Lens Market Value Share Analysis, by End-use (2030)

Figure 82: Asia Pacific Medical Imaging Lens Market Value Share Analysis, by Country (2020)

Figure 83: Asia Pacific Medical Imaging Lens Market Value Share Analysis, by Country (2030)

Figure 84: Asia Pacific Medical Imaging Lens Market Volume Share Analysis, by Country (2020)

Figure 85: Asia Pacific Medical Imaging Lens Market Volume Share Analysis, by Country (2030)

Figure 86: Asia Pacific Medical Imaging Lens Market Attractiveness Analysis, by Product Application

Figure 87: Asia Pacific Medical Imaging Lens Market Attractiveness Analysis, by Functional Application

Figure 88: Asia Pacific Medical Imaging Lens Market Attractiveness Analysis, by End-use

Figure 89: Asia Pacific Medical Imaging Lens Market Attractiveness Analysis, by Country

Figure 90: China Medical Imaging Lens Market Revenue Projection and Y-o-Y Growth, 2014–2030 (US$ Mn and %)

Figure 91: China Medical Imaging Lens Market Value Share Analysis, by Product Application (2020)

Figure 92: China Medical Imaging Lens Market Value Share Analysis, by Product Application (2030)

Figure 93: China Medical Imaging Lens Market Value Share Analysis, by Functional Application (2020)

Figure 94: China Medical Imaging Lens Market Value Share Analysis, by Functional Application (2030)

Figure 95: China Medical Imaging Lens Market Value Share Analysis, by End-use (2020)

Figure 96: China Medical Imaging Lens Market Value Share Analysis, by End-use (2030)

Figure 97: Middle East & Africa Medical Imaging Lens Market Revenue Projection and Y-o-Y Growth, 2014–2030 (US$ Mn and %)

Figure 98: Middle East & Africa Medical Imaging Lens Market Value Share Analysis, by Product Application (2020)

Figure 99: Middle East & Africa Medical Imaging Lens Market Value Share Analysis, by Product Application (2030)

Figure 100: Middle East & Africa Medical Imaging Lens Market Value Share Analysis, by Functional Application (2020)

Figure 101: Middle East & Africa Medical Imaging Lens Market Value Share Analysis, by Functional Application (2030)

Figure 102: Middle East & Africa Medical Imaging Lens Market Value Share Analysis, by End-use (2020)

Figure 103: Middle East & Africa Medical Imaging Lens Market Value Share Analysis, by End-use (2030)

Figure 104: Middle East & Africa Medical Imaging Lens Market Value Share Analysis, by Country (2020)

Figure 105: Middle East & Africa Medical Imaging Lens Market Value Share Analysis, by Country (2030)

Figure 106: Middle East & Africa Medical Imaging Lens Market Volume Share Analysis, by Country (2020)

Figure 107: Middle East & Africa Medical Imaging Lens Market Volume Share Analysis, by Country (2030)

Figure 108: Middle East & Africa Medical Imaging Lens Market Attractiveness Analysis, by Product Application

Figure 109: Middle East & Africa Medical Imaging Lens Market Attractiveness Analysis, by Functional Application

Figure 110: Middle East & Africa Medical Imaging Lens Market Attractiveness Analysis, by End-use

Figure 111: Middle East & Africa Medical Imaging Lens Market Attractiveness Analysis, by Country

Figure 112: Global Medical Imaging Lens Market Share Analysis, by Company