Analysts’ Viewpoint on Medical Imaging Equipment Services Market Scenario

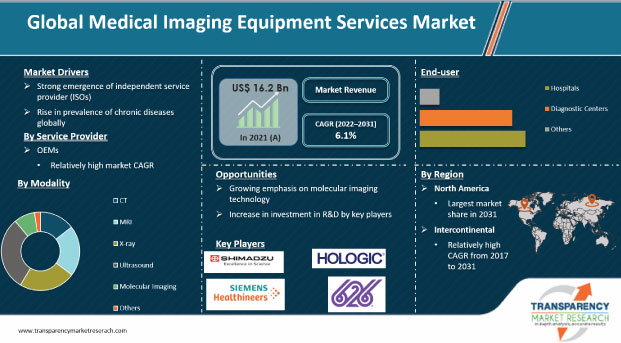

The medical imaging equipment services market is witnessing ongoing changes in customer base and competitive landscape, as the rapid shift toward value-added service offerings has increased providers’ budgetary constraints. The medical imaging equipment services market is primarily divided between independent services organizations (ISOs) and original equipment manufacturers (OEMs), which differentiate from one another through imaging equipment serviced and other service offerings. In the past few years, prominent OEMs have captured the competitive landscape of the medical imaging equipment service industry, as majority of medical imaging was conducted in hospitals. On the other hand, in response to the OEMs prominent position, ISOs have differentiated themselves in the industry through engineering experience, personalized service, and pricing. Moreover, several ISOs globally have started providing services on time and materials basis, and have eliminated pre-approval processing. Additionally, notable transactions within the medical imaging equipment services sector drives the global market.

The global medical imaging equipment services market is expected to grow at a fast rate during the forecast period from 2022 to 2031, owing to major technological advancements in medical imaging equipment services, increase in R&D funding, surge in demand for overall surgeries, and rise in prevalence of chronic diseases.

The number of diagnostic and surgical procedures is increasing due to rise in incidence and prevalence of various diseases such cancer and cardiovascular diseases. According to the Global Cancer Observatory (GCO), an interactive web-based platform representing global cancer statistics, the number of new cancer cases stood at 219,292,789 in 2020, and it is expected to reach 28,887,940 in 2040.

As per the data published by the American Heart Association, a nonprofit organization in the U.S. that supports cardiovascular medical research worldwide, nearly 18.6 million patients succumbed to cardiovascular disease (CVDs) in 2019, an increase of 17.1% in the last decade. There were over 523.2 million cases of CVDs in 2019, a rise of 26.6% over that in 2010.

The figures mentioned above indicate that the demand for advanced imaging systems is expected to increase, which, in turn, is likely to propel the medical imaging equipment services market during the forecast period.

The global medical imaging equipment services market is experiencing unprecedented dynamics, owing to a shift toward value-based service offerings. Additionally, strategic collaborations between ISOs are expected to drive the global medical imaging equipment services market.

In February 2022, DirectMed Parts & Service, LLC., a U.S.-based medical imaging equipment repair & maintenance service provider, announced that it has completed the acquisition of LBN Medical, a leading provider of pre-owned and refurbished medical imaging equipment, in order to gain prominent share in the global medical imaging equipment services market. Moreover, in February 2021, the American Medical Imaging (AMI) and Tech Knowledge Associates (TKA) announced the official imaging equipment sales and service partnership. This new partnership aims to deliver the entire spectrum of sales, repair, and maintenance solutions to health care facilities across the U.S. In the same year in January, Probo Medical, a renowned provider of medical imaging parts, equipment, repair, and service, announced the official acquisition of Mount International United Services Ltd., a U.K.-based provider of third-party repairs, service, and maintenance for medical imaging equipment.

In terms of service provider, the global medical imaging equipment services market has been bifurcated into OEMs and ISOs. The OEMs segment held key share of the global market in 2021. The segment is projected to grow at a moderate rate during the forecast period. Key manufacturers, including Philips, GE, and Toshiba, invest in the expansion of their service offerings. Moreover, technological advancements leading to faster processing and shorter test time are anticipated to accelerate the growth of the segment from 2022 to 2031.

Based on modality, the global medical imaging equipment services market has been classified into computed tomography (CT), magnetic resonance imaging (MRI), X-ray, ultrasound, molecular imaging, and others. Molecular imaging is a rapidly-growing segment of the global medical imaging equipment services market. The segment is expected to expand at a growth rate of 6.6% during the forecast period. Molecular imaging has significant potential in detecting disorders in early stages, selecting disease as well as patient-specific therapeutic treatment, ascertaining extent of disease, measuring molecular-specific effects of treatment, and applying a directed or targeted therapy.

In terms of end-user, the global medical imaging equipment service market has been divided into hospitals, diagnostic centers, and others. The hospitals segment of the global medical imaging equipment services market held prominent market share in 2021. Moreover, the segment is likely to grow at the fastest CAGR during the forecast period. Growth of the segment can be attributed to rise in utilization of medical imaging equipment services by hospitals in order to deliver better health services.

North America held key share of around 35% of the global medical imaging equipment service market in 2021. Increase in spending on research & innovations and rise in patients with oncological and cardiovascular diseases, specifically across Canada and the U.S., are the key drivers of the medical imaging equipment service market in North America. Additionally, robust presence of healthcare facilities, specifically diagnostic imaging centers and hospitals, and increase in installed base of innovative medical imaging technologies across the healthcare sector are also projected to drive the market in the region. Moreover, in July 2021, Novacap, Canada's prominent private equity firm, announced investment in Canada Diagnostic Centres (CDC), a multi-modality medical diagnostic equipment provider, in order to support CDC's business expansion worldwide. These supportive investments open new doors for the medical imaging services market.

EMEA and Intercontinental are also large customers of medical imaging equipment services, and held second and third largest share, respectively, of the global market in 2021. The medical imaging equipment services market in Intercontinental countries is propelled by the rise in focus on early diagnosis. Moreover, early detection of chronic diseases, such as cancer, increases the chances of successful treatment. Therefore, the healthcare systems across Asia and Latin America emphasize on the early detection of such disorders rather than investing in costly treatments. Furthermore, strong presence of Shimadzu, Canon Medical Systems Corporation (Canon, Inc.), and Fujifilm Holding Corporation in countries in Asia and Latin America is expected to augment the market.

Latin America is a larger medical imaging equipment services market compared to Middle East & Africa. Moreover, the market in Latin America is projected to grow at a faster pace than in Middle East & Africa.

The global medical imaging equipment service market is consolidated, with the presence of large-scale and small-scale vendors. Majority of the companies make significant investments in research & development, primarily to develop innovative devices. Moreover, strategic alliances between key players to increase revenue and market share accelerate the growth of the global market. Furthermore, diversification of product portfolios and mergers & acquisitions are the key strategies adopted by the key players.

Althea Group, Agfa-Gevaert Group, Carestream Health (ONEX Corporation), Canon Medical Systems Corporation (Canon, Inc.), Hitachi, Ltd., GE Healthcare (General Electric Company), Koninklijke Philips N.V., Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Hologic, Inc., Shimadzu Corporation, Siemens Healthineers AG, Universal Hospital Services, Inc., 626, TRIMEDX, United Imaging Healthcare Co., Ltd., and Drägerwerk AG & Co. KGaA are the prominent companies in the medical imaging equipment services market.

Each of these players has been profiled in the medical imaging equipment service market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 16.2 Bn |

|

Market Forecast Value in 2031 |

US$ 29.2 Bn |

|

Growth Rate (CAGR) |

6.1% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value & Tons for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global medical imaging equipment services market was valued at US$ 16.2 Bn in 2021.

The global medical imaging equipment services market is projected to surpass US$ 29.2 Bn by 2031.

The global medical imaging equipment services market grew at a CAGR of 5.2% from 2017 to 2021.

The global medical imaging equipment services market is anticipated to grow at a CAGR of 6.1% from 2022 to 2031.

Increase in patient population with CVDs & cancer disorders and technologically advanced products boost the growth of the global market.

The ultrasound segment held over 30% share of the global medical imaging equipment services market in 2021.

Prominent players in the global medical imaging equipment services market include Hitachi, Ltd., GE Healthcare (General Electric Company), Koninklijke Philips N.V., Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Hologic, Inc., Shimadzu Corporation, and Siemens Healthineers AG.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Medical Imaging Equipment Services Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Medical Imaging Equipment Services Market Analysis and Forecast, 2017-2031

4.4.1. Market Revenue Projections (US$ Mn)

4.5. Porter’s Five Force Analysis

5. Key Insights

5.1. Key Vendor and Distributor Analysis

5.1.1. Key Vendor Analysis, by Major Players

5.2. COVID-19 Pandemics Impact on Industry (value chain and short / mid / long term impact)

5.3. Growing Adoption of Remote Monitoring Technology, by Medical Imaging Service Providers

5.4. Winning Imperatives by Key Players

5.5. Evolving Trends in Medical Imaging Services

5.6. Installed Base, by Region/Country for Computed Tomography (CT)

5.7. Installed Base, by Region/Country for Magnetic Resonance Imaging (MRI)

5.8. Business Expansion in Teleradiology Services Sector

5.9. Technological Advancements

5.10. Key Vendor and Distributor Analysis

6. Global Medical Imaging Equipment Services Market Analysis and Forecast. by Service Provider

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Service Provider, 2017-2031

6.3.1. Original Equipment Manufacturers

6.3.2. Independent Service Providers

6.4. Market Attractiveness Analysis, by Service Provider

7. Global Medical Imaging Equipment Services Market Analysis and Forecast. by Modality

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Modality, 2017-2031

7.3.1. Computed Tomography (CT)

7.3.2. Magnetic Resonance Imaging (MRI)

7.3.3. X-ray

7.3.4. Ultrasound

7.3.5. Molecular Imaging

7.3.5.1. PET & PET/CT

7.3.5.2. Nuclear Medicine

7.3.5.3. Radiopharmacy Service

7.3.6. Others

7.4. Market Attractiveness Analysis, by Modality

8. Global Medical Imaging Equipment Services Market Analysis and Forecast. by Service Type

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Service Type, 2017-2031

8.3.1. Equipment Removal & Relocation

8.3.2. Equipment Repair & Maintenance

8.3.3. Refurbished Systems

8.3.4. Technical Training

8.3.5. Software Upgrades

8.4. Market Attractiveness Analysis, by Service Type

9. Global Medical Imaging Equipment Services Market Analysis and Forecast. by End-user

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Value Forecast, by End-user, 2017-2031

9.3.1. Hospitals

9.3.2. Diagnostic Centers

9.3.3. Others

9.4. Market Attractiveness Analysis, by End-user

10. Global Medical Imaging Equipment Services Market Analysis and Forecast. by Region

10.1. Key Findings

10.2. Market Value Forecast, by Region

10.2.1. North America

10.2.2. EMEA

10.2.3. China

10.2.4. Intercontinental

10.3. Market Attractiveness Analysis, by Region

11. North America Medical Imaging Equipment Services Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Service Provider, 2017-2031

11.2.1. Original Equipment Manufacturers

11.2.2. Independent Service Providers

11.3. Market Value Forecast, by Modality, 2017-2031

11.3.1. Computed Tomography (CT)

11.3.2. Magnetic Resonance Imaging (MRI)

11.3.3. X-ray

11.3.4. Ultrasound

11.3.5. Molecular Imaging

11.3.5.1. PET & PET/CT

11.3.5.2. Nuclear Medicine

11.3.5.3. Radiopharmacy Service

11.3.6. Others

11.4. Market Value Forecast, by Service Type, 2017-2031

11.4.1. Equipment Removal & Relocation

11.4.2. Equipment Repair & Maintenance

11.4.3. Refurbished Systems

11.4.4. Technical Training

11.4.5. Software Upgrades

11.5. Market Value Forecast, by End-user, 2017-2031

11.5.1. Hospitals

11.5.2. Diagnostic Centers

11.5.3. Others

11.6. Market Value Forecast, by Country, 2017-2031

11.6.1. U.S.

11.6.2. Canada

11.7. Market Attractiveness Analysis

11.7.1. By Service Provider

11.7.2. By Modality

11.7.3. By Service Type

11.7.4. By End-user

11.7.5. By Country

12. EMEA Medical Imaging Equipment Services Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Service Provider, 2017-2031

12.2.1. Original Equipment Manufacturers

12.2.2. Independent Service Providers

12.3. Market Value Forecast, by Modality, 2017-2031

12.3.1. Computed Tomography (CT)

12.3.2. Magnetic Resonance Imaging (MRI)

12.3.3. X-ray

12.3.4. Ultrasound

12.3.5. Molecular Imaging

12.3.5.1. PET & PET/CT

12.3.5.2. Nuclear Medicine

12.3.5.3. Radiopharmacy Service

12.3.6. Others

12.4. Market Value Forecast, by Service Type, 2017-2031

12.4.1. Equipment Removal & Relocation

12.4.2. Equipment Repair & Maintenance

12.4.3. Refurbished Systems

12.4.4. Technical Training

12.4.5. Software Upgrades

12.5. Market Value Forecast, by End-user, 2017-2031

12.5.1. Hospitals

12.5.2. Diagnostic Centers

12.5.3. Others

12.6. Market Value Forecast, by Country/Sub-region, 2017-2031

12.6.1. Europe

12.6.2. Middle East

12.6.3. Africa

12.6.4. Russia/CIS

12.7. Market Attractiveness Analysis

12.7.1. By Service Provider

12.7.2. By Modality

12.7.3. By Service Type

12.7.4. By End-user

12.7.5. By Country/Sub-region

13. China Pacific Medical Imaging Equipment Services Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Service Provider, 2017-2031

13.2.1. Original Equipment Manufacturers

13.2.2. Independent Service Providers

13.3. Market Value Forecast, by Modality, 2017-2031

13.3.1. Computed Tomography (CT)

13.3.2. Magnetic Resonance Imaging (MRI)

13.3.3. X-ray

13.3.4. Ultrasound

13.3.5. Molecular Imaging

13.3.5.1. PET & PET/CT

13.3.5.2. Nuclear Medicine

13.3.5.3. Radiopharmacy Service

13.3.6. Others

13.4. Market Value Forecast, by Service Type, 2017-2031

13.4.1. Equipment Removal & Relocation

13.4.2. Equipment Repair & Maintenance

13.4.3. Refurbished Systems

13.4.4. Technical Training

13.4.5. Software Upgrades

13.5. Market Value Forecast, by End-user, 2017-2031

13.5.1. Hospitals

13.5.2. Diagnostic Centers

13.5.3. Others

13.6. Market Attractiveness Analysis

13.6.1. By Service Provider

13.6.2. By Modality

13.6.3. By Service Type

13.6.4. By End-user

14. Intercontinental Medical Imaging Equipment Services Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Service Provider, 2017-2031

14.2.1. Original Equipment Manufacturers

14.2.2. Independent Service Providers

14.3. Market Value Forecast, by Modality, 2017-2031

14.3.1. Computed Tomography (CT)

14.3.2. Magnetic Resonance Imaging (MRI)

14.3.3. X-ray

14.3.4. Ultrasound

14.3.5. Molecular Imaging

14.3.5.1. PET & PET/CT

14.3.5.2. Nuclear Medicine

14.3.5.3. Radiopharmacy Service

14.3.6. Others

14.4. Market Value Forecast, by Service Type, 2017-2031

14.4.1. Equipment Removal & Relocation

14.4.2. Equipment Repair & Maintenance

14.4.3. Refurbished Systems

14.4.4. Technical Training

14.4.5. Software Upgrades

14.5. Market Value Forecast, by End-user, 2017-2031

14.5.1. Hospitals

14.5.2. Diagnostic Centers

14.5.3. Others

14.6. Market Value Forecast, by Country/Sub-region, 2017-2031

14.6.1. Latin America

14.6.2. Japan

14.6.3. Australia & New Zealand

14.6.4. South Korea

14.6.5. Indonesia

14.6.6. Vietnam

14.6.7. Thailand

14.6.8. Philippines

14.6.9. Singapore

14.6.10. Malaysia

14.6.11. Cambodia

14.6.12. Laos

14.6.13. Myanmar

14.6.14. India

14.6.15. South Asia

14.7. Market Attractiveness Analysis

14.7.1. By Service Provider

14.7.2. By Modality

14.7.3. By Service Type

14.7.4. By End-user

14.7.5. By Country/Sub-region

15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of companies)

15.2. Competitive Business Strategies

15.3. Company Profiles

15.3.1. Agfa-Gevaert Group

15.3.1.1. Company Overview

15.3.1.2. Product Portfolio

15.3.1.3. SWOT Analysis

15.3.1.4. Strategic Overview

15.3.2. Althea Group

15.3.2.1. Company Overview

15.3.2.2. Product Portfolio

15.3.2.3. SWOT Analysis

15.3.2.4. Strategic Overview

15.3.3. Canon Medical Systems Corporation (Canon, Inc.)

15.3.3.1. Company Overview

15.3.3.2. Product Portfolio

15.3.3.3. SWOT Analysis

15.3.3.4. Strategic Overview

15.3.4. Carestream Health (ONEX Corporation)

15.3.4.1. Company Overview

15.3.4.2. Product Portfolio

15.3.4.3. SWOT Analysis

15.3.4.4. Strategic Overview

15.3.5. GE Healthcare (General Electric Company)

15.3.5.1. Company Overview

15.3.5.2. Product Portfolio

15.3.5.3. SWOT Analysis

15.3.5.4. Strategic Overview

15.3.6. Hitachi, Ltd.

15.3.6.1. Company Overview

15.3.6.2. Product Portfolio

15.3.6.3. SWOT Analysis

15.3.6.4. Strategic Overview

15.3.7. Hologic, Inc.

15.3.7.1. Company Overview

15.3.7.2. Product Portfolio

15.3.7.3. SWOT Analysis

15.3.7.4. Strategic Overview

15.3.8. Koninklijke Philips N.V.

15.3.8.1. Company Overview

15.3.8.2. Product Portfolio

15.3.8.3. SWOT Analysis

15.3.8.4. Strategic Overview

15.3.9. Shimadzu Corporation

15.3.9.1. Company Overview

15.3.9.2. Product Portfolio

15.3.9.3. SWOT Analysis

15.3.9.4. Strategic Overview

15.3.10. Siemens Healthineers AG

15.3.10.1. Company Overview

15.3.10.2. Product Portfolio

15.3.10.3. SWOT Analysis

15.3.10.4. Strategic Overview

15.3.11. Universal Hospital Services, Inc.

15.3.11.1. Company Overview

15.3.11.2. Product Portfolio

15.3.11.3. SWOT Analysis

15.3.11.4. Strategic Overview

15.3.12. 626

15.3.12.1. Company Overview

15.3.12.2. Product Portfolio

15.3.12.3. SWOT Analysis

15.3.12.4. Strategic Overview

15.3.13. TRIMEDX

15.3.13.1. Company Overview

15.3.13.2. Product Portfolio

15.3.13.3. SWOT Analysis

15.3.13.4. Strategic Overview

15.3.14. United Imaging Healthcare Co., Ltd.

15.3.14.1. Company Overview

15.3.14.2. Product Portfolio

15.3.14.3. SWOT Analysis

15.3.14.4. Strategic Overview

15.3.15. Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

15.3.15.1. Company Overview

15.3.15.2. Product Portfolio

15.3.15.3. SWOT Analysis

15.3.15.4. Strategic Overview

15.3.16. Drägerwerk AG & Co. KGaA

15.3.16.1. Company Overview

15.3.16.2. Product Portfolio

15.3.16.3. SWOT Analysis

15.3.16.4. Strategic Overview

List of Tables

Table 01: Global Medical Imaging Equipment Services Market Value (US$ Mn) Forecast, by Service Provider, 2017–2031

Table 02: Global Medical Imaging Equipment Services Market Value (US$ Mn) Forecast, by Modality, 2017–2031

Table 03: Global Medical Imaging Equipment Services Market Value (US$ Mn) Forecast, by Modality, 2017–2031

Table 04: Global Medical Imaging Equipment Services Market Value (US$ Mn) Forecast, by Service Type, 2017–2031

Table 05: Global Medical Imaging Equipment Services Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 06: Global Medical Imaging Equipment Services Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 07: North America Medical Imaging Equipment Service Market Value (US$ Mn) Forecast, by Country2017–2031

Table 08: North America Medical Imaging Equipment Service Market Value (US$ Mn) Forecast, by Modality, 2017–2031

Table 09: North America Medical Imaging Equipment Service Market Value (US$ Mn) Forecast, by Modality, 2017–2031

Table 10: North America Medical Imaging Equipment Service Market Value (US$ Mn) Forecast, by Service Provider, 2017–2031

Table 11: North America Medical Imaging Equipment Service Market Value (US$ Mn) Forecast, by Service Type, 2017–2031

Table 12: North America Medical Imaging Equipment Service Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 13: EMEA Medical Imaging Equipment Service Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: EMEA Medical Imaging Equipment Service Market Value (US$ Mn) Forecast, by Modality, 2017–2031

Table 15: EMEA Medical Imaging Equipment Service Market Value (US$ Mn) Forecast, by Molecular Imaging, 2017–2031

Table 16: EMEA Medical Imaging Equipment Service Market Value (US$ Mn) Forecast, by Service Provider, 2017–2031

Table 17: EMEA Medical Imaging Equipment Service Market Value (US$ Mn) Forecast, by Service Type, 2017–2031

Table 18: EMEA Medical Imaging Equipment Service Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 19: Intercontinental Medical Imaging Equipment Service Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 20: Intercontinental Medical Imaging Equipment Service Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 21: Intercontinental Medical Imaging Equipment Service Market Value (US$ Mn) Forecast, by Modality, 2017–2031

Table 22: Intercontinental Medical Imaging Equipment Service Market Value (US$ Mn) Forecast, by Molecular Imaging, 2017–2031

Table 23: Intercontinental Medical Imaging Equipment Service Market Value (US$ Mn) Forecast, by Service Provider, 2017–2031

Table 24: Intercontinental Medical Imaging Equipment Service Market Value (US$ Mn) Forecast, by Service Type, 2017–2031

Table 25: Intercontinental Medical Imaging Equipment Service Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 26: China Medical Imaging Equipment Service Market Value (US$ Mn) Forecast, by Modality, 2017–2031

Table 27: China Medical Imaging Equipment Service Market Value (US$ Mn) Forecast, by Molecular Imaging, 2017–2031

Table 28: China Medical Imaging Equipment Service Market Value (US$ Mn) Forecast, by Service Provider, 2017–2031

Table 29: China Medical Imaging Equipment Service Market Value (US$ Mn) Forecast, by Service Type, 2017–2031

Table 30: China Medical Imaging Equipment Service Market Value (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Medical Imaging Equipment Services Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Medical Imaging Equipment Services Market Value Share, by Modality, 2021

Figure 03: Global Medical Imaging Equipment Services Market Value Share, by Service Provider, 2021

Figure 04: Global Medical Imaging Equipment Services Market Value Share, by Service Type, 2021

Figure 05: Global Medical Imaging Equipment Services Market Value Share, by End-user, 2021

Figure 06: Global Medical Imaging Equipment Services Market Value Share, by Region, 2021

Figure 07: Global Medical Imaging Equipment Services Market Value Share Analysis, by Service Provider, 2021 and 2031

Figure 08: Global Medical Imaging Equipment Services Market Attractiveness Analysis, by Service Provider, 2022–2031

Figure 09: Global Medical Imaging Equipment Services Market Revenue (US$ Mn), by Original Equipment Manufacturers, 2017–2031

Figure 10: Global Medical Imaging Equipment Services Market Revenue (US$ Mn), by Independent Service Providers, 2017–2031

Figure 11: Global Medical Imaging Equipment Services Market Value Share Analysis, by Modality, 2021 and 2031

Figure 12: Global Medical Imaging Equipment Services Market Attractiveness Analysis, by Modality, 2022–2031

Figure 13: Global Medical Imaging Equipment Services Market Revenue (US$ Mn), by CT, 2017–2031

Figure 14: Global Medical Imaging Equipment Services Market Revenue (US$ Mn), by MRI, 2017–2031

Figure 15: Global Medical Imaging Equipment Services Market Revenue (US$ Mn), by X-ray, 2017–2031

Figure 16: Global Medical Imaging Equipment Services Market Revenue (US$ Mn), by Ultrasound, 2017–2031

Figure 17: Global Medical Imaging Equipment Services Market Revenue (US$ Mn), by Molecular Imaging, 2017–2031

Figure 18: Global Medical Imaging Equipment Services Market Revenue (US$ Mn), by Others, 2017–2031

Figure 19: Global Medical Imaging Equipment Services Market Value Share Analysis, by Service Type, 2021 and 2031

Figure 20: Global Medical Imaging Equipment Services Market Attractiveness Analysis, by Service Type, 2022–2031

Figure 21: Global Medical Imaging Equipment Services Market Revenue (US$ Mn), by Equipment Removal & Relocation, 2017–2031

Figure 22: Global Medical Imaging Equipment Services Market Revenue (US$ Mn), by Equipment Repair & Maintenance, 2017–2031

Figure 23: Global Medical Imaging Equipment Services Market Revenue (US$ Mn), by Refurbished Systems, 2017–2031

Figure 24: Global Medical Imaging Equipment Services Market Revenue (US$ Mn), by Technical Training, 2017–2031

Figure 25: Global Medical Imaging Equipment Services Market Revenue (US$ Mn), by Software Upgrades, 2017–2031

Figure 26: Global Medical Imaging Equipment Services Market Value Share Analysis, by End-user, 2021 and 2031

Figure 27: Global Medical Imaging Equipment Services Market Attractiveness Analysis, by End-user, 2022–2031

Figure 28: Global Medical Imaging Equipment Services Market Revenue (US$ Mn), by Hospitals, 2017–2031

Figure 29: Global Medical Imaging Equipment Services Market Revenue (US$ Mn), by Diagnostic Centers, 2017–2031

Figure 30: Global Medical Imaging Equipment Services Market Revenue (US$ Mn), by Others, 2017–2031

Figure 31: Global Medical Imaging Equipment Services Market Value Share Analysis, by Region, 2021 and 2031

Figure 32: Global Medical Imaging Equipment Services Market Attractiveness Analysis, by Region, 2022–2031

Figure 33: North America Medical Imaging Equipment Service Market Value (US$ Mn) Forecast, 2017–2031

Figure 34: North America Medical Imaging Equipment Service Market Value Share Analysis, by Country, 2021 and 2031

Figure 35: North America Medical Imaging Equipment Service Market Attractiveness Analysis, by Country, 2022–2031

Figure 36: North America Medical Imaging Equipment Service Market Value Share Analysis, by Modality, 2021 and 2031

Figure 37: North America Medical Imaging Equipment Service Market Attractiveness Analysis, by Modality, 2022–2031

Figure 38: North America Medical Imaging Equipment Service Market Value Share Analysis, by Service Provider, 2021 and 2031

Figure 39: North America Medical Imaging Equipment Service Market Attractiveness Analysis, by Service Provider, 2022–2031

Figure 40: North America Medical Imaging Equipment Service Market Value Share Analysis, by Service Type, 2021 and 2031

Figure 41: North America Medical Imaging Equipment Service Market Attractiveness Analysis, by Service Type, 2022–2031

Figure 42: North America Medical Imaging Equipment Service Market Value Share Analysis, by End-user, 2021 and 2031

Figure 43: North America Medical Imaging Equipment Service Market Attractiveness Analysis, by End-user, 2022–2031

Figure 44: EMEA Medical Imaging Equipment Service Market Value (US$ Mn) Forecast, 2017–2031

Figure 45: EMEA Medical Imaging Equipment Service Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 46: EMEA Medical Imaging Equipment Service Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 47: EMEA Medical Imaging Equipment Service Market Value Share Analysis, by Modality, 2021 and 2031

Figure 48: EMEA Medical Imaging Equipment Service Market Attractiveness Analysis, by Modality, 2022–2031

Figure 49: EMEA Medical Imaging Equipment Service Market Value Share Analysis, by Service Provider, 2021 and 2031

Figure 50: EMEA Medical Imaging Equipment Service Market Attractiveness Analysis, by Service Provider, 2022–2031

Figure 51: EMEA Medical Imaging Equipment Service Market Value Share Analysis, by Service Type, 2021 and 2031

Figure 52: EMEA Medical Imaging Equipment Service Market Attractiveness Analysis, by Service Type, 2022–2031

Figure 53: EMEA Medical Imaging Equipment Service Market Value Share Analysis, by End-user, 2021 and 2031

Figure 54: EMEA Medical Imaging Equipment Service Market Attractiveness Analysis, by End-user, 2022–2031

Figure 55: Intercontinental Medical Imaging Equipment Service Market Value (US$ Mn) Forecast, 2017–2031

Figure 56: Intercontinental Medical Imaging Equipment Service Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 57: Intercontinental Medical Imaging Equipment Service Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 58: Intercontinental Medical Imaging Equipment Service Market Value Share Analysis, by Modality, 2021 and 2031

Figure 59: Intercontinental Medical Imaging Equipment Service Market Attractiveness Analysis, by Modality, 2022–2031

Figure 60: Intercontinental Medical Imaging Equipment Service Market Value Share Analysis, by Service Provider, 2021 and 2031

Figure 61: Intercontinental Medical Imaging Equipment Service Market Attractiveness Analysis, by Service Provider, 2022–2031

Figure 62: Intercontinental Medical Imaging Equipment Service Market Value Share Analysis, by Service Type, 2021 and 2031

Figure 63: Intercontinental Medical Imaging Equipment Service Market Attractiveness Analysis, by Service Type, 2022–2031

Figure 64: Intercontinental Medical Imaging Equipment Service Market Value Share Analysis, by End-user, 2021 and 2031

Figure 65: Intercontinental Medical Imaging Equipment Service Market Attractiveness Analysis, by End-user, 2022–2031

Figure 66: China Medical Imaging Equipment Service Market Value (US$ Mn) Forecast, 2017–2031

Figure 67: China Medical Imaging Equipment Service Market Value Share Analysis, by Modality, 2021 and 2031

Figure 68: China Medical Imaging Equipment Service Market Attractiveness Analysis, by Modality, 2022–2031

Figure 69: China Medical Imaging Equipment Service Market Value Share Analysis, by Service Provider, 2021 and 2031

Figure 70: China Medical Imaging Equipment Service Market Attractiveness Analysis, by Service Provider, 2022–2031

Figure 71: China Medical Imaging Equipment Service Market Value Share Analysis, by Service Type, 2021 and 2031

Figure 72: China Medical Imaging Equipment Service Market Attractiveness Analysis, by Service Type, 2022–2031

Figure 73: China Medical Imaging Equipment Service Market Value Share Analysis, by End-user, 2021 and 2031

Figure 74: China Medical Imaging Equipment Service Market Attractiveness Analysis, by End-user, 2022–2031