Analysts’ Viewpoint

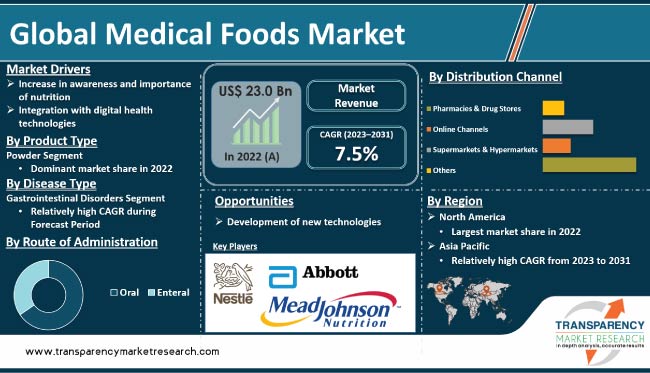

The global medical foods market experienced significant growth in the past few years, driven by increase in demand for specialized nutrition products that address specific medical conditions. Medical foods are specially formulated products that are intended for the dietary management of diseases and medical conditions that have unique nutritional requirements. Rise in prevalence of chronic diseases, such as diabetes, cancer, and Alzheimer's disease, is a major factor propelling market expansion. Increase in consumer interest in personalized nutrition is another factor bolstering market development.

Advances in technology and research on medical foods tailored to specific patient needs offer lucrative opportunities for market players. Manufacturers are focused on ensuring that medical foods are safe, effective, and accessible to patients.

Medical foods are specially formulated products that are intended for the dietary management of diseases and medical conditions that have unique nutritional requirements. Unlike conventional foods, medical foods are designed to be consumed under the supervision of a healthcare professional and are not typically available over the counter.

Medical foods are intended to provide targeted nutritional support to patients with specific medical needs. These could contain various ingredients, including vitamins, minerals, amino acids, and other nutrients, which are carefully selected to support the health and well-being of patients with specific medical conditions.

Some common examples of medical foods include products for the management of metabolic disorders, such as phenylketonuria (PKU), which requires a strict low-protein diet; and products for the management of neurological conditions, such as Alzheimer's disease, which may require increased intake of certain nutrients.

Medical foods are regulated by the U.S. Food and Drug Administration (FDA) and must meet certain criteria to be considered medical food. These criteria include being intended for the dietary management of a specific medical condition, used under medical supervision, and formulated to meet distinctive nutritional requirements.

Increase in awareness about the importance of nutrition in managing health and well-being is driving the global medical foods business growth. This trend is driven by a range of factors, including rise in rate of chronic diseases, aging global population, and increase in demand for personalized nutrition.

The incidence rate of chronic diseases, such as diabetes, obesity, and heart diseases, has increased in the past few years. These conditions can often be managed through diet and nutrition. This has led to increase in demand for medical foods that are designed to support the management of these conditions. For instance, Nestle's Glucerna products are designed for people with diabetes and are formulated to help manage blood sugar levels.

Aging global population is another factor propelling market progress. The nutritional needs of people could change with age, and there is increasing demand for medical foods that can support these needs of older adults. For instance, Abbott Laboratories offers Ensure products, which are designed to provide complete nutrition for older adults who may have difficulty consuming conventional foods.

Increase in awareness about the importance of nutrition is a key driver of the global medical foods industry. As consumers become more educated about the role of nutrition in maintaining good health, they are seeking out specialized products that could address specific health concerns and conditions.

Medical foods are typically prescribed by healthcare professionals and are formulated to meet unique nutritional requirements that cannot be met by conventional foods alone. Demand for these foods is expected to continue to rise as the importance of nutrition in managing chronic diseases and conditions becomes better understood.

The regulatory environment for medical foods is an important factor fueling market expansion. In the U.S., the Food and Drug Administration (FDA) provides clear guidelines for the development and marketing of these foods. A favorable regulatory environment for these foods has encouraged investment in the sector and led to the development of a range of innovative products that could help manage different medical conditions. Investment in the development of medical foods has surged in the past few years, as companies strive to capitalize on the growing demand for personalized nutrition solutions.

Integration with digital health technologies is bolstering global medical foods market growth. Digital health technologies are used to improve patient outcomes by providing personalized nutrition recommendations and tracking patient progress. Mobile apps and wearables are used to track patient progress. These tools could help patients monitor food intake, track progress toward nutritional goals, and provide personalized recommendations based on individual needs. For instance, the Nutrino app uses artificial intelligence to create personalized meal plans and track nutrition data in real-time.

Digital health platforms are also used to connect patients with healthcare providers and nutritionists. These platforms allow patients to receive personalized nutrition advice from experts, and provide a convenient way for patients to track their progress and receive feedback. For instance, MyPlate by Livestrong app connects users with a nutrition coach who can provide personalized nutrition advice and track progress toward health goals.

Digital health technologies are also being used to develop new medical food products that are tailored to individual patient needs. For instance, Nutricia's FODMAP range of medical foods is designed to help people with irritable bowel syndrome, and is based on the results of a clinical trial that used a digital platform to identify patients who could benefit from a low FODMAP diet.

In terms of product type, the powder segment dominated the global medical foods market in 2022 due to its ease of use and versatility. Powdered medical foods are a convenient way to provide complete nutrition to patients. These can be easily mixed with liquids or other foods to create different nutritional products.

One of the key advantages of powdered medical foods is convenience. Powdered products are easy to transport and store, and have a long shelf life. This makes them an ideal choice for patients who need to manage their nutrition over an extended period. These foods also offer high degree of flexibility in terms of dosing, as these could be easily adjusted to meet the individual needs of each patient.

Powdered medical foods are also versatile. These can be mixed with different liquids and foods to create customized nutritional products that meet the unique needs of each patient. For instance, these foods can be mixed with water or milk to create a drink, or these can be added to smoothies or other foods to boost their nutritional value.

Popularity of powdered medical foods is reflected in the growth of the segment. It is expected to dominate the global market in the next few years. The segment is likely to be driven by increase in demand for convenient and versatile nutritional products that can be tailored to individual patient needs.

Based on disease type, the gastrointestinal disorders segment is expected to grow at a faster pace than other segments. This is ascribed to rise in prevalence of gastrointestinal disorders, increase in awareness about the importance of gut health, and development of new medical foods specifically designed to support digestive health.

Rise in prevalence of conditions, such as irritable bowel syndrome (IBS), inflammatory bowel disease (IBD), and gastroesophageal reflux disease (GERD), is another key factor propelling the gastrointestinal disorders segment. These conditions could often be managed through dietary changes and usage of medical foods that are formulated to support digestive health. Therefore, demand for these foods that are designed to meet the specific nutritional needs of patients with gastrointestinal disorders is increasing.

In terms of route of administration, the oral segment dominated the global medical foods market in 2022. The segment is projected to grow at a rapid pace during the forecast period. The segment includes medical foods that are designed to be taken orally, such as beverages, powders, and snacks. These products can be consumed by patients without the need for medical supervision, making them an ideal choice for patients who need to manage their nutrition at home or on-the-go.

Development of new products that are tailored to the specific nutritional needs of different patient populations is another factor driving the segment. For instance, oral medical foods that are designed to support the nutritional needs of patients with conditions such as diabetes, cancer, and malnutrition are now available in the market. These products provide a convenient way for patients to obtain the nutrients they need to support their health.

Based on distribution channel, the pharmacies & drug stores segment led the global medical foods market in 2022. The segment is expected to grow at a faster pace in the next few years. This segment includes medical foods that are sold through pharmacies and drug stores, either over-the-counter or with a prescription.

The pharmacies & drug stores segment is driven by increase in focus on preventive healthcare. As consumers become aware about the importance of nutrition in maintaining good health, they are seeking out medical foods that can help to prevent and manage health conditions. Pharmacies and drug stores are well-positioned to meet this demand, offering a range of medical foods that support different health needs.

As per medical foods industry trends, North America accounted for the largest share of the global medical foods market in 2022. Rise in prevalence of chronic diseases, such as diabetes, cancer, and cardiovascular disease, is driving demand for these foods in the region. Additionally, increase in awareness about the importance of nutrition in maintaining good health and well-established healthcare infrastructure are ascribed to North America's global dominance.

Europe is also a significant market for medical foods, driven by increase in consumer awareness about health and wellness. Aging population and rise in demand for products that could support specific health conditions are expected to propel the market in the region in the next few years. Additionally, regulatory frameworks in Europe are supportive of the development and marketing of these foods.

The market in Asia Pacific is expected to witness significant growth during the forecast period. Rise in disposable income, increase in health-consciousness, and large population with chronic diseases are driving demand for medical foods in the region. Additionally, a growing middle class is expected to increase demand for these products. However, regulatory hurdles and lack of awareness about the benefits of these foods in some parts of the region are likely to hamper market growth.

This report provides profiles of leading players operating in the global medical foods market. These include Nutricia (Danone), Nestlé S.A., Abbott Laboratories, Mead Johnson Nutrition, Fresenius Kabi, Friso, Morinaga Milk Industry, Primus Pharmaceuticals, Inc., Targeted Medical Pharma, Inc., and Medtrition, Inc. These players engage in merger & acquisition, strategic collaborations, and new product launches to expand presence and gain global medical foods market share.

The report profiles the top players based on various factors including a company overview, financial summary, strategies, product portfolio, segments, and recent advancements in the market.

|

Attribute |

Detail |

|

Size in 2022 |

US$ 23.0 Bn |

|

Forecast (Value) in 2031 |

More than US$ 44.0 Bn |

|

Growth Rate (CAGR) 2023-2031 |

7.5% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2022 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global industry was valued at US$ 23.0 Bn in 2022

It is projected to reach more than US$ 44.0 Bn by 2031

The CAGR is anticipated to be 7.5% from 2023 to 2031

The powder segment held the largest share in 2022

North America is expected to account for the significant share during the forecast period.

Nutricia (Danone), Nestlé S.A., Abbott Laboratories, Mead Johnson Nutrition, Fresenius Kabi, Friso, Morinaga Milk Industry, Primus Pharmaceuticals, Inc., Targeted Medical Pharma, Inc., and Medtrition, Inc. are the prominent players in the market.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Medical Foods Market

4. Market Overview

4.1. Introduction

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

5. Key Insights

5.1. Important market developments

5.2. Top 3 Players Operating in the Market Space

5.3. New competitive market entrants

5.4. Medical food regulation overview

5.5. Reimbursement Scenario

5.6. Overview of the Distribution Channel of Medical Foods in various diseases along with examples

6. Global Medical Foods Market Analysis and Forecast, by Product Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product Type, 2017–2031

6.3.1. Pills

6.3.2. Powder

6.3.3. Liquid

6.3.4. Others

6.4. Market Attractiveness Analysis, by Product Type

7. Global Medical Foods Market Analysis and Forecast, by Disease Type

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Disease Type, 2017–2031

7.3.1. Orphan Disease

7.3.1.1. Duchenne Muscular Dystrophy (DMD)

7.3.1.2. Sickle Cell Anemia

7.3.1.3. Hemophilia

7.3.1.4. Others

7.3.2. Cancer

7.3.3. Neurological & Psychological Disorders

7.3.4. Metabolic Disorders

7.3.5. Pain Management

7.3.6. Gastrointestinal Disorders

7.3.7. Ophthalmology

7.3.8. Diabetes

7.3.9. Phenylketonuria (PKU)

7.3.10. Epilepsy

7.4. Market Attractiveness Analysis, by Disease Type

8. Global Medical Foods Market Analysis and Forecast, by Route of Administration

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Route of Administration, 2017–2031

8.3.1. Oral

8.3.2. Enteral

8.4. Market Attractiveness Analysis, by Route of Administration

9. Global Medical Foods Market Analysis and Forecast, by Distribution Channel

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Value Forecast, by Distribution Channel, 2017–2031

9.3.1. Pharmacies & Drug Stores

9.3.2. Online Channels

9.3.3. Supermarkets & Hypermarkets

9.3.4. Others

9.4. Market Attractiveness Analysis, by Distribution Channel

10. Global Medical Foods Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Market Value Forecast, by Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness Analysis, by Region

11. North America Medical Foods Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product Type, 2017–2031

11.2.1. Pills

11.2.2. Powder

11.2.3. Liquid

11.2.4. Others

11.3. Market Value Forecast, by Disease Type, 2017–2031

11.3.1. Orphan Disease

11.3.1.1. Duchenne Muscular Dystrophy (DMD)

11.3.1.2. Sickle Cell Anemia

11.3.1.3. Hemophilia

11.3.1.4. Others

11.3.2. Cancer

11.3.3. Neurological & Psychological Disorders

11.3.4. Metabolic Disorders

11.3.5. Pain Management

11.3.6. Gastrointestinal Disorders

11.3.7. Ophthalmology

11.3.8. Diabetes

11.3.9. Phenylketonuria (PKU)

11.3.10. Epilepsy

11.4. Market Value Forecast, by Route of Administration, 2017–2031

11.4.1. Oral

11.4.2. Enteral

11.5. Market Value Forecast, by Distribution Channel, 2017–2031

11.5.1. Pharmacies & Drug Stores

11.5.2. Online Channels

11.5.3. Supermarkets & Hypermarkets

11.5.4. Others

11.6. Market Value Forecast, by Country, 2017–2031

11.6.1. U.S.

11.6.2. Canada

11.7. Market Attractiveness Analysis

11.7.1. By Product

11.7.2. By Disease Type

11.7.3. By Route of Administration

11.7.4. By Distribution Channel

11.7.5. By Country

12. Europe Medical Foods Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product Type, 2017–2031

12.2.1. Pills

12.2.2. Powder

12.2.3. Liquid

12.2.4. Others

12.3. Market Value Forecast, by Disease Type, 2017–2031

12.3.1. Orphan Disease

12.3.1.1. Duchenne Muscular Dystrophy (DMD)

12.3.1.2. Sickle Cell Anemia

12.3.1.3. Hemophilia

12.3.1.4. Others

12.3.2. Cancer

12.3.3. Neurological & Psychological Disorders

12.3.4. Metabolic Disorders

12.3.5. Pain Management

12.3.6. Gastrointestinal Disorders

12.3.7. Ophthalmology

12.3.8. Diabetes

12.3.9. Phenylketonuria (PKU)

12.3.10. Epilepsy

12.4. Market Value Forecast, by Route of Administration, 2017–2031

12.4.1. Oral

12.4.2. Enteral

12.5. Market Value Forecast, by Distribution Channel, 2017–2031

12.5.1. Pharmacies & Drug Stores

12.5.2. Online Channels

12.5.3. Supermarkets & Hypermarkets

12.5.4. Others

12.6. Market Value Forecast, by Country/Sub-region, 2017–2031

12.6.1. Germany

12.6.2. U.K.

12.6.3. France

12.6.4. Spain

12.6.5. Italy

12.6.6. Rest of Europe

12.7. Market Attractiveness Analysis

12.7.1. by Product Type

12.7.2. By Disease Type

12.7.3. By Route of Administration

12.7.4. By Distribution Channel

12.7.5. By Country/Sub-region

13. Asia Pacific Medical Foods Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product Type, 2017–2031

13.2.1. Pills

13.2.2. Powder

13.2.3. Liquid

13.2.4. Others

13.3. Market Value Forecast, by Disease Type, 2017–2031

13.3.1. Orphan Disease

13.3.1.1. Duchenne Muscular Dystrophy (DMD)

13.3.1.2. Sickle Cell Anemia

13.3.1.3. Hemophilia

13.3.1.4. Others

13.3.2. Cancer

13.3.3. Neurological & Psychological Disorders

13.3.4. Metabolic Disorders

13.3.5. Pain Management

13.3.6. Gastrointestinal Disorders

13.3.7. Ophthalmology

13.3.8. Diabetes

13.3.9. Phenylketonuria (PKU)

13.3.10. Epilepsy

13.4. Market Value Forecast, by Route of Administration, 2017–2031

13.4.1. Oral

13.4.2. Enteral

13.5. Market Value Forecast, by Distribution Channel, 2017–2031

13.5.1. Pharmacies & Drug Stores

13.5.2. Online Channels

13.5.3. Supermarkets & Hypermarkets

13.5.4. Others

13.6. Market Value Forecast, by Country/Sub-region, 2017–2031

13.6.1. China

13.6.2. Japan

13.6.3. India

13.6.4. Australia & New Zealand

13.6.5. Rest of Asia Pacific

13.7. Market Attractiveness Analysis

13.7.1. by Product Type

13.7.2. By Disease Type

13.7.3. By Route of Administration

13.7.4. By Distribution Channel

13.7.5. By Country/Sub-region

14. Latin America Medical Foods Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product Type, 2017–2031

14.2.1. Pills

14.2.2. Powder

14.2.3. Liquid

14.2.4. Others

14.3. Market Value Forecast, by Disease Type, 2017–2031

14.3.1. Orphan Disease

14.3.1.1. Duchenne Muscular Dystrophy (DMD)

14.3.1.2. Sickle Cell Anemia

14.3.1.3. Hemophilia

14.3.1.4. Others

14.3.2. Cancer

14.3.3. Neurological & Psychological Disorders

14.3.4. Metabolic Disorders

14.3.5. Pain Management

14.3.6. Gastrointestinal Disorders

14.3.7. Ophthalmology

14.3.8. Diabetes

14.3.9. Phenylketonuria (PKU)

14.3.10. Epilepsy

14.4. Market Value Forecast, by Route of Administration, 2017–2031

14.4.1. Oral

14.4.2. Enteral

14.5. Market Value Forecast, by Distribution Channel, 2017–2031

14.5.1. Pharmacies & Drug Stores

14.5.2. Online Channels

14.5.3. Supermarkets & Hypermarkets

14.5.4. Others

14.6. Market Value Forecast, by Country/Sub-region, 2017–2031

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Rest of Latin America

14.7. Market Attractiveness Analysis

14.7.1. by Product Type

14.7.2. By Disease Type

14.7.3. By Route of Administration

14.7.4. By Distribution Channel

14.7.5. By Country/Sub-region

15. Middle East & Africa Medical Foods Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Product Type, 2017–2031

15.2.1. Pills

15.2.2. Powder

15.2.3. Liquid

15.2.4. Others

15.3. Market Value Forecast, by Disease Type, 2017–2031

15.3.1. Orphan Disease

15.3.1.1. Duchenne Muscular Dystrophy (DMD)

15.3.1.2. Sickle Cell Anemia

15.3.1.3. Hemophilia

15.3.1.4. Others

15.3.2. Cancer

15.3.3. Neurological & Psychological Disorders

15.3.4. Metabolic Disorders

15.3.5. Pain Management

15.3.6. Gastrointestinal Disorders

15.3.7. Ophthalmology

15.3.8. Diabetes

15.3.9. Phenylketonuria (PKU)

15.3.10. Epilepsy

15.4. Market Value Forecast, by Route of Administration, 2017–2031

15.4.1. Oral

15.4.2. Enteral

15.5. Market Value Forecast, by Distribution Channel, 2017–2031

15.5.1. Pharmacies & Drug Stores

15.5.2. Online Channels

15.5.3. Supermarkets & Hypermarkets

15.5.4. Others

15.6. Market Value Forecast, by Country/Sub-region, 2017–2031

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Rest of Middle East & Africa

15.7. Market Attractiveness Analysis

15.7.1. by Product Type

15.7.2. By Disease Type

15.7.3. By Route of Administration

15.7.4. By Distribution Channel

15.7.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Player - Competition Matrix (by tier and size of companies)

16.2. Competitive Business Strategies

16.3. Company Profiles

16.3.1. Nutricia (Danone)

16.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.1.2. Product Portfolio

16.3.1.3. Financial Overview

16.3.1.4. SWOT Analysis

16.3.1.5. Strategic Overview

16.3.2. Nestlé S.A.

16.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.2.2. Product Portfolio

16.3.2.3. Financial Overview

16.3.2.4. SWOT Analysis

16.3.2.5. Strategic Overview

16.3.3. Abbott Laboratories

16.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.3.2. Product Portfolio

16.3.3.3. Financial Overview

16.3.3.4. SWOT Analysis

16.3.3.5. Strategic Overview

16.3.4. Mead Johnson Nutrition

16.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.4.2. Product Portfolio

16.3.4.3. Financial Overview

16.3.4.4. SWOT Analysis

16.3.4.5. Strategic Overview

16.3.5. Fresenius Kabi

16.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.5.2. Product Portfolio

16.3.5.3. Financial Overview

16.3.5.4. SWOT Analysis

16.3.5.5. Strategic Overview

16.3.6. Friso

16.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.6.2. Product Portfolio

16.3.6.3. Financial Overview

16.3.6.4. SWOT Analysis

16.3.6.5. Strategic Overview

16.3.7. Morinaga Milk Industry

16.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.7.2. Product Portfolio

16.3.7.3. Financial Overview

16.3.7.4. SWOT Analysis

16.3.7.5. Strategic Overview

16.3.8. Primus Pharmaceuticals, Inc.

16.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.8.2. Product Portfolio

16.3.8.3. Financial Overview

16.3.8.4. SWOT Analysis

16.3.8.5. Strategic Overview

16.3.9. Targeted Medical Pharma, Inc.

16.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.9.2. Product Portfolio

16.3.9.3. Financial Overview

16.3.9.4. SWOT Analysis

16.3.9.5. Strategic Overview

16.3.10. Medtrition, Inc.

16.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.10.2. Product Portfolio

16.3.10.3. Financial Overview

16.3.10.4. SWOT Analysis

16.3.10.5. Strategic Overview

List of Tables

Table 01: Global Medical Foods Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 02: Global Medical Foods Market Value (US$ Mn) Forecast, by Disease Type, 2017–2031

Table 03: Global Medical Foods Market Value (US$ Mn) Forecast, by Orphan Disease, 2017–2031

Table 04: Global Medical Foods Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 05: Global Medical Foods Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 06: Global Medical Foods Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 07: Europe Medical Foods Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 08: Europe Medical Foods Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 09: Europe Medical Foods Market Value (US$ Mn) Forecast, by Disease Type, 2017‒2031

Table 10: Europe Medical Foods Market Value (US$ Mn) Forecast, by Orphan Disease, 2017‒2031

Table 11: Europe Medical Foods Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 12: Europe Medical Foods Value (US$ Mn) Forecast, by Distribution Channel, 2017‒2031

Table 13: North America Medical Foods Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 14: North America Medical Foods Market Value (US$ Mn) Forecast, by Disease Type, 2017‒2031

Table 15: North America Medical Foods Market Value (US$ Mn) Forecast, by Orphan Disease, 2017‒2031

Table 16: North America Medical Foods Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 17: North America Medical Foods Value (US$ Mn) Forecast, by Distribution Channel, 2017‒2031

Table 18: Asia Pacific Medical Foods Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 19: Asia Pacific Medical Foods Market Value (US$ Mn) Forecast, by Disease Type, 2017‒2031

Table 20: Asia Pacific Medical Foods Market Value (US$ Mn) Forecast, by Orphan Disease, 2017‒2031

Table 21: Asia Pacific Medical Foods Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 22: Asia Pacific Medical Foods Value (US$ Mn) Forecast, by Distribution Channel, 2017‒2031

Table 23: Latin America Medical Foods Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 24: Latin America Medical Foods Market Value (US$ Mn) Forecast, by Disease Type, 2017‒2031

Table 25: Latin America Medical Foods Market Value (US$ Mn) Forecast, by Orphan Disease, 2017‒2031

Table 26: Latin America Medical Foods Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 27: Latin America Medical Foods Value (US$ Mn) Forecast, by Distribution Channel, 2017‒2031

Table 28: Middle East and Africa Medical Foods Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 29: Middle East and Africa Medical Foods Market Value (US$ Mn) Forecast, by Disease Type, 2017‒2031

Table 30: Middle East and Africa Medical Foods Market Value (US$ Mn) Forecast, by Orphan Disease, 2017‒2031

Table 31: Middle East and Africa Medical Foods Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 32: Middle East and Africa Medical Foods Value (US$ Mn) Forecast, by Distribution Channel, 2017‒2031

List of Figures

Figure 01: Global Medical Foods Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 02: Global Medical Foods Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 03: Global Medical Foods Market Revenue (US$ Mn), by Pills, 2017–2031

Figure 04: Global Medical Foods Market Revenue (US$ Mn), by Powder, 2017–2031

Figure 05: Global Medical Foods Market Revenue (US$ Mn), by Liquid, 2017–2031

Figure 06: Global Medical Foods Market Revenue (US$ Mn), by Others, 2017–2031

Figure 07: Global Medical Foods Market Value Share Analysis, by Disease Type, 2022 and 2031

Figure 08: Global Medical Foods Market Attractiveness Analysis, by Disease Type, 2023–2031

Figure 09: Global Medical Foods Market Revenue (US$ Mn), by Orphan Disease, 2017–2031

Figure 10: Global Medical Foods Market Revenue (US$ Mn), by Cancer, 2017–2031

Figure 11: Global Medical Foods Market Revenue (US$ Mn), by Neurological & Psychological Disorders, 2017–2031

Figure 12: Global Medical Foods Market Revenue (US$ Mn), by Metabolic Disorders, 2017–2031

Figure 13: Global Medical Foods Market Revenue (US$ Mn), by Pain Management, 2017–2031

Figure 14: Global Medical Foods Market Revenue (US$ Mn), by Gastrointestinal Disorders, 2017–2031

Figure 15: Global Medical Foods Market Revenue (US$ Mn), by Ophthalmology, 2017–2031

Figure 16 Global Medical Foods Market Revenue (US$ Mn), by Diabetes, 2017–2031

Figure 17: Global Medical Foods Market Revenue (US$ Mn), by Phenylketonuria (PKU), 2017–2031

Figure 18: Global Medical Foods Market Revenue (US$ Mn), by Epilepsy, 2017–2031

Figure 19: Global Medical Foods Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 20: Global Medical Foods Market Attractiveness Analysis, by Route of Administration, 2023–2031

Figure 21: Global Medical Foods Market Revenue (US$ Mn), by Oral, 2017–2031

Figure 22: Global Medical Foods Market Revenue (US$ Mn), by Enteral, 2017–2031

Figure 23: Global Medical Foods Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 24: Global Medical Foods Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 25: Global Medical Foods Market Revenue (US$ Mn), by Pharmacies & Drug Stores, 2017–2031

Figure 26: Global Medical Foods Market Revenue (US$ Mn), by Online Channels, 2017–2031

Figure 27: Global Medical Foods Market Revenue (US$ Mn), by Supermarkets & Hypermarkets, 2017–2031

Figure 28: Global Medical Foods Market Revenue (US$ Mn), by Others, 2017–2031

Figure 29: Global Medical Foods Market Value Share Analysis, by Country, 2022 and 2031

Figure 30: Global Medical Foods Market Attractiveness Analysis, by Country, 2023–2031

Figure 31: North America Medical Foods Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 32: North America Medical Foods Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 33: North America Medical Foods Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 34: North America Medical Foods Market Value Share Analysis, by Disease Type, 2022 and 2031

Figure 35 North America Medical Foods Market Attractiveness Analysis, by Disease Type, 2023-2031

Figure 36: North America Medical Foods Market Value Share Analysis, by Route of Administration, 2021 and 2031

Figure 37: North America Medical Foods Market Attractiveness Analysis, by Route of Administration, 2022–2031

Figure 38: North America Medical Foods Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 39: North America Medical Foods Market Attractiveness Analysis, by Distribution Channel, 2022-2031

Figure 40: Europe Medical Foods Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 41: Europe Medical Foods Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 42: Europe Medical Foods Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 43: Europe Medical Foods Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 44: Europe Medical Foods Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 45: Europe Medical Foods Market Value Share Analysis, by Disease Type, 2022 and 2031

Figure 46: Europe Medical Foods Market Attractiveness Analysis, by Disease Type, 2023-2031

Figure 47: Europe Medical Foods Market Value Share Analysis, by Route of Administration, 2021 and 2031

Figure 48: Europe Medical Foods Market Attractiveness Analysis, by Route of Administration, 2022–2031

Figure 49: Europe Medical Foods Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 50: Europe Medical Foods Market Attractiveness Analysis, by Distribution Channel, 2022-2031

Figure 51: Asia Pacific Medical Foods Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 52: Asia Pacific Medical Foods Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 53: Asia Pacific Medical Foods Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 54: Asia Pacific Medical Foods Market Value Share Analysis, by Disease Type, 2022 and 2031

Figure 55: Asia Pacific Medical Foods Market Attractiveness Analysis, by Disease Type, 2023-2031

Figure 56: Asia Pacific Medical Foods Market Value Share Analysis, by Route of Administration, 2021 and 2031

Figure 57: Asia Pacific Medical Foods Market Attractiveness Analysis, by Route of Administration, 2022–2031

Figure 58: Asia Pacific Medical Foods Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 59: Asia Pacific Medical Foods Market Attractiveness Analysis, by Distribution Channel, 2022-2031

Figure 60: Latin America Medical Foods Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 61: Latin America Medical Foods Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 62: Latin America Medical Foods Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 63: Latin America Medical Foods Market Value Share Analysis, by Disease Type, 2022 and 2031

Figure 64: Latin America Medical Foods Market Attractiveness Analysis, by Disease Type, 2023-2031

Figure 65: Latin America Medical Foods Market Value Share Analysis, by Route of Administration, 2021 and 2031

Figure 66: Latin America Medical Foods Market Attractiveness Analysis, by Route of Administration, 2022–2031

Figure 67: Latin America Medical Foods Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 68: Latin America Medical Foods Market Attractiveness Analysis, by Distribution Channel, 2022-2031

Figure 69: Middle East and Africa Medical Foods Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 70: Middle East and Africa Medical Foods Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 71: Middle East and Africa Medical Foods Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 72: Middle East and Africa Medical Foods Market Value Share Analysis, by Disease Type, 2022 and 2031

Figure 73: Middle East and Africa Medical Foods Market Attractiveness Analysis, by Disease Type, 2023-2031

Figure 74: Middle East and Africa Medical Foods Market Value Share Analysis, by Route of Administration, 2021 and 2031

Figure 75: Middle East and Africa Medical Foods Market Attractiveness Analysis, by Route of Administration, 2022–2031

Figure 76: Middle East and Africa Medical Foods Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 77: Middle East and Africa Medical Foods Market Attractiveness Analysis, by Distribution Channel, 2022-2031