Analyst Viewpoint

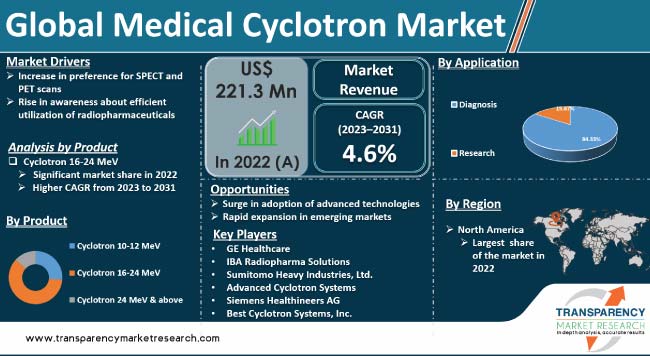

Increase in demand for diagnostic imaging owing to aging population and surge in chronic disease burden are driving the global market. Medical cyclotron is used to produce radioisotopes for radiopharmaceuticals to diagnose and treat cancer. Rise in preference for SPECT and PET scans in hospitals and diagnostic centers for diagnosis of various cancers is another major factor propelling market expansion. Furthermore, surge in awareness about the efficient utilization of radiopharmaceuticals to treat cancer is expected to bolster the global medical cyclotron market size during the forecast period.

Technological advancements such as compact design and automation in medical cyclotrons offers lucrative opportunities to market players. Companies are focusing on developing affordable personalized medicine and targeted therapies for cancer treatment in order to increase market revenue.

The medical cyclotron market involves producing and distributing cyclotron systems used to generate radioisotopes for medical imaging and nuclear medicine. These systems speed up charged particles to create radioisotopes used in diagnoses and treatments.

Medical cyclotrons primarily produce short-lived radioisotopes for diagnostic imaging such as PET scans and manufacture isotopes used in targeted cancer therapies and radiopharmaceuticals.

Recent progress in cyclotron technology has led to more efficient systems. These updated cyclotrons aim to improve radionuclide production, broaden imaging capabilities, and enhance diagnostic precision. Manufacturers focus on innovations enabling higher radioisotope yields, shorter production times, and better radionuclide purity.

Efforts are ongoing to create compact, cost-effective cyclotrons suited for smaller healthcare facilities and research centers. Increase in emphasis on early disease detection, personalized medicine, and integrating advanced technologies such as PET-CT and SPECT with cyclotron-made radiopharmaceuticals is likely to fuel global medical cyclotron market growth in the near future.

SPECT and PET are modern systems used to detect and treat cancer, cardiovascular diseases, and other neurology related diseases. PET installations across the world have cyclotrons beside a PET machine. PET radioisotopes have relatively short half-lives. Once the radioactive isotope is produced, it has to be synthesized and injected into a patient as soon as possible.

According to the American Nuclear Society, 90% of radioisotopes are used in gamma cameras or PET scan nuclear diagnostics. Remaining 10% are used in radioactive therapeutics drugs to treat diseases such as cancer, heart diseases, gastrointestinal, endocrine, and neurological disorders.

Molecular imaging with novel radiopharmaceuticals has been engineered to target specific subcellular processes and improve diagnostic accuracy using radioactive molecule as a tracer. These factors are expected to bolster the global medical cyclotron market in the next few years.

Radionuclide therapy has emerged as a successful treatment method for persistent diseases, while exhibiting lower levels of toxic side effects. Thus, there has been a notable surge in the global production of radioisotopes, intended for utilization in both medical imaging and nuclear medicine applications.

The World Nuclear Association reports that radioisotopes find applications in medical practices across more than 10,000 hospitals worldwide. Around 90% of medical procedures, including diagnosis and treatment of conditions such as infectious diseases, cancer, and neurological disorders, rely on these radioisotopes.

Continuous rise in research and development activities, coupled with increase in pool of patients afflicted with ailments such as cancer, has triggered advancements in medical technology. This has led to the introduction of innovative, technologically advanced systems aimed at improving treatment outcomes. Consequently, the global medical cyclotron market is poised for significant growth in the next few years.

In terms of product, the cyclotron 16-24 MeV segment is projected to account for the largest global medical cyclotron market share during the forecast period. Compared to larger cyclotrons, 16-24 MeV models are smaller. This makes them more affordable for mid-sized hospitals and clinics seeking to expand their nuclear medicine capabilities. The 16-24 MeV cyclotrons are easy to use and have the ability to produce various radioisotopes for essential diagnostic procedures.

Based on application, the diagnosis segment is expected dominate the global medical cyclotron market demand during the forecast period. This is ascribed to versatility of cyclotrons in FDG production, theranostics, and personalized medicine which are used to diagnose various diseases. As healthcare technology evolves, cyclotrons are likely to continue to play a critical role in diagnosis and treatment of diseases.

However, applications of medical cyclotron are increasing at a rapid pace across the world. Their role in drug development, preclinical studies, radiopharmaceutical optimization, and translational medicine is becoming increasingly crucial. As research continues to propel advancements in medical imaging and therapy, cyclotrons are poised to play a significant role in shaping the future of healthcare.

In terms of end-user, the hospitals segment is anticipated to witness robust growth during forecast period. High demand for diagnostic imaging, the need for on-site radioisotope production, cost-effectiveness for high-volume hospitals, advancements in technology, and the versatility of cyclotrons are ascribed to the segment’s market dominance.

As healthcare continues to evolve, hospitals are likely to remain the primary users of medical cyclotrons, driving innovation and improving patient care through efficient and reliable access to this vital technology.

North America dominated the global market in 2022. This is ascribed to availability of advanced healthcare infrastructure, presence of prominent pharmaceutical & biotechnology firms, and substantial investment in research & development.

According to the Centers for Disease Control and Prevention (CDC), chronic diseases such as cancer, heart disease, and diabetes affect over 80% of American adults. This high prevalence fuels demand for diagnostic imaging tools such as PET scans that rely on cyclotrons for radioisotope production.

As per medical cyclotron market forecast, the industry in Europe is likely to expand at a high CAGR during the forecast period. Advancements in medical technologies play a significant role in identifying cancer and diabetes at early stages, leading to improved treatment outcomes. Early detection enables for more targeted and personalized therapies, enhancing patient response and survival rates.

The market in Asia Pacific is projected to grow at a rapid pace in the next few years. This is ascribed to rise in prevalence of diseases and increase in geriatric population, specifically in China India, and Japan. Moreover, lifestyle changes and environmental factors contribute to increased incidence of cancer and diabetes.

The global medical cyclotron market is fragmented, with the presence of several players. Key players have adopted strategies such as partnerships and merger & acquisition in order to increase market share.

GE Healthcare, IBA Radiopharma Solutions, Sumitomo Heavy Industries, Ltd., Advanced Cyclotron Systems, Siemens Healthineers AG, and Best Cyclotron Systems, Inc. are prominent players in the medical cyclotron market.

Key players in the medical cyclotron market report have been profiled based on parameters such as company overview, latest developments, business strategies, application portfolio, business segments, and financial overview.

| Attribute | Detail |

|---|---|

| Size in 2022 | US$ 221.3 Mn |

| Forecast Value in 2031 | More than US$ 306.3 Mn |

| Growth Rate (CAGR) | 4.6% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Mn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 221.3 Mn in 2022

It is projected to reach more than US$ 306.3 Mn by 2031

The CAGR is anticipated to be 4.6% from 2023 to 2031

North America is expected to account for the largest share from 2023 to 2031

GE Healthcare, IBA Radiopharma Solutions, Sumitomo Heavy Industries, Ltd., Advanced Cyclotron Systems, Siemens Healthineers AG, and Best Cyclotron Systems, Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Medical Cyclotron Market

4. Market Overview

4.1. Introduction

4.1.1. Market Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Medical Cyclotron Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Regulatory Scenario

5.2. Overview of types of cyclotrons currently on the market for various applications

5.3. Technological Advancements

5.4. Cyclotron and Radiopharmaceutical Facilities per region

5.5. COVID-19 Impact Analysis

6. Global Medical Cyclotron Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product, 2017–2031

6.3.1. Cyclotron 10-12 MeV

6.3.2. Cyclotron 16-24 MeV

6.3.3. Cyclotron 24 MeV & above

6.4. Market Attractiveness Analysis, by Product

7. Global Medical Cyclotron Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Application, 2017–2031

7.3.1. Diagnosis

7.3.1.1. Oncology

7.3.1.2. Cardiology

7.3.1.3. Neurology

7.3.2. Research

7.4. Market Attractiveness Analysis, by Application

8. Global Medical Cyclotron Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by End-user, 2017–2031

8.3.1. Hospitals

8.3.2. Diagnostics Centers

8.3.3. Others

8.4. Market Attractiveness Analysis, by End-user

9. Global Medical Cyclotron Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Medical Cyclotron Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product, 2017–2031

10.2.1. Cyclotron 10-12 MeV

10.2.2. Cyclotron 16-24 MeV

10.2.3. Cyclotron 24 MeV & above

10.3. Market Value Forecast, by Application, 2017–2031

10.3.1. Diagnosis

10.3.1.1. Oncology

10.3.1.2. Cardiology

10.3.1.3. Neurology

10.3.2. Research

10.4. Market Value Forecast, by End-user, 2017–2031

10.4.1. Hospitals

10.4.2. Diagnostics Centers

10.4.3. Others

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product

10.6.2. By Application

10.6.3. By End-user

10.6.4. By Country

11. Europe Medical Cyclotron Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2017–2031

11.2.1. Cyclotron 10-12 MeV

11.2.2. Cyclotron 16-24 MeV

11.2.3. Cyclotron 24 MeV & above

11.3. Market Value Forecast, by Application, 2017–2031

11.3.1. Diagnosis

11.3.1.1. Oncology

11.3.1.2. Cardiology

11.3.1.3. Neurology

11.3.2. Research

11.4. Market Value Forecast, by End-user, 2017–2031

11.4.1. Hospitals

11.4.2. Diagnostics Centers

11.4.3. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. U.K.

11.5.2. Germany

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product

11.6.2. By Application

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Medical Cyclotron Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2017–2031

12.2.1. Cyclotron 10-12 MeV

12.2.2. Cyclotron 16-24 MeV

12.2.3. Cyclotron 24 MeV & above

12.3. Market Value Forecast, by Application, 2017–2031

12.3.1. Diagnosis

12.3.1.1. Oncology

12.3.1.2. Cardiology

12.3.1.3. Neurology

12.3.2. Research

12.4. Market Value Forecast, by End-user, 2017–2031

12.4.1. Hospitals

12.4.2. Diagnostics Centers

12.4.3. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of APAC

12.6. Market Attractiveness Analysis

12.6.1. By Product

12.6.2. By Application

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Medical Cyclotron Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2017–2031

13.2.1. Cyclotron 10-12 MeV

13.2.2. Cyclotron 16-24 MeV

13.2.3. Cyclotron 24 MeV & above

13.3. Market Value Forecast, by Application, 2017–2031

13.3.1. Diagnosis

13.3.1.1. Oncology

13.3.1.2. Cardiology

13.3.1.3. Neurology

13.3.2. Research

13.4. Market Value Forecast, by End-user, 2017–2031

13.4.1. Hospitals

13.4.2. Diagnostics Centers

13.4.3. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product

13.6.2. By Application

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Medical Cyclotron Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product, 2017–2031

14.2.1. Cyclotron 10-12 MeV

14.2.2. Cyclotron 16-24 MeV

14.2.3. Cyclotron 24 MeV & above

14.3. Market Value Forecast, by Application, 2017–2031

14.3.1. Diagnosis

14.3.1.1. Oncology

14.3.1.2. Cardiology

14.3.1.3. Neurology

14.3.2. Research

14.4. Market Value Forecast, by End-user, 2017–2031

14.4.1. Hospitals

14.4.2. Diagnostics Centers

14.4.3. Others

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of MEA

14.6. Market Attractiveness Analysis

14.6.1. By Product

14.6.2. By Application

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player – Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company (2022)

15.3. Company Profiles

15.3.1. GE Healthcare

15.3.1.1. Company Overview

15.3.1.2. Financial Overview

15.3.1.3. Product Portfolio

15.3.1.4. Business Strategies

15.3.1.5. Recent Developments

15.3.2. IBA Radiopharma Solutions

15.3.2.1. Company Overview

15.3.2.2. Financial Overview

15.3.2.3. Product Portfolio

15.3.2.4. Business Strategies

15.3.2.5. Recent Developments

15.3.3. Sumitomo Heavy Industries, Ltd.

15.3.3.1. Company Overview

15.3.3.2. Financial Overview

15.3.3.3. Product Portfolio

15.3.3.4. Business Strategies

15.3.3.5. Recent Developments

15.3.4. Advanced Cyclotron Systems

15.3.4.1. Company Overview

15.3.4.2. Financial Overview

15.3.4.3. Product Portfolio

15.3.4.4. Business Strategies

15.3.4.5. Recent Developments

15.3.5. Siemens Healthineers AG

15.3.5.1. Company Overview

15.3.5.2. Financial Overview

15.3.5.3. Product Portfolio

15.3.5.4. Business Strategies

15.3.5.5. Recent Developments

15.3.6. Best Cyclotron Systems, Inc.

15.3.6.1. Company Overview

15.3.6.2. Financial Overview

15.3.6.3. Product Portfolio

15.3.6.4. Business Strategies

15.3.6.5. Recent Developments

List of Tables

Table 01: Global Medical Cyclotron Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 02: Global Medical Cyclotron Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 03: Global Medical Cyclotron Market Value (US$ Mn) Forecast, by Diagnosis, 2017–2031

Table 04: Global Medical Cyclotron Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 05: Global Medical Cyclotron Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 06: North America Medical Cyclotron Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 07: North America Medical Cyclotron Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 08: North America Medical Cyclotron Market Value (US$ Mn) Forecast, by Diagnosis, 2017–2031

Table 09: North America Medical Cyclotron Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 10: North America Medical Cyclotron Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 11: Europe Medical Cyclotron Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 12: Europe Medical Cyclotron Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 13: Europe Medical Cyclotron Market Value (US$ Mn) Forecast, by Diagnosis, 2017–2031

Table 14: Europe Medical Cyclotron Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 15: Europe Medical Cyclotron Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 16: Asia Pacific Medical Cyclotron Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 17: Asia Pacific Medical Cyclotron Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 18: Asia Pacific Medical Cyclotron Market Value (US$ Mn) Forecast, by Diagnosis, 2017–2031

Table 19: Asia Pacific Medical Cyclotron Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 20: Asia Pacific Medical Cyclotron Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 21: Latin America Medical Cyclotron Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 22: Latin America Medical Cyclotron Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 23: Latin America Medical Cyclotron Market Value (US$ Mn) Forecast, by Diagnosis, 2017–2031

Table 24: Latin America Medical Cyclotron Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 25: Latin America Medical Cyclotron Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 26: Middle East & Africa Medical Cyclotron Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 27: Middle East & Africa Medical Cyclotron Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 28: Middle East & Africa Medical Cyclotron Market Value (US$ Mn) Forecast, by Diagnosis, 2017–2031

Table 29: Middle East & Africa Medical Cyclotron Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 30: Middle East & Africa Medical Cyclotron Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

List of Figures

Figure 01: Global Medical Cyclotron Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Medical Cyclotron Market Value Share Analysis, by Product, 2022 and 2031

Figure 03: Global Medical Cyclotron Market Value Share Analysis, by Cyclotron 10-12 MeV, 2022 and 2031

Figure 04: Global Medical Cyclotron Market Value Share Analysis, by Cyclotron 16-24 MeV, 2022 and 2031

Figure 05: Global Medical Cyclotron Market Value Share Analysis, by Cyclotron 24 MeV above, 2022 and 2031

Figure 06: Global Medical Cyclotron Market Attractiveness Analysis, by Product, 2023–2031

Figure 07: Global Medical Cyclotron Market Value Share Analysis, by Application, 2022 and 2031

Figure 08: Global Medical Cyclotron Market Value Share Analysis, by Diagnosis, 2022 and 2031

Figure 09: Global Medical Cyclotron Market Value Share Analysis, by Research, 2022 and 2031

Figure 10: Global Medical Cyclotron Market Attractiveness Analysis, by Application, 2023–2031

Figure 11: Global Medical Cyclotron Market Value Share Analysis, by End-user, 2022 and 2031

Figure 12: Global Medical Cyclotron Market Value Share Analysis, by Hospitals, 2022 and 2031

Figure 13: Global Medical Cyclotron Market Value Share Analysis, by Diagnostic Centers, 2022 and 2031

Figure 14: Global Medical Cyclotron Market Value Share Analysis, by Others, 2022 and 2031

Figure 15: Global Medical Cyclotron Market Attractiveness Analysis, by End-user, 2023–2031

Figure 16: Global Medical Cyclotron Market Value Share Analysis, by Region, 2022 and 2031

Figure 17: Global Medical Cyclotron Market Attractiveness Analysis, by Region, 2023–2031

Figure 18: North America Medical Cyclotron Market Value (US$ Mn) Forecast, 2017–2031

Figure 19: North America Medical Cyclotron Market Value Share Analysis, by Product, 2022 and 2031

Figure 20: North America Medical Cyclotron Market Attractiveness Analysis, by Product, 2023–2031

Figure 21: North America Medical Cyclotron Market Value Share Analysis, by Application, 2022 and 2031

Figure 22: North America Medical Cyclotron Market Attractiveness Analysis, by Application, 2023–2031

Figure 23: North America Medical Cyclotron Market Value Share Analysis, by End-user, 2022 and 2031

Figure 24: North America Medical Cyclotron Market Attractiveness Analysis, by End-user, 2023–2031

Figure 25: North America Medical Cyclotron Market Value Share Analysis, by Country, 2022 and 2031

Figure 26: North America Medical Cyclotron Market Attractiveness Analysis, by Country, 2023–2031

Figure 27: Europe Medical Cyclotron Market Value (US$ Mn) Forecast, 2017–2031

Figure 28: Europe Medical Cyclotron Market Value Share Analysis, by Product, 2022 and 2031

Figure 29: Europe Medical Cyclotron Market Attractiveness Analysis, by Product, 2023–2031

Figure 30: Europe Medical Cyclotron Market Value Share Analysis, by Application, 2022 and 2031

Figure 31: Europe Medical Cyclotron Market Attractiveness Analysis, by Application, 2023–2031

Figure 32: Europe Medical Cyclotron Market Value Share Analysis, by End-user, 2022 and 2031

Figure 33: Europe Medical Cyclotron Market Attractiveness Analysis, by End-user, 2023–2031

Figure 34: Europe Medical Cyclotron Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 35: Europe Medical Cyclotron Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 36: Asia Pacific Medical Cyclotron Market Value (US$ Mn) Forecast, 2017–2031

Figure 37: Asia Pacific Medical Cyclotron Market Value Share Analysis, by Product, 2022 and 2031

Figure 38: Asia Pacific Medical Cyclotron Market Attractiveness Analysis, by Product, 2023–2031

Figure 39: Asia Pacific Medical Cyclotron Market Value Share Analysis, by Application 2022 and 2031

Figure 40: Asia Pacific Medical Cyclotron Market Attractiveness Analysis, by Application, 2023–2031

Figure 41: Asia Pacific Medical Cyclotron Market Value Share Analysis, by End-user, 2022 and 2031

Figure 42: Asia Pacific Medical Cyclotron Market Attractiveness Analysis, by End-user, 2023–2031

Figure 43: Asia Pacific Medical Cyclotron Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 44: Asia Pacific Medical Cyclotron Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 45: Latin America Medical Cyclotron Market Value (US$ Mn) Forecast, 2017–2031

Figure 46: Latin America Medical Cyclotron Market Value Share Analysis, by Product, 2022 and 2031

Figure 47: Latin America Medical Cyclotron Market Attractiveness Analysis, by Product, 2023–2031

Figure 48: Latin America Medical Cyclotron Market Value Share Analysis, by Application, 2022 and 2031

Figure 49: Latin America Medical Cyclotron Market Attractiveness Analysis, by Application, 2023–2031

Figure 50: Latin America Medical Cyclotron Market Value Share Analysis, by End-user, 2022 and 2031

Figure 51: Latin America Medical Cyclotron Market Attractiveness Analysis, by End-user, 2023–2031

Figure 52: Latin America Medical Cyclotron Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 53: Latin America Medical Cyclotron Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 54: Middle East & Africa Medical Cyclotron Market Value (US$ Mn) Forecast, 2017–2031

Figure 55: Middle East & Africa Medical Cyclotron Market Value Share Analysis, by Product, 2022 and 2031

Figure 56: Middle East & Africa Medical Cyclotron Market Attractiveness Analysis, by Product, 2023–2031

Figure 57: Middle East & Africa Medical Cyclotron Market Value Share Analysis, by Application, 2022 and 2031

Figure 58: Middle East & Africa Medical Cyclotron Market Attractiveness Analysis, by Application, 2023–2031

Figure 59: Middle East & Africa Medical Cyclotron Market Value Share Analysis, by End-user, 2022 and 2031

Figure 60: Middle East & Africa Medical Cyclotron Market Attractiveness Analysis, by End-user, 2023–2031

Figure 61: Middle East & Africa Medical Cyclotron Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 62: Middle East & Africa Medical Cyclotron Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 63: Global Medical Cyclotron Market Share Analysis, by Company, 2022