Efforts are being made to locally and globally collaborate in order to address industry issues during the ongoing COVID-19 pandemic. Companies in the medical composites market are expecting flattening of the curve with the emergence of various treatment options and vaccines. As such, the reopening of factories and full capacity production activities are estimated to replenish economic growth in the medical composites market. The trend of virtual events and webinars is also growing at a rapid pace.

The mindset pertaining to COVID-19 is gradually changing. This is encouraging onsite visits to hospitals and other healthcare facilities. As such, manufacturers are trying to maintain robust supply chains, since healthcare falls under the list of essential industries worldwide. However, supply chain disruptions are anticipated to cause a slowdown in business activities. Hence, manufacturers are focusing on mission critical applications to establish stable revenue streams during the pandemic.

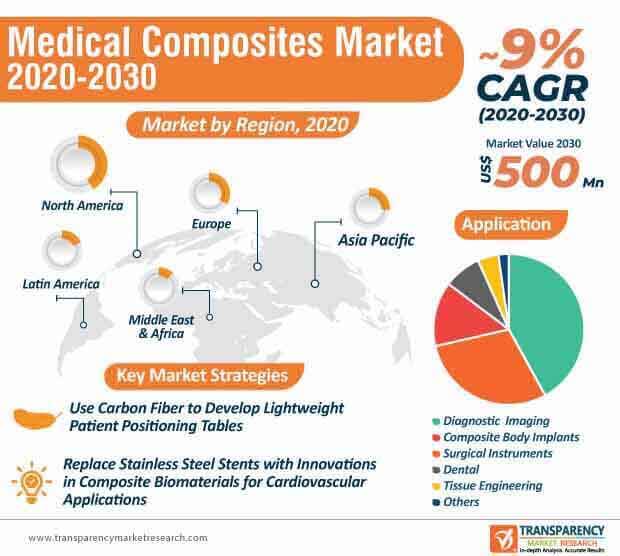

Fiber reinforced polymer composites (FRPs) are finding several applications in the medical sector. However, manufacturers in the medical composites market need to understand the pros and cons of every material to meet the demanding needs of end users. For instance, composite biomaterials such as metal and polymer matrix composites are serving as better alternatives to stents made from stainless steel, titanium, and magnesium alloys, among others. Manufacturers should capitalize on such opportunities, as the high prevalence of cardiovascular diseases is triggering the demand for composite biomaterials.

The medical composites market is projected to advance at a robust CAGR of ~9% during the assessment period. Currently, North America dictates the highest share among all regions of the market in terms of output. Low cost, biodegradability, and easy manufacturability of composite biomaterials are grabbing the attention of healthcare companies.

FRPs are gaining importance for their high strength, lightweight, and biocompatibility advantages. FRPs are being used to manufacture artificial limbs in order to provide fatigue resistance. The flexibility in manufacturing with the help of FRPs is being highly preferred by manufacturers in the medical composites market. This explains why the medical composites market is predicted to cross the value mark of US$ 500 Mn by the end of 2030. Chemical inertness of carbon fiber is helping manufacturers to establish stable revenue streams, as this material is gaining popularity in surgical applications.

Carbon fiber is replacing metallic and polymeric materials in surgical applications. Recent developments in carbon fiber involve its use in load carrying links in joint mechanisms of artificial limbs. Companies in the medical composites market are increasing their output capacities in carbon composites that are being implanted into cartilage to promote biological resurfacing of damaged areas.

Carbon composites deploy an open weave structure to promote cell growth along and between individual fibers resulting in a suitable repair. Companies in the medical composites market are boosting their production of carbon fiber tows that can be used either individually or in plaits in order to repair damaged ligament. It has been found that the chemical properties of bone repair materials made from self-curing acrylic can be enhanced with the addition of carbon fibers. Carbon fibers are associated with high tensile, compressive, shear strength of materials. This is helping to commercialize carbon fibers in materials for wider clinical use.

The carbon fiber reinforced polymer (CFRP) is gaining increased visibility in the medical technology. Composites United— a specialist in high-performance fiber composite technology is expanding its business in X-ray and other medical imaging applications.

CFRP is being highly publicized for its X-ray transparency and rigidity, as x-rays are hardly absorbed by CFRP. Manufacturers in the medical composites market are boosting their production of carbon fiber composites, since they are suitable for components of CT systems and particle accelerators. The high transmissivity advantage of CFRP creates no effects that could impair imaging. The high temperature sterilization of CFRP is being preferred in medical imaging applications.

The corrosion-resistant, biocompatible, and physiologically harmless CFRP is being extensively used in medical imaging applications. Companies in the medical composites market are tapping into incremental opportunities via radiolucent, orthopedic, and low distortion insertion guides made from CFRP to position implants. High strength attributes of CFRP are suitable for spreaders used during surgical procedures and components for the external fixation of bone structures.

There is a growing awareness to reduce energy consumption and environmental impacts, which are fueling the demand for natural fiber reinforced composites (NFRCs). As compared to synthesized fiber, natural fiber offers several advantages in terms of weight, biodegradability, and low price. However, inherent features of NFRCs are presenting challenges for the development of NFRCs. Manufacturers in the medical composites market need to address drawbacks of NFRCs such as low thermal stability, limited mechanical properties, and incompatibility with hydrophobic matrices. Hence, manufacturers are increasing their focus in plant-based NFRCs to improve their performance via fiber modification, fiber hybridization, and additive manufacturing (3D printing).

The rising application of plant-based NFRCs is creating revenue opportunities for manufacturers in the medical composites market. Recycling of waste carbon fiber and glass fiber reinforced composites is a fast growing phenomenon in the healthcare industry. Manufacturers are gaining proficiency in cost efficient recycling of valuable glass and carbon fibers.

Companies in the medical composites market are taking giant strides in sandwich composite panels made from carbon fiber to manufacture patient positioning tables. For instance, family-owned composites fabricator ACP composites is designing composite patient positioning tables for healthcare equipment company Broncus Medical Inc. Manufacturers in the medical composites market are entering into strategic partnerships to improve the performance of composite materials. They are increasing efforts to develop lightweight and durable composite patient positioning tables that are transparent to X-ray radiation. There is a demand for patient positioning tables that can be easily machined to accommodate a specific type of insert for the attachment of medical instruments and clamps.

Analysts’ Viewpoint

Trinity Technology Group’s latest innovation AIRADIGM™ is gaining popularity amidst the ongoing COVID-19 pandemic, since it is a three layer composite medical face mask media. Companies in the medical composites market are using FRPs to manufacture artificial limbs to offer better fatigue resistance. However, manufacturers are striving to innovate in materials and components used in X-ray and other imaging applications. Hence, manufacturers should increase their R&D capabilities in carbon fiber composites to gain a competitive edge over other manufacturers. The weight and volume advantage of carbon materials is emerging as a substitute to conventional materials, as it creates new possibilities in X-ray procedures.

Medical Composites Market is expected to Reach US$ 500 Mn by 2030

Medical Composites Market is estimated to rise at a CAGR of 9% during forecast period

Rise in demand for medical composites, owing to their significant usage in diagnostic imaging, surgical instruments, and composite body implants applications is expected to drive the Medical Composites Market

North America is more attractive for vendors in the Medical Composites Market

Key players of Medical Composites Market are 3M, Toray Advanced Composites, DSM, Polygon Company, PolyOne, Composiflex, ACP COMPOSITES, INC, Mitsubishi Chemical Corporation, Icotec Ag, Plastic Reinforcement Fabrics Ltd and others

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

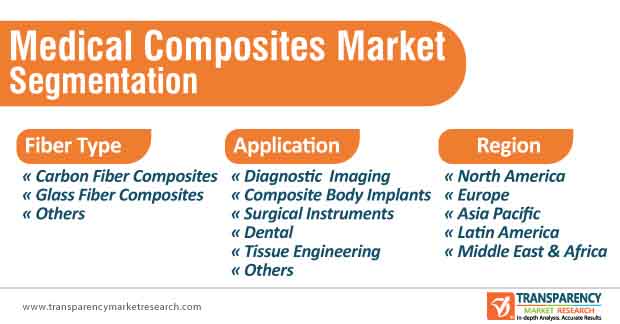

2.1. Market Segmentation

2.2. Market Tendency

2.3. Key Developments/Fiber Type Timeline

2.4. Market Definitions

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Global Medical Composites Market Analysis and Forecast

2.6.1. Global Medical Composites Market Volume (Tons), 2019–2030

2.6.2. Global Medical Composites Market Value (US$ Mn), 2019–2030

2.7. Porters Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Medical Composites Manufacturers

2.9.2. List of Suppliers/Distributors

2.9.3. List of Potential Customers

3. Covid-19 Impact Analysis

3.1. Impact on the Supply Chain of Medical Composites Market

4. Global Fiber Production Output Analysis, 2019 (%)

4.1. North America

4.2. Europe

4.3. Asia Pacific

4.4. Latin America

4.5. Middle East & Africa

5. Global Medical Composites Market Price Trend Analysis, 2019–2030

5.1. By Fiber Type

5.2. By Region

6. Global Medical Composites Market Analysis and Forecast, by Fiber Type

6.1. Key Findings, by Fiber Type

6.2. Global Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Fiber Type, 2019–2030

6.2.1. Carbon Fiber Composites

6.2.2. Glass Fiber Composites

6.2.3. Others

6.3. Global Medical Composites Market Attractiveness Analysis, by Fiber Type

7. Global Medical Composites Market Analysis and Forecast, by Application

7.1. Key Findings, by Application

7.2. Global Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

7.2.1. Diagnostic Imaging

7.2.2. Composite Body Implants

7.2.3. Surgical Instruments

7.2.4. Dental

7.2.5. Tissue Engineering

7.2.6. Others

7.3. Global Medical Composites Market Attractiveness Analysis, by Application

8. Global Medical Composites Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Global Medical Composites Market Volume (Tons) and Value (US$ Mn), by Region, 2019–2030

8.2.1. North America

8.2.2. Latin America

8.2.3. Europe

8.2.4. Asia Pacific

8.2.5. Middle East & Africa

9. North America Medical Composites Market Analysis and Forecast, by Fiber Type

9.1. Key Findings, by Fiber Type

9.2. North America Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Fiber Type, 2019–2030

9.2.1. Carbon Fiber Composites

9.2.2. Glass Fiber Composites

9.2.3. Others

9.3. North America Medical Composites Market Attractiveness Analysis, by Fiber Type

10. North America Medical Composites Market Analysis and Forecast, by Application

10.1. Key Findings, by Application

10.2. North America Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

10.2.1. Diagnostic Imaging

10.2.2. Composite Body Implants

10.2.3. Surgical Instruments

10.2.4. Dental

10.2.5. Tissue Engineering

10.2.6. Others

10.3. North America Medical Composites Market Attractiveness Analysis, by Application

10.4. North America Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Country, 2019–2030

10.5. U.S. Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Fiber Type, 2019–2030

10.5.1. Carbon Fiber Composites

10.5.2. Glass Fiber Composites

10.5.3. Others

10.6. U.S. Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

10.6.1. Diagnostic Imaging

10.6.2. Composite Body Implants

10.6.3. Surgical Instruments

10.6.4. Dental

10.6.5. Tissue Engineering

10.6.6. Others

10.7. Canada Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Fiber Type, 2019–2030

10.7.1. Carbon Fiber Composites

10.7.2. Glass Fiber Composites

10.7.3. Others

10.8. Canada Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

10.8.1. Diagnostic Imaging

10.8.2. Composite Body Implants

10.8.3. Surgical Instruments

10.8.4. Dental

10.8.5. Tissue Engineering

10.8.6. Others

11. Europe Medical Composites Market Analysis and Forecast, by Fiber Type

11.1. Key Findings, by Fiber Type

11.2. Europe Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Fiber Type, 2019–2030

11.2.1. Carbon Fiber Composites

11.2.2. Glass Fiber Composites

11.2.3. Others

11.3. Europe Medical Composites Market Attractiveness Analysis, by Fiber Type

12. Europe Medical Composites Market Analysis and Forecast, by Application

12.1. Key Findings, by Application

12.2. Europe Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

12.2.1. Diagnostic Imaging

12.2.2. Composite Body Implants

12.2.3. Surgical Instruments

12.2.4. Dental

12.2.5. Tissue Engineering

12.2.6. Others

12.3. Europe Medical Composites Market Attractiveness Analysis, by Application

12.4. Europe Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2019–2030

12.5. Germany Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Fiber Type, 2019–2030

12.5.1. Carbon Fiber Composites

12.5.2. Glass Fiber Composites

12.5.3. Others

12.6. Germany Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

12.6.1. Diagnostic Imaging

12.6.2. Composite Body Implants

12.6.3. Surgical Instruments

12.6.4. Dental

12.6.5. Tissue Engineering

12.6.6. Others

12.7. France Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Fiber Type, 2019–2030

12.7.1. Carbon Fiber Composites

12.7.2. Glass Fiber Composites

12.7.3. Others

12.8. France Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

12.8.1. Diagnostic Imaging

12.8.2. Composite Body Implants

12.8.3. Surgical Instruments

12.8.4. Dental

12.8.5. Tissue Engineering

12.8.6. Others

12.9. U.K Potassium Sulfate Market Volume (Tons) and Value (US$ Mn) Forecast, by Fiber Type, 2019–2030

12.9.1. Carbon Fiber Composites

12.9.2. Glass Fiber Composites

12.9.3. Others

12.10. U.K. Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

12.10.1. Diagnostic Imaging

12.10.2. Composite Body Implants

12.10.3. Surgical Instruments

12.10.4. Dental

12.10.5. Tissue Engineering

12.10.6. Others

12.11. Italy Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Fiber Type, 2019–2030

12.11.1. Carbon Fiber Composites

12.11.2. Glass Fiber Composites

12.11.3. Others

12.12. Italy Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

12.12.1. Diagnostic Imaging

12.12.2. Composite Body Implants

12.12.3. Surgical Instruments

12.12.4. Dental

12.12.5. Tissue Engineering

12.12.6. Others

12.13. Spain Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Fiber Type, 2019–2030

12.13.1. Carbon Fiber Composites

12.13.2. Glass Fiber Composites

12.13.3. Others

12.14. Spain Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

12.14.1. Diagnostic Imaging

12.14.2. Composite Body Implants

12.14.3. Surgical Instruments

12.14.4. Dental

12.14.5. Tissue Engineering

12.14.6. Others

12.15. Russia & CIS Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Fiber Type, 2019–2030

12.15.1. Carbon Fiber Composites

12.15.2. Glass Fiber Composites

12.15.3. Others

12.16. Russia & CIS Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

12.16.1. Diagnostic Imaging

12.16.2. Composite Body Implants

12.16.3. Surgical Instruments

12.16.4. Dental

12.16.5. Tissue Engineering

12.16.6. Others

12.17. Rest of Europe Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Fiber Type, 2019–2030

12.17.1. Carbon Fiber Composites

12.17.2. Glass Fiber Composites

12.17.3. Others

12.18. Rest of Europe Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

12.18.1. Diagnostic Imaging

12.18.2. Composite Body Implants

12.18.3. Surgical Instruments

12.18.4. Dental

12.18.5. Tissue Engineering

12.18.6. Others

13. Asia Pacific Medical Composites Market Analysis and Forecast, by Fiber Type

13.1. Key Findings, by Fiber Type

13.2. Asia Pacific Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Fiber Type, 2019–2030

13.2.1. Carbon Fiber Composites

13.2.2. Glass Fiber Composites

13.2.3. Others

13.3. Asia Pacific Medical Composites Market Attractiveness Analysis, by Fiber Type

14. Asia Pacific Medical Composites Market Analysis and Forecast, by Application

14.1. Key Findings, by Application

14.2. Asia Pacific Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

14.2.1. Diagnostic Imaging

14.2.2. Composite Body Implants

14.2.3. Surgical Instruments

14.2.4. Dental

14.2.5. Tissue Engineering

14.2.6. Others

14.3. Asia Pacific Medical Composites Market Attractiveness Analysis, by Application

14.4. Asia Pacific Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2019–2030

14.5. China Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Fiber Type, 2019–2030

14.5.1. Carbon Fiber Composites

14.5.2. Glass Fiber Composites

14.5.3. Others

14.6. China Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

14.6.1. Diagnostic Imaging

14.6.2. Composite Body Implants

14.6.3. Surgical Instruments

14.6.4. Dental

14.6.5. Tissue Engineering

14.6.6. Others

14.7. India Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Fiber Type, 2019–2030

14.7.1. Carbon Fiber Composites

14.7.2. Glass Fiber Composites

14.7.3. Others

14.8. India Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

14.8.1. Diagnostic Imaging

14.8.2. Composite Body Implants

14.8.3. Surgical Instruments

14.8.4. Dental

14.8.5. Tissue Engineering

14.8.6. Others

14.9. Japan Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Fiber Type, 2019–2030

14.9.1. Carbon Fiber Composites

14.9.2. Glass Fiber Composites

14.9.3. Others

14.10. Japan Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

14.10.1. Diagnostic Imaging

14.10.2. Composite Body Implants

14.10.3. Surgical Instruments

14.10.4. Dental

14.10.5. Tissue Engineering

14.10.6. Others

14.11. ASEAN Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Fiber Type, 2019–2030

14.11.1. Carbon Fiber Composites

14.11.2. Glass Fiber Composites

14.11.3. Others

14.12. ASEAN Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

14.12.1. Diagnostic Imaging

14.12.2. Composite Body Implants

14.12.3. Surgical Instruments

14.12.4. Dental

14.12.5. Tissue Engineering

14.12.6. Others

14.13. Rest of Asia Pacific Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Fiber Type, 2019–2030

14.13.1. Carbon Fiber Composites

14.13.2. Glass Fiber Composites

14.13.3. Others

14.14. Rest of Asia Pacific Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

14.14.1. Diagnostic Imaging

14.14.2. Composite Body Implants

14.14.3. Surgical Instruments

14.14.4. Dental

14.14.5. Tissue Engineering

14.14.6. Others

15. Latin America Medical Composites Market Analysis and Forecast, by Fiber Type

15.1. Key Findings, by Fiber Type

15.2. Latin America Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Fiber Type, 2019–2030

15.2.1. Carbon Fiber Composites

15.2.2. Glass Fiber Composites

15.2.3. Others

15.3. Latin America Medical Composites Market Attractiveness Analysis, by Fiber Type

16. Latin America Medical Composites Market Analysis and Forecast, by Application

16.1. Key Findings, by Application

16.2. Latin America Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

16.2.1. Diagnostic Imaging

16.2.2. Composite Body Implants

16.2.3. Surgical Instruments

16.2.4. Dental

16.2.5. Tissue Engineering

16.2.6. Others

16.3. Latin America Medical Composites Market Attractiveness Analysis, by Application

16.4. Latin America Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2019–2030

16.5. Brazil Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Fiber Type, 2019–2030

16.5.1. Carbon Fiber Composites

16.5.2. Glass Fiber Composites

16.5.3. Others

16.6. Brazil Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

16.6.1. Diagnostic Imaging

16.6.2. Composite Body Implants

16.6.3. Surgical Instruments

16.6.4. Dental

16.6.5. Tissue Engineering

16.6.6. Others

16.7. Mexico Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Fiber Type, 2019–2030

16.7.1. Carbon Fiber Composites

16.7.2. Glass Fiber Composites

16.7.3. Others

16.8. Mexico Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

16.8.1. Diagnostic Imaging

16.8.2. Composite Body Implants

16.8.3. Surgical Instruments

16.8.4. Dental

16.8.5. Tissue Engineering

16.8.6. Others

16.9. Rest of Latin America Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Fiber Type, 2019–2030

16.9.1. Carbon Fiber Composites

16.9.2. Glass Fiber Composites

16.9.3. Others

16.10. Rest of Latin America Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

16.10.1. Diagnostic Imaging

16.10.2. Composite Body Implants

16.10.3. Surgical Instruments

16.10.4. Dental

16.10.5. Tissue Engineering

16.10.6. Others

17. Middle East & Africa Medical Composites Market Analysis and Forecast, by Fiber Type

17.1. Key Findings, by Fiber Type

17.2. Middle East & Africa Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Fiber Type, 2019–2030

17.2.1. Carbon Fiber Composites

17.2.2. Glass Fiber Composites

17.2.3. Others

17.3. Middle East & Africa Medical Composites Market Attractiveness Analysis, by Fiber Type

18. Middle East & Africa Medical Composites Market Analysis and Forecast, by Application

18.1. Key Findings, by Application

18.2. Middle East & Africa Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

18.2.1. Diagnostic Imaging

18.2.2. Composite Body Implants

18.2.3. Surgical Instruments

18.2.4. Dental

18.2.5. Tissue Engineering

18.2.6. Others

18.3. Middle East & Africa Medical Composites Market Attractiveness Analysis, by Application

18.4. Middle East & Africa Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2019–2030

18.5. GCC Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Fiber Type, 2019–2030

18.5.1. Carbon Fiber Composites

18.5.2. Glass Fiber Composites

18.5.3. Others

18.6. GCC Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

18.6.1. Diagnostic Imaging

18.6.2. Composite Body Implants

18.6.3. Surgical Instruments

18.6.4. Dental

18.6.5. Tissue Engineering

18.6.6. Others

18.7. South Africa Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Fiber Type, 2019–2030

18.7.1. Carbon Fiber Composites

18.7.2. Glass Fiber Composites

18.7.3. Others

18.8. South Africa Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

18.8.1. Diagnostic Imaging

18.8.2. Composite Body Implants

18.8.3. Surgical Instruments

18.8.4. Dental

18.8.5. Tissue Engineering

18.8.6. Others

18.9. Rest of Middle East & Africa Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Fiber Type, 2019–2030

18.9.1. Carbon Fiber Composites

18.9.2. Glass Fiber Composites

18.9.3. Others

18.10. Rest of Middle East & Africa Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

18.10.1. Diagnostic Imaging

18.10.2. Composite Body Implants

18.10.3. Surgical Instruments

18.10.4. Dental

18.10.5. Tissue Engineering

18.10.6. Others

19. Competition Landscape

19.1. Competition Matrix, by Key Players

19.2. Global Medical Composites Market Share Analysis, by Company (2019)

19.3. Market Footprint Analysis

19.3.1. By Application

19.4. Key Business Strategies

19.5. Company Profiles

19.5.1. 3M

19.5.1.1. Company Description

19.5.1.2. Business Overview

19.5.1.3. Product Type

19.5.1.4. Revenue Analysis

19.5.2. Toray Advanced Composites

19.5.2.1. Company Description

19.5.2.2. Business Overview

19.5.2.3. Product Type

19.5.2.4. Strategic Outlook

19.5.3. DSM

19.5.3.1. Company Description

19.5.3.2. Business Overview

19.5.3.3. Product Type

19.5.3.4. Revenue Analysis

19.5.4. Polygon Company

19.5.4.1. Company Description

19.5.4.2. Business Overview

19.5.4.3. Product Type

19.5.5. PolyOne

19.5.5.1. Company Description

19.5.5.2. Business Overview

19.5.5.3. Product Type

19.5.6. Composiflex

19.5.6.1. Company Description

19.5.6.2. Business Overview

19.5.6.3. Product Type

19.5.7. ACP COMPOSITES, INC

19.5.7.1. Company Description

19.5.7.2. Business Overview

19.5.7.3. Product Type

19.5.8. Mitsubishi Chemical Corporation

19.5.8.1. Company Description

19.5.8.2. Business Overview

19.5.8.3. Product Type

19.5.8.4. Revenue Analysis

19.5.8.5. Strategic Outlook

19.5.9. Icotec Ag

19.5.9.1. Company Description

19.5.9.2. Business Overview

19.5.9.3. Product Type

19.5.10. Plastic Reinforcement Fabrics Ltd

19.5.10.1. Company Description

19.5.10.2. Business Overview

19.5.10.3. Product Type

19.5.11. Jiangsu Aosheng Composite Materials Hi-Tech Co., Ltd.

19.5.11.1. Company Description

19.5.11.2. Business Overview

19.5.11.3. Product Type

19.5.12. Shanghai Cedar Composites Technology Co. Ltd.

19.5.12.1. Company Description

19.5.12.2. Business Overview

19.5.12.3. Product Type

20. Key Primary Insight

List of Tables

Table 1 Global Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Fiber Type, 2019–2030

Table 2 Global Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

Table 3 Global Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Region, 2019–2030

Table 4 North America Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Fiber Type, 2019–2030

Table 5 North America Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

Table 6 North America Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Country, 2019–2030

Table 7 U.S. Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Fiber Type, 2019–2030

Table 8 U.S. Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

Table 9 Canada Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Fiber Type, 2019–2030

Table 10 Canada Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

Table 11 Europe Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Fiber Type, 2019–2030

Table 12 Europe Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

Table 13 Europe Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2019–2030

Table 14 Germany Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Fiber Type, 2019–2030

Table 15 Germany Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

Table 16 France Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Fiber Type, 2019–2030

Table 17 France Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

Table 18 U.K. Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2019–2030

Table 19 U.K. Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

Table 20 Italy Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Fiber Type, 2019–2030

Table 21 Italy Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

Table 22 Spain Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Fiber Type, 2019–2030

Table 23 Spain Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

Table 24 Russia & CIS Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Fiber Type, 2019–2030

Table 25 Russia & CIS Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

Table 26 Rest of Europe Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Fiber Type, 2019–2030

Table 27 Rest of Europe Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

Table 28 Asia Pacific Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Fiber Type, 2019–2030

Table 29 Asia Pacific Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

Table 30 Asia Pacific Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2019–2030

Table 31 China Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Fiber Type, 2019–2030

Table 32 China Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

Table 33 India Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Fiber Type, 2019–2030

Table 34 India Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

Table 35 Japan Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Fiber Type, 2019–2030

Table 36 Japan Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

Table 37 ASEAN Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Fiber Type, 2019–2030

Table 38 ASEAN Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

Table 39 Rest of Asia Pacific Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Fiber Type, 2019–2030

Table 40 Rest of Asia Pacific Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

Table 41 Latin America Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Fiber Type, 2019–2030

Table 42 Latin America Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

Table 43 Latin America Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2019–2030

Table 44 Brazil Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Fiber Type, 2019–2030

Table 45 Brazil Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

Table 46 Mexico Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Fiber Type, 2019–2030

Table 47 Mexico Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

Table 48 Rest of Latin America Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Fiber Type, 2019–2030

Table 49 Rest of Latin America Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

Table 50 Middle East & Africa Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Fiber Type, 2019–2030

Table 51 Middle East & Africa Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

Table 52 Middle East & Africa Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2019–2030

Table 53 GCC Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Fiber Type, 2019–2030

Table 54 GCC Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

Table 55 South Africa Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Fiber Type, 2019–2030

Table 56 South Africa Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

Table 57 Rest of Middle East & Africa Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Fiber Type, 2019–2030

Table 58 Rest of Middle East & Africa Medical Composites Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

List of Figures

Figure 1 Global Medical Composites Market Share Analysis, by Fiber Type

Figure 2 Global Medical Composites Market Attractiveness Analysis, by Fiber Type

Figure 3 Global Medical Composites Market Share Analysis, by Application

Figure 4 Global Medical Composites Market Attractiveness Analysis, by Application

Figure 5 Global Medical Composites Market Share Analysis, by Region

Figure 6 Global Medical Composites Market Attractiveness Analysis, by Region

Figure 7 North America Medical Composites Market Share Analysis, by Fiber Type

Figure 8 North America Medical Composites Market Attractiveness Analysis, by Fiber Type

Figure 9 North America Medical Composites Market Share Analysis, by Application

Figure 10 North America Medical Composites Market Attractiveness Analysis, by Application

Figure 11 North America Medical Composites Market Share Analysis, by Country

Figure 12 North America Medical Composites Market Attractiveness Analysis, by Country

Figure 13 Europe Medical Composites Market Share Analysis, by Fiber Type

Figure 14 Europe Medical Composites Market Attractiveness Analysis, by Fiber Type

Figure 15 Europe Medical Composites Market Share Analysis, by Application

Figure 16 Europe Medical Composites Market Attractiveness Analysis, by Application

Figure 17 Europe Medical Composites Market Share Analysis, by Country and Sub-region

Figure 18 Europe Medical Composites Market Attractiveness Analysis, by Country and Sub-region

Figure 19 Asia Pacific Medical Composites Market Share Analysis, by Fiber Type

Figure 20 Asia Pacific Medical Composites Market Attractiveness Analysis, by Fiber Type

Figure 21 Asia Pacific Medical Composites Market Share Analysis, by Application

Figure 22 Asia Pacific Medical Composites Market Attractiveness Analysis, by Application

Figure 23 Asia Pacific Medical Composites Market Share Analysis, by Country and Sub-region

Figure 24 Asia Pacific Medical Composites Market Attractiveness Analysis, by Country and Sub-region

Figure 25 Latin America Medical Composites Market Share Analysis, by Fiber Type

Figure 26 Latin America Medical Composites Market Attractiveness Analysis, by Fiber Type

Figure 27 Latin America Medical Composites Market Share Analysis, by Application

Figure 28 Latin America Medical Composites Market Attractiveness Analysis, by Application

Figure 29 Latin America Medical Composites Market Share Analysis, by Country and Sub-region

Figure 30 Latin America Medical Composites Market Attractiveness Analysis, by Country and Sub-region

Figure 31 Middle East & Africa Medical Composites Market Share Analysis, by Fiber Type

Figure 32 Middle East & Africa Medical Composites Market Attractiveness Analysis, by Fiber Type

Figure 33 Middle East & Africa Medical Composites Market Share Analysis, by Application

Figure 34 Middle East & Africa Medical Composites Market Attractiveness Analysis, by Application

Figure 35 Middle East & Africa Medical Composites Market Share Analysis, by Country and Sub-region

Figure 36 Middle East & Africa Medical Composites Market Attractiveness Analysis, by Country and Sub-region