One of the key concerns of a packaging producer is to significantly reduce packaging costs by replacing less desirable materials, eliminating the secondary process of conversion and downgauging. Achieving this effectively can help producers make accelerate gains on type of materials used and cost incurred on various steps of processing.

Machine direction orientation or MDO is known to considerably change the physical properties of polymer films, enhancing their mechanical and barrier strength alike. Using MDO processing to improve mechanical properties of films also enables downgauging them without compromising on their intrinsic properties.

Cost reduction is of key importance especially in heavy duty shipping sacks. Transparency Market Research (TMR) in its recent study has outlined the prospects for the MDO films market at a time when the global economy is at the cusp of a major transformation.

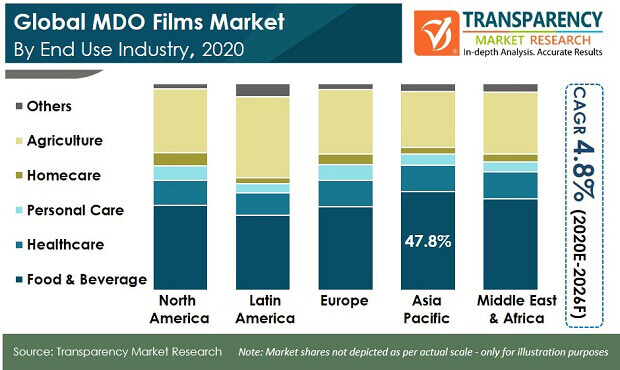

According to the report, the global MDO Films market is forecast to rise at a CAGR of 4.8% between 2020 and 2026. MDO films are recently witnessing diverse scopes for application. TMR finds the demand for packaging of healthcare products to be a lucrative sector. Owing to their high barrier properties and flawless print finish for a plethora of packages, MDO films sales uptick is forecast.

Food sector has emerged as a highly attractive segment, accounting for a significant percentage of sales proceeds. Consumers’ inclination for convenient food has in turn made them seek convenient packaging, which includes features such as easy-to-open and are re-sealable.

The demand for customization also is at all-time high as consumers across cities and high potential markets are seemingly inclined towards ready-to-cook packaging. Their changing preference is expected to have a considerable impact on the market. The rising demand for on-the-go consumption, attributable to time constraints, is viewed as opportunity in the making for MDO films producers.

MDO films have enhanced mechanical, barrier, and optical properties, which make them ideal packaging solutions for the food sector. With dealers augmenting their portfolio as a result of solid focus on convenience for consumers, the market can expect the sales to steadily pick up over the course of the forecast tenure.

In tandem with consumers’ needs, an increasing number of manufacturers are developing MDO films that offer robust seal performance. These films address a wide range of packaging needs besides exhibiting superior sealing functionality. These properties offer longer shelf-life to food packed inside.

A key point to note here is that a small increase in shelf life, especially in meat products, is a valuable proposition offered by the manufacturers. This also helps them in expanding their footprint.

MDO films producers often contribute towards extending shelf life of various products by offering improvements such as modified packaging, vacuum, and atmosphere and implementing novel packaging formats. As a result of similar efforts, the market today is witnessing increasing demand for diverse applications within the food sector.

For instance, these films are used in the packaging of various products such as confectioneries and bakeries, ready-to-eat and frozen foods, fruits and vegetables, and others. Sales uptick witnessed in the market also it attributable to the expansion of large retail chains in developed and high potential markets alike.

Producers of MDO films are still discovering novel market opportunities. However, some of the existing technical difficulties are withholding even a few big projects from coming of age. However, advent of new equipment could make the journey easier.

Despite all the aforementioned benefits, there isn’t enough supply of MDO film products in the market. According to experts, several types of MDO films besides a few relatively simpler ones such as monolayer stretch films are quite difficult to get right.

For instance, MDO films can be used to enhance barrier properties in EVOH and nylon, but it can also make them brittle. To mitigate these concerns, market players are looking at novel technologies and equipment to improve the flexibility of MDO films. In the past few years, a small but significant change is witnessed in the market in this regard.

Innovation of novel technologies to improve flexibility is also enabling growth in the market. According to TMR, similar improvements will help the MDO films market surpass US$5.02 Bn by 2026.

The market is expected to undergo a period of decline owing to the COVID-19 outbreak in 2020. Disruption of growth witnessed in food and food service businesses in response to extended lockdown orders will hamper growth in the MDO films market as well.

Against the backdrop of ongoing pandemic, governments are compelled to implement stringent regulations curbing free movement and transport in countries worst hit by the virus. This has been creating supply chain disruptions for several markets. MDO films producers are not immune to the suddenness of the change.

Several companies had to pause their operations to obey government decisions, which has significantly affected their growth trajectory. Besides this disruption in product management and distribution network and constantly changing financial conditions and tariffs in many countries may hamper the growth of the market to an extent.

According to TMR, the MDO films market is expected to get more competitive owing to the entry of local players. In order to gain competitive advantage, companies are primarily focusing on research and development and innovations.

Companies are constantly aiming at bettering their products. For instance, with the launch of the Global MDO Next Generation films, Avery Dennison is able to achieve a significant improvement in clarity to offer no-label look.

To study the competition prevailing in the global market, TMR profiles them as Tier 1, Tier 2, and Tier 3 companies. Tier 1 comprises established market players such as Klöckner Pentaplast Group, CCL Industries Inc., Borealis AG and Toray Plastics (America), Inc. Tier 2 includes companies such as Futamura Chemical Co. Ltd, Davis-Standard, LLC, and UPM Raflatac Inc. Finally, Tier 3 is consists of Lenzing Plastics GmbH & Co KG, NOWOFOL Kunststoffprodukte GmbH & Co. KG, Polythene UK Ltd., Trico Specialty Films LLC and many others.

1. Executive Summary

1.1. Market Overview

1.2. Market Analysis

1.3. Analysis and Recommendations

1.4. Wheel of Opportunity

2. Market Introduction

2.1. Market Taxonomy

2.2. Market Definition

3. Market Background

3.1. Porter’s Analysis

3.2. Macro-Economic Factors

3.3. Forecast Factors – Relevance & Impact

3.4. Value Chain

3.5. Market Dynamics

3.5.1. Drivers

3.5.2. Restraints

3.5.3. Opportunity Analysis

3.5.4. Trends

4. Market Forecast

4.1. Market Volume Projections

4.2. Pricing Analysis

4.3. Market Size Projections

4.3.1. Y-o-Y Projections

4.3.2. Absolute $ Opportunity Analysis

5. Global Machine Direction Oriented (MDO) Films Market Analysis By Manufacturing Process

5.1. Introduction

5.1.1. Market Value Share Analysis By Manufacturing Process

5.1.2. Y-o-Y Growth Analysis By Manufacturing Process

5.2. Market Size (US$ Mn) and Volume (Tons) Forecast By Manufacturing Process 2018–2026

5.2.1. Blown film

5.2.2. Cast film

5.3. Market Attractiveness Analysis By Manufacturing Process

6. Global Machine Direction Oriented (MDO) Films Market Analysis By Material Type

6.1. Introduction

6.1.1. Market Value Share Analysis By Material Type

6.1.2. Y-o-Y Growth Analysis By Material Type

6.2. Market Size (US$ Mn) and Volume (Tons) Forecast By Material Type 2018–2026

6.2.1. Polyethylene (PE)

6.2.1.1. LDPE

6.2.1.2. LLDPE

6.2.1.3. HDPE

6.2.2. Polypropylene (PP)

6.2.3. Polyamide (PA)

6.2.4. EVOH

6.2.5. PET

6.2.6. Others

6.3. Market Attractiveness Analysis By Material Type

7. Global Machine Direction Oriented (MDO) Films Market Analysis By Application

7.1. Introduction

7.1.1. Market Value Share Analysis By Application

7.1.2. Y-o-Y Growth Analysis By Application

7.2. Market Size (US$ Mn) and Volume (Tons) Forecast By Application 2018–2026

7.2.1. Bags & pouches

7.2.2. Shrink labels

7.2.3. Shrink Wrap films

7.2.4. Agro-textile

7.2.5. Tapes

7.2.6. Liners & coatings

7.2.7. Others

7.3. Market Attractiveness Analysis By Application

8. Global Machine Direction Oriented (MDO) Films Market Analysis By End-User Industry

8.1. Introduction

8.1.1. Market Value Share Analysis By End-User Industry

8.1.2. Y-o-Y Growth Analysis By End-User Industry

8.2. Market Size (US$ Mn) and Volume (Tons) Forecast By End-User Industry 2018–2026

8.2.1. Food

8.2.2. Beverage

8.2.3. Healthcare

8.2.4. Personal Care

8.2.5. Homecare

8.2.6. Agriculture

8.2.7. Others

8.3. Market Attractiveness Analysis By End-User Industry

9. Global Machine Direction Oriented (MDO) Films Market Analysis By Region

9.1. Introduction

9.1.1. Market Value Share Analysis By Region

9.1.2. Y-o-Y Growth Analysis By Region

9.2. Market Size (US$ Mn) and Volume (Tons) Forecast By Region 2018–2026

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific (APAC)

9.2.4. Latin America

9.2.5. Middle East & Africa (MEA)

9.3. Market Attractiveness Analysis By Region

10. Global Supply Demand Analysis

10.1.1. North America (Production, Consumption, Export, Import) Analysis

10.1.2. Europe (Production, Consumption, Export, Import) Analysis

10.1.3. APAC (Production, Consumption, Export, Import) Analysis

10.1.4. Latin America (Production, Consumption, Export, Import) Analysis

10.1.5. Middle East and Africa (Production, Consumption, Export, Import) Analysis

11. North America Machine Direction Oriented (MDO) Films Market Analysis

11.1. Introduction

11.2. Pricing Analysis

11.3. Market Size (US$ Mn) and Volume (Tons) Forecast By Country, 2018–2026

11.3.1. U.S.

11.3.2. Canada

11.4. Market Size (US$ Mn) and Volume (Tons) Forecast By Manufacturing Process 2018–2026

11.4.1. Cast film

11.4.2. Blown film

11.5. Market Size (US$ Mn) and Volume (Tons) Forecast By Material Type 2018–2026

11.5.1. Polyethylene (PE)

11.5.1.1. LDPE

11.5.1.2. LLDPE

11.5.1.3. HDPE

11.5.2. Polypropylene (PP)

11.5.3. Polyamide (PA)

11.5.4. EVOH

11.5.5. PET

11.5.6. Others

11.6. Market Size (US$ Mn) and Volume (Tons) Forecast By Application 2018–2026

11.6.1. Bags & pouches

11.6.2. Shrink labels

11.6.3. Shrink Wrap films

11.6.4. Agro-textile

11.6.5. Tapes

11.6.6. Liners & coatings

11.6.7. Others

11.7. Market Size (US$ Mn) and Volume (Tons) Forecast By End-User Industry 2018–2026

11.7.1. Food

11.7.2. Beverage

11.7.3. Healthcare

11.7.4. Personal Care

11.7.5. Homecare

11.7.6. Agriculture

11.7.7. Others

11.8. Key Market Participants – Intensity Mapping

12. Latin America Machine Direction Oriented (MDO) Films Market Analysis

12.1. Introduction

12.2. Pricing Analysis

12.3. Market Size (US$ Mn) and Volume (Tons) Forecast By Country, 2018–2026

12.3.1. Brazil

12.3.2. Mexico

12.3.3. Rest of Latin America

12.4. Market Size (US$ Mn) and Volume (Tons) Forecast By Manufacturing Process 2018–2026

12.4.1. Cast film

12.4.2. Blown film

12.5. Market Size (US$ Mn) and Volume (Tons) Forecast By Material Type 2018–2026

12.5.1. Polyethylene (PE)

12.5.1.1. LDPE

12.5.1.2. LLDPE

12.5.1.3. HDPE

12.5.2. Polypropylene (PP)

12.5.3. Polyamide (PA)

12.5.4. EVOH

12.5.5. PET

12.5.6. Others

12.6. Market Size (US$ Mn) and Volume (Tons) Forecast By Application 2018–2026

12.6.1. Bags & pouches

12.6.2. Shrink labels

12.6.3. Shrink Wrap films

12.6.4. Agro-textile

12.6.5. Tapes

12.6.6. Liners & coatings

12.6.7. Others

12.7. Market Size (US$ Mn) and Volume (Tons) Forecast By End-User Industry 2018–2026

12.7.1. Food

12.7.2. Beverage

12.7.3. Healthcare

12.7.4. Personal Care

12.7.5. Homecare

12.7.6. Agriculture

12.7.7. Others

12.8. Key Market Participants – Intensity Mapping

13. Europe Machine Direction Oriented (MDO) Films Market Analysis

13.1. Introduction

13.2. Pricing Analysis

13.3. Market Size (US$ Mn) and Volume (Tons) Forecast By Country, 2018–2026

13.3.1. Germany

13.3.2. Italy

13.3.3. France

13.3.4. U.K.

13.3.5. Spain

13.3.6. Benelux

13.3.7. Nordic

13.3.8. Russia

13.3.9. Poland

13.3.10. Rest of Europe

13.4. Market Size (US$ Mn) and Volume (Tons) Forecast By Manufacturing Process 2018–2026

13.4.1. Cast film

13.4.2. Blown film

13.5. Market Size (US$ Mn) and Volume (Tons) Forecast By Material Type 2018–2026

13.5.1. Polyethylene (PE)

13.5.1.1. LDPE

13.5.1.2. LLDPE

13.5.1.3. HDPE

13.5.2. Polypropylene (PP)

13.5.3. Polyamide (PA)

13.5.4. EVOH

13.5.5. PET

13.5.6. Others

13.6. Market Size (US$ Mn) and Volume (Tons) Forecast By Application 2018–2026

13.6.1. Bags & pouches

13.6.2. Shrink labels

13.6.3. Shrink Wrap films

13.6.4. Agro-textile

13.6.5. Tapes

13.6.6. Liners & coatings

13.6.7. Others

13.7. Market Size (US$ Mn) and Volume (Tons) Forecast By End-User Industry 2018–2026

13.7.1. Food

13.7.2. Beverage

13.7.3. Healthcare

13.7.4. Personal Care

13.7.5. Homecare

13.7.6. Agriculture

13.7.7. Others

13.8. Key Market Participants – Intensity Mapping

14. APAC Machine Direction Oriented (MDO) Films Market Analysis

14.1. Introduction

14.2. Pricing Analysis

14.3. Market Size (US$ Mn) and Volume (Tons) Forecast By Country, 2018–2026

14.3.1. China

14.3.2. India

14.3.3. ASEAN

14.3.4. Australia and New Zealand

14.3.5. Japan

14.3.6. Rest of APAC

14.4. Market Size (US$ Mn) and Volume (Tons) Forecast By Manufacturing Process 2018–2026

14.4.1. Cast film

14.4.2. Blown film

14.5. Market Size (US$ Mn) and Volume (Tons) Forecast By Material Type 2018–2026

14.5.1. Polyethylene (PE)

14.5.1.1. LDPE

14.5.1.2. LLDPE

14.5.1.3. HDPE

14.5.2. Polypropylene (PP)

14.5.3. Polyamide (PA)

14.5.4. EVOH

14.5.5. PET

14.5.6. Others

14.6. Market Size (US$ Mn) and Volume (Tons) Forecast By Application 2018–2026

14.6.1. Bags & pouches

14.6.2. Shrink labels

14.6.3. Shrink Wrap films

14.6.4. Agro-textile

14.6.5. Tapes

14.6.6. Liners & coatings

14.6.7. Others

14.7. Market Size (US$ Mn) and Volume (Tons) Forecast By End-User Industry 2018–2026

14.7.1. Food

14.7.2. Beverage

14.7.3. Healthcare

14.7.4. Personal Care

14.7.5. Homecare

14.7.6. Agriculture

14.7.7. Others

14.8. Key Market Participants – Intensity Mapping

15. MEA Machine Direction Oriented (MDO) Films Market Analysis

15.1. Introduction

15.2. Pricing Analysis

15.3. Market Size (US$ Mn) and Volume (Tons) Forecast By Country, 2018–2026

15.3.1. GCC

15.3.2. North Africa

15.3.3. South Africa

15.3.4. Rest of MEA

15.4. Market Size (US$ Mn) and Volume (Tons) Forecast By Manufacturing Process 2018–2026

15.4.1. Cast film

15.4.2. Blown film

15.5. Market Size (US$ Mn) and Volume (Tons) Forecast By Material Type 2018–2026

15.5.1. Polyethylene (PE)

15.5.1.1. LDPE

15.5.1.2. LLDPE

15.5.1.3. HDPE

15.5.2. Polypropylene (PP)

15.5.3. Polyamide (PA)

15.5.4. EVOH

15.5.5. PET

15.5.6. Others

15.6. Market Size (US$ Mn) and Volume (Tons) Forecast By Application 2018–2026

15.6.1. Bags & pouches

15.6.2. Shrink labels

15.6.3. Shrink Wrap films

15.6.4. Agro-textile

15.6.5. Tapes

15.6.6. Liners & coatings

15.6.7. Others

15.7. Market Size (US$ Mn) and Volume (Tons) Forecast By End-User Industry 2018–2026

15.7.1. Food

15.7.2. Beverage

15.7.3. Healthcare

15.7.4. Personal Care

15.7.5. Homecare

15.7.6. Agriculture

15.7.7. Others

15.8. Key Market Participants – Intensity Mapping

16. Market Structure Analysis

16.1. Market Analysis by Tier of Companies

16.1.1. By Large, Medium and Small

16.2. Market Concentration

16.2.1. By Top 5 and by Top 10

16.3. Production Capacity Share Analysis

16.3.1. BY Large, Medium and Small

16.3.2. By Top 5 and Top 10

16.4. Market Share Analysis of Top 10 Players

16.4.1. North America Market Share Analysis by Top Players

16.4.2. Europe Market Share Analysis by Top Players

16.4.3. Asia Pacific Market Share Analysis by Top Players

16.5. Market Presence Analysis

16.5.1. By Regional footprint of Players

16.5.2. Product foot print by Players

16.5.3. Channel Foot Print by Players

17. Competition Analysis

17.1. Competition Dashboard

17.2. Competition Benchmarking

17.3. Profitability and Gross Margin Analysis By Competition

17.4. Competition Developments

17.5. Competition Deep Dive

17.5.1. Lenzing Plastics GmbH & Co KG

17.5.1.1. Overview

17.5.1.2. Product Portfolio

17.5.1.3. Profitability

17.5.1.4. Production Footprint

17.5.1.5. Sales Footprint

17.5.1.6. Channel Footprint

17.5.1.7. Competition Benchmarking

17.5.1.8. Strategy

17.5.1.8.1. Marketing Strategy

17.5.1.8.2. Product Strategy

17.5.1.8.3. Channel Strategy

17.5.2. Toray Industries Inc.

17.5.2.1. Overview

17.5.2.2. Product Portfolio

17.5.2.3. Profitability

17.5.2.4. Production Footprint

17.5.2.5. Sales Footprint

17.5.2.6. Channel Footprint

17.5.2.7. Competition Benchmarking

17.5.2.8. Strategy

17.5.2.8.1. Marketing Strategy

17.5.2.8.2. Product Strategy

17.5.2.8.3. Channel Strategy

17.5.3. Avery Dennison Corporation

17.5.3.1. Overview

17.5.3.2. Product Portfolio

17.5.3.3. Profitability

17.5.3.4. Production Footprint

17.5.3.5. Sales Footprint

17.5.3.6. Channel Footprint

17.5.3.7. Competition Benchmarking

17.5.3.8. Strategy

17.5.3.8.1. Marketing Strategy

17.5.3.8.2. Product Strategy

17.5.3.8.3. Channel Strategy

17.5.4. Klöckner Pentaplast Group

17.5.4.1. Overview

17.5.4.2. Product Portfolio

17.5.4.3. Profitability

17.5.4.4. Production Footprint

17.5.4.5. Sales Footprint

17.5.4.6. Channel Footprint

17.5.4.7. Competition Benchmarking

17.5.4.8. Strategy

17.5.4.8.1. Marketing Strategy

17.5.4.8.2. Product Strategy

17.5.4.8.3. Channel Strategy

17.5.5. CCL Industries Inc.

17.5.5.1. Overview

17.5.5.2. Product Portfolio

17.5.5.3. Profitability

17.5.5.4. Production Footprint

17.5.5.5. Sales Footprint

17.5.5.6. Channel Footprint

17.5.5.7. Competition Benchmarking

17.5.5.8. Strategy

17.5.5.8.1. Marketing Strategy

17.5.5.8.2. Product Strategy

17.5.5.8.3. Channel Strategy

17.5.6. 4. NOWOFOL Kunststoffprodukte GmbH & Co. KG

NOWOFOL Kunststoffprodukte GmbH & Co. KG

17.5.6.1. Overview

17.5.6.2. Product Portfolio

17.5.6.3. Profitability

17.5.6.4. Production Footprint

17.5.6.5. Sales Footprint

17.5.6.6. Channel Footprint

17.5.6.7. Competition Benchmarking

17.5.6.8. Strategy

17.5.6.8.1. Marketing Strategy

17.5.6.8.2. Product Strategy

17.5.6.8.3. Channel Strategy

17.5.7. Polysack Ltd

17.5.7.1. Overview

17.5.7.2. Product Portfolio

17.5.7.3. Profitability

17.5.7.4. Production Footprint

17.5.7.5. Sales Footprint

17.5.7.6. Channel Footprint

17.5.7.7. Competition Benchmarking

17.5.7.8. Strategy

17.5.7.8.1. Marketing Strategy

17.5.7.8.2. Product Strategy

17.5.7.8.3. Channel Strategy

17.5.8. UPM Raflatac Inc.

17.5.8.1. Overview

17.5.8.2. Product Portfolio

17.5.8.3. Profitability

17.5.8.4. Production Footprint

17.5.8.5. Sales Footprint

17.5.8.6. Channel Footprint

17.5.8.7. Competition Benchmarking

17.5.8.8. Strategy

17.5.8.8.1. Marketing Strategy

17.5.8.8.2. Product Strategy

17.5.8.8.3. Channel Strategy

17.5.9. Polythene UK Ltd

17.5.9.1. Overview

17.5.9.2. Product Portfolio

17.5.9.3. Profitability

17.5.9.4. Production Footprint

17.5.9.5. Sales Footprint

17.5.9.6. Channel Footprint

17.5.9.7. Competition Benchmarking

17.5.9.8. Strategy

17.5.9.8.1. Marketing Strategy

17.5.9.8.2. Product Strategy

17.5.9.8.3. Channel Strategy

17.5.10. Borealis AG

17.5.10.1 Overview

17.5.10.2 Product Portfolio

17.5.10.3 Profitability

17.5.10.4 Production Footprint

17.5.10.5 Sales Footprint

17.5.10.6 Channel Footprint

17.5.10.7 Competition Benchmarking

17.5.10.8 Strategy

17.5.10.8.1. Marketing Strategy

17.5.10.8.2. Product Strategy

17.5.10.8.3. Channel Strategy

17.5.11. Trico Specialty Films LLC

17.5.11.1 Overview

17.5.11.2 Product Portfolio

17.5.11.3 Profitability

17.5.11.4 Production Footprint

17.5.11.5 Sales Footprint

17.5.11.6 Channel Footprint

17.5.11.7 Competition Benchmarking

17.5.11.8 Strategy

17.5.11.8.1. Product Strategy

17.5.11.8.2. Channel Strategy

17.5.12. Wytwórnia Wyrobów Foliowych FOLPLAST

17.5.12.1 Overview

17.5.12.2 Product Portfolio

17.5.12.3 Profitability

17.5.12.4 Production Footprint

17.5.12.5 Sales Footprint

17.5.12.6 Channel Footprint

17.5.12.7 Competition Benchmarking

17.5.12.8 Strategy

17.5.12.8.1. Marketing Strategy

17.5.12.8.2. Product Strategy

17.5.12.8.3. Channel Strategy

17.5.13. Davis-Standard, LLC

17.5.13.1 Overview

17.5.13.2 Product Portfolio

17.5.13.3 Profitability

17.5.13.4 Production Footprint

17.5.13.5 Sales Footprint

17.5.13.6 Channel Footprint

17.5.13.7 Competition Benchmarking

17.5.13.8 Strategy

17.5.13.8.1. Marketing Strategy

17.5.13.8.2. Product Strategy

17.5.13.8.3. Channel Strategy

17.5.14. LA Plastpacks Pvt. Ltd.

17.5.14.1 Overview

17.5.14.2 Product Portfolio

17.5.14.3 Profitability

17.5.14.4 Production Footprint

17.5.14.5 Sales Footprint

17.5.14.6 Channel Footprint

17.5.14.7 Competition Benchmarking

17.5.14.8 Strategy

17.5.14.8.1. Marketing Strategy

17.5.14.8.2. Product Strategy

17.5.14.8.3. Channel Strategy

18. Assumptions and Acronyms Used

19. Research Methodology

List of Tables

Table 01: Global MDO Films Market Value (US$ Mn) and Volume (Tonnes) Forecast, by Manufacturing Process, 2017 (A) – 2026 (F)

Table 02: Global MDO Films Market Value (US$ Mn) and Volume (Tonnes) Forecast, by Material Type, 2017 (A) – 2026 (F)

Table 03: Global MDO Films Market Value (US$ Mn) and Volume (Tonnes) Forecast, by Application, 2017 (A) – 2026 (F)

Table 04: Global MDO Films Market Value (US$ Mn) and Volume (Tonnes) Forecast, by End Use Industry, 2017 (A) – 2026 (F)

Table 05: Global MDO Films Market Value (US$ Mn) and Volume (Tonnes) Forecast, by Region, 2017 (A) – 2026 (F)

Table 06: North America MDO Films Market Value (US$ Mn) and Volume (Tonnes) Forecast, by Country, 2017(A)-2026 (F)

Table 07: North America MDO Films Market Value (US$ Mn) and Volume (Tonnes) Forecast, by Manufacturing Process, 2017(A)-2026 (F)

Table 08: North America MDO Films Market Value (US$ Mn) and Volume (Tonnes) Forecast, by Material Type, 2017(A)-2026 (F)

Table 09: North America MDO Films Market Value (US$ Mn) and Volume (Tonnes) Forecast, by Application, 2017(A)-2026 (F)

Table 10: North America MDO Films Market Value (US$ Mn) and Volume (Tonnes) Forecast, by End Use Industry, 2017(A)-2026 (F)

Table 11: Latin America MDO Films Market Value (US$ Mn) and Volume (Tonnes) Forecast, by Country, 2017(A)-2026 (F)

Table 12: Latin America MDO Films Market Value (US$ Mn) and Volume (Tonnes) Forecast, by Manufacturing Process, 2017(A)-2026 (F)

Table 13: Latin America MDO Films Market Value (US$ Mn) and Volume (Tonnes) Forecast, by Material Type, 2017(A)-2026 (F)

Table 14: Latin America MDO Films Market Value (US$ Mn) and Volume (Tonnes) Forecast, by Application, 2017(A)-2026 (F)

Table 15: Latin America MDO Films Market Value (US$ Mn) and Volume (Tonnes) Forecast, by End Use Industry, 2017(A)-2026 (F)

Table 16: Europe MDO Films Market Value (US$ Mn) and Volume (Tonnes) Forecast, by Country, 2017(A)-2026 (F)

Table 17: Europe MDO Films Market Value (US$ Mn) and Volume (Tonnes) Forecast, by Country, 2017(A)-2026 (F)

Table 18: Europe MDO Films Market Value (US$ Mn) and Volume (Tonnes) Forecast, by Manufacturing Process, 2017(A)-2026 (F)

Table 19: Europe MDO Films Market Value (US$ Mn) and Volume (Tonnes) Forecast, by Material Type, 2017(A)-2026 (F)

Table 20: Europe MDO Films Market Value (US$ Mn) and Volume (Tonnes) Forecast, by Application, 2017(A)-2026 (F)

Table 21: Europe MDO Films Market Value (US$ Mn) and Volume (Tonnes) Forecast, by End Use Industry, 2017(A)-2026 (F)

Table 22: APAC MDO Films Market Value (US$ Mn) and Volume (Tonnes) Forecast, by Country, 2017(A)-2026 (F)

Table 23: APAC MDO Films Market Value (US$ Mn) and Volume (Tonnes) Forecast, by Manufacturing Process, 2017(A)-2026 (F)

Table 24: APAC MDO Films Market Value (US$ Mn) and Volume (Tonnes) Forecast, by Material Type, 2017(A)-2026 (F)

Table 25: APAC MDO Films Market Value (US$ Mn) and Volume (Tonnes) Forecast, by Application, 2017(A)-2026 (F)

Table 26: APAC MDO Films Market Value (US$ Mn) and Volume (Tonnes) Forecast, by End Use Industry, 2017(A)-2026 (F)

Table 27: MEA MDO Films Market Value (US$ Mn) and Volume (Tonnes) Forecast, by Country, 2017(A)-2026 (F)

Table 28: MEA MDO Films Market Value (US$ Mn) and Volume (Tonnes) Forecast, by Manufacturing Process, 2017(A)-2026 (F)

Table 29: MEA MDO Films Market Value (US$ Mn) and Volume (Tonnes) Forecast, by Material Type, 2017(A)-2026 (F)

Table 30: MEA MDO Films Market Value (US$ Mn) and Volume (Tonnes) Forecast, by Application, 2017(A)-2026 (F)

Table 31: MEA MDO Films Market Value (US$ Mn) and Volume (Tonnes) Forecast, by End Use Industry, 2017(A)-2026 (F)

List of Figures

Figure 01: Global MDO Films Market Value (US$ Mn) and Volume (Tonnes), 2017 (A) – 2026 (F)

Figure 02: Global MDO Films Market, Absolute $ Opportunity Analysis, 2017 (A) – 2026 (F)

Figure 03: Global MDO Films Market Share & Basis Points (BPS) Analysis, by Manufacturing Process, 2018 (E) & 2026 (F)

Figure 04: Global MDO Films Market Y-o-Y Growth, by Manufacturing Process, 2017 (A) – 2026 (F)

Figure 05: Global MDO Films Market Share & Basis Points (BPS) Analysis, by Material Type, 2018 (E) & 2026 (F)

Figure 06: Global MDO Films Market Y-o-Y Growth, by Material Type, 2017 (A) – 2026 (F)

Figure 07: Global MDO Films Market Share & Basis Points (BPS) Analysis, by Application, 2018 (E) & 2026 (F)

Figure 08: Global MDO Films Market Y-o-Y Growth, by Application, 2017 (A) – 2026 (F)

Figure 09: Global MDO Films Market Share & Basis Points (BPS) Analysis, by End Use Industry, 2018 (E) & 2026 (F)

Figure 10: Global MDO Films Market Y-o-Y Growth, by End Use Industry, 2017 (A) – 2026 (F)

Figure 11: Global MDO Films Market Share & Basis Points (BPS) Analysis, by Region, 2018(E) & 2026 (F)

Figure 12: Global MDO Films Market Y-o-Y Growth, by Region, 2018 (E) – 2026 (F)

Figure 13: Global MDO Films Market Attractiveness Index, by Region, 2018

Figure 14: North America MDO Films Market Value (US$ Mn) and Volume (Tonnes), 2017(A)-2026 (F)

Figure 15: North America MDO Films Market, Absolute $ Opportunity Analysis, 2017(A)-2026 (F)

Figure 16: North America MDO Films Market Share & Basis Points (BPS) Analysis, by Country, 2018 (E) & 2026 (F)

Figure 17: North America MDO Films Market Y-o-Y Growth, by Country, 2017(A)-2026 (F)

Figure 18: North America MDO Films Market Attractiveness Index, by Country, 2018

Figure 19: Latin America MDO Films Market Value (US$ Mn) and Volume (Tonnes), 2017(A)-2026 (F)

Figure 20: Latin America MDO Films Market, Absolute $ Opportunity Analysis, 2017(A)-2026 (F)

Figure 21: Latin America MDO Films Market Share & Basis Points (BPS) Analysis, by Country, 2018 (E) & 2026 (F)

Figure 22: Latin America MDO Films Market Y-o-Y Growth, by Country, 2017(A)-2026 (F)

Figure 23: Latin America MDO Films Market Attractiveness Index, by Country, 2018

Figure 24: Europe MDO Films Market Value (US$ Mn) and Volume (Tonnes), 2017(A)-2026 (F)

Figure 25: Europe MDO Films Market, Absolute $ Opportunity Analysis, 2017(A)-2026 (F)

Figure 26: Europe MDO Films Market Share & Basis Points (BPS) Analysis, by Country, 2018 (E) & 2026 (F)

Figure 27: Europe MDO Films Market Y-o-Y Growth, by Country, 2017(A)-2026 (F)

Figure 28: Europe MDO Films Market Attractiveness Index, by Country, 2018

Figure 29: APAC MDO Films Market Value (US$ Mn) and Volume (Tonnes), 2017(A)-2026 (F)

Figure 30: APAC MDO Films Market, Absolute $ Opportunity Analysis, 2017(A)-2026 (F)

Figure 31: APAC MDO Films Market Share & Basis Points (BPS) Analysis, by Country, 2018 (E) & 2026 (F)

Figure 32: APAC MDO Films Market Y-o-Y Growth, by Country, 2017(A)-2026 (F)

Figure 33: APAC MDO Films Market Attractiveness Index, by Country, 2018

Figure 34: MEA MDO Films Market Value (US$ Mn) and Volume (Tonnes), 2017(A)-2026 (F)

Figure 35: MEA MDO Films Market, Absolute $ Opportunity Analysis, 2017(A)-2026 (F)

Figure 36: MEA MDO Films Market Share & Basis Points (BPS) Analysis, by Country, 2018 (E) & 2026 (F)

Figure 37: MEA MDO Films Market Y-o-Y Growth, by Country, 2017(A)-2026 (F)

Figure 38: MEA MDO Films Market Attractiveness Index, by Country, 2018