Analysts’ Viewpoint on Mattress and Mattress Component Market Scenario

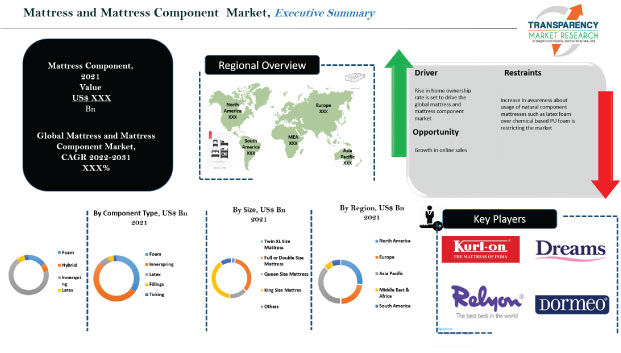

Companies in the mattress and mattress component market are focusing on high-growth products such as foam mattresses and innerspring mattresses to drive their businesses post the peak of the COVID-19 pandemic. The market for mattress and mattress components is estimated to witness a growth rate (CAGR) of 5.5% and 4.6% during the forecast period. However, rise in awareness about the usage of natural component mattresses, such as latex foam mattresses over chemical-based PU foam (Polyurethane Foam) mattresses, is restricting the market. Hence, manufacturers should diversify their production in natural latex foam mattresses and chemical-based PU foam mattresses to broaden their revenue streams. Increasing number of customers prefer to use natural products. This can adversely affect the mattress and mattress component market. Thus, companies should increase their R&D in natural component mattresses as well as focus on technology that provides high durability, uniform space, good back support, and comfort.

Demand for memory foam & latex mattresses as well as eco-friendly mattresses is rising across the globe. Customers often choose online distribution channels to select the latest mattress designs, sizes, and patterns. Online channels provide a high level of price transparency and a wide range of product possibilities.

Increase in awareness about health has led to a rise in demand for eco-friendly and comfortable mattresses. This is driving the mattress and mattress component market.

Customers have started shifting from chemical foam mattresses to eco-friendly component mattresses or certified foam mattresses due to the increasing prevalence of cancer, genetic defects, and harm caused to the unborn child by the use of chemical foam mattresses. According to a survey conducted by CertiPUR-US, about 88% of customers indicated that certified foam is important; more than 90% of mattress shoppers surveyed said that they were willing to pay more to ensure the foam in their new mattress is certified.

Shorter mattress replacement cycle is also an important factor that is driving the mattress and mattress component market. According to the National Bed Federation, customers are replacing their mattresses more frequently. Increasing number of customers are replacing their mattresses every seven years. This indicates a 10-year drop from 1995 when customers bought a new mattress every 17 years on an average.

Increase in new component technologies and advancements in mattress construction techniques, which cater to different levels of comfort, are anticipated to fuel the mattress and mattress component market during the forecast period. These technologies are leading to innovations in pressure relief mattresses.

Customers are increasingly opting to replace old household goods with new ones to improve the interior design of residences. Nowadays, people prefer the latest designs of mattresses that match the interiors of their residences. Rise in income and improvement in lifestyle have also encouraged the purchase of new mattresses. Such trends are leading to innovations in luxury mattresses, heated mattress pads, and air mattresses.

Interior design is also a key factor in industries such as hospitality and healthcare. These sectors aim to expand their business by providing end-users with comfortable facilities and services. Mattress and mattresses components play a vital role in interiors of hospitality and healthcare establishments. Thus, manufacturers are compelled to innovate in pressure relief devices, medical mattresses, and smart mattresses.

In terms of product type, the global mattress and mattresses component market has been divided into foam mattress, hybrid, innerspring, latex, and others (waterbed and airbed). The innerspring mattress segment held major share of 67% in 2021 and is likely to maintain the status quo at a growth rate of more than 5.1% during the forecast period. Innerspring mattresses are one of the oldest and most common types of mattresses. Pure innerspring mattresses, aside from their abundant availability, are one of the most cost-effective mattress solutions.

Mattress and mattress components are classified in terms of component type into foam (polyurethane, memory, gel, polyester, convoluted, Evlon, and latex), innerspring (bonnell coils, pocket coils, continuous coils, and offset coils), latex (natural and synthetic), fillings (coir, wool, cotton, and others), and ticking. The innerspring (Bonnell coils and continuous coils) segment dominated the mattress component market in 2021. It is expected to hold its position during the forecast period.

Innerspring mattress is a pocket-friendly option. Among innerspring, continuous coil and Bonnell coil account for the maximum share of the market. Their growth has been impacted by the emergence of pocket coils. However, demand for continuous coil and Bonnell coil mattresses is likely to rise during the forecast period.

Asia Pacific is estimated to hold the largest volume share of the global mattress and mattress component market during the forecast period. Large share of the market in Asia Pacific can be ascribed to the high demand for latex and natural fiber mattresses compared to pocket spring mattresses in the region. Latex and natural fiber mattresses remain the most preferred type among Chinese and Indian customers.

North America was the second-largest market in the global mattress industry in 2021. It generates around 27% of the total mattress revenue globally. In terms of consumption, the U.S. has been leading the global mattress market during the past few years. The mattress market is constantly growing with general-purpose and specialized products, innovation of products, and new introductions.

The usage of mattresses is likely to be increase significantly in Middle East & Africa, as employment prospects in GCC (Gulf Cooperation Council) countries are expected to improve in the near future. Large numbers of foreign workers are anticipated to come to GCC countries for jobs. This is likely to boost the demand for new houses and mattresses.

The global mattress and mattress component market is consolidated with a small number of large-scale vendors controlling the majority of the share. Most of the firms are investing significantly in comprehensive research and development activities, primarily to develop environment-friendly products. Diversification of product portfolios and mergers & acquisitions are important strategies adopted by key players. Spring Air Company, King Koil, Inc., Paramount Bed Holdings Co., Ltd., Relyon Limited, Casper, Simba, Dreams Ltd, Jinbaoma Furniture Manufacturer, and Duroflex Pvt Ltd are the prominent entities operating in this market.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 42.24 Bn and US$ 27.44 Bn |

|

Market Forecast Value in 2031 |

US$ 71.31 Bn and US$ 42.3 Bn |

|

Growth Rate (CAGR) |

5.5% and 4.6% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value & Million Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The market stood at US$ 42.24 Bn and US$ 27.44 Bn in 2021

The market is estimated to expand at a CAGR of 5.5% and 4.6% during 2022-2031

• Rise in health awareness among consumers • Rise in home ownership rate

The innerspring mattress component segment accounted for around 67% share of the market in 2021

Asia Pacific is likely to be one of the lucrative markets in the next few years

Spring Air Company, King Koil, Inc., Paramount Bed Holdings Co., Ltd., Relyon Limited, Casper, Simba, Dreams Ltd, Jinbaoma Furniture Manufacturer, and Duroflex Pvt Ltd.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.4.1. Overall Mattress and Mattress Component Market Overview

5.5. Raw Material Analysis

5.6. Porter’s Five Forces Analysis

5.7. Industry SWOT Analysis

5.8. Value Chain Analysis

5.9. Covid-19 Impact Analysis

5.10. Global Mattress and Mattress Component Market Analysis and Forecast, 2017 - 2031

5.10.1. Market Value Projections (US$ Bn)

5.10.2. Market Volume Projections (Million Units)

6. Global Mattress and Mattress Component Market Analysis and Forecast, By Product Type

6.1. Mattress and Mattress Component Market Size (US$ Bn and Million Units) By Product Type, 2017 – 2031

6.1.1. Foam Mattress

6.1.2. Hybrid

6.1.3. Innerspring

6.1.4. Latex

6.1.5. Others (Waterbed and Airbed)

6.2. Incremental Opportunity, By Product Type

7. Global Mattress and Mattress Component Market Analysis and Forecast, By Component Type

7.1. Mattress and Mattress Component Market Size (US$ Bn and Million Units) By Component Type, 2017 - 2031

7.1.1. Foam

7.1.1.1. Polyurethane

7.1.1.2. Polyethylene

7.1.1.3. Memory

7.1.1.4. Gel

7.1.1.5. Polyester

7.1.1.6. Latex

7.1.1.7. Convoluted

7.1.1.8. Evlon

7.1.2. Innerspring

7.1.2.1. Bonnell Coils

7.1.2.2. Pocket Coils

7.1.2.3. Continuous Coils

7.1.2.4. Offset Coils

7.1.3. Latex

7.1.3.1. Natural

7.1.3.2. Synthetic

7.1.4. Fillings

7.1.4.1. Coir

7.1.4.2. Wool

7.1.4.3. Cotton

7.1.4.4. Other (Fiber, Polyester)

7.1.5. Ticking

7.2. Incremental Opportunity, By Component Type

8. Global Mattress and Mattress Component Market Analysis and Forecast, By Size

8.1. Mattress and Mattress Component Market Size (US$ Bn and Million Units) By Size, 2017 - 2031

8.1.1. Twin or Single Size

8.1.2. Twin XL Size

8.1.3. Full or Double Size

8.1.4. Queen Size

8.1.5. Other Size

8.2. Incremental Opportunity, By Size

9. Global Mattress and Mattress Component Market Analysis and Forecast, By Region

9.1. Mattress and Mattress Component Market Size (US$ Bn and Million Units), By Region, 2017 - 2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Incremental Opportunity, By Region

10. North America Mattress and Mattress Component Market Analysis and Forecast

10.1. Regional Snapshot

10.2. Key Supplier Analysis

10.3. Price Trend Analysis

10.3.1. Weighted Average Price

10.4. Key Trends Analysis

10.4.1. Demand Side

10.4.2. Supplier Side

10.5. Mattress and Mattress Component Market Size (US$ Bn and Million Units), By Product Type, 2017 – 2031

10.5.1. Foam Mattress

10.5.2. Hybrid

10.5.3. Innerspring

10.5.4. Latex

10.5.5. Others (Waterbed and Airbed)

10.5.6. Trimmers

10.6. Mattress and Mattress Component Market Size (US$ Bn and Million Units), By Component Type, 2017 - 2031

10.6.1. Foam

10.6.1.1. Polyurethane

10.6.1.2. Polyethylene

10.6.1.3. Memory

10.6.1.4. Gel

10.6.1.5. Polyester

10.6.1.6. Latex

10.6.1.7. Convoluted

10.6.1.8. Evlon

10.6.2. Innerspring

10.6.2.1. Bonnell Coils

10.6.2.2. Pocket Coils

10.6.2.3. Continuous Coils

10.6.2.4. Offset Coils

10.6.3. Latex

10.6.3.1. Natural

10.6.3.2. Synthetic

10.6.4. Fillings

10.6.4.1. Coir

10.6.4.2. Wool

10.6.4.3. Cotton

10.6.4.4. Other (Fiber, Polyester)

10.6.5. Ticking

10.7. Mattress and Mattress Component Market Size (US$ Bn and Million Units) By Size, 2017 - 2031

10.7.1. Twin or Single Size

10.7.2. Twin XL Size

10.7.3. Full or Double Size

10.7.4. Queen Size

10.8. Mattress and Mattress Component Market Size (US$ Bn and Million Units), By Country & Sub-region, 2017 - 2031

10.8.1. U.S

10.8.2. Canada

10.8.3. Rest of North America

10.9. Incremental Opportunity Analysis

11. Europe Mattress and Mattress Component Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Key Supplier Analysis

11.3. Price Trend Analysis

11.3.1. Weighted Average Price

11.4. Key Trends Analysis

11.4.1. Demand Side

11.4.2. Supplier Side

11.5. Mattress and Mattress Component Market Size (US$ Bn and Million Units), By Product Type, 2017 – 2031

11.5.1. Foam Mattress

11.5.2. Hybrid

11.5.3. Innerspring

11.5.4. Latex

11.5.5. Others (Waterbed and Airbed)

11.6. Mattress and Mattress Component Market Size (US$ Bn and Million Units), By Component Type, 2017 - 2031

11.6.1. Foam

11.6.1.1. Polyurethane

11.6.1.2. Polyethylene

11.6.1.3. Memory

11.6.1.4. Gel

11.6.1.5. Polyester

11.6.1.6. Latex

11.6.1.7. Convoluted

11.6.1.8. Evlon

11.6.2. Innerspring

11.6.2.1. Bonnell Coils

11.6.2.2. Pocket Coils

11.6.2.3. Continuous Coils

11.6.2.4. Offset Coils

11.6.3. Latex

11.6.3.1. Natural

11.6.3.2. Synthetic

11.6.4. Fillings

11.6.4.1. Coir

11.6.4.2. Wool

11.6.4.3. Cotton

11.6.4.4. Other (Fiber, Polyester)

11.6.5. Ticking

11.7. Mattress and Mattress Component Market Size (US$ Bn and Million Units) By Size, 2017 - 2031

11.7.1. Twin or Single Size

11.7.2. Twin XL Size

11.7.3. Full or Double Size

11.7.4. Queen Size

11.7.5. Other Size

11.8. Mattress and Mattress Component Market Size (US$ Bn and Million Units) By Country & Sub-region, 2017 - 2031

11.8.1. U.K

11.8.2. Germany

11.8.3. France

11.8.4. Rest of Europe

11.9. Incremental Opportunity Analysis

12. Asia Pacific Mattress and Mattress Component Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Supplier Analysis

12.3. Price Trend Analysis

12.3.1. Weighted Average Price

12.4. Key Trends Analysis

12.4.1. Demand Side

12.4.2. Supplier Side

12.5. Mattress and Mattress Component Market Size (US$ Bn and Million Units), By Product Type, 2017 – 2031

12.5.1. Foam Mattress

12.5.2. Hybrid

12.5.3. Innerspring

12.5.4. Latex

12.5.5. Others (Waterbed and Airbed)

12.6. Mattress and Mattress Component Market Size (US$ Bn and Million Units), By Component Type, 2017 - 2031

12.6.1. Foam

12.6.1.1. Polyurethane

12.6.1.2. Polyethylene

12.6.1.3. Memory

12.6.1.4. Gel

12.6.1.5. Polyester

12.6.1.6. Latex

12.6.1.7. Convoluted

12.6.1.8. Evlon

12.6.2. Innerspring

12.6.2.1. Bonnell Coils

12.6.2.2. Pocket Coils

12.6.2.3. Continuous Coils

12.6.2.4. Offset Coils

12.6.3. Latex

12.6.3.1. Natural

12.6.3.2. Synthetic

12.6.4. Fillings

12.6.4.1. Coir

12.6.4.2. Wool

12.6.4.3. Cotton

12.6.4.4. Other (Fiber, Polyester)

12.6.5. Ticking

12.7. Mattress and Mattress Component Market Size (US$ Bn and Million Units) By Size, 2017 - 2031

12.7.1. Twin or Single Size

12.7.2. Twin XL Size

12.7.3. Full or Double Size

12.7.4. Queen Size

12.7.5. Other Size

12.8. Mattress and Mattress Component Market Size (US$ Bn and Million Units) By Country & Sub-region, 2017 - 2031

12.8.1. India

12.8.2. China

12.8.3. Japan

12.8.4. Rest of Asia Pacific

12.9. Incremental Opportunity Analysis

13. Middle East & Africa Mattress and Mattress Component Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Supplier Analysis

13.3. Price Trend Analysis

13.3.1. Weighted Average Price

13.4. Key Trends Analysis

13.4.1. Demand Side

13.4.2. Supplier Side

13.5. Mattress and Mattress Component Market Size (US$ Bn and Million Units), By Product Type, 2017 – 2031

13.5.1. Foam Mattress

13.5.2. Hybrid

13.5.3. Innerspring

13.5.4. Latex

13.5.5. Others (Waterbed and Airbed)

13.6. Mattress and Mattress Component Market Size (US$ Bn and Million Units), By Component Type, 2017 - 2031

13.6.1. Foam

13.6.1.1. Polyurethane

13.6.1.2. Polyethylene

13.6.1.3. Memory

13.6.1.4. Gel

13.6.1.5. Polyester

13.6.1.6. Latex

13.6.1.7. Convoluted

13.6.1.8. Evlon

13.6.2. Innerspring

13.6.2.1. Bonnell Coils

13.6.2.2. Pocket Coils

13.6.2.3. Continuous Coils

13.6.2.4. Offset Coils

13.6.3. Latex

13.6.3.1. Natural

13.6.3.2. Synthetic

13.6.4. Fillings

13.6.4.1. Coir

13.6.4.2. Wool

13.6.4.3. Cotton

13.6.4.4. Other (Fiber, Polyester)

13.6.5. Ticking

13.7. Mattress and Mattress Component Market Size (US$ Bn and Million Units) By Size, 2017 - 2031

13.7.1. Twin or Single Size

13.7.2. Twin XL Size

13.7.3. Full or Double Size

13.7.4. Queen Size

13.7.5. Other Size

13.8. Mattress and Mattress Component Market Size (US$ Bn and Million Units) By Country & Sub-region, 2017 - 2031

13.8.1. GCC

13.8.2. South Africa

13.8.3. Rest of MEA

13.9. Incremental Opportunity Analysis

14. South America Mattress and Mattress Component Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Supplier Analysis

14.3. Price Trend Analysis

14.3.1. Weighted Average Price

14.4. Key Trends Analysis

14.4.1. Demand Side

14.4.2. Supplier Side

14.5. Mattress and Mattress Component Market Size (US$ Bn and Million Units), By Product Type, 2017 – 2031

14.5.1. Foam Mattress

14.5.2. Hybrid

14.5.3. Innerspring

14.5.4. Latex

14.5.5. Others (Waterbed and Airbed)

14.6. Mattress and Mattress Component Market Size (US$ Bn and Million Units), By Component Type, 2017 - 2031

14.6.1. Foam

14.6.1.1. Polyurethane

14.6.1.2. Polyethylene

14.6.1.3. Memory

14.6.1.4. Gel

14.6.1.5. Polyester

14.6.1.6. Latex

14.6.1.7. Convoluted

14.6.1.8. Evlon

14.6.2. Innerspring

14.6.2.1. Bonnell Coils

14.6.2.2. Pocket Coils

14.6.2.3. Continuous Coils

14.6.2.4. Offset Coils

14.6.3. Latex

14.6.3.1. Natural

14.6.3.2. Synthetic

14.6.4. Fillings

14.6.4.1. Coir

14.6.4.2. Wool

14.6.4.3. Cotton

14.6.4.4. Other (Fiber, Polyester)

14.6.5. Ticking

14.7. Mattress and Mattress Component Market Size (US$ Bn and Million Units) By Size, 2017 - 2031

14.7.1. Twin or Single Size

14.7.2. Twin XL Size

14.7.3. Full or Double Size

14.7.4. Queen Size

14.7.5. Other Size Men

14.7.6. Women

14.7.7. Kids

14.8. Mattress and Mattress Component Market Size (US$ Bn and Million Units) By Country & Sub-region, 2017 - 2031

14.8.1. Brazil

14.8.2. Rest of South America

14.9. Incremental Opportunity Analysis

15. Competition Landscape

15.1. Market Player – Competition Dashboard

15.2. Market Share Analysis (%), by Company, (2021)

15.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

15.3.1. Spring Air Company

15.3.1.1. Company Overview

15.3.1.2. Sales Area/Geographical Presence

15.3.1.3. Revenue

15.3.1.4. Strategy & Business Overview

15.3.2. King Koil, Inc.

15.3.2.1. Company Overview

15.3.2.2. Sales Area/Geographical Presence

15.3.2.3. Revenue

15.3.2.4. Strategy & Business Overview

15.3.3. Paramount Bed Holdings Co., Ltd.

15.3.3.1. Company Overview

15.3.3.2. Sales Area/Geographical Presence

15.3.3.3. Revenue

15.3.3.4. Strategy & Business Overview

15.3.4. Relyon Limited

15.3.4.1. Company Overview

15.3.4.2. Sales Area/Geographical Presence

15.3.4.3. Revenue

15.3.4.4. Strategy & Business Overview

15.3.5. Casper

15.3.5.1. Company Overview

15.3.5.2. Sales Area/Geographical Presence

15.3.5.3. Revenue

15.3.5.4. Strategy & Business Overview

15.3.6. Simba

15.3.6.1. Company Overview

15.3.6.2. Sales Area/Geographical Presence

15.3.6.3. Revenue

15.3.6.4. Strategy & Business Overview

15.3.7. Dormeo

15.3.7.1. Company Overview

15.3.7.2. Sales Area/Geographical Presence

15.3.7.3. Revenue

15.3.7.4. Strategy & Business Overview

15.3.8. Dreams Ltd

15.3.8.1. Company Overview

15.3.8.2. Sales Area/Geographical Presence

15.3.8.3. Revenue

15.3.8.4. Strategy & Business Overview

15.3.9. Kurl On

15.3.9.1. Company Overview

15.3.9.2. Sales Area/Geographical Presence

15.3.9.3. Revenue

15.3.9.4. Strategy & Business Overview

15.3.10. Jinbaoma Furniture Manufacturer

15.3.10.1. Company Overview

15.3.10.2. Sales Area/Geographical Presence

15.3.10.3. Revenue

15.3.10.4. Strategy & Business Overview

15.3.11. Ministry of Sleep

15.3.11.1. Company Overview

15.3.11.2. Sales Area/Geographical Presence

15.3.11.3. Revenue

15.3.11.4. Strategy & Business Overview

15.3.12. Duroflex Pvt Ltd

15.3.12.1. Company Overview

15.3.12.2. Sales Area/Geographical Presence

15.3.12.3. Revenue

15.3.12.4. Strategy & Business Overview

15.3.13. M.H. POLYMERS PVT. LTD.

15.3.13.1. Company Overview

15.3.13.2. Sales Area/Geographical Presence

15.3.13.3. Revenue

15.3.13.4. Strategy & Business Overview

15.3.14. Talalay Global

15.3.14.1. Company Overview

15.3.14.2. Sales Area/Geographical Presence

15.3.14.3. Revenue

15.3.14.4. Strategy & Business Overview

15.3.15. Latex Global

15.3.15.1. Company Overview

15.3.15.2. Sales Area/Geographical Presence

15.3.15.3. Revenue

15.3.15.4. Strategy & Business Overview

15.3.16. Sheela Foam Limited

15.3.16.1. Company Overview

15.3.16.2. Sales Area/Geographical Presence

15.3.16.3. Revenue

15.3.16.4. Strategy & Business Overview

15.3.17. Richard Pieris Natural Foams Ltd.

15.3.17.1. Company Overview

15.3.17.2. Sales Area/Geographical Presence

15.3.17.3. Revenue

15.3.17.4. Strategy & Business Overview

15.3.18. Gogo Foam Products Company Limited

15.3.18.1. Company Overview

15.3.18.2. Sales Area/Geographical Presence

15.3.18.3. Revenue

15.3.18.4. Strategy & Business Overview

15.3.19. Mar-Pak, Inc.

15.3.19.1. Company Overview

15.3.19.2. Sales Area/Geographical Presence

15.3.19.3. Revenue

15.3.19.4. Strategy & Business Overview

15.3.20. The Made Well Group

15.3.20.1. Company Overview

15.3.20.2. Sales Area/Geographical Presence

15.3.20.3. Revenue

15.3.20.4. Strategy & Business Overview

15.3.21. ALLBECO

15.3.21.1. Company Overview

15.3.21.2. Sales Area/Geographical Presence

15.3.21.3. Revenue

15.3.21.4. Strategy & Business Overview

15.3.22. The Mattress Underground

15.3.22.1. Company Overview

15.3.22.2. Sales Area/Geographical Presence

15.3.22.3. Revenue

15.3.22.4. Strategy & Business Overview

16. Key Takeaways

16.1. Identification of Potential Market Spaces

16.1.1. By Product Type

16.1.2. By Component Type

16.1.3. By Size

16.1.4. By Region

16.2. Understanding the Buying Process of Customers

16.3. Prevailing Market Risks

16.4. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Mattress and Mattress Component Market By Product Type, Million Units, 2017-2031

Table 2: Global Mattress and Mattress Component Market By Product Type, US$ Bn 2017-2031

Table 3: Global Mattress and Mattress Component Market By Component Million Units, 2017-2031

Table 4: Global Mattress and Mattress Component Market By Component US$ Bn 2017-2031

Table 5: Global Mattress and Mattress Component Market By Size Million Units, 2017-2031

Table 6: Global Mattress and Mattress Component Market By Size US$ Bn 2017-2031

Table 7: North America Mattress and Mattress Component Market By Product Type, Million Units, 2017-2031

Table 8: North America Mattress and Mattress Component Market By Product Type, US$ Bn, 2017-2031

Table 9: North America Mattress and Mattress Component Market By Component Million Units, 2017-2031

Table 10: North America Mattress and Mattress Component Market By Component US$ Bn 2017-2031

Table 11: North America Mattress and Mattress Component Market By Size Million Units 2017-2031

Table 12: North America Mattress and Mattress Component Market By Size US$ Bn 2017-2031

Table 13: Europe Mattress and Mattress Component Market By Product Type, Million Units 2017-2031

Table 14: Europe Mattress and Mattress Component Market By Product Type, US$ Bn 2017-2031

Table 15: Europe Mattress and Mattress Component Market By Component Million Units 2017-2031

Table 16: Europe Mattress and Mattress Component Market By Component US$ Bn 2017-2031

Table 17: Europe Mattress and Mattress Component Market By Size Million Units 2017-2031

Table 18: Europe Mattress and Mattress Component Market By Size US$ Bn 2017-2031

Table 19: Asia Pacific Mattress and Mattress Component Market By Product Type, Million Units 2017-2031

Table 20: Asia Pacific Mattress and Mattress Component Market By Product Type, US$ Bn 2017-2031

Table 21: Asia Pacific Mattress and Mattress Component Market By Component Million Units 2017-2031

Table 22: Asia Pacific Mattress and Mattress Component Market By Component US$ Bn 2017-2031

Table 23: Asia Pacific Mattress and Mattress Component Market By Size Million Units 2017-2031

Table 24: Asia Pacific Mattress and Mattress Component Market By Size US$ Bn 2017-2031

Table 25: Middle East & Africa Mattress and Mattress Component Market By Product Type, Million Units 2017-2031

Table 26: Middle East & Africa Mattress and Mattress Component Market By Product Type, US$ Bn 2017-2031

Table 27: Middle East & Africa Mattress and Mattress Component Market By Component Million Units 2017-2031

Table 28: Middle East & Africa Mattress and Mattress Component Market By Component US$ Bn 2017-2031

Table 29: Middle East & Africa Mattress and Mattress Component Market By Size Million Units 2017-2031

Table 30: Middle East & Africa Mattress and Mattress Component Market By Size US$ Bn 2017-2031

Table 31: South America Mattress and Mattress Component Market By Product Type, Million Units 2017-2031

Table 32: South America Mattress and Mattress Component Market By Product Type, US$ Bn 2017-2031

Table 33: South America Mattress and Mattress Component Market By Component Million Units 2017-2031

Table 34: South America Mattress and Mattress Component Market By Component US$ Bn 2017-2031

Table 35: South America Mattress and Mattress Component Market By Size Million Units 2017-2031

Table 36: South America Mattress and Mattress Component Market By Size US$ Bn 2017-2031

List of Figures

Figure 1: Global Mattress and Mattress Component Market By Product Type, Million Units 2017-2031

Figure 2: Global Mattress and Mattress Component Market By Product Type, US$ Bn 2017-2031

Figure 3: Global Mattress and Mattress Component Market Incremental Opportunity, By Product Type 2017-2031

Figure 4: Global Mattress and Mattress Component Market By Component Type Million Units 2017-2031

Figure 5: Global Mattress and Mattress Component Market By Component Type US$ Bn 2017-2031

Figure 6: Global Mattress and Mattress Component Market Incremental Opportunity, By Product Type 2017-2031

Figure 7: Global Mattress and Mattress Component Market By Size Million Units 2017-2031

Figure 8: Global Mattress and Mattress Component Market By Size US$ Bn 2017-2031

Figure 9: Global Mattress and Mattress Component Market Incremental Opportunity, By Product Type 2017-2031

Figure 10: North America Mattress and Mattress Component Market By Product Type, Million Units 2017-2031

Figure 11: North America Mattress and Mattress Component Market By Product Type, US$ Bn 2017-2031

Figure 12: North America Mattress and Mattress Component Market Incremental Opportunity, By Product Type 2017-2031

Figure 13: North America Mattress and Mattress Component Market By Component Type Million Units 2017-2031

Figure 14: North America Mattress and Mattress Component Market By Component Type US$ Bn 2017-2031

Figure 15: North America Mattress and Mattress Component Market Incremental Opportunity, By Product Type 2017-2031

Figure 16: North America Mattress and Mattress Component Market By Size Million Units 2017-2031

Figure 17: North America Mattress and Mattress Component Market By Size US$ Bn 2017-2031

Figure 18: North America Mattress and Mattress Component Market Incremental Opportunity, By Product Type 2017-2031

Figure 19: Europe Mattress and Mattress Component Market By Product Type, Million Units 2017-2031

Figure 20: Europe Mattress and Mattress Component Market By Product Type, US$ Bn 2017-2031

Figure 21: Europe Mattress and Mattress Component Market Incremental Opportunity, By Product Type 2017-2031

Figure 22: Europe Mattress and Mattress Component Market By Component Type Million Units 2017-2031

Figure 23: Europe Mattress and Mattress Component Market By Component Type US$ Bn 2017-2031

Figure 24: Europe Mattress and Mattress Component Market Incremental Opportunity, By Product Type 2017-2031

Figure 25: Europe Mattress and Mattress Component Market By Size Million Units 2017-2031

Figure 26: Europe Mattress and Mattress Component Market By Size US$ Bn 2017-2031

Figure 27: Europe Mattress and Mattress Component Market Incremental Opportunity, By Product Type 2017-2031

Figure 28: Asia Pacific Mattress and Mattress Component Market By Product Type, Million Units 2017-2031

Figure 29: Asia Pacific Mattress and Mattress Component Market By Product Type, US$ Bn 2017-2031

Figure 30: Asia Pacific Mattress and Mattress Component Market Incremental Opportunity, By Product Type 2017-2031

Figure 31: Asia Pacific Mattress and Mattress Component Market By Component Type Million Units 2017-2031

Figure 32: Asia Pacific Mattress and Mattress Component Market By Component Type US$ Bn 2017-2031

Figure 33: Asia Pacific Mattress and Mattress Component Market Incremental Opportunity, By Product Type 2017-2031

Figure 34: Asia Pacific Mattress and Mattress Component Market By Size Million Units 2017-2031

Figure 35: Asia Pacific Mattress and Mattress Component Market By Size US$ Bn 2017-2031

Figure 36: Asia Pacific Mattress and Mattress Component Market Incremental Opportunity, By Product Type 2017-2031

Figure 37: Middle East & Africa Mattress and Mattress Component Market By Product Type, Million Units 2017-2031

Figure 38: Middle East & Africa Mattress and Mattress Component Market By Product Type, US$ Bn 2017-2031

Figure 39: Middle East & Africa Mattress and Mattress Component Market Incremental Opportunity, By Product Type 2017-2031

Figure 40: Middle East & Africa Mattress and Mattress Component Market By Component Type Million Units 2017-2031

Figure 41: Middle East & Africa Mattress and Mattress Component Market By Component Type US$ Bn 2017-2031

Figure 42: Middle East & Africa Mattress and Mattress Component Market Incremental Opportunity, By Product Type 2017-2031

Figure 43: Middle East & Africa Mattress and Mattress Component Market By Size Million Units 2017-2031

Figure 44: Middle East & Africa Mattress and Mattress Component Market By Size US$ Bn 2017-2031

Figure 45: Middle East & Africa Mattress and Mattress Component Market Incremental Opportunity, By Product Type 2017-2031

Figure 46: South America Mattress and Mattress Component Market By Product Type, Million Units 2017-2031

Figure 47: South America Mattress and Mattress Component Market By Product Type, US$ Bn 2017-2031

Figure 48: South America Mattress and Mattress Component Market Incremental Opportunity, By Product Type 2017-2031

Figure 49: South America Mattress and Mattress Component Market By Component Type Million Units 2017-2031

Figure 50: South America Mattress and Mattress Component Market By Component Type US$ Bn 2017-2031

Figure 51: South America Mattress and Mattress Component Market Incremental Opportunity, By Product Type 2017-2031

Figure 52: South America Mattress and Mattress Component Market By Size Million Units 2017-2031

Figure 53: South America Mattress and Mattress Component Market By Size US$ Bn 2017-2031

Figure 54: South America Mattress and Mattress Component Market Incremental Opportunity, By Product Type 2017-2031