Analysts’ Viewpoint

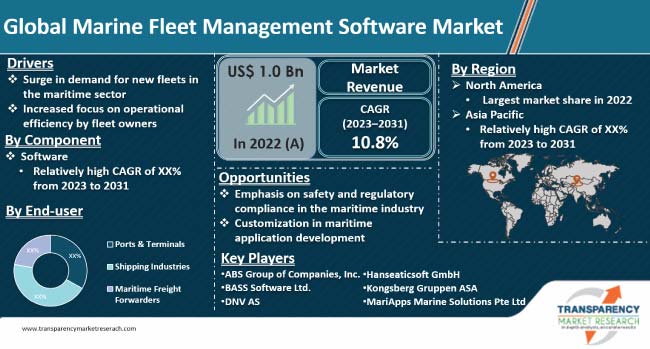

Continuous adoption of new and advanced technology is the primary factor boosting the marine fleet management software market share. Furthermore, the increase in deployment of port and shipping fleet software among small and medium-sized shipping companies due to the availability of cloud-based oceanic fleet performance management software is expected to trigger market progress.

Digitization and automation of compliance processes reduces the administrative burden, enhances data accuracy, and minimizes the risk of human errors. Industry players seek to improve safety, streamline compliance, leverage data, manage risks, and enhance operational efficiency, by launching naval fleet operations software that address these requirements, which is expected to drive the market in the near future.

Marine fleet management software is used to enhance the efficiency of fleet operations and identify vital operational insights from ship management data. Data smart marine fleet management software are required to efficiently manage a modern fleet of hundreds of vessels. A solution based on an integrated approach can provide the insight, which is required to gain efficiency, reduce OPEX, and remain competitive in the maritime market.

Marine fleet management software is normally deployed by fleet management companies that handle aspects such as crewing maintenance and day-to-day operations. This gives ship owners and managers time to focus on cargo booking.

Marine fleet management software includes modules such as maintenance management, operations management, inventory management, crew management, safety management, finance management, and purchase management. Furthermore, the software features include port management, cargo management, voyage management, report generation, office staff management, fleet management, stock management, and attendance management.

Adoption of cloud-based software services is anticipated to create better business opportunities for solution providers. Rise in demand for marine fleet management solutions with broad functional coverage and flexible modular structure from the shipping industry is expected to drive the global marine fleet management software market. Organizations investing in platforms or tools to be used in centralized administration of data is further boosting market expansion.

Demand for transportation activities through waterways is rising across the world as it is secure and reliable. The shipping industry is witnessing growth in the load factor in line with the increasing trade among various countries and continents. This has increased the demand for new fleets with advanced marine fleet management software to address safety management, document management, procurement management, environment management, accounting & billing management, navigation & tracking management, asset management, and inventory management. Moreover, the loading capacity of vessels is relatively high and these are routed through various ports across various regions.

As per the records of United Nations Conference on Trade and Development (UNCTAD), in 2022, approximately 80% of the world’s trade volume was transported by sea and the percentage is high for most of the developing countries.

Technology developments related to commercial ship management and with players introducing more efficient and improved cargo ships management solutions leveraging improved navigation and communication systems have been instrumental in influencing the marine fleet management software market statistics.

The need to reduce carbon footprint in the maritime industry is increasing. This coupled with the aging fleet have effectively increased the investments in new ships. Emission went up by 4.7% between 2020 and 2021 due to the dry bulk carriers, container ships, and general cargo vessels. Going by the number of ships, in 2022, the average age of the global shipping fleet was 21.9 years.

The maritime industry needs a new generation of ships that use the most cost-efficient fuels and integrate seamlessly with smart digital systems. Investments in energy-efficient shipping technologies and the need to opt for low-carbon fuels to cut the carbon footprint of maritime transport are increasing the demand for new fleets.

The new fleets are equipped with advanced navigation systems, automation technologies, and energy-efficient propulsion systems. This, in turn, increases the demand for maritime fleet management software that provides real-time monitoring and control of vessel operations. It also helps to enhance safety and security, proactive maintenance, and predictive analytics.

Providers of marine fleet management software are offering customized applications tailored to address the specific requirement of their clients. The tailored approach provides clients with the features and functionalities they require to address their specific concerns related to efficiency, effectiveness, and overall performance.

Marine fleet management software, by leveraging customized maritime application development, is tailored to include certain features and capabilities, such as real-time tracking and monitoring of vessels, voyage planning and optimization, maintenance and repair management, fuel consumption analysis, crew management, and compliance with maritime regulations.

MariApps Marine Solutions, for instance, is a maritime digital solutions company focused on offering customized applications and software to maritime enterprises through its product smartPAL. The product allows users to manage multiple functions on a cloud-supported, web-based, and mobile-compliant platform. smartPAL provides end-to-end solutions that support customers in enhancing decision-making, providing real-time insights, and eliminating manual reporting of fleet operations and conditions.

Testing and implementation of leading-edge custom applications and streamlined workflows ultimately contribute to the success of fleet management operations in the maritime industry.

According to the latest marine fleet management software market report, North America is anticipated to hold the dominant share of the global industry during the forecast period. Presence of latest technological infrastructure and growth in adoption of advanced technologies are driving the regional marine fleet management software market value.

The marine fleet management software market growth in Asia Pacific is expected to be at the highest CAGR during the forecast period. Rapid growth of the market is ascribed to the presence of some of the largest and busiest ports in the region. Presence of growing economies and manufacturing hubs is also augmenting the market in the region.

The marine fleet management software market research report profiles major service providers based on parameters such as financials, key product offerings, recent developments, and strategies.

ABS Group of Companies, Inc., BASS Software Ltd., DNV AS, Hanseaticsoft GmbH, Kongsberg Gruppen ASA, MariApps Marine Solutions Pte Ltd SpecTec, Star Information System AS, ShipNet, JiBe ERP, and ConnectShip, Inc. Incorporated are the key fleet management software companies.

Prominent providers are investing in R&D activities to introduce cost-effective fleet management solutions for the marine industry that can meet the growing marine fleet management software market demand. These service providers are tapping into the latest marine fleet management software market trends to gain new opportunities and stay ahead of the competitive curve.

Key players have been profiled in the marine fleet management software market forecast report based on parameters such as product portfolio, recent developments, business strategies, financial overview, company overview, and business segments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 1.0 Bn |

|

Market Forecast Value in 2031 |

US$ 2.5 Bn |

|

Growth Rate (CAGR) |

10.8% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2018-2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

Qualitative analysis includes drivers, restraints, opportunities, key trends, analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 1.0 Bn in 2022

It is anticipated to reach US$ 2.5 Bn by the end of 2031

The CAGR is projected to be 10.8% from 2023 to 2031

Surge in demand for new fleets in the maritime sector and increased focus on operational efficiency by fleet owners

North America was a major region for vendors in 2022

ABS Group of Companies, Inc., BASS Software Ltd., DNV AS, Hanseaticsoft GmbH, Kongsberg Gruppen ASA, MariApps Marine Solutions Pte Ltd SpecTec, Star Information System AS, ShipNet, JiBe ERP, and ConnectShip, Inc.

1. Preface

1.1. Market Introduction

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Research Methodology

2.1.1. List of Primary and Secondary Sources

2.2. Key Assumptions for Data Modelling

3. Executive Summary - Global Marine Fleet Management Software Market

4. Market Overview

4.1. Market Definition

4.2. Technology/Product Roadmap

4.3. Market Factor Analysis

4.3.1. Forecast Factors

4.3.2. Ecosystem/Value Chain Analysis

4.3.3. Market Dynamics (Growth Influencers)

4.3.3.1. Drivers

4.3.3.2. Restraints

4.3.3.3. Opportunities

4.3.3.4. Impact Analysis of Drivers and Restraints

4.4. COVID-19 Impact Analysis

4.4.1. Impact of COVID-19 on Marine Fleet Management Software Market

4.5. Market Opportunity Assessment - by Region (North America/Europe/Asia Pacific/Middle East & Africa/South America)

4.5.1. By Component

4.5.2. By Deployment Type

4.5.3. By End-user

4.6. PORTERs Analysis

4.7. PEST Analysis

5. Global Marine Fleet Management Software Market Analysis and Forecast

5.1. Market Revenue Analysis (US$ Bn), 2018-2031

5.1.1. Historic Growth Trends, 2018-2022

5.1.2. Forecast Trends, 2023-2031

5.2. Pricing Model Analysis/ Price Trend Analysis

6. Global Marine Fleet Management Software Market Analysis, by Component

6.1. Overview and Definitions

6.2. Key Segment Analysis

6.3. Marine Fleet Management Software Market Size (US$ Bn) Forecast, by Component, 2018 - 2031

6.3.1. Software

6.3.1.1. Safety Management

6.3.1.2. Document/Form Management

6.3.1.3. Procurement Management

6.3.1.4. Environment Management

6.3.1.5. Accounting/Billing & Compliance Management

6.3.1.6. Navigation & Tracking Management

6.3.1.7. Others

6.3.2. Services

6.3.2.1. Training & Consulting

6.3.2.2. Integration & Implementation

6.3.2.3. Support & Maintenance

7. Global Marine Fleet Management Software Market Analysis, by Deployment Type

7.1. Overview and Definitions

7.2. Key Segment Analysis

7.3. Marine Fleet Management Software Market Size (US$ Bn) Forecast, by Deployment Type, 2018 - 2031

7.3.1. Premise-based Deployment

7.3.2. Cloud Deployment

8. Global Marine Fleet Management Software Market Analysis, by End-user

8.1. Key Segment Analysis

8.2. Marine Fleet Management Software Market Size (US$ Bn) Forecast, by End-user, 2018 - 2031

8.2.1. Ports & Terminals

8.2.2. Shipping Industries

8.2.3. Maritime Freight Forwarders

9. Global Marine Fleet Management Software Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Marine Fleet Management Software Market Size (US$ Bn) Forecast, by Region, 2018 - 2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. South America

10. North America Marine Fleet Management Software Market Analysis

10.1. Regional Outlook

10.2. Marine Fleet Management Software Market Size (US$ Bn) Analysis and Forecast (2018 - 2031)

10.2.1. By Component

10.2.2. By Deployment Type

10.2.3. By End-user

10.3. Marine Fleet Management Software Market Size (US$ Bn) Forecast, by Country, 2018 - 2031

10.3.1. U.S.

10.3.2. Canada

10.3.3. Mexico

11. Europe Marine Fleet Management Software Market Analysis and Forecast

11.1. Regional Outlook

11.2. Marine Fleet Management Software Market Size (US$ Bn) Analysis and Forecast (2018 - 2031)

11.2.1. By Component

11.2.2. By Deployment Type

11.2.3. By End-user

11.3. Marine Fleet Management Software Market Size (US$ Bn) Forecast, by Country/Sub-region, 2018 - 2031

11.3.1. U.K.

11.3.2. Germany

11.3.3. France

11.3.4. Spain

11.3.5. Italy

11.3.6. Rest of Europe

12. APAC Marine Fleet Management Software Market Analysis and Forecast

12.1. Regional Outlook

12.2. Marine Fleet Management Software Market Size (US$ Bn) Analysis and Forecast (2018 - 2031)

12.2.1. By Component

12.2.2. By Deployment Type

12.2.3. By End-user

12.3. Marine Fleet Management Software Market Size (US$ Bn) Forecast, by Country/Sub-region, 2018 - 2031

12.3.1. China

12.3.2. India

12.3.3. Japan

12.3.4. ASEAN

12.3.5. Rest of Asia Pacific

13. Middle East & Africa (MEA) Marine Fleet Management Software Market Analysis and Forecast

13.1. Regional Outlook

13.2. Marine Fleet Management Software Market Size (US$ Bn) Analysis and Forecast (2018 - 2031)

13.2.1. By Component

13.2.2. By Deployment Type

13.2.3. By End-user

13.3. Marine Fleet Management Software Market Size (US$ Bn) Forecast, by Country/Sub-region, 2018 - 2031

13.3.1. Saudi Arabia

13.3.2. U.A.E.

13.3.3. South Africa

13.3.4. Rest of Middle East & Africa (MEA)

14. South America Marine Fleet Management Software Market Analysis and Forecast

14.1. Regional Outlook

14.2. Marine Fleet Management Software Market Size (US$ Bn) Analysis and Forecast (2018 - 2031)

14.2.1. By Component

14.2.2. By Deployment Type

14.2.3. By End-user

14.3. Marine Fleet Management Software Market Size (US$ Bn) Forecast, by Country/Sub-region, 2018 - 2031

14.3.1. Brazil

14.3.2. Argentina

14.3.3. Rest of South America

15. Competition Landscape

15.1. Market Competition Matrix, by Leading Players

15.2. Competitive Landscape by Tier Structure of Companies

15.3. Scale of Competition, 2022

15.4. Scale of Competition at Regional Level, 2022

15.5. Market Revenue Share/Ranking Analysis, by Leading Players

15.6. Major Mergers & Acquisitions, Expansions, Partnership, Contacts, Deals, etc.

16. Company Profiles

16.1. ABS Group of Companies, Inc.

16.1.1. Business Overview

16.1.2. Company Revenue

16.1.3. Product Portfolio

16.1.4. Geographic Footprint

16.1.5. Recent Developments

16.1.6. Impact of COVID-19

16.1.7. TMR View

16.1.8. Competitive Threats and Weakness

16.2. BASS Software Ltd.

16.2.1. Business Overview

16.2.2. Company Revenue

16.2.3. Product Portfolio

16.2.4. Geographic Footprint

16.2.5. Recent Developments

16.2.6. Impact of COVID-19

16.2.7. TMR View

16.2.8. Competitive Threats and Weakness

16.3. ConnectShip, Inc.

16.3.1. Business Overview

16.3.2. Company Revenue

16.3.3. Product Portfolio

16.3.4. Geographic Footprint

16.3.5. Recent Developments

16.3.6. Impact of COVID-19

16.3.7. TMR View

16.3.8. Competitive Threats and Weakness

16.4. DNV AS

16.4.1. Business Overview

16.4.2. Company Revenue

16.4.3. Product Portfolio

16.4.4. Geographic Footprint

16.4.5. Recent Developments

16.4.6. Impact of COVID-19

16.4.7. TMR View

16.4.8. Competitive Threats and Weakness

16.5. Hanseaticsoft GmbH

16.5.1. Business Overview

16.5.2. Company Revenue

16.5.3. Product Portfolio

16.5.4. Geographic Footprint

16.5.5. Recent Developments

16.5.6. Impact of COVID-19

16.5.7. TMR View

16.5.8. Competitive Threats and Weakness

16.6. JiBe ERP

16.6.1. Business Overview

16.6.2. Company Revenue

16.6.3. Product Portfolio

16.6.4. Geographic Footprint

16.6.5. Recent Developments

16.6.6. Impact of COVID-19

16.6.7. TMR View

16.6.8. Competitive Threats and Weakness

16.7. Kongsberg Gruppen ASA

16.7.1. Business Overview

16.7.2. Company Revenue

16.7.3. Product Portfolio

16.7.4. Geographic Footprint

16.7.5. Recent Developments

16.7.6. Impact of COVID-19

16.7.7. TMR View

16.7.8. Competitive Threats and Weakness

16.8. MariApps Marine Solutions Pte Ltd

16.8.1. Business Overview

16.8.2. Company Revenue

16.8.3. Product Portfolio

16.8.4. Geographic Footprint

16.8.5. Recent Developments

16.8.6. Impact of COVID-19

16.8.7. TMR View

16.8.8. Competitive Threats and Weakness

16.9. PRIME Marine

16.9.1. Business Overview

16.9.2. Company Revenue

16.9.3. Product Portfolio

16.9.4. Geographic Footprint

16.9.5. Recent Developments

16.9.6. Impact of COVID-19

16.9.7. TMR View

16.9.8. Competitive Threats and Weakness

16.10. Micromarin

16.10.1. Business Overview

16.10.2. Company Revenue

16.10.3. Product Portfolio

16.10.4. Geographic Footprint

16.10.5. Recent Developments

16.10.6. Impact of COVID-19

16.10.7. TMR View

16.10.8. Competitive Threats and Weakness

16.11. Norcomms

16.11.1. Business Overview

16.11.2. Company Revenue

16.11.3. Product Portfolio

16.11.4. Geographic Footprint

16.11.5. Recent Developments

16.11.6. Impact of COVID-19

16.11.7. TMR View

16.11.8. Competitive Threats and Weakness

16.12. SBN Technologies Pvt. Ltd.

16.12.1. Business Overview

16.12.2. Company Revenue

16.12.3. Product Portfolio

16.12.4. Geographic Footprint

16.12.5. Recent Developments

16.12.6. Impact of COVID-19

16.12.7. TMR View

16.12.8. Competitive Threats and Weakness

16.13. Seaspeedmarine

16.13.1. Business Overview

16.13.2. Company Revenue

16.13.3. Product Portfolio

16.13.4. Geographic Footprint

16.13.5. Recent Developments

16.13.6. Impact of COVID-19

16.13.7. TMR View

16.13.8. Competitive Threats and Weakness

16.14. SERTICA

16.14.1. Business Overview

16.14.2. Company Revenue

16.14.3. Product Portfolio

16.14.4. Geographic Footprint

16.14.5. Recent Developments

16.14.6. Impact of COVID-19

16.14.7. TMR View

16.14.8. Competitive Threats and Weakness

16.15. Shipamax Ltd.

16.15.1. Business Overview

16.15.2. Company Revenue

16.15.3. Product Portfolio

16.15.4. Geographic Footprint

16.15.5. Recent Developments

16.15.6. Impact of COVID-19

16.15.7. TMR View

16.15.8. Competitive Threats and Weakness

16.16. Shipnet

16.16.1. Business Overview

16.16.2. Company Revenue

16.16.3. Product Portfolio

16.16.4. Geographic Footprint

16.16.5. Recent Developments

16.16.6. Impact of COVID-19

16.16.7. TMR View

16.16.8. Competitive Threats and Weakness

16.17. Softcom Solutions

16.17.1. Business Overview

16.17.2. Company Revenue

16.17.3. Product Portfolio

16.17.4. Geographic Footprint

16.17.5. Recent Developments

16.17.6. Impact of COVID-19

16.17.7. TMR View

16.17.8. Competitive Threats and Weakness

16.18. SpecTec

16.18.1. Business Overview

16.18.2. Company Revenue

16.18.3. Product Portfolio

16.18.4. Geographic Footprint

16.18.5. Recent Developments

16.18.6. Impact of COVID-19

16.18.7. TMR View

16.18.8. Competitive Threats and Weakness

16.19. Star Information System AS

16.19.1. Business Overview

16.19.2. Company Revenue

16.19.3. Product Portfolio

16.19.4. Geographic Footprint

16.19.5. Recent Developments

16.19.6. Impact of COVID-19

16.19.7. TMR View

16.19.8. Competitive Threats and Weakness

16.20. Tero Marine (Ocean Technologies Group)

16.20.1. Business Overview

16.20.2. Company Revenue

16.20.3. Product Portfolio

16.20.4. Geographic Footprint

16.20.5. Recent Developments

16.20.6. Impact of COVID-19

16.20.7. TMR View

16.20.8. Competitive Threats and Weakness

16.21. Veson Nautical

16.21.1. Business Overview

16.21.2. Company Revenue

16.21.3. Product Portfolio

16.21.4. Geographic Footprint

16.21.5. Recent Developments

16.21.6. Impact of COVID-19

16.21.7. TMR View

16.21.8. Competitive Threats and Weakness

16.22. Others

16.22.1. Business Overview

16.22.2. Company Revenue

16.22.3. Product Portfolio

16.22.4. Geographic Footprint

16.22.5. Recent Developments

16.22.6. Impact of COVID-19

16.22.7. TMR View

16.22.8. Competitive Threats and Weakness

17. Key Takeaways

List of Tables

Table 1: Acronyms Used in Marine Fleet Management Software Market

Table 2: North America Marine Fleet Management Software Market Revenue Analysis, by Country, 2023 - 2031 (US$ Bn)

Table 3: Europe Marine Fleet Management Software Market Revenue Analysis, by Country/Sub-region, 2023 - 2031 (US$ Bn)

Table 4: Asia Pacific Marine Fleet Management Software Market Revenue Analysis, by Country/Sub-region, 2023 - 2031 (US$ Bn)

Table 5: Middle East & Africa Marine Fleet Management Software Market Revenue Analysis, by Country/Sub-region, 2023 and 2031 (US$ Bn)

Table 6: South America Marine Fleet Management Software Market Revenue Analysis, by Country/Sub-region, 2023 - 2031 (US$ Bn)

Table 7: Forecast Factors: Relevance and Impact (1/2)

Table 8: Forecast Factors: Relevance and Impact (2/2)

Table 9: Impact Analysis of Drivers & Restraints

Table 10: Global Marine Fleet Management Software Market Value (US$ Bn) Forecast, by Component, 2018 - 2031

Table 11: Global Marine Fleet Management Software Market Value (US$ Bn) Forecast, by Deployment Type, 2018 - 2031

Table 12: Global Marine Fleet Management Software Market Value (US$ Bn) Forecast, by End-user, 2018 - 2031

Table 13: Global Marine Fleet Management Software Market Volume (US$ Bn) Forecast, by Region, 2018 - 2031

Table 14: North America Marine Fleet Management Software Market Value (US$ Bn) Forecast, by Component, 2018 - 2031

Table 15: North America Marine Fleet Management Software Market Value (US$ Bn) Forecast, by Deployment Type, 2018 - 2031

Table 16: North America Marine Fleet Management Software Market Value (US$ Bn) Forecast, by End-user, 2018 - 2031

Table 17: North America Marine Fleet Management Software Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 18: U.S. Marine Fleet Management Software Market Revenue CAGR Breakdown (%), by Growth Term

Table 19: Canada Marine Fleet Management Software Market Revenue CAGR Breakdown (%), by Growth Term

Table 20: Mexico Marine Fleet Management Software Market Revenue CAGR Breakdown (%), by Growth Term

Table 21: Europe Marine Fleet Management Software Market Value (US$ Bn) Forecast, by Component, 2018 - 2031

Table 22: Europe Marine Fleet Management Software Market Value (US$ Bn) Forecast, by Deployment Type, 2018 - 2031

Table 23: Europe Marine Fleet Management Software Market Value (US$ Bn) Forecast, by End-user, 2018 - 2031

Table 24: Europe Marine Fleet Management Software Market Value (US$ Bn) Forecast, by Country/Sub-region, 2018 - 2031

Table 25: Germany Marine Fleet Management Software Market Revenue CAGR Breakdown (%), by Growth Term

Table 26: U.K. Marine Fleet Management Software Market Revenue CAGR Breakdown (%), by Growth Term

Table 27: France Marine Fleet Management Software Market Revenue CAGR Breakdown (%), by Growth Term

Table 28: Italy Marine Fleet Management Software Market Revenue CAGR Breakdown (%), by Growth Term

Table 29: Spain Marine Fleet Management Software Market Revenue CAGR Breakdown (%), by Growth Term

Table 30: Asia Pacific Marine Fleet Management Software Market Value (US$ Bn) Forecast, by Component, 2018 - 2031

Table 31: Asia Pacific Marine Fleet Management Software Market Value (US$ Bn) Forecast, by Deployment Type, 2018 - 2031

Table 32: Asia Pacific Marine Fleet Management Software Market Value (US$ Bn) Forecast, by End-user, 2018 - 2031

Table 33: Asia Pacific Marine Fleet Management Software Market Value (US$ Bn) Forecast, by Country/Sub-region, 2018 - 2031

Table 34: China Marine Fleet Management Software Market Revenue CAGR Breakdown (%), by Growth Term

Table 35: India Marine Fleet Management Software Market Revenue CAGR Breakdown (%), by Growth Term

Table 36: Japan Marine Fleet Management Software Market Revenue CAGR Breakdown (%), by Growth Term

Table 37: ASEAN Marine Fleet Management Software Market Revenue CAGR Breakdown (%), by Growth Term

Table 38: Middle East & Africa Marine Fleet Management Software Market Value (US$ Bn) Forecast, by Component, 2018 - 2031

Table 39: Middle East & Africa Marine Fleet Management Software Market Value (US$ Bn) Forecast, by Deployment Type, 2018 - 2031

Table 40: Middle East & Africa Marine Fleet Management Software Market Value (US$ Bn) Forecast, by End-user, 2018 - 2031

Table 41: Middle East & Africa Marine Fleet Management Software Market Value (US$ Bn) Forecast, by Country/Sub-region, 2018 - 2031

Table 42: Saudi Arabia Marine Fleet Management Software Market Revenue CAGR Breakdown (%), by Growth Term

Table 43: U.A.E. Marine Fleet Management Software Market Revenue CAGR Breakdown (%), by Growth Term

Table 44: South Africa Marine Fleet Management Software Market Revenue CAGR Breakdown (%), by Growth Term

Table 45: South America Marine Fleet Management Software Market Value (US$ Bn) Forecast, by Component, 2018 - 2031

Table 46: South America Marine Fleet Management Software Market Value (US$ Bn) Forecast, by Deployment Type, 2018 - 2031

Table 47: South America Marine Fleet Management Software Market Value (US$ Bn) Forecast, by End-user, 2018 - 2031

Table 48: South America Marine Fleet Management Software Market Value (US$ Bn) Forecast, by Country/Sub-region, 2018 - 2031

Table 49: Brazil Marine Fleet Management Software Market Revenue CAGR Breakdown (%), by Growth Term

Table 50: Argentina Marine Fleet Management Software Market Revenue CAGR Breakdown (%), by Growth Term

Table 51: Mergers & Acquisitions, Partnerships (1/2)

Table 52: Mergers & Acquisitions, Partnership (2/2)

List of Figures

Figure 1: Global Marine Fleet Management Software Market Size (US$ Bn) Forecast, 2018-2031

Figure 2: Global Marine Fleet Management Software Market Revenue (US$ Bn) Opportunity Assessment, by Region, 2023E

Figure 3: Top Segment Analysis of Marine Fleet Management Software Market

Figure 4: Global Marine Fleet Management Software Market Revenue (US$ Bn) Opportunity Assessment, by Region, 2031F

Figure 5: Global Marine Fleet Management Software Market Attractiveness Assessment, by Component

Figure 6: Global Marine Fleet Management Software Market Attractiveness Assessment, by Deployment Type

Figure 7: Global Marine Fleet Management Software Market Attractiveness Assessment, by End-user

Figure 8: Global Marine Fleet Management Software Market Attractiveness Assessment, by Region

Figure 9: Global Marine Fleet Management Software Market Revenue (US$ Bn) Historic Trends, 2017 - 2022

Figure 10: Global Marine Fleet Management Software Market Revenue Opportunity (US$ Bn) Historic Trends, 2017 - 2022

Figure 11: Global Marine Fleet Management Software Market Value Share Analysis, by Component, 2023

Figure 12: Global Marine Fleet Management Software Market Value Share Analysis, by Component, 2031

Figure 13: Global Marine Fleet Management Software Market Absolute Opportunity (US$ Bn), by Software, 2023 - 2031

Figure 14: Global Marine Fleet Management Software Market Absolute Opportunity (US$ Bn), by Services, 2023 - 2031

Figure 15: Global Marine Fleet Management Software Market Value Share Analysis, by Deployment Type, 2023

Figure 16: Global Marine Fleet Management Software Market Value Share Analysis, by Deployment Type, 2031

Figure 17: Global Marine Fleet Management Software Market Absolute Opportunity (US$ Bn), by Premise-based Deployment, 2023 - 2031

Figure 18: Global Marine Fleet Management Software Market Absolute Opportunity (US$ Bn), by Cloud Deployment, 2023 - 2031

Figure 19: Global Marine Fleet Management Software Market Value Share Analysis, by End-user, 2023

Figure 20: Global Marine Fleet Management Software Market Value Share Analysis, by End-user, 2031

Figure 21: Global Marine Fleet Management Software Market Absolute Opportunity (US$ Bn), by Ports & Terminals, 2023 - 2031

Figure 22: Global Marine Fleet Management Software Market Absolute Opportunity (US$ Bn), by Shipping Industries, 2023 - 2031

Figure 23: Global Marine Fleet Management Software Market Absolute Opportunity (US$ Bn), by Maritime Freight Forwarders, 2023 - 2031

Figure 24: Global Marine Fleet Management Software Market Opportunity (US$ Bn), by Region

Figure 25: Global Marine Fleet Management Software Market Opportunity Share (%), by Region, 2023-2031

Figure 26: Global Marine Fleet Management Software Market Size (US$ Bn), by Region, 2023 & 2031

Figure 27: Global Marine Fleet Management Software Market Value Share Analysis, by Region, 2023

Figure 28: Global Marine Fleet Management Software Market Value Share Analysis, by Region, 2031

Figure 29: North America Marine Fleet Management Software Market Absolute Opportunity (US$ Bn), 2023 - 2031

Figure 30: Europe Marine Fleet Management Software Market Absolute Opportunity (US$ Bn), 2023 - 2031

Figure 31: Asia Pacific Marine Fleet Management Software Market Absolute Opportunity (US$ Bn), 2023 - 2031

Figure 32: Middle East & Africa Marine Fleet Management Software Market Absolute Opportunity (US$ Bn), 2023 - 2031

Figure 33: South America Marine Fleet Management Software Market Absolute Opportunity (US$ Bn), 2023 - 2031

Figure 34: North America Marine Fleet Management Software Market Revenue Opportunity Share, by Component

Figure 35: North America Marine Fleet Management Software Market Revenue Opportunity Share, by Deployment Type

Figure 36: North America Marine Fleet Management Software Market Revenue Opportunity Share, by End-user

Figure 37: North America Marine Fleet Management Software Market Revenue Opportunity Share, by Country

Figure 38: North America Marine Fleet Management Software Market Value Share Analysis, by Component, 2023

Figure 39: North America Marine Fleet Management Software Market Value Share Analysis, by Component, 2031

Figure 40: North America Marine Fleet Management Software Market Absolute Opportunity (US$ Bn), by Software, 2023 - 2031

Figure 41: North America Marine Fleet Management Software Market Absolute Opportunity (US$ Bn), by Services, 2023 - 2031

Figure 42: North America Marine Fleet Management Software Market Value Share Analysis, by Deployment Type, 2023

Figure 43: North America Marine Fleet Management Software Market Value Share Analysis, by Deployment Type, 2031

Figure 44: North America Marine Fleet Management Software Market Absolute Opportunity (US$ Bn), by Premise-based Deployment, 2023 - 2031

Figure 45: North America Marine Fleet Management Software Market Absolute Opportunity (US$ Bn), by Cloud Deployment, 2023 - 2031

Figure 46: North America Marine Fleet Management Software Market Value Share Analysis, by End-user, 2023

Figure 47: North America Marine Fleet Management Software Market Value Share Analysis, by End-user, 2031

Figure 48: North America Marine Fleet Management Software Market Absolute Opportunity (US$ Bn), by Ports & Terminals, 2023 - 2031

Figure 49: North America Marine Fleet Management Software Market Absolute Opportunity (US$ Bn), by Shipping Industries, 2023 - 2031

Figure 50: North America Marine Fleet Management Software Market Absolute Opportunity (US$ Bn), by Maritime Freight Forwarders, 2023 - 2031

Figure 51: North America Marine Fleet Management Software Market Value Share Analysis, by Country, 2023

Figure 52: North America Marine Fleet Management Software Market Value Share Analysis, by Country, 2031

Figure 53: U.S. Marine Fleet Management Software Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 54: Canada Marine Fleet Management Software Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 55: Mexico Marine Fleet Management Software Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 56: Europe Marine Fleet Management Software Market Revenue Opportunity Share, by Component

Figure 57: Europe Marine Fleet Management Software Market Revenue Opportunity Share, by Deployment Type

Figure 58: Europe Marine Fleet Management Software Market Revenue Opportunity Share, by End-user

Figure 59: Europe Marine Fleet Management Software Market Revenue Opportunity Share, by Country/Sub-region

Figure 60: Europe Marine Fleet Management Software Market Value Share Analysis, by Component, 2023

Figure 61: Europe Marine Fleet Management Software Market Value Share Analysis, by Component, 2031

Figure 62: Europe Marine Fleet Management Software Market Absolute Opportunity (US$ Bn), by Software, 2023 - 2031

Figure 63: Europe Marine Fleet Management Software Market Absolute Opportunity (US$ Bn), by Services, 2023 - 2031

Figure 64: Europe Marine Fleet Management Software Market Value Share Analysis, by Deployment Type, 2023

Figure 65: Europe Marine Fleet Management Software Market Value Share Analysis, by Deployment Type, 2031

Figure 66: Europe Marine Fleet Management Software Market Absolute Opportunity (US$ Bn), by Premise-based Deployment, 2023 - 2031

Figure 67: Europe Marine Fleet Management Software Market Absolute Opportunity (US$ Bn), by Cloud Deployment, 2023 - 2031

Figure 68: Europe Marine Fleet Management Software Market Value Share Analysis, by End-user, 2023

Figure 69: Europe Marine Fleet Management Software Market Value Share Analysis, by End-user, 2031

Figure 70: Europe Marine Fleet Management Software Market Absolute Opportunity (US$ Bn), by Ports & Terminals, 2023 - 2031

Figure 71: Europe Marine Fleet Management Software Market Absolute Opportunity (US$ Bn), by Shipping Industries, 2023 - 2031

Figure 72: Europe Marine Fleet Management Software Market Absolute Opportunity (US$ Bn), by Maritime Freight Forwarders, 2023 - 2031

Figure 73: Europe Marine Fleet Management Software Market Value Share Analysis, by Country/Sub-region, 2023

Figure 74: Europe Marine Fleet Management Software Market Value Share Analysis, by Country/Sub-region, 2031

Figure 75: Germany Marine Fleet Management Software Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 76: U.K. Marine Fleet Management Software Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 77: France Marine Fleet Management Software Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 78: Italy Marine Fleet Management Software Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 79: Spain Marine Fleet Management Software Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 80: Asia Pacific Marine Fleet Management Software Market Revenue Opportunity Share, by Component

Figure 81: Asia Pacific Marine Fleet Management Software Market Revenue Opportunity Share, by Deployment Type

Figure 82: Asia Pacific Marine Fleet Management Software Market Revenue Opportunity Share, by End-user

Figure 83: Asia Pacific Marine Fleet Management Software Market Revenue Opportunity Share, by Country/Sub-region

Figure 84: Asia Pacific Marine Fleet Management Software Market Value Share Analysis, by Component, 2023

Figure 85: Asia Pacific Marine Fleet Management Software Market Value Share Analysis, by Component, 2031

Figure 86: Asia Pacific Marine Fleet Management Software Market Absolute Opportunity (US$ Bn), by Software, 2023 - 2031

Figure 87: Asia Pacific Marine Fleet Management Software Market Absolute Opportunity (US$ Bn), by Services, 2023 - 2031

Figure 88: Asia Pacific Marine Fleet Management Software Market Value Share Analysis, by Deployment Type, 2023

Figure 89: Asia Pacific Marine Fleet Management Software Market Value Share Analysis, by Deployment Type, 2031

Figure 90: Asia Pacific Marine Fleet Management Software Market Absolute Opportunity (US$ Bn), by Premise-based Deployment, 2023 - 2031

Figure 91: Asia Pacific Marine Fleet Management Software Market Absolute Opportunity (US$ Bn), by Cloud Deployment, 2023 - 2031

Figure 92: Asia Pacific Marine Fleet Management Software Market Value Share Analysis, by End-user, 2023

Figure 93: Asia Pacific Marine Fleet Management Software Market Value Share Analysis, by End-user, 2031

Figure 94: Asia Pacific Marine Fleet Management Software Market Absolute Opportunity (US$ Bn), by Ports & Terminals, 2023 - 2031

Figure 95: Asia Pacific Marine Fleet Management Software Market Absolute Opportunity (US$ Bn), by Shipping Industries, 2023 - 2031

Figure 96: Asia Pacific Marine Fleet Management Software Market Absolute Opportunity (US$ Bn), by Maritime Freight Forwarders, 2023 - 2031

Figure 97: Asia Pacific Marine Fleet Management Software Market Value Share Analysis, by Country/Sub-region, 2023

Figure 98: Asia Pacific Marine Fleet Management Software Market Value Share Analysis, by Country/Sub-region, 2031

Figure 99: China Marine Fleet Management Software Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 100: India Marine Fleet Management Software Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 101: Japan Marine Fleet Management Software Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 102: ASEAN Marine Fleet Management Software Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 103: Middle East & Africa Marine Fleet Management Software Market Revenue Opportunity Share, by Component

Figure 104: Middle East & Africa Marine Fleet Management Software Market Revenue Opportunity Share, by Deployment Type

Figure 105: Middle East & Africa Marine Fleet Management Software Market Revenue Opportunity Share, by End-user

Figure 106: Middle East & Africa Marine Fleet Management Software Market Revenue Opportunity Share, by Country/Sub-region

Figure 107: Middle East & Africa Marine Fleet Management Software Market Value Share Analysis, by Component, 2023

Figure 108: Middle East & Africa Marine Fleet Management Software Market Value Share Analysis, by Component, 2031

Figure 109: Middle East & Africa Marine Fleet Management Software Market Absolute Opportunity (US$ Bn), by Software, 2023 - 2031

Figure 110: Middle East & Africa Marine Fleet Management Software Market Absolute Opportunity (US$ Bn), by Services, 2023 - 2031

Figure 111: Middle East & Africa Marine Fleet Management Software Market Value Share Analysis, by Deployment Type, 2023

Figure 112: Middle East & Africa Marine Fleet Management Software Market Value Share Analysis, by Deployment Type, 2031

Figure 113: Middle East & Africa Marine Fleet Management Software Market Absolute Opportunity (US$ Bn), by Premise-based Deployment, 2023 - 2031

Figure 114: Middle East & Africa Marine Fleet Management Software Market Absolute Opportunity (US$ Bn), by Cloud Deployment, 2023 - 2031

Figure 115: Middle East & Africa Marine Fleet Management Software Market Value Share Analysis, by End-user, 2023

Figure 116: Middle East & Africa Marine Fleet Management Software Market Value Share Analysis, by End-user, 2031

Figure 117: Middle East & Africa Marine Fleet Management Software Market Absolute Opportunity (US$ Bn), by Ports & Terminals, 2023 - 2031

Figure 118: Middle East & Africa Marine Fleet Management Software Market Absolute Opportunity (US$ Bn), by Shipping Industries, 2023 - 2031

Figure 119: Middle East & Africa Marine Fleet Management Software Market Absolute Opportunity (US$ Bn), by Maritime Freight Forwarders, 2023 - 2031

Figure 120: Middle East & Africa East & Africa East & Africa Marine Fleet Management Software Market Value Share Analysis, by Country/Sub-region, 2023

Figure 121: Middle East & Africa Marine Fleet Management Software Market Value Share Analysis, by Country/Sub-region, 2031

Figure 122: Saudi Arabia Marine Fleet Management Software Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 123: U.A.E. Marine Fleet Management Software Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 124: South Africa Marine Fleet Management Software Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 125: South America Marine Fleet Management Software Market Revenue Opportunity Share, by Component

Figure 126: South America Marine Fleet Management Software Market Revenue Opportunity Share, by Deployment Type

Figure 127: South America Marine Fleet Management Software Market Revenue Opportunity Share, by End-user

Figure 128: South America Marine Fleet Management Software Market Revenue Opportunity Share, by Country/Sub-region

Figure 129: South America Marine Fleet Management Software Market Value Share Analysis, by Component, 2023

Figure 130: South America Marine Fleet Management Software Market Value Share Analysis, by Component, 2031

Figure 131: South America Marine Fleet Management Software Market Absolute Opportunity (US$ Bn), by Software, 2023 - 2031

Figure 132: South America Marine Fleet Management Software Market Absolute Opportunity (US$ Bn), by Services, 2023 - 2031

Figure 133: South America Marine Fleet Management Software Market Value Share Analysis, by Deployment Type, 2023

Figure 134: South America Marine Fleet Management Software Market Value Share Analysis, by Deployment Type, 2031

Figure 135: South America Marine Fleet Management Software Market Absolute Opportunity (US$ Bn), by Premise-based Deployment, 2023 - 2031

Figure 136: South America Marine Fleet Management Software Market Absolute Opportunity (US$ Bn), by Cloud Deployment, 2023 - 2031

Figure 137: South America Marine Fleet Management Software Market Value Share Analysis, by End-user, 2023

Figure 138: South America Marine Fleet Management Software Market Value Share Analysis, by End-user, 2031

Figure 139: South America Marine Fleet Management Software Market Absolute Opportunity (US$ Bn), by Ports & Terminals, 2023 - 2031

Figure 140: South America Marine Fleet Management Software Market Absolute Opportunity (US$ Bn), by Shipping Industries, 2023 - 2031

Figure 141: South America Marine Fleet Management Software Market Absolute Opportunity (US$ Bn), by Maritime Freight Forwarders, 2023 - 2031

Figure 142: South America Marine Fleet Management Software Market Value Share Analysis, by Country/Sub-region, 2023

Figure 143: South America Marine Fleet Management Software Market Value Share Analysis, by Country/Sub-region, 2031

Figure 144: Brazil Marine Fleet Management Software Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 145: Argentina Marine Fleet Management Software Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031