Analysts’ Viewpoint on Market Scenario

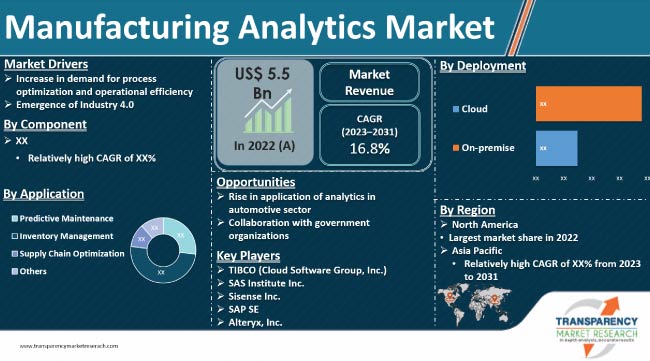

Increase in demand for operational efficiency, quality improvement, and predictive maintenance is expected to drive the manufacturing analytics market size in the next few years. Manufacturers are leveraging advanced analytics techniques, such as machine learning and artificial intelligence, to optimize their production plan, reduce costs, and improve quality.

Rise in adoption of industry 4.0, which aims to integrate digital technologies and data-driven solutions into the manufacturing sector, is also boosting market progress. Increase in awareness about sustainability and environmental compliance and need to leverage data-driven insights to produce effective products are likely to augment the manufacturing analytics market in the near future.

Manufacturing analytics is the utilization of data and advanced technologies in the manufacturing industry to improve operations, ensure high-quality products, increase productivity, reduce costs, and optimize supply chains.

By analyzing operations and events data, manufacturers can gain insights into their processes and identify areas for improvement, which can ultimately lead to better outcomes for the business.

Manufacturers face significant pressure to enhance operations and boost efficiency to stay ahead of the competition. Manufacturing analytics solutions provide manufacturers with the ability to collect and analyze large amounts of data generated during production, which helps identify areas that need improvement and inefficiencies, and offer valuable insights that enable manufacturers to optimize their processes and reduce costs.

Manufacturers need to optimize both their production and back-end processes to achieve optimal performance. Analytics-driven applications monitor critical assets, enhance Overall Equipment Effectiveness (OEE), boost production quality, and provide insights to improve profitability.

Manufacturing data analytics can help manufacturers make informed decisions that would enable them to optimize operations. According to a study on data visibility in manufacturing by Rainmaker Associates, Inc., the adoption of manufacturing analytics solutions improves the OEE by 88% in manufacturing. Hence, rise in demand for process optimization and operational efficiency is expected to spur the manufacturing analytics market growth in the near future.

Manufacturing data analytics solutions provide real-time visibility into the production process, thus allowing manufacturers to identify and respond to issues proactively. These solutions play a vital role in enabling manufacturers to achieve zero accidents and zero defects in the manufacturing process. By providing insights into the production process, manufacturers can take proactive measures to prevent safety hazards and improve product quality.

Industry 4.0 is the fourth industrial revolution, which is characterized by the integration of digital technologies, such as the Internet of Things (IoT), big data analytics, cloud computing, Artificial Intelligence (AI), and Machine Learning (ML), into the manufacturing process. This integration results in the development of smart factories that are efficient, productive, and responsive to customer demands.

With rapid industrialization and automation in industrial processes, companies are generating vast amounts of data that need to be analyzed to increase productivity. Manufacturing analytics solutions can be utilized to collect, analyze, and visualize this data to make informed decisions in real time.

Hence, surge in adoption of Industry 4.0, which involves the integration of advanced technologies such as AI and Radio Frequency Identification (RFID), is propelling manufacturing analytics market development.

Various companies are increasingly adopting manufacturing analytics to improve their manufacturing processes and achieve greater efficiency and output. Manufacturing analytics enable manufacturers to gain valuable insights into their operations by analyzing data and using modeling techniques. Thus, manufacturers can identify areas that require improvement and optimize their operations for better results.

According to the latest manufacturing analytics market forecast, North America is expected to account for the largest share from 2023 to 2031. The region constituted major manufacturing analytics market share in 2022.

Growth in adoption of analytics tools in manufacturing and rise in investment in R&D of advanced technologies in manufacturing are propelling market dynamics of North America.

Asia Pacific is projected to be the fastest-growing market for manufacturing analytics in the near future. Surge in demand for big data analytics in the manufacturing sector is driving market statistics in the region.

Detailed profiles of some of the key vendors are included in the manufacturing analytics market report. These profiles are evaluated based on various parameters such as financials, key product offerings, recent developments, and growth strategies adopted by the companies.

TIBCO (Cloud Software Group, Inc.), SAS Institute Inc., Sisense Inc., SAP SE, Alteryx, Inc., Tableau Software, Inc., Oracle Corporation, KNIME, GE Digital, QlikTech International AB, IBM Corporation, Infragistics, Northwest Analytics, Inc., Aegis Software, and Keysight Technologies, Inc. are key manufacturing analytics companies.

| Attribute | Detail |

|---|---|

|

Market Size Value in 2022 |

US$ 5.5 Bn |

|

Market Forecast Value in 2031 |

US$ 22.3 Bn |

|

Growth Rate (CAGR) |

16.8% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2018-2022 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

Includes cross-segment analysis at the global as well as regional levels. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, ecosystem analysis, and key trends analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 5.5 Bn in 2022

It is projected to grow at a CAGR of 16.8% from 2023 to 2031

It is anticipated to reach US$ 22.3 Bn by the end of 2031

Increase in demand for process optimization and operational efficiency and emergence of Industry 4.0

North America is estimated to record the highest demand during the forecast period

TIBCO (Cloud Software Group, Inc.), SAS Institute Inc., Sisense Inc., SAP SE, Alteryx, Inc., Tableau Software, Inc., Oracle Corporation, KNIME, GE Digital, QlikTech International AB, IBM Corporation, Infragistics, Northwest Analytics, Inc., Aegis Software, and Keysight Technologies, Inc.

1. Preface

1.1. Market Introduction

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Research Methodology

2.1.1. List of Primary and Secondary Sources

2.2. Key Assumptions for Data Modelling

3. Executive Summary: Global Manufacturing Analytics Market

4. Market Overview

4.1. Market Definition

4.2. Technology/ Product Roadmap

4.3. Market Factor Analysis

4.3.1. Forecast Factors

4.3.2. Ecosystem/ Value Chain Analysis

4.3.3. Market Dynamics (Growth Influencers)

4.3.3.1. Drivers

4.3.3.2. Restraints

4.3.3.3. Opportunities

4.3.3.4. Impact Analysis of Drivers and Restraints

4.4. COVID-19 Impact Analysis

4.4.1. Impact of COVID-19 on Manufacturing Analytics Market

4.5. Market Opportunity Assessment - by Region (North America/ Europe/ Asia Pacific/ Middle East & Africa/ South America)

4.5.1. By Component

4.5.2. By Deployment

4.5.3. By Deployment

4.5.4. By Enterprise Size

4.5.5. By Industry Vertical

4.6. PORTERs Analysis

4.7. PEST Analysis

5. Global Manufacturing Analytics Market Analysis and Forecast

5.1. Market Revenue Analysis (US$ Mn), 2017-2031

5.1.1. Historic Growth Trends, 2017-2022

5.1.2. Forecast Trends, 2023-2031

6. Global Manufacturing Analytics Market Analysis, by Component

6.1. Overview and Definitions

6.2. Key Segment Analysis

6.3. Manufacturing Analytics Market Size (US$ Mn) Forecast, by Component, 2018 - 2031

6.3.1. Software

6.3.2. Services

6.3.2.1. Professional Services

6.3.2.1.1. Consulting & Training

6.3.2.1.2. Deployment & Integration

6.3.2.1.3. Support & Maintenance

6.3.2.2. Managed Services

7. Global Manufacturing Analytics Market Analysis, by Deployment

7.1. Overview and Definitions

7.2. Key Segment Analysis

7.3. Manufacturing Analytics Market Size (US$ Mn) Forecast, by Deployment, 2018 - 2031

7.3.1. Cloud

7.3.2. On-premise

8. Global Manufacturing Analytics Market Analysis, by Application

8.1. Key Segment Analysis

8.2. Manufacturing Analytics Market Size (US$ Mn) Forecast, by Application, 2018 - 2031

8.2.1. Predictive Maintenance

8.2.2. Inventory Management

8.2.3. Supply Chain Optimization

8.2.4. Others

9. Global Manufacturing Analytics Market Analysis, by Enterprise Size

9.1. Overview and Definitions

9.2. Key Segment Analysis

9.3. Manufacturing Analytics Market Size (US$ Mn) Forecast, by Enterprise Size, 2018 - 2031

9.3.1. SMEs

9.3.2. Large Enterprises

10. Global Manufacturing Analytics Market Analysis, by Industry Vertical

10.1. Key Segment Analysis

10.2. Manufacturing Analytics Market Size (US$ Mn) Forecast, by Industry Vertical, 2018 - 2031

10.2.1. Industrial Manufacturing

10.2.2. Automotive

10.2.3. Food & Beverage

10.2.4. Chemical

10.2.5. Pharmaceutical

10.2.6. Oil & Gas

10.2.7. Electronics & Semiconductor

10.2.8. Others

11. Global Manufacturing Analytics Market Analysis and Forecast, by Region

11.1. Key Findings

11.2. Manufacturing Analytics Market Size (US$ Mn) Forecast by Region, 2018-2031

11.2.1. North America

11.2.2. Europe

11.2.3. Asia Pacific

11.2.4. Middle East & Africa

11.2.5. South America

12. North America Manufacturing Analytics Market Analysis and Forecast

12.1. Regional Outlook

12.2. Manufacturing Analytics Market Size (US$ Mn) Analysis and Forecast, 2018 - 2031

12.2.1. By Component

12.2.2. By Deployment

12.2.3. By Application

12.2.4. By Enterprise Size

12.2.5. By Industry Vertical

12.3. Manufacturing Analytics Market Size (US$ Mn) Forecast, by Country, 2018 - 2031

12.3.1. U.S.

12.3.2. Canada

12.3.3. Mexico

13. Europe Manufacturing Analytics Market Analysis and Forecast

13.1. Regional Outlook

13.2. Manufacturing Analytics Market Size (US$ Mn) Analysis and Forecast, 2018 - 2031

13.2.1. By Component

13.2.2. By Deployment

13.2.3. By Application

13.2.4. By Enterprise Size

13.2.5. By Industry Vertical

13.3. Manufacturing Analytics Market Size (US$ Mn) Forecast, by Country, 2018 - 2031

13.3.1. Germany

13.3.2. U.K.

13.3.3. France

13.3.4. Italy

13.3.5. Spain

13.3.6. Rest of Europe

14. Asia Pacific Manufacturing Analytics Market Analysis and Forecast

14.1. Regional Outlook

14.2. Manufacturing Analytics Market Size (US$ Mn) Analysis and Forecast, 2018 - 2031

14.2.1. By Component

14.2.2. By Deployment

14.2.3. By Application

14.2.4. By Enterprise Size

14.2.5. By Industry Vertical

14.3. Manufacturing Analytics Market Size (US$ Mn) Forecast, by Country, 2018 - 2031

14.3.1. China

14.3.2. India

14.3.3. Japan

14.3.4. ASEAN

14.3.5. Rest of Asia Pacific

15. Middle East & Africa Manufacturing Analytics Market Analysis and Forecast

15.1. Regional Outlook

15.2. Manufacturing Analytics Market Size (US$ Mn) Analysis and Forecast, 2018 - 2031

15.2.1. By Component

15.2.2. By Deployment

15.2.3. By Application

15.2.4. By Enterprise Size

15.2.5. By Industry Vertical

15.3. Manufacturing Analytics Market Size (US$ Mn) Forecast, by Country, 2018 - 2031

15.3.1. Saudi Arabia

15.3.2. United Arab Emirates

15.3.3. South Africa

15.3.4. Rest of Middle East & Africa

16. South America Manufacturing Analytics Market Analysis and Forecast

16.1. Regional Outlook

16.2. Manufacturing Analytics Market Size (US$ Mn) Analysis and Forecast, 2018 - 2031

16.2.1. By Component

16.2.2. By Deployment

16.2.3. By Application

16.2.4. By Enterprise Size

16.2.5. By Industry Vertical

16.3. Manufacturing Analytics Market Size (US$ Mn) Forecast, by Country, 2018 - 2031

16.3.1. Brazil

16.3.2. Argentina

16.3.3. Rest of South America

17. Competition Landscape

17.1. Market Competition Matrix, by Leading Players

17.2. Competitive Landscape by Tier Structure of Companies

17.3. Scale of Competition, 2022

17.4. Scale of Competition at Regional Level, 2022

17.5. Market Revenue Share/Ranking Analysis, by Leading Players (2022)

17.6. List of Startups

17.7. Competition Evolution

17.8. Major Mergers & Acquisitions, Expansions, Partnership, Contacts, Deals, etc.

18. Company Profiles

18.1. TIBCO (Cloud Software Group, Inc.)

18.1.1. Business Overview

18.1.2. Company Revenue

18.1.3. Product Portfolio

18.1.4. Geographic Footprint

18.1.5. Recent Developments

18.1.6. Impact of COVID-19

18.1.7. TMR View

18.1.8. Competitive Threats and Weakness

18.2. SAS Institute Inc.

18.2.1. Business Overview

18.2.2. Company Revenue

18.2.3. Product Portfolio

18.2.4. Geographic Footprint

18.2.5. Recent Developments

18.2.6. Impact of COVID-19

18.2.7. TMR View

18.2.8. Competitive Threats and Weakness

18.3. Sisense Inc.

18.3.1. Business Overview

18.3.2. Company Revenue

18.3.3. Product Portfolio

18.3.4. Geographic Footprint

18.3.5. Recent Developments

18.3.6. Impact of COVID-19

18.3.7. TMR View

18.3.8. Competitive Threats and Weakness

18.4. SAP SE

18.4.1. Business Overview

18.4.2. Company Revenue

18.4.3. Product Portfolio

18.4.4. Geographic Footprint

18.4.5. Recent Developments

18.4.6. Impact of COVID-19

18.4.7. TMR View

18.4.8. Competitive Threats and Weakness

18.5. Alteryx, Inc.

18.5.1. Business Overview

18.5.2. Company Revenue

18.5.3. Product Portfolio

18.5.4. Geographic Footprint

18.5.5. Recent Developments

18.5.6. Impact of COVID-19

18.5.7. TMR View

18.5.8. Competitive Threats and Weakness

18.6. Tableau Software, Inc.

18.6.1. Business Overview

18.6.2. Company Revenue

18.6.3. Product Portfolio

18.6.4. Geographic Footprint

18.6.5. Recent Developments

18.6.6. Impact of COVID-19

18.6.7. TMR View

18.6.8. Competitive Threats and Weakness

18.7. Oracle Corporation

18.7.1. Business Overview

18.7.2. Company Revenue

18.7.3. Product Portfolio

18.7.4. Geographic Footprint

18.7.5. Recent Developments

18.7.6. Impact of COVID-19

18.7.7. TMR View

18.7.8. Competitive Threats and Weakness

18.8. KNIME

18.8.1. Business Overview

18.8.2. Company Revenue

18.8.3. Product Portfolio

18.8.4. Geographic Footprint

18.8.5. Recent Developments

18.8.6. Impact of COVID-19

18.8.7. TMR View

18.8.8. Competitive Threats and Weakness

18.9. GE Digital

18.9.1. Business Overview

18.9.2. Company Revenue

18.9.3. Product Portfolio

18.9.4. Geographic Footprint

18.9.5. Recent Developments

18.9.6. Impact of COVID-19

18.9.7. TMR View

18.9.8. Competitive Threats and Weakness

18.10. QlikTech International AB

18.10.1. Business Overview

18.10.2. Company Revenue

18.10.3. Product Portfolio

18.10.4. Geographic Footprint

18.10.5. Recent Developments

18.10.6. Impact of COVID-19

18.10.7. TMR View

18.10.8. Competitive Threats and Weakness

18.11. IBM Corporation

18.11.1. Business Overview

18.11.2. Company Revenue

18.11.3. Product Portfolio

18.11.4. Geographic Footprint

18.11.5. Recent Developments

18.11.6. Impact of COVID-19

18.11.7. TMR View

18.11.8. Competitive Threats and Weakness

18.12. Infragistics

18.12.1. Business Overview

18.12.2. Company Revenue

18.12.3. Product Portfolio

18.12.4. Geographic Footprint

18.12.5. Recent Developments

18.12.6. Impact of COVID-19

18.12.7. TMR View

18.12.8. Competitive Threats and Weakness

18.13. Northwest Analytics, Inc.

18.13.1. Business Overview

18.13.2. Company Revenue

18.13.3. Product Portfolio

18.13.4. Geographic Footprint

18.13.5. Recent Developments

18.13.6. Impact of COVID-19

18.13.7. TMR View

18.13.8. Competitive Threats and Weakness

18.14. Aegis Software

18.14.1. Business Overview

18.14.2. Company Revenue

18.14.3. Product Portfolio

18.14.4. Geographic Footprint

18.14.5. Recent Developments

18.14.6. Impact of COVID-19

18.14.7. TMR View

18.14.8. Competitive Threats and Weakness

18.15. Keysight Technologies, Inc.

18.15.1. Business Overview

18.15.2. Company Revenue

18.15.3. Product Portfolio

18.15.4. Geographic Footprint

18.15.5. Recent Developments

18.15.6. Impact of COVID-19

18.15.7. TMR View

18.15.8. Competitive Threats and Weakness

18.16. Others

18.16.1. Business Overview

18.16.2. Company Revenue

18.16.3. Product Portfolio

18.16.4. Geographic Footprint

18.16.5. Recent Developments

18.16.6. Impact of COVID-19

18.16.7. TMR View

18.16.8. Competitive Threats and Weakness

19. Key Takeaways

List of Tables

Table 1: Acronyms Used in Manufacturing Analytics Market

Table 2: North America Manufacturing Analytics Market Revenue Analysis, by Country, 2023 and 2031 (US$ Mn)

Table 3: Europe Manufacturing Analytics Market Revenue Analysis, by Country, 2023 and 2031 (US$ Mn)

Table 4: Asia Pacific Manufacturing Analytics Market Revenue Analysis, by Country, 2023 and 2031 (US$ Mn)

Table 5: Middle East & Africa Manufacturing Analytics Market Revenue Analysis, by Country, 2023 and 2031 (US$ Mn)

Table 6: South America Manufacturing Analytics Market Revenue Analysis, by Country, 2023 and 2031 (US$ Mn)

Table 7: Forecast Factors: Relevance and Impact

Table 8: Impact Analysis of Drivers & Restraints

Table 9: Global Manufacturing Analytics Market Value (US$ Mn) Forecast, by Component, 2018 - 2031

Table 10: Global Manufacturing Analytics Market Value (US$ Mn) Forecast, by Deployment, 2018 - 2031

Table 11: Global Manufacturing Analytics Market Value (US$ Mn) Forecast, by Application, 2018 - 2031

Table 12: Global Manufacturing Analytics Market Value (US$ Mn) Forecast, by Enterprise Size, 2018 - 2031

Table 13: Global Manufacturing Analytics Market Value (US$ Mn) Forecast, by Industry Vertical, 2018 - 2031

Table 14: Global Manufacturing Analytics Market Value (US$ Mn) Forecast, by Region, 2018 - 2031

Table 15: North America Manufacturing Analytics Market Value (US$ Mn) Forecast, by Component, 2018 - 2031

Table 16: North America Manufacturing Analytics Market Value (US$ Mn) Forecast, by Deployment, 2018 - 2031

Table 17: North America Manufacturing Analytics Market Value (US$ Mn) Forecast, by Application, 2018 - 2031

Table 18: North America Manufacturing Analytics Market Value (US$ Mn) Forecast, by Enterprise Size, 2018 - 2031

Table 19: North America Manufacturing Analytics Market Value (US$ Mn) Forecast, by Industry Vertical, 2018 - 2031

Table 20: North America Manufacturing Analytics Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 21: U.S. Manufacturing Analytics Market Revenue CAGR Breakdown (%), by Growth Term

Table 22: Canada Manufacturing Analytics Market Revenue CAGR Breakdown (%), by Growth Term

Table 23: Mexico Manufacturing Analytics Market Revenue CAGR Breakdown (%), by Growth Term

Table 24: Europe Manufacturing Analytics Market Value (US$ Mn) Forecast, by Component, 2018 - 2031

Table 25: Europe Manufacturing Analytics Market Value (US$ Mn) Forecast, by Deployment, 2018 - 2031

Table 26: Europe Manufacturing Analytics Market Value (US$ Mn) Forecast, by Application, 2018 - 2031

Table 27: Europe Manufacturing Analytics Market Value (US$ Mn) Forecast, by Enterprise Size, 2018 - 2031

Table 28: Europe Manufacturing Analytics Market Value (US$ Mn) Forecast, by Industry Vertical, 2018 - 2031

Table 29: Europe Manufacturing Analytics Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 30: Germany Manufacturing Analytics Market Revenue CAGR Breakdown (%), by Growth Term

Table 31: U.K. Manufacturing Analytics Market Revenue CAGR Breakdown (%), by Growth Term

Table 32: France Manufacturing Analytics Market Revenue CAGR Breakdown (%), by Growth Term

Table 33: Spain Manufacturing Analytics Market Revenue CAGR Breakdown (%), by Growth Term

Table 34: Italy Manufacturing Analytics Market Revenue CAGR Breakdown (%), by Growth Term

Table 35: Asia Pacific Manufacturing Analytics Market Value (US$ Mn) Forecast, by Component, 2018 - 2031

Table 36: Asia Pacific Manufacturing Analytics Market Value (US$ Mn) Forecast, by Deployment, 2018 - 2031

Table 37: Asia Pacific Manufacturing Analytics Market Value (US$ Mn) Forecast, by Application, 2018 - 2031

Table 38: China Manufacturing Analytics Market Revenue CAGR Breakdown (%), by Growth Term

Table 39: India Manufacturing Analytics Market Revenue CAGR Breakdown (%), by Growth Term

Table 40: Japan Manufacturing Analytics Market Revenue CAGR Breakdown (%), by Growth Term

Table 41: ASEAN Manufacturing Analytics Market Revenue CAGR Breakdown (%), by Growth Term

Table 42: Middle East & Africa Manufacturing Analytics Market Value (US$ Mn) Forecast, by Component, 2018 - 2031

Table 43: Middle East & Africa Manufacturing Analytics Market Value (US$ Mn) Forecast, by Deployment, 2018 - 2031

Table 44: Middle East & Africa Manufacturing Analytics Market Value (US$ Mn) Forecast, by Application, 2018 - 2031

Table 45: Middle East & Africa Manufacturing Analytics Market Value (US$ Mn) Forecast, by Enterprise Size, 2018 - 2031

Table 46: Middle East & Africa Manufacturing Analytics Market Value (US$ Mn) Forecast, by Industry Vertical, 2018 - 2031

Table 47: Middle East & Africa Manufacturing Analytics Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 48: Saudi Arabia Manufacturing Analytics Market Revenue CAGR Breakdown (%), by Growth Term

Table 49: United Arab Emirates Manufacturing Analytics Market Revenue CAGR Breakdown (%), by Growth Term

Table 50: South Africa Manufacturing Analytics Market Revenue CAGR Breakdown (%), by Growth Term

Table 51: South America Manufacturing Analytics Market Value (US$ Mn) Forecast, by Component, 2018 - 2031

Table 52: South Africa Manufacturing Analytics Market Value (US$ Mn) Forecast, by Deployment, 2018 - 2031

Table 53: South Africa Manufacturing Analytics Market Value (US$ Mn) Forecast, by Application, 2018 - 2031

Table 54: South America Manufacturing Analytics Market Value (US$ Mn) Forecast, by Enterprise Size, 2018 - 2031

Table 55: South America Manufacturing Analytics Market Value (US$ Mn) Forecast, by Industry Vertical, 2018 - 2031

Table 56: South America Manufacturing Analytics Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 57: Brazil Manufacturing Analytics Market Revenue CAGR Breakdown (%), by Growth Term

Table 58: Argentina Manufacturing Analytics Market Revenue CAGR Breakdown (%), by Growth Term

Table 59: Mergers & Acquisitions, Partnerships (1/2)

Table 60: Mergers & Acquisitions, Partnerships (2/2)

List of Figures

Figure 1: Global Manufacturing Analytics Market Size (US$ Mn) Forecast, 2018-2031

Figure 2: Global Manufacturing Analytics Market Revenue (US$ Mn) Opportunity Assessment, by Region, 2023E

Figure 3: Top Segment Analysis of Manufacturing Analytics Market

Figure 4: Global Manufacturing Analytics Market Revenue (US$ Mn) Opportunity Assessment, by Region, 2031F

Figure 5: Global Manufacturing Analytics Market Attractiveness Assessment, by Component

Figure 6: Global Manufacturing Analytics Market Attractiveness Assessment, by Deployment

Figure 7: Global Manufacturing Analytics Market Attractiveness Assessment, by Application

Figure 8: Global Manufacturing Analytics Market Attractiveness Assessment, by Enterprise Size

Figure 9: Global Manufacturing Analytics Market Attractiveness Assessment, by Industry Vertical

Figure 10: Global Manufacturing Analytics Market Attractiveness Assessment, by Region

Figure 11: Global Manufacturing Analytics Market Revenue (US$ Mn) Historic Trends, 2018 - 2021

Figure 12: Global Manufacturing Analytics Market Revenue Opportunity (US$ Mn) Historic Trends, 2018 - 2021

Figure 13: Global Manufacturing Analytics Market Value Share Analysis, by Component, 2023

Figure 14: Global Manufacturing Analytics Market Value Share Analysis, by Component, 2031

Figure 15: Global Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Software, 2023 - 2031

Figure 16: Global Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Services, 2023 - 2031

Figure 17: Global Manufacturing Analytics Market Value Share Analysis, by Deployment, 2023

Figure 18: Global Manufacturing Analytics Market Value Share Analysis, by Deployment, 2031

Figure 19: Global Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Cloud, 2023 - 2031

Figure 20: Global Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by On-premise, 2023 - 2031

Figure 21: Global Manufacturing Analytics Market Value Share Analysis, by Application, 2023

Figure 22: Global Manufacturing Analytics Market Value Share Analysis, by Application, 2031

Figure 23: Global Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Predictive Maintenance, 2023 - 2031

Figure 24: Global Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Inventory Management, 2023 - 2031

Figure 25: Global Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Supply Chain Optimization, 2023 - 2031

Figure 26: Global Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 27: Global Manufacturing Analytics Market Value Share Analysis, by Enterprise Size, 2023

Figure 28: Global Manufacturing Analytics Market Value Share Analysis, by Enterprise Size, 2031

Figure 29: Global Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by SMEs, 2023 - 2031

Figure 30: Global Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Large Enterprises, 2023 - 2031

Figure 31: Global Manufacturing Analytics Market Value Share Analysis, by Industry Vertical, 2023

Figure 32: Global Manufacturing Analytics Market Value Share Analysis, by Industry Vertical, 2031

Figure 33: Global Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Industrial Manufacturing, 2023 - 2031

Figure 34: Global Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Automotive, 2023 - 2031

Figure 35: Global Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Food & Beverage, 2023 - 2031

Figure 36: Global Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Chemical, 2023 - 2031

Figure 37: Global Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Pharmaceutical, 2023 - 2031

Figure 38: Global Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Oil & Gas, 2023 - 2031

Figure 39: Global Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Electronics & Semiconductor, 2023 - 2031

Figure 40: Global Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 41: Global Manufacturing Analytics Market Opportunity (US$ Mn), by Region

Figure 42: Global Manufacturing Analytics Market Opportunity Share (%), by Region, 2023-2031

Figure 43: Global Manufacturing Analytics Market Size (US$ Mn), by Region, 2023 & 2031

Figure 44: Global Manufacturing Analytics Market Value Share Analysis, by Region, 2023

Figure 45: Global Manufacturing Analytics Market Value Share Analysis, by Region, 2031

Figure 46: North America Manufacturing Analytics Market Absolute Opportunity (US$ Mn), 2023 - 2031

Figure 47: Europe Manufacturing Analytics Market Absolute Opportunity (US$ Mn), 2023 - 2031

Figure 48: Asia Pacific Manufacturing Analytics Market Absolute Opportunity (US$ Mn), 2023 - 2031

Figure 49: Middle East & Africa Manufacturing Analytics Market Absolute Opportunity (US$ Mn), 2023 - 2031

Figure 50: South America Manufacturing Analytics Market Absolute Opportunity (US$ Mn), 2023 - 2031

Figure 51: North America Absolute Dollar Opportunity

Figure 52: North America Manufacturing Analytics Market Value Share Analysis, by Component, 2023

Figure 53: North America Manufacturing Analytics Market Value Share Analysis, by Component, 2031

Figure 54: North America Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Software, 2023 - 2031

Figure 55: North America Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Services, 2023 - 2031

Figure 56: North America Manufacturing Analytics Market Value Share Analysis, by Deployment, 2023

Figure 57: North America Manufacturing Analytics Market Value Share Analysis, by Deployment, 2031

Figure 58: North America Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Cloud, 2023 - 2031

Figure 59: North America Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by On-premise, 2023 - 2031

Figure 60: North America Manufacturing Analytics Market Value Share Analysis, by Application, 2023

Figure 61: North America Manufacturing Analytics Market Value Share Analysis, by Application, 2031

Figure 62: North America Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Predictive Maintenance, 2023 - 2031

Figure 63: North America Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Inventory Management, 2023 - 2031

Figure 64: North America Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Supply Chain Optimization, 2023 - 2031

Figure 65: North America Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 66: North America Manufacturing Analytics Market Value Share Analysis, by Enterprise Size, 2023

Figure 67: North America Manufacturing Analytics Market Value Share Analysis, by Enterprise Size, 2031

Figure 68: North America Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by SMEs, 2023 - 2031

Figure 69: North America Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Large Enterprises, 2023 - 2031

Figure 70: North America Manufacturing Analytics Market Value Share Analysis, by Industry Vertical, 2023

Figure 71: North America Manufacturing Analytics Market Value Share Analysis, by Industry Vertical, 2031

Figure 72: North America Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Industrial Manufacturing, 2023 - 2031

Figure 73: North America Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Automotive, 2023 - 2031

Figure 74: North America Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Food & Beverage, 2023 - 2031

Figure 75: North America Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Chemical, 2023 - 2031

Figure 76: North America Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Pharmaceutical, 2023 - 2031

Figure 77: North America Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Oil & Gas, 2023 - 2031

Figure 78: North America Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Electronics & Semiconductor, 2023 - 2031

Figure 79: North America Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 80: North America Manufacturing Analytics Market Value Share Analysis, by Country, 2023

Figure 81: North America Manufacturing Analytics Market Value Share Analysis, by Country, 2031

Figure 82: U.S. Manufacturing Analytics Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 83: Canada Manufacturing Analytics Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 84: Mexico Manufacturing Analytics Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 85: Europe Absolute Dollar Opportunity

Figure 86: Europe Manufacturing Analytics Market Value Share Analysis, by Component, 2023

Figure 87: Europe Manufacturing Analytics Market Value Share Analysis, by Component, 2031

Figure 88: Europe Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Software, 2023 - 2031

Figure 89: Europe Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Services, 2023 - 2031

Figure 90: Europe Manufacturing Analytics Market Value Share Analysis, by Deployment, 2023

Figure 91: Europe Manufacturing Analytics Market Value Share Analysis, by Deployment, 2031

Figure 92: Europe Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Cloud, 2023 - 2031

Figure 93: Europe Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by On-premise, 2023 - 2031

Figure 94: Europe Manufacturing Analytics Market Value Share Analysis, by Application, 2023

Figure 95: Europe Manufacturing Analytics Market Value Share Analysis, by Application, 2031

Figure 96: Europe Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Predictive Maintenance, 2023 - 2031

Figure 97: Europe Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Inventory Management, 2023 - 2031

Figure 98: Europe Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Supply Chain Optimization, 2023 - 2031

Figure 99: Europe Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 100: Europe Manufacturing Analytics Market Value Share Analysis, by Enterprise Size, 2023

Figure 101: Europe Manufacturing Analytics Market Value Share Analysis, by Enterprise Size, 2031

Figure 102: Europe Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by SMEs, 2023 - 2031

Figure 103: Europe Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Large Enterprises, 2023 - 2031

Figure 104: Europe Manufacturing Analytics Market Value Share Analysis, by Industry Vertical, 2023

Figure 105: Europe Manufacturing Analytics Market Value Share Analysis, by Industry Vertical, 2031

Figure 106: Europe Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Industrial Manufacturing, 2023 - 2031

Figure 107: Europe Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Automotive, 2023 - 2031

Figure 108: Europe Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Food & Beverage, 2023 - 2031

Figure 109: Europe Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Chemical, 2023 - 2031

Figure 110: Europe Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Pharmaceutical, 2023 - 2031

Figure 111: Europe Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Oil & Gas, 2023 - 2031

Figure 112: Europe Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Electronics & Semiconductor, 2023 - 2031

Figure 113: Europe Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 114: Europe Manufacturing Analytics Market Value Share Analysis, by Country, 2023

Figure 115: Europe Manufacturing Analytics Market Value Share Analysis, by Country, 2031

Figure 116: Germany Manufacturing Analytics Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 117: U.K. Manufacturing Analytics Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 118: France Manufacturing Analytics Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 119: Spain Manufacturing Analytics Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 120: Italy Manufacturing Analytics Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 121: Asia Pacific Absolute Dollar Opportunity

Figure 122: Asia Pacific Manufacturing Analytics Market Value Share Analysis, by Component, 2023

Figure 123: Asia Pacific Manufacturing Analytics Market Value Share Analysis, by Component, 2031

Figure 124: Asia Pacific Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Software, 2023 - 2031

Figure 125: Asia Pacific Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Services, 2023 - 2031

Figure 126: Asia Pacific Manufacturing Analytics Market Value Share Analysis, by Deployment, 2023

Figure 127: Asia Pacific Manufacturing Analytics Market Value Share Analysis, by Deployment, 2031

Figure 128: Asia Pacific Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Cloud, 2023 - 2031

Figure 129: Asia Pacific Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by On-premise, 2023 - 2031

Figure 130: Asia Pacific Manufacturing Analytics Market Value Share Analysis, by Application, 2023

Figure 131: Asia Pacific Manufacturing Analytics Market Value Share Analysis, by Application, 2031

Figure 132: Asia Pacific Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Predictive Maintenance, 2023 - 2031

Figure 133: Asia Pacific Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Inventory Management, 2023 - 2031

Figure 134: Asia Pacific Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Supply Chain Optimization, 2023 - 2031

Figure 135: Asia Pacific Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 136: Asia Pacific Manufacturing Analytics Market Value Share Analysis, by Enterprise Size, 2023

Figure 137: Asia Pacific Manufacturing Analytics Market Value Share Analysis, by Enterprise Size, 2031

Figure 138: Asia Pacific Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by SMEs, 2023 - 2031

Figure 139: Asia Pacific Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Large Enterprises, 2023 - 2031

Figure 140: Asia Pacific Manufacturing Analytics Market Value Share Analysis, by Industry Vertical, 2023

Figure 141: Asia Pacific Manufacturing Analytics Market Value Share Analysis, by Industry Vertical, 2031

Figure 142: Asia Pacific Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Industrial Manufacturing, 2023 - 2031

Figure 143: Asia Pacific Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Automotive, 2023 - 2031

Figure 144: Asia Pacific Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Food & Beverage, 2023 - 2031

Figure 145: Asia Pacific Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Chemical, 2023 - 2031

Figure 146: Asia Pacific Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Pharmaceutical, 2023 - 2031

Figure 147: Asia Pacific Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Oil & Gas, 2023 - 2031

Figure 148: Asia Pacific Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Electronics & Semiconductor, 2023 - 2031

Figure 149: Asia Pacific Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 150: Asia Pacific Manufacturing Analytics Market Value Share Analysis, by Country, 2023

Figure 151: Asia Pacific Manufacturing Analytics Market Value Share Analysis, by Country, 2031

Figure 152: China Manufacturing Analytics Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 153: India Manufacturing Analytics Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 154: Japan Manufacturing Analytics Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 155: ASEAN Manufacturing Analytics Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 156: Middle East & Africa Absolute Dollar Opportunity

Figure 157: Middle East & Africa Manufacturing Analytics Market Value Share Analysis, by Component, 2023

Figure 158: Middle East & Africa Manufacturing Analytics Market Value Share Analysis, by Component, 2031

Figure 159: Middle East & Africa Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Software, 2023 - 2031

Figure 160: Middle East & Africa Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Services, 2023 - 2031

Figure 161: Middle East & Africa Manufacturing Analytics Market Value Share Analysis, by Deployment, 2023

Figure 162: Middle East & Africa Manufacturing Analytics Market Value Share Analysis, by Deployment, 2031

Figure 163: Middle East & Africa Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Cloud, 2023 - 2031

Figure 164: Middle East & Africa Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by On-premise, 2023 - 2031

Figure 165: Middle East & Africa Manufacturing Analytics Market Value Share Analysis, by Application, 2023

Figure 166: Middle East & Africa Manufacturing Analytics Market Value Share Analysis, by Application, 2031

Figure 167: Middle East & Africa Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Predictive Maintenance, 2023 - 2031

Figure 168: Middle East & Africa Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Inventory Management, 2023 - 2031

Figure 169: Middle East & Africa Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Supply Chain Optimization, 2023 - 2031

Figure 170: Middle East & Africa Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 171: Middle East & Africa Manufacturing Analytics Market Value Share Analysis, by Enterprise Size, 2023

Figure 172: Middle East & Africa Manufacturing Analytics Market Value Share Analysis, by Enterprise Size, 2031

Figure 173: Middle East & Africa Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by SMEs, 2023 - 2031

Figure 174: Middle East & Africa Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Large Enterprises, 2023 - 2031

Figure 175: Middle East & Africa Manufacturing Analytics Market Value Share Analysis, by Industry Vertical, 2023

Figure 176: Middle East & Africa Manufacturing Analytics Market Value Share Analysis, by Industry Vertical, 2031

Figure 177: Middle East & Africa Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Industrial Manufacturing, 2023 - 2031

Figure 178: Middle East & Africa Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Automotive, 2023 - 2031

Figure 179: Middle East & Africa Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Food & Beverage, 2023 - 2031

Figure 180: Middle East & Africa Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Chemical, 2023 - 2031

Figure 181: Middle East & Africa Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Pharmaceutical, 2023 - 2031

Figure 182: Middle East & Africa Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Oil & Gas, 2023 - 2031

Figure 183: Middle East & Africa Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Electronics & Semiconductor, 2023 - 2031

Figure 184: Middle East & Africa Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 185: Middle East & Africa Manufacturing Analytics Market Value Share Analysis, by Country, 2023

Figure 186: Middle East & Africa Manufacturing Analytics Market Value Share Analysis, by Country, 2031

Figure 187: Saudi Arabia Manufacturing Analytics Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 188: United Arab Emirates Manufacturing Analytics Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 189: South Africa Manufacturing Analytics Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 190: South America Absolute Dollar Opportunity

Figure 191: South America Manufacturing Analytics Market Value Share Analysis, by Component, 2023

Figure 192: South America Manufacturing Analytics Market Value Share Analysis, by Component, 2031

Figure 193: South America Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Software, 2023 - 2031

Figure 194: South America Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Services, 2023 - 2031

Figure 195: South America Manufacturing Analytics Market Value Share Analysis, by Deployment, 2023

Figure 196: South America Manufacturing Analytics Market Value Share Analysis, by Deployment, 2031

Figure 197: South America Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Cloud, 2023 - 2031

Figure 198: South America Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by On-premise, 2023 - 2031

Figure 199: South America Manufacturing Analytics Market Value Share Analysis, by Application, 2023

Figure 200: South America Manufacturing Analytics Market Value Share Analysis, by Application, 2031

Figure 201: South America Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Predictive Maintenance, 2023 - 2031

Figure 202: South America Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Inventory Management, 2023 - 2031

Figure 203: South America Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Supply Chain Optimization, 2023 - 2031

Figure 204: South America Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 205: South America Manufacturing Analytics Market Value Share Analysis, by Enterprise Size, 2023

Figure 206: South America Manufacturing Analytics Market Value Share Analysis, by Enterprise Size, 2031

Figure 207: South America Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by SMEs, 2023 - 2031

Figure 208: South America Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Large Enterprises, 2023 - 2031

Figure 209: South America Manufacturing Analytics Market Value Share Analysis, by Industry Vertical, 2023

Figure 210: South America Manufacturing Analytics Market Value Share Analysis, by Industry Vertical, 2031

Figure 211: South America Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Industrial Manufacturing, 2023 - 2031

Figure 212: South America Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Automotive, 2023 - 2031

Figure 213: South America Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Food & Beverage, 2023 - 2031

Figure 214: South America Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Chemical, 2023 - 2031

Figure 215: South America Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Pharmaceutical, 2023 - 2031

Figure 216: South America Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Oil & Gas, 2023 - 2031

Figure 217: South America Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Electronics & Semiconductor, 2023 - 2031

Figure 218: South America Manufacturing Analytics Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 219: South America Manufacturing Analytics Market Value Share Analysis, by Country, 2023

Figure 220: South America Manufacturing Analytics Market Value Share Analysis, by Country, 2031

Figure 221: Brazil Manufacturing Analytics Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 222: Argentina Manufacturing Analytics Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031