Analysts’ Viewpoint

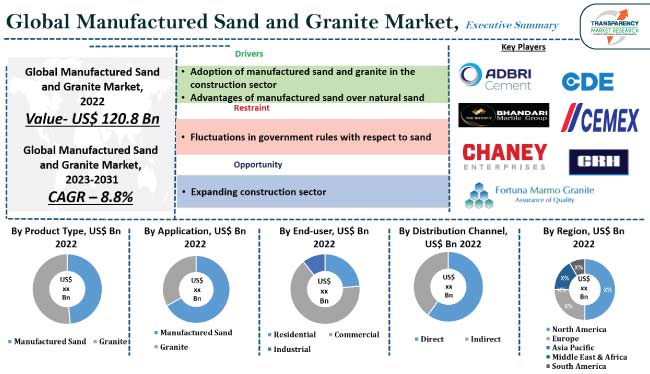

The dynamic nature of the manufactured sand and granite industry can be attributed to rapid urbanization, unprecedented population growth, and governmental participation in infrastructure development. Key vendors in the manufactured sand and granite market are anticipated to increasingly invest in R&D to create different sand and granite materials for both residential and commercial buildings.

Manufacturers are setting up new manufacturing plants and continuously emphasizing on better quality and cost-effective innovative solutions to keep their businesses growing across regions. Additionally, they are striving to provide better solutions for different end-use industries. Customized solutions to customers to fulfill their overall requirements is one of the recent manufactured sand and granite market trends, which is enhancing the overall performance in different construction sectors.

Manufactured sand (M-Sand) is artificial sand derived by crushing hard stones into tiny sand-sized angular-shaped particles. These are cleaned and finely graded to be used as construction aggregate. M-Sand is manufactured in three stages: vertical shaft impact crushers crush stones of varying sizes into aggregates. This material is then fed into a machine to be crushed into sand. The grain size can be determined and adjusted according to the requirement. Finally, dust particles are removed during the screening process.

M-Sand does not contain impurities such as clay particles, silt content, organic compounds, or other soluble compounds that can affect its strength and durability.

Demand for residential and commercial infrastructure has expanded as a result of rapid urbanization. The preference for manufactured sand over natural sand in the construction sector fuels market progress. Demand for engineered sand and granite, and artificial stone and granite has increased tremendously due to the fast-growing construction industry.

M-Sand is obtained from specific hard rock (granite) using technology, thus fulfilling the need for sand in the construction industry. Many commercial structures, such as retail complexes, multiplexes, hospitals, hotels, and restaurants, require strength in order to carry the heavy load. Manufactured sand does not contain any compound that affects the properties and setting time of cement; thus, the strength of concrete can be maintained.

According to the Construction Products Association, the commercial sector is expected to expand by 9.7% in 2022 and 1.1% in 2023. A cumulative total of US$ 135 Trillion in construction sector output is forecast for the decade to 2030. Annual Infrastructure average growth is projected to be 5.1% globally during the period from 2020 to 2025, driven by government participation and the acceleration of global mega infrastructure projects. In the upcoming years, rapid urbanization and expansion of the construction sector are expected to fuel the global manufactured sand and granite market.

Manufactured sand is made by crushing granite stone. It is an alternative to river sand and is used for concrete construction. The demand for good quality sand has been on the rise and deficiency of river sand has led to the search for alternative sources of sand. Extensive, and often unlawful ways of extracting natural sand can lead to significant environmental impacts such as erosion in rivers and coastlines, and changes in water’s PH levels. Thus, the use of manufactured sand can play a vital role in ensuring the sustainable use of sand.

M-Sand is more uniform in structure than natural sand. Besides, in concrete production, only about 5% to 20% manufactured sand is required in the concrete mix than natural sand when filling voids volume between the particles. Superior raw materials are essential for high-quality concrete. Thus, high-quality manufactured sand enhances the concrete quality and drives the manufactured sand and granite market demand.

According to the latest manufactured sand and granite market forecast, Asia Pacific is the most mature market followed by North America and is expected to grow at the highest CAGR, due to rising construction activities across the region.

The region is expected to witness significant growth on account of rapid infrastructure development coupled with surge in construction activities in China, India, Japan, and Southeast Asian countries. Additionally, rise in disposable income and a growing population are expected to fuel the manufactured sand and granite market size during the forecast period.

North America is the second largest regional market after Asia Pacific due to substantial investments made by governments toward infrastructural development, leading to economic growth, as well as other factors such as changing lifestyles resulting in increased need for commercial spaces such as offices.

Detailed profiles of players are provided in the manufactured sand and granite market report to evaluate their financials, key product offerings, recent developments, and strategies. Most of the firms are spending significantly on comprehensive R&D activities, primarily to develop innovative products. Expansion of product portfolios and mergers and acquisitions are the key strategies adopted by top players to ensure manufactured sand and granite market development.

Key players in the manufactured sand and granite market include Adelaide Brighton, Bhandari Marble Group, CDE, CEMEX, Chaney Enterprises, CRH, Fortuna Marmo Granite, Granite India Pvt. Ltd, Holliston Sand, and Metso.

Each of these players has been profiled in the manufactured sand and granite market report based on parameters such as business segments, product portfolio, company overview, financial overview, business strategies, and recent developments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | USD 120.8 Bn |

| Market Forecast Value in 2031 | USD 255.6 Bn |

| Growth Rate (CAGR) | 8.8% |

| Forecast Period | 2023-2031 |

| Quantitative Units | US$ Bn for value and Thousand tons for volume |

| Market Analysis | Global qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape | Market Player - Competition Dashboard and Revenue Share Analysis 2022 Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, COVID-19 Response, Strategy & Business Overview) |

| Regions Covered |

|

| Market Segmentation |

|

| Companies Profile |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 120.8 Bn in 2022

It is expected to reach US$ 255.6 Bn by the end of 2031

Surge in adoption of manufactured sand and granite in the construction sector and advantages of manufactured sand over natural sand

The manufactured sand segment contributed the highest share in 2022

Asia Pacific contributed about 36% in terms of share in 2022

Adelaide Brighton, Bhandari Marble Group, CDE, CEMEX, Chaney Enterprises, CRH, Fortuna Marmo Granite, Granite India Pvt Ltd, Holliston Sand, and Metso.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.5. Porter’s Five Forces Analysis

5.6. Industry SWOT Analysis

5.7. Value Chain Analysis

5.8. Regulatory Framework & Guidelines

5.9. Technological Overview

5.10. Global Manufactured Sand and Granite Market Analysis and Forecast, 2017 - 2031

5.10.1. Market Value Projections (US$ Bn)

5.10.2. Market Volume Projections (Thousand Tons)

6. Global Manufactured Sand and Granite Market Analysis and Forecast, By Product Type

6.1. Manufactured Sand and Granite Market Size (US$ Bn and Thousand Tons), By Product Type, 2017 - 2031

6.1.1. Manufactured Sand

6.1.2. Granite

6.1.2.1. Black Granite

6.1.2.2. Brown Granite

6.1.2.3. Green Granite

6.1.2.4. White Granite

6.1.2.5. Others

6.2. Incremental Opportunity, By Product Type

7. Global Manufactured Sand and Granite Market Analysis and Forecast, By Application

7.1. Manufactured Sand and Granite Market Size (US$ Bn and Thousand Tons), By Application, 2017 - 2031

7.1.1. Manufactured Sand

7.1.1.1. Concreting

7.1.1.2. Plastering

7.1.1.3. Brick or Blockwork

7.1.2. Granite

7.1.2.1. Countertops

7.1.2.2. Flooring

7.1.2.3. Backsplashes

7.1.2.4. Walls

7.1.2.5. Others

7.2. Incremental Opportunity, By Application

8. Global Manufactured Sand and Granite Market Analysis and Forecast, By End-user

8.1. Manufactured Sand and Granite Market Size (US$ Bn and Thousand Tons), By End-user, 2017 - 2031

8.1.1. Residential

8.1.2. Commercial

8.1.3. Industrial

8.2. Incremental Opportunity, By End-user

9. Global Manufactured Sand and Granite Market Analysis and Forecast, By Distribution Channel

9.1. Manufactured Sand and Granite Market Size (US$ Bn and Thousand Tons), By Distribution Channel, 2017 - 2031

9.1.1. Direct

9.1.2. Indirect

9.2. Incremental Opportunity, By Distribution Channel

10. Global Manufactured Sand and Granite Market Analysis and Forecast, By Region

10.1. Manufactured Sand and Granite Market Size (US$ Bn and Thousand Tons), By Region, 2017 - 2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Incremental Opportunity, By Region

11. North America Manufactured Sand and Granite Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Key Supplier Analysis

11.3. Price Trend Analysis

11.3.1. Weighted Average Price

11.4. Key Trends Analysis

11.4.1. Demand Side

11.4.2. Supply Side

11.5. Manufactured Sand and Granite Market Size (US$ Bn and Thousand Tons), By Product Type, 2017 - 2031

11.5.1. Manufactured Sand

11.5.2. Granite

11.5.2.1. Black Granite

11.5.2.2. Brown Granite

11.5.2.3. Green Granite

11.5.2.4. White Granite

11.5.2.5. Others

11.6. Manufactured Sand and Granite Market Size (US$ Bn and Thousand Tons), By Application, 2017 - 2031

11.6.1. Manufactured Sand

11.6.1.1. Concreting

11.6.1.2. Plastering

11.6.1.3. Brick or Blockwork

11.6.2. Granite

11.6.2.1. Countertops

11.6.2.2. Flooring

11.6.2.3. Backsplashes

11.6.2.4. Walls

11.6.2.5. Others

11.7. Manufactured Sand and Granite Market Size (US$ Bn and Thousand Tons), By End-user, 2017 - 2031

11.7.1. Residential

11.7.2. Commercial

11.7.3. Industrial

11.8. Manufactured Sand and Granite Market Size (US$ Bn and Thousand Tons), By Distribution Channel, 2017 - 2031

11.8.1. Direct

11.8.2. Indirect

11.9. Manufactured Sand and Granite Market Size (US$ Bn and Thousand Tons), By Country, 2017 - 2031

11.9.1. U.S

11.9.2. Canada

11.9.3. Rest of North America

11.10. Incremental Opportunity Analysis

12. Europe Manufactured Sand and Granite Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Supplier Analysis

12.3. Price Trend Analysis

12.3.1. Weighted Average Price

12.4. Key Trends Analysis

12.4.1. Demand Side

12.4.2. Supply Side

12.5. Manufactured Sand and Granite Market Size (US$ Bn and Thousand Tons), By Product Type, 2017 - 2031

12.5.1. Manufactured Sand

12.5.2. Granite

12.5.2.1. Black Granite

12.5.2.2. Brown Granite

12.5.2.3. Green Granite

12.5.2.4. White Granite

12.5.2.5. Others

12.6. Manufactured Sand and Granite Market Size (US$ Bn and Thousand Tons), By Application, 2017 - 2031

12.6.1. Manufactured Sand

12.6.1.1. Concreting

12.6.1.2. Plastering

12.6.1.3. Brick or Blockwork

12.6.2. Granite

12.6.2.1. Countertops

12.6.2.2. Flooring

12.6.2.3. Backsplashes

12.6.2.4. Walls

12.6.2.5. Others

12.7. Manufactured Sand and Granite Market Size (US$ Bn and Thousand Tons), By End-user, 2017 - 2031

12.7.1. Residential

12.7.2. Commercial

12.7.3. Industrial

12.8. Manufactured Sand and Granite Market Size (US$ Bn and Thousand Tons), By Distribution Channel, 2017 - 2031

12.8.1. Direct

12.8.2. Indirect

12.9. Manufactured Sand and Granite Market Size (US$ Bn and Thousand Tons), By Country, 2017 - 2031

12.9.1. U.K

12.9.2. Germany

12.9.3. France

12.9.4. Rest of Europe

12.10. Incremental Opportunity Analysis

13. Asia Pacific Manufactured Sand and Granite Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Supplier Analysis

13.3. Price Trend Analysis

13.3.1. Weighted Average Price

13.4. Key Trends Analysis

13.4.1. Demand Side

13.4.2. Supply Side

13.5. Manufactured Sand and Granite Market Size (US$ Bn and Thousand Tons), By Product Type, 2017 - 2031

13.5.1. Manufactured Sand

13.5.2. Granite

13.5.2.1. Black Granite

13.5.2.2. Brown Granite

13.5.2.3. Green Granite

13.5.2.4. White Granite

13.5.2.5. Others

13.6. Manufactured Sand and Granite Market Size (US$ Bn and Thousand Tons), By Application, 2017 - 2031

13.6.1. Manufactured Sand

13.6.1.1. Concreting

13.6.1.2. Plastering

13.6.1.3. Brick or Blockwork

13.6.2. Granite

13.6.2.1. Countertops

13.6.2.2. Flooring

13.6.2.3. Backsplashes

13.6.2.4. Walls

13.6.2.5. Others

13.7. Manufactured Sand and Granite Market Size (US$ Bn and Thousand Tons), By End-user, 2017 - 2031

13.7.1. Residential

13.7.2. Commercial

13.7.3. Industrial

13.8. Manufactured Sand and Granite Market Size (US$ Bn and Thousand Tons), By Distribution Channel, 2017 - 2031

13.8.1. Direct

13.8.2. Indirect

13.9. Manufactured Sand and Granite Market Size (US$ Bn and Thousand Tons), By Country, 2017 - 2031

13.9.1. India

13.9.2. China

13.9.3. Japan

13.9.4. Rest of Asia Pacific

13.10. Incremental Opportunity Analysis

14. Middle East & Africa Manufactured Sand and Granite Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Supplier Analysis

14.3. Price Trend Analysis

14.3.1. Weighted Average Price

14.4. Key Trends Analysis

14.4.1. Demand Side

14.4.2. Supply Side

14.5. Manufactured Sand and Granite Market Size (US$ Bn and Thousand Tons), By Product Type,2017 - 2031

14.5.1. Manufactured Sand

14.5.2. Granite

14.5.2.1. Black Granite

14.5.2.2. Brown Granite

14.5.2.3. Green Granite

14.5.2.4. White Granite

14.5.2.5. Others

14.6. Manufactured Sand and Granite Market Size (US$ Bn and Thousand Tons), By Application, 2017 - 2031

14.6.1. Manufactured Sand

14.6.1.1. Concreting

14.6.1.2. Plastering

14.6.1.3. Brick or Blockwork

14.6.2. Granite

14.6.2.1. Countertops

14.6.2.2. Flooring

14.6.2.3. Backsplashes

14.6.2.4. Walls

14.6.2.5. Others

14.7. Manufactured Sand and Granite Market Size (US$ Bn and Thousand Tons), By End-user, 2017 - 2031

14.7.1. Residential

14.7.2. Commercial

14.7.3. Industrial

14.8. Manufactured Sand and Granite Market Size (US$ Bn and Thousand Tons), By Distribution Channel, 2017 - 2031

14.8.1. Direct

14.8.2. Indirect

14.9. Manufactured Sand and Granite Market Size (US$ Bn and Thousand Tons), By Country, 2017 - 2031

14.9.1. GCC

14.9.2. South Africa

14.9.3. Rest of Middle East & Africa

14.10. Incremental Opportunity Analysis

15. South America Manufactured Sand and Granite Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Key Supplier Analysis

15.3. Price Trend Analysis

15.3.1. Weighted Average Price

15.4. Key Trends Analysis

15.4.1. Demand Side

15.4.2. Supply Side

15.5. Manufactured Sand and Granite Market Size (US$ Bn and Thousand Tons), By Product Type,2017 - 2031

15.5.1. Manufactured Sand

15.5.2. Granite

15.5.2.1. Black Granite

15.5.2.2. Brown Granite

15.5.2.3. Green Granite

15.5.2.4. White Granite

15.5.2.5. Others

15.6. Manufactured Sand and Granite Market Size (US$ Bn and Thousand Tons), By Application, 2017 - 2031

15.6.1. Manufactured Sand

15.6.1.1. Concreting

15.6.1.2. Plastering

15.6.1.3. Brick or Blockwork

15.6.2. Granite

15.6.2.1. Countertops

15.6.2.2. Flooring

15.6.2.3. Backsplashes

15.6.2.4. Walls

15.6.2.5. Others

15.7. Manufactured Sand and Granite Market Size (US$ Bn and Thousand Tons), By End-user, 2017 - 2031

15.7.1. Residential

15.7.2. Commercial

15.7.3. Industrial

15.8. Manufactured Sand and Granite Market Size (US$ Bn and Thousand Tons), By Distribution Channel, 2017 - 2031

15.8.1. Direct

15.8.2. Indirect

15.9. Manufactured Sand and Granite Market Size (US$ Bn and Thousand Tons), By Country, 2017 - 2031

15.9.1. Brazil

15.9.2. Rest of South America

15.10. Incremental Opportunity Analysis

16. Competition Landscape

16.1. Market Player - Competition Dashboard

16.2. Market Share Analysis (%), by Company, (2022)

16.3. Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

16.3.1. Adelaide Brighton

16.3.1.1. Company Overview

16.3.1.2. Sales Area/Geographical Presence

16.3.1.3. Revenue

16.3.1.4. Strategy & Business Overview

16.3.2. Bhandari Marble Group

16.3.2.1. Company Overview

16.3.2.2. Sales Area/Geographical Presence

16.3.2.3. Revenue

16.3.2.4. Strategy & Business Overview

16.3.3. CDE

16.3.3.1. Company Overview

16.3.3.2. Sales Area/Geographical Presence

16.3.3.3. Revenue

16.3.3.4. Strategy & Business Overview

16.3.4. CEMEX

16.3.4.1. Company Overview

16.3.4.2. Sales Area/Geographical Presence

16.3.4.3. Revenue

16.3.4.4. Strategy & Business Overview

16.3.5. Chaney Enterprises

16.3.5.1. Company Overview

16.3.5.2. Sales Area/Geographical Presence

16.3.5.3. Revenue

16.3.5.4. Strategy & Business Overview

16.3.6. CRH

16.3.6.1. Company Overview

16.3.6.2. Sales Area/Geographical Presence

16.3.6.3. Revenue

16.3.6.4. Strategy & Business Overview

16.3.7. Fortuna Marmo Granite

16.3.7.1. Company Overview

16.3.7.2. Sales Area/Geographical Presence

16.3.7.3. Revenue

16.3.7.4. Strategy & Business Overview

16.3.8. Granite India Pvt. Ltd

16.3.8.1. Company Overview

16.3.8.2. Sales Area/Geographical Presence

16.3.8.3. Revenue

16.3.8.4. Strategy & Business Overview

16.3.9. Holliston Sand

16.3.9.1. Company Overview

16.3.9.2. Sales Area/Geographical Presence

16.3.9.3. Revenue

16.3.9.4. Strategy & Business Overview

16.3.10. Metso

16.3.10.1. Company Overview

16.3.10.2. Sales Area/Geographical Presence

16.3.10.3. Revenue

16.3.10.4. Strategy & Business Overview

16.3.11. Other Key Players

16.3.11.1. Company Overview

16.3.11.2. Sales Area/Geographical Presence

16.3.11.3. Revenue

16.3.11.4. Strategy & Business Overview

17. Go to Market Strategy

17.1. Identification of Potential Market Spaces

17.2. Understanding the Procurement Process of Industries

17.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Manufactured Sand and Granite Market Value, by Product Type, US$ Bn, 2017-2031

Table 2: Global Manufactured Sand and Granite Market Volume, by Product Type, Thousand Tons, 2017-2031

Table 3: Global Manufactured Sand and Granite Market Value, by Application, US$ Bn, 2017-2031

Table 4: Global Manufactured Sand and Granite Market Volume, by Application, Thousand Tons, 2017-2031

Table 5: Global Manufactured Sand and Granite Market Value, by End-user, US$ Bn, 2017-2031

Table 6: Global Manufactured Sand and Granite Market Volume, by End-user, Thousand Tons, 2017-2031

Table 7: Global Manufactured Sand and Granite Market Value, by Distribution Channel, US$ Bn, 2017-2031

Table 8: Global Manufactured Sand and Granite Market Volume, by Distribution Channel, Thousand Tons,2017-2031

Table 9: Global Manufactured Sand and Granite Market Value, by Region, US$ Bn, 2017-2031

Table 10: Global Manufactured Sand and Granite Market Volume, by Region, Thousand Tons,2017-2031

Table 11: North America Manufactured Sand and Granite Market Value, by Product Type, US$ Bn, 2017-2031

Table 12: North America Manufactured Sand and Granite Market Volume, by Product Type, Thousand Tons,2017-2031

Table 13: North America Manufactured Sand and Granite Market Value, by Application, US$ Bn, 2017-2031

Table 14: North America Manufactured Sand and Granite Market Volume, by Application, Thousand Tons,2017-2031

Table 15: North America Manufactured Sand and Granite Market Value, by End-user, US$ Bn, 2017-2031

Table 16: North America Manufactured Sand and Granite Market Volume, by End-user, Thousand Tons,2017-2031

Table 17: North America Manufactured Sand and Granite Market Value, by Distribution Channel, US$ Bn, 2017-2031

Table 18: North America Manufactured Sand and Granite Market Volume, by Distribution Channel, Thousand Tons,2017-2031

Table 19: North America Manufactured Sand and Granite Market Value, by Country/Sub-Region, US$ Bn, 2017-2031

Table 20: North America Manufactured Sand and Granite Market Volume, by Country/Sub-Region, Thousand Tons,2017-2031

Table 21: Europe Manufactured Sand and Granite Market Value, by Product Type, US$ Bn, 2017-2031

Table 22: Europe Manufactured Sand and Granite Market Volume, by Product Type, Thousand Tons,2017-2031

Table 23: Europe Manufactured Sand and Granite Market Value, by Application, US$ Bn, 2017-2031

Table 24: Europe Manufactured Sand and Granite Market Volume, by Application, Thousand Tons,2017-2031

Table 25: Europe Manufactured Sand and Granite Market Value, by End-user, US$ Bn, 2017-2031

Table 26: Europe Manufactured Sand and Granite Market Volume, by End-user, Thousand Tons,2017-2031

Table 27: Europe Manufactured Sand and Granite Market Value, by Distribution Channel, US$ Bn, 2017-2031

Table 28: Europe Manufactured Sand and Granite Market Volume, by Distribution Channel, Thousand Tons,2017-2031

Table 29: Europe Manufactured Sand and Granite Market Value, by Country/Sub-Region, US$ Bn, 2017-2031

Table 30: Europe Manufactured Sand and Granite Market Volume, by Country/Sub-Region, Thousand Tons,2017-2031

Table 31: Asia Pacific Manufactured Sand and Granite Market Volume, by Product Type, US$ Bn, 2017-2031

Table 32: Asia Pacific Manufactured Sand and Granite Market Volume, by Product Type, Thousand Tons,2017-2031

Table 33: Asia Pacific Manufactured Sand and Granite Market Value, by Application, US$ Bn, 2017-2031

Table 34: Asia Pacific Manufactured Sand and Granite Market Volume, by Application, Thousand Tons,2017-2031

Table 35: Asia Pacific Manufactured Sand and Granite Market Value, by End-user, US$ Bn, 2017-2031

Table 36: Asia Pacific Manufactured Sand and Granite Market Volume, by End-user, Thousand Tons,2017-2031

Table 37: Asia Pacific Manufactured Sand and Granite Market Value, by Distribution Channel, US$ Bn, 2017-2031

Table 38: Asia Pacific Manufactured Sand and Granite Market Volume, by Distribution Channel, Thousand Tons,2017-2031

Table 39: Asia Pacific Manufactured Sand and Granite Market Value, by Country/Sub-Region, US$ Bn, 2017-2031

Table 40: Asia Pacific Manufactured Sand and Granite MarketVolume, by Country/Sub-Region, Thousand Tons,2017-2031

Table 41: MEA Manufactured Sand and Granite MarketValue, by Product Type, US$ Bn, 2017-2031

Table 42: MEA Manufactured Sand and Granite MarketVolume, by Product Type, Thousand Tons,2017-2031

Table 43: MEA Manufactured Sand and Granite MarketValue, by Application, US$ Bn, 2017-2031

Table 44: MEA Manufactured Sand and Granite MarketVolume, by Application, Thousand Tons,2017-2031

Table 45: MEA Manufactured Sand and Granite MarketValue, by End-user, US$ Bn, 2017-2031

Table 46: MEA Manufactured Sand and Granite MarketVolume, by End-user, Thousand Tons,2017-2031

Table 47: MEA Manufactured Sand and Granite MarketValue, by Distribution Channel, US$ Bn, 2017-2031

Table 48: MEA Manufactured Sand and Granite MarketVolume, by Distribution Channel, Thousand Tons,2017-2031

Table 49: MEA Manufactured Sand and Granite MarketValue, by Country/Sub-Region, US$ Bn, 2017-2031

Table 50: MEA Manufactured Sand and Granite MarketVolume, by Country/Sub-Region, Thousand Tons,2017-2031

Table 51: South America Manufactured Sand and Granite MarketValue, by Product Type, US$ Bn, 2017-2031

Table 52: South America Manufactured Sand and Granite MarketVolume, by Product Type, Thousand Tons,2017-2031

Table 53: South America Manufactured Sand and Granite MarketValue, by Application, US$ Bn, 2017-2031

Table 54: South America Manufactured Sand and Granite MarketVolume, by Application, Thousand Tons,2017-2031

Table 55: South America Manufactured Sand and Granite MarketValue, by End-user, US$ Bn, 2017-2031

Table 56: South America Manufactured Sand and Granite MarketVolume, by End-user, Thousand Tons,2017-2031

Table 57: South America Manufactured Sand and Granite MarketValue, by Distribution Channel, US$ Bn, 2017-2031

Table 58: South America Manufactured Sand and Granite MarketVolume, by Distribution Channel, Thousand Tons,2017-2031

Table 59: South America Manufactured Sand and Granite MarketValue, by Country/Sub-Region, US$ Bn, 2017-2031

Table 60: South America Manufactured Sand and Granite MarketVolume, by Country/Sub-Region, Thousand Tons,2017-2031

List of Figures

Figure 1: Global Manufactured Sand and Granite Market Value, by Product Type, US$ Bn, 2017-2031

Figure 2: Global Manufactured Sand and Granite Market Volume, by Product Type, Thousand Tons,2017-2031

Figure 3: Global Manufactured Sand and Granite Market Incremental Opportunity, by Product Type, 2021-2031

Figure 4: Global Manufactured Sand and Granite Market Value, by Application, US$ Bn, 2017-2031

Figure 5: Global Manufactured Sand and Granite Market Volume, by Application, Thousand Tons,2017-2031

Figure 6: Global Manufactured Sand and Granite Market Incremental Opportunity, by Application, 2021-2031

Figure 7: Global Manufactured Sand and Granite Market Value, by End-user, US$ Bn, 2017-2031

Figure 8: Global Manufactured Sand and Granite Market Volume, by End-user, Thousand Tons,2017-2031

Figure 9: Global Manufactured Sand and Granite Market Incremental Opportunity, by End-user, 2021-2031

Figure 10: Global Manufactured Sand and Granite Market Value, by Distribution Channel, US$ Bn, 2017-2031

Figure 11: Global Manufactured Sand and Granite Market Volume, by Distribution Channel, Thousand Tons,2017-2031

Figure 12: Global Manufactured Sand and Granite Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 13: Global Manufactured Sand and Granite Market Value, by Region, US$ Bn, 2017-2031

Figure 14: Global Manufactured Sand and Granite Market Volume, by Region, Thousand Tons,2017-2031

Figure 15: Global Manufactured Sand and Granite Market Incremental Opportunity, by Region,2021-2031

Figure 16: North America Manufactured Sand and Granite Market Value, by Product Type, US$ Bn, 2017-2031

Figure 17: North America Manufactured Sand and Granite Market Volume, by Product Type, Thousand Tons,2017-2031

Figure 18: North America Manufactured Sand and Granite Market Incremental Opportunity, by Product Type, 2021-2031

Figure 19: North America Manufactured Sand and Granite Market Value, by Application, US$ Bn, 2017-2031

Figure 20: North America Manufactured Sand and Granite Market Volume, by Application, Thousand Tons,2017-2031

Figure 21: North America Manufactured Sand and Granite Market Incremental Opportunity, by Application, 2021-2031

Figure 22: North America Manufactured Sand and Granite Market Value, by End-user, US$ Bn, 2017-2031

Figure 23: North America Manufactured Sand and Granite Market Volume, by End-user, Thousand Tons,2017-2031

Figure 24: North America Manufactured Sand and Granite Market Incremental Opportunity, by End-user, 2021-2031

Figure 25: North America Manufactured Sand and Granite Market Value, by Distribution Channel, US$ Bn, 2017-2031

Figure 26: North America Manufactured Sand and Granite Market Volume, by Distribution Channel, Thousand Tons,2017-2031

Figure 27: North America Manufactured Sand and Granite Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 28: North America Manufactured Sand and Granite Market Value, by Country/Sub-Region, US$ Bn, 2017-2031

Figure 29: North America Manufactured Sand and Granite Market Volume, by Country/Sub-Region, Thousand Tons,2017-2031

Figure 30: North America Manufactured Sand and Granite Market Incremental Opportunity, by Country/Sub-Region, 2021-2031

Figure 31: Europe Manufactured Sand and Granite Market Value, by Product Type, US$ Bn, 2017-2031

Figure 32: Europe Manufactured Sand and Granite Market Volume, by Product Type, Thousand Tons,2017-2031

Figure 33: Europe Manufactured Sand and Granite Market Incremental Opportunity, by Product Type, 2021-2031

Figure 34: Europe Manufactured Sand and Granite Market Value, by Application, US$ Bn, 2017-2031

Figure 35: Europe Manufactured Sand and Granite Market Volume, by Application, Thousand Tons,2017-2031

Figure 36: Europe Manufactured Sand and Granite Market Incremental Opportunity, by Application, 2021-2031

Figure 37: Europe Manufactured Sand and Granite Market Value, by End-user, US$ Bn, 2017-2031

Figure 38: Europe Manufactured Sand and Granite Market Volume, by End-user, Thousand Tons,2017-2031

Figure 39: Europe Manufactured Sand and Granite Market Incremental Opportunity, by End-user, 2021-2031

Figure 40: Europe Manufactured Sand and Granite Market Value, by Distribution Channel, US$ Bn, 2017-2031

Figure 41: Europe Manufactured Sand and Granite Market Volume, by Distribution Channel, Thousand Tons,2017-2031

Figure 42: Europe Manufactured Sand and Granite Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 43: Europe Manufactured Sand and Granite Market Value, by Country/Sub-Region, US$ Bn, 2017-2031

Figure 44: Europe Manufactured Sand and Granite Market Volume, by Country/Sub-Region, Thousand Tons,2017-2031

Figure 45: Europe Manufactured Sand and Granite Market Incremental Opportunity, by Country/Sub-Region, 2021-2031

Figure 46: Asia Pacific Manufactured Sand and Granite Market Value, by Product Type, US$ Bn, 2017-2031

Figure 47: Asia Pacific Manufactured Sand and Granite Market Volume, by Product Type, Thousand Tons,2017-2031

Figure 48: Asia Pacific Manufactured Sand and Granite Market Incremental Opportunity, by Product Type, 2021-2031

Figure 49: Asia Pacific Manufactured Sand and Granite Market Value, by Application, US$ Bn, 2017-2031

Figure 50: Asia Pacific Manufactured Sand and Granite Market Volume, by Application, Thousand Tons, 2017-2031

Figure 51: Asia Pacific Manufactured Sand and Granite Market Incremental Opportunity, by Application, 2021-2031

Figure 52: Asia Pacific Manufactured Sand and Granite Market Value, by End-user, US$ Bn, 2017-2031

Figure 53: Asia Pacific Manufactured Sand and Granite Market Volume, by End-user, Thousand Tons, 2017-2031

Figure 54: Asia Pacific Manufactured Sand and Granite Market Incremental Opportunity, by End-user, 2021-2031

Figure 55: Asia Pacific Manufactured Sand and Granite Market Value, by Distribution Channel, US$ Bn, 2017-2031

Figure 56: Asia Pacific Manufactured Sand and Granite Market Volume, by Distribution Channel, Thousand Tons,2017-2031

Figure 57: Asia Pacific Manufactured Sand and Granite Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 58: Asia Pacific Manufactured Sand and Granite Market Value, by Country/Sub-Region, US$ Bn, 2017-2031

Figure 59: Asia Pacific Manufactured Sand and Granite Market Volume, by Country/Sub-Region, Thousand Tons,2017-2031

Figure 60: Asia Pacific Manufactured Sand and Granite Market Incremental Opportunity, by Country/Sub-Region, 2021-2031

Figure 61: MEA Manufactured Sand and Granite Market Value, by Product Type, US$ Bn, 2017-2031

Figure 62: MEA Manufactured Sand and Granite Market Volume, by Product Type, Thousand Tons,2017-2031

Figure 63: MEA Manufactured Sand and Granite Market Incremental Opportunity, by Product Type, 2021-2031

Figure 64: MEA Manufactured Sand and Granite Market Value, by Application, US$ Bn, 2017-2031

Figure 65: MEA Manufactured Sand and Granite Market Volume, by Application, Thousand Tons,2017-2031

Figure 66: MEA Manufactured Sand and Granite Market Incremental Opportunity, by Application, 2021-2031

Figure 67: MEA Manufactured Sand and Granite Market Value, by End-user, US$ Bn, 2017-2031

Figure 68: MEA Manufactured Sand and Granite Market Volume, by End-user, Thousand Tons,2017-2031

Figure 69: MEA Manufactured Sand and Granite Market Incremental Opportunity, by End-user, 2021-2031

Figure 70: MEA Manufactured Sand and Granite Market Value, by Distribution Channel, US$ Bn, 2017-2031

Figure 71: MEA Manufactured Sand and Granite Market Volume, by Distribution Channel, Thousand Tons, 2017-2031

Figure 72: MEA Manufactured Sand and Granite Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 73: MEA Manufactured Sand and Granite Market Value, by Country/Sub-Region, US$ Bn, 2017-2031

Figure 74: MEA Manufactured Sand and Granite Market Volume, by Country/Sub-Region, Thousand Tons, 2017-2031

Figure 75: MEA Manufactured Sand and Granite Market Incremental Opportunity, by Country/Sub-Region, 2021-2031

Figure 76: South America Manufactured Sand and Granite Market Value, by Product Type, US$ Bn, 2017-2031

Figure 77: South America Manufactured Sand and Granite Market Volume, by Product Type, Thousand Tons, 2017-2031

Figure 78: South America Manufactured Sand and Granite Market Incremental Opportunity, by Product Type, 2021-2031

Figure 79: South America Manufactured Sand and Granite Market Value, by Application, US$ Bn, 2017-2031

Figure 80: South America Manufactured Sand and Granite Market Volume, by Application, Thousand Tons, 2017-2031

Figure 81: South America Manufactured Sand and Granite Market Incremental Opportunity, by Application, 2021-2031

Figure 82: South America Manufactured Sand and Granite Market Value, by End-user, US$ Bn, 2017-2031

Figure 83: South America Manufactured Sand and Granite Market Volume, by End-user, Thousand Tons, 2017-2031

Figure 84: South America Manufactured Sand and Granite Market Incremental Opportunity, by End-user, 2021-2031

Figure 85: South America Manufactured Sand and Granite Market Value, by Distribution Channel, US$ Bn, 2017-2031

Figure 86: South America Manufactured Sand and Granite Market Volume, by Distribution Channel, Thousand Tons, 2017-2031

Figure 87: South America Manufactured Sand and Granite Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 88: South America Manufactured Sand and Granite Market Value, by Country/Sub-Region, US$ Bn, 2017-2031

Figure 89: South America Manufactured Sand and Granite Market Volume, by Country/Sub-Region, Thousand Tons, 2017-2031

Figure 90: South America Manufactured Sand and Granite Market Incremental Opportunity, by Country/Sub-Region, 2021-2031