Analyst Viewpoint

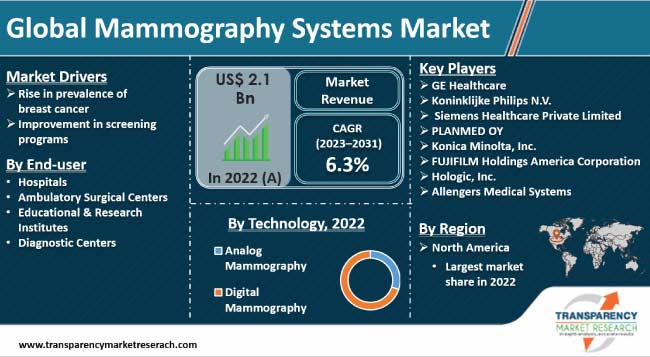

Technology advancements, increase in prevalence of breast cancer, and supportive government initiatives are the key factors that are driving the mammography systems market size. Screening mammograms play an important role in detecting the incidence of breast cancer in the initial stage. Rise in awareness about the importance of early breast cancer detection is also augmenting market progress.

Key players operating in the sector are introducing new & innovative products such as digital mammography machines and portable mammogram equipment, and enhancing the features of their current portfolio to expand customer base and increase their mammography systems market share. They are also investing in manufacture of cutting-edge 3D tomosynthesis mammography equipment to ensure early and accurate detection of breast cancer.

Mammography systems are medical imaging tools that look at the internal structure of the breasts using a low-dose X-ray to detect breast cancer. These are minimally invasive systems that use digital mammography, computer-aided detection, and breast tomosynthesis to detect breast cancer.

Breast cancer, which is one of the most prevalent cancers, affects both men and women; however, it is more dominant in women. Patients who display symptoms of breast cancer, such as lumps, skin dimpling, and pain, are usually screened using mammography systems.

Mammography system is used as a screening method for the incidence of breast cancer even before the patient shows any symptoms. There are two key types of mammography systems: digital mammography in 2D and digital mammography in 3D.

Breast cancer is becoming increasingly prevalent worldwide, thus raising serious concerns for public health, especially those of women. More than 2.3 million new cases of breast cancer were detected in 2020, according to the World Health Organization. This makes it the most frequent cancer among women globally.

The number of women living with breast cancer increased to around 7.9 million by 2021, indicating a rising prevalence of the disease. Women over 40 are more likely to be afflicted with breast cancer, as age is a substantial risk factor for the disease.

Almost one in eight women in North America is likely to be afflicted with breast cancer at some point in their life, according to the American Cancer Society. Around 685,000 people were anticipated to succumb to cancer in 2020. Early detection is the only key to improve the prognosis of the disease. Mammography machines are essential tools in the battle against breast cancer. Thus, rise in prevalence of breast cancer is boosting the global mammography systems market.

A number of women are seeking early detection and treatment options for breast cancer, thus propelling the demand for mammography systems. Improvement in frequency of breast cancer screening programs, such as regular mammography, is crucial for early disease detection, when treatment is most effective.

Thus, increase in efforts by healthcare providers to meet the rising demand for breast cancer screening services is augmenting market statistics.

Technological developments in mammography systems, such as development of full field digital mammography systems, are also fueling the global mammography systems market. These technologies provide various advantages such decreased radiation dosage, lower recall rates, and enhanced workflow efficiency in addition to excellent accuracy and early breast cancer diagnosis.

Effective screening programs are necessary to identify breast cancer at an early stage, when it is most treatable. Regular mammograms is one of the ideal ways to check for breast cancer, and their usage has increased in recent years.

Advancements in technology, such as full field digital mammography machines, have significantly improved the precision of breast cancer diagnosis. Studies indicate that full field digital mammography equipment shows lower false-positive rates and higher detection rates compared to traditional film mammography.

Development in digital mammography technology has also contributed to the introduction of advanced screening methods such as tomosynthesis and 3D mammography, which provide more accurate images of breast tissue and can detect small breast tumors.

Tomosynthesis has been shown to increase the detection of breast cancer by as much as 40%, leading to an earlier diagnosis and improved prognoses.

Increase in success rate and accuracy of modern screening methods such as digital mammography systems is driving the adoption for high-resolution breast imaging solutions for early cancer detection. Healthcare providers are integrating these technologies to better serve patients and meet the growing demand for breast cancer screening services.

According to the latest mammography systems market research, North America held the largest share in 2022. Breast cancer is the most common type of cancer among the U.S. women, accounting for 30% (or 1 in 3) of all new cases of cancer diagnosed in women, according to the American Cancer Society.

Presence of developed economies, advancements in healthcare infrastructure, and rise in awareness about screening and diagnostics of breast cancer among the population are some of the factors that are driving the mammography systems market demand in North America.

Future analysis of mammography systems suggests that the sector in Asia Pacific is likely to grow at a steady pace in the near future owing to the presence of a large population, development of emerging economies, and increase in healthcare facilities in the region.

Manufacturers of mammography systems are investing in R&D of new and cost-effective products to expand their product portfolio and increase their market share. They are constantly studying the latest mammography systems market trends in order to introduce products that are functionally superior and made of the finest quality raw materials.

GE Healthcare, Koninklijke Philips N.V., Siemens Healthcare Private Limited, PLANMED OY, Konica Minolta, Inc., FUJIFILM Holdings America Corporation, Hologic, Inc., and Allengers Medical Systems are prominent players operating in the global mammography systems market .

Each of these companies has been profiled in the mammography systems market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size in 2022 | US$ 2.1 Bn |

| Market Forecast (Value) in 2031 | US$ 3.7 Bn |

| Growth Rate (CAGR) | 6.3% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional-level analysis. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces Analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 2.1 Bn in 2022

It is anticipated to grow at a CAGR of 6.3% from 2023 to 2031

Improvement in screening programs and rise in prevalence of breast cancer

The digital mammography segment held the largest share in 2022

North America led the global landscape in 2022

GE Healthcare, Koninklijke Philips N.V., Siemens Healthcare Private Limited, PLANMED OY, Konica Minolta, Inc., FUJIFILM Holdings America Corporation, Hologic, Inc., and Allengers Medical Systems

1. Executive Summary

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Mammography Systems Market

4. Market Overview

4.1. Market Segmentation

4.1.1. Segment Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Mammography Systems Market Analysis and Forecast, 2017-2031

5. Key Insights

5.1. Pipeline Analysis

5.2. COVID-19 Pandemic Impact on Industry

6. Mammography Systems Market Analysis and Forecast, by Technology

6.1. Introduction and Definitions

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Technology, 2017–2031

6.3.1. Analog Mammography

6.3.2. Digital Mammography

6.3.2.1. 2-D Mammography

6.3.2.2. 3-D Mammography

6.4. Market Attractiveness, by Technology

7. Global Mammography Systems Market Analysis and Forecast, by End-user

7.1. Introduction and Definitions

7.2. Key Findings/Developments

7.3. Market Value Forecast, by End-user, 2017–2031

7.3.1. Hospitals

7.3.2. Ambulatory Surgical Centers

7.3.3. Educational & Research Institutes

7.3.4. Diagnostic Centers

7.4. Market Attractiveness, by End-user

8. Global Mammography Systems Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region, 2017–2031

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness, by Region

9. North America Mammography Systems Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Technology, 2017–2031

9.2.1. Analog Mammography

9.2.2. Digital Mammography

9.2.2.1. 2-D Mammography

9.2.2.2. 3-D Mammography

9.3. Market Value Forecast, by End-user, 2017–2031

9.3.1. Hospitals

9.3.2. Ambulatory Surgical Centers

9.3.3. Educational & Research Institutes

9.3.4. Diagnostic Centers

9.4. Market Value Forecast, by Country, 2022–2031

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Technology

9.5.2. By End-user

9.5.3. By Country

10. Europe Mammography Systems Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Technology, 2017–2031

10.2.1. Analog Mammography

10.2.2. Digital Mammography

10.2.2.1. 2-D Mammography

10.2.2.2. 3-D Mammography

10.3. Market Value Forecast, by End-user, 2017–2031

10.3.1. Hospitals

10.3.2. Ambulatory Surgical Centers

10.3.3. Educational & Research Institutes

10.3.4. Diagnostic Centers

10.4. Market Value Forecast, by Country/Sub-region, 2017–2031

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Italy

10.4.5. Spain

10.4.6. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Technology

10.5.2. By End-user

10.5.3. By Country/Sub-region

11. Asia Pacific Mammography Systems Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Technology, 2017–2031

11.2.1. Analog Mammography

11.2.2. Digital Mammography

11.2.2.1. 2-D Mammography

11.2.2.2. 3-D Mammography

11.3. Market Value Forecast, by End-user, 2017–2031

11.3.1. Hospitals

11.3.2. Ambulatory Surgical Centers

11.3.3. Educational & Research Institutes

11.3.4. Diagnostic Centers

11.4. Market Value Forecast, by Country/Sub-region, 2017–2031

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Technology

11.5.2. By End-user

11.5.3. By Country/Sub-region

12. Latin America Mammography Systems Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Technology, 2017–2031

12.2.1. Analog Mammography

12.2.2. Digital Mammography

12.2.2.1. 2-D Mammography

12.2.2.2. 3-D Mammography

12.3. Market Value Forecast, by End-user, 2017–2031

12.3.1. Hospitals

12.3.2. Ambulatory Surgical Centers

12.3.3. Educational & Research Institutes

12.3.4. Diagnostic Centers

12.4. Market Value Forecast, by Country/Sub-region, 2017–2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Technology

12.5.2. By End-user

12.5.3. By Country/Sub-region

13. Middle East & Africa Mammography Systems Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Technology, 2017–2031

13.2.1. Analog Mammography

13.2.2. Digital Mammography

13.2.2.1. 2-D Mammography

13.2.2.2. 3-D Mammography

13.2.3. Others

13.3. Market Value Forecast, by End-user, 2017–2031

13.3.1. Hospital Pharmacies

13.3.2. Online Pharmacies

13.3.3. Retail Pharmacies & Drug Stores

13.4. Market Value Forecast, by Country/Sub-region, 2017–2031

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Technology

13.5.2. By End-user

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player - Competition Matrix (By Tier and Size of Companies)

14.2. Market Share Analysis, by Company (2022)

14.3. Company Profiles

14.3.1. GE Healthcare

14.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.1.2. Product Portfolio

14.3.1.3. Financial Overview

14.3.1.4. SWOT Analysis

14.3.1.5. Strategic Overview

14.3.2. Koninklijke Philips N.V.

14.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.2.2. Product Portfolio

14.3.2.3. Financial Overview

14.3.2.4. SWOT Analysis

14.3.2.5. Strategic Overview

14.3.3. Siemens Healthcare Private Limited

14.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.3.2. Product Portfolio

14.3.3.3. Financial Overview

14.3.3.4. SWOT Analysis

14.3.3.5. Strategic Overview

14.3.4. PLANMED OY

14.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.4.2. Product Portfolio

14.3.4.3. Financial Overview

14.3.4.4. SWOT Analysis

14.3.4.5. Strategic Overview

14.3.5. Konica Minolta, Inc.

14.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.5.2. Product Portfolio

14.3.5.3. Financial Overview

14.3.5.4. SWOT Analysis

14.3.5.5. Strategic Overview

14.3.6. FUJIFILM Holdings America Corporation

14.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.6.2. Product Portfolio

14.3.6.3. Financial Overview

14.3.6.4. SWOT Analysis

14.3.6.5. Strategic Overview

14.3.7. Hologic, Inc.

14.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.7.2. Product Portfolio

14.3.7.3. Financial Overview

14.3.7.4. SWOT Analysis

14.3.7.5. Strategic Overview

14.3.8. CONMED Corporation

14.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.8.2. Product Portfolio

14.3.8.3. Financial Overview

14.3.8.4. SWOT Analysis

14.3.8.5. Strategic Overview

List of Tables

Table 01: Global Mammography Systems Market Value (US$ Mn) Forecast, by Technology, 2017–2031

Table 02: Global Mammography Systems Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 03: Global Mammography Systems Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 04: North America Mammography Systems Market Value (US$ Mn) Forecast, by Technology, 2017–2031

Table 05: North America Mammography Systems Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 06: North America Mammography Systems Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 07: Europe Mammography Systems Market Value (US$ Mn) Forecast, by Technology, 2017–2031

Table 08: Europe Mammography Systems Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 09: Europe Mammography Systems Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 10: Asia Pacific Mammography Systems Market Value (US$ Mn) Forecast, by Technology, 2017–2031

Table 11: Asia Pacific Mammography Systems Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 12: Asia Pacific Mammography Systems Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 13: Latin America Mammography Systems Market Value (US$ Mn) Forecast, by Technology, 2017–2031

Table 14: Latin America Mammography Systems Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 15: Latin America Mammography Systems Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 16: Middle East & Africa Mammography Systems Market Value (US$ Mn) Forecast, by Technology, 2017–2031

Table 17: Middle East & Africa Mammography Systems Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 18: Middle East & Africa Mammography Systems Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

List of Figures

Figure 01: Global Mammography Systems Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Mammography Systems Market Value Share Analysis, by Technology, 2022 and 2031

Figure 03: Global Mammography Systems Market Attractiveness Analysis, by Technology, 2023–2031

Figure 04: Global Mammography Systems Market Value Share Analysis, by End-user, 2022 and 2031

Figure 05: Global Mammography Systems Market Attractiveness Analysis, by End-user, 2023–2031

Figure 06: Global Mammography Systems Market Value Share Analysis, by Region, 2022 and 2031

Figure 07: Global Mammography Systems Market Attractiveness Analysis, by Region, 2023–2031

Figure 08: North America Mammography Systems Market Value (US$ Mn) Forecast, 2017–2031

Figure 09: North America Mammography Systems Market Value Share Analysis, by Technology, 2022 and 2031

Figure 10: North America Mammography Systems Market Attractiveness Analysis, by Technology, 2023–2031

Figure 11: North America Mammography Systems Market Value Share Analysis, by End-user, 2022 and 2031

Figure 12: North America Mammography Systems Market Attractiveness Analysis, by End-user, 2023–2031

Figure 13: North America Mammography Systems Market Value Share Analysis, by Country, 2022 and 2031

Figure 14: North America Mammography Systems Market Attractiveness Analysis, by Country, 2023–2031

Figure 15: Europe Mammography Systems Market Value (US$ Mn) Forecast, 2017–2031

Figure 16: Europe Mammography Systems Market Value Share Analysis, by Technology, 2022 and 2031

Figure 17: Europe Mammography Systems Market Attractiveness Analysis, by Technology, 2023–2031

Figure 18: Europe Mammography Systems Market Value Share Analysis, by End-user, 2022 and 2031

Figure 19: Europe Mammography Systems Market Attractiveness Analysis, by End-user, 2017–2031

Figure 20: Europe Mammography Systems Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 21: Europe Mammography Systems Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 22: Asia Pacific Mammography Systems Market Value (US$ Mn) Forecast, 2017–2031

Figure 23: Asia Pacific Mammography Systems Market Value Share Analysis, by Technology, 2022 and 2031

Figure 24: Asia Pacific Mammography Systems Market Attractiveness Analysis, by Technology, 2023–2031

Figure 25: Asia Pacific Mammography Systems Market Value Share Analysis, by End-user, 2022 and 2031

Figure 26: Asia Pacific Mammography Systems Market Attractiveness Analysis, by End-user, 2023–2031

Figure 27: Asia Pacific Mammography Systems Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 28: Asia Pacific Mammography Systems Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 29: Latin America Mammography Systems Market Value (US$ Mn) Forecast, 2017–2031

Figure 30: Latin America Mammography Systems Market Value Share Analysis, by Technology, 2022 and 2031

Figure 31: Latin America Mammography Systems Market Attractiveness Analysis, by Technology, 2023–2031

Figure 32: Latin America Mammography Systems Market Value Share Analysis, by End-user, 2022 and 2031

Figure 33: Latin America Mammography Systems Market Attractiveness Analysis, by End-user, 2023–2031

Figure 34: Latin America Mammography Systems Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 35: Latin America Mammography Systems Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 36: Middle East & Africa Mammography Systems Market Value (US$ Mn) Forecast, 2017–2031

Figure 37: Middle East & Africa Mammography Systems Market Value Share Analysis, by Technology, 2022 and 2031

Figure 38: Middle East & Africa Mammography Systems Market Attractiveness Analysis, by Technology, 2023–2031

Figure 39: Middle East & Africa Mammography Systems Market Value Share Analysis, by End-user, 2022 and 2031

Figure 40: Middle East & Africa Mammography Systems Market Attractiveness Analysis, by End-user, 2023–2031

Figure 41: Middle East & Africa Mammography Systems Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 42: Middle East & Africa Mammography Systems Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 43: Global Mammography Systems Market Share Analysis, by Company, 2022