Analysts’ Viewpoint

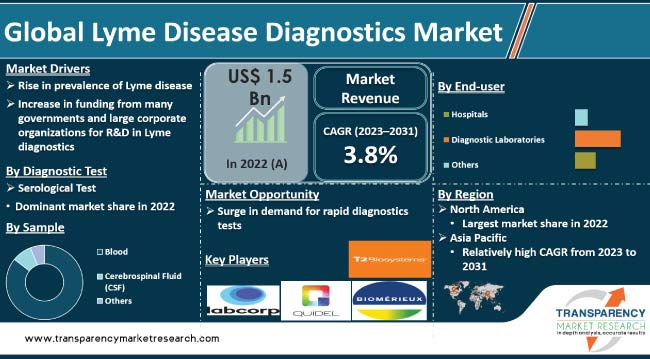

Rise in incidence of the Lyme disease and growth in awareness about diagnostic tests are key Lyme disease diagnostics market drivers. The number of people affected with the Lyme disease is rising, particularly in regions with high prevalence of ticks. Development of advanced diagnostic technologies, such as nucleic acid amplification tests (NAATs), enzyme immunoassays (EIAs), and multiplex assays, has improved the accuracy and efficiency of Lyme disease diagnosis. Availability of innovative diagnostic tools is expected to boost market statistics in the near future.

Increase in funding from several governments and large corporate organizations for R&D in the field of Lyme disease diagnostics is contributing to market growth. Advancements in the field are anticipated to enhance accuracy, sensitivity, and specificity of Lyme disease testing, thereby creating lucrative opportunities for test providers.

Lyme disease diagnostics is a rapidly growing market in the healthcare industry. Lyme disease, caused by the bacteria Borrelia burgdorferi, is a tick-borne illness that spreads to humans through the infected blacklegged ticks. Typical symptoms include fever, headache, tiredness, and skin rash, which can have serious health implications if left untreated.

Prevalence of the Lyme disease has been rising, especially in regions with high tick populations. This has led to an increase in awareness about the disease and need for early detection and treatment. Demand for accurate and efficient diagnostic tools is rising across the globe owing to the growth in incidence of the Lyme disease.

According to the CDC, confirmed cases of the Lyme disease in the U.S. rose to 44.0% from 1999 to 2019. Lyme disease is more prevalent in North America and Europe. According to an article published by BMJ Global Health (June 2022), more than 14.0% of the world’s population is suffering from the tick-borne Lyme disease, indicated by the presence of antibodies in the blood.

There are just a few accurate tests for diagnosis of the Lyme disease. Furthermore, continual mutations and genotypic variations in the bacteria are augmenting the chances of their prevalence among the population across the globe.

Rise in incidence of the disease is encouraging research and development activities in the field of Lyme disease detection technology. As a result, the global Lyme disease diagnostics market is experiencing steady growth.

The serological diagnostic test segment is projected to dominate the global landscape during the forecast period. Serological test is an initial test performed in most cases of suspected Lyme disease. It detects antibodies that the body produces in response to the infection.

Serological test is the most affordable option for Lyme disease diagnosis. ELISA and western blot are the commonly used serological tests. ELISA accounted for the larger market share in 2022. ELISA is known for its high sensitivity in detecting antibodies against Borrelia burgdorferi, the bacteria that causes Lyme disease.

Affordability and widespread availability of ELISA kits and rapid turnaround time for prompt detection have led to high utilization of the diagnostic test in hospitals and other healthcare settings.

The blood sample segment held the largest share of the global Lyme disease diagnostics market in 2022. The trend is expected to continue during the forecast period.

Blood samples are increasingly used to detect the Lyme disease. In Lyme disease tests, physicians are able to visualize the reaction between antibodies in an infected person's blood to specific antigens that cause the disease.

Blood sample can be drawn easily in a doctor’s office or other medical settings. These samples are analyzed with enzyme immunoassay, immunofluorescence assay, or the western blot method for the Lyme disease. For instance, the CDC-approved two-tiered serologic test for Lyme disease is carried out via the blood sample.

The diagnostic laboratories end-user segment accounted for significant market share in 2022. The segment is projected to dominate during the next few years.

Diagnostic labs typically have lower overhead costs than hospitals. They offer Lyme disease tests at more affordable prices, making them more accessible to patients. Diagnostic laboratories adhere to stringent quality assurance protocols to ensure the accuracy and reliability of Lyme disease diagnostic tests.

Diagnostic laboratories also collaborate with research institutes and industry partners to drive innovation in Lyme disease diagnostics. Such collaborations facilitate the development of new diagnostic technologies, improvement of existing testing methods, and validation of novel assays. Diagnostic laboratories are gaining traction due to faster turnaround times, diagnostic testing expertise, and convenience to patients in terms of location and time.

According to the latest Lyme disease diagnostics market forecast, North America is likely to constitute large share of the global industry in the near future. Increase in incidence of the Lyme disease, specifically in the U.S., and presence of a well-established healthcare system are contributing to the Lyme disease diagnostics market growth in the region. Latest advancements in Lyme disease diagnostics in the U.S. are also fueling market dynamics of North America.

Rise in awareness about Lyme disease screening among healthcare professionals and the general population is leading to more proactive testing and early detection of the disease. North America also has a robust diagnostic infrastructure and easy availability of advanced diagnostic tools and assays. This is accelerating Lyme disease diagnostics market development in the region.

The Lyme disease diagnostics market size in Asia Pacific is likely to increase at a steady pace during the forecast period, owing to expansion in the healthcare infrastructure, rise in prevalence of the Lyme disease, growth in R&D efforts, and surge in government initiatives to promote screening programs in the region.

The global landscape is fragmented, with the presence of a few leading players that control majority of the Lyme disease diagnostics market share. As per the latest Lyme disease diagnostics market analysis, these players are involved in mergers & acquisitions, partnerships, strategic collaborations, and new product launches to strengthen their position.

Some of the key players operating in the global market are LabCorp, Quest Diagnostics, Abbott Laboratories, Bio-Rad Laboratories, Inc., bioMérieux SA, DiaSorin S.p.A, T2 Biosystems, Inc., F. Hoffmann-La Roche AG, Meridian Bioscience, Inc., Quidel Corporation, and Thermo Fisher Scientific Inc. These companies are following the latest Lyme disease diagnostics market trends to avail lucrative growth opportunities.

Prominent players have been profiled in the Lyme disease diagnostics market report based on parameters such as product portfolio, company overview, recent developments, financial overview, business strategies, and business segments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 1.5 Bn |

|

Market Forecast Value in 2031 |

More than US$ 2.1 Bn |

|

Growth Rate (CAGR) |

3.8% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 1.5 Bn in 2022

It is projected to reach more than US$ 2.1 Bn 2031

The CAGR is anticipated to be 3.8% from 2023 to 2031

Rise in prevalence of Lyme disease and increase in funding from several governments and large corporate organizations for R&D in Lyme diagnostics

The serological test segment accounted for more than 75.0% share in 2022

North America is anticipated to constitute significant share from 2023 to 2031

LabCorp, Quest Diagnostics, Abbott Laboratories, Bio-Rad Laboratories, Inc., bioMérieux SA, DiaSorin S.p.A., T2 Biosystems, Inc., F. Hoffmann-La Roche AG, Meridian Bioscience, Inc., Quidel Corporation, and Thermo Fisher Scientific Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Lyme Disease Diagnostics Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Lyme Disease Diagnostics Market Analysis and Forecast, 2017-2031

4.4.1. Market Revenue Projection (US$ Mn)

5. Key Insights

5.1. Innovations in Diagnostic Testing for Lyme disease

5.2. Incidence and Prevalence of Lyme Disease

5.3. Regulatory Scenario by Region/Globally

5.4. COVID-19 Pandemic Impact on Industry (Value Chain and Short/Mid/Long Term Impact)

6. Global Lyme Disease Diagnostics Market Analysis and Forecast, by Diagnostic Test

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Diagnostic Test, 2017-2031

6.3.1. Serological Test

6.3.1.1. ELISA

6.3.1.2. Western Blot

6.3.2. Polymerase Chain Reaction (PCR) test

6.3.3. Others

6.4. Market Attractiveness Analysis, by Diagnostic Test

7. Global Lyme Disease Diagnostics Market Analysis and Forecast, by Sample

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Sample, 2017-2031

7.3.1. Blood

7.3.2. Cerebrospinal Fluid (CSF)

7.3.3. Others

7.4. Market Attractiveness Analysis, by Sample

8. Global Lyme Disease Diagnostics Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by End-user, 2017-2031

8.3.1. Hospitals

8.3.2. Diagnostic Laboratories

8.3.3. Others

8.4. Market Attractiveness Analysis, by End-user

9. Global Lyme Disease Diagnostics Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region, 2017-2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Lyme Disease Diagnostics Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Diagnostic Test, 2017-2031

10.2.1. Serological Test

10.2.1.1. ELISA

10.2.1.2. Western Blot

10.2.2. Polymerase Chain Reaction (PCR) test

10.2.3. Others

10.3. Market Value Forecast, by Sample, 2017-2031

10.3.1. Blood

10.3.2. Cerebrospinal Fluid (CSF)

10.3.3. Others

10.4. Market Value Forecast, by End-user, 2017-2031

10.4.1. Hospitals

10.4.2. Diagnostic Laboratories

10.4.3. Others

10.5. Market Value Forecast, by Country, 2017-2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Diagnostic Test

10.6.2. By Sample

10.6.3. By End-user

10.6.4. By Country

11. Europe Lyme Disease Diagnostics Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Diagnostic Test, 2017-2031

11.2.1. Serological Test

11.2.1.1. ELISA

11.2.1.2. Western Blot

11.2.2. Polymerase Chain Reaction (PCR) test

11.2.3. Others

11.3. Market Value Forecast, by Sample, 2017-2031

11.3.1. Blood

11.3.2. Cerebrospinal Fluid (CSF)

11.3.3. Others

11.4. Market Value Forecast, by End-user, 2017-2031

11.4.1. Hospitals

11.4.2. Diagnostic Laboratories

11.4.3. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017-2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Diagnostic Test

11.6.2. By Sample

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Lyme Disease Diagnostics Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Diagnostic Test, 2017-2031

12.2.1. Serological Test

12.2.1.1. ELISA

12.2.1.2. Western Blot

12.2.2. Polymerase Chain Reaction (PCR) test

12.2.3. Others

12.3. Market Value Forecast, by Sample, 2017-2031

12.3.1. Blood

12.3.2. Cerebrospinal Fluid (CSF)

12.3.3. Others

12.4. Market Value Forecast, by End-user, 2017-2031

12.4.1. Hospitals

12.4.2. Diagnostic Laboratories

12.4.3. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017-2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Diagnostic Test

12.6.2. By Sample

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Lyme Disease Diagnostics Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Diagnostic Test, 2017-2031

13.2.1. Serological Test

13.2.1.1. ELISA

13.2.1.2. Western Blot

13.2.2. Polymerase Chain Reaction (PCR) test

13.2.3. Others

13.3. Market Value Forecast, by Sample, 2017-2031

13.3.1. Blood

13.3.2. Cerebrospinal Fluid (CSF)

13.3.3. Others

13.4. Market Value Forecast, by End-user, 2017-2031

13.4.1. Hospitals

13.4.2. Diagnostic Laboratories

13.4.3. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017-2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Diagnostic Test

13.6.2. By Sample

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Lyme Disease Diagnostics Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Diagnostic Test, 2017-2031

14.2.1. Serological Test

14.2.1.1. ELISA

14.2.1.2. Western Blot

14.2.2. Polymerase Chain Reaction (PCR) test

14.2.3. Others

14.3. Market Value Forecast, by Sample, 2017-2031

14.3.1. Blood

14.3.2. Cerebrospinal Fluid (CSF)

14.3.3. Others

14.4. Market Value Forecast, by End-user, 2017-2031

14.4.1. Hospitals

14.4.2. Diagnostic Laboratories

14.4.3. Others

14.5. Market Value Forecast, by Country/Sub-region, 2017-2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Diagnostic Test

14.6.2. By Sample

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (By Tier and Size of Companies)

15.2. Market Share Analysis, by Company (2022)

15.3. Company Profiles

15.3.1. LabCorp

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Product Portfolio

15.3.1.3. Financial Overview

15.3.1.4. SWOT Analysis

15.3.1.5. Strategic Overview

15.3.2. Quest Diagnostics

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Product Portfolio

15.3.2.3. Financial Overview

15.3.2.4. SWOT Analysis

15.3.2.5. Strategic Overview

15.3.3. Abbott Laboratories

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Product Portfolio

15.3.3.3. Financial Overview

15.3.3.4. SWOT Analysis

15.3.3.5. Strategic Overview

15.3.4. Bio-Rad Laboratories, Inc.

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Product Portfolio

15.3.4.3. Financial Overview

15.3.4.4. SWOT Analysis

15.3.4.5. Strategic Overview

15.3.5. bioMérieux SA

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Product Portfolio

15.3.5.3. Financial Overview

15.3.5.4. SWOT Analysis

15.3.5.5. Strategic Overview

15.3.6. DiaSorin S.p.A.

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Product Portfolio

15.3.6.3. Financial Overview

15.3.6.4. SWOT Analysis

15.3.6.5. Strategic Overview

15.3.7. T2 Biosystems, Inc.

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Product Portfolio

15.3.7.3. Financial Overview

15.3.7.4. SWOT Analysis

15.3.7.5. Strategic Overview

15.3.8. F. Hoffmann-La Roche AG

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Product Portfolio

15.3.8.3. Financial Overview

15.3.8.4. SWOT Analysis

15.3.8.5. Strategic Overview

15.3.9. Meridian Bioscience, Inc.

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Product Portfolio

15.3.9.3. Financial Overview

15.3.9.4. SWOT Analysis

15.3.9.5. Strategic Overview

15.3.10. Quidel Corporation

15.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.2. Product Portfolio

15.3.10.3. Financial Overview

15.3.10.4. SWOT Analysis

15.3.10.5. Strategic Overview

List of Tables

Table 01: Global Lyme Disease Diagnostics Market Size (US$ Mn) Forecast, by Diagnostic Test, 2017-2031

Table 02: Global Lyme Disease Diagnostics Market Size (US$ Mn) Forecast, by Serological Test, 2017-2032

Table 03: Global Lyme Disease Diagnostics Market Size (US$ Mn) Forecast, by Sample, 2017-2031

Table 04: Global Lyme Disease Diagnostics Market Size (US$ Mn) Forecast, by End-user, 2017-2032

Table 05: Global Lyme Disease Diagnostics Market Size (US$ Mn) Forecast, by Region, 2017-2031

Table 06: North America Lyme Disease Diagnostics Market Size (US$ Mn) Forecast, by Diagnostic Test, 2017-2031

Table 07: North America Lyme Disease Diagnostics Market Size (US$ Mn) Forecast, by Serological Test, 2017-2031

Table 08: North America Lyme Disease Diagnostics Market Size (US$ Mn) Forecast, by Sample, 2017-2032

Table 09: North America Lyme Disease Diagnostics Market Size (US$ Mn) Forecast, by End-user, 2017-2031

Table 10: North America Lyme Disease Diagnostics Market Size (US$ Mn) Forecast, by Region, 2017-2031

Table 11: Europe Lyme Disease Diagnostics Market Size (US$ Mn) Forecast, by Diagnostic Test, 2017-2031

Table 12: Europe Lyme Disease Diagnostics Market Size (US$ Mn) Forecast, by Serological Test, 2017-2031

Table 13: Europe Lyme Disease Diagnostics Market Size (US$ Mn) Forecast, by Sample, 2017-2031

Table 14: Europe Lyme Disease Diagnostics Market Size (US$ Mn) Forecast, by End-user, 2017-2031

Table 15: Europe Lyme Disease Diagnostics Market Size (US$ Mn) Forecast, by Region, 2017-2031

Table 16: Asia Pacific Lyme Disease Diagnostics Market Size (US$ Mn) Forecast, by Diagnostic Test, 2017-2031

Table 17: Asia Pacific Lyme Disease Diagnostics Market Size (US$ Mn) Forecast, by Serological Test, 2017-2031

Table 18: Asia Pacific Lyme Disease Diagnostics Market Size (US$ Mn) Forecast, by Sample, 2017-2031

Table 19: Asia Pacific Lyme Disease Diagnostics Market Size (US$ Mn) Forecast, by End-user, 2017-2031

Table 20: Asia Pacific Lyme Disease Diagnostics Market Size (US$ Mn) Forecast, by Region, 2017-2031

Table 21: Latin America Lyme Disease Diagnostics Market Size (US$ Mn) Forecast, by Diagnostic Test, 2017-2031

Table 22: Latin America Lyme Disease Diagnostics Market Size (US$ Mn) Forecast, by Serological Test, 2017-2031

Table 23: Latin America Lyme Disease Diagnostics Market Size (US$ Mn) Forecast, by Sample, 2017-2031

Table 24: Latin America Lyme Disease Diagnostics Market Size (US$ Mn) Forecast, by End-user, 2017-2031

Table 25: Latin America Lyme Disease Diagnostics Market Size (US$ Mn) Forecast, by Region, 2017-2031

Table 26: Middle East & Africa Lyme Disease Diagnostics Market Size (US$ Mn) Forecast, by Diagnostic test, 2017-2031

Table 27: Middle East & Africa Lyme Disease Diagnostics Market Size (US$ Mn) Forecast, by Serological Test, 2017-2031

Table 28: Middle East & Africa Lyme Disease Diagnostics Market Size (US$ Mn) Forecast, by Sample, 2017-2031

Table 29: Middle East & Africa Lyme Disease Diagnostics Market Size (US$ Mn) Forecast, by End-user, 2017-2031

Table 30: Middle East & Africa Lyme Disease Diagnostics Market Size (US$ Mn) Forecast, by Region, 2017-2031

List of Figures

Figure 01: Global Lyme Disease Diagnostics Market Value (US$ Mn) Forecast, 2017-2031

Figure 02: Global Lyme Disease Diagnostics Market Value Share, by Diagnostic Test, 2022

Figure 03: Global Lyme Disease Diagnostics Market Value Share, by Sample, 2022

Figure 04: Global Lyme Disease Diagnostics Market Value Share, by End-user, 2022

Figure 05: Global Lyme Disease Diagnostics Market Value Share, Analysis, by Diagnostic Test, 2022 and 2031

Figure 06: Global Lyme Disease Diagnostics Market Revenue (US$ Mn), by Serological Test, 2017-2031

Figure 07: Global Lyme Disease Diagnostics Market Revenue (US$ Mn), by Polymerase Chain Reaction (PCR) Test, 2017-2031

Figure 08: Global Lyme Disease Diagnostics Market Revenue (US$ Mn), by Others, 2017-2031

Figure 09: Global Lyme Disease Diagnostics Market Attractiveness Analysis, by Diagnostic Test, 2023-2031

Figure 10: Global Lyme Disease Diagnostics Market Value Share, Analysis, by Sample, 2022 and 2031

Figure 11: Global Lyme Disease Diagnostics Market Revenue (US$ Mn) by Blood, 2017-2031

Figure 12: Global Lyme Disease Diagnostics Market Revenue (US$ Mn), by Cerebrospinal Fluid (CSF), 2017-2031

Figure 13: Global Lyme Disease Diagnostics Market Revenue (US$ Mn), by Others, 2017-2031

Figure 14: Global Lyme Disease Diagnostics Market Attractiveness Analysis, by Sample, 2023-2031

Figure 15: Global Lyme Disease Diagnostics Market Value Share, Analysis, by End-user, 2022 and 2031

Figure 16: Global Lyme Disease Diagnostics Market Revenue (US$ Mn), by Hospitals, 2017-2031

Figure 17: Global Lyme Disease Diagnostics Market Revenue (US$ Mn), by Diagnostic Laboratories, 2017-2031

Figure 18: Global Lyme Disease Diagnostics Market Revenue (US$ Mn), by Others, 2017-2031

Figure 19: Global Lyme Disease Diagnostics Market Attractiveness Analysis, by End-user, 2023-2031

Figure 20: Global Lyme Disease Diagnostics Market Value Share, Analysis, by Region, 2022 and 2031

Figure 21: Global Lyme Disease Diagnostics Market Attractiveness Analysis, by Region, 2023-2031

Figure 22: North America Lyme Disease Diagnostics Market Value (US$ Mn) Forecast, 2017-2031

Figure 23: North America Lyme Disease Diagnostics Market Value Share, Analysis, by Country, 2022 and 2031

Figure 24: North America Lyme Disease Diagnostics Market Attractiveness Analysis, by Country, 2023-2031

Figure 25: North America Lyme Disease Diagnostics Market Value Share, Analysis, by Diagnostic Test, 2022 and 2031

Figure 26: North America Lyme Disease Diagnostics Market Attractiveness Analysis, by Diagnostic Test, 2023-2031

Figure 27: North America Lyme Disease Diagnostics Market Value Share, Analysis, by Sample, 2022 and 2031

Figure 28: North America Lyme Disease Diagnostics Market Attractiveness Analysis, by Sample, 2023-2031

Figure 29: North America Lyme Disease Diagnostics Market Attractiveness Analysis, by End-user, 2023-2032

Figure 30: North America Lyme Disease Diagnostics Market Attractiveness Analysis, by End-user, 2023-2031

Figure 31: Europe Lyme Disease Diagnostics Market Value (US$ Mn) Forecast, 2017-2031

Figure 32: Europe Lyme Disease Diagnostics Market Value Share, Analysis, by Country, 2022 and 2031

Figure 33: Europe Lyme Disease Diagnostics Market Attractiveness Analysis, by Country, 2023-2031

Figure 34: Europe Lyme Disease Diagnostics Market Value Share, Analysis, by Diagnostic Test, 2022 and 2031

Figure 35: Europe Lyme Disease Diagnostics Market Attractiveness Analysis, by Diagnostic Test, 2023-2031

Figure 36: Europe Lyme Disease Diagnostics Market Value Share Analysis, by Sample, 2022 and 2031

Figure 37: Europe Lyme Disease Diagnostics Market Attractiveness Analysis, by Sample, 2023-2031

Figure 38: Europe Lyme Disease Diagnostics Market Attractiveness Analysis, by End-user, 2023-2032

Figure 39: Europe Lyme Disease Diagnostics Market Attractiveness Analysis, by End-user, 2023-2031

Figure 40: Asia Pacific Lyme Disease Diagnostics Market Value (US$ Mn) Forecast, 2017-2031

Figure 41: Asia Pacific Lyme Disease Diagnostics Market Value Share Analysis, by Country, 2022 and 2031

Figure 42: Asia Pacific Lyme Disease Diagnostics Market Attractiveness Analysis, by Country, 2023-2031

Figure 43: Asia Pacific Lyme Disease Diagnostics Market Value Share, Analysis, by Diagnostic Test, 2022 and 2031

Figure 44: Asia Pacific Lyme Disease Diagnostics Market Attractiveness Analysis, by Diagnostic Test, 2023-2031

Figure 45: Asia Pacific Lyme Disease Diagnostics Market Value Share, Analysis, by Sample, 2022 and 2031

Figure 46: Asia Pacific Lyme Disease Diagnostics Market Attractiveness Analysis, by Sample, 2023-2031

Figure 47: Asia Pacific Lyme Disease Diagnostics Market Attractiveness Analysis, by End-user, 2023-2032

Figure 48: Asia Pacific Lyme Disease Diagnostics Market Attractiveness Analysis, by End-user, 2023-2031

Figure 49: Latin America Lyme Disease Diagnostics Market Value (US$ Mn) Forecast, 2017-2031

Figure 50: Latin America Lyme Disease Diagnostics Market Value Share, Analysis, by Country, 2022 and 2031

Figure 51: Latin America Lyme Disease Diagnostics Market Attractiveness Analysis, by Country, 2023-2031

Figure 52: Latin America Lyme Disease Diagnostics Market Value Share, Analysis, by Diagnostic Test, 2022 and 2031

Figure 53: Latin America Lyme Disease Diagnostics Market Attractiveness Analysis, by Diagnostic Test, 2023-2031

Figure 54: Latin America Lyme Disease Diagnostics Market Value Share Analysis, by Sample, 2022 and 2031

Figure 55: Latin America Lyme Disease Diagnostics Market Attractiveness Analysis, by Sample, 2023-2031

Figure 56: Latin America Lyme Disease Diagnostics Market Attractiveness Analysis, by End-user, 2023-2032

Figure 57: Latin America Lyme Disease Diagnostics Market Attractiveness Analysis, by End-user, 2023-2031

Figure 58: Middle East & Africa Lyme Disease Diagnostics Market Value (US$ Mn), 2017-2031

Figure 59: Middle East & Africa Lyme Disease Diagnostics Market Value Share Analysis, by Country, 2022 and 2031

Figure 60: Middle East & Africa Lyme Disease Diagnostics Market Attractiveness, by Country, 2023-2031

Figure 61: Middle East & Africa Lyme Disease Diagnostics Market Value Share Analysis, by Diagnostic Test, 2022 and 2031

Figure 62: Middle East & Africa Lyme Disease Diagnostics Market Attractiveness, by Diagnostic Test, 2023-2031

Figure 63: Middle East & Africa Lyme Disease Diagnostics Market Value Share Analysis, by Sample, 2022 and 2031

Figure 64: Middle East & Africa Lyme Disease Diagnostics Market Attractiveness, by Sample, 2023-2031

Figure 65: Middle East & Africa Lyme Disease Diagnostics Market Attractiveness, by End-user, 2023-2032

Figure 66: Middle East & Africa Lyme Disease Diagnostics Market Attractiveness, by End-user, 2023-2031

Figure 67: Company Share Analysis Lyme Disease Diagnostics, 2022