Reports

Reports

The luxury handbag market poised to witness consistency supported by brand exclusivity, high quality materials, and superior artisanship. Handbags are looked upon as more than accessories as they have become a status symbol of late. Consumers are attracted to limited edition and collectible creations of legendary brands such as Hermès, Chanel, and Louis Vuitton that may gain value later. The industry is fueled by the escalating brand recognition, social media campaigns, and consumer appreciation for style and long-term value.

The market drivers are investment and collectible value of handbags and the desire of the consumers to recognize a brand and claim some form of social status. Limited edition releases, exclusive designs, and historic brand identity appeal to the high net worth, and fashionable consumer.

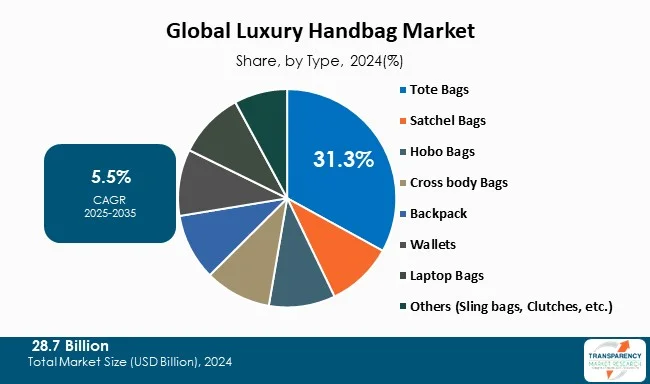

Promotions through social media and celebrity endorsements also increase consumer interaction and brand loyalty. Tote bags are a preferred choice in the handbag market due their multi-functionality and flexibility across various occasions.

Europe dominates the market due to long-term culture of artisanship and luxury brands and highly developed retailing infrastructure with flagship-stores and international fashion shows. The most active regions are North America and Asia-Pacific as the awareness of fashion continues to grow, especially among younger generations.

Luxury handbag market is a part of the fashion industry that deals with luxurious handbags. They are characterized by artisanship, style, and individuality. These are high end bags constructed using high quality materials such as suede, leather, canvas and exotic skin, usually finely decorated, and detailed.

In addition to functionality, luxury handbags are fashion accessories and status symbols in which an individual accumulates personal taste, wealth, and social status.

Designer handbags are categorized in many ways according to design, composition, and usage. The different types of handbags consist of tote bags, shoulder bags, cross body bags, clutch bags, satchels, and backpacks. They target unisex population and are provided in various price ranges between premiums and ultra-luxury.

The major characteristics are durability, versatile compartments, safe closures, and, in some scenarios, a possibility to customize the product with monograms or tailored designs. The consumers are attracted to such types of handbags due to their functional and exclusive nature coupled with their brand identification.

The market seems to have consistent growth worldwide as brand awareness continues to rise as along with social media influence. The luxury brands are also incorporating sustainable materials, partnerships, and online customization to appeal to the younger crowd to make sure that the market keeps evolving vigorously.

| Attribute | Detail |

|---|---|

| Luxury Handbag Market Drivers |

|

Luxury handbags are also gaining acceptance among people as investment-based products rather than fashion products. The items of such legendary brands as Hermès, Chanel, and Louis Vuitton are also symbols of famous brands and become more valuable with time, which makes them desirable to buyers and even collectors.

The relatively small number of limited-edition releases, limited materials, and unique designs appeal to this investment. Some examples include the Birkin and Kelly bags by Hermès, which are not only known to keep themselves stable in value but can, in fact, be sold higher than the initial retail price. This investment outlook pushes the high-net-worth consumers to consume the use of luxury handbags as a status symbol and as long-term assets.

The financial performance of Hermès is a vivid example of this tendency. The Leather Goods and Saddlery industry recorded sales of under 3.58 Bn Euros in just the first half of 2025, of which 1.765 Bn Euros were in the second quarter alone as demand continued to surge on handbags and leather accessories.

High-end handbags are an important source of social and intra-individual identity. Consumers buy the designer handbags, as it is indicative of their social status, sophistication, and style. The influence of celebrities, social media influencers, and other high-profile events intensify the impact. A branded handbag is a symbol of belonging to the elite circle of society that improves the personal prestige of many consumers. This affective and hopeful appeal stimulates repeat buying and brand loyalty, thus making the brand awareness a vital factor in luxury handbag market.

For instance, Hermès’ market performance shows a strong climb in Leather Goods and Saddlery segment due to preference of known high status brands by the consumers. Social acceptance and the status of flaunting luxury products remain deep-rooted impacts of influencing purchasing behavior across the globe while brand awareness and social stature would play a crucial role in maintaining market demand and growth as a whole.

The tote bag segment dominates of the luxury handbag market due to its ability to be used in applicability in diverse scenarios, the spacey design, and its timelessness. Tote bags are wearable and functional, thus a great item to use at work, travelling or in day to day lives. Well-known brands such as Neverfull by Louis Vuitton or Saint Louis by Goyard have become cult items and it supports the idea of tote bags being a necessity in the high-end fashion industry. They are more popular than satchels, hobo bags or wallets because of their flexibility to various occasions.

In addition, tote bags serve as both a gateway to owning luxury and capturing younger and first-time purchasers without losing popularity among luxury shoppers. Tote bags remain aspirational and collectible with customizable features, sustainable materials and limited-edition releases that are frequent. With the support of strong brand recognition, celebrity and the social media presence, tote bags dominate the market compared to other categories.

| Attribute | Detail |

|---|---|

| Leading Region |

|

Europe has occupied the leading position in luxury handbag market due to a strong legacy of artisanship and well-established original brands, which are already famous in the other parts of the world. Brands including Hermès, Louis Vuitton, Chanel, and Prada are Europe-based manufacturers that offer product superiority and status to customers in other global markets.

The region is well endowed with infrastructural retail support; for instance - flagship stores in prime shopping locations and international events in fashion such as Paris and Milan Fashion Weeks. The European consumers also yield high purchasing power and a culture of luxury consumption is deeply entrenched thus acquiring leadership in the market.

The markets in North America and Asia-Pacific are the major ones with high growth potential. North America holds a significant proportion of the global market for luxury handbags as the high income of its people have driven consumption of the products although European brands tend to import such products. Asia-Pacific is currently developing at a faster rate due to raised fashion awareness quotient among the young people in countries such as China, India, Japan, and South Korea. Though these two areas are growing strong, Europe, with its rich history, brand value and developed luxury system manages to stay on the top.

Prominent manufacturers' luxury handbag business models involve mergers and acquisitions, product expansions, and R&D expenditures. One important marketing tactic used by companies in the luxury handbag sector is product development. There are numerous international and regional companies in this fiercely competitive and stagnant sector.

Furla S.p.A., GANNI A/S, Giorgio Armani S.p.A. (Armani), Loeffler Randall, LVMH Moët Hennessy Louis Vuitton SE, Macy's Inc., MAUS Freres SA (The Lacoste Group), Michael Kors Holdings Limited, MILLY NY, Tapestry, Inc. (Coach, Inc.), PVH Corp. (Calvin Klein), Hermès are the major players in the luxury handbag market.

Each of these players has been profiled in the luxury handbag market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

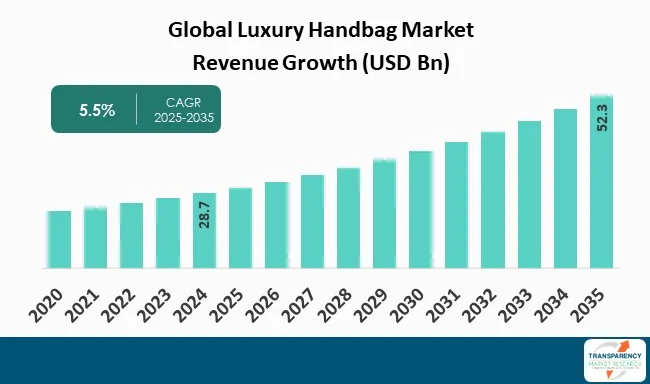

| Size in 2024 | US$ 28.7 Bn |

| Forecast Value in 2035 | US$ 52.3 Bn |

| CAGR | 5.5% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn & Thousand Units for Volume |

| Luxury Handbag Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Type

|

| Regions Covered |

|

| Countries Covered |

|

| Company Profiles |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The luxury handbag market was valued at US$ 28.7 Bn in 2024

The luxury handbag industry is projected to reach at US$ 52.3 Bn by the end of 2035

Collectible value and investment, and consumer desire for brand recognition are some of the factors driving the expansion of luxury handbag market.

The CAGR is anticipated to be 5.5% from 2025 to 2035

Furla S.p.A., GANNI A/S, Giorgio Armani S.p.A. (Armani), Loeffler Randall, LVMH Moët Hennessy Louis Vuitton SE, Macy's Inc., MAUS Freres SA (The Lacoste Group), Michael Kors Holdings Limited, MILLY NY, Tapestry, Inc. (Coach, Inc.), PVH Corp. (Calvin Klein), Hermès and other key players

Table 1: Global Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Type

Table 2: Global Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Type

Table 3: Global Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Category

Table 4: Global Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Category

Table 5: Global Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Design

Table 6: Global Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Design

Table 7: Global Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Material

Table 8: Global Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Material

Table 9: Global Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By End-user

Table 10: Global Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By End-user

Table 11: Global Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Distribution Channel

Table 12: Global Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Distribution Channel

Table 13: Global Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Region

Table 14: Global Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Region

Table 15: North America Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Type

Table 16: North America Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Type

Table 17: North America Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Category

Table 18: North America Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Category

Table 19: North America Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Design

Table 20: North America Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Design

Table 21: North America Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Material

Table 22: North America Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Material

Table 23: North America Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By End-user

Table 24: North America Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By End-user

Table 25: North America Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Distribution Channel

Table 26: North America Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Distribution Channel

Table 27: North America Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Country

Table 28: North America Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Country

Table 29: U.S. Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Type

Table 30: U.S. Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Type

Table 31: U.S. Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Category

Table 32: U.S. Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Category

Table 33: U.S. Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Design

Table 34: U.S. Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Design

Table 35: U.S. Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Material

Table 36: U.S. Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Material

Table 37: U.S. Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By End-user

Table 38: U.S. Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By End-user

Table 39: U.S. Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Distribution Channel

Table 40: U.S. Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Distribution Channel

Table 41: Canada Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Type

Table 42: Canada Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Type

Table 43: Canada Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Category

Table 44: Canada Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Category

Table 45: Canada Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Design

Table 46: Canada Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Design

Table 47: Canada Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Material

Table 48: Canada Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Material

Table 49: Canada Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By End-user

Table 50: Canada Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By End-user

Table 51: Canada Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Distribution Channel

Table 52: Canada Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Distribution Channel

Table 53: Europe Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Type

Table 54: Europe Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Type

Table 55: Europe Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Category

Table 56: Europe Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Category

Table 57: Europe Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Design

Table 58: Europe Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Design

Table 59: Europe Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Material

Table 60: Europe Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Material

Table 61: Europe Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By End-user

Table 62: Europe Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By End-user

Table 63: Europe Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Distribution Channel

Table 64: Europe Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Distribution Channel

Table 65: Europe Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Country

Table 66: Europe Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Country

Table 67: U.K. Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Type

Table 68: U.K. Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Type

Table 69: U.K. Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Category

Table 70: U.K. Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Category

Table 71: U.K. Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Design

Table 72: U.K. Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Design

Table 73: U.K. Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Material

Table 74: U.K. Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Material

Table 75: U.K. Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By End-user

Table 76: U.K. Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By End-user

Table 77: U.K. Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Distribution Channel

Table 78: U.K. Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Distribution Channel

Table 79: Germany Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Type

Table 80: Germany Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Type

Table 81: Germany Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Category

Table 82: Germany Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Category

Table 83: Germany Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Design

Table 84: Germany Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Design

Table 85: Germany Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Material

Table 86: Germany Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Material

Table 87: Germany Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By End-user

Table 88: Germany Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By End-user

Table 89: Germany Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Distribution Channel

Table 90: Germany Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Distribution Channel

Table 91: France Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Type

Table 92: France Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Type

Table 93: France Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Category

Table 94: France Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Category

Table 95: France Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Design

Table 96: France Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Design

Table 97: France Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Material

Table 98: France Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Material

Table 99: France Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035By End-user

Table 100: France Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By End-user

Table 101: France Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Distribution Channel

Table 102: France Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Distribution Channel

Table 103: Italy Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Type

Table 104: Italy Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Type

Table 105: Italy Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Category

Table 106: Italy Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Category

Table 107: Italy Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Design

Table 108: Italy Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Design

Table 109: Italy Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Material

Table 110: Italy Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Material

Table 111: Italy Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By End-user

Table 112: Italy Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By End-user

Table 113: Italy Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Distribution Channel

Table 114: Italy Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Distribution Channel

Table 115: Spain Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Type

Table 116: Spain Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Type

Table 117: Spain Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Category

Table 118: Spain Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Category

Table 119: Spain Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Design

Table 120: Spain Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Design

Table 121: Spain Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Material

Table 122: Spain Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Material

Table 123: Spain Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By End-user

Table 124: Spain Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By End-user

Table 125: Spain Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Distribution Channel

Table 126: Spain Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Distribution Channel

Table 127: The Netherlands Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Type

Table 128: The Netherlands Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Type

Table 129: The Netherlands Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Category

Table 130: The Netherlands Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Category

Table 131: The Netherlands Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Design

Table 132: The Netherlands Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Design

Table 133: The Netherlands Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Material

Table 134: The Netherlands Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Material

Table 135: The Netherlands Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By End-user

Table 136: The Netherlands Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By End-user

Table 137: The Netherlands Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Distribution Channel

Table 138: The Netherlands Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Distribution Channel

Table 139: Asia Pacific Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Type

Table 140: Asia Pacific Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Type

Table 141: Asia Pacific Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Category

Table 142: Asia Pacific Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Category

Table 143: Asia Pacific Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Design

Table 144: Asia Pacific Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Design

Table 145: Asia Pacific Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Material

Table 146: Asia Pacific Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Material

Table 147: Asia Pacific Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By End-user

Table 148: Asia Pacific Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By End-user

Table 149: Asia Pacific Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Distribution Channel

Table 150: Asia Pacific Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Distribution Channel

Table 151: Asia Pacific Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Country

Table 152: Asia Pacific Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Country

Table 153: China Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Type

Table 154: China Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Type

Table 155: China Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Category

Table 156: China Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Category

Table 157: China Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Design

Table 158: China Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Design

Table 159: China Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Material

Table 160: China Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Material

Table 161: China Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By End-user

Table 162: China Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By End-user

Table 163: China Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Distribution Channel

Table 164: China Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Distribution Channel

Table 165: India Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Type

Table 166: India Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Type

Table 167: India Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Category

Table 168: India Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Category

Table 169: India Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Design

Table 170: India Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Design

Table 171: India Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Material

Table 172: India Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Material

Table 173: India Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By End-user

Table 174: India Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By End-user

Table 175: India Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Distribution Channel

Table 176: India Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Distribution Channel

Table 177: Japan Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Type

Table 178: Japan Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Type

Table 179: Japan Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Category

Table 180: Japan Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Category

Table 181: Japan Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Design

Table 182: Japan Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Design

Table 183: Japan Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Material

Table 184: Japan Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Material

Table 185: Japan Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By End-user

Table 186: Japan Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By End-user

Table 187: Japan Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Distribution Channel

Table 188: Japan Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Distribution Channel

Table 189: Australia Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Type

Table 190: Australia Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Type

Table 191: Australia Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Category

Table 192: Australia Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Category

Table 193: Australia Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Design

Table 194: Australia Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Design

Table 195: Australia Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Material

Table 196: Australia Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Material

Table 197: Australia Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By End-user

Table 198: Australia Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By End-user

Table 199: Australia Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Distribution Channel

Table 200: Australia Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Distribution Channel

Table 201: South Korea Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Type

Table 202: South Korea Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Type

Table 203: South Korea Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Category

Table 204: South Korea Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Category

Table 205: South Korea Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Design

Table 206: South Korea Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Design

Table 207: South Korea Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Material

Table 208: South Korea Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Material

Table 209: South Korea Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By End-user

Table 210: South Korea Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By End-user

Table 211: South Korea Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Distribution Channel

Table 212: South Korea Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Distribution Channel

Table 213: ASEAN Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Type

Table 214: ASEAN Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Type

Table 215: ASEAN Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Category

Table 216: ASEAN Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Category

Table 217: ASEAN Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Design

Table 218: ASEAN Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Design

Table 219: ASEAN Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Material

Table 220: ASEAN Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Material

Table 221: ASEAN Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By End-user

Table 222: ASEAN Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By End-user

Table 223: ASEAN Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Distribution Channel

Table 224: ASEAN Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Distribution Channel

Table 225: Middle East & Africa Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Type

Table 226: Middle East & Africa Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Type

Table 227: Middle East & Africa Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Category

Table 228: Middle East & Africa Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Category

Table 229: Middle East & Africa Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Design

Table 230: Middle East & Africa Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Design

Table 231: Middle East & Africa Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Material

Table 232: Middle East & Africa Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Material

Table 233: Middle East & Africa Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By End-user

Table 234: Middle East & Africa Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By End-user

Table 235: Middle East & Africa Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Distribution Channel

Table 236: Middle East & Africa Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Distribution Channel

Table 237: Middle East & Africa Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Country

Table 238: Middle East & Africa Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Country

Table 239: GCC Countries Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Type

Table 240: GCC Countries Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Type

Table 241: GCC Countries Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Category

Table 242: GCC Countries Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Category

Table 243: GCC Countries Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Design

Table 244: GCC Countries Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Design

Table 245: GCC Countries Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Material

Table 246: GCC Countries Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Material

Table 247: GCC Countries Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By End-user

Table 248: GCC Countries Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By End-user

Table 249: GCC Countries Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Distribution Channel

Table 250: GCC Countries Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Distribution Channel

Table 251: South Africa Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Type

Table 252: South Africa Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Type

Table 253: South Africa Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Category

Table 254: South Africa Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Category

Table 255: South Africa Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Design

Table 256: South Africa Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Design

Table 257: South Africa Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Material

Table 258: South Africa Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Material

Table 259: South Africa Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By End-user

Table 260: South Africa Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By End-user

Table 261: South Africa Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Distribution Channel

Table 262: South Africa Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Distribution Channel

Table 263: Latin America Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Type

Table 264: Latin America Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Type

Table 265: Latin America Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Category

Table 266: Latin America Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Category

Table 267: Latin America Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Design

Table 268: Latin America Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Design

Table 269: Latin America Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Material

Table 270: Latin America Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Material

Table 271: Latin America Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By End-user

Table 272: Latin America Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By End-user

Table 273: Latin America Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Distribution Channel

Table 274: Latin America Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Distribution Channel

Table 275: Latin America Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Country

Table 276: Latin America Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Country

Table 277: Brazil Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Type

Table 278: Brazil Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Type

Table 279: Brazil Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Category

Table 280: Brazil Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Category

Table 281: Brazil Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Design

Table 282: Brazil Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Design

Table 283: Brazil Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Material

Table 284: Brazil Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Material

Table 285: Brazil Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By End-user

Table 286: Brazil Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By End-user

Table 287: Brazil Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Distribution Channel

Table 288: Brazil Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Distribution Channel

Table 289: Argentina Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Type

Table 290: Argentina Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Type

Table 291: Argentina Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Category

Table 292: Argentina Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Category

Table 293: Argentina Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Design

Table 294: Argentina Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Design

Table 295: Argentina Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Material

Table 296: Argentina Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Material

Table 297: Argentina Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By End-user

Table 298: Argentina Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By End-user

Table 299: Argentina Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Distribution Channel

Table 300: Argentina Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Distribution Channel

Table 301: Mexico Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Type

Table 302: Mexico Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Type

Table 303: Mexico Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Category

Table 304: Mexico Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Category

Table 305: Mexico Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Design

Table 306: Mexico Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Design

Table 307: Mexico Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Material

Table 308: Mexico Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Material

Table 309: Mexico Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By End-user

Table 310: Mexico Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By End-user

Table 311: Mexico Luxury Handbag Market Value (US$ Bn) Projection, 2020 to 2035, By Distribution Channel

Table 312: Mexico Luxury Handbag Market Volume (Thousand Units) Projection, 2020 to 2035, By Distribution Channel

Figure 1: Global Luxury Handbag Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 2: Global Luxury Handbag Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 3: Global Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 4: Global Luxury Handbag Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 5: Global Luxury Handbag Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Figure 6: Global Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 7: Global Luxury Handbag Market Value (US$ Bn) Projection, By Design 2020 to 2035

Figure 8: Global Luxury Handbag Market Volume (Thousand Units) Projection, By Design 2020 to 2035

Figure 9: Global Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Design 2025 to 2035

Figure 10: Global Luxury Handbag Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 11: Global Luxury Handbag Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 12: Global Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 13: Global Luxury Handbag Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Figure 14: Global Luxury Handbag Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Figure 15: Global Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2025 to 2035

Figure 16: Global Luxury Handbag Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 17: Global Luxury Handbag Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 18: Global Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 19: Global Luxury Handbag Market Value (US$ Bn) Projection, By Region 2020 to 2035

Figure 20: Global Luxury Handbag Market Volume (Thousand Units) Projection, By Region 2020 to 2035

Figure 21: Global Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Region 2025 to 2035

Figure 22: North America Luxury Handbag Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 23: North America Luxury Handbag Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 24: North America Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 25: North America Luxury Handbag Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 26: North America Luxury Handbag Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Figure 27: North America Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 28: North America Luxury Handbag Market Value (US$ Bn) Projection, By Design 2020 to 2035

Figure 29: North America Luxury Handbag Market Volume (Thousand Units) Projection, By Design 2020 to 2035

Figure 30: North America Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Design 2025 to 2035

Figure 31: North America Luxury Handbag Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 32: North America Luxury Handbag Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 33: North America Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 34: North America Luxury Handbag Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Figure 35: North America Luxury Handbag Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Figure 36: North America Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2025 to 2035

Figure 37: North America Luxury Handbag Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 38: North America Luxury Handbag Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 39: North America Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 40: North America Luxury Handbag Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 41: North America Luxury Handbag Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 42: North America Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 43: U.S. Luxury Handbag Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 44: U.S. Luxury Handbag Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 45: U.S. Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 46: U.S. Luxury Handbag Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 47: U.S. Luxury Handbag Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Figure 48: U.S. Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 49: U.S. Luxury Handbag Market Value (US$ Bn) Projection, By Design 2020 to 2035

Figure 50: U.S. Luxury Handbag Market Volume (Thousand Units) Projection, By Design 2020 to 2035

Figure 51: U.S. Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Design 2025 to 2035

Figure 52: U.S. Luxury Handbag Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 53: U.S. Luxury Handbag Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 54: U.S. Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 55: U.S. Luxury Handbag Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Figure 56: U.S. Luxury Handbag Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Figure 57: U.S. Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2025 to 2035

Figure 58: U.S. Luxury Handbag Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 59: U.S. Luxury Handbag Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 60: U.S. Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 61: Canada Luxury Handbag Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 62: Canada Luxury Handbag Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 63: Canada Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 64: Canada Luxury Handbag Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 65: Canada Luxury Handbag Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Figure 66: Canada Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 67: Canada Luxury Handbag Market Value (US$ Bn) Projection, By Design 2020 to 2035

Figure 68: Canada Luxury Handbag Market Volume (Thousand Units) Projection, By Design 2020 to 2035

Figure 69: Canada Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Design 2025 to 2035

Figure 70: Canada Luxury Handbag Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 71: Canada Luxury Handbag Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 72: Canada Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 73: Canada Luxury Handbag Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Figure 74: Canada Luxury Handbag Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Figure 75: Canada Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2025 to 2035

Figure 76: Canada Luxury Handbag Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 77: Canada Luxury Handbag Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 78: Canada Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 79: Europe Luxury Handbag Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 80: Europe Luxury Handbag Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 81: Europe Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 82: Europe Luxury Handbag Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 83: Europe Luxury Handbag Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Figure 84: Europe Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 85: Europe Luxury Handbag Market Value (US$ Bn) Projection, By Design 2020 to 2035

Figure 86: Europe Luxury Handbag Market Volume (Thousand Units) Projection, By Design 2020 to 2035

Figure 87: Europe Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Design 2025 to 2035

Figure 88: Europe Luxury Handbag Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 89: Europe Luxury Handbag Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 90: Europe Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 91: Europe Luxury Handbag Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Figure 92: Europe Luxury Handbag Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Figure 93: Europe Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2025 to 2035

Figure 94: Europe Luxury Handbag Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 95: Europe Luxury Handbag Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 96: Europe Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 97: Europe Luxury Handbag Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 98: Europe Luxury Handbag Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 99: Europe Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 100: U.K. Luxury Handbag Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 101: U.K. Luxury Handbag Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 102: U.K. Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 103: U.K. Luxury Handbag Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 104: U.K. Luxury Handbag Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Figure 105: U.K. Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 106: U.K. Luxury Handbag Market Value (US$ Bn) Projection, By Design 2020 to 2035

Figure 107: U.K. Luxury Handbag Market Volume (Thousand Units) Projection, By Design 2020 to 2035

Figure 108: U.K. Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Design 2025 to 2035

Figure 109: U.K. Luxury Handbag Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 110: U.K. Luxury Handbag Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 111: U.K. Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 112: U.K. Luxury Handbag Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Figure 113: U.K. Luxury Handbag Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Figure 114: U.K. Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2025 to 2035

Figure 115: U.K. Luxury Handbag Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 116: U.K. Luxury Handbag Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 117: U.K. Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 118: Germany Luxury Handbag Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 119: Germany Luxury Handbag Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 120: Germany Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 121: Germany Luxury Handbag Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 122: Germany Luxury Handbag Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Figure 123: Germany Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 124: Germany Luxury Handbag Market Value (US$ Bn) Projection, By Design 2020 to 2035

Figure 125: Germany Luxury Handbag Market Volume (Thousand Units) Projection, By Design 2020 to 2035

Figure 126: Germany Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Design 2025 to 2035

Figure 127: Germany Luxury Handbag Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 128: Germany Luxury Handbag Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 129: Germany Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 130: Germany Luxury Handbag Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Figure 131: Germany Luxury Handbag Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Figure 132: Germany Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2025 to 2035

Figure 133: Germany Luxury Handbag Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 134: Germany Luxury Handbag Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 135: Germany Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 136: France Luxury Handbag Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 137: France Luxury Handbag Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 138: France Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 139: France Luxury Handbag Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 140: France Luxury Handbag Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Figure 141: France Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 142: France Luxury Handbag Market Value (US$ Bn) Projection, By Design 2020 to 2035

Figure 143: France Luxury Handbag Market Volume (Thousand Units) Projection, By Design 2020 to 2035

Figure 144: France Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Design 2025 to 2035

Figure 145: France Luxury Handbag Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 146: France Luxury Handbag Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 147: France Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 148: France Luxury Handbag Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Figure 149: France Luxury Handbag Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Figure 150: France Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2025 to 2035

Figure 151: France Luxury Handbag Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 152: France Luxury Handbag Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 153: France Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 154: Italy Luxury Handbag Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 155: Italy Luxury Handbag Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 156: Italy Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 157: Italy Luxury Handbag Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 158: Italy Luxury Handbag Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Figure 159: Italy Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 160: Italy Luxury Handbag Market Value (US$ Bn) Projection, By Design 2020 to 2035

Figure 161: Italy Luxury Handbag Market Volume (Thousand Units) Projection, By Design 2020 to 2035

Figure 162: Italy Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Design 2025 to 2035

Figure 163: Italy Luxury Handbag Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 164: Italy Luxury Handbag Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 165: Italy Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 166: Italy Luxury Handbag Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Figure 167: Italy Luxury Handbag Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Figure 168: Italy Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2025 to 2035

Figure 169: Italy Luxury Handbag Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 170: Italy Luxury Handbag Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 171: Italy Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 172: Spain Luxury Handbag Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 173: Spain Luxury Handbag Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 174: Spain Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 175: Spain Luxury Handbag Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 176: Spain Luxury Handbag Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Figure 177: Spain Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 178: Spain Luxury Handbag Market Value (US$ Bn) Projection, By Design 2020 to 2035

Figure 179: Spain Luxury Handbag Market Volume (Thousand Units) Projection, By Design 2020 to 2035

Figure 180: Spain Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Design 2025 to 2035

Figure 181: Spain Luxury Handbag Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 182: Spain Luxury Handbag Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 183: Spain Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 184: Spain Luxury Handbag Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Figure 185: Spain Luxury Handbag Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Figure 186: Spain Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2025 to 2035

Figure 187: Spain Luxury Handbag Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 188: Spain Luxury Handbag Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 189: Spain Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 190: The Netherlands Luxury Handbag Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 191: The Netherlands Luxury Handbag Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 192: The Netherlands Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 193: The Netherlands Luxury Handbag Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 194: The Netherlands Luxury Handbag Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Figure 195: The Netherlands Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 196: The Netherlands Luxury Handbag Market Value (US$ Bn) Projection, By Design 2020 to 2035

Figure 197: The Netherlands Luxury Handbag Market Volume (Thousand Units) Projection, By Design 2020 to 2035

Figure 198: The Netherlands Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Design 2025 to 2035

Figure 199: The Netherlands Luxury Handbag Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 200: The Netherlands Luxury Handbag Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 201: The Netherlands Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 202: The Netherlands Luxury Handbag Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Figure 203: The Netherlands Luxury Handbag Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Figure 204: The Netherlands Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2025 to 2035

Figure 205: The Netherlands Luxury Handbag Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 206: The Netherlands Luxury Handbag Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 207: The Netherlands Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 208: Asia Pacific Luxury Handbag Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 209: Asia Pacific Luxury Handbag Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 210: Asia Pacific Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 211: Asia Pacific Luxury Handbag Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 212: Asia Pacific Luxury Handbag Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Figure 213: Asia Pacific Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 214: Asia Pacific Luxury Handbag Market Value (US$ Bn) Projection, By Design 2020 to 2035

Figure 215: Asia Pacific Luxury Handbag Market Volume (Thousand Units) Projection, By Design 2020 to 2035

Figure 216: Asia Pacific Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Design 2025 to 2035

Figure 217: Asia Pacific Luxury Handbag Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 218: Asia Pacific Luxury Handbag Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 219: Asia Pacific Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 220: Asia Pacific Luxury Handbag Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Figure 221: Asia Pacific Luxury Handbag Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Figure 222: Asia Pacific Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2025 to 2035

Figure 223: Asia Pacific Luxury Handbag Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 224: Asia Pacific Luxury Handbag Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 225: Asia Pacific Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 226: Asia Pacific Luxury Handbag Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 227: Asia Pacific Luxury Handbag Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 228: Asia Pacific Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 229: China Luxury Handbag Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 230: China Luxury Handbag Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 231: China Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 232: China Luxury Handbag Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 233: China Luxury Handbag Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Figure 234: China Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 235: China Luxury Handbag Market Value (US$ Bn) Projection, By Design 2020 to 2035

Figure 236: China Luxury Handbag Market Volume (Thousand Units) Projection, By Design 2020 to 2035

Figure 237: China Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Design 2025 to 2035

Figure 238: China Luxury Handbag Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 239: China Luxury Handbag Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 240: China Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 241: China Luxury Handbag Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Figure 242: China Luxury Handbag Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Figure 243: China Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2025 to 2035

Figure 244: China Luxury Handbag Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 245: China Luxury Handbag Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 246: China Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 247: India Luxury Handbag Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 248: India Luxury Handbag Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 249: India Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 250: India Luxury Handbag Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 251: India Luxury Handbag Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Figure 252: India Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 253: India Luxury Handbag Market Value (US$ Bn) Projection, By Design 2020 to 2035

Figure 254: India Luxury Handbag Market Volume (Thousand Units) Projection, By Design 2020 to 2035

Figure 255: India Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Design 2025 to 2035

Figure 256: India Luxury Handbag Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 257: India Luxury Handbag Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 258: India Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 259: India Luxury Handbag Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Figure 260: India Luxury Handbag Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Figure 261: India Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2025 to 2035

Figure 262: India Luxury Handbag Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 263: India Luxury Handbag Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 264: India Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 265: Japan Luxury Handbag Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 266: Japan Luxury Handbag Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 267: Japan Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 268: Japan Luxury Handbag Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 269: Japan Luxury Handbag Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Figure 270: Japan Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 271: Japan Luxury Handbag Market Value (US$ Bn) Projection, By Design 2020 to 2035

Figure 272: Japan Luxury Handbag Market Volume (Thousand Units) Projection, By Design 2020 to 2035

Figure 273: Japan Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Design 2025 to 2035

Figure 274: Japan Luxury Handbag Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 275: Japan Luxury Handbag Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 276: Japan Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 277: Japan Luxury Handbag Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Figure 278: Japan Luxury Handbag Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Figure 279: Japan Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2025 to 2035

Figure 280: Japan Luxury Handbag Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 281: Japan Luxury Handbag Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 282: Japan Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 283: Australia Luxury Handbag Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 284: Australia Luxury Handbag Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 285: Australia Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 286: Australia Luxury Handbag Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 287: Australia Luxury Handbag Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Figure 288: Australia Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 289: Australia Luxury Handbag Market Value (US$ Bn) Projection, By Design 2020 to 2035

Figure 290: Australia Luxury Handbag Market Volume (Thousand Units) Projection, By Design 2020 to 2035

Figure 291: Australia Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Design 2025 to 2035

Figure 292: Australia Luxury Handbag Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 293: Australia Luxury Handbag Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 294: Australia Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 295: Australia Luxury Handbag Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Figure 296: Australia Luxury Handbag Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Figure 297: Australia Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2025 to 2035

Figure 298: Australia Luxury Handbag Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 299: Australia Luxury Handbag Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 300: Australia Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 301: South Korea Luxury Handbag Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 302: South Korea Luxury Handbag Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 303: South Korea Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 304: South Korea Luxury Handbag Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 305: South Korea Luxury Handbag Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Figure 306: South Korea Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 307: South Korea Luxury Handbag Market Value (US$ Bn) Projection, By Design 2020 to 2035

Figure 308: South Korea Luxury Handbag Market Volume (Thousand Units) Projection, By Design 2020 to 2035

Figure 309: South Korea Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Design 2025 to 2035

Figure 310: South Korea Luxury Handbag Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 311: South Korea Luxury Handbag Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 312: South Korea Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 313: South Korea Luxury Handbag Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Figure 314: South Korea Luxury Handbag Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Figure 315: South Korea Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2025 to 2035

Figure 316: South Korea Luxury Handbag Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 317: South Korea Luxury Handbag Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 318: South Korea Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 319: ASEAN Luxury Handbag Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 320: ASEAN Luxury Handbag Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 321: ASEAN Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 322: ASEAN Luxury Handbag Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 323: ASEAN Luxury Handbag Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Figure 324: ASEAN Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 325: ASEAN Luxury Handbag Market Value (US$ Bn) Projection, By Design 2020 to 2035

Figure 326: ASEAN Luxury Handbag Market Volume (Thousand Units) Projection, By Design 2020 to 2035

Figure 327: ASEAN Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Design 2025 to 2035

Figure 328: ASEAN Luxury Handbag Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 329: ASEAN Luxury Handbag Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 330: ASEAN Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 331: ASEAN Luxury Handbag Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Figure 332: ASEAN Luxury Handbag Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Figure 333: ASEAN Luxury Handbag Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2025 to 2035

Figure 334: ASEAN Luxury Handbag Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 335: ASEAN Luxury Handbag Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035