Analysts’ Viewpoint

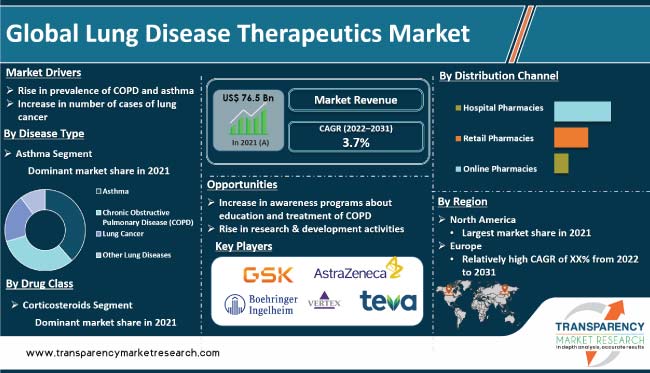

Lung disease therapeutics, such as drugs, are used to treat various lung diseases. High incidence and prevalence of Chronic Obstructive Pulmonary Disease (COPD) and rise in awareness programs are driving the global lung disease therapeutics market. Ongoing research & development activities and launch of products for the treatment of COPD are fueling market expansion. Advancements in technology, such as development of biologic therapies, are expected to augment market progress in the near future.

Development of new approaches in therapeutic agent delivery, vaccine development, and nanotechnology-based medical detections are likely to present lucrative opportunities to market players. Companies are focusing on developing new drugs and treatments to improve treatment options for patients with lung disease.

Lung disease therapeutics include a range of drugs and treatments used to manage various lung conditions, including asthma, COPD, lung cancer, and idiopathic pulmonary fibrosis (IPF). The market is driven by factors such as rise in aging population, increase in rate of smoking, growth in air pollution, and surge in awareness about lung diseases.

Some respiratory diseases are acute, such as an infection, and improve with treatment. Other diseases are chronic and must be managed. Chronic respiratory conditions can be caused by various lung diseases. Millions of people in the U.S. suffer from chronic respiratory diseases. Lung diseases are classified into specific conditions; hence, it is difficult to estimate how many people suffer from them.

Asthma is the largest segment of the lung disease therapeutics market, due to its high prevalence and the need for ongoing treatment and management. Asthma affects 24.8 million people in the U.S., including 5.5 million children, and is responsible for millions of emergency department visits and tens of billions of dollars in healthcare costs each year.

Increase in prevalence of lung cancer is a key driver of lung disease therapeutics market growth. It is the leading cause of cancer-related deaths globally, with a projected 1.8 million deaths per year. Incidence of the disease is expected to rise in the next few years. Development of new treatments, such as immunotherapies and targeted therapies, has improved the survival rate and management of lung cancer patients.

Lung cancer is the second most common cancer in both men and women in the U.S., with an estimated 228,820 new cases and 135,720 deaths in 2021. The five-year survival rate for lung cancer is 18%, which is lower than many other types of cancer.

Increase in adoption of screening and early detection methods are expected to contribute to market growth in the next few years. Rise in sophistication in treatment and management of lung cancer is also anticipated to augment market expansion.

Increase in incidence of COPD and rich clinical trial pipeline for new treatments are projected to boost lung disease therapeutics market size. COPD is a major public health concern due to high prevalence and significant impact on quality of life and mortality. Development of new treatments, such as biologics and targeted therapies, is estimated to improve the management of COPD and other lung diseases, leading to an increase in demand for these products. Additionally, the market is expected to benefit from the development of new indications for existing therapies and introduction of new combination therapies.

Leading COPD companies, such as Sanofi, United Therapeutics Corporation, AstraZeneca, Verona Pharma plc, Novartis, Genentech, and Vertex Pharmaceuticals, are focusing on developing new molecules. In September 2021, Renovion and the COPD Foundation announced a new partnership to accelerate the development of a novel therapy for the treatment of excessive airway mucus and inflammation in people with COPD and non-cystic fibrosis (CF) bronchiectasis.

In terms of disease type, the asthma segment accounted for significant global lung disease therapeutics market share in 2021. Asthma is a chronic lung disease that affects the airways, making it difficult to breathe. It is characterized by inflammation and narrowing of the airways, leading to symptoms such as wheezing, coughing, and shortness of breath.

High prevalence and the need for ongoing treatment & management can be ascribed to the large market share of the segment. Different types of medication, including inhaled corticosteroids, beta-agonists, and leukotriene modifiers, are used to manage asthma symptoms and prevent exacerbations.

Based on drug class, the corticosteroids segment led the global lung disease therapeutics market in 2021. Corticosteroids are a class of drugs commonly used to treat lung diseases such as asthma and COPD. These drugs reduce inflammation in the airways, which helps improve breathing.

High effectiveness can be ascribed to the corticosteroids segment's significant share of the lung disease therapeutics market. These drugs are widely used in the treatment of various lung diseases and have been proven to be safe and effective. Therefore, they are often prescribed as first-line therapy for several lung diseases.

The bronchodilators segment held the second-largest share of the market in 2021. Bronchodilator is a type of medication that makes breathing easier. It relaxes the muscles in the lungs and widens the airways. This drug class is used to treat long-term conditions such as asthma and COPD.

In terms of distribution channel, the hospital pharmacies segment dominated the global lung disease therapeutics industry in 2021. Hospital pharmacies are responsible for supplying and dispensing medications to inpatients. Thus, they play a critical role in the management of lung diseases such as COPD and asthma.

Hospital pharmacies have access to a range of medications, including specialized therapeutics for lung diseases. These pharmacies are staffed by trained pharmacists who provide expert advice on medication usage and management. Hospital pharmacies are closely connected to other healthcare professionals such as doctors and nurses, leading to better coordination of care and improved patient outcomes.

Hospital pharmacies have the infrastructure and resources to handle complex medication regimens and manage potential drug interactions or adverse reactions. They also play a key role in monitoring and managing the usage of antibiotics, which are often prescribed for lung infection treatment.

North America accounted for the largest share in 2021. The region has a well-established market and advanced healthcare systems. Market players are making significant investments in research & development activities in the region. Furthermore, high prevalence of lung diseases, such as COPD and asthma, is driving market statistics in North America.

Emerging markets in Asia Pacific and Latin America have less investment in the lung disease therapeutics industry and low prevalence of lung diseases. However, these regions are likely to witness significant market development in the next few years due to improvement in healthcare systems and increase in prevalence of lung diseases.

As per lung disease therapeutics market analysis, Middle East & Africa held small share in 2021. The market in the region is expected to experience robust growth during the forecast period. This can be ascribed to the increase in efforts to improve healthcare infrastructure and rise in patient access to treatment.

Expansion of product portfolio and merger & acquisition are the key strategies adopted by prominent manufacturers in the global lung disease therapeutics market. GSK, AstraZeneca, Boehringer Ingelheim, IQVIA, Novartis, Vertex Pharmaceuticals, F. Hoffman La Roche, Teva Pharmaceuticals, Cipla, Fibrogen, Liminal Biosciences, and PharmAkea Therapeutics are the prominent players in the market.

The lung disease therapeutics market report profiles key players based on parameters such as company overview, financial overview, strategies, portfolio, segments, and recent developments.

|

Attribute |

Detail |

|

Size in 2021 |

US$ 76.5 Bn |

|

Forecast (Value) in 2031 |

More than US$ 109.4 Bn |

|

Growth Rate (CAGR) |

3.7% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The industry was valued at US$ 76.5 Bn in 2021.

It is projected to reach more than US$ 109.4 Bn by 2031.

The CAGR is anticipated to be 3.7% from 2022 to 2031.

Rise in prevalence of chronic obstructive pulmonary disease (COPD) & asthma and increase in number of cases of lung cancer.

North America is projected to account for significant share during the forecast period.

GSK, AstraZeneca, IQVIA, Boehringer Ingelheim, Novartis, Vertex Pharmaceuticals, F. Hoffman La Roche, Teva Pharmaceuticals, Cipla, Fibrogen, Liminal Biosciences, and PharmAkea Therapeutics.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Lung Disease Therapeutics Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Lung Disease Therapeutics Market Analysis and Forecast, 2017–2031

5. Key Insights

5.1. Technological Advancements

5.2. Drug Pipeline Analysis

5.3. Disease Prevalence & Incidence Rate Globally With Key Countries

5.4. Regulatory Scenario by Region/Globally

5.5. COVID-19 Impact Analysis

6. Global Lung Disease Therapeutics Market Analysis and Forecast, by Disease Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Disease Type, 2017–2031

6.3.1. Asthma

6.3.2. Chronic Obstructive Pulmonary Disease (COPD)

6.3.3. Lung Cancer

6.3.4. Others

6.4. Market Attractiveness Analysis, by Disease Type

7. Global Lung Disease Therapeutics Market Analysis and Forecast, by Drug Class

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Drug Class, 2017–2031

7.3.1. Corticosteroids

7.3.2. Bronchodilator Medications

7.3.3. Mucolytics

7.3.4. Antimicrobial Medications

7.3.5. Others

7.4. Market Attractiveness Analysis, by Drug Class

8. Global Lung Disease Therapeutics Market Analysis and Forecast, by Distribution Channel

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by Distribution Channel, 2017–2031

8.3.1. Hospital Pharmacies

8.3.2. Retail Pharmacies

8.3.3. Online Pharmacies

8.4. Market Attractiveness Analysis, by Distribution Channel

9. Global Lung Disease Therapeutics Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region, 2017–2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Lung Disease Therapeutics Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Disease Type, 2017–2031

10.2.1. Asthma

10.2.2. Chronic Obstructive Pulmonary Disease (COPD)

10.2.3. Lung Cancer

10.2.4. Others

10.3. Market Value Forecast, by Drug Class, 2017–2031

10.3.1. Corticosteroids

10.3.2. Bronchodilator Medications

10.3.3. Mucolytics

10.3.4. Antimicrobial Medications

10.3.5. Others

10.4. Market Value Forecast, by Distribution Channel, 2017–2031

10.4.1. Hospital Pharmacies

10.4.2. Retail Pharmacies

10.4.3. Online Pharmacies

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Disease Type

10.6.2. By Drug Class

10.6.3. By Distribution Channel

10.6.4. By Country

11. Europe Lung Disease Therapeutics Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Disease Type, 2017–2031

11.2.1. Asthma

11.2.2. Chronic Obstructive Pulmonary Disease (COPD)

11.2.3. Lung Cancer

11.2.4. Others

11.3. Market Value Forecast, by Drug Class, 2017–2031

11.3.1. Corticosteroids

11.3.2. Bronchodilator Medications

11.3.3. Mucolytics

11.3.4. Antimicrobial Medications

11.3.5. Others

11.4. Market Value Forecast, by Distribution Channel, 2017–2031

11.4.1. Hospital Pharmacies

11.4.2. Retail Pharmacies

11.4.3. Online Pharmacies

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Disease Type

11.6.2. By Drug Class

11.6.3. By Distribution Channel

11.6.4. By Country/Sub-region

12. Asia Pacific Lung Disease Therapeutics Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Disease Type, 2017–2031

12.2.1. Asthma

12.2.2. Chronic Obstructive Pulmonary Disease (COPD)

12.2.3. Lung Cancer

12.2.4. Others

12.3. Market Value Forecast, by Drug Class, 2017–2031

12.3.1. Corticosteroids

12.3.2. Bronchodilator Medications

12.3.3. Mucolytics

12.3.4. Antimicrobial Medications

12.3.5. Others

12.4. Market Value Forecast, by Distribution Channel, 2017–2031

12.4.1. Hospital Pharmacies

12.4.2. Retail Pharmacies

12.4.3. Online Pharmacies

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Disease Type

12.6.2. By Drug Class

12.6.3. By Distribution Channel

12.6.4. By Country/Sub-region

13. Latin America Lung Disease Therapeutics Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Disease Type, 2017–2031

13.2.1. Asthma

13.2.2. Chronic Obstructive Pulmonary Disease (COPD)

13.2.3. Lung Cancer

13.2.4. Others

13.3. Market Value Forecast, by Drug Class, 2017–2031

13.3.1. Corticosteroids

13.3.2. Bronchodilator Medications

13.3.3. Mucolytics

13.3.4. Antimicrobial Medications

13.3.5. Others

13.4. Market Value Forecast, by Distribution Channel, 2017–2031

13.4.1. Hospital Pharmacies

13.4.2. Retail Pharmacies

13.4.3. Online Pharmacies

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Disease Type

13.6.2. By Drug Class

13.6.3. By Distribution Channel

13.6.4. By Country/Sub-region

14. Middle East & Africa Lung Disease Therapeutics Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Disease Type, 2017–2031

14.2.1. Asthma

14.2.2. Chronic Obstructive Pulmonary Disease (COPD)

14.2.3. Lung Cancer

14.2.4. Others

14.3. Market Value Forecast, by Drug Class, 2017–2031

14.3.1. Corticosteroids

14.3.2. Bronchodilator Medications

14.3.3. Mucolytics

14.3.4. Antimicrobial Medications

14.3.5. Others

14.4. Market Value Forecast, by Distribution Channel, 2017–2031

14.4.1. Hospital Pharmacies

14.4.2. Retail Pharmacies

14.4.3. Online Pharmacies

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of MEA

14.6. Market Attractiveness Analysis

14.6.1. By Disease Type

14.6.2. By Drug Class

14.6.3. By Distribution Channel

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competitive Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company (2021)

15.3. Company Profiles

15.3.1. GSK

15.3.1.1. Company Overview

15.3.1.2. Disease Type Portfolio

15.3.1.3. SWOT Analysis

15.3.1.4. Financial Overview

15.3.1.5. Strategic Overview

15.3.2. AstraZeneca

15.3.2.1. Company Overview

15.3.2.2. Disease Type Portfolio

15.3.2.3. SWOT Analysis

15.3.2.4. Financial Overview

15.3.2.5. Strategic Overview

15.3.3. Boehringer Ingelheim

15.3.3.1. Company Overview

15.3.3.2. Disease Type Portfolio

15.3.3.3. SWOT Analysis

15.3.3.4. Financial Overview

15.3.3.5. Strategic Overview

15.3.4. Novartis

15.3.4.1. Company Overview

15.3.4.2. Disease Type Portfolio

15.3.4.3. SWOT Analysis

15.3.4.4. Financial Overview

15.3.4.5. Strategic Overview

15.3.5. Vertex Pharmaceuticals

15.3.5.1. Company Overview

15.3.5.2. Disease Type Portfolio

15.3.5.3. SWOT Analysis

15.3.5.4. Financial Overview

15.3.5.5. Strategic Overview

15.3.6. F. Hoffman La Roche

15.3.6.1. Company Overview

15.3.6.2. Disease Type Portfolio

15.3.6.3. SWOT Analysis

15.3.6.4. Financial Overview

15.3.6.5. Strategic Overview

15.3.7. Teva Pharmaceuticals

15.3.7.1. Company Overview

15.3.7.2. Disease Type Portfolio

15.3.7.3. SWOT Analysis

15.3.7.4. Financial Overview

15.3.7.5. Strategic Overview

15.3.8. Cipla

15.3.8.1. Company Overview

15.3.8.2. Disease Type Portfolio

15.3.8.3. SWOT Analysis

15.3.8.4. Financial Overview

15.3.8.5. Strategic Overview

15.3.9. Liminal Biosciences

15.3.9.1. Company Overview

15.3.9.2. Disease Type Portfolio

15.3.9.3. SWOT Analysis

15.3.9.4. Financial Overview

15.3.9.5. Strategic Overview

15.3.10. Fibrogen

15.3.10.1. Company Overview

15.3.10.2. Disease Type Portfolio

15.3.10.3. SWOT Analysis

15.3.10.4. Financial Overview

15.3.10.5. Strategic Overview

15.3.11. PharmAkea Therapeutics

15.3.11.1. Company Overview

15.3.11.2. Disease Type Portfolio

15.3.11.3. SWOT Analysis

15.3.11.4. Financial Overview

15.3.11.5. Strategic Overview

15.3.12. IQVIA

15.3.12.1. Company Overview

15.3.12.2. Disease Type Portfolio

15.3.12.3. SWOT Analysis

15.3.12.4. Financial Overview

15.3.12.5. Strategic Overview

List of Tables

Table 01: Global Lung Disease Therapeutics Market Size (US$ Mn) Forecast, by Disease Type, 2017–2031

Table 02: Global Lung Disease Therapeutics Market Size (US$ Mn) Forecast, by Drug Class, 2017–2031

Table 03: Global Lung Disease Therapeutics Market Size (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 04: Global Lung Disease Therapeutics Market Size (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Lung Disease Therapeutics Market Size (US$ Mn) Forecast, by Country, 2017–2031

Table 06: North America Lung Disease Therapeutics Market Size (US$ Mn) Forecast, by Disease Type, 2017–2031

Table 07: North America Lung Disease Therapeutics Market Size (US$ Mn) Forecast, by Drug Class, 2017–2031

Table 08: North America Lung Disease Therapeutics Market Size (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 09: Europe Lung Disease Therapeutics Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 10: Europe Lung Disease Therapeutics Market Size (US$ Mn) Forecast, by Disease Type, 2017–2031

Table 11: Europe Lung Disease Therapeutics Market Size (US$ Mn) Forecast, by Drug Class, 2017–2031

Table 12: Europe Lung Disease Therapeutics Market Size (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 13: Asia Pacific Lung Disease Therapeutics Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Asia Pacific Lung Disease Therapeutics Market Size (US$ Mn) Forecast, by Disease Type, 2017–2031

Table 15: Asia Pacific Lung Disease Therapeutics Market Size (US$ Mn) Forecast, by Drug Class, 2017–2031

Table 16: Asia Pacific Lung Disease Therapeutics Market Size (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 17: Latin America Lung Disease Therapeutics Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 18: Latin America Lung Disease Therapeutics Market Size (US$ Mn) Forecast, by Disease Type, 2017–2031

Table 19: Latin America Lung Disease Therapeutics Market Size (US$ Mn) Forecast, by Drug Class, 2017–2031

Table 20: Latin America Lung Disease Therapeutics Market Size (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 21: Middle East & Africa Lung Disease Therapeutics Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 22: Middle East & Africa Lung Disease Therapeutics Market Size (US$ Mn) Forecast, by Disease Type, 2017–2031

Table 23: Middle East & Africa Lung Disease Therapeutics Market Size (US$ Mn) Forecast, by Drug Class, 2017–2031

Table 24: Middle East & Africa Lung Disease Therapeutics Market Size (US$ Mn) Forecast, by Distribution Channel, 2017–2031

List of Figures

Figure 01: Global Lung Disease Therapeutics Market Size (US$ Mn) and Distribution (%), by Region, 2017 and 2031

Figure 02: Global Lung Disease Therapeutics Market Revenue (US$ Mn), by Disease Type, 2021

Figure 03: Global Lung Disease Therapeutics Market Value Share, by Disease Type, 2021

Figure 04: Global Lung Disease Therapeutics Market Revenue (US$ Mn), by Drug Class, 2021

Figure 05: Global Lung Disease Therapeutics Market Value Share, by Drug Class, 2021

Figure 06: Global Lung Disease Therapeutics Market Revenue (US$ Mn), by Distribution Channel, 2021

Figure 07: Global Lung Disease Therapeutics Market Value Share, by Distribution Channel, 2021

Figure 08: Global Lung Disease Therapeutics Market Value Share, by Region, 2021

Figure 09: Global Lung Disease Therapeutics Market Value (US$ Mn) Forecast, 2017–2031

Figure 10: Global Lung Disease Therapeutics Market Value Share Analysis, by Disease Type, 2017 and 2031

Figure 11: Global Lung Disease Therapeutics Market Attractiveness Analysis, by Disease Type, 2022-2031

Figure 12: Global Lung Disease Therapeutics Market Value Share Analysis, by Drug Class, 2017 and 2031

Figure 13: Global Lung Disease Therapeutics Market Attractiveness Analysis, by Drug Class, 2022-2031

Figure 14: Global Lung Disease Therapeutics Market Value Share Analysis, by Distribution Channel, 2017 and 2031

Figure 15: Global Lung Disease Therapeutics Market Attractiveness Analysis, by Distribution Channel, 2022-2031

Figure 16: Global Lung Disease Therapeutics Market Value Share Analysis, by Region, 2017 and 2031

Figure 17: Global Lung Disease Therapeutics Market Attractiveness Analysis, by Region, 2022-2031

Figure 18: North America Lung Disease Therapeutics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 19: North America Lung Disease Therapeutics Market Attractiveness Analysis, by Country, 2017–2031

Figure 20: North America Lung Disease Therapeutics Market Value Share Analysis, by Country, 2017 and 2031

Figure 21: North America Lung Disease Therapeutics Market Value Share Analysis, by Disease Type, 2017 and 2031

Figure 22: North America Lung Disease Therapeutics Market Value Share Analysis, by Drug Class, 2017 and 2031

Figure 23: North America Lung Disease Therapeutics Market Value Share Analysis, by Distribution Channel, 2017 and 2031

Figure 24: North America Lung Disease Therapeutics Market Attractiveness Analysis, by Disease Type, 2022–2031

Figure 25: North America Lung Disease Therapeutics Market Attractiveness Analysis, by Drug Class, 2022–2031

Figure 26: North America Lung Disease Therapeutics Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 27: Europe Lung Disease Therapeutics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 28: Europe Lung Disease Therapeutics Market Attractiveness Analysis, by Country/Sub-region, 2017–2031

Figure 29: Europe Lung Disease Therapeutics Market Value Share Analysis, by Country/Sub-region, 2017 and 2031

Figure 30: Europe Lung Disease Therapeutics Market Value Share Analysis, by Disease Type, 2017 and 2031

Figure 31: Europe Lung Disease Therapeutics Market Value Share Analysis, by Drug Class, 2017 and 2031

Figure 32: Europe Lung Disease Therapeutics Market Value Share Analysis, by Distribution Channel, 2017 and 2031

Figure 33: Europe Lung Disease Therapeutics Market Attractiveness Analysis, by Disease Type, 2022–2031

Figure 34: Europe Lung Disease Therapeutics Market Attractiveness Analysis, by Drug Class, 2022–2031

Figure 35: Europe Lung Disease Therapeutics Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 36: Asia Pacific Lung Disease Therapeutics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 37: Asia Pacific Lung Disease Therapeutics Market Attractiveness Analysis, by Country/Sub-region, 2017–2031

Figure 38: Asia Pacific Lung Disease Therapeutics Market Value Share Analysis, by Country/Sub-region, 2017 and 2031

Figure 39: Asia Pacific Lung Disease Therapeutics Market Value Share Analysis, by Disease Type, 2017 and 2031

Figure 40: Asia Pacific Lung Disease Therapeutics Market Value Share Analysis, by Drug Class, 2017 and 2031

Figure 41: Asia Pacific Lung Disease Therapeutics Market Value Share Analysis, by Distribution Channel, 2017 and 2031

Figure 42: Asia Pacific Lung Disease Therapeutics Market Attractiveness Analysis, by Disease Type, 2022–2031

Figure 43: Asia Pacific Lung Disease Therapeutics Market Attractiveness Analysis, by Drug Class, 2022–2031

Figure 44: Asia Pacific Lung Disease Therapeutics Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 45: Latin America Lung Disease Therapeutics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 46: Latin America Lung Disease Therapeutics Market Attractiveness Analysis, by Country/Sub-region, 2017–2031

Figure 47: Latin America Lung Disease Therapeutics Market Value Share Analysis, by Country/Sub-region, 2017 and 2031

Figure 48: Latin America Lung Disease Therapeutics Market Value Share Analysis, by Disease Type, 2017 and 2031

Figure 49: Latin America Lung Disease Therapeutics Market Value Share Analysis, by Drug Class, 2017 and 2031

Figure 50: Latin America Lung Disease Therapeutics Market Value Share Analysis, by Distribution Channel, 2017 and 2031

Figure 51: Latin America Lung Disease Therapeutics Market Attractiveness Analysis, by Disease Type, 2022–2031

Figure 52: Latin America Lung Disease Therapeutics Market Attractiveness Analysis, by Drug Class, 2022–2031

Figure 53: Latin America Lung Disease Therapeutics Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 54: Middle East & Africa Lung Disease Therapeutics Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 55: Middle East & Africa Lung Disease Therapeutics Market Attractiveness Analysis, by Country/Sub-region, 2017–2031

Figure 56: Middle East & Africa Lung Disease Therapeutics Market Value Share Analysis, by Country/Sub-region, 2017 and 2031

Figure 57: Middle East & Africa Lung Disease Therapeutics Market Value Share Analysis, by Disease Type, 2017 and 2031

Figure 58: Middle East & Africa Lung Disease Therapeutics Market Value Share Analysis, by Drug Class, 2017 and 2031

Figure 59: Middle East & Africa Lung Disease Therapeutics Market Value Share Analysis, by Distribution Channel, 2017 and 2031

Figure 60: Middle East & Africa Lung Disease Therapeutics Market Attractiveness Analysis, by Disease Type, 2022–2031

Figure 61: Middle East & Africa Lung Disease Therapeutics Market Attractiveness Analysis, by Drug Class, 2022–2031

Figure 62: Middle East & Africa Lung Disease Therapeutics Market Attractiveness Analysis, by Distribution Channel, 2022–2031