Analysts’ Viewpoint

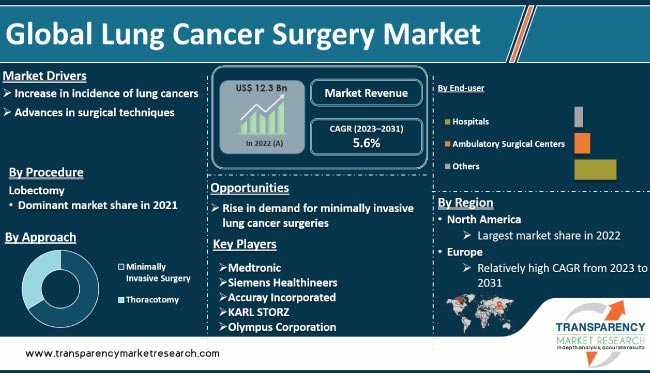

Rise in incidence of lung cancer across the globe is driving the need for surgical operations. According to the WHO, around 2.21 million lung cancer cases were recorded worldwide in 2020. New developments in surgical technologies, such as minimally invasive surgical techniques, are making lung cancer surgeries safer, more efficient, and less traumatic. The global market is expanding as a result of increased patient demand for care in the early stages of the disease, when surgical intervention is most successful.

Growth in adoption of customized medicines and introduction of cutting-edge cancer therapies, such as immunotherapy, are likely to contribute to lung cancer surgery market development. The market for lung cancer surgery is primarily influenced by the availability of reimbursement policies and rise in accessibility of advanced medical technologies.

Lung cancer can be treated through various methods, including surgery, radiation therapy, chemotherapy, targeted therapy, immunotherapy, or a combination of these approaches. The surgical procedure a patient undergoes is contingent on multiple considerations, such as the position and size of the tumor, patient's general well-being, and progression of the cancer.

Minimally invasive surgical techniques, such as video-assisted thoracoscopic surgery (VATS) and robotic surgery, have revolutionized lung cancer surgery, making it less traumatic and more effective. These advanced surgical methods have reduced surgical time, improved patient outcomes, and reduced hospital stay.

Recovery times for surgeries performed via thoracotomy tend to be longer compared to minimally invasive VATS and robot-assisted procedures. Furthermore, wedge resection is performed in patients when reduced lung function does not allow them to undergo a lobectomy.

As per the lung cancer surgery market research report, lung cancer is one of the most common types of cancer. Incidence of the disease has been rising across the globe due to a number of factors such as smoking, air pollution, and exposure to radon gas. This is boosting the demand for its treatment, including surgical intervention.

Early detection along with availability of treatment for lung cancer is crucial in increasing survival rate and improving patient outcomes. As a result, lung cancer surgeries are becoming more prevalent, leading to a growth in the lung cancer surgery business. Rise in prevalence of lung cancer has led to an increase in R&D activities in the field, thus resulting in the development of more advanced surgical techniques and equipment. This is positively impacting the lung cancer surgery market value.

According to the lung cancer surgery market analysis report, advances in surgical techniques are expected to drive the industry in the near future. Technological advancements and emergence of new surgical techniques, such as minimally invasive procedures, have significantly reduced surgical invasiveness. These new techniques offer less pain, fewer complications, and improved results compared to traditional open surgeries. This has led to an increase in demand for these procedures, thus contributing to lung cancer surgery market growth.

Development of new and advanced surgical equipment, such as robotic systems and 3D-printed models, has also improved the precision and accuracy of lung cancer surgeries. For instance, minimally invasive procedures such as video-assisted thoracoscopic surgery (VATS) and robot-assisted thoracic surgery have reduced the invasiveness of lung cancer surgeries and led to faster recovery times. This has further increased the success rate of these procedures.

In terms of procedure, the global market has been classified into lobectomy, segmentectomy, wedge resection, and pneumonectomy. The lobectomy segment held dominant share in 2022. The procedure is chosen for its high success rate in removing cancerous tissues and the minimal impact it has on lung function. As a result, it has become the standard of care for the treatment of early-stage lung cancer. Thus, the lobectomy segment is anticipated to maintain its dominant position in the next few years.

Advent of minimally invasive techniques, such as video-assisted thoracoscopic technique, has made lobectomy a less invasive option, thus increasing its popularity among patients and healthcare providers. The procedure is also well tolerated by patients, due to the low risk of complications and relatively quick recovery time. Thus, rise in demand for lobectomy procedures among lung cancer patients is fueling lung cancer surgery industry growth.

Based on approach, the global market has been divided into thoracotomy and minimally invasive surgery. Rise in adoption of minimally invasive procedures is likely to boost lung cancer surgery market demand during the forecast period.

Smaller incision and less invasive nature of these procedures result in less pain for patients and a faster recovery time. Patients are able to return to their normal activities sooner and experience less discomfort during the healing process.

Minimally invasive surgery has reduced the risk of postoperative complications. There is less risk of infection and wound complication since the incisions are smaller. Additionally, blood loss is often significantly less with minimally invasive procedures. This reduces the need for blood transfusions. Development of specialized instruments and techniques has allowed surgeons to perform complex procedures with greater precision and control.

According to the lung cancer surgery market report, the hospitals end-user segment is anticipated to account for major share during the forecast period. Hospitals are equipped with specialized resources, such as advanced medical equipment and highly skilled medical personnel, that are essential for the successful treatment of lung cancer. Hospitals have teams of specialists who are trained in the latest surgical techniques and technologies, which increases the likelihood of a positive outcome for patients.

Hospitals provide a centralized and comprehensive care system that offers a range of diagnostic and treatment options under one roof. This makes it easier for patients to access the care they need, as they do not have to navigate multiple providers and locations. Hospitals also provide a full range of support services such as rehabilitation and postoperative care. This can significantly improve patient outcomes.

According to the lung cancer surgery market analysis report, North America is projected to dominate the global landscape during the forecast period. High incidence of lung cancer in the region is driving the demand for its treatment.

According to the American Cancer Society, 234,030 new cases of lung cancer were diagnosed in the U.S. and around 144,000 people died from the disease in 2021. Increase in awareness about minimally invasive treatment is further driving lung cancer surgery market dynamics in the region.

Lung cancer surgery market share of North America is anticipated to increase further during the forecast period, owing to the rise in geriatric population in the region. Older individuals are more susceptible to lung cancer, leading to an increase in demand for its treatment.

The prevalence rate for lung cancer is high in Europe. It is the second most frequently diagnosed cancer in men, following prostate cancer, and the third most frequently diagnosed cancer in women, after breast and colorectal cancers.

Asia Pacific has a large population of smokers, which increases the risk of lung cancer. The region recorded 1,315,136 new cases of lung cancer in 2020, leading to high demand for surgical procedures. Additionally, increase in awareness about early diagnosis and treatment for lung cancer has led to a rise in demand for surgical procedures in the region.

The global industry is fragmented, with the presence of a large numbers of key players. Some of the prominent market players are Medtronic, Siemens Healthineers, Accuray Incorporated, KARL STORZ, Olympus Corporation, Intuitive Surgical, and Ethicon (Johnson & Johnson Services, Inc.).

Each of these players has been profiled in the global lung cancer surgery market forecast report based on parameters such as product portfolio, business segments, recent developments, company overview, and business strategies.

|

Attribute |

Detail |

|

Size in 2022 |

US$ 12.3 Bn |

|

Forecast Value in 2031 |

More than US$ 20.2 Bn |

|

CAGR |

5.6% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

.Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

It was valued at US$ 12.3 Bn in 2022

It is projected to reach more than US$ 20.2 Bn by 2031

The CAGR is anticipated to be 5.6% from 2023 to 2031

Based on approach, the minimally invasive surgery segment held more than 60.0% share in 2022

North America is expected to account for the largest share from 2023 to 2031

Medtronic, Siemens Healthineers, Accuray Incorporated, KARL STORZ, Olympus Corporation, Intuitive Surgical, and Ethicon (Johnson & Johnson Services, Inc.)

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Lung Cancer Surgery Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Lung Cancer Surgery Market Analysis and Forecasts, 2017 - 2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Technological Advancements

5.2. Disease Prevalence & Incidence Rate globally with key countries

5.3. Covid-19 Impact Analysis

6. Global Lung Cancer Surgery Market Analysis and Forecasts, By Procedure

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast By Procedure, 2017 - 2031

6.3.1. Lobectomy

6.3.2. Segmentectomy

6.3.3. Wedge Resection

6.3.4. Pneumonectomy

6.4. Market Attractiveness By Procedure

7. Global Lung Cancer Surgery Market Analysis and Forecasts, By Approach

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast By Approach, 2017 - 2031

7.3.1. Thoracotomy

7.3.2. Minimally Invasive Surgery

7.4. Market Attractiveness By Approach

8. Global Lung Cancer Surgery Market Analysis and Forecasts, By End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast By End-user, 2017 - 2031

8.3.1. Hospitals

8.3.2. Ambulatory Surgical Centers

8.3.3. Others

8.4. Market Attractiveness By End-user

9. Global Lung Cancer Surgery Market Analysis and Forecasts, By Region

9.1. Key Findings

9.2. Market Value Forecast By Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness By Country/Region

10. North America Lung Cancer Surgery Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast By Procedure, 2017 - 2031

10.2.1. Lobectomy

10.2.2. Segmentectomy

10.2.3. Wedge Resection

10.2.4. Pneumonectomy

10.3. Market Value Forecast By Approach, 2017 - 2031

10.3.1. Thoracotomy

10.3.2. Minimally Invasive Surgery

10.4. Market Value Forecast By End-user, 2017 - 2031

10.4.1. Hospitals

10.4.2. Ambulatory Surgical Centers

10.4.3. Others

10.5. Market Value Forecast By Country, 2017 - 2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Procedure

10.6.2. By Approach

10.6.3. By End-user

10.6.4. By Country

11. Europe Lung Cancer Surgery Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast By Procedure, 2017 - 2031

11.2.1. Lobectomy

11.2.2. Segmentectomy

11.2.3. Wedge Resection

11.2.4. Pneumonectomy

11.3. Market Value Forecast By Approach, 2017 - 2031

11.3.1. Thoracotomy

11.3.2. Minimally Invasive Surgery

11.4. Market Value Forecast By End-user, 2017 - 2031

11.4.1. Hospitals

11.4.2. Ambulatory Surgical Centers

11.4.3. Others

11.5. Market Value Forecast By Country, 2017 - 2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Procedure

11.6.2. By Approach

11.6.3. By End-user

11.6.4. By Country

12. Asia Pacific Lung Cancer Surgery Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast By Procedure, 2017 - 2031

12.2.1. Lobectomy

12.2.2. Segmentectomy

12.2.3. Wedge Resection

12.2.4. Pneumonectomy

12.3. Market Value Forecast By Approach, 2017 - 2031

12.3.1. Thoracotomy

12.3.2. Minimally Invasive Surgery

12.4. Market Value Forecast By End-user, 2017 - 2031

12.4.1. Hospitals

12.4.2. Ambulatory Surgical Centers

12.4.3. Others

12.5. Market Value Forecast By Country, 2017 - 2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Resr of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Procedure

12.6.2. By Approach

12.6.3. By End-user

12.6.4. By Country

13. Latin America Lung Cancer Surgery Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast By Procedure, 2017 - 2031

13.2.1. Lobectomy

13.2.2. Segmentectomy

13.2.3. Wedge Resection

13.2.4. Pneumonectomy

13.3. Market Value Forecast By Approach, 2017 - 2031

13.3.1. Thoracotomy

13.3.2. Minimally Invasive Surgery

13.4. Market Value Forecast By End-user, 2017 - 2031

13.4.1. Hospitals

13.4.2. Ambulatory Surgical Centers

13.4.3. Others

13.5. Market Value Forecast By Country, 2017 - 2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Procedure

13.6.2. By Approach

13.6.3. By End-user

13.6.4. By Country

14. Middle East & Africa Lung Cancer Surgery Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast By Procedure, 2017 - 2031

14.2.1. Lobectomy

14.2.2. Segmentectomy

14.2.3. Wedge Resection

14.2.4. Pneumonectomy

14.3. Market Value Forecast By Approach, 2017 - 2031

14.3.1. Thoracotomy

14.3.2. Minimally Invasive Surgery

14.4. Market Value Forecast By End-user, 2017 - 2031

14.4.1. Hospitals

14.4.2. Ambulatory Surgical Centers

14.4.3. Others

14.5. Market Value Forecast By Country, 2017 - 2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Procedure

14.6.2. By Approach

14.6.3. By End-user

14.6.4. By Country

15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of companies)

15.2. Market Share Analysis By Company (2022)

15.3. Company Profiles

15.3.1. Medtronic

15.3.1.1. Company Overview

15.3.1.2. Financial Overview

15.3.1.3. Product Portfolio

15.3.1.4. Business Strategies

15.3.1.5. Recent Developments

15.3.2. Siemens Healthineers

15.3.2.1. Company Overview

15.3.2.2. Financial Overview

15.3.2.3. Product Portfolio

15.3.2.4. Business Strategies

15.3.2.5. Recent Developments

15.3.3. Accuray Incorporated

15.3.3.1. Company Overview

15.3.3.2. Financial Overview

15.3.3.3. Product Portfolio

15.3.3.4. Business Strategies

15.3.3.5. Recent Developments

15.3.4. KARL STORZ

15.3.4.1. Company Overview

15.3.4.2. Financial Overview

15.3.4.3. Product Portfolio

15.3.4.4. Business Strategies

15.3.4.5. Recent Developments

15.3.5. Olympus Corporation

15.3.5.1. Company Overview

15.3.5.2. Financial Overview

15.3.5.3. Product Portfolio

15.3.5.4. Business Strategies

15.3.5.5. Recent Developments

15.3.6. Intuitive Surgical

15.3.6.1. Company Overview

15.3.6.2. Financial Overview

15.3.6.3. Product Portfolio

15.3.6.4. Business Strategies

15.3.6.5. Recent Developments

15.3.7. Ethicon (Johnson & Johnson Services, Inc.)

15.3.7.1. Company Overview

15.3.7.2. Financial Overview

15.3.7.3. Product Portfolio

15.3.7.4. Business Strategies

15.3.7.5. Recent Developments

15.3.8. Other Prominent Players

List of Tables

Table 01: Global Lung Cancer Surgery Market Value (US$ Mn) Forecast, by Procedure, 2017‒2031

Table 02: Global Lung Cancer Surgery Market Value (US$ Mn) Forecast, by Approach, 2017–2031

Table 03: Global Lung Cancer Surgery Market Value (US$ Mn) Forecast, By End-user, 2017–2031

Table 04: Global Lung Cancer Surgery Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Lung Cancer Surgery Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 06: North America Lung Cancer Surgery Market Value (US$ Mn) Forecast, by Procedure, 2017‒2031

Table 07: North America Lung Cancer Surgery Market Value (US$ Mn) Forecast, by Approach, 2017–2031

Table 08: North America Lung Cancer Surgery Market Value (US$ Mn) Forecast, By End-user, 2017–2031

Table 09: Europe Lung Cancer Surgery Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017–2031

Table 10: Europe Lung Cancer Surgery Market Value (US$ Mn) Forecast, by Procedure, 2017‒2031

Table 11: Europe Lung Cancer Surgery Market Value (US$ Mn) Forecast, by Approach, 2017–2031

Table 12: Europe Lung Cancer Surgery Market Value (US$ Mn) Forecast, By End-user, 2017–2031

Table 13: Asia Pacific Lung Cancer Surgery Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Asia Pacific Lung Cancer Surgery Market Value (US$ Mn) Forecast, by Procedure, 2017‒2031

Table 15: Asia Pacific Lung Cancer Surgery Market Value (US$ Mn) Forecast, by Approach, 2017–2031

Table 16: Asia Pacific Lung Cancer Surgery Market Value (US$ Mn) Forecast, By End-user, 2017–2031

Table 17: Latin America Lung Cancer Surgery Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 18: Latin America Lung Cancer Surgery Market Value (US$ Mn) Forecast, by Procedure, 2017‒2031

Table 19: Latin America Lung Cancer Surgery Market Value (US$ Mn) Forecast, by Approach, 2017–2031

Table 20: Latin America Lung Cancer Surgery Market Value (US$ Mn) Forecast, By End-user, 2017–2031

Table 21: Middle East & Africa Lung Cancer Surgery Market Value (US$ Mn) Forecast, by Procedure, 2017‒2031

Table 22: Middle East & Africa Lung Cancer Surgery Market Value (US$ Mn) Forecast, by Approach, 2017–2031

Table 23: Middle East & Africa Lung Cancer Surgery Market Value (US$ Mn) Forecast, By End-user, 2017–2031

Table 24: Middle East & Africa Lung Cancer Surgery Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

List of Figures

Figure 01: Global Lung Cancer Surgery Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Lung Cancer Surgery Market Value Share, by Procedure, 2022

Figure 03: Lung Cancer Surgery Market Value Share, by Approach, 2022

Figure 04: Lung Cancer Surgery Market Value Share, By End-user, 2022

Figure 05: Global Lung Cancer Surgery Market Value Share Analysis, by Procedure, 2022 and 2031

Figure 06: Global Lung Cancer Surgery Market Attractiveness Analysis, by Procedure, 2023–2031

Figure 07: Global Lung Cancer Surgery Market Value (US$ Mn), by Lobectomy, 2017‒2031

Figure 08: Global Lung Cancer Surgery Market Value (US$ Mn), by Segmentectomy, 2017‒2031

Figure 09: Global Lung Cancer Surgery Market Value (US$ Mn), by Wedge Resection, 2017‒2031

Figure 10: Global Lung Cancer Surgery Market Value (US$ Mn), by Pneumonectomy, 2017‒2031

Figure 11: Global Lung Cancer Surgery Market Value Share Analysis, by Approach, 2022 and 2031

Figure 12: Global Lung Cancer Surgery Market Attractiveness Analysis, by Approach, 2023–2031

Figure 13: Global Lung Cancer Surgery Market Revenue (US$ Mn), by Thoracotomy, 2017–2031

Figure 14: Global Lung Cancer Surgery Market Revenue (US$ Mn), by Minimally Invasive Surgery 2017–2031

Figure 15: Global Lung Cancer Surgery Market Value Share Analysis, By End-user, 2022 and 2031

Figure 16: Global Lung Cancer Surgery Market Attractiveness Analysis, By End-user, 2023–2031

Figure 17: Global Lung Cancer Surgery Market Revenue (US$ Mn), by Hospitals 2017–2031

Figure 18: Global Lung Cancer Surgery Market Revenue (US$ Mn), by Ambulatory Surgical Centers, 2017–2031

Figure 19: Global Lung Cancer Surgery Market Revenue (US$ Mn), by Others, 2017–2031

Figure 20: Global Lung Cancer Surgery Market Value Share Analysis, by Region, 2022 and 2031

Figure 21: Global Lung Cancer Surgery Market Attractiveness Analysis, by Region, 2023–2031

Figure 22: North America Lung Cancer Surgery Market Value (US$ Mn) Forecast, 2017–2031

Figure 23: North America Lung Cancer Surgery Market Value Share Analysis, by Country, 2022 and 2031

Figure 24: North America Lung Cancer Surgery Market Attractiveness Analysis, by Country, 2023–2031

Figure 25: North America Lung Cancer Surgery Market Value Share Analysis, by Procedure, 2022 and 2031

Figure 26: North America Lung Cancer Surgery Market Attractiveness Analysis, by Procedure, 2023–2031

Figure 27: North America Lung Cancer Surgery Market Value Share Analysis, by Approach, 2022 and 2031

Figure 28: North America Lung Cancer Surgery Market Attractiveness Analysis, by Approach, 2023–2031

Figure 29: North America Lung Cancer Surgery Market Value Share Analysis, By End-user, 2022 and 2031

Figure 30: North America Lung Cancer Surgery Market Attractiveness Analysis, By End-user, 2023–2031

Figure 31: Europe Lung Cancer Surgery Market Value (US$ Mn) Forecast, 2017–2031

Figure 32: Europe Lung Cancer Surgery Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 33: Europe Lung Cancer Surgery Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 34: Europe Lung Cancer Surgery Market Value Share Analysis, by Procedure, 2022 and 2031

Figure 35: Europe Lung Cancer Surgery Market Attractiveness Analysis, by Procedure, 2023–2031

Figure 36: Europe Lung Cancer Surgery Market Value Share Analysis, by Approach, 2022 and 2031

Figure 37: Europe Lung Cancer Surgery Market Attractiveness Analysis, by Approach, 2023–2031

Figure 38: Europe Lung Cancer Surgery Market Value Share Analysis, By End-user, 2022 and 2031

Figure 39: Europe Lung Cancer Surgery Market Attractiveness Analysis, By End-user, 2023–2031

Figure 40: Asia Pacific Lung Cancer Surgery Market Value (US$ Mn) Forecast, 2017–2031

Figure 41: Asia Pacific Lung Cancer Surgery Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 42: Asia Pacific Lung Cancer Surgery Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 43: Asia Pacific Lung Cancer Surgery Market Value Share Analysis, by Procedure, 2022 and 2031

Figure 44: Asia Pacific Lung Cancer Surgery Market Attractiveness Analysis, by Procedure, 2023–2031

Figure 45: Asia Pacific Lung Cancer Surgery Market Value Share Analysis, by Approach, 2022 and 2031

Figure 46: Asia Pacific Lung Cancer Surgery Market Attractiveness Analysis, by Approach, 2023–2031

Figure 47: Asia Pacific Lung Cancer Surgery Market Value Share Analysis, By End-user, 2022 and 2031

Figure 48: Asia Pacific Lung Cancer Surgery Market Attractiveness Analysis, By End-user, 2023–2031

Figure 49: Latin America Lung Cancer Surgery Market Value (US$ Mn) Forecast, 2017–2031

Figure 50: Latin America Lung Cancer Surgery Market Value Share Analysis, by Country/Sub-Region, 2022 and 2031

Figure 51: Latin America Lung Cancer Surgery Market Attractiveness Analysis, by Country/Sub-Region, 2023-2031

Figure 52: Latin America Lung Cancer Surgery Market Value Share Analysis, by Procedure, 2022 and 2031

Figure 53: Latin America Lung Cancer Surgery Market Attractiveness Analysis, by Procedure, 2023–2031

Figure 54: Latin America Lung Cancer Surgery Market Value Share Analysis, by Approach, 2022 and 2031

Figure 55: Latin America Lung Cancer Surgery Market Attractiveness Analysis, by Approach, 2023–2031

Figure 56: Latin America Lung Cancer Surgery Market Value Share Analysis, By End-user, 2022 and 2031

Figure 57: Latin America Lung Cancer Surgery Market Attractiveness Analysis, By End-user, 2023–2031

Figure 58: Middle East & Africa Lung Cancer Surgery Market Value (US$ Mn) Forecast, 2017–2031

Figure 59: Middle East & Africa Lung Cancer Surgery Market Value Share Analysis, by Country/Sub-Region, 2022 and 2031

Figure 60: Middle East & Africa Lung Cancer Surgery Market Attractiveness Analysis, by Country/Sub-Region, 2023-2031

Figure 61: Middle East & Africa Lung Cancer Surgery Market Value Share Analysis, by Procedure, 2022 and 2031

Figure 62: Middle East & Africa Lung Cancer Surgery Market Attractiveness Analysis, by Procedure, 2023–2031

Figure 63: Middle East & Africa Lung Cancer Surgery Market Value Share Analysis, by Approach, 2022 and 2031

Figure 64: Middle East & Africa Lung Cancer Surgery Market Attractiveness Analysis, by Approach, 2023–2031

Figure 65: Middle East & Africa Lung Cancer Surgery Market Value Share Analysis, By End-user, 2022 and 2031

Figure 66: Middle East & Africa Lung Cancer Surgery Market Attractiveness Analysis, By End-user, 2023–2031

Figure 67: Company Share Analysis, 2022