Analysts’ Viewpoint on Market Outlook

Lubricant additive technology helps minimize costs by lowering maintenance requirements, reducing fuel and oil consumption, reducing downtime losses, extending service intervals, and enhancing vehicle reliability. Several benefits associated with lubricant additives, including boundary lubricity, extreme pressure (EP), inhibiting corrosion, boosting reserve alkalinity, emulsification, antimisting and antimicrobial pesticide, are estimated to fuel the market demand for lubricant additives during the forecast period.

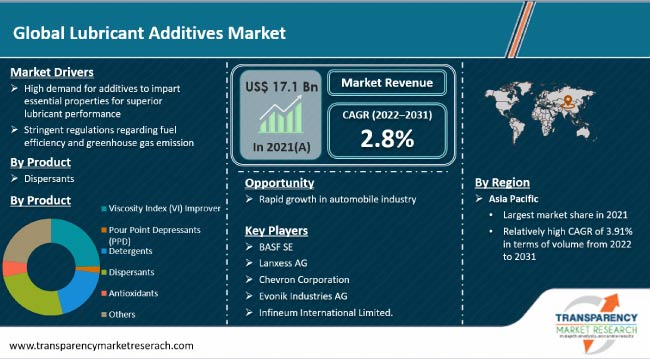

Moreover, rapid growth in global automotive and industrial sectors is also anticipated to aid market progress. However, volatility in prices of crude oil is expected to hamper the lubricant additives industry. The price of base and crude oil influences the cost of additives, as many of these additives are base oil-containing petrochemical derivatives.

Key market trends include adoption of nanotechnology and a shift toward bio-based lubricants. The adoption of nanotechnology in lubricant additives is anticipated to offer significant market opportunities for manufacturers in the next few years. The adoption of nanoparticle additives helps enhance lubricant characteristics such as thermal properties, anti-oxidation capability, and tribological features.

Lubricant additives are organic or inorganic chemical compounds suspended in base oil in order to form a single fluid mixture. In the total oil volume, these additives range from approximately 0.1 to 30 percent. Lubricant manufacturing companies extensively utilize lubricant additives to enhance the characteristics of base stock under variable operating conditions and to meet the high performance requirements of machinery.

Based on their respective functions, these additives are classified as viscosity index improver and pour point depressants (PPD). These are employed to enhance the intrinsic characteristics of base oils. Detergents and dispersants are utilized for addition of new properties and to protect the metal surfaces of engines, while antioxidants are used as lubricant protective substances.

The key functions of additives include impart new properties to base oils, enhance existing base oil properties, and suppress undesirable base oil properties. Therefore, additives are widely used in automotive lubricants, industrial engine oil, general industrial oil, metalworking fluids, grease and process oils. This, in turn, is aiding lubricant additives market development across the globe.

Lubricant additives are employed to control chemical and physical parameters of oil. Chemical parameters include resistance to high temperature & oxidation, foam inhibition, corrosion control, seal compatibility, shear stability, low temperature flow viscosity, oil thickening by viscosity increase, low volatility, and soot dispersion.

Physical parameters of oil include friction reduction, wear resistance, maintain oil film thickness, heat transfer, compatibility with after treatment devices, and sludge and deposits handling.

Furthermore, viscosity is considered as key physical characteristics of any lubricant, which measures intermolecular interactions of the oil and, consequently, its flow resistance. The viscosity of lubricants decreases with rise in temperature, which can result in reduction in the thickness of the lubricating coating between parts in relative motion. Thus, viscosity index improvers (VI improvers) are being widely used to maintain the relation between viscosity and temperature.

Demand for pour point depressants is expected to grow significantly during the forecast period owing to their desired characteristics. Pour point depressants (PPD) are extensively used in lubricants to reduce the pour point of the lubricant. This aids to keep lubricants in liquid state and enhances the fluidity at relatively lower temperatures.

Focus on enhancing vehicle design and lubrication has increased in order to minimize vehicle emissions and conserve resources. Lubricant additives help enhance fuel efficiency, which in turn has a positive influence on minimizing carbon dioxide emission by reducing friction in passenger cars and commercial vehicles.

Corporate Average Fuel Economy (CAFE) standards for the manufacture of passenger cars have been the primary focus in the U.S., as road transport is among the key contributors ‒ nearly around 25% ‒ to the emission of carbon dioxide and other greenhouse gases.

Europe enacted the exhaust emission law with penalties for non-compliance after the previous voluntary agreement between the ACEA and the European Commission's targets were not met. Therefore, the lubricant additives market forecast for Europe during the forecast period is estimated to be highly promising.

Based on product, the global market segmentation comprises viscosity index (VI) improver, pour point depressants (PPD), detergents, dispersants, antioxidants, and others (extreme pressure (ep) additives, corrosion and rust inhibitor).

The dispersants segment held prominent market share of 25.6%, in terms of volume, in 2021. Dispersants are widely used in engine oils along with detergents in order to keep engine surfaces clean and free of deposits. The primary purpose of dispersants is to keep diesel engine soot particles finely dispersed or suspended in the oil.

Alkylsuccinimides, alkylthiophosphonates, succinic acid esters/amides, and their respective derivatives are the widely used polymeric and ashless dispersants. The mixture of dispersants and detergent enhances the further neutralization of acid compounds and also keeps contaminant particles suspended. Thus, rise in demand for dispersants would have positive influence on the lubricant additives industry.

The antioxidants segment is expected to grow at a rapid pace during the forecast period. Antioxidants, also termed as oxidation inhibitors, are widely utilized for prevention of oxidation of the base oil components, which in turn enhances lubricant life. Lubricant molecules oxidize at nearly all temperatures; however, oxidation accelerates at high temperatures.

Furthermore, water, wear particles, and several other contaminants can lead to oxidation of lubricant molecules, which can results in the formation of acids and sludge. Demand for antioxidants is likely to rise in the near future in order to avoid the oxidation of lubricant molecules. Thus, extensive adoption of these additives is projected to boost market expansion during the forecast period.

Demand for extreme pressure additives is expected to rise in the next few years owing to rise in the demand for extreme pressure grease. Extreme pressure lubrication is necessary in heavy duty applications of gears and bearings at high temperatures and pressures in order to reduce friction, control wear, and avoid severe surface damage.

Demand for lubricant additives is anticipated to grow significantly in Asia Pacific. The region accounted for 34.2% of the global market share in 2021. This can be attributed to growth in the automotive industry, increased disposable income, and stringent emission regulations in the region.

For instance, as per estimates published by Invest India, sales of passenger cars are accelerating owing to huge demand for small and mid-sized cars and passenger cars, which accounts for approximately 17.4% share of Indian automobile sector. In India, export of passenger vehicles increased from 404,397 to 577,875 units, while commercial vehicles exports rose from 50,334 to 92,297 units in the period of April 2021 to March 2022.

North America and Europe also accounted for notable share of the global lubricant additives business. This can be attributed to strengthening emission standards in these regions, which may lead to the adoption of additives for the manufacture of lubricants. These lubricants are compatible with engines and result in lower emission and better fuel economy.

These additives are widely used in the food industry, which would have positive influence on market demand for lubricant additives in these regions. For instance, according to FoodDrinkEurope, Europe is leading food and drinks exporter across the globe with extra-EU exports reaching EUR 145 Bn, and EUR 67 Bn of trade surplus.

The global lubricant additives industry witnesses the presence of several small and large-scale service providers who control a major share of the global business. Most of the firms are adopting new technologies and strategies with comprehensive research and development activities, primarily to develop and prioritize sustainable lubricant additives.

Insights on the lubricant additives market suggest that expansion of product portfolios and mergers and acquisitions are prominent strategies adopted by key players. BASF SE, Lanxess AG, Chevron Corporation, Evonik Industries AG, Infineum International Limited, The Lubrizol Corporation, Afton Chemical, Croda International plc, ADEKA CORPORATION and Italmatch Chemicals S.p.A are the prominent entities operating in the market.

Key players have been profiled in the lubricant additives market research report in terms of financial overview, company overview, product portfolio, business strategies, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 17.1 Bn |

|

Market Forecast Value in 2031 |

US$ 22.7 Bn |

|

Growth Rate (CAGR) |

2.8% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, drivers, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The market was valued at US$ 17.1 Bn in 2021

Its size is expected to expand at a CAGR of 2.88% from 2022 to 2031

High demand for additives to impart essential properties for superior lubricant performance and stringent regulations regarding fuel efficiency and greenhouse gas emission.

Dispersants was the largest product segment in 2021

Asia Pacific was the most lucrative region of the global market in 2021.

BASF SE, Lanxess AG, Chevron Corporation, Evonik Industries AG, Infineum International Limited, The Lubrizol Corporation, Afton Chemical, Croda International plc , ADEKA CORPORATION, and Italmatch Chemicals S.p.A

1. Executive Summary

1.1. Lubricant Additives Market Snapshot

1.2. Current Market and Future Potential

2. Market Overview

2.1. Market Segmentation

2.2. Market Trends

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunities

2.4. Porter’s Five Forces Analysis

2.5. Regulatory Analysis

2.6. Value Chain Analysis

2.6.1. List of Manufacturers

2.6.2. List of Distributors

2.6.3. List of Potential Customers

3. COVID-19 Impact Analysis

4. Impact of Current Geopolitical Scenario on the Market

5. Global Lubricant Additives Market Analysis and Forecast, by Product, 2022–2031

5.1. Introduction and Definitions

5.2. Global Lubricant Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product, 2022–2031

5.2.1. Viscosity Index (VI) Improver

5.2.2. Pour Point Depressants (PPD)

5.2.3. Detergents

5.2.4. Dispersants

5.2.5. Antioxidants

5.2.6. Others

5.2.6.1. Extreme pressure (EP) additives

5.2.6.2. Corrosion and rust inhibitor

5.2.6.3. Corrosion and rust inhibitor

5.2.6.4. Others

5.3. Global Lubricant Additives Market Attractiveness, by Product

6. Global Lubricant Additives Market Analysis and Forecast, by Region, 2022–2031

6.1. Key Findings

6.2. Global Lubricant Additives Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Region, 2022–2031

6.2.1. North America

6.2.2. Europe

6.2.3. Asia Pacific

6.2.4. Middle East & Africa

6.2.5. Latin America

6.3. Global Lubricant Additives Market Attractiveness, by Region

7. North America Lubricant Additives Market Analysis, 2022–2031

7.1. Key Findings

7.2. North America Lubricant Additives Market Value (US$ Bn) & Volume (Kilo Tons) Analysis & Forecast, by Product

7.3. North America Lubricant Additives Market Value (US$ Bn) & Volume (Kilo Tons) Analysis & Forecast, by Country

7.3.1. U.S. Lubricant Additives Market Value (US$ Bn) & Volume (Kilo Tons) Forecast, by Product

7.3.2. Canada Lubricant Additives Market Value (US$ Bn) & Volume (Kilo Tons) Forecast, by Product

7.4. North America Lubricant Additives Market Attractiveness Analysis, by Product

7.5. North America Lubricant Additives Market Attractiveness Analysis, by Country

8. Europe Lubricant Additives Market Analysis, 2022–2031

8.1. Europe Lubricant Additives Market Value (US$ Bn) & Volume (Kilo Tons) Analysis & Forecast, by Product

8.2. Europe Lubricant Additives Market Value (US$ Bn) & Volume (Kilo Tons) Analysis & Forecast, by Country and Sub-region

8.2.1. Germany Lubricant Additives Market Value (US$ Bn) & Volume (Kilo Tons) Forecast, by Product

8.2.2. France Lubricant Additives Market Value (US$ Bn) & Volume (Kilo Tons) Forecast, by Product

8.2.3. U.K. Lubricant Additives Market Value (US$ Bn) & Volume (Kilo Tons) Forecast, by Product

8.2.4. Italy Lubricant Additives Market Value (US$ Bn) & Volume (Kilo Tons) Forecast, by Product

8.2.5. France Lubricant Additives Market Value (US$ Bn) & Volume (Kilo Tons) Forecast, by Product

8.2.6. Spain Lubricant Additives Market Value (US$ Bn) & Volume (Kilo Tons) Forecast, by Product

8.2.7. Russia & CIS Lubricant Additives Market Value (US$ Bn) & Volume (Kilo Tons) Forecast, by Product

8.2.8. Rest of Europe Lubricant Additives Market Value (US$ Bn) & Volume (Kilo Tons) Forecast, by Product

8.3. Europe Lubricant Additives Market Attractiveness Analysis, by Product

8.4. Europe Lubricant Additives Market Attractiveness Analysis, by Country and Sub-region

9. Asia Pacific Lubricant Additives Market Analysis, 2022–2031

9.1. Key Findings

9.2. Asia Pacific Lubricant Additives Market Value (US$ Bn) & Volume (Kilo Tons) Analysis & Forecast, by Product

9.3. Asia Pacific Lubricant Additives Market Value (US$ Bn) & Volume (Kilo Tons) Analysis & Forecast, by Country and Sub-region

9.3.1. China Lubricant Additives Market Value (US$ Bn) & Volume (Kilo Tons) Forecast, by Product

9.3.2. Japan Lubricant Additives Market Value (US$ Bn) & Volume (Kilo Tons) Forecast, by Product

9.3.3. India Lubricant Additives Market Value (US$ Bn) & Volume (Kilo Tons) Forecast, by Product

9.3.4. ASEAN Lubricant Additives Market Value (US$ Bn) & Volume (Kilo Tons) Forecast, by Product

9.3.5. Rest of Asia Pacific Lubricant Additives Market Value (US$ Bn) & Volume (Kilo Tons) Forecast, by Product

9.4. Asia Pacific Lubricant Additives Market Attractiveness Analysis, by Product

9.5. Asia Pacific Lubricant Additives Market Attractiveness Analysis, by Country and Sub-region

10. Middle East & Africa Lubricant Additives Market Analysis, 2022–2031

10.1. Key Findings

10.2. Middle East & Africa Lubricant Additives Market Value (US$ Bn) & Volume (Kilo Tons) Analysis & Forecast, by Product

10.3. Middle East & Africa Lubricant Additives Market Value (US$ Bn) & Volume (Kilo Tons) Analysis & Forecast, by Country and Sub-region

10.3.1. GCC Lubricant Additives Market Value (US$ Bn) & Volume (Kilo Tons) Forecast, by Product

10.3.2. South Africa Lubricant Additives Market Value (US$ Bn) & Volume (Kilo Tons) Forecast, by Product

10.3.3. Rest of Middle East & Africa Lubricant Additives Market Value (US$ Bn) & Volume (Kilo Tons) Forecast, by Product

10.4. Middle East & Africa Lubricant Additives Market Attractiveness Analysis, by Product

10.5. Middle East & Africa Lubricant Additives Market Attractiveness Analysis, by Country and Sub-region

11. Latin America Lubricant Additives Market Analysis, 2022–2031

11.1. Key Findings

11.2. Latin America Lubricant Additives Market Value (US$ Bn) & Volume (Kilo Tons) Analysis & Forecast, by Product

11.3. Latin America Lubricant Additives Market Value (US$ Bn) & Volume (Kilo Tons) Analysis & Forecast, by Country and Sub-region

11.3.1. Brazil Lubricant Additives Market Value (US$ Bn) & Volume (Kilo Tons) Forecast, by Product

11.3.2. Mexico Lubricant Additives Market Value (US$ Bn) & Volume (Kilo Tons) Forecast, by Product

11.3.3. Rest of Latin America Lubricant Additives Market Value (US$ Bn) & Volume (Kilo Tons) Forecast, by Product

11.4. Latin America Lubricant Additives Market Attractiveness Analysis, by Product

11.5. Latin America Lubricant Additives Market Attractiveness Analysis, by Country and Sub-region

12. Competition Landscape

12.1. Competition Matrix

12.2. Global Lubricant Additives Market Share Analysis, by Company (2021)

12.3. Company Profiles

12.3.1. BASF SE

12.3.1.1. Company Details

12.3.1.2. Company Description

12.3.1.3. Business Overview

12.3.1.4. Recent Developments

12.3.2. Lanxess AG

12.3.2.1. Company Details

12.3.2.2. Company Description

12.3.2.3. Business Overview

12.3.2.4. Recent Developments

12.3.3. Chevron Corporation

12.3.3.1. Company Details

12.3.3.2. Company Description

12.3.3.3. Business Overview

12.3.3.4. Recent Developments

12.3.4. Evonik Industries AG

12.3.4.1. Company Details

12.3.4.2. Company Description

12.3.4.3. Business Overview

12.3.4.4. Recent Developments

12.3.5. Infineum International Limited.

12.3.5.1. Company Details

12.3.5.2. Company Description

12.3.5.3. Business Overview

12.3.5.4. Recent Developments

12.3.6. The Lubrizol Corporation

12.3.6.1. Company Details

12.3.6.2. Company Description

12.3.6.3. Business Overview

12.3.6.4. Recent Developments

12.3.7. Afton Chemical

12.3.7.1. Company Details

12.3.7.2. Company Description

12.3.7.3. Business Overview

12.3.7.4. Recent Developments

12.3.8. Croda International plc

12.3.8.1. Company Details

12.3.8.2. Company Description

12.3.8.3. Business Overview

12.3.8.4. Recent Developments

12.3.9. ADEKA CORPORATION

12.3.9.1. Company Details

12.3.9.2. Company Description

12.3.9.3. Business Overview

12.3.9.4. Recent Developments

12.3.10. Italmatch Chemicals S.p.A

12.3.10.1. Company Details

12.3.10.2. Company Description

12.3.10.3. Business Overview

12.3.10.4. Recent Developments

13. Primary Research: Key Insights

14. Appendix

List of Tables

Table 01: Global Lubricant Additives Market Volume (Kilo Tons) Forecast, by Product, 2022–2031

Table 02: Global Lubricant Additives Market Value (US$ Bn) Forecast, by Product, 2022–2031

Table 03: Global Lubricant Additives Market Volume (Kilo Tons) Forecast, by Region, 2022–2031

Table 04: Global Lubricant Additives Market Value (US$ Bn) Forecast, by Region, 2022–2031

Table 05: North America Lubricant Additives Market Volume (Kilo Tons) Forecast, By Country, 2022–2031

Table 06: North America Lubricant Additives Market Value (US$ Bn) Forecast, By Country, 2022–2031

Table 07: North America Lubricant Additives Market Volume (Kilo Tons) Forecast, by Product, 2022–2031

Table 08: North America Lubricant Additives Market Value (US$ Bn) Forecast, by Product, 2022–2031

Table 09: U.S. Lubricant Additives Market Volume (Kilo Tons) Forecast, By Product, 2022–2031

Table 10: U.S. Lubricant Additives Market Value (US$ Bn) Forecast, By Product, 2022–2031

Table 11: Canada Lubricant Additives Market Volume (Kilo Tons) Forecast, By Product, 2022–2031

Table 12: Canada Lubricant Additives Market Value (US$ Bn) Forecast, By Product, 2022–2031

Table 13: Europe Lubricant Additives Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2022–2031

Table 14: Germany Lubricant Additives Market Volume (Kilo Tons) Forecast, By Product, 2022–2031

Table 15: Germany Lubricant Additives Market Value (US$ Bn) Forecast, By Product, 2022–2031

Table 16: France Lubricant Additives Market Volume (Kilo Tons) Forecast, By Product, 2022–2031

Table 17: France Lubricant Additives Market Value (US$ Bn) Forecast, By Product, 2022–2031

Table 18: U.K. Lubricant Additives Market Volume (Kilo Tons) Forecast, By Product, 2022–2031

Table 19: U.K. Lubricant Additives Market Value (US$ Bn) Forecast, By Product, 2022–2031

Table 20: Italy Lubricant Additives Market Volume (Kilo Tons) Forecast, By Product, 2022–2031

Table 21: Italy Lubricant Additives Market Value (US$ Bn) Forecast, By Product, 2022–2031

Table 22: Spain Lubricant Additives Market Volume (Kilo Tons) Forecast, By Product, 2022–2031

Table 23: Spain Lubricant Additives Market Value (US$ Bn) Forecast, By Product, 2022–2031

Table 24: France Lubricant Additives Market Volume (Kilo Tons) Forecast, By Product, 2022–2031

Table 25: France Lubricant Additives Market Value (US$ Bn) Forecast, By Product, 2022–2031

Table 26: Russia & CIS Lubricant Additives Market Volume (Kilo Tons) Forecast, By Product, 2022–2031

Table 27: Russia & CIS Lubricant Additives Market Value (US$ Bn) Forecast, By Product, 2022–2031

Table 28: Rest of Europe Lubricant Additives Market Volume (Kilo Tons) Forecast, By Product, 2022–2031

Table 29: Rest of Europe Lubricant Additives Market Value (US$ Bn) Forecast, By Product, 2022–2031

Table 30: Asia Pacific Lubricant Additives Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2022–2031

Table 31: Asia Pacific Lubricant Additives Market Value (US$ Bn) Forecast, by Country and Sub-region, 2022–2031

Table 32: Asia Pacific Lubricant Additives Market Volume (Kilo Tons) Forecast, by Product, 2022–2031

Table 33: Asia Pacific Lubricant Additives Market Value (US$ Bn) Forecast, by Product, 2022–2031

Table 34: China Lubricant Additives Market Volume (Kilo Tons) Forecast, By Product, 2022–2031

Table 35: China Lubricant Additives Market Value (US$ Bn) Forecast, By Product, 2022–2031

Table 36: Japan Lubricant Additives Market Volume (Kilo Tons) Forecast, By Product, 2022–2031

Table 37: Japan Lubricant Additives Market Value (US$ Bn) Forecast, By Product, 2022–2031

Table 38: India Lubricant Additives Market Volume (Kilo Tons) Forecast, By Product, 2022–2031

Table 39: India Lubricant Additives Market Value (US$ Bn) Forecast, By Product, 2022–2031

Table 40: ASEAN Lubricant Additives Market Volume (Kilo Tons) Forecast, By Product, 2022–2031

Table 41: ASEAN Lubricant Additives Market Value (US$ Bn) Forecast, By Product, 2022–2031

Table 42: Rest of Asia Pacific Lubricant Additives Market Volume (Kilo Tons) Forecast, By Product, 2022–2031

Table 43: Rest of Asia Pacific Lubricant Additives Market Value (US$ Bn) Forecast, By Product, 2022–2031

Table 44: Middle East & Africa Lubricant Additives Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2022–2031

Table 45: Middle East & Africa Lubricant Additives Market Value (US$ Bn) Forecast, by Country and Sub-region, 2022–2031

Table 46: Middle East & Africa Lubricant Additives Market Volume (Kilo Tons) Forecast, by Product, 2022–2031

Table 47: Middle East & Africa Lubricant Additives Market Value (US$ Bn) Forecast, by Product, 2022–2031

Table 48: GCC Lubricant Additives Market Volume (Kilo Tons) Forecast, By Product, 2022–2031

Table 49: GCC Lubricant Additives Market Value (US$ Bn) Forecast, By Product, 2022–2031

Table 50: South Africa Lubricant Additives Market Volume (Kilo Tons) Forecast, By Product, 2022–2031

Table 51: South Africa Lubricant Additives Market Value (US$ Bn) Forecast, By Product, 2022–2031

Table 52: Rest of Middle East & Africa Lubricant Additives Market Volume (Kilo Tons) Forecast, By Product, 2022–2031

Table 53: Rest of Middle East & Africa Lubricant Additives Market Value (US$ Bn) Forecast, By Product, 2022–2031

Table 54: Latin America Lubricant Additives Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2022–2031

Table 55: Latin America Lubricant Additives Market Value (US$ Bn) Forecast, by Country and Sub-region, 2022–2031

Table 56: Latin America Lubricant Additives Market Volume (Kilo Tons) Forecast, by Product, 2022–2031

Table 57: Latin America Lubricant Additives Market Value (US$ Bn) Forecast, by Product, 2022–2031

Table 58: Brazil Lubricant Additives Market Volume (Kilo Tons) Forecast, By Product, 2022–2031

Table 59: Brazil Lubricant Additives Market Value (US$ Bn) Forecast, By Product, 2022–2031

Table 60: Mexico Lubricant Additives Market Volume (Kilo Tons) Forecast, By Product, 2022–2031

Table 61: Mexico Lubricant Additives Market Value (US$ Bn) Forecast, By Product, 2022–2031

Table 62: Rest of Latin America Lubricant Additives Market Volume (Kilo Tons) Forecast, By Product, 2022–2031

Table 63: Rest of Latin America Lubricant Additives Market Value (US$ Bn) Forecast, By Product, 2022–2031

List of Figures

Figure 01: Global Lubricant Additives Market Volume (Kilo Tons) Forecast, 2022–2031

Figure 02: Global Lubricant Additives Market Size (US$ Bn) Forecast, 2022–2031

Figure 03: Global Lubricant Additives Market Value Share Analysis, by Product, 2020 and 2031

Figure 04: Global Lubricant Additives Market Attractiveness Analysis, by Product, 2022–2031

Figure 05: Global Lubricant Additives Market Value Share Analysis, by Region, 2020 and 2031

Figure 06: Global Lubricant Additives Market Attractiveness Analysis, by Region, 2022–2031

Figure 07: North America Lubricant Additives Market Volume (Kilo Tons) Forecast, 2022–2031

Figure 08: North America Lubricant Additives Market Value (US$ Bn) Forecast, 2022–2031

Figure 09: North America Lubricant Additives Market Value Share Analysis, by Product, 2020 and 2031

Figure 10: U.S. Lubricant Additives Market Volume (Kilo Tons) Forecast, 2022–2031

Figure 11: U.S. Lubricant Additives Market Value (US$ Bn) Forecast, 2022–2031

Figure 12: Canada Lubricant Additives Market Volume (Kilo Tons) Forecast, 2022–2031

Figure 13: Canada Lubricant Additives Market Value (US$ Bn) Forecast, 2022–2031

Figure 14: North America Lubricant Additives Market Attractiveness Analysis, by Product

Figure 15: North America Lubricant Additives Market Attractiveness Analysis, by Country

Figure 16: Europe Lubricant Additives Market Volume (Kilo Tons) Forecast, 2022–2031

Figure 17: Europe Lubricant Additives Market Value (US$ Bn) Forecast, 2022–2031

Figure 18: Europe Lubricant Additives Market Value Share Analysis, by Product, 2020 and 2031

Figure 19: Germany Lubricant Additives Market Volume (Kilo Tons) Forecast, 2022–2031

Figure 20: Germany Lubricant Additives Market Value (US$ Bn) Forecast, 2022–2031

Figure 21: France Lubricant Additives Market Volume (Kilo Tons) Forecast, 2022–2031

Figure 22: France Lubricant Additives Market Value (US$ Bn) Forecast, 2022–2031

Figure 23: U.K. Lubricant Additives Market Volume (Kilo Tons) Forecast, 2022–2031

Figure 24: U.K. Lubricant Additives Market Value (Bn) Forecast, 2022–2031

Figure 25: Spain Lubricant Additives Market Value (US$ Bn) Forecast, 2022–2031

Figure 26: Spain Lubricant Additives Market Volume (Kilo Tons) Forecast, 2022–2031

Figure 27: France Lubricant Additives Market Value (US$ Bn) Forecast, 2022–2031

Figure 28: France Lubricant Additives Market Volume (Kilo Tons) Forecast, 2022–2031

Figure 29: Russia & CIS Lubricant Additives Market Value (US$ Bn) Forecast, 2022–2031

Figure 30: Russia & CIS Lubricant Additives Market Volume (Kilo Tons) Forecast, 2022–2031

Figure 31: Italy Lubricant Additives Market Volume (Kilo Tons) Forecast, 2022–2031

Figure 32: Italy Lubricant Additives Market Value (US$ Bn) Forecast, 2022–2031

Figure 33: Rest of Europe Lubricant Additives Market Volume (Kilo Tons) Forecast, 2022–2031

Figure 34: Rest of Europe Lubricant Additives Market Value (US$ Bn) Forecast, 2022–2031

Figure 35: Europe Lubricant Additives Market Attractiveness Analysis, by Product

Figure 36: Europe Lubricant Additives Market Attractiveness Analysis, by Country

Figure 37: Asia Pacific Lubricant Additives Market Volume (Kilo Tons) Forecast, 2022–2031

Figure38: Asia Pacific Lubricant Additives Market Value (US$ Bn) Forecast, 2022–2031

Figure 39: Asia Pacific Lubricant Additives Market Value Share Analysis, by Product, 2020 and 2031

Figure 40: China Lubricant Additives Market Volume (Kilo Tons) Forecast, 2022–2031

Figure 41: China Lubricant Additives Market Value (US$ Bn) Forecast, 2022–2031

Figure 42: Japan Lubricant Additives Market Volume (Kilo Tons) Forecast, 2022–2031

Figure 43: Japan Lubricant Additives Market Value (US$ Bn) Forecast, 2022–2031

Figure 44: India Lubricant Additives Market Volume (Kilo Tons) Forecast, 2022–2031

Figure 45: India Lubricant Additives Market Value (US$ Bn) Forecast, 2022–2031

Figure 46: ASEAN Lubricant Additives Market Volume (Kilo Tons) Forecast, 2022–2031

Figure 47: ASEAN Lubricant Additives Market Value (US$ Bn) Forecast, 2022–2031

Figure 48: Rest of Asia Pacific Lubricant Additives Market Volume (Kilo Tons) Forecast, 2022–2031

Figure 49: Rest of Asia Pacific Lubricant Additives Market Value (US$ Bn) Forecast, 2022–2031

Figure 50: Asia Pacific Lubricant Additives Market Attractiveness Analysis, by Product

Figure 51: Asia Pacific Lubricant Additives Market Attractiveness Analysis, by Country

Figure 52: Middle East & Africa Lubricant Additives Market Volume (Kilo Tons) Forecast, 2022–2031

Figure 53: Middle East & Africa Lubricant Additives Market Value (US$ Bn) Forecast, 2022–2031

Figure 54: Middle East & Africa Lubricant Additives Market Value Share Analysis, by Product, 2020 and 2031

Figure 55: GCC Lubricant Additives Market Volume (Kilo Tons) Forecast, 2022–2031

Figure 56: GCC Lubricant Additives Market Value (US$ Bn) Forecast, 2022–2031

Figure 57: South Africa Lubricant Additives Market Volume (Kilo Tons) Forecast, 2022–2031

Figure 58: South Africa Lubricant Additives Market Value (US$ Bn) Forecast, 2022–2031

Figure 59: Rest of Middle East & Africa Lubricant Additives Market Volume (Kilo Tons) Forecast, 2022–2031

Figure 60: Rest of Middle East & Africa Lubricant Additives Market Value (US$ Bn) Forecast, 2022–2031

Figure 61: Middle East & Africa Lubricant Additives Market Attractiveness Analysis, by Product

Figure 62: Middle East & Africa Lubricant Additives Market Attractiveness Analysis, by Country

Figure 63: Latin America Lubricant Additives Market Volume (Kilo Tons) Forecast, 2022–2031

Figure 64: Latin America Lubricant Additives Market Value (US$ Bn) Forecast, 2022–2031

Figure 65: Latin America Lubricant Additives Market Value Share Analysis, by Product, 2020 and 2031

Figure 66: Brazil Lubricant Additives Market Volume (Kilo Tons) Forecast, 2022–2031

Figure 67: Brazil Lubricant Additives Market Value (US$ Bn) Forecast, 2022–2031

Figure 68: Mexico Lubricant Additives Market Volume (Kilo Tons) Forecast, 2022–2031

Figure 69: Mexico Lubricant Additives Market Value (US$ Bn) Forecast, 2022–2031

Figure 70: Rest of Latin America Lubricant Additives Market Volume (Kilo Tons) Forecast, 2022–2031

Figure 71: Rest of Latin America Lubricant Additives Market Value (US$ Bn) Forecast, 2022–2031

Figure 72: Latin America Lubricant Additives Market Attractiveness Analysis, by Product

Figure 73: Latin America Lubricant Additives Market Attractiveness Analysis, by Country

Figure 74: Global Lubricant Additives Market Share Analysis, by Company (2021)