Analysts’ Viewpoint

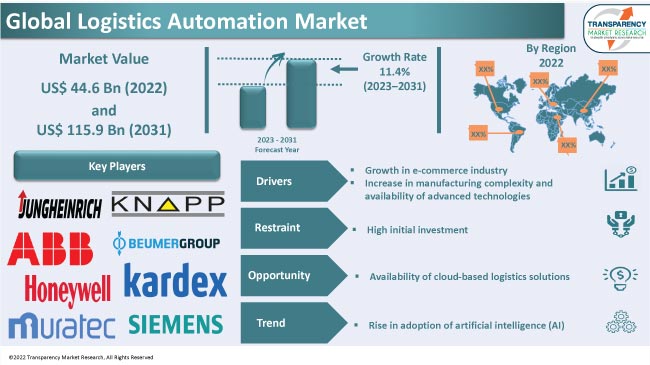

Expansion in the e-commerce industry is driving the demand for efficient and reliable logistics solutions. Increase in manufacturing complexity and availability of advanced technologies are key growth drivers of the logistics automation market. Companies are increasingly adopting logistics automation to reduce lead times, minimize errors, and improve overall supply chain efficiency by automating tasks such as warehouse operation, inventory management, and order fulfillment. This is boosting market dynamics.

Rapid advancements in technologies such as robotics, IoT, AI, and machine learning have made logistics automation more feasible and cost-effective. Market players are focusing on growth strategies such as partnerships, mergers & acquisitions, and new product launches to strengthen their industry position. They are also developing a strong worldwide distribution network to increase their market share.

Automation is revolutionizing the logistics sector by leveraging advanced technologies to optimize and streamline operations. Companies are becoming aware of the benefits of automation in improving supply chain operations and enhancing productivity. Other benefits of logistics automation include improved accuracy, faster delivery times, and reduced costs.

Technological advancements, increase in investment in warehouse automation, and rise in collaboration activities among logistics providers and technology vendors are some of the significant factors fueling market progress.

Stringent regulations and sustainability goals are encouraging companies to adopt automation to reduce carbon emissions, optimize routes, and minimize waste. This is creating lucrative business opportunities in the logistics automation market for participants.

Automation in logistics plays a vital role in supporting the success of e-commerce businesses. Of late, the e-commerce sector has been witnessing rapid growth. Increase in internet penetration, rise in adoption of smartphones, and changing consumer behavior have contributed to the surge in online shopping. This growth trend is expected to continue in the next few years, led by factors such as convenience, wider product selections, competitive pricing, and improved logistics capabilities.

Expansion in the e-commerce sector and rise in demand for efficient logistics solutions have fueled innovation in the logistics automation sector. Companies are investing in R&D activities to create advanced technologies, improve existing systems, and stay ahead of the competition. This is augmenting logistics automation market demand.

According to the India Brand Equity Foundation, the e-commerce market in the country was valued at US$ 74.8 Bn in 2022 and is projected to reach US$ 350.0 Bn by 2030.

Modern manufacturing operations have become increasingly complex due to factors such as global supply chains, diverse product portfolios, and customized production requirements. This complexity poses challenges in managing logistics activities efficiently, including inventory management, order fulfillment, and distribution.

Availability of advanced technologies has played a crucial role in driving the adoption of logistics automation in the manufacturing sector. Robotics, AI, IoT, and data analytics have become more accessible and affordable, thus allowing manufacturers to deploy automation solutions. These technologies allow intelligent decision-making, real-time monitoring, and automation of complex logistics processes.

Manufacturers are striving to enhance operational efficiency, improve supply chain visibility, and reduce costs. Hence, integration of automation technologies in logistics has become a critical factor for success.

Thus, growth in complexity of manufacturing processes and availability of advanced technologies are significantly influencing the adoption of automation in logistics.

The inventory management application segment held large share of 31.3% in 2022. It is likely to maintain its dominant position during the forecast period.

Inventory management helps track and manage inventory levels, generate picking and packing lists, and optimize routes for transportation, thus resulting in faster order fulfillment and reduced lead times.

Automation of inventory tracking and management enables companies to gain real-time visibility into their inventory levels, thus enabling them to make informed decisions regarding procurement, production, and order fulfillment. This helps prevent stockouts and overstocking. In turn, this is likely to create value-grab logistics automation market opportunities for companies.

As per the latest logistics automation market forecast, North America is estimated to dominate the global landscape during the forecast period, owing to the increase in awareness about the importance of automation in enhancing competitiveness and economic growth in the region. It held 34.8% share in 2022.

Governments of several countries in the region are providing incentives, grants, and tax benefits to encourage companies to adopt automation technologies and drive innovation in logistics and supply chain management. This is positively impacting logistics automation market growth in North America.

The logistics automation market size in Asia Pacific is anticipated to increase in the near future, owing to technological advancements and digital transformation in the region. Asia Pacific constituted 25.2% share in 2022. Governments of several countries in the region are taking initiatives to promote automation and digitalization in the logistics sector.

The global landscape is fragmented, with the presence of a large number of leading players that control majority of the logistics automation market share. Several companies are investing significantly in logistics automation services.

Some of the prominent companies operating in the global market are ABB Ltd, CIGNEX, Dematic, Hitachi, Ltd. (JR Automation), Jungheinrich AG, Knapp AG, Oracle Corporation, Siemens AG, Beumer Group GmbH & Co. KG, Honeywell International, Inc., Kardex Group, Murata Machinery, Ltd, Seegrid Corporation, Daifuku Co. Ltd, and Zebra Technologies Corp. These players are following the latest logistics automation industry trends to avail lucrative growth opportunities.

Key players have been profiled in the logistics automation market report based on parameters such as business strategies, financial overview, product portfolio, company overview, latest developments, and business segments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 44.6 Bn |

|

Market Forecast Value in 2031 |

US$ 115.9 Bn |

|

Growth Rate (CAGR) |

11.4% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value and Billion Units for Volume |

|

Market Analysis |

It includes cross-segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 44.6 Bn in 2022

It is likely to advance at a CAGR of 11.4% from 2023 to 2031

Increase in manufacturing complexity and technology availability and growth in the e-commerce industry

The inventory management application segment accounted for major share of 31.3% in 2022

North America is a more attractive region

It was valued at US$ 11.0 Bn in 2022

ABB Ltd, Beumer Group GmbH & Co. KG, CIGNEX, Daifuku Co. Ltd, Dematic, Hitachi, Ltd. (JR Automation), Honeywell International, Inc., Jungheinrich AG, Kardex Group, Knapp AG, Murata Machinery, Ltd, Oracle Corporation, Seegrid Corporation, Siemens AG, and Zebra Technologies Corp.

1. Preface

1.1. Market and Segments Definition

1.2. Market Taxonomy

1.3. Research Methodology

1.4. Assumption and Acronyms

2. Executive Summary

2.1. Global Logistics Automation Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview - Industry Automation Overview

4.2. Ecosystem Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap Analysis

4.5. Industry SWOT Analysis

4.6. Porter Five Forces Analysis

5. Global Logistics Automation Market Analysis By Offering

5.1. Logistics Automation Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Offering, 2017-2031

5.1.1. Hardware (US$ Bn and Billion Units)

5.1.1.1. Robots

5.1.1.2. Automated Storage and Retrieval System (ASRS)

5.1.1.3. Vehicle Trackers

5.1.1.4. Others

5.1.2. Software

5.1.2.1. WMS (Warehouse Management System)

5.1.2.2. TMS (Transportation Management System)

5.1.2.3. Automatic Identification and Data Capture (AIDC)

5.1.3. Services

5.1.3.1. Training and Consulting Services

5.1.3.2. Repair and Maintenance Services

5.2. Market Attractiveness Analysis, By Offering

6. Global Logistics Automation Market Analysis By Application

6.1. Logistics Automation Market Size (US$ Bn) Analysis & Forecast, By Application, 2017-2031

6.1.1. Loading and Unloading

6.1.2. Sortation and Storage

6.1.3. Inventory Management

6.1.4. Shipment Scheduling and Tracking

6.1.5. Others

6.2. Market Attractiveness Analysis, By Application

7. Global Logistics Automation Market Analysis By End-use Industry

7.1. Logistics Automation Market Size (US$ Bn) Analysis & Forecast, By End-use Industry, 2017-2031

7.1.1. Food and Beverage

7.1.2. FMCG (Fast-moving Consumer Goods)

7.1.3. Fashion and Apparel

7.1.4. Healthcare

7.1.5. Automotive

7.1.6. Retail

7.1.7. 3PL

7.1.8. Consumer Electronics

7.1.9. Chemical

7.1.10. Metals and Mining

7.1.11. Others

7.2. Market Attractiveness Analysis, By End-use Industry

8. Global Logistics Automation Market Analysis and Forecast, By Region

8.1. Logistics Automation Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Region, 2017-2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. South America

8.2. Market Attractiveness Analysis, By Region

9. North America Logistics Automation Market Analysis and Forecast

9.1. Market Snapshot

9.2. Logistics Automation Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Offering, 2017-2031

9.2.1. Hardware (US$ Bn and Billion Units)

9.2.1.1. Robots

9.2.1.2. Automated Storage and Retrieval System (ASRS)

9.2.1.3. Vehicle Trackers

9.2.1.4. Others

9.2.2. Software

9.2.2.1. WMS (Warehouse Management System)

9.2.2.2. TMS (Transportation Management System)

9.2.2.3. Automatic Identification and Data Capture (AIDC)

9.2.3. Services

9.2.3.1. Training and Consulting Services

9.2.3.2. Repair and Maintenance Services

9.3. Logistics Automation Market Size (US$ Bn) Analysis & Forecast, By Application, 2017-2031

9.3.1. Loading and Unloading

9.3.2. Sortation and Storage

9.3.3. Inventory Management

9.3.4. Shipment Scheduling and Tracking

9.3.5. Others

9.4. Logistics Automation Market Size (US$ Bn) Analysis & Forecast, By End-use Industry, 2017-2031

9.4.1. Food and Beverage

9.4.2. FMCG (Fast-moving Consumer Goods)

9.4.3. Fashion and Apparel

9.4.4. Healthcare

9.4.5. Automotive

9.4.6. Retail

9.4.7. 3PL

9.4.8. Consumer Electronics

9.4.9. Chemical

9.4.10. Metals and Mining

9.4.11. Others

9.5. Logistics Automation Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

9.5.1. The U.S.

9.5.2. Canada

9.5.3. Rest of North America

9.6. Market Attractiveness Analysis

9.6.1. By Offering

9.6.2. By Application

9.6.3. By End-use Industry

9.6.4. By Country/Sub-region

10. Europe Logistics Automation Market Analysis and Forecast

10.1. Market Snapshot

10.2. Logistics Automation Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Offering, 2017-2031

10.2.1. Hardware (US$ Bn and Billion Units)

10.2.1.1. Robots

10.2.1.2. Automated Storage and Retrieval System (ASRS)

10.2.1.3. Vehicle Trackers

10.2.1.4. Others

10.2.2. Software

10.2.2.1. WMS (Warehouse Management System)

10.2.2.2. TMS (Transportation Management System)

10.2.2.3. Automatic Identification and Data Capture (AIDC)

10.2.3. Services

10.2.3.1. Training and Consulting Services

10.2.3.2. Repair and Maintenance Services

10.3. Logistics Automation Market Size (US$ Bn) Analysis & Forecast, By Application, 2017-2031

10.3.1. Loading and Unloading

10.3.2. Sortation and Storage

10.3.3. Inventory Management

10.3.4. Shipment Scheduling and Tracking

10.3.5. Others

10.4. Logistics Automation Market Size (US$ Bn) Analysis & Forecast, By End-use Industry, 2017-2031

10.4.1. Food and Beverage

10.4.2. FMCG (Fast-moving Consumer Goods)

10.4.3. Fashion and Apparel

10.4.4. Healthcare

10.4.5. Automotive

10.4.6. Retail

10.4.7. 3PL

10.4.8. Consumer Electronics

10.4.9. Chemical

10.4.10. Metals and Mining

10.4.11. Others

10.5. Logistics Automation Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

10.5.1. The U.K.

10.5.2. Germany

10.5.3. France

10.5.4. Rest of Europe

10.6. Market Attractiveness Analysis

10.6.1. By Offering

10.6.2. By Application

10.6.3. By End-use Industry

10.6.4. By Country/Sub-region

11. Asia Pacific Logistics Automation Market Analysis and Forecast

11.1. Market Snapshot

11.2. Logistics Automation Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Offering, 2017-2031

11.2.1. Hardware (US$ Bn and Billion Units)

11.2.1.1. Robots

11.2.1.2. Automated Storage and Retrieval System (ASRS)

11.2.1.3. Vehicle Trackers

11.2.1.4. Others

11.2.2. Software

11.2.2.1. WMS (Warehouse Management System)

11.2.2.2. TMS (Transportation Management System)

11.2.2.3. Automatic Identification and Data Capture (AIDC)

11.2.3. Services

11.2.3.1. Training and Consulting Services

11.2.3.2. Repair and Maintenance Services

11.3. Logistics Automation Market Size (US$ Bn) Analysis & Forecast, By Application, 2017-2031

11.3.1. Loading and Unloading

11.3.2. Sortation and Storage

11.3.3. Inventory Management

11.3.4. Shipment Scheduling and Tracking

11.3.5. Others

11.4. Logistics Automation Market Size (US$ Bn) Analysis & Forecast, By End-use Industry, 2017-2031

11.4.1. Food and Beverage

11.4.2. FMCG (Fast-moving Consumer Goods)

11.4.3. Fashion and Apparel

11.4.4. Healthcare

11.4.5. Automotive

11.4.6. Retail

11.4.7. 3PL

11.4.8. Consumer Electronics

11.4.9. Chemical

11.4.10. Metals and Mining

11.4.11. Others

11.5. Logistics Automation Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

11.5.1. China

11.5.2. Japan

11.5.3. India

11.5.4. South Korea

11.5.5. ASEAN

11.5.6. Rest of Asia Pacific

11.6. Market Attractiveness Analysis

11.6.1. By Offering

11.6.2. By Application

11.6.3. By End-use Industry

11.6.4. By Country/Sub-region

12. Middle East and Africa Logistics Automation Market Analysis and Forecast

12.1. Market Snapshot

12.2. Logistics Automation Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Offering, 2017-2031

12.2.1. Hardware (US$ Bn and Billion Units)

12.2.1.1. Robots

12.2.1.2. Automated Storage and Retrieval System (ASRS)

12.2.1.3. Vehicle Trackers

12.2.1.4. Others

12.2.2. Software

12.2.2.1. WMS (Warehouse Management System)

12.2.2.2. TMS (Transportation Management System)

12.2.2.3. Automatic Identification and Data Capture (AIDC)

12.2.3. Services

12.2.3.1. Training and Consulting Services

12.2.3.2. Repair and Maintenance Services

12.3. Logistics Automation Market Size (US$ Bn) Analysis & Forecast, By Application, 2017-2031

12.3.1. Loading and Unloading

12.3.2. Sortation and Storage

12.3.3. Inventory Management

12.3.4. Shipment Scheduling and Tracking

12.3.5. Others

12.4. Logistics Automation Market Size (US$ Bn) Analysis & Forecast, By End-use Industry, 2017-2031

12.4.1. Food and Beverage

12.4.2. FMCG (Fast-moving Consumer Goods)

12.4.3. Fashion and Apparel

12.4.4. Healthcare

12.4.5. Automotive

12.4.6. Retail

12.4.7. 3PL

12.4.8. Consumer Electronics

12.4.9. Chemical

12.4.10. Metals and Mining

12.4.11. Others

12.5. Logistics Automation Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

12.5.1. GCC

12.5.2. South Africa

12.5.3. Rest of Middle East and Africa

12.6. Market Attractiveness Analysis

12.6.1. By Offering

12.6.2. By Application

12.6.3. By End-use Industry

12.6.4. By Country/Sub-region

13. South America Logistics Automation Market Analysis and Forecast

13.1. Market Snapshot

13.2. Logistics Automation Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Offering, 2017-2031

13.2.1. Hardware (US$ Bn and Billion Units)

13.2.1.1. Robots

13.2.1.2. Automated Storage and Retrieval System (ASRS)

13.2.1.3. Vehicle Trackers

13.2.1.4. Others

13.2.2. Software

13.2.2.1. WMS (Warehouse Management System)

13.2.2.2. TMS (Transportation Management System)

13.2.2.3. Automatic Identification and Data Capture (AIDC)

13.2.3. Services

13.2.3.1. Training and Consulting Services

13.2.3.2. Repair and Maintenance Services

13.3. Logistics Automation Market Size (US$ Bn) Analysis & Forecast, By Application, 2017-2031

13.3.1. Loading and Unloading

13.3.2. Sortation and Storage

13.3.3. Inventory Management

13.3.4. Shipment Scheduling and Tracking

13.3.5. Others

13.4. Logistics Automation Market Size (US$ Bn) Analysis & Forecast, By End-use Industry, 2017-2031

13.4.1. Food and Beverage

13.4.2. FMCG (Fast-moving Consumer Goods)

13.4.3. Fashion and Apparel

13.4.4. Healthcare

13.4.5. Automotive

13.4.6. Retail

13.4.7. 3PL

13.4.8. Consumer Electronics

13.4.9. Chemical

13.4.10. Metals and Mining

13.4.11. Others

13.5. Logistics Automation Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

13.5.1. Brazil

13.5.2. Rest of South America

13.6. Market Attractiveness Analysis

13.6.1. By Offering

13.6.2. By Application

13.6.3. By End-use Industry

13.6.4. By Country/Sub-region

14. Competition Assessment

14.1. Global Logistics Automation Market Competition Matrix - a Dashboard View

14.1.1. Global Logistics Automation Market Company Share Analysis, by Value (2022)

14.1.2. Technological Differentiator

15. Company Profiles (Global Manufacturers/Suppliers)

15.1. ABB Ltd.

15.1.1. Overview

15.1.2. Product Portfolio

15.1.3. Sales Footprint

15.1.4. Key Subsidiaries or Distributors

15.1.5. Strategy and Recent Developments

15.1.6. Key Financials

15.2. Beumer Group GmbH & Co. KG

15.2.1. Overview

15.2.2. Product Portfolio

15.2.3. Sales Footprint

15.2.4. Key Subsidiaries or Distributors

15.2.5. Strategy and Recent Developments

15.2.6. Key Financials

15.3. CIGNEX

15.3.1. Overview

15.3.2. Product Portfolio

15.3.3. Sales Footprint

15.3.4. Key Subsidiaries or Distributors

15.3.5. Strategy and Recent Developments

15.3.6. Key Financials

15.4. Daifuku Co. Ltd

15.4.1. Overview

15.4.2. Product Portfolio

15.4.3. Sales Footprint

15.4.4. Key Subsidiaries or Distributors

15.4.5. Strategy and Recent Developments

15.4.6. Key Financials

15.5. Dematic

15.5.1. Overview

15.5.2. Product Portfolio

15.5.3. Sales Footprint

15.5.4. Key Subsidiaries or Distributors

15.5.5. Strategy and Recent Developments

15.5.6. Key Financials

15.6. Hitachi, Ltd. (JR Automation)

15.6.1. Overview

15.6.2. Product Portfolio

15.6.3. Sales Footprint

15.6.4. Key Subsidiaries or Distributors

15.6.5. Strategy and Recent Developments

15.6.6. Key Financials

15.7. Honeywell International, Inc.

15.7.1. Overview

15.7.2. Product Portfolio

15.7.3. Sales Footprint

15.7.4. Key Subsidiaries or Distributors

15.7.5. Strategy and Recent Developments

15.7.6. Key Financials

15.8. Jungheinrich AG

15.8.1. Overview

15.8.2. Product Portfolio

15.8.3. Sales Footprint

15.8.4. Key Subsidiaries or Distributors

15.8.5. Strategy and Recent Developments

15.8.6. Key Financials

15.9. Kardex Group

15.9.1. Overview

15.9.2. Product Portfolio

15.9.3. Sales Footprint

15.9.4. Key Subsidiaries or Distributors

15.9.5. Strategy and Recent Developments

15.9.6. Key Financials

15.10. Knapp AG

15.10.1. Overview

15.10.2. Product Portfolio

15.10.3. Sales Footprint

15.10.4. Key Subsidiaries or Distributors

15.10.5. Strategy and Recent Developments

15.10.6. Key Financials

15.11. Murata Machinery, Ltd.

15.11.1. Overview

15.11.2. Product Portfolio

15.11.3. Sales Footprint

15.11.4. Key Subsidiaries or Distributors

15.11.5. Strategy and Recent Developments

15.11.6. Key Financials

15.12. Oracle Corporation

15.12.1. Overview

15.12.2. Product Portfolio

15.12.3. Sales Footprint

15.12.4. Key Subsidiaries or Distributors

15.12.5. Strategy and Recent Developments

15.12.6. Key Financials

15.13. Seegrid Corporation

15.13.1. Overview

15.13.2. Product Portfolio

15.13.3. Sales Footprint

15.13.4. Key Subsidiaries or Distributors

15.13.5. Strategy and Recent Developments

15.13.6. Key Financials

15.14. Siemens AG

15.14.1. Overview

15.14.2. Product Portfolio

15.14.3. Sales Footprint

15.14.4. Key Subsidiaries or Distributors

15.14.5. Strategy and Recent Developments

15.14.6. Key Financials

15.15. Zebra Technologies Corp.

15.15.1. Overview

15.15.2. Product Portfolio

15.15.3. Sales Footprint

15.15.4. Key Subsidiaries or Distributors

15.15.5. Strategy and Recent Developments

15.15.6. Key Financials

16. Go to Market Strategy

16.1. Identification of Potential Market Spaces

16.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Logistics Automation Market Value (US$ Bn) & Forecast, by Offering, 2017-2031

Table 2: Global Logistics Automation Market Volume (Billion Units) & Forecast, by Offering, 2017-2031

Table 3: Global Logistics Automation Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 4: Global Logistics Automation Market Value (US$ Bn) & Forecast, by End-use Industry, 2017-2031

Table 5: Global Logistics Automation Market Value (US$ Bn) & Forecast, by Region, 2017-2031

Table 6: Global Logistics Automation Market Volume (Billion Units) & Forecast, by Region, 2017-2031

Table 7: North America Logistics Automation Market Value (US$ Bn) & Forecast, by Offering, 2017-2031

Table 8: North America Logistics Automation Market Volume (Billion Units) & Forecast, by Offering, 2017-2031

Table 9: North America Logistics Automation Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 10: North America Logistics Automation Market Value (US$ Bn) & Forecast, by End-use Industry, 2017-2031

Table 11: North America Logistics Automation Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017-2031

Table 12: North America Logistics Automation Market Volume (Billion Units) & Forecast, by Country and Sub-region, 2017-2031

Table 13: Europe Logistics Automation Market Value (US$ Bn) & Forecast, by Offering, 2017-2031

Table 14: Europe Logistics Automation Market Volume (Billion Units) & Forecast, by Offering, 2017-2031

Table 15: Europe Logistics Automation Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 16: Europe Logistics Automation Market Value (US$ Bn) & Forecast, by End-use Industry, 2017-2031

Table 17: Europe Logistics Automation Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017-2031

Table 18: Europe Logistics Automation Market Volume (Billion Units) & Forecast, by Country and Sub-region, 2017-2031

Table 19: Asia Pacific Logistics Automation Market Value (US$ Bn) & Forecast, by Offering, 2017-2031

Table 20: Asia Pacific Logistics Automation Market Volume (Billion Units) & Forecast, by Offering, 2017-2031

Table 21: Asia Pacific Logistics Automation Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 22: Asia Pacific Logistics Automation Market Value (US$ Bn) & Forecast, by End-use Industry, 2017-2031

Table 23: Asia Pacific Logistics Automation Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017-2031

Table 24: Asia Pacific Logistics Automation Market Volume (Billion Units) & Forecast, by Country and Sub-region, 2017-2031

Table 25: Middle East and Africa Logistics Automation Market Value (US$ Bn) & Forecast, by Offering, 2017-2031

Table 26: Middle East and Africa Logistics Automation Market Volume (Billion Units) & Forecast, by Offering, 2017-2031

Table 27: Middle East and Africa Logistics Automation Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 28: Middle East and Africa Logistics Automation Market Value (US$ Bn) & Forecast, by End-use Industry, 2017-2031

Table 29: Middle East and Africa Logistics Automation Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017-2031

Table 30: Middle East and Africa Logistics Automation Market Volume (Billion Units) & Forecast, by Country and Sub-region, 2017-2031

Table 31: South America Logistics Automation Market Value (US$ Bn) & Forecast, by Offering, 2017-2031

Table 32: South America Logistics Automation Market Volume (Billion Units) & Forecast, by Offering, 2017-2031

Table 33: South America Logistics Automation Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 34: South America Logistics Automation Market Value (US$ Bn) & Forecast, by End-use Industry, 2017-2031

Table 35: South America Logistics Automation Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017-2031

Table 36: South America Logistics Automation Market Volume (Billion Units) & Forecast, by Country and Sub-region, 2017-2031

List of Figures

Figure 01: Supply Chain Analysis - Global Logistics Automation

Figure 02: Porter Five Forces Analysis - Global Logistics Automation

Figure 03: Technology Road Map - Global Logistics Automation

Figure 04: Global Logistics Automation Market, Value (US$ Bn), 2017-2031

Figure 05: Global Logistics Automation Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 06: Global Logistics Automation Market Projections by Offering, Value (US$ Bn), 2017‒2031

Figure 07: Global Logistics Automation Market, Incremental Opportunity, by Offering, 2023‒2031

Figure 08: Global Logistics Automation Market Share Analysis, by Offering, 2023 and 2031

Figure 09: Global Logistics Automation Market Projections by Application, Value (US$ Bn), 2017‒2031

Figure 10: Global Logistics Automation Market, Incremental Opportunity, by Application, 2023‒2031

Figure 11: Global Logistics Automation Market Share Analysis, by Application, 2023 and 2031

Figure 12: Global Logistics Automation Market Projections by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 13: Global Logistics Automation Market, Incremental Opportunity, by End-use Industry, 2023‒2031

Figure 14: Global Logistics Automation Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 15: Global Logistics Automation Market Projections by Region, Value (US$ Bn), 2017‒2031

Figure 16: Global Logistics Automation Market, Incremental Opportunity, by Region, 2023‒2031

Figure 17: Global Logistics Automation Market Share Analysis, by Region, 2023 and 2031

Figure 18: North America Logistics Automation Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 19: North America Logistics Automation Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 20: North America Logistics Automation Market Projections by Offering Value (US$ Bn), 2017‒2031

Figure 21: North America Logistics Automation Market, Incremental Opportunity, by Offering, 2023‒2031

Figure 22: North America Logistics Automation Market Share Analysis, by Offering, 2023 and 2031

Figure 23: North America Logistics Automation Market Projections by Application (US$ Bn), 2017‒2031

Figure 24: North America Logistics Automation Market, Incremental Opportunity, by Application, 2023‒2031

Figure 25: North America Logistics Automation Market Share Analysis, by Application, 2023 and 2031

Figure 26: North America Logistics Automation Market Projections by End-use Industry Value (US$ Bn), 2017‒2031

Figure 27: North America Logistics Automation Market, Incremental Opportunity, by End-use Industry, 2023‒2031

Figure 28: North America Logistics Automation Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 29: North America Logistics Automation Market Projections by Country and sub-region, Value (US$ Bn), 2017‒2031

Figure 30: North America Logistics Automation Market, Incremental Opportunity, by Country and sub-region, 2023‒2031

Figure 31: North America Logistics Automation Market Share Analysis, by Country and sub-region 2023 and 2031

Figure 32: Europe Logistics Automation Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 33: Europe Logistics Automation Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 34: Europe Logistics Automation Market Projections by Offering Value (US$ Bn), 2017‒2031

Figure 35: Europe Logistics Automation Market, Incremental Opportunity, by Offering, 2023‒2031

Figure 36: Europe Logistics Automation Market Share Analysis, by Offering, 2023 and 2031

Figure 37: Europe Logistics Automation Market Projections by Application, Value (US$ Bn), 2017‒2031

Figure 38: Europe Logistics Automation Market, Incremental Opportunity, by Application, 2023‒2031

Figure 39: Europe Logistics Automation Market Share Analysis, by Application, 2023 and 2031

Figure 40: Europe Logistics Automation Market Projections by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 41: Europe Logistics Automation Market, Incremental Opportunity, by End-use Industry, 2023‒2031

Figure 42: Europe Logistics Automation Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 43: Europe Logistics Automation Market Projections by Country and sub-region, Value (US$ Bn), 2017‒2031

Figure 44: Europe Logistics Automation Market, Incremental Opportunity, by Country and sub-region, 2023‒2031

Figure 45: Europe Logistics Automation Market Share Analysis, by Country and sub-region 2023 and 2031

Figure 46: Asia Pacific Logistics Automation Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 47: Asia Pacific Logistics Automation Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 48: Asia Pacific Logistics Automation Market Projections by Offering Value (US$ Bn), 2017‒2031

Figure 49: Asia Pacific Logistics Automation Market, Incremental Opportunity, by Offering, 2023‒2031

Figure 50: Asia Pacific Logistics Automation Market Share Analysis, by Offering, 2023 and 2031

Figure 51: Asia Pacific Logistics Automation Market Projections by Application, Value (US$ Bn), 2017‒2031

Figure 52: Asia Pacific Logistics Automation Market, Incremental Opportunity, by Application, 2023‒2031

Figure 53: Asia Pacific Logistics Automation Market Share Analysis, by Application, 2023 and 2031

Figure 54: Asia Pacific Logistics Automation Market Projections by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 55: Asia Pacific Logistics Automation Market, Incremental Opportunity, by End-use Industry, 2023‒2031

Figure 56: Asia Pacific Logistics Automation Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 57: Asia Pacific Logistics Automation Market Projections by Country and sub-region, Value (US$ Bn), 2017‒2031

Figure 58: Asia Pacific Logistics Automation Market, Incremental Opportunity, by Country and sub-region, 2023‒2031

Figure 59: Asia Pacific Logistics Automation Market Share Analysis, by Country and sub-region 2023 and 2031

Figure 60: Middle East & Africa Logistics Automation Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 61: Middle East & Africa Logistics Automation Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 62: Middle East & Africa Logistics Automation Market Projections by Offering Value (US$ Bn), 2017‒2031

Figure 63: Middle East & Africa Logistics Automation Market, Incremental Opportunity, by Offering, 2023‒2031

Figure 64: Middle East & Africa Logistics Automation Market Share Analysis, by Offering, 2023 and 2031

Figure 65: Middle East & Africa Logistics Automation Market Projections by Application, Value (US$ Bn), 2017‒2031

Figure 66: Middle East & Africa Logistics Automation Market, Incremental Opportunity, by Application, 2023‒2031

Figure 67: Middle East & Africa Logistics Automation Market Share Analysis, by Application, 2023 and 2031

Figure 68: Middle East & Africa Logistics Automation Market Projections by End-use Industry Value (US$ Bn), 2017‒2031

Figure 69: Middle East & Africa Logistics Automation Market, Incremental Opportunity, by End-use Industry, 2023‒2031

Figure 70: Middle East & Africa Logistics Automation Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 71: Middle East & Africa Logistics Automation Market Projections by Country and sub-region, Value (US$ Bn), 2017‒2031

Figure 72: Middle East & Africa Logistics Automation Market, Incremental Opportunity, by Country and sub-region, 2023‒2031

Figure 73: Middle East & Africa Logistics Automation Market Share Analysis, by Country and sub-region 2023 and 2031

Figure 74: South America Logistics Automation Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 75: South America Logistics Automation Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 76: South America Logistics Automation Market Projections by Offering Value (US$ Bn), 2017‒2031

Figure 77: South America Logistics Automation Market, Incremental Opportunity, by Offering, 2023‒2031

Figure 78: South America Logistics Automation Market Share Analysis, by Offering, 2023 and 2031

Figure 79: South America Logistics Automation Market Projections by Application, Value (US$ Bn), 2017‒2031

Figure 80: South America Logistics Automation Market, Incremental Opportunity, by Application, 2023‒2031

Figure 81: South America Logistics Automation Market Share Analysis, by Application, 2023 and 2031

Figure 82: South America Logistics Automation Market Projections by End-use Industry Value (US$ Bn), 2017‒2031

Figure 83: South America Logistics Automation Market, Incremental Opportunity, by End-use Industry, 2023‒2031

Figure 84: South America Logistics Automation Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 85: South America Logistics Automation Market Projections by Country and sub-region, Value (US$ Bn), 2017‒2031

Figure 86: South America Logistics Automation Market, Incremental Opportunity, by Country and sub-region, 2023‒2031

Figure 87: South America Logistics Automation Market Share Analysis, by Country and sub-region 2023 and 2031

Figure 88: Global Logistics Automation Market Competition

Figure 89: Global Logistics Automation Market Company Share Analysis