The healthcare sector is converging with the Information and Communications Technology (ICT) sector rapidly, as the need for tech-driven, highly-efficient electronic appliances is growing in various applications, including assisted living. Statistics published by the United Nations state that, in 2013, elderly people accounted for nearly 12% of the global population, and this number is likely to grow rapidly to reach 21% by 2050. This is expected to give rise to the demand for automatic machine-based assistance for the elderly population, consequently providing a fillip to the growth of the location-based ambient intelligence market.

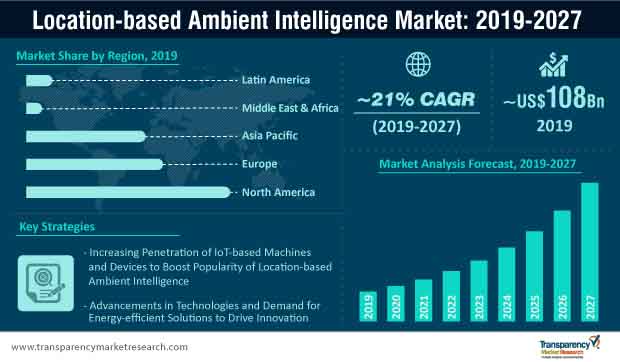

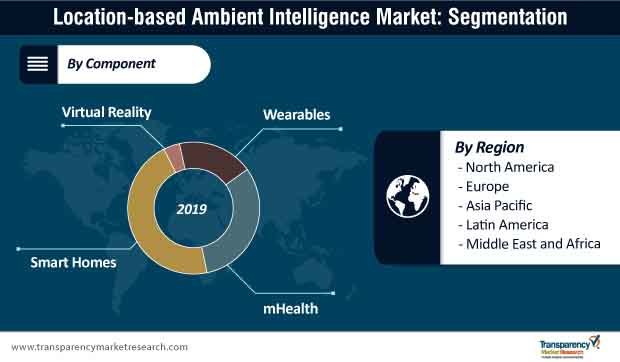

The global market for location-based ambient intelligence reached ~US$ 91.7 billion in 2018, and is likely to reach ~US$ 108 Bn in 2019, with a two-fifth revenue share occupied its applications in smart homes. While the integration of location-based ambient intelligence is observed largely in connected homes, emerging trends in the e-healthcare and telemedicine industries will underscore the new growth prospects for the market in the coming future.

Ongoing advancements in technologies are likely to boost the popularity of ambient-assisted living and the integration of ambient intelligence solutions for assisting medical diagnosis. Increasing sales potential of medical devices that are integrated with ambient intelligence technology, which is intrinsically and thoroughly connected with artificial intelligence (AI), will create a massive window of opportunities for stakeholders in the healthcare sector.

Market players are likely adopt new strategies to focus on changing end users’ needs in specific application areas. This will remain the primary driving engine for the battle for the development of next-gen devices and evolved personal assistant applications of location-based ambient intelligence that can predict dynamic end-user requirements, and make changes in systems that can facilitate these needs.

While the world of Internet of Things (IoT), Virtual Reality (VR), and Ambient Intelligence is mainly characterized by advancements in technology, innovations in the location-based ambient intelligence landscape are not driven by the newest additions in technologies anymore. Commercial applications in the market are mainly driven by consumer perception about their experience with IoT-based, wearable devices.

With the increasing dependence of digital innovation on consumer experience, a majority of market players’ strategies and decision-making policies will be influenced by the thought of providing intuitive and personalized features through the integration of high-quality sensors in location-based ambient intelligence applications. This is redefining the emerging trends and winning imperatives for stakeholders in the location-based ambient intelligence market.

With increasing consumer awareness about the environmental impact of various appliances that they use, the demand for energy-efficient location-based ambient intelligence solutions is surging rapidly. In addition, consumers are also voicing their concerns about cyber threats and the need for security features in location-based ambient-intelligent devices.

These trends in the market are giving rise to technology-driven partnerships among leading players in the location-based ambient intelligence market. For instance, HTC Corporation, a Taiwanese consumer electronics company, has partnered with several ecosystem players to expand its VR footprint, globally. The company partnered with Valve Corp. in order to provide VR based games, specifically to promote HTC Vive among end users. Furthermore, the company partnered with several input controller providers and software & service providers to increase the usage of HTC Vive in different end-user applications.

Another leading player in the market and a Chinese multinational technology company – Huawei Technologies Co., Ltd., focuses on partnerships with companies for the integration and licensing of advanced technologies. It partnered with ARM, a processor design company. The incorporation of ARM’s new ARMv8 license enables technology in networking and cloud computing.

Furthermore, the increasing need for constant advancements in connectivity has been triggering new trends in the location-based ambient intelligence market, and this is bolstering more collaborations among electronic companies with telecommunication service providers. For instance, in February 2018, Samsung Electronics partnered with Vodafone Group to develop and launch a range of consumer Internet of Things (IoT) 'Smart Home' product and services.

Other major players operating in the global location-based ambient intelligence market and profiled in the report include

1. Preface

1.1. Market Scope

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Report Assumptions

2.2. Acronyms

2.3. Research Methodology

3. Executive Summary : Global Location-based Ambient Intelligence Market

4. Market Overview

4.1. Introduction

4.2. Global Market – Macro Economic Factors Overview

4.2.1. World GDP Indicator – For Top 20 Economies

4.2.2. Key Regional Socio-political-technological Developments and Their Impact Considerations

4.3. Technology/Product Roadmap

4.4. Market Factor Analysis

4.4.1. Porter’s Five Forces Analysis

4.4.2. PEST Analysis

4.4.3. Market Dynamics (Growth Influencers)

4.4.3.1. Drivers

4.4.3.2. Restraints

4.4.3.3. Opportunities

4.5. Global Location-based Ambient Intelligence Market Analysis and Forecast, 2017 - 2027

4.5.1. Market Revenue Analysis (US$ Bn)

4.5.1.1. Historic Growth Trends, 2013-2018

4.5.1.2. Forecast trends, 2019-2027

4.6. Market Opportunity Assessment – By Region (Global/North America/Europe/Asia Pacific/Middle East & Africa/South America)

4.6.1. By Region/Country

4.6.2. By Component

4.6.3. By Institution Type

4.7. Market Outlook

5. Global Location-based Ambient Intelligence Market Analysis and Forecast, by Component

5.1. Overview

5.2. Key Segment Analysis

5.3. Location-based Ambient Intelligence Market Size (US$ Bn) Forecast, by Component, 2017 - 2027

5.3.1. Virtual Reality

5.3.1.1. Hardware

5.3.1.2. Software

5.3.2. Wearables

5.3.3. mHealth

5.3.4. Smart Homes

5.3.4.1. Lighting Control

5.3.4.2. Security & Access Control

5.3.4.3. HVAC Control

5.3.4.4. Entertainment Control

5.3.4.5. Others

6. Global Location-based Ambient Intelligence Market Analysis and Forecast, by Region

6.1. Overview

6.2. Key Segment Analysis

6.3. Location-based Ambient Intelligence Market Size (US$ Bn) Forecast, by Region, 2017 - 2027

6.3.1. North America

6.3.2. Europe

6.3.3. Asia Pacific

6.3.4. Middle East & Africa

6.3.5. South America

7. North America Location-based Ambient Intelligence Market Analysis and Forecast

7.1. Overview

7.2. Location-based Ambient Intelligence Market Size (US$ Bn) Forecast, by Component, 2017 - 2027

7.2.1. Virtual Reality

7.2.1.1. Hardware

7.2.1.2. Software

7.2.2. Wearables

7.2.3. mHealth

7.2.4. Smart Homes

7.2.4.1. Lighting Control

7.2.4.2. Security & Access Control

7.2.4.3. HVAC Control

7.2.4.4. Entertainment Control

7.2.4.5. Others

7.3. Location-based Ambient Intelligence Market Size (US$ Bn) Forecast, by Country & Sub-region, 2017 - 2027

7.3.1. The U.S.

7.3.2. Canada

7.3.3. Rest of North America

8. Europe Location-based Ambient Intelligence Market Analysis and Forecast

8.1. Overview

8.2. Location-based Ambient Intelligence Market Size (US$ Bn) Forecast, by Component, 2017 - 2027

8.2.1. Virtual Reality

8.2.1.1. Hardware

8.2.1.2. Software

8.2.2. Wearables

8.2.3. mHealth

8.2.4. Smart Homes

8.2.4.1. Lighting Control

8.2.4.2. Security & Access Control

8.2.4.3. HVAC Control

8.2.4.4. Entertainment Control

8.2.4.5. Others

8.3. Location-based Ambient Intelligence Market Size (US$ Bn) Forecast, by Country & Sub-region, 2017 - 2027

8.3.1. Germany

8.3.2. France

8.3.3. UK

8.3.4. Rest of Europe

9. Asia Pacific Location-based Ambient Intelligence Market Analysis and Forecast

9.1. Overview

9.2. Location-based Ambient Intelligence Market Size (US$ Bn) Forecast, by Component, 2017 - 2027

9.2.1. Virtual Reality

9.2.1.1. Hardware

9.2.1.2. Software

9.2.2. Wearables

9.2.3. mHealth

9.2.4. Smart Homes

9.2.4.1. Lighting Control

9.2.4.2. Security & Access Control

9.2.4.3. HVAC Control

9.2.4.4. Entertainment Control

9.2.4.5. Others

9.3. Location-based Ambient Intelligence Market Size (US$ Bn) Forecast, by Country & Sub-region, 2017 - 2027

9.3.1. China

9.3.2. Japan

9.3.3. India

9.3.4. Australia

9.3.5. Rest of Asia Pacific

10. Middle East & Africa Location-based Ambient Intelligence Market Analysis and Forecast

10.1. Overview

10.2. Location-based Ambient Intelligence Market Size (US$ Bn) Forecast, by Component, 2017 - 2027

10.2.1. Virtual Reality

10.2.1.1. Hardware

10.2.1.2. Software

10.2.2. Wearables

10.2.3. mHealth

10.2.4. Smart Homes

10.2.4.1. Lighting Control

10.2.4.2. Security & Access Control

10.2.4.3. HVAC Control

10.2.4.4. Entertainment Control

10.2.4.5. Others

10.3. Location-based Ambient Intelligence Market Size (US$ Bn) Forecast, by Country & Sub-region, 2017 – 2027

10.3.1. GCC

10.3.2. South Africa

10.3.3. Rest of Middle East & Africa

11. South America Location-based Ambient Intelligence Market Analysis and Forecast

11.1. Overview

11.2. Location-based Ambient Intelligence Market Size (US$ Bn) Forecast, by Component, 2017 - 2027

11.2.1. Virtual Reality

11.2.1.1. Hardware

11.2.1.2. Software

11.2.2. Wearables

11.2.3. mHealth

11.2.4. Smart Homes

11.2.4.1. Lighting Control

11.2.4.2. Security & Access Control

11.2.4.3. HVAC Control

11.2.4.4. Entertainment Control

11.2.4.5. Others

11.3. Location-based Ambient Intelligence Market Size (US$ Bn) Forecast, by Country & Sub-region, 2017 - 2027

11.3.1. Brazil

11.3.2. Rest of South America

12. Competition Landscape

12.1. Market Player –Regional Presence Intensity Map

13. Company Profiles(Details – Basic Overview, Geographical Presence, Revenue, Strategy)

13.1. Huawei Technologies Co., Ltd.

13.1.1. Overview

13.1.2. Product Portfolio

13.1.3. Revenue

13.1.4. Key Developments

13.1.5. Strategic Overview

13.2. Samsung Electronics Co., Ltd.

13.2.1. Overview

13.2.2. Product Portfolio

13.2.3. Revenue

13.2.4. Key Developments

13.2.5. Strategic Overview

13.3. ABB Ltd.

13.3.1. Overview

13.3.2. Product Portfolio

13.3.3. Revenue

13.3.4. Key Developments

13.3.5. Strategic Overview

13.4. Honeywell International Inc.

13.4.1. Overview

13.4.2. Product Portfolio

13.4.3. Revenue

13.4.4. Key Developments

13.4.5. Strategic Overview

13.5. Johnson Controls Inc.

13.5.1. Overview

13.5.2. Product Portfolio

13.5.3. Revenue

13.5.4. Key Developments

13.5.5. Strategic Overview

13.6. Nokia Corporation

13.6.1. Overview

13.6.2. Product Portfolio

13.6.3. Revenue

13.6.4. Key Developments

13.6.5. Strategic Overview

13.7. Schneider Electric SE

13.7.1. Overview

13.7.2. Product Portfolio

13.7.3. Revenue

13.7.4. Key Developments

13.7.5. Strategic Overview

13.8. Siemens AG

13.8.1. Overview

13.8.2. Product Portfolio

13.8.3. Revenue

13.8.4. Key Developments

13.8.5. Strategic Overview

13.9. Google, LLC.

13.9.1. Overview

13.9.2. Product Portfolio

13.9.3. Revenue

13.9.4. Key Developments

13.9.5. Strategic Overview

13.10. HTC Corporation

13.10.1. Overview

13.10.2. Product Portfolio

13.10.3. Revenue

13.10.4. Key Developments

13.10.5. Strategic Overview

14. Key Takeaways

List of Tables

Table 1: North America ICT Spending (US$ Mn)

Table 2: Europe ICT Spending (US$ Mn)

Table 3: Asia Pacific ICT Spending (US$ Mn)

Table 4: MEA ICT Spending (US$ Mn)

Table 5: South America ICT Spending (US$ Mn)

Table 6: Global Location-based Ambient Intelligence Market Size (US$ Bn) Forecast, By Component, 2017 – 2027

Table 7: Global Location-based Ambient Intelligence MarketSize (US$ Bn) Forecast, By Virtual Reality, 2017 – 2027

Table 8: Global Location-based Ambient Intelligence MarketSize (US$ Bn) Forecast, By Smart Homes, 2017 – 2027

Table 9: Global Location-based Ambient Intelligence Market Size (US$ Bn) Forecast, By Virtual Reality, By region 2017 – 2027

Table 10: Global Location-based Ambient Intelligence Market Size (US$ Bn) Forecast, By Wearables, By region 2017 – 2027

Table 11: Global Location-based Ambient Intelligence Market Size (US$ Bn) Forecast, By mHealth, By region 2017 – 2027

Table 12: Global Location-based Ambient Intelligence Market Size (US$ Bn) Forecast, By Smart Homes, By region 2017 – 2027

Table 13: Global Location-based Ambient Intelligence Market Revenue (US$ Bn) Forecast, by Region, 2017 - 2027

Table 14: North America Location-based Ambient Intelligence Market Size (US$ Bn) Forecast, By Component, 2017 – 2027

Table 15: North America Location-based Ambient Intelligence Market Size (US$ Bn) Forecast, By Virtual Reality, 2017 – 2027

Table 16: North America Location-based Ambient Intelligence Market Size (US$ Bn) Forecast, By Smart Homes, 2017 – 2027

Table 17: North America Location-based Ambient Intelligence Market Size (US$ Bn) Forecast, By Country, 2017 – 2027

Table 18: Europe Location-based Ambient Intelligence Market Size (US$ Bn) Forecast, By Component, 2017 – 2027

Table 19: Europe Location-based Ambient Intelligence Market Size (US$ Bn) Forecast, By Virtual Reality, 2017 – 2027

Table 20: Europe Location-based Ambient Intelligence Market Size (US$ Bn) Forecast, By Smart Homes, 2017 – 2027

Table 21: Europe Location-based Ambient Intelligence Market Size (US$ Bn) Forecast, By Country, 2017 – 2027

Table 22: Asia Pacific Location-based Ambient Intelligence Market Size (US$ Bn) Forecast, By Component, 2017 – 2027

Table 23: Asia Pacific Location-based Ambient Intelligence Market Size (US$ Bn) Forecast, By Virtual Reality, 2017 – 2027

Table 24: Asia Pacific Location-based Ambient Intelligence Market Size (US$ Bn) Forecast, By Smart Homes, 2017 – 2027

Table 25: Asia Pacific Location-based Ambient Intelligence Market Size (US$ Bn) Forecast, By Country, 2017 – 2027

Table 26: Middle East & Africa Location-based Ambient Intelligence Market Size (US$ Bn) Forecast, By Component, 2017 – 2027

Table 27: Middle East & Africa Location-based Ambient Intelligence Market Size (US$ Bn) Forecast, By Virtual Reality, 2017 – 2027

Table 28: Middle East & Africa Location-based Ambient Intelligence Market Size (US$ Bn) Forecast, By Smart Homes, 2017 – 2027

Table 29: Middle East & Africa Location-based Ambient Intelligence Market Size (US$ Bn) Forecast, By Country, 2017 – 2027

Table 30: South America Location-based Ambient Intelligence Market Size (US$ Bn) Forecast, By Component, 2017 – 2027

Table 31: South America Location-based Ambient Intelligence Market Size (US$ Bn) Forecast, By Virtual Reality, 2017 – 2027

Table 32: South America Location-based Ambient Intelligence Market Size (US$ Bn) Forecast, By Smart Homes, 2017 – 2027

Table 33: South America Location-based Ambient Intelligence Market Size (US$ Bn) Forecast, By Country, 2017 – 2027

List of Figures

Figure 1: Global Market Value (US$ Bn)

Figure 2: Dominating Segments

Figure 3: Fastest Growing Segments, (CAGR 2019-2027)

Figure 4: North America Market Value, US$ Bn

Figure 5: Europe Market Value, US$ Bn

Figure 6: Asia Pacific Market Value, US$ Bn

Figure 7: South America Market Value, US$ Bn

Figure 8: South America Market Value, US$ Bn

Figure 9: Gross Domestic Product (GDP) per Capita; Analysis (1/2) (US$ Tn), By Major Countries, 2012-2017

Figure 10: Global Location-based Ambient Intelligence Market Size (US$ Bn) Forecast, 2013 – 2018

Figure 11: Global Location-based Ambient Intelligence Market Size (US$ Bn) Forecast, 2019 – 2027

Figure 12: Global Location-based Ambient Intelligence Market Attractiveness Analysis, by Country

Figure 13: Global Location-based Ambient Intelligence Market Attractiveness Analysis, by Country

Figure 14: Global Location-based Ambient Intelligence Market Attractiveness Analysis, by Component

Figure 15: Global Location-based Ambient Intelligence Market Attractiveness Analysis, by Component

Figure 16: Global Location-based Ambient Intelligence Value Share Analysis, By Component, 2017

Figure 17: Global Location-based Ambient Intelligence Value Share Analysis, By Component, 2027

Figure 18: Global Location-based Ambient Intelligence Value Share Analysis, By Virtual Reality, By Region, 2017

Figure 19: Global Location-based Ambient Intelligence Value Share Analysis, By Virtual Reality, By Region, 2027

Figure 20: Global Location-based Ambient Intelligence Value Share Analysis, By Wearables, By Region, 2017

Figure 21: Global Location-based Ambient Intelligence Value Share Analysis, By Wearables, By Region, 2027

Figure 22: Global Location-based Ambient Intelligence Value Share Analysis, By mHealth, By Region, 2017

Figure 23: Global Location-based Ambient Intelligence Value Share Analysis, By mHealth, By Region, 2027

Figure 24: Global Location-based Ambient Intelligence Value Share Analysis, By Smart Homes, By Region, 2017

Figure 25: Global Location-based Ambient Intelligence Value Share Analysis, By Smart Homes, By Region, 2027

Figure 26: Global Location-based Ambient Intelligence Market Share Analysis, by Region (2019)

Figure 27: Global Location-based Ambient Intelligence Market Share Analysis, by Region (2027)

Figure 28: North America Location-based Ambient Intelligence Market Revenue (US$ Bn) and Y-o-Y Forecast, 2018– 2026

Figure 29: North America Location-based Ambient Intelligence Market Opportunity Growth Analysis (US$ Bn), 2016 – 2026

Figure 30: North America Location-based Ambient Intelligence Value Share Analysis, By Component, 2017

Figure 31: North America Location-based Ambient Intelligence Value Share Analysis, By Component, 2027

Figure 32: North America Location-based Ambient Intelligence Value Share Analysis, By Country, 2017

Figure 33: North America Location-based Ambient Intelligence Value Share Analysis, By Country, 2027

Figure 34: Europe Location-based Ambient Intelligence Market Revenue (US$ Bn) and Y-o-Y Forecast, 2018– 2026

Figure 35: Europe Location-based Ambient Intelligence Market Opportunity Growth Analysis (US$ Bn), 2016 – 2026

Figure 36: Europe Location-based Ambient Intelligence Value Share Analysis, By Component, 2017

Figure 37: Europe Location-based Ambient Intelligence Value Share Analysis, By Component, 2027

Figure 38: Europe Location-based Ambient Intelligence Value Share Analysis, By Country, 2017

Figure 39: Europe Location-based Ambient Intelligence Value Share Analysis, By Country, 2027

Figure 40: Asia Pacific Location-based Ambient Intelligence Market Revenue (US$ Bn) and Y-o-Y Forecast, 2018– 2026

Figure 41: Asia Pacific Location-based Ambient Intelligence Market Opportunity Growth Analysis (US$ Bn), 2016 – 2026

Figure 42: Asia Pacific Location-based Ambient Intelligence Value Share Analysis, By Component, 2017

Figure 43: Asia Pacific Location-based Ambient Intelligence Value Share Analysis, By Component, 2027

Figure 44: Asia Pacific Location-based Ambient Intelligence Value Share Analysis, By Country, 2017

Figure 45: Asia Pacific Location-based Ambient Intelligence Value Share Analysis, By Country, 2027

Figure 46: Middle East & Africa Location-based Ambient Intelligence Market Revenue (US$ Bn) and Y-o-Y Forecast, 2018– 2026

Figure 47: Middle East & Africa Location-based Ambient Intelligence Market Opportunity Growth Analysis (US$ Bn), 2016 – 2026

Figure 48: Middle East & Africa Location-based Ambient Intelligence Value Share Analysis, By Component, 2017

Figure 49: Middle East & Africa Location-based Ambient Intelligence Value Share Analysis, By Component, 2027

Figure 50: Middle East & Africa Location-based Ambient Intelligence Value Share Analysis, By Country, 2017

Figure 51: Middle East & Africa Location-based Ambient Intelligence Value Share Analysis, By Country, 2027

Figure 52: South America Location-based Ambient Intelligence Market Revenue (US$ Bn) and Y-o-Y Forecast, 2018– 2026

Figure 53: South America Location-based Ambient Intelligence Market Opportunity Growth Analysis (US$ Bn), 2016 – 2026

Figure 54: South America Location-based Ambient Intelligence Value Share Analysis, By Component, 2017

Figure 55: South America Location-based Ambient Intelligence Value Share Analysis, By Component, 2027

Figure 56: South America Location-based Ambient Intelligence Value Share Analysis, By Country, 2017

Figure 57: South America Location-based Ambient Intelligence Value Share Analysis, By Country, 2027

Figure 58: Huawei Technologies Co., Ltd Breakdown of Net Sales, by Geography, 2018

Figure 59:Huawei Technologies Co., LtdRevenue (US$ Mn) & Y-o-Y Growth (%), 2015–2018

Figure 60: Samsung Electronics Co., Ltd Breakdown of Net Sales, by Segment, 2018

Figure 61: Samsung Electronics Co., Ltd Revenue (US$ Mn) & Y-o-Y Growth (%), 2016–2018

Figure 62: ABB Ltd Breakdown of Net Sales, by Geography, 2017

Figure 63: ABB Ltd Revenue (US$ Mn) & Y-o-Y Growth (%), 2016–2018

Figure 64: Honeywell International Inc Breakdown of Net Sales, by Segment, 2018

Figure 65: Honeywell International Inc Revenue (US$ Mn) & Y-o-Y Growth (%), 2015–2018

Figure 66: Johnson Controls Inc Breakdown of Net Sales, by Segment, 2018

Figure 67: Johnson Controls Inc Revenue (US$ Bn) & Y-o-Y Growth (%), 2015–2018

Figure 68: Nokia Corporation Breakdown of Net Sales, by Geography, 2018

Figure 69: Nokia Corporation Revenue (US$ Mn) & Y-o-Y Growth (%), 2015–2018

Figure 70: Schneider Electric SE Breakdown of Net Sales, by Geography, 2018

Figure 71: Schneider Electric SE Revenue (US$ Bn) & Y-o-Y Growth (%), 2015–2018

Figure 72: Siemens AG Breakdown of Net Sales, by Geography, 2018

Figure 73: Siemens AG Revenue (US$ Mn) & Y-o-Y Growth (%), 2015–2018

Figure 74: Google, LLC Breakdown of Net Sales, by Geography, 2018

Figure 75: Google, LLC Revenue (US$ Mn) & Y-o-Y Growth (%), 2015–2018

Figure 76: HTC Corporation Breakdown of Net Sales, by Geography, 2017

Figure 77: HTC Corporation Revenue (US$ Mn) & Y-o-Y Growth (%), 2017–2018