Analysts’ Viewpoint

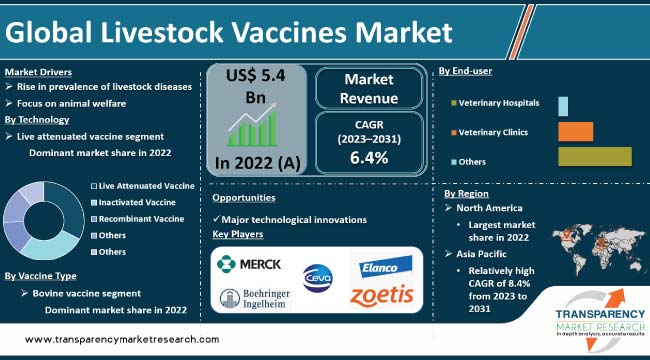

Livestock vaccines are crucial for preventing and controlling infectious/viral/bacterial diseases in farm animals, ensuring their productivity, health, and welfare. The global market for livestock vaccines is experiencing notable growth and is projected to continue expanding during the forecast period. Advances in vaccine development and biotechnology have led to the introduction of innovative and highly-effective vaccines for livestock population. Newer vaccine types, including recombinant vaccines and DNA vaccines, are gaining traction in the global livestock market.

The global livestock vaccines market is characterized by the presence of several key players, including multinational pharmaceutical companies, biotechnology firms, and regional manufacturers. These companies are focusing on research and development activities, strategic collaborations, and product launches to strengthen their market position and cater to the evolving needs of livestock producers.

Livestock farming is a key subsector of agriculture, specifically in developing regions such as India. It is a crucial livelihood source for farmers, contributing to the health and nutritional security of households and supporting agriculture along with supplementing incomes with employment opportunities.

The most efficient way of improving livestock productivity and reduce losses from disease mortality and morbidity is by monitoring health and controlling multiple diseases by utilizing effective vaccines. Research and development activities on veterinary biologicals worldwide have led to successful eradication of various diseases such as African horse sickness, contagious bovine pleuropneumonia, and rinderpest.

Vaccination helps protect animals from preventable diseases, reduces the need for invasive and stressful treatments, and ultimately improves their quality of life. The use of prophylactic vaccines controls numerous viral and bacterial diseases afflicting buffaloes and cattle, poultry, goats and sheep, and pigs.

Livestock diseases pose a considerable threat to welfare, productivity, and animal health, leading to substantial economic losses for farmers and the livestock industry as a whole. The huge need for effective preventive measures, including vaccines is a response to this growing challenge.

Diseases such as avian influenza, swine fever, foot-and-mouth disease, and numerous reproductive and respiratory diseases can have devastating clinical consequences for livestock animals. As per data published by World Organization for Animal Health, an intergovernmental organization, supporting and promoting animal disease control, FMD is projected to circulate in 77% of the global livestock population, specifically in the Middle East, Asia, Africa, and in several area of South America. Outbreaks of such diseases can result in reduced productivity, high mortality rates, public health risks, and trade restrictions. Vaccines play a crucial role in preventing and controlling the spread of these diseases, reducing the overall disease burden and its associated economic and social impacts.

Moreover, the globalization of trade and travel has increased the risk of disease transmission across borders. Livestock diseases can rapidly spread across countries and continents, causing widespread outbreaks and economic disruptions. Governments and regulatory bodies are increasingly recognizing the importance of vaccination in disease control, and implementing stringent biosecurity measures. These measures often include mandatory vaccination programs for livestock populations, further driving the demand for vaccines and ensuring livestock vaccines market progress.

Stakeholders in the livestock industry recognize the importance of vaccination as a key strategy to safeguard animal health, enhance productivity, and ensure sustainable livestock production, thus driving the livestock vaccines market growth.

Increase in emphasis on ethical livestock production practices and ensuring the welfare of animals throughout their lives are likely to offer lucrative opportunities for market expansion. Vaccination plays a crucial role in promoting animal welfare by preventing and controlling infectious diseases that can cause significant suffering and compromise the overall well-being of livestock.

Animal welfare concerns are driven by societal awareness and consumer demand for ethically produced animal products. Consumers are becoming more conscious of the conditions in which animals are raised and the impact of livestock production on animal welfare. They are actively seeking out products from producers who prioritize animal health and welfare, including the use of preventive measures like vaccination.

Vaccination is a proactive approach to disease prevention, reducing the need for antimicrobial treatments and minimizing the stress and discomfort experienced by animals due to illness. By effectively preventing diseases, vaccines contribute to better overall health and reduced suffering in livestock populations. This aligns with the principles of animal welfare, which emphasize providing animals with a life free from pain, distress, and disease.

As the demand for ethically produced animal products continues to rise, the use of vaccines as a preventive measure will likely be prioritized, fueling the livestock vaccines market size.

The livestock vaccines market segmentation in terms of vaccine type includes bovine vaccine, poultry vaccine, porcine vaccine, and others. The bovine vaccine segment accounted for major share of the global market in 2022.

Cattle are one of the most widely raised livestock species globally, with a large population spread across various regions. China, India, and Brazil account for approximately 64% of the global cattle inventory. The sheer number of cattle necessitates extensive disease prevention measures, including vaccination. The high demand for bovine vaccines is driven by the need to protect and maintain the health of this significant livestock population.

Any disease outbreak among cattle can have severe economic consequences for farmers and the livestock industry. Bovine vaccines are essential tools in reducing disease-related losses, enhancing productivity, and ensuring the production of safe and high-quality meat and dairy products.

Multiple nations have established regulatory frameworks and mandatory vaccination programs for cattle to control and prevent specific diseases. For instance, foot-and-mouth disease is a highly contagious viral disease that requires strict vaccination programs to prevent its spread. Compliance with these regulations drives the demand for bovine vaccines.

Continued focus on cattle health and welfare, along with the growth in demand for animal protein, is expected to sustain the prominence of the bovine vaccine segment in the coming years.

The livestock vaccines market analysis based on end-user includes veterinary hospitals, veterinary clinics, and others. The veterinary hospitals segment is projected to be highly lucrative during the forecast period.

Specialized infrastructure and expertise in animal care of veterinary hospitals, as well as state-of-the-art equipment and experienced healthcare professionals allows for accurate diagnosis and appropriate veterinary patient selection, ensuring optimal outcomes.

Veterinary hospitals provide a convenient and reliable setting for livestock owners to access vaccination services. Availability of comprehensive healthcare services in one location makes veterinary hospitals an attractive choice for livestock owners.

The market for livestock vaccines varies across regions owing to differences in disease incidence, livestock production systems, economic factors, and regulatory policies.

According to the latest livestock vaccines market forecast, North America dominated the global landscape in 2022 and is expected to continue its dominance.

Robust government policies are expected to drive the North America livestock vaccines market in the next few years. In July 2023, the Government of Canada announced plans to create a vaccine bank for FMD in animals. Strong presence of prominent players, including Merck Animal Health, Zoetis Animal Health, and Elanco and their effective strategies are driving market dynamics in the region.

However, Asia Pacific is the fastest growing region in the livestock vaccines market, with China being the largest contributor to market revenue. Rise in prevalence of livestock animal diseases, specifically in Southeast Asian countries, is driving market statistics in Asia Pacific.

The global livestock vaccines market report provides profiles of prominent players operating in the animal health sector. These include Dechra Pharmaceuticals PLC, Ceva Santé Animale, Elanco, Merck & Co., Inc., Zoetis Services LLC, Boehringer Ingelheim International GmbH., Virbac, Biogénesis Bagó, Ourofino Saúde Animal, and VETAL Animal Health Products, Inc. These players engage in mergers & acquisitions, strategic collaborations, and new product launches to expand presence and gain significant livestock vaccines industry share.

The livestock vaccine market research report profiles the top players based on various factors including company overview, financial summary, strategies, product portfolio, segments, and recent advancements.

| Attribute | Detail |

|---|---|

| Size in 2022 | US$ 5.4 Bn |

| Forecast (Value) in 2031 | More than US$ 9.4 Bn |

| Growth Rate (CAGR) | 6.4% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2022 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 5.4 Bn in 2022

It is projected to reach more than US$ 9.4 Bn by 2031

The business is anticipated to grow at a CAGR of 6.4% from 2023 to 2031

Rise in prevalence of livestock diseases, and increase in demand for effective preventive care such as recombinant vaccines

North America is projected to account for major share during the forecast period

Dechra Pharmaceuticals PLC, Ceva Santé Animale, Elanco, Merck & Co., Inc., Zoetis Services LLC, Boehringer Ingelheim International GmbH, Virbac, Biogénesis Bagó, Ourofino Saúde Animal, and VETAL Animal Health Products, Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Livestock Vaccines Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Livestock Vaccines Market Analysis and Forecast, 2023–2031

5. Key Insights

5.1. Disease Epidemiology

5.2. Pipeline Analysis

5.3. Key Industry Events

5.4. COVID-19 Pandemic Impact on Industry

6. Global Livestock Vaccines Market Analysis and Forecast, by Vaccine Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Vaccine Type, 2023–2031

6.3.1. Bovine Vaccine

6.3.2. Poultry Vaccine

6.3.3. Porcine Vaccine

6.3.4. Others

6.4. Market Attractiveness Analysis, by Vaccine Type

7. Global Livestock Vaccines Market Analysis and Forecast, by Technology

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Technology, 2023–2031

7.3.1. Live Attenuated Vaccine

7.3.2. Inactivated Vaccine

7.3.3. Recombinant Vaccine

7.3.4. Others

7.4. Market Attractiveness Analysis, by Technology

8. Global Livestock Vaccines Market Analysis and Forecasts, by Route of Administration

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by Route of Administration, 2023–2031

8.3.1. Oral

8.3.2. Parenteral

8.3.3. Others

8.4. Market Attractiveness Analysis, by Route of Administration

9. Global Livestock Vaccines Market Analysis and Forecast, by End-user

9.1. Introduction & Definition

9.2. Key Findings/Developments

9.3. Market Value Forecast, by End-user, 2023–2031

9.3.1. Veterinary Hospitals

9.3.2. Veterinary Clinics

9.3.3. Others

9.4. Market Attractiveness Analysis, by End-user

10. Global Livestock Vaccines Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Market Value Forecast, by Region, 2023–2031

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness By Country/Region

11. North America Livestock Vaccines Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Vaccine Type, 2023–2031

11.2.1. Bovine Vaccine

11.2.2. Poultry Vaccine

11.2.3. Poultry Vaccine

11.2.4. Others

11.3. Market Value Forecast, by Technology, 2023–2031

11.3.1. Live Attenuated Vaccine

11.3.2. Inactivated Vaccine

11.3.3. Recombinant Vaccine

11.3.4. Others

11.4. Market Value Forecast, by Route of Administration, 2023–2031

11.4.1. Oral

11.4.2. Parenteral

11.4.3. Others

11.5. Market Value Forecast, by End-user, 2023–2031

11.5.1. Veterinary Hospitals

11.5.2. Veterinary Clinics

11.5.3. Others

11.6. Market Value Forecast, by Country, 2023–2031

11.6.1. U.S.

11.6.2. Canada

11.7. Market Attractiveness Analysis

11.7.1. By Vaccine Type

11.7.2. By Technology

11.7.3. By Route of Administration

11.7.4. By End-user

11.7.5. By Country/Sub-region

12. Europe Livestock Vaccines Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Vaccine Type, 2023–2031

12.2.1. Bovine Vaccine

12.2.2. Poultry Vaccine

12.2.3. Porcine Vaccine

12.2.4. Others

12.3. Market Value Forecast, by Technology, 2023–2031

12.3.1. Live Attenuated Vaccine

12.3.2. Inactivated Vaccine

12.3.3. Recombinant Vaccine

12.3.4. Others

12.4. Market Value Forecast, by Route of Administration, 2023–2031

12.4.1. Oral

12.4.2. Parenteral

12.4.3. Others

12.5. Market Value Forecast, by End-user, 2023–2031

12.5.1. Veterinary Hospitals

12.5.2. Veterinary Clinics

12.5.3. Others

12.6. Market Value Forecast, by Country/Sub-region, 2023–2031

12.6.1. Germany

12.6.2. U.K.

12.6.3. France

12.6.4. Italy

12.6.5. Spain

12.6.6. Rest of Europe

12.7. Market Attractiveness Analysis

12.7.1. By Vaccine Type

12.7.2. By Technology

12.7.3. By Route of Administration

12.7.4. By End-user

12.7.5. By Country/Sub-region

13. Asia Pacific Livestock Vaccines Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Vaccine Type, 2023–2031

13.2.1. Bovine Vaccine

13.2.2. Poultry Vaccine

13.2.3. Porcine Vaccine

13.2.4. others

13.3. Market Value Forecast, by Technology, 2023–2031

13.3.1. Live Attenuated Vaccine

13.3.2. Inactivated Vaccine

13.3.3. Recombinant Vaccine

13.3.4. Others

13.4. Market Value Forecast, by Route of Administration, 2023–2031

13.4.1. Oral

13.4.2. Parenteral

13.4.3. Others

13.5. Market Value Forecast, by End-user, 2023–2031

13.5.1. Veterinary Hospitals

13.5.2. Veterinary Clinics

13.5.3. Others

13.6. Market Value Forecast, by Country/Sub-region, 2023–2031

13.6.1. China

13.6.2. Japan

13.6.3. India

13.6.4. Australia & New Zealand

13.6.5. Rest of Asia Pacific

13.7. Market Attractiveness Analysis

13.7.1. By Vaccine Type

13.7.2. By Technology

13.7.3. By Route of Administration

13.7.4. By End-user

13.7.5. By Country/Sub-region

14. Latin America Livestock Vaccines Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Vaccine Type, 2023–2031

14.2.1. Bovine Vaccine

14.2.2. Poultry Vaccine

14.2.3. Porcine Vaccine

14.2.4. Others Vaccine

14.3. Market Value Forecast, by Technology, 2023–2031

14.3.1. Live Attenuated Vaccine

14.3.2. Inactivated Vaccine

14.3.3. Recombinant Vaccine

14.3.4. Others

14.4. Market Value Forecast, by Route of Administration, 2023–2031

14.4.1. Oral

14.4.2. Parenteral

14.4.3. Others

14.5. Market Value Forecast, by End-user, 2023–2031

14.5.1. Veterinary Hospitals

14.5.2. Veterinary Clinics

14.5.3. Others

14.6. Market Value Forecast, by Country/Sub-region, 2023–2031

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Rest of Latin America

14.7. Market Attractiveness Analysis

14.7.1. By Vaccine Type

14.7.2. By Technology

14.7.3. By Route of Administration

14.7.4. By End-user

14.7.5. By Country/Sub-region

15. Middle East & Africa Livestock Vaccines Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Vaccine Type, 2023–2031

15.2.1. Bovine Vaccine

15.2.2. Poultry Vaccine

15.2.3. Porcine Vaccine

15.2.4. Others

15.3. Market Value Forecast, by Technology, 2023–2031

15.3.1. Live Attenuated Vaccine

15.3.2. Inactivated Vaccine

15.3.3. Recombinant Vaccine

15.3.4. Others

15.4. Market Value Forecast, by Route of Administration, 2023–2031

15.4.1. Oral

15.4.2. Parenteral

15.4.3. Others

15.5. Market Value Forecast, by End-user, 2023–2031

15.5.1. Veterinary Hospitals

15.5.2. Veterinary Clinics

15.5.3. Others

15.6. Market Value Forecast, by Country/Sub-region, 2023–2031

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Rest of Middle East & Africa

15.7. Market Attractiveness Analysis

15.7.1. By Vaccine Type

15.7.2. By Technology

15.7.3. By Route of Administration

15.7.4. By End-user

15.7.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Player – Competition Matrix (By Tier and Size of Companies)

16.2. Market Share Analysis, by Company (2022)

16.3. Company Profiles

16.3.1. Dechra Pharmaceuticals PLC

16.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.1.2. Product Portfolio

16.3.1.3. Financial Overview

16.3.1.4. SWOT Analysis

16.3.1.5. Strategic Overview

16.3.2. Ceva Santé Animale

16.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.2.2. Product Portfolio

16.3.2.3. Financial Overview

16.3.2.4. SWOT Analysis

16.3.2.5. Strategic Overview

16.3.3. Elanco

16.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.3.2. Product Portfolio

16.3.3.3. Financial Overview

16.3.3.4. SWOT Analysis

16.3.3.5. Strategic Overview

16.3.4. Merck & Co., Inc.

16.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.4.2. Product Portfolio

16.3.4.3. Financial Overview

16.3.4.4. SWOT Analysis

16.3.4.5. Strategic Overview

16.3.5. Zoetis Services LLC

16.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.5.2. Product Portfolio

16.3.5.3. Financial Overview

16.3.5.4. SWOT Analysis

16.3.5.5. Strategic Overview

16.3.6. Boehringer Ingelheim International GmbH.

16.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.6.2. Product Portfolio

16.3.6.3. Financial Overview

16.3.6.4. SWOT Analysis

16.3.6.5. Strategic Overview

16.3.7. Virbac

16.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.7.2. Product Portfolio

16.3.7.3. Financial Overview

16.3.7.4. SWOT Analysis

16.3.7.5. Strategic Overview

16.3.8. Biogénesis Bagó

16.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.8.2. Product Portfolio

16.3.8.3. Financial Overview

16.3.8.4. SWOT Analysis

16.3.8.5. Strategic Overview

16.3.9. Ourofino Saúde Animal

16.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.9.2. Product Portfolio

16.3.9.3. Financial Overview

16.3.9.4. SWOT Analysis

16.3.9.5. Strategic Overview

16.3.10. VETAL Animal Health Products, Inc.

16.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.10.2. Product Portfolio

16.3.10.3. Financial Overview

16.3.10.4. SWOT Analysis

16.3.10.5. Strategic Overview

16.3.11. Other prominent Players

16.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.11.2. Product Portfolio

16.3.11.3. Financial Overview

16.3.11.4. SWOT Analysis

16.3.11.5. Strategic Overview

List of Tables

Table 01: Global Livestock Vaccines Market Value (US$ Mn) Forecast, by Vaccine Type, 2023–2031

Table 02: Global Livestock Vaccines Market Value (US$ Mn) Forecast, by Technology, 2023‒2031

Table 03: Global Livestock Vaccines Market Value (US$ Mn) Forecast, by Route of Administration, 2023–2031

Table 04: Global Livestock Vaccines Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 05: Global Livestock Vaccines Market Value (US$ Mn) Forecast, by Region, 2023–2031

Table 06: North America Livestock Vaccines Market Value (US$ Mn) Forecast, by Country, 2023–2031

Table 07: North America Livestock Vaccines Market Value (US$ Mn) Forecast, by Vaccine Type, 2023–2031

Table 08: North America Livestock Vaccines Market Value (US$ Mn) Forecast, by Technology, 2023‒2031

Table 09: North America Livestock Vaccines Market Value (US$ Mn) Forecast, by Route of Administration, 2023–2031

Table 10: North America Livestock Vaccines Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 11: Europe Livestock Vaccines Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 12: Europe Livestock Vaccines Market Value (US$ Mn) Forecast, by Vaccine Type, 2023–2031

Table 13: Europe Livestock Vaccines Market Value (US$ Mn) Forecast, by Technology, 2023‒2031

Table 14: Europe Livestock Vaccines Market Value (US$ Mn) Forecast, by Route of Administration, 2023–2031

Table 15: Europe Livestock Vaccines Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 16: Asia Pacific Livestock Vaccines Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 17: Asia Pacific Livestock Vaccines Market Value (US$ Mn) Forecast, by Vaccine Type, 2023–2031

Table 18: Asia Pacific Livestock Vaccines Market Value (US$ Mn) Forecast, by Technology, 2023‒2031

Table 19: Asia Pacific Livestock Vaccines Market Value (US$ Mn) Forecast, by Route of Administration, 2023–2031

Table 20: Asia Pacific Livestock Vaccines Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 21: Latin America Livestock Vaccines Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 22: Latin America Livestock Vaccines Market Value (US$ Mn) Forecast, by Vaccine Type, 2023–2031

Table 23: Latin America Livestock Vaccines Market Value (US$ Mn) Forecast, by Technology, 2023‒2031

Table 24: Latin America Livestock Vaccines Market Value (US$ Mn) Forecast, by Route of Administration, 2023–2031

Table 25: Latin America Livestock Vaccines Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 26: Middle East & Africa Livestock Vaccines Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 27: Middle East & Africa Livestock Vaccines Market Value (US$ Mn) Forecast, by Vaccine Type, 2023–2031

Table 28: Middle East & Africa Livestock Vaccines Market Value (US$ Mn) Forecast, by Technology, 2023‒2031

Table 29: Middle East & Africa Livestock Vaccines Market Value (US$ Mn) Forecast, by Route of Administration, 2023–2031

Table 30: Middle East & Africa Livestock Vaccines Market Value (US$ Mn) Forecast, by End-user, 2023–2031

List of Figures

Figure 01: Global Livestock Vaccines Market Value (US$ Mn) Forecast, 2023–2031

Figure 02: Global Livestock Vaccines Market Value Share, by Vaccine Type, 2022

Figure 03: Livestock Vaccines Market Value Share, by Technology, 2022

Figure 04: Livestock Vaccines Market Value Share, by Route of Administration, 2022

Figure 05: Global Livestock Vaccines Market Value Share, by End-user, 2022

Figure 06: Global Livestock Vaccines Market Value Share Analysis, by Vaccine Type, 2022 and 2031

Figure 07: Global Livestock Vaccines Market Attractiveness Analysis, by Vaccine Type, 2023–2031

Figure 08: Global Livestock Vaccines Market Revenue (US$ Mn), by Bovine Vaccine , 2023–2031

Figure 09: Global Livestock Vaccines Market Revenue (US$ Mn), by Poultry Vaccine, 2023–2031

Figure 10: Global Livestock Vaccines Market Revenue (US$ Mn), by Porcine Vaccine, 2023–2031

Figure 11: Global Livestock Vaccines Market Revenue (US$ Mn), by Others, 2023–2031

Figure 12: Global Livestock Vaccines Market Value Share Analysis, by Technology, 2022 and 2031

Figure 13: Global Livestock Vaccines Market Attractiveness Analysis, by Technology 2023–2031

Figure 14: Global Livestock Vaccines Market Value (US$ Mn), by Live Attenuated Vaccine, 2023‒2031

Figure 15: Global Livestock Vaccines Market Value (US$ Mn), by Inactivated Vaccine, 2023‒2031

Figure 16: Global Livestock Vaccines Market Value (US$ Mn), by Recombinant Vaccine, 2023‒2031

Figure 17: Global Livestock Vaccines Market Value (US$ Mn), by Others, 2023‒2031

Figure 18: Global Livestock Vaccines Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 19: Global Livestock Vaccines Market Attractiveness Analysis, Route of Administration, 2023–2031

Figure 20: Global Livestock Vaccines Market Revenue (US$ Mn), by Oral , 2023–2031

Figure 21: Global Livestock Vaccines Market Revenue (US$ Mn), by Parenteral, 2023–2031

Figure 22: Global Livestock Vaccines Market Revenue (US$ Mn), by Others, 2023–2031

Figure 23: Global Livestock Vaccines Market Value Share Analysis, by End-user, 2022 and 2031

Figure 24: Global Livestock Vaccines Market Attractiveness Analysis, by End-user, 2023–2031

Figure 25: Global Livestock Vaccines Market Revenue (US$ Mn), by Veterinary Hospitals, 2023–2031

Figure 26: Global Livestock Vaccines Market Revenue (US$ Mn), by Veterinary Clinics, 2023–2031

Figure 27: Global Livestock Vaccines Market Revenue (US$ Mn), by Others, 2023–2031

Figure 28: Global Livestock Vaccines Market Value Share Analysis, by Region, 2022 and 2031

Figure 29: Global Livestock Vaccines Market Attractiveness Analysis, by Region, 2023–2031

Figure 30: North America Livestock Vaccines Market Value (US$ Mn) Forecast, 2023–2031

Figure 31: North America Livestock Vaccines Market Value Share Analysis, by Country, 2022 and 2031

Figure 32: North America Livestock Vaccines Market Attractiveness Analysis, by Country, 2023–2031

Figure 33: North America Livestock Vaccines Market Value Share Analysis, by Vaccine Type, 2022 and 2031

Figure 34: North America Livestock Vaccines Market Attractiveness Analysis, by Vaccine Type, 2023–2031

Figure 35: North America Livestock Vaccines Market Value Share Analysis, by Technology, 2022 and 2031

Figure 36: North America Livestock Vaccines Market Attractiveness Analysis, by Technology 2023–2031

Figure 37: North America Livestock Vaccines Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 38: North America Livestock Vaccines Market Attractiveness Analysis, Route of Administration, 2023–2031

Figure 39: North America Livestock Vaccines Market Value Share Analysis, by End-user, 2022 and 2031

Figure 40: North America Livestock Vaccines Market Attractiveness Analysis, by End-user, 2023–2031

Figure 41: Europe Livestock Vaccines Market Value (US$ Mn) Forecast, 2023–2031

Figure 42: Europe Livestock Vaccines Market Value Share Analysis, by Country, 2022 and 2031

Figure 43: Europe Livestock Vaccines Market Attractiveness Analysis, by Country, 2023–2031

Figure 44: Europe Livestock Vaccines Market Value Share Analysis, by Vaccine Type, 2022 and 2031

Figure 45: Europe Livestock Vaccines Market Attractiveness Analysis, by Vaccine Type, 2023–2031

Figure 46: Europe Livestock Vaccines Market Value Share Analysis, by Technology, 2022 and 2031

Figure 47: Europe Livestock Vaccines Market Attractiveness Analysis, by Technology 2023–2031

Figure 48: Europe Livestock Vaccines Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 49: Europe Livestock Vaccines Market Attractiveness Analysis, Route of Administration, 2023–2031

Figure 50: Europe Livestock Vaccines Market Value Share Analysis, by End-user, 2022 and 2031

Figure 51: Europe Livestock Vaccines Market Attractiveness Analysis, by End-user, 2023–2031

Figure 52: Asia Pacific Livestock Vaccines Market Value (US$ Mn) Forecast, 2023–2031

Figure 53: Asia Pacific Livestock Vaccines Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 54: Asia Pacific Livestock Vaccines Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 55: Asia Pacific Livestock Vaccines Market Value Share Analysis, by Vaccine Type, 2022 and 2031

Figure 56: Asia Pacific Livestock Vaccines Market Attractiveness Analysis, by Vaccine Type, 2023–2031

Figure 57: Asia Pacific Livestock Vaccines Market Value Share Analysis, by Technology, 2022 and 2031

Figure 58: Asia Pacific Livestock Vaccines Market Attractiveness Analysis, by Technology 2023–2031

Figure 59: Asia Pacific Livestock Vaccines Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 60: Asia Pacific Livestock Vaccines Market Attractiveness Analysis, Route of Administration, 2023–2031

Figure 61: Asia Pacific Livestock Vaccines Market Value Share Analysis, by End-user, 2022 and 2031

Figure 62: Asia Pacific Livestock Vaccines Market Attractiveness Analysis, by End-user, 2023–2031

Figure 63: Latin America Livestock Vaccines Market Value (US$ Mn) Forecast, 2023–2031

Figure 64: Latin America Livestock Vaccines Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 65: Latin America Livestock Vaccines Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 66: Latin America Livestock Vaccines Market Value Share Analysis, by Vaccine Type, 2022 and 2031

Figure 67: Latin America Livestock Vaccines Market Attractiveness Analysis, by Vaccine Type, 2023–2031

Figure 68: Latin America Livestock Vaccines Market Value Share Analysis, by Technology, 2022 and 2031

Figure 69: Latin America Livestock Vaccines Market Attractiveness Analysis, by Technology, 2023–2031

Figure 70: Latin America Livestock Vaccines Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 71: Latin America Livestock Vaccines Market Attractiveness Analysis, Route of Administration, 2023–2031

Figure 72: Latin America Livestock Vaccines Market Value Share Analysis, by End-user, 2022 and 2031

Figure 73: Latin America Livestock Vaccines Market Attractiveness Analysis, by End-user, 2023–2031

Figure 74: Middle East & Africa Livestock Vaccines Market Value (US$ Mn) Forecast, 2023–2031

Figure 75: Middle East & Africa Livestock Vaccines Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 76: Middle East & Africa Livestock Vaccines Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 77: Middle East & Africa Livestock Vaccines Market Value Share Analysis, by Vaccine Type, 2022 and 2031

Figure 78: Middle East & Africa Livestock Vaccines Market Attractiveness Analysis, by Vaccine Type, 2023–2031

Figure 79: Middle East & Africa Livestock Vaccines Market Value Share Analysis, by Technology, 2022 and 2031

Figure 80: Middle East & Africa Livestock Vaccines Market Attractiveness Analysis, by Technology 2023–2031

Figure 81: Middle East & Africa Livestock Vaccines Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 82: Middle East & Africa Livestock Vaccines Market Attractiveness Analysis, by Route of Administration, 2023–2031

Figure 83: Middle East & Africa Livestock Vaccines Market Value Share Analysis, by End-user, 2022 and 2031

Figure 84: Middle East & Africa Livestock Vaccines Market Attractiveness Analysis, by End-user, 2023–2031

Figure 85: Global Livestock Vaccines Market Share Analysis By Company (2022)