Analysts’ Viewpoint on Market Scenario

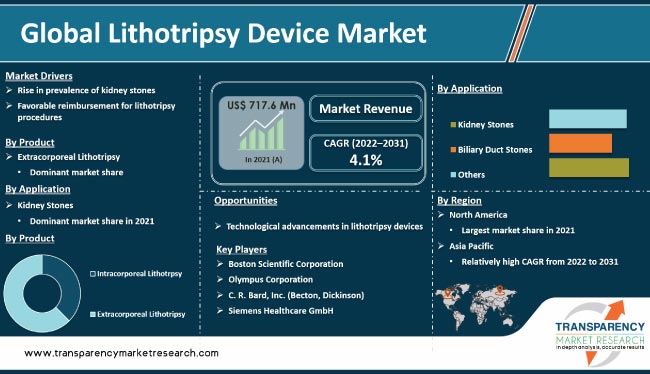

Rise in the prevalence of kidney stone across the globe and surge in emerging technologies are propelling the global lithotripsy device market. Favorable reimbursement for lithotripsy procedure and increase in awareness about kidney health are likely to augment the global market during the forecast period. Furthermore, rise in inclination toward minimally invasive procedures is likely to augment the global market in the next few years.

Extracorporeal shock wave lithotripsy is a noninvasive method to remove kidney stones. High cost of extracorporeal lithotripter and available alternative treatments act as restraints of the global market. Key players in the global market are focusing on the development of advanced lithotripsy devices that are minimally invasive and reasonably priced.

Lithotripsy is a non-invasive procedure utilized to break stones present in various organs such as kidneys, liver or gallbladder, and pancreas. Lithotripsy comprises products such as intracorporeal and extracorporeal lithotripter. Intracorporeal lithotripsy is used for the treatment of urolithiasis and the removal of urinary calculi. Similarly, mechanical lithotripters are utilized to remove relatively large bile duct stones, while electrohydraulic lithotripters are used to remove biliary and renal calculi.

Ultrasonic lithotripsy employs high-frequency vibration of metal transducers for stone fragmentation. It is the standard method for intracorporeal lithotripsy, as it provides fine and better fragmentation of urinary tract stones. Extracorporeal shock wave lithotripsy (ESWL) is employed for the fragmentation of kidney stones. Kidney stones are broken down into small crystals with the help of a high-energy shock wave. Additionally, ESWL has been developed for the treatment of biliary or pancreatic stone, urethral stones, and upper urinary tract stone diseases; however, it is rarely used for gallbladder stones.

The COVID-19 pandemic had a negative impact on the market revenue. Governments of affected countries postponed non-essential surgeries and patient visits during the breakout year of COVID-19.

Hospital personnel and medical staff were reassigned to COVID-19 cases, prompting the suspension of outpatient visits for kidney stone treatment. This led to a substantial decline in overall kidney stone treatments and surgery, which in turn hampered the global lithotripsy device market. Key players reported lower revenue due to the pandemic, which led to a decline in Y-o-Y market share in the global market. However, the market has recovered from COVID-19 due to the easing of restrictions by governments across the globe.

In terms of product, the market has been bifurcated into intracorporeal lithotripsy and extracorporeal lithotripsy. The intracorporeal lithotripsy segment has been classified into mechanical lithotripsy, electrohydraulic lithotripsy, laser lithotripsy, ultrasonic lithotripsy, and others. The extracorporeal lithotripsy segment dominated the market in 2021 due to rise in prevalence of kidney stones.

Increase in demand for lithotripsy devices owing to an inclination toward minimally invasive procedure is projected to propel the intracorporeal lithotripsy segment during the forecast period. For instance, thulium laser is a new technology in laser lithotripsy. Its advantages include smaller fibers, increase in stone ablation, and higher flexibility. RevoLix DUO is a combination of holmium and thulium laser, offered by LISA Laser Products GmbH, and is used for urological application of lithotripsy.

Based on application, the kidney stones segment dominated the global market in 2021 owing to rise in prevalence of kidney stones due to renal tubular acidosis. For instance, in the U.S., kidney stone affects 1 in 11 people, and an estimated 600,000 people in the country suffer from urinary stones every year.

According to a report published in 2020, about 12% of the population of India is expected to have urinary stone. Furthermore, surge in awareness and increase in kidney stone surgeries are likely to augment the segment.

As per global lithotripsy device market forecast, North America is projected to be a highly attractive region during the forecast period. The region accounted for the largest share of the global market in 2021.

Increase in health awareness, rise in investment in healthcare infrastructure, and surge in demand for better healthcare facilities augment the market in North America. The U.S. dominated the market in the region in 2021. The trend is anticipated to continue during the forecast period due to large number of kidney stone patients and favorable reimbursement for surgical procedures.

Additionally, rise in the prevalence of kidney stone disease is likely to propel the market in the region. According to an article published in the Cleveland Clinic Journal of Medicine, 10% to 25% of adults in the U.S. was suffering from gall bladder stones in 2015. Approximately 13% of men and 7% of women in the country are diagnosed with kidney stones once during their lifetime.

Europe was the second largest lithotripsy device market in 2021. Favorable regulatory scenario, approval of products, and presence of highly developed infrastructure are likely to propel the market in the region.

The market in Asia Pacific is projected to grow at a significantly high CAGR during the forecast period owing to the large population in countries such as Japan, India and China, higher incidence rate of kidney stone, rise in per capita income, and improved healthcare infrastructure. Moreover, increase in healthcare expenditure and rise in investment by key players in the market in emerging economies are expected to propel the lithotripsy device industry demand in the region.

The lithotripsy device market report includes vital information about the key players operating in the global market. Companies focus on strategies such as product launches, divestiture, mergers & acquisitions (M&A), and partnerships to strengthen their position in the market. Boston Scientific Corporation, Olympus Corporation, C. R. Bard, Inc. (Becton, Dickinson), EDAP TMS, Siemens Healthcare GmbH, Dornier MedTech, Cook Medical, KARL STORZ, Richard Wolf GmbH, and EMS are the prominent players operating in the global market.

Key players have been profiled in the lithotripsy device market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 717.6 Mn |

|

Market Forecast Value in 2031 |

More than US$ 1.1 Bn |

|

Compound Annual Growth Rate (CAGR) |

4.1% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Mn/Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 717.6 Mn in 2021.

The market is projected to reach more than US$ 1.1 Bn by 2031.

The market is anticipated to grow at a CAGR of 4.1% from 2022 to 2031.

Rise in prevalence of kidney stones and favorable reimbursement for lithotripsy procedures.

North America is expected to account for major share of the global market during the forecast period.

Boston Scientific Corporation, Olympus Corporation, C. R. Bard, Inc. (Becton, Dickinson), EDAP TMS, Siemens Healthcare GmbH, Dornier MedTech, Cook Medical, KARL STORZ, Richard Wolf GmbH, and EMS.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Lithotripsy Device Market

4. Market Overview

4.1. Overview

4.2. Market Dynamics

4.2.1. Drivers

4.2.1.1. Rise in Prevalence of Kidney Stone

4.2.1.2. Increase in Awareness about Kidney Health

4.2.1.3. Favorable Reimbursement Policies

4.2.2. Restraints

4.2.2.1. Availability of Alternatives of Lithotripsy

4.2.2.2. High Cost

4.2.3. Opportunities

4.2.3.1. Research and Development

4.2.3.2. Launch of New Products and Acquisition in Emerging Markets

4.3. Global Lithotripsy Device Market Analysis and Forecast, 2017–2031

5. Key Insight

5.1. Advances in Laser Lithotripsy

5.2. Key Mergers & Acquisitions

5.3. New Product Launch, FDA Approvals

5.4. COVID-19 Impact Analysis

6. Global Lithotripsy Device Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Global Lithotripsy Device Market Value Forecast, by Product, 2017–2031

6.3.1. Intracorporeal Lithotripsy

6.3.1.1. Mechanical Lithotripsy

6.3.1.2. Electrohydraulic Lithotripsy

6.3.1.3. Laser Lithotripsy

6.3.1.4. Ultrasonic Lithotripsy

6.3.1.5. Others

6.3.2. Extracorporeal Lithotripsy

6.4. Global Lithotripsy Device Market Attractiveness Analysis, by Product

7. Global Lithotripsy Device Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Global Lithotripsy Device Market Value Forecast, by Application, 2017–2031

7.3.1. Kidney Stones

7.3.2. Biliary Duct Stones

7.3.3. Others

7.4. Global Lithotripsy Device Market Attractiveness Analysis, by Application

8. Global Lithotripsy Device Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Global Lithotripsy Device Market Value Forecast, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Global Lithotripsy Device Market Attractiveness Analysis, by Region

9. North America Lithotripsy Device Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. North America Lithotripsy Device Market Value Forecast, by Product, 2017–2031

9.2.1. Intracorporeal Lithotripsy

9.2.1.1. Mechanical Lithotripsy

9.2.1.2. Electrohydraulic Lithotripsy

9.2.1.3. Laser Lithotripsy

9.2.1.4. Ultrasonic Lithotripsy

9.2.1.5. Others

9.2.2. Extracorporeal Lithotripsy

9.3. North America Lithotripsy Device Market Value Forecast, by Application, 2017–2031

9.3.1. Kidney Stones

9.3.2. Biliary Duct Stones

9.3.3. Others

9.4. North America Lithotripsy Device Market Value Forecast, by Country, 2017–2031

9.4.1. U.S.

9.4.2. Canada

9.5. North America Lithotripsy Device Market Attractiveness Analysis

9.5.1. By Product

9.5.2. By Application

9.5.3. By Country

10. Europe Lithotripsy Device Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Europe Lithotripsy Device Market Value Forecast, by Product, 2017–2031

10.2.1. Intracorporeal Lithotripsy

10.2.1.1. Mechanical Lithotripsy

10.2.1.2. Electrohydraulic Lithotripsy

10.2.1.3. Laser Lithotripsy

10.2.1.4. Ultrasonic Lithotripsy

10.2.1.5. Others

10.2.2. Extracorporeal Lithotripsy

10.3. Europe Lithotripsy Device Market Value Forecast, by Application, 2017–2031

10.3.1. Kidney Stones

10.3.2. Biliary Duct Stones

10.3.3. Others

10.4. Europe Lithotripsy Device Market Value Forecast, by Country/Sub-region, 2017–2031

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Spain

10.4.5. Italy

10.4.6. Rest of Europe

10.5. Europe Lithotripsy Device Market Attractiveness Analysis

10.5.1. By Product

10.5.2. By Application

10.5.3. By Country/Sub-region

11. Asia Pacific Lithotripsy Device Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Asia Pacific Lithotripsy Device Market Value Forecast, by Product, 2017–2031

11.2.1. Intracorporeal Lithotripsy

11.2.1.1. Mechanical Lithotripsy

11.2.1.2. Electrohydraulic Lithotripsy

11.2.1.3. Laser Lithotripsy

11.2.1.4. Ultrasonic Lithotripsy

11.2.1.5. Others

11.2.2. Extracorporeal Lithotripsy

11.3. Asia Pacific Lithotripsy Device Market Value Forecast, by Application, 2017–2031

11.3.1. Kidney Stones

11.3.2. Biliary Duct Stones

11.3.3. Others

11.4. Asia Pacific Lithotripsy Device Market Value Forecast, by Country/Sub-region, 2017–2031

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Asia Pacific Lithotripsy Device Market Attractiveness Analysis

11.5.1. By Product

11.5.2. By Application

11.5.3. By Country/Sub-region

12. Latin America Lithotripsy Device Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Latin America Lithotripsy Device Market Value Forecast, by Product, 2017–2031

12.2.1. Intracorporeal Lithotripsy

12.2.1.1. Mechanical Lithotripsy

12.2.1.2. Electrohydraulic Lithotripsy

12.2.1.3. Laser Lithotripsy

12.2.1.4. Ultrasonic Lithotripsy

12.2.1.5. Others

12.2.2. Extracorporeal Lithotripsy

12.3. Latin America Lithotripsy Device Market Value Forecast, by Application, 2017–2031

12.3.1. Kidney Stones

12.3.2. Biliary Duct Stones

12.3.3. Others

12.4. Latin America Lithotripsy Device Market Value Forecast, by Country/Sub-region, 2017–2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Latin America Lithotripsy Device Market Attractiveness Analysis

12.5.1. By Product

12.5.2. By Application

12.5.3. By Country/Sub-region

13. Middle East & Africa Lithotripsy Device Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Middle East & Africa Lithotripsy Device Market Value Forecast, by Product, 2017–2031

13.2.1. Intracorporeal Lithotripsy

13.2.1.1. Mechanical Lithotripsy

13.2.1.2. Electrohydraulic Lithotripsy

13.2.1.3. Laser Lithotripsy

13.2.1.4. Ultrasonic Lithotripsy

13.2.1.5. Others

13.2.2. Extracorporeal Lithotripsy

13.3. Middle East & Africa Lithotripsy Device Market Value Forecast, by Application, 2017–2031

13.3.1. Kidney Stones

13.3.2. Biliary Duct Stones

13.3.3. Others

13.4. Middle East & Africa Lithotripsy Device Market Value Forecast, by Country/Sub-region, 2017–2031

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Middle East & Africa Lithotripsy Device Market Attractiveness Analysis

13.5.1. By Product

13.5.2. By Application

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player - Competition Matrix (by tier and size of companies)

14.2. Market Share Analysis, by Company, 2021

14.3. Company Profiles

14.3.1. Boston Scientific Corporation

14.3.1.1. Company Overview

14.3.1.2. Product Portfolio

14.3.1.3. SWOT Analysis

14.3.1.4. Financial Overview

14.3.1.5. Strategic Overview

14.3.2. Olympus Corporation

14.3.2.1. Company Overview

14.3.2.2. Product Portfolio

14.3.2.3. SWOT Analysis

14.3.2.4. Financial Overview

14.3.2.5. Strategic Overview

14.3.3. C. R. Bard, Inc. (Becton, Dickinson)

14.3.3.1. Company Overview

14.3.3.2. Product Portfolio

14.3.3.3. SWOT Analysis

14.3.3.4. Financial Overview

14.3.3.5. Strategic Overview

14.3.4. EDAP TMS

14.3.4.1. Company Overview

14.3.4.2. Product Portfolio

14.3.4.3. SWOT Analysis

14.3.4.4. Financial Overview

14.3.4.5. Strategic Overview

14.3.5. Siemens Healthcare GmbH

14.3.5.1. Company Overview

14.3.5.2. Product Portfolio

14.3.5.3. SWOT Analysis

14.3.5.4. Financial Overview

14.3.5.5. Strategic Overview

14.3.6. Dornier MedTech

14.3.6.1. Company Overview

14.3.6.2. Product Portfolio

14.3.6.3. SWOT Analysis

14.3.6.4. Strategic Overview

14.3.7. Cook

14.3.7.1. Company Overview

14.3.7.2. Product Portfolio

14.3.7.3. SWOT Analysis

14.3.8. KARL STORZ

14.3.8.1. Company Overview

14.3.8.2. Product Portfolio

14.3.8.3. SWOT Analysis

14.3.8.4. Strategic Overview

14.3.9. Richard Wolf GmbH

14.3.9.1. Company Overview

14.3.9.2. Product Portfolio

14.3.9.3. SWOT Analysis

14.3.9.4. Strategic Overview

14.3.10. EMS

14.3.10.1. Company Overview

14.3.10.2. Product Portfolio

14.3.10.3. SWOT Analysis

List of Tables

Table 01: Global Lithotripsy Device Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 02: Global Lithotripsy Device Market Value (US$ Mn) Forecast, by Intracorporeal Lithotripsy, 2017–2031

Table 03: Global Lithotripsy Device Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 04: Global Lithotripsy Device Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Lithotripsy Device Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 06: North America Lithotripsy Device Market Value (US$ Mn) Forecast, by Intracorporeal Lithotripsy, 2017–2031

Table 07: North America Lithotripsy Device Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 08: North America Lithotripsy Device Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 09: Europe Lithotripsy Device Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 10: Europe Lithotripsy Device Market Value (US$ Mn) Forecast, by Intracorporeal Lithotripsy, 2017–2031

Table 11: Europe Lithotripsy Device Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 12: Europe Lithotripsy Device Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 13: Asia Pacific Lithotripsy Device Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 14: Asia Pacific Lithotripsy Device Market Value (US$ Mn) Forecast, by Intracorporeal Lithotripsy, 2017–2031

Table 15: Asia Pacific Lithotripsy Device Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 16: Asia Pacific Lithotripsy Device Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 17: Latin America Lithotripsy Device Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 18: Latin America Lithotripsy Device Market Value (US$ Mn) Forecast, by Intracorporeal Lithotripsy, 2017–2031

Table 19: Latin America Lithotripsy Device Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 20: Latin America Lithotripsy Device Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 21: Middle East & Africa Lithotripsy Device Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 22: Middle East & Africa Lithotripsy Device Market Value (US$ Mn) Forecast, by Intracorporeal Lithotripsy, 2017–2031

Table 23: Middle East & Africa Lithotripsy Device Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 24: Middle East & Africa Lithotripsy Device Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

List of Figures

Figure 01: Global Lithotripsy Device Market Value (US$ Mn) and Distribution (%), by Region, 2021 and 2031

Figure 02: Global Lithotripsy Device Market Value (US$ Mn), by Product, 2021

Figure 03: Market Snapshot - Top 2 Trends

Figure 04: Market Overview

Figure 05: Global Lithotripsy Device Market Value Share, by Product, 2021

Figure 06: Global Lithotripsy Device Market Value Share, by Application, 2021

Figure 07: Global Lithotripsy Device Market Value Share, by Region, 2021

Figure 08: Global Lithotripsy Device Market Value (US$ Mn) Forecast, 2017–2031

Figure 09: Global Lithotripsy Devices Market Value Share Analysis, by Product, 2021 and 2031

Figure 10: Global Lithotripsy Devices Market Value (US$ Mn) and Y-o-Y Growth, by Intracorporeal Lithotripsy, 2017–2031

Figure 11: Global Lithotripsy Devices Market Value (US$ Mn) and Y-o-Y Growth, by Extracorporeal Lithotripsy, 2017–2031

Figure 12: Global Lithotripsy Devices Market Attractiveness Analysis, by Product, 2021–2031

Figure 13: Global Lithotripsy Devices Market Value Share Analysis, by Application, 2021 and 2031

Figure 14: Global Lithotripsy Devices Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Kidney Stones, 2017–2031

Figure 15: Global Lithotripsy Devices Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Biliary Duct Stones, 2017–2031

Figure 16: Global Lithotripsy Devices Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Others, 2017–2031

Figure 17: Global Lithotripsy Devices Market Attractiveness Analysis, by Application, 2021–2031

Figure 18: Global Lithotripsy Devices Market Value Share Analysis, by Region, 2021 and 2031

Figure 19: Global Lithotripsy Devices Market Attractiveness Analysis, by Region, 2021–2031

Figure 20: North America Lithotripsy Device Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 21: North America Lithotripsy Device Market Value Share Analysis, by Product, 2021 and 2031

Figure 22: North America Lithotripsy Devices Market Attractiveness Analysis, by Product, 2021–2031

Figure 23: North America Lithotripsy Devices Market Value Share Analysis, by Application, 2021 and 2031

Figure 24: North America Lithotripsy Devices Market Attractiveness Analysis, by Application, 2021–2031

Figure 25: North America Lithotripsy Devices Market Value Share Analysis, by Country, 2021 and 2031

Figure 26: North America Lithotripsy Devices Market Attractiveness Analysis, by Country, 2021–2031

Figure 27: Europe Lithotripsy Device Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 28: Europe Lithotripsy Device Market Value Share Analysis, by Product, 2021 and 2031

Figure 29: Europe Lithotripsy Devices Market Attractiveness Analysis, by Product, 2021–2031

Figure 30: Europe Lithotripsy Devices Market Value Share Analysis, by Application, 2021 and 2031

Figure 31: Europe Lithotripsy Devices Market Attractiveness Analysis, by Application, 2021–2031

Figure 32: Europe Lithotripsy Devices Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 33: Europe Lithotripsy Devices Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 34: Asia Pacific Lithotripsy Device Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 35: Asia Pacific Lithotripsy Device Market Value Share Analysis, by Product, 2021 and 2031

Figure 36: Asia Pacific Lithotripsy Devices Market Attractiveness Analysis, by Product, 2021–2031

Figure 37: Asia Pacific Lithotripsy Devices Market Value Share Analysis, by Application, 2021 and 2031

Figure 38: Asia Pacific Lithotripsy Devices Market Attractiveness Analysis, by Application, 2021–2031

Figure 39: Asia Pacific Lithotripsy Devices Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 40: Asia Pacific Lithotripsy Devices Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 41: Latin America Lithotripsy Device Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 42: Latin America Lithotripsy Device Market Value Share Analysis, by Product, 2021 and 2031

Figure 43: Latin America Lithotripsy Devices Market Attractiveness Analysis, by Product, 2021–2031

Figure 44: Latin America Lithotripsy Devices Market Value Share Analysis, by Application, 2021 and 2031

Figure 45: Latin America Lithotripsy Devices Market Attractiveness Analysis, by Application, 2021–2031

Figure 46: Latin America Lithotripsy Devices Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 47: Latin America Lithotripsy Devices Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 48: Middle East & Africa Lithotripsy Device Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 49: Middle East & Africa Lithotripsy Device Market Value Share Analysis, by Product, 2021 and 2031

Figure 50: Middle East & Africa Lithotripsy Devices Market Attractiveness Analysis, by Product, 2021–2031

Figure 51: Middle East & Africa Lithotripsy Devices Market Value Share Analysis, by Application, 2021 and 2031

Figure 52: Middle East & Africa Lithotripsy Devices Market Attractiveness Analysis, by Application, 2021–2031

Figure 53: Middle East & Africa Lithotripsy Devices Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 54: Middle East & Africa Lithotripsy Devices Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 55: Global Lithotripsy Device Market Analysis, by Top Company Ranking, 2021

Figure 56: Global Lithotripsy Device Market Share, by Company, 2021

Figure 57: Boston Scientific Corporation Revenue (US$ Mn) and Y-o-Y Growth (%), 2017–2021

Figure 58: Boston Scientific Corporation Breakdown of Net Sales (%), by Region/Country, 2021

Figure 59: Boston Scientific Corporation Breakdown of Net Sales (%), by Business Segment, 2021

Figure 60: Boston Scientific Corporation R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2017–2021

Figure 61: Olympus Corporation Revenue (US$ Mn) and Y-o-Y Growth (%), 2017–2021

Figure 62: Olympus Corporation Breakdown of Net Sales (%), by Region/Country, 2021

Figure 63: Olympus Corporation Breakdown of Net Sales (%), by Business Segment, 2021

Figure 64: Olympus Corporation R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2017–2021

Figure 65: Becton, Dickinson. Revenue (US$ Mn) and Y-o-Y Growth (%), 2017–2021

Figure 66: Becton, Dickinson. Breakdown of Net Sales (%), by Region/Country, 2021

Figure 67: Becton, Dickinson. Revenue Breakdown of Net Sales (%), by Business Segment, 2021

Figure 68: Becton, Dickinson. R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2017–2021

Figure 69: EDAP TMS Revenue (US$ Mn) and Y-o-Y Growth (%), 2017–2021

Figure 70: EDAP TMS Breakdown of Net Sales (%), by Region/Country, 2021

Figure 71: EDAP TMS Breakdown of Net Sales (%), by Product Segment, 2021

Figure 72: EDAP TMS R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2017–2021

Figure 73: Siemens Healthcare GmbH Revenue (US$ Mn) and Y-o-Y Growth (%), 2017–2021

Figure 74: Siemens Healthcare GmbH Breakdown of Net Sales (%), by Region/Country, 2021

Figure 75: Siemens Healthcare GmbH Breakdown of Net Sales (%), by Product Segment, 2021

Figure 76: Siemens Healthcare GmbH R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2017–2021