Analysts’ Viewpoint

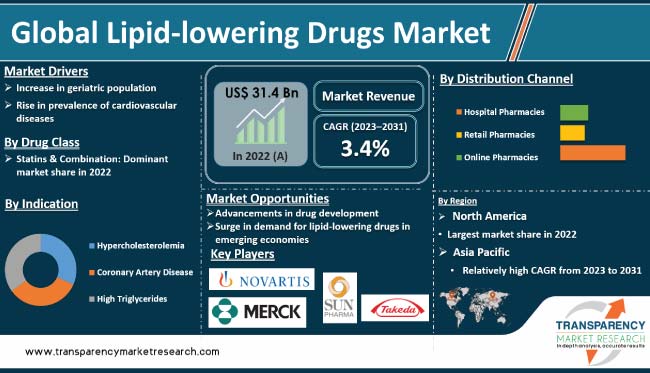

Rise in incidence of heart diseases, increase in awareness about the health risks associated with high cholesterol levels, and availability of effective drugs are significant factors driving the global market for lipid-lowering drugs. Increase in healthcare spending, growth in geriatric population, and rise in awareness about the benefits of early detection and treatment of cardiovascular diseases are expected to fuel market progress in the near future.

Advancements in drug development are also expected to drive the global market in the next few years. Companies in the global market are investing in R&D to introduce effective and safe medications for patients with high cholesterol levels. Moreover, surge in demand for lipid-lowering drugs in emerging economies and growth in number of clinical trials focused on cardiac treatments are creating lucrative lipid-lowering drugs market opportunities for market participants.

Lipid-lowering agents are medications that are used to lower the levels of cholesterol and other lipids (fats) in the blood. These drugs are typically prescribed to people with high levels of cholesterol or people suffering from cardiovascular diseases, such as diabetes, high blood pressure, or heart disease. There are several classes of lipid-lowering medications such as statins, ezetimibe, PCSK9 inhibitors, fibrates, and niacin.

Statins are the drugs that inhibit the enzyme HMG-CoA reductase, which is involved in the production of cholesterol in the liver. Statins are highly effective at lowering LDL (‘bad’) cholesterol levels and reducing the risk of cardiovascular events such as heart attack and stroke. Ezetimibe works by blocking the absorption of cholesterol in the intestines, thereby reducing the amount of cholesterol that enters the bloodstream.

PCSK9 inhibitors work by blocking the PCSK9 protein, which plays a role in the breakdown of LDL cholesterol in the liver. Fibrates can lower triglyceride levels and raise HDL (‘good’) cholesterol levels. They are often used in combination with statins. Niacin, or Vitamin B3, can also raise HDL cholesterol levels and lower LDL cholesterol levels. It is often used in combination with other lipid-lowering drugs.

Cardiovascular diseases (CVDs) are a leading cause of death globally and are associated with high levels of cholesterol in the blood. Lipid-regulating drugs are a class of medications that are used to lower cholesterol levels in the blood and reduce the risk of CVDs.

According to the World Health Organization (WHO), CVD is the leading cause of death globally. As per estimation, around 17.9 million people died from CVD in 2019, which represents around 32% of the deaths globally. Moreover, 85% of deaths occurred due to strokes and heart attacks. Thus, high prevalence of CVDs is anticipated to augment the lipid-lowering drugs market value in the near future.

Lipid-lowering drugs, also known as cholesterol-lowering drugs, are used to reduce cholesterol levels in the blood and are prescribed to people with high cholesterol levels. Several advancements in drug development have been witnessed in the global market for lipid-lowering drugs in the last few years.

PCSK9 inhibitors are a new class of drugs that help lower LDL cholesterol levels by blocking the PCSK9 protein, which reduces the number of LDL receptors in the liver. In 2015, the FDA approved two PCSK9 inhibitors: evolocumab and alirocumab.

Moreover, there has been a trend toward developing combination therapies that use two or more lipid-lowering drugs with different mechanisms of action to achieve greater cholesterol-lowering effects. Examples of combination therapies include statins plus ezetimibe and statins plus PCSK9 inhibitors.

Gene therapy is also a new approach to treating high cholesterol levels. It involves introducing a new gene into the body to replace a defective or missing gene that is responsible for producing a protein that helps regulate cholesterol levels.

Several drugs are under development that use novel mechanisms of action to lower cholesterol levels. For instance, bempedoic acid inhibits an enzyme called ATP citrate lyase, which is involved in the production of cholesterol in the liver.

In terms of drug class, the global market has been divided into statins & combination, PCSK9 inhibitors, bile acid sequestrants, fibrates, cholesterol absorption inhibitors, and others. According to the latest lipid-lowering drugs market forecast report, the statins & combination drug class segment is projected to dominate the global market during the forecast period. This segment held major share of the global market in 2022.

Statins are a type of medication that is used to decrease cholesterol levels in the blood. They function by blocking the enzyme HMG-CoA reductase, which is involved in cholesterol synthesis in the liver. Statins are among the most commonly prescribed medications, and they have been found to reduce the incidence of cardiovascular events such as heart attacks and strokes.

Based on indication, the global market has been segregated into hypercholesterolemia, coronary artery disease, and high triglycerides. The hypercholesterolemia indication segment accounted for major share of the global market in 2022. It is anticipated to maintain its dominance during the forecast period.

Hypercholesterolemia is a medical condition characterized by high levels of cholesterol in the blood. Hypercholesterolemia can be caused by several factors, which include genetics, diet, and lifestyle. People with a family history of high cholesterol are more likely to develop the condition.

A diet high in saturated and trans fats can also contribute to high cholesterol levels. Additionally, lack of physical activity, smoking, and obesity can increase the risk of developing hypercholesterolemia. Demand for lipid-lowering drugs is rising due to increase in incidence of hypercholesterolemia.

In terms of distribution channel, the global market has been divided into hospital pharmacies, retail pharmacies, and online pharmacies. According to the latest lipid-lowering drugs market trends, the retail pharmacies distribution channel segment is likely to dominate the global market during the forecast period. This segment held major share of the global market in 2022.

Retail pharmacies offer several benefits to consumers including convenience and ease of access. This has led to increase in consumer preference for retail pharmacies.

According to the lipid-lowering drugs market analysis, North America dominated the global market in 2022. It is likely to maintain its dominance during the forecast period. Lipid-lowering drugs market demand is increasing in the region due to rise in prevalence of cardiovascular diseases.

According to the Centers for Disease Control and Prevention, almost 94 million people in the U. S. aged 20 years and above have high cholesterol levels, i.e. greater than 200 mg/dL. This drives demand for lipid-lowering drugs in the U.S., further fueling lipid-lowering drugs market development in North America.

The lipid-lowering drugs market size in Asia Pacific is likely to increase during the forecast period. The region has a high number of cardiovascular patients. This factor is fueling lipid-lowering drugs industry growth in the region. According to the American College of Cardiology Foundation, CVD was the biggest cause of mortality in Asia Pacific in 2019, accounting for 10.8 million deaths, or nearly 35% of all deaths in Asia Pacific.

The global industry is fragmented, with the presence of a large number of local as well as international players that control majority of the lipid-lowering drugs market share. According to the latest lipid-lowering drugs market research report, leading players are implementing innovative strategies strengthen their market share. Some of the major strategies include expansion of product portfolio and mergers & acquisitions.

Leading players operating in the global market are Sanofi, Pfizer, Inc., GlaxoSmithKline plc, Novartis AG, Merck & Co., Inc., Amgen Inc., Takeda Pharmaceutical Company Limited, Sun Pharmaceutical Industries Ltd., AbbVie, Inc., Viatris (Mylan N.V.), AstraZeneca PLC, and Dr. Reddy’s Laboratories Ltd.

Key players have been profiled in the lipid-lowering drugs market report based on parameters such as company overview, product portfolio, business strategies, recent developments, financial overview, and business segments.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 31.4 Bn |

|

Market Forecast Value in 2031 |

US$ 42.5 Bn |

|

Growth Rate (CAGR) |

3.4% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis at global as well as regional level. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 31.4 Bn in 2022

It is projected to reach more than US$ 42.5 Bn by 2031

The CAGR is anticipated to be 3.4% from 2023 to 2031

Increase in prevalence of cardiovascular diseases and rise in geriatric population

North America is expected to account for major share during the forecast period

Sanofi, Pfizer, Inc., GlaxoSmithKline plc, Novartis AG, Merck & Co., Inc., Amgen Inc., Takeda Pharmaceutical Company Limited, Sun Pharmaceutical Industries Ltd., AbbVie, Inc., Viatris (Mylan N.V.), AstraZeneca PLC, and Dr. Reddy’s Laboratories Ltd.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Lipid-lowering Drugs Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Lipid-lowering Drugs Market Analysis and Forecast, 2017-2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Drug Pipeline Analysis

5.2. COVID-19 Pandemic Impact on Industry (Value Chain and Short / Mid / Long Term Impact)

5.3. Regulatory Scenario by Region/globally

5.4. Patent Analysis

6. Global Lipid-lowering Drugs Market Analysis and Forecast, by Drug Class

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Drug Class, 2017-2031

6.3.1. Statins & Combination

6.3.2. PCSK9 Inhibitors

6.3.3. Bile Acid Sequestrants

6.3.4. Fibrates

6.3.5. Cholesterol Absorption Inhibitors

6.3.6. Others

6.4. Market Attractiveness, by Drug Class

7. Global Lipid-lowering Drugs Market Analysis and Forecast, by Indication

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Indication, 2017-2031

7.3.1. Hypercholesterolemia

7.3.2. Coronary Artery Disease

7.3.3. High Triglycerides

7.4. Market Attractiveness, by Indication

8. Global Lipid-lowering Drugs Market Analysis and Forecast, by Distribution Channel

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Distribution Channel, 2017-2031

8.3.1. Hospital Pharmacies

8.3.2. Retail Pharmacies

8.3.3. Online Pharmacies

8.4. Market Attractiveness, by Distribution Channel

9. Global Lipid-lowering Drugs Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness, by Country/Region

10. North America Lipid-lowering Drugs Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Drug Class, 2017-2031

10.2.1. Statins & Combination

10.2.2. PCSK9 Inhibitors

10.2.3. Bile Acid Sequestrants

10.2.4. Fibrates

10.2.5. Cholesterol Absorption Inhibitors

10.2.6. Others

10.3. Market Value Forecast, by Indication, 2017-2031

10.3.1. Hypercholesterolemia

10.3.2. Coronary Artery Disease

10.3.3. High Triglycerides

10.4. Market Value Forecast, by Distribution Channel, 2017-2031

10.4.1. Hospital Pharmacies

10.4.2. Retail Pharmacies

10.4.3. Online Pharmacies

10.5. Market Value Forecast, by Country, 2017-2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Drug Class

10.6.2. By Indication

10.6.3. By Distribution Channel

10.6.4. By Country

11. Europe Lipid-lowering Drugs Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Drug Class, 2017-2031

11.2.1. Statins & Combination

11.2.2. PCSK9 Inhibitors

11.2.3. Bile Acid Sequestrants

11.2.4. Fibrates

11.2.5. Cholesterol Absorption Inhibitors

11.2.6. Others

11.3. Market Value Forecast, by Indication, 2017-2031

11.3.1. Hypercholesterolemia

11.3.2. Coronary Artery Disease

11.3.3. High Triglycerides

11.4. Market Value Forecast, by Distribution Channel, 2017-2031

11.4.1. Hospital Pharmacies

11.4.2. Retail Pharmacies

11.4.3. Online Pharmacies

11.5. Market Value Forecast, by Country/Sub-region, 2017-2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Drug Class

11.6.2. By Indication

11.6.3. By Distribution Channel

11.6.4. By Country/Sub-region

12. Asia Pacific Lipid-lowering Drugs Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Drug Class, 2017-2031

12.2.1. Statins & Combination

12.2.2. PCSK9 Inhibitors

12.2.3. Bile Acid Sequestrants

12.2.4. Fibrates

12.2.5. Cholesterol Absorption Inhibitors

12.2.6. Others

12.3. Market Value Forecast, by Indication, 2017-2031

12.3.1. Hypercholesterolemia

12.3.2. Coronary Artery Disease

12.3.3. High Triglycerides

12.4. Market Value Forecast, by Distribution Channel, 2017-2031

12.4.1. Hospital Pharmacies

12.4.2. Retail Pharmacies

12.4.3. Online Pharmacies

12.5. Market Value Forecast, by Country/Sub-region, 2017-2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Drug Class

12.6.2. By Indication

12.6.3. By Distribution Channel

12.6.4. By Country/Sub-region

13. Latin America Lipid-lowering Drugs Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Drug Class, 2017-2031

13.2.1. Statins & Combination

13.2.2. PCSK9 Inhibitors

13.2.3. Bile Acid Sequestrants

13.2.4. Fibrates

13.2.5. Cholesterol Absorption Inhibitors

13.2.6. Others

13.3. Market Value Forecast, by Indication, 2017-2031

13.3.1. Hypercholesterolemia

13.3.2. Coronary Artery Disease

13.3.3. High Triglycerides

13.4. Market Value Forecast, by Distribution Channel, 2017-2031

13.4.1. Hospital Pharmacies

13.4.2. Retail Pharmacies

13.4.3. Online Pharmacies

13.5. Market Value Forecast By Country/Sub-region, 2017-2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Drug Class

13.6.2. By Indication

13.6.3. By Distribution Channel

13.6.4. By Country/Sub-region

14. Middle East & Africa Lipid-lowering Drugs Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Drug Class, 2017-2031

14.2.1. Statins & Combination

14.2.2. PCSK9 Inhibitors

14.2.3. Bile Acid Sequestrants

14.2.4. Fibrates

14.2.5. Cholesterol Absorption Inhibitors

14.2.6. Others

14.3. Market Value Forecast, by Indication, 2017-2031

14.3.1. Hypercholesterolemia

14.3.2. Coronary Artery Disease

14.3.3. High Triglycerides

14.4. Market Value Forecast, by Distribution Channel, 2017-2031

14.4.1. Hospital Pharmacies

14.4.2. Retail Pharmacies

14.4.3. Online Pharmacies

14.5. Market Value Forecast, by Country/Sub-region, 2017-2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Drug Class

14.6.2. By Indication

14.6.3. By Distribution Channel

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of companies)

15.2. Market Share/Ranking Analysis By Company (2022)

15.3. Company Profiles

15.3.1. Sanofi

15.3.1.1. Company Overview

15.3.1.2. Product Portfolio

15.3.1.3. SWOT Analysis

15.3.1.4. Strategic Overview

15.3.2. Pfizer, Inc.

15.3.2.1. Company Overview

15.3.2.2. Product Portfolio

15.3.2.3. SWOT Analysis

15.3.2.4. Strategic Overview

15.3.3. GlaxoSmithKline plc

15.3.3.1. Company Overview

15.3.3.2. Product Portfolio

15.3.3.3. SWOT Analysis

15.3.3.4. Strategic Overview

15.3.4. Novartis AG

15.3.4.1. Company Overview

15.3.4.2. Product Portfolio

15.3.4.3. SWOT Analysis

15.3.4.4. Strategic Overview

15.3.5. Merck & Co., Inc.

15.3.5.1. Company Overview

15.3.5.2. Product Portfolio

15.3.5.3. SWOT Analysis

15.3.5.4. Strategic Overview

15.3.6. Amgen Inc.

15.3.6.1. Company Overview

15.3.6.2. Product Portfolio

15.3.6.3. SWOT Analysis

15.3.6.4. Strategic Overview

15.3.7. Takeda Pharmaceutical Company Limited

15.3.7.1. Company Overview

15.3.7.2. Product Portfolio

15.3.7.3. SWOT Analysis

15.3.7.4. Strategic Overview

15.3.8. Sun Pharmaceutical Industries Ltd.

15.3.8.1. Company Overview

15.3.8.2. Product Portfolio

15.3.8.3. SWOT Analysis

15.3.8.4. Strategic Overview

15.3.9. AbbVie, Inc.

15.3.9.1. Company Overview

15.3.9.2. Product Portfolio

15.3.9.3. SWOT Analysis

15.3.9.4. Strategic Overview

15.3.10. Viatris (Mylan N.V.)

15.3.10.1. Company Overview

15.3.10.2. Product Portfolio

15.3.10.3. SWOT Analysis

15.3.10.4. Strategic Overview

15.3.11. AstraZeneca PLC

15.3.11.1. Company Overview

15.3.11.2. Product Portfolio

15.3.11.3. SWOT Analysis

15.3.11.4. Strategic Overview

15.3.12. Dr. Reddy’s Laboratories Ltd.

15.3.12.1. Company Overview

15.3.12.2. Product Portfolio

15.3.12.3. SWOT Analysis

15.3.12.4. Strategic Overview

List of Tables

Table 01: Global Lipid-lowering Drugs Market Value (US$ Mn) Forecast, by Drug Class, 2017‒2031

Table 02: Global Lipid-lowering Drugs Market Value (US$ Mn) Forecast, by 2017‒2031, by Indication

Table 03: Global Lipid-lowering Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 04: Global Lipid-lowering Drugs Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Lipid-lowering Drugs Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 06: North America Lipid-lowering Drugs Market Value (US$ Mn) Forecast, by Drug Class, 2017‒2031

Table 07: North America Lipid-lowering Drugs Market Value (US$ Mn) Forecast, by Indication, 2017‒2031

Table 08: North America Lipid-lowering Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 09: Europe Lipid-lowering Drugs Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017–2031

Table 10: Europe Lipid-lowering Drugs Market Value (US$ Mn) Forecast, by Drug Class, 2017‒2031

Table 11: Europe Lipid-lowering Drugs Market Value (US$ Mn) Forecast, by Indication, 2017‒2031

Table 12: Europe Lipid-lowering Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 13: Asia Pacific Lipid-lowering Drugs Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Asia Pacific Lipid-lowering Drugs Market Value (US$ Mn) Forecast, by Drug Class, 2017‒2031

Table 15: Asia Pacific Lipid-lowering Drugs Market Value (US$ Mn) Forecast, by Indication, 2017‒2031

Table 16: Asia Pacific Lipid-lowering Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 17: Latin America Lipid-lowering Drugs Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 18: Latin America Lipid-lowering Drugs Market Value (US$ Mn) Forecast, by Drug Class, 2017‒2031

Table 19: Latin America Lipid-lowering Drugs Market Value (US$ Mn) Forecast, by Indication, 2017‒2031

Table 20: Latin America Lipid-lowering Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 21: Middle East & Africa Lipid-lowering Drugs Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 22: Middle East & Africa Lipid-lowering Drugs Market Value (US$ Mn) Forecast, by Drug Class, 2017‒2031

Table 23: Middle East & Africa Lipid-lowering Drugs Market Value (US$ Mn) Forecast, by Indication, 2017‒2031

Table 24: Middle East & Africa Lipid-lowering Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

List of Figures

Figure 01: Global Lipid-lowering Drugs Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Lipid-lowering Drugs Market Value Share, by Drug Class, 2021

Figure 03: Global Lipid-lowering Drugs Market Value Share, by Indication, 2021

Figure 04: Global Lipid-lowering Drugs Market Value Share, by Distribution Channel, 2021

Figure 05: Global Lipid-lowering Drugs Market Value Share Analysis, by Drug Class, 2021 and 2031

Figure 06: Global Lipid-lowering Drugs Market Attractiveness Analysis, by Drug Class, 2022–2031

Figure 09: Global Lipid-lowering Drugs Market Value Share Analysis, by Indication, 2021 and 2031

Figure 10: Global Lipid-lowering Drugs Market Attractiveness Analysis, by Indication, 2022–2031

Figure 11: Global Lipid-lowering Drugs Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 12: Global Lipid-lowering Drugs Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 13: Global Lipid-lowering Drugs Market Value Share Analysis, by Region, 2021 and 2031

Figure 14: Global Lipid-lowering Drugs Market Attractiveness Analysis, by Region, 2022–2031

Figure 15: North America Lipid-lowering Drugs Market Value (US$ Mn) Forecast, 2017–2031

Figure 16: North America Lipid-lowering Drugs Market Value Share Analysis, by Country, 2021 and 2031

Figure 17: North America Lipid-lowering Drugs Market Attractiveness Analysis, by Country, 2022–2031

Figure 18: North America Lipid-lowering Drugs Market Value Share Analysis, by Drug Class, 2021 and 2031

Figure 19: North America Lipid-lowering Drugs Market Attractiveness Analysis, by Drug Class, 2022–2031

Figure 20: North America Lipid-lowering Drugs Market Value Share Analysis, by Indication, 2021 and 2031

Figure 21: North America Lipid-lowering Drugs Market Attractiveness Analysis, by Indication, 2022–2031

Figure 22: North America Lipid-lowering Drugs Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 23: North America Lipid-lowering Drugs Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 24: Europe Lipid-lowering Drugs Market Value (US$ Mn) Forecast, 2017–2031

Figure 25: Europe Lipid-lowering Drugs Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 26: Europe Lipid-lowering Drugs Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 27: Europe Lipid-lowering Drugs Market Value Share Analysis, by Drug Class, 2021 and 2031

Figure 28: Europe Lipid-lowering Drugs Market Attractiveness Analysis, by Drug Class, 2022–2031

Figure 29: Europe Lipid-lowering Drugs Market Value Share Analysis, by Indication, 2021 and 2031

Figure 30: Europe Lipid-lowering Drugs Market Attractiveness Analysis, by Indication, 2022–2031

Figure 31: Europe Lipid-lowering Drugs Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 32: Europe Lipid-lowering Drugs Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 33: Asia Pacific Lipid-lowering Drugs Market Value (US$ Mn) Forecast, 2017–2031

Figure 34: Asia Pacific Lipid-lowering Drugs Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 35: Asia Pacific Lipid-lowering Drugs Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 36: Asia Pacific Lipid-lowering Drugs Market Value Share Analysis, by Drug Class, 2021 and 2031

Figure 37: Asia Pacific Lipid-lowering Drugs Market Attractiveness Analysis, by Drug Class, 2022–2031

Figure 38: Asia Pacific Lipid-lowering Drugs Market Value Share Analysis, by Indication, 2021 and 2031

Figure 39: Asia Pacific Lipid-lowering Drugs Market Attractiveness Analysis, by Indication, 2022–2031

Figure 40: Asia Pacific Lipid-lowering Drugs Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 41: Asia Pacific Lipid-lowering Drugs Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 42: Latin America Lipid-lowering Drugs Market Value (US$ Mn) Forecast, 2017–2031

Figure 43: Latin America Lipid-lowering Drugs Market Value Share Analysis, by Country/Sub-Region, 2021 and 2031

Figure 44: Latin America Lipid-lowering Drugs Market Attractiveness Analysis, by Country/Sub-Region, 2021-2031

Figure 45: Latin America Lipid-lowering Drugs Market Value Share Analysis, by Drug Class, 2021 and 2031

Figure 46: Latin America Lipid-lowering Drugs Market Attractiveness Analysis, by Drug Class, 2022–2031

Figure 47: Latin America Lipid-lowering Drugs Market Value Share Analysis, by Indication, 2021 and 2031

Figure 48: Latin America Lipid-lowering Drugs Market Attractiveness Analysis, by Indication, 2022–2031

Figure 49: Latin America Lipid-lowering Drugs Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 50: Latin America Lipid-lowering Drugs Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 51: Middle East & Africa Lipid-lowering Drugs Market Value (US$ Mn) Forecast, 2017–2031

Figure 52: Middle East & Africa Lipid-lowering Drugs Market Value Share Analysis, by Country/Sub-Region, 2021 and 2031

Figure 53: Middle East & Africa Lipid-lowering Drugs Market Attractiveness Analysis, by Country/Sub-Region, 2021-2031

Figure 54: Middle East & Africa Lipid-lowering Drugs Market Value Share Analysis, by Drug Class, 2021 and 2031

Figure 55: Middle East & Africa Lipid-lowering Drugs Market Attractiveness Analysis, by Drug Class, 2022–2031

Figure 56: Middle East & Africa Lipid-lowering Drugs Market Value Share Analysis, by Indication, 2021 and 2031

Figure 57: Middle East & Africa Lipid-lowering Drugs Market Attractiveness Analysis, by Indication, 2022–2031

Figure 58: Middle East & Africa Lipid-lowering Drugs Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 59: Middle East & Africa Lipid-lowering Drugs Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 60: Company Share Analysis, 2021