Analyst Viewpoint

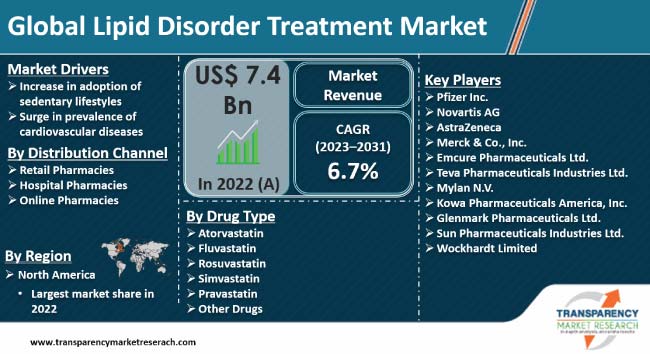

Increase in adoption of sedentary lifestyles and surge in prevalence of cardiovascular diseases are fueling the lipid disorder treatment market size. Lipid disorder treatment helps control cholesterol levels to reduce the risk of severe heart diseases. Rise working population and excessive consumption of alcohol and smoking are fostering the market expansion.

Technological advancements in drug development processes offer lucrative lipid disorder treatment market opportunities to the companies operating in this industry. Leading players are launching new products to meet consumer demands and provide effective treatments to patients. Moreover, increase in investments in business expansion allows companies to improve their global brand presence.

Lipid disorder refers to abnormal levels of lipids (fats) in the bloodstream, including elevated cholesterol and triglycerides. Imbalances can contribute to atherosclerosis and cardiovascular disease. Lifestyle changes, diet modifications, and medications are employed to manage lipid disorders and reduce the risk of cardiovascular complications. Weight management, ezetimibe, statins, fibrates, and bile acid substrates are some of the common types of lipid disorder treatment.

Cardiovascular risk reduction, improved lipid profiles, prevention of complications, customized treatment plans, long-term health maintenance, and enhanced quality of life are major advantages of lipid disorder treatment. Managing lipid disorders can prevent or slow the progression of atherosclerosis, reducing the likelihood of complications such as coronary artery disease, peripheral artery disease, and cerebrovascular disease.

Sedentary lifestyles involve prolonged periods of physical inactivity, often associated with sitting or minimal physical movement. These habits contribute to health risks, including obesity, cardiovascular issues, and overall diminished well-being. Growth in the working population and an increase in on-the-desk jobs are driving the adoption of sedentary lifestyles.

Moreover, physical inactivity and excessive consumption of processed food lead to obesity having high cholesterol, thereby causing lipid disorders. Thus, surge in adoption of sedentary lifestyles and lack of nutritional diets is boosting the lipid disorder treatment market revenue.

According to the Bureau of Labor Statistics, the number of people working or looking for work in the U.S. is projected to reach 163.8 million in 2024. The labor force is anticipated to grow by 7.9 million, reflecting an average annual growth rate of 0.5% in 2024.

Cardiovascular Diseases (CVDs) are a group of disorders affecting the heart and blood vessels. Coronary artery disease, heart failure, stroke, hypertension, peripheral artery disease, rheumatic heart disease, cardiomyopathy, and arrhythmias are some of the diseases leading to lipid disorders. Cholesterol management solutions may help reduce the risk of lipid disorders by maintaining well-being. Excessive smoking and drinking at a young age is a major cause of cardiovascular diseases. Thus, increase in prevalence of cardiovascular diseases is contributing to the lipid disorder treatment industry growth.

According to the World Health Organization, around 17.9 million fatalities are registered each year due to cardiovascular diseases. Approximately more than 4 out of 5 CVD fatalities are due to strokes and heart attacks and around one-third of these deaths occur prematurely in people under 70 years of age.

As per the latest market analysis, North America dominated the global market in 2022. Increase in prevalence of lipid disorders and growth in consumption of drugs, including fluvastatin and atorvastatin is likely to propel the lipid disorder treatment market share during the forecast period. Moreover, growth in geriatric population and excessive consumption of alcohol among young adults are driving the risk of cardiovascular diseases, thereby driving the demand for lipid disorder treatment.

According to the 2022 National Survey on Drug Use and Health (NSDUH), 221.3 million people ages 12 and older which is around 78.5% in this age group reported that they drank alcohol at some point in their lifetime. This includes 110.2 million males ages 12 and older (79.7% in this age group), and 111.1 million females ages 12 and older (77.3% in this age group).

Leading companies in the market are focusing on research and development activities to introduce new products and drugs to cure lipid disorders. As per the latest lipid disorder treatment market trends, technological advancements in drug development processes allow companies to increase their productivity. Innovation in drugs for lipid disorders helps companies enhance their product portfolio, thereby augmenting market statistics.

Some of the players in the lipid disorder treatment market are Pfizer Inc., Novartis AG, AstraZeneca, Merck & Co., Inc., Emcure Pharmaceuticals Ltd., Teva Pharmaceuticals Industries Ltd., Mylan N.V., Kowa Pharmaceuticals America, Inc., Glenmark Pharmaceuticals Ltd., Sun Pharmaceuticals Industries Ltd., and Wockhardt Limited.

These companies have been profiled in the lipid disorder treatment market report based on various parameters including company overview, business segments, product portfolio, recent developments, business strategies, and financial overview.

| Attribute | Detail |

|---|---|

| Market Size in 2022 | US$ 7.4 Bn |

| Market Forecast (Value) in 2031 | US$ 13.7 Bn |

| Growth Rate (CAGR) | 6.7% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Tons | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces Analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 7.4 Bn in 2022

It is projected to register a CAGR of 6.7% from 2023 to 2031

Increase in adoption of sedentary lifestyles and surge in prevalence of cardiovascular diseases

North America was the most lucrative region in 2022

Pfizer Inc., Novartis AG, AstraZeneca, Merck & Co., Inc., Emcure Pharmaceuticals Ltd., Teva Pharmaceuticals Industries Ltd., Mylan N.V., Kowa Pharmaceuticals America, Inc., Glenmark Pharmaceuticals Ltd., Sun Pharmaceuticals Industries Ltd., and Wockhardt Limited.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Lipid Disorder Treatment Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution/Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Lipid Disorder Treatment Market Analysis and Forecast, 2017–2031

5. Key Insights

5.1. Pipeline Analysis

5.2. Key Product/Brand Analysis

5.3. Key Mergers & Acquisitions

5.4. COVID-19 Pandemic Impact on Industry

6. Global Lipid Disorder Treatment Market Analysis and Forecast, by Drug Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Drug Type, 2017–2031

6.3.1. Atorvastatin

6.3.2. Fluvastatin

6.3.3. Rosuvastatin

6.3.4. Simvastatin

6.3.5. Pravastatin

6.3.6. Other Drugs

6.4. Market Attractiveness Analysis, by Drug Type

7. Global Lipid Disorder Treatment Market Analysis and Forecast, by Distribution Channel

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Distribution Channel, 2017–2031

7.3.1. Retail Pharmacies

7.3.2. Hospital Pharmacies

7.3.3. Online Pharmacies

7.4. Market Attractiveness Analysis, by Distribution Channel

8. Global Lipid Disorder Treatment Market Analysis and Forecast, by Indication

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by Indication, 2017–2031

8.3.1. Familial Combined Hyperlipidemia

8.3.2. Familial Defective Apolipoprotein B-100

8.3.3. Familial Dysbetalipoproteinemia

8.3.4. Familial Hypertriglyceridemia

8.3.5. Heterozygous Familial Hypercholesterolemia

8.3.6. Other Indications

8.4. Market Attractiveness Analysis, by Indication

9. Global Lipid Disorder Treatment Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region, 2017–2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Lipid Disorder Treatment Market Analysis and Forecast

10.1. Introduction

10.2. Key Findings

10.3. Market Value Forecast, by Drug Type, 2017–2031

10.3.1. Atorvastatin

10.3.2. Fluvastatin

10.3.3. Rosuvastatin

10.3.4. Simvastatin

10.3.5. Pravastatin

10.3.6. Other Drugs

10.4. Market Value Forecast, by Distribution Channel, 2017–2031

10.4.1. Retail Pharmacies

10.4.2. Hospital Pharmacies

10.4.3. Online Pharmacies

10.5. Market Value Forecast, by Indication, 2017–2031

10.5.1. Familial Combined Hyperlipidemia

10.5.2. Familial Defective Apolipoprotein B-100

10.5.3. Familial Dysbetalipoproteinemia

10.5.4. Familial Hypertriglyceridemia

10.5.5. Heterozygous Familial Hypercholesterolemia

10.5.6. Other Indications

10.6. Market Value Forecast, by Country, 2017–2031

10.6.1. U.S.

10.6.2. Canada

10.7. Market Attractiveness Analysis

10.7.1. By Drug Type

10.7.2. By Distribution Channel

10.7.3. By Indication

10.7.4. By Country

11. Europe Lipid Disorder Treatment Market Analysis and Forecast

11.1. Introduction

11.2. Key Findings

11.3. Market Value Forecast, by Drug Type, 2017–2031

11.3.1. Atorvastatin

11.3.2. Fluvastatin

11.3.3. Rosuvastatin

11.3.4. Simvastatin

11.3.5. Pravastatin

11.3.6. Other Drugs

11.4. Market Value Forecast, by Distribution Channel, 2017–2031

11.4.1. Retail Pharmacies

11.4.2. Hospital Pharmacies

11.4.3. Online Pharmacies

11.5. Market Value Forecast, by Indication, 2017–2031

11.5.1. Familial Combined Hyperlipidemia

11.5.2. Familial Defective Apolipoprotein B-100

11.5.3. Familial Dysbetalipoproteinemia

11.5.4. Familial Hypertriglyceridemia

11.5.5. Heterozygous Familial Hypercholesterolemia

11.5.6. Other Indications

11.6. Market Value Forecast, by Country/Sub-region, 2017–2031

11.6.1. Germany

11.6.2. U.K.

11.6.3. France

11.6.4. Italy

11.6.5. Spain

11.6.6. Rest of Europe

11.7. Market Attractiveness Analysis

11.7.1. By Drug Type

11.7.2. By Distribution Channel

11.7.3. By Indication

11.7.4. By Country/Sub-region

12. Asia Pacific Lipid Disorder Treatment Market Analysis and Forecast

12.1. Introduction

12.2. Key Findings

12.3. Market Value Forecast, by Drug Type, 2017–2031

12.3.1. Atorvastatin

12.3.2. Fluvastatin

12.3.3. Rosuvastatin

12.3.4. Simvastatin

12.3.5. Pravastatin

12.3.6. Other Drugs

12.4. Market Value Forecast, by Distribution Channel, 2017–2031

12.4.1. Retail Pharmacies

12.4.2. Hospital Pharmacies

12.4.3. Online Pharmacies

12.5. Market Value Forecast, by Indication, 2017–2031

12.5.1. Familial Combined Hyperlipidemia

12.5.2. Familial Defective Apolipoprotein B-100

12.5.3. Familial Dysbetalipoproteinemia

12.5.4. Familial Hypertriglyceridemia

12.5.5. Heterozygous Familial Hypercholesterolemia

12.5.6. Other Indications

12.6. Market Value Forecast, by Country/Sub-region, 2017–2031

12.6.1. China

12.6.2. Japan

12.6.3. India

12.6.4. Australia & New Zealand

12.6.5. Rest of Asia Pacific

12.7. Market Attractiveness Analysis

12.7.1. By Drug Type

12.7.2. By Distribution Channel

12.7.3. By Indication

12.7.4. By Country/Sub-region

13. Latin America Lipid Disorder Treatment Market Analysis and Forecast

13.1. Introduction

13.2. Key Findings

13.3. Market Value Forecast, by Drug Type, 2017–2031

13.3.1. Atorvastatin

13.3.2. Fluvastatin

13.3.3. Rosuvastatin

13.3.4. Simvastatin

13.3.5. Pravastatin

13.3.6. Other Drugs

13.4. Market Value Forecast, by Distribution Channel, 2017–2031

13.4.1. Retail Pharmacies

13.4.2. Hospital Pharmacies

13.4.3. Online Pharmacies

13.5. Market Value Forecast, by Indication, 2017–2031

13.5.1. Familial Combined Hyperlipidemia

13.5.2. Familial Defective Apolipoprotein B-100

13.5.3. Familial Dysbetalipoproteinemia

13.5.4. Familial Hypertriglyceridemia

13.5.5. Heterozygous Familial Hypercholesterolemia

13.5.6. Other Indications

13.6. Market Value Forecast, by Country/Sub-region, 2017–2031

13.6.1. Brazil

13.6.2. Mexico

13.6.3. Rest of Latin America

13.7. Market Attractiveness Analysis

13.7.1. By Drug Type

13.7.2. By Distribution Channel

13.7.3. By Indication

13.7.4. By Country/Sub-region

14. Middle East & Africa Lipid Disorder Treatment Market Analysis and Forecast

14.1. Introduction

14.2. Key Findings

14.3. Market Value Forecast, by Drug Type, 2017–2031

14.3.1. Atorvastatin

14.3.2. Fluvastatin

14.3.3. Rosuvastatin

14.3.4. Simvastatin

14.3.5. Pravastatin

14.3.6. Other Drugs

14.4. Market Value Forecast, by Distribution Channel, 2017–2031

14.4.1. Retail Pharmacies

14.4.2. Hospital Pharmacies

14.4.3. Online Pharmacies

14.5. Market Value Forecast, by Indication, 2017–2031

14.5.1. Familial Combined Hyperlipidemia

14.5.2. Familial Defective Apolipoprotein B-100

14.5.3. Familial Dysbetalipoproteinemia

14.5.4. Familial Hypertriglyceridemia

14.5.5. Heterozygous Familial Hypercholesterolemia

14.5.6. Other Indications

14.6. Market Value Forecast, by Country/Sub-region, 2017–2031

14.6.1. GCC Countries

14.6.2. South Africa

14.6.3. Rest of Middle East & Africa

14.7. Market Attractiveness Analysis

14.7.1. By Drug Type

14.7.2. By Distribution Channel

14.7.3. By Indication

14.7.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competitive Matrix (by Tier and Size of Companies)

15.2. Market Share Analysis, by Company (2022)

15.3. Company Profiles

15.3.1. Pfizer Inc.

15.3.1.1. Company Overview

15.3.1.2. Product Portfolio

15.3.1.3. SWOT Analysis

15.3.1.4. Financial Overview

15.3.1.5. Strategic Overview

15.3.2. Novartis AG

15.3.2.1. Company Overview

15.3.2.2. Product Portfolio

15.3.2.3. SWOT Analysis

15.3.2.4. Financial Overview

15.3.2.5. Strategic Overview

15.3.3. AstraZeneca

15.3.3.1. Company Overview

15.3.3.2. Product Portfolio

15.3.3.3. SWOT Analysis

15.3.3.4. Financial Overview

15.3.3.5. Strategic Overview

15.3.4. Merck & Co., Inc.

15.3.4.1. Company Overview

15.3.4.2. Product Portfolio

15.3.4.3. SWOT Analysis

15.3.4.4. Financial Overview

15.3.4.5. Strategic Overview

15.3.5. Emcure Pharmaceuticals Ltd.

15.3.5.1. Company Overview

15.3.5.2. Product Portfolio

15.3.5.3. SWOT Analysis

15.3.5.4. Financial Overview

15.3.5.5. Strategic Overview

15.3.6. Teva Pharmaceuticals Industries Ltd.

15.3.6.1. Company Overview

15.3.6.2. Product Portfolio

15.3.6.3. SWOT Analysis

15.3.6.4. Financial Overview

15.3.6.5. Strategic Overview

15.3.7. Mylan N.V.

15.3.7.1. Company Overview

15.3.7.2. Product Portfolio

15.3.7.3. SWOT Analysis

15.3.7.4. Financial Overview

15.3.7.5. Strategic Overview

15.3.8. Kowa Pharmaceuticals America, Inc.

15.3.8.1. Company Overview

15.3.8.2. Product Portfolio

15.3.8.3. SWOT Analysis

15.3.8.4. Financial Overview

15.3.8.5. Strategic Overview

15.3.9. Glenmark Pharmaceuticals Ltd.

15.3.9.1. Company Overview

15.3.9.2. Product Portfolio

15.3.9.3. SWOT Analysis

15.3.9.4. Financial Overview

15.3.9.5. Strategic Overview

15.3.10. Sun Pharmaceuticals Industries Ltd.

15.3.10.1. Company Overview

15.3.10.2. Product Portfolio

15.3.10.3. SWOT Analysis

15.3.10.4. Financial Overview

15.3.10.5. Strategic Overview

15.3.11. Wockhardt Limited

15.3.11.1. Company Overview

15.3.11.2. Product Portfolio

15.3.11.3. SWOT Analysis

15.3.11.4. Financial Overview

15.3.11.5. Strategic Overview

List of Tables

Table 01: Global Lipid Disorder Treatment Market Size (US$ Mn) Forecast, by Drug Type, 2017–2031

Table 02: Global Lipid Disorder Treatment Market Size (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 03: Global Lipid Disorder Treatment Market Size (US$ Mn) Forecast, by Indication, 2017–2031

Table 04: Global Lipid Disorder Treatment Market Size (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Lipid Disorder Treatment Market Size (US$ Mn) Forecast, by Country, 2017–2031

Table 06: North America Lipid Disorder Treatment Market Size (US$ Mn) Forecast, by Drug Type, 2017–2031

Table 07: North America Lipid Disorder Treatment Market Size (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 08: North America Lipid Disorder Treatment Market Size (US$ Mn) Forecast, by Indication, 2017–2031

Table 09: Europe Lipid Disorder Treatment Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 10: Europe Lipid Disorder Treatment Market Size (US$ Mn) Forecast, by Drug Type, 2017–2031

Table 11: Europe Lipid Disorder Treatment Market Size (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 12: Europe Lipid Disorder Treatment Market Size (US$ Mn) Forecast, by Indication, 2017–2031

Table 13: Asia Pacific Lipid Disorder Treatment Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Asia Pacific Lipid Disorder Treatment Market Size (US$ Mn) Forecast, by Drug Type, 2017–2031

Table 15: Asia Pacific Lipid Disorder Treatment Market Size (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 16: Asia Pacific Lipid Disorder Treatment Market Size (US$ Mn) Forecast, by Indication, 2017–2031

Table 17: Latin America Lipid Disorder Treatment Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 18: Latin America Lipid Disorder Treatment Market Size (US$ Mn) Forecast, by Drug Type, 2017–2031

Table 19: Latin America Lipid Disorder Treatment Market Size (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 20: Latin America Lipid Disorder Treatment Market Size (US$ Mn) Forecast, by Indication, 2017–2031

Table 21: Middle East & Africa Lipid Disorder Treatment Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 22: Middle East & Africa Lipid Disorder Treatment Market Size (US$ Mn) Forecast, by Drug Type, 2017–2031

Table 23: Middle East & Africa Lipid Disorder Treatment Market Size (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 24: Middle East & Africa Lipid Disorder Treatment Market Size (US$ Mn) Forecast, by Indication, 2017–2031

List of Figures

Figure 01: Global Lipid Disorder Treatment Market Size (US$ Mn) and Distribution (%), by Region, 2022 and 2031

Figure 02: Global Lipid Disorder Treatment Market Revenue (US$ Mn), by Drug Type, 2022

Figure 03: Global Lipid Disorder Treatment Market Value Share, by Drug Type, 2022

Figure 04: Global Lipid Disorder Treatment Market Revenue (US$ Mn), by Distribution Channel, 2022

Figure 05: Global Lipid Disorder Treatment Market Value Share, by Distribution Channel, 2022

Figure 06: Global Lipid Disorder Treatment Market Revenue (US$ Mn), by Indication, 2022

Figure 07: Global Lipid Disorder Treatment Market Value Share, by Indication, 2022

Figure 08: Global Lipid Disorder Treatment Market Value Share, by Region, 2022

Figure 09: Global Lipid Disorder Treatment Market Value (US$ Mn) Forecast, 2017–2031

Figure 10: Global Lipid Disorder Treatment Market Value Share Analysis, by Drug Type, 2022 and 2031

Figure 11: Global Lipid Disorder Treatment Market Attractiveness Analysis, by Drug Type, 2023-2031

Figure 12: Global Lipid Disorder Treatment Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 13: Global Lipid Disorder Treatment Market Attractiveness Analysis, by Distribution Channel, 2023-2031

Figure 14: Global Lipid Disorder Treatment Market Value Share Analysis, by Indication, 2022 and 2031

Figure 15: Global Lipid Disorder Treatment Market Attractiveness Analysis, by Indication, 2022-2031

Figure 16: Global Lipid Disorder Treatment Market Value Share Analysis, by Region, 2022 and 2031

Figure 17: Global Lipid Disorder Treatment Market Attractiveness Analysis, by Region, 2022-2031

Figure 18: North America Lipid Disorder Treatment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 19: North America Lipid Disorder Treatment Market Attractiveness Analysis, by Country, 2023–2031

Figure 20: North America Lipid Disorder Treatment Market Value Share Analysis, by Country, 2022 and 2031

Figure 21: North America Lipid Disorder Treatment Market Value Share Analysis, by Drug Type, 2022 and 2031

Figure 22: North America Lipid Disorder Treatment Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 23: North America Lipid Disorder Treatment Market Value Share Analysis, by Indication, 2022 and 2031

Figure 24: North America Lipid Disorder Treatment Market Attractiveness Analysis, by Drug Type, 2023–2031

Figure 25: North America Lipid Disorder Treatment Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 26: North America Lipid Disorder Treatment Market Attractiveness Analysis, by Indication, 2023–2031

Figure 27: Europe Lipid Disorder Treatment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 28: Europe Lipid Disorder Treatment Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 29: Europe Lipid Disorder Treatment Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 30: Europe Lipid Disorder Treatment Market Value Share Analysis, by Drug Type, 2022 and 2031

Figure 31: Europe Lipid Disorder Treatment Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 32: Europe Lipid Disorder Treatment Market Value Share Analysis, by Indication, 2022 and 2031

Figure 33: Europe Lipid Disorder Treatment Market Attractiveness Analysis, by Drug Type, 2023–2031

Figure 34: Europe Lipid Disorder Treatment Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 35: Europe Lipid Disorder Treatment Market Attractiveness Analysis, by Indication, 2023–2031

Figure 36: Asia Pacific Lipid Disorder Treatment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 37: Asia Pacific Lipid Disorder Treatment Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 38: Asia Pacific Lipid Disorder Treatment Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 39: Asia Pacific Lipid Disorder Treatment Market Value Share Analysis, by Drug Type, 2022 and 2031

Figure 40: Asia Pacific Lipid Disorder Treatment Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 41: Asia Pacific Lipid Disorder Treatment Market Value Share Analysis, by Indication, 2022 and 2031

Figure 42: Asia Pacific Lipid Disorder Treatment Market Attractiveness Analysis, by Drug Type, 2023–2031

Figure 43: Asia Pacific Lipid Disorder Treatment Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 44: Asia Pacific Lipid Disorder Treatment Market Attractiveness Analysis, by Indication, 2023–2031

Figure 45: Latin America Lipid Disorder Treatment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 46: Latin America Lipid Disorder Treatment Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 47: Latin America Lipid Disorder Treatment Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 48: Latin America Lipid Disorder Treatment Market Value Share Analysis, by Drug Type, 2022 and 2031

Figure 49: Latin America Lipid Disorder Treatment Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 50: Latin America Lipid Disorder Treatment Market Value Share Analysis, by Indication, 2022 and 2031

Figure 51: Latin America Lipid Disorder Treatment Market Attractiveness Analysis, by Drug Type, 2023–2031

Figure 52: Latin America Lipid Disorder Treatment Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 53: Latin America Lipid Disorder Treatment Market Attractiveness Analysis, by Indication, 2023–2031

Figure 54: Middle East & Africa Lipid Disorder Treatment Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 55: Middle East & Africa Lipid Disorder Treatment Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 56: Middle East & Africa Lipid Disorder Treatment Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 57: Middle East & Africa Lipid Disorder Treatment Market Value Share Analysis, by Drug Type, 2022 and 2031

Figure 58: Middle East & Africa Lipid Disorder Treatment Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 59: Middle East & Africa Lipid Disorder Treatment Market Value Share Analysis, by Indication, 2022 and 2031

Figure 60: Middle East & Africa Lipid Disorder Treatment Market Attractiveness Analysis, by Drug Type, 2023–2031

Figure 61: Middle East & Africa Lipid Disorder Treatment Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 62: Middle East & Africa Lipid Disorder Treatment Market Attractiveness Analysis, by Indication, 2023–2031