Analysts’ Viewpoint on Life Science Instrumentation Market Scenario

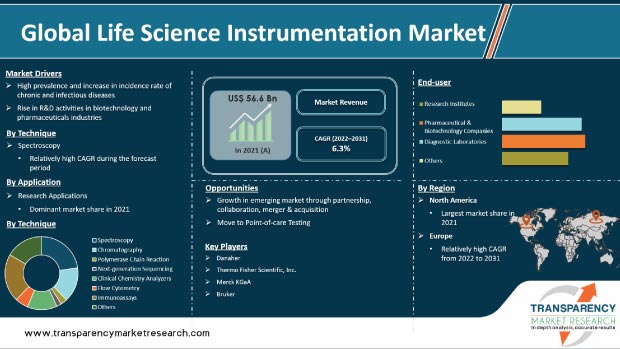

Increase in R&D spending by leading players, rise in prevalence and incidence rate of infectious diseases, and technological developments are projected to drive the global life science instrumentation market during the forecast period. Companies operating in the market are increasingly investing in research and development activities in life sciences. Several companies are also engaged in mergers and acquisitions, joint ventures, partnerships, and collaborations to maintain their position in the global life science instrumentation market. Government bodies across the world are focusing on research operations to discover treatments for severe infections and rare diseases such as COVID-19. This is expected to drive the global life science instrumentation market during the forecast period.

Usage of various methods such as chromatography, spectroscopy, next-generation sequencing, polymerase chain reaction, flow cytometry, immunoassays, and clinical chemistry analyzers has increased significantly. This has led to a rise in demand for life science and chemical instrumentation in the global market, thus boosting the life science and chemical instrumentation market. Companies in the global life science instrumentation market are emphasizing on the release of innovative, cutting-edge products. This is likely to augment the global life science instrumentation market size in the near future.

Life science laboratory equipment is primarily used for the diagnosis of infectious and chronic diseases. The advent and breakout of several infectious diseases have presented obstacles as well as new possibilities for researchers working on diagnostic tools and tests for advanced disease detection and prevention. According to the WHO's World Health Report, infectious diseases account for around 17 million deaths globally each year. Furthermore, the emergence of new diseases has increased in the last few years, as a number of countries have reportedly not made enough investment in R&D to combat prevalent infectious diseases. The need for diagnostic technologies for the early diagnosis of infectious diseases to prevent outbreaks is rising. This is anticipated to propel the global life science instrumentation market.

Industries such as biotechnology and pharmaceuticals are investing significantly in R&D. This can be ascribed to the rise in need for quick medication development and innovative drug molecule commercialization for the treatment of uncommon illnesses. According to the International Federation of Pharmaceutical Manufacturers and Association (IFPMA), the pharmaceutical industry spends around US$ 150 Bn on research and development annually. More than 7,000 novel compounds were developed, while 56 new medications were introduced in 2015. Rapid and effective life science instrumentation devices are required to accelerate the drug development process. Rise in R&D in drug development for conditions such as cardiovascular illnesses, neurological disorders, cancer, and infectious diseases is expected to drive the global life science instrumentation market.

In terms of technique, the life science instrumentation market has been classified into spectroscopy, chromatography, polymerase chain reaction, next-generation sequencing, clinical chemistry analyzers, flow cytometry, immunoassays, and others (incubator, electrophoresis, etc.). The spectroscopy segment dominated the global life science instrumentation market in 2021. Spectroscopy is essential in domains relating to bio- and life sciences for detection, identification, and quantification of molecules. The spectroscopy segment is anticipated to be driven by ongoing improvements in spectroscopic technology and rise in demand for real-time sample analysis.

Based on application, the global market has been divided into research applications, laboratory applications, and others. Research applications is expected to be a highly attractive segment of the global life science instrumentation market during the forecast period. This can be ascribed to the mounting pressure on the pharmaceutical industry to create novel, affordable treatments for different ailments. Surge in drug discovery activities is also projected to drive the demand for life science lab instruments. Rise in innovative medications & treatments under development is likely to augment the research applications segment during the forecast period.

In terms of end-user, the global life science instrumentation market has been classified into research institutes, pharmaceutical & biotechnology companies, diagnostic laboratories, and others. The pharmaceutical & biotechnology companies segment held the major share of the global market in 2021. The segment is projected to sustain its market share during the forecast period due to the increase in usage of life science and chemical instrumentation in drug manufacturing processes to maintain the quality of drugs.

North America dominated the global life science instrumentation market in 2021. It is projected to maintain its share during the forecast period. This can be ascribed to a large patient pool, technological advancements, and high acceptance of advanced treatments in the region. Increase in health care expenditure, rise in prevalence & incidence of chronic infectious diseases, and surge in investments are also anticipated to propel the life science instrumentation market in North America in the next few years.

Europe accounted for the second largest share of the global market in 2021. High prevalence of chronic diseases such as diabetes, cancer, kidney disease, and inflammatory bowel disease; increase in geriatric population requiring regular medical tests; and well-established health care infrastructure are the major factors contributing to the region’s large share of the global life science instrumentation market.

The life science instrumentation market in Asia Pacific is expected to grow at a high CAGR during the forecast period due to the increase in demand for efficient and high-speed diagnostic equipment in developing countries; and rise in research initiatives in countries such as Japan and China.

The global life science instrumentation market comprises several small and large-scale companies that control majority of the share. Mergers and acquisitions and development of product portfolios, product launches, product approvals, and agreements are major strategies implemented by several key players. Prominent players operating in the global life science instrumentation market are Danaher, Thermo Fisher Scientific, Inc., Merck KGaA, Bio-Rad Laboratories, Inc., Agilent Technologies, Inc., Illumina, Inc., PerkinElmer, Inc., BD, Bruker, and Hitachi High-Tech Corporation.

Each of these players has been profiled in the life science instrumentation market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 56.6 Bn |

|

Market Forecast Value in 2031 |

More than US$ 104.5 Bn |

|

Growth Rate (CAGR) 2022-2031 |

6.3% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global life science instrumentation market was valued at US$ 56.6 Bn in 2021

The global life science instrumentation market is projected to reach more than US$ 104.5 Bn by 2031

The global life science instrumentation market grew at a CAGR of 5.3% from 2017 to 2021

The global life science instrumentation market is anticipated to grow at a CAGR of 6.3% from 2022 to 2031

The research applications segment held major share of around 42% of the global life science instrumentation market in 2021

North America is expected to account for major share of the global life science instrumentation market during the forecast period

Danaher, Thermo Fisher Scientific, Inc., Merck KGaA, Bio-Rad Laboratories, Inc., Agilent Technologies, Inc., Illumina, Inc., PerkinElmer, Inc., BD, Bruker, and Hitachi High-Tech Corporation

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Life Science Instrumentation Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Life Science Instrumentation Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Market Outlook

5.1. Reimbursement Scenario, by Region/globally

5.2. Key Mergers & Acquisitions

5.3. Technological Advancement

6. Global Life Science Instrumentation Market Analysis and Forecast, by Technique

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Technique, 2017–2031

6.3.1. Spectroscopy

6.3.2. Chromatography

6.3.3. Polymerase Chain Reaction

6.3.4. Next-generation Sequencing

6.3.5. Clinical Chemistry Analyzers

6.3.6. Flow Cytometry

6.3.7. Immunoassays

6.3.8. Others

6.4. Market Attractiveness Analysis, by Technique

7. Global Life Science Instrumentation Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Application, 2017–2031

7.3.1. Research Applications

7.3.2. Clinical Applications

7.3.3. Others

7.4. Market Attractiveness Analysis, by Application

8. Global Life Science Instrumentation Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by End-user, 2017–2031

8.3.1. Research Institutes

8.3.2. Pharmaceutical & Biotechnology Companies

8.3.3. Diagnostic Laboratories

8.3.4. Others

8.4. Market Attractiveness Analysis, by End-user

9. Global Life Science Instrumentation Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Life Science Instrumentation Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Technique, 2017–2031

10.2.1. Spectroscopy

10.2.2. Chromatography

10.2.3. Polymerase Chain Reaction

10.2.4. Next-generation Sequencing

10.2.5. Clinical Chemistry Analyzers

10.2.6. Flow Cytometry

10.2.7. Immunoassays

10.2.8. Others

10.3. Market Value Forecast, by Application, 2017–2031

10.3.1. Research Applications

10.3.2. Clinical Applications

10.3.3. Others

10.4. Market Value Forecast, by End-user, 2017–2031

10.4.1. Research Institutes

10.4.2. Pharmaceutical & Biotechnology Companies

10.4.3. Diagnostic Laboratories

10.4.4. Others

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Technique

10.6.2. By Application

10.6.3. By End-user

10.6.4. By Country

11. Europe Life Science Instrumentation Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Technique, 2017–2031

11.2.1. Spectroscopy

11.2.2. Chromatography

11.2.3. Polymerase Chain Reaction

11.2.4. Next-generation Sequencing

11.2.5. Clinical Chemistry Analyzers

11.2.6. Flow Cytometry

11.2.7. Immunoassays

11.2.8. Others

11.3. Market Value Forecast, by Application, 2017–2031

11.3.1. Research Applications

11.3.2. Clinical Applications

11.3.3. Others

11.4. Market Value Forecast, by End-user, 2017–2031

11.4.1. Research Institutes

11.4.2. Pharmaceutical & Biotechnology Companies

11.4.3. Diagnostic Laboratories

11.4.4. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Technique

11.6.2. By Application

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Life Science Instrumentation Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Technique, 2017–2031

12.2.1. Chromatography

12.2.2. Polymerase Chain Reaction

12.2.3. Next-generation Sequencing

12.2.4. Clinical Chemistry Analyzers

12.2.5. Flow Cytometry

12.2.6. Immunoassays

12.2.7. Others

12.3. Market Value Forecast, by Application, 2017–2031

12.3.1. Research Applications

12.3.2. Clinical Applications

12.3.3. Others

12.4. Market Value Forecast, by End-user, 2017–2031

12.4.1. Research Institutes

12.4.2. Pharmaceutical & Biotechnology Companies

12.4.3. Diagnostic Laboratories

12.4.4. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Technique

12.6.2. By Application

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Life Science Instrumentation Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Technique, 2017–2031

13.2.1. Spectroscopy

13.2.2. Chromatography

13.2.3. Polymerase Chain Reaction

13.2.4. Next-generation Sequencing

13.2.5. Clinical Chemistry Analyzers

13.2.6. Flow Cytometry

13.2.7. Immunoassays

13.2.8. Others

13.3. Market Value Forecast, by Application, 2017–2031

13.3.1. Research Applications

13.3.2. Clinical Applications

13.3.3. Others

13.4. Market Value Forecast, by End-user, 2017–2031

13.4.1. Research Institutes

13.4.2. Pharmaceutical & Biotechnology Companies

13.4.3. Diagnostic Laboratories

13.4.4. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Technique

13.6.2. By Application

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Life Science Instrumentation Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Technique, 2017–2031

14.2.1. Spectroscopy

14.2.2. Chromatography

14.2.3. Polymerase Chain Reaction

14.2.4. Next-generation Sequencing

14.2.5. Clinical Chemistry Analyzers

14.2.6. Flow Cytometry

14.2.7. Immunoassays

14.2.8. Others

14.3. Market Value Forecast, by Application, 2017–2031

14.3.1. Research Applications

14.3.2. Clinical Applications

14.3.3. Others

14.4. Market Value Forecast, by End-user, 2017–2031

14.4.1. Research Institutes

14.4.2. Pharmaceutical & Biotechnology Companies

14.4.3. Diagnostic Laboratories

14.4.4. Others

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Technique

14.6.2. By Application

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Company Profiles

15.1.1. Danaher

15.1.1.1. Company Overview

15.1.1.2. Product Portfolio

15.1.1.3. SWOT Analysis

15.1.1.4. Financial Overview

15.1.1.5. Strategic Overview

15.1.2. Thermo Fisher Scientific, Inc.

15.1.2.1. Company Overview

15.1.2.2. Product Portfolio

15.1.2.3. SWOT Analysis

15.1.2.4. Financial Overview

15.1.2.5. Strategic Overview

15.1.3. Merck KGaA

15.1.3.1. Company Overview

15.1.3.2. Product Portfolio

15.1.3.3. SWOT Analysis

15.1.3.4. Financial Overview

15.1.3.5. Strategic Overview

15.1.4. Bio-Rad Laboratories, Inc.

15.1.4.1. Company Overview

15.1.4.2. Product Portfolio

15.1.4.3. SWOT Analysis

15.1.4.4. Financial Overview

15.1.4.5. Strategic Overview

15.1.5. Agilent Technologies, Inc.

15.1.5.1. Company Overview

15.1.5.2. Product Portfolio

15.1.5.3. SWOT Analysis

15.1.5.4. Financial Overview

15.1.5.5. Strategic Overview

15.1.6. Illumina, Inc.

15.1.6.1. Company Overview

15.1.6.2. Product Portfolio

15.1.6.3. SWOT Analysis

15.1.6.4. Financial Overview

15.1.6.5. Strategic Overview

15.1.7. PerkinElmer, Inc.

15.1.7.1. Company Overview

15.1.7.2. Product Portfolio

15.1.7.3. SWOT Analysis

15.1.7.4. Financial Overview

15.1.7.5. Strategic Overview

15.1.8. BD

15.1.8.1. Company Overview

15.1.8.2. Product Portfolio

15.1.8.3. SWOT Analysis

15.1.8.4. Financial Overview

15.1.8.5. Strategic Overview

15.1.9. Bruker

15.1.9.1. Company Overview

15.1.9.2. Product Portfolio

15.1.9.3. SWOT Analysis

15.1.9.4. Financial Overview

15.1.9.5. Strategic Overview

15.1.10. Hitachi High-Technologies Corporation

15.1.10.1. Company Overview

15.1.10.2. Product Portfolio

15.1.10.3. SWOT Analysis

15.1.10.4. Financial Overview

15.1.10.5. Strategic Overview

List of Tables

Table 01: Global Life Science Instrumentation Market Size (US$ Mn) Forecast, by Technique, 2017–2031

Table 02: Global Life Science Instrumentation Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 03: Global Life Science Instrumentation Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 04: Global Life Science Instrumentation Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Life Science Instrumentation Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 06: North America Life Science Instrumentation Market Value (US$ Mn) Forecast, by Technique, 2017–2031

Table 07: North America Life Science Instrumentation Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 08: North America Life Science Instrumentation Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 09: U.S. Life Science Instrumentation Market Value (US$ Mn) Forecast, by Technique, 2017–2031

Table 10: U.S. Life Science Instrumentation Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 11: U.S. Life Science Instrumentation Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 12: Canada Life Science Instrumentation Market Value (US$ Mn) Forecast, by Technique, 2017–2031

Table 13: Canada Life Science Instrumentation Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 14: Canada Life Science Instrumentation Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 15: Europe Life Science Instrumentation Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 16: Europe Life Science Instrumentation Market Value (US$ Mn) Forecast, by Technique, 2017–2031

Table 17: Europe Life Science Instrumentation Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 18: Europe Life Science Instrumentation Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 19: Germany Life Science Instrumentation Market Value (US$ Mn) Forecast, by Technique, 2017–2031

Table 20: Germany Life Science Instrumentation Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 21: Germany Life Science Instrumentation Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 22: U.K. Life Science Instrumentation Market Value (US$ Mn) Forecast, by Technique, 2017–2031

Table 23: U.K. Life Science Instrumentation Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 24: U.K. Life Science Instrumentation Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 25: France Life Science Instrumentation Market Value (US$ Mn) Forecast, by Technique, 2017–2031

Table 26: France Life Science Instrumentation Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 27: France Life Science Instrumentation Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 28: Italy Life Science Instrumentation Market Value (US$ Mn) Forecast, by Technique, 2017–2031

Table 29: Italy Life Science Instrumentation Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 30: Italy Life Science Instrumentation Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 31: Spain Life Science Instrumentation Market Value (US$ Mn) Forecast, by Technique, 2017–2031

Table 32: Spain Life Science Instrumentation Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 33: Spain Life Science Instrumentation Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 34: Rest of Europe Life Science Instrumentation Market Value (US$ Mn) Forecast, by Technique, 2017–2031

Table 35: Rest of Europe Life Science Instrumentation Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 36: Rest of Europe Life Science Instrumentation Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 37: Asia Pacific Life Science Instrumentation Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 38: Asia Pacific Life Science Instrumentation Market Value (US$ Mn) Forecast, by Technique, 2017–2031

Table 39: Asia Pacific Life Science Instrumentation Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 40: Europe Life Science Instrumentation Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 41: Japan Life Science Instrumentation Market Value (US$ Mn) Forecast, by Technique, 2017–2031

Table 42: Japan Life Science Instrumentation Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 43: Japan Life Science Instrumentation Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 44: China Life Science Instrumentation Market Value (US$ Mn) Forecast, by Technique, 2017–2031

Table 45: China Life Science Instrumentation Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 46: China Life Science Instrumentation Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 47: India Life Science Instrumentation Market Value (US$ Mn) Forecast, by Technique, 2017–2031

Table 48: India Life Science Instrumentation Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 49: India Life Science Instrumentation Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 50: Australia & New Zealand Life Science Instrumentation Market Value (US$ Mn) Forecast, by Technique, 2017–2031

Table 51: Australia & New Zealand Life Science Instrumentation Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 52: Australia & New Zealand Life Science Instrumentation Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 53: Rest of Asia Pacific Life Science Instrumentation Market Value (US$ Mn) Forecast, by Technique, 2017–2031

Table 54: Rest of Asia Pacific Life Science Instrumentation Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 55: Rest of Asia Pacific Life Science Instrumentation Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 56: Latin America Life Science Instrumentation Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 57: Latin America Life Science Instrumentation Market Value (US$ Mn) Forecast, by Technique, 2017–2031

Table 58: Latin America Life Science Instrumentation Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 59: Latin America Life Science Instrumentation Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 60: Brazil Life Science Instrumentation Market Value (US$ Mn) Forecast, by Technique, 2017–2031

Table 61: Brazil Life Science Instrumentation Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 62: Brazil Life Science Instrumentation Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 63: Mexico Life Science Instrumentation Market Value (US$ Mn) Forecast, by Technique, 2017–2031

Table 64: Mexico Life Science Instrumentation Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 65: Mexico Life Science Instrumentation Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 66: Rest of Latin America Life Science Instrumentation Market Value (US$ Mn) Forecast, by Technique, 2017–2031

Table 67: Rest of Latin America Life Science Instrumentation Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 68: Rest of Latin America Life Science Instrumentation Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 69: Middle East & Africa Life Science Instrumentation Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 70: Middle East & Africa Life Science Instrumentation Market Value (US$ Mn) Forecast, by Technique, 2017–2031

Table 71: Middle East & Africa Life Science Instrumentation Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 72: Middle East & Africa Life Science Instrumentation Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 73: GCC Countries Life Science Instrumentation Market Value (US$ Mn) Forecast, by Technique, 2017–2031

Table 74: GCC Countries Life Science Instrumentation Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 75: GCC Countries Life Science Instrumentation Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 76: South Africa Life Science Instrumentation Market Value (US$ Mn) Forecast, by Technique, 2017–2031

Table 77: South Africa Life Science Instrumentation Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 78: South Africa Life Science Instrumentation Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 79: Rest of Middle East & Africa Life Science Instrumentation Market Value (US$ Mn) Forecast, by Technique, 2017–2031

Table 80: Rest of Middle East & Africa Life Science Instrumentation Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 81: Rest of Middle East & Africa Life Science Instrumentation Market Value (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Life Science Instrumentation Market Size (US$ Mn) and Distribution, by Region, 2022 and 2031

Figure 02: Market Snapshot of Global Life Science Instrumentation Market

Figure 03: Market Opportunity Map, Revenue Share, by Technique

Figure 04: Market Opportunity Map, Revenue Share, by Application

Figure 05: Market Opportunity Map, Revenue Share, by End-user

Figure 06: Global Life Science Instrumentation Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 07: Global Life Science Instrumentation Market Value Share, by Technique, 2021

Figure 08: Global Life Science Instrumentation Market Value Share, by Application, 2021

Figure 09: Global Life Science Instrumentation Market Value Share, by End-user, 2021

Figure 10: Global Life Science Instrumentation Market Value Share, by Region, 2021

Figure 11: Global Life Science Instrumentation Market Value Share Analysis, by Technique, 2022 and 2031

Figure 12: Global Life Science Instrumentation Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Spectroscopy, 2017–2031

Figure 13: Global Custom Procedure Packs Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Chromatography, 2017–2031

Figure 14: Global Life Science Instrumentation Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Polymerase Chain Reaction, 2017–2031

Figure 15: Global Custom Procedure Packs Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Next-generation Sequencing, 2017–2031

Figure 16: Global Life Science Instrumentation Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Clinical Chemistry Analyzers, 2017–2031

Figure 17: Global Custom Procedure Packs Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Flow Cytometry, 2017–2031

Figure 18: Global Life Science Instrumentation Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Immunoassays, 2017–2031

Figure 19: Global Custom Procedure Packs Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Others, 2017–2031

Figure 20: Global Life Science Instrumentation Market Attractiveness Analysis, by Technique, 2021 and 2031

Figure 21: Global Life Science Instrumentation Market Value Share Analysis, by Application, 2022 and 2031

Figure 22: Global Life Science Instrumentation Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Research Applications, 2017–2031

Figure 23: Global Life Science Instrumentation Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Clinical Applications, 2017–2031

Figure 24: Global Life Science Instrumentation Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Others, 2017–2031

Figure 25: Global Life Science Instrumentation Market Attractiveness Analysis, by Application, 2021–2027

Figure 26: Global Life Science Instrumentation Market Value Share Analysis, by End-user, 2022 and 2031

Figure 27: Global Life Science Instrumentation Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Research Institutes, 2017–2031

Figure 28: Global Life Science Instrumentation Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Pharmaceutical & Biotechnology Companies, 2017–2031

Figure 29: Global Life Science Instrumentation Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Diagnostic Laboratories, 2017–2031

Figure 30: Global Life Science Instrumentation Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Others, 2017–2031

Figure 31: Global Life Science Instrumentation Market Attractiveness Analysis, by End-user, 2021–2031

Figure 32: Global Life Science Instrumentation Market Value Share (%), by Region, 2022 and 2031

Figure 33: Global Life Science Instrumentation Market Attractiveness Analysis, by Region, 2021–2031

Figure 34: North America Life Science Instrumentation Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2031

Figure 35: North America Life Science Instrumentation Market Value Share, by Country, 2022 and 2031

Figure 36: North America Life Science Instrumentation Market Attractiveness Analysis, by Country, 2021–2031

Figure 37: North America Life Science Instrumentation Market Value Share, by Technique, 2022 and 2031

Figure 38: North America Life Science Instrumentation Market Attractiveness Analysis, by Technique, 2021–2031

Figure 39: North America Life Science Instrumentation Market Value Share, by Application, 2022 and 2031

Figure 40: North America Life Science Instrumentation Market Attractiveness Analysis, by Application, 2021–2031

Figure 41: North America Life Science Instrumentation Market Value Share, by End-user, 2022 and 2031

Figure 42: North America Life Science Instrumentation Market Attractiveness Analysis, by End-user, 2021–2031

Figure 43: Europe Life Science Instrumentation Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2031

Figure 44: Europe Life Science Instrumentation Market Value Share, by Country/Sub-region, 2022 and 2031

Figure 45: Europe Life Science Instrumentation Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 46: Europe Life Science Instrumentation Market Value Share, by Technique, 2022 and 2031

Figure 47: Europe Life Science Instrumentation Market Attractiveness Analysis, by Technique, 2021–2031

Figure 48: Europe Life Science Instrumentation Market Value Share, by Application, 2022 and 2031

Figure 49: Europe Life Science Instrumentation Market Attractiveness Analysis, by Application, 2021–2031

Figure 50: Europe Life Science Instrumentation Market Value Share, by End-user, 2022 and 2031

Figure 51: Europe Life Science Instrumentation Market Attractiveness Analysis, by End-user, 2021–2031

Figure 52: Asia Pacific Life Science Instrumentation Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2031

Figure 53: Asia Pacific Life Science Instrumentation Market Value Share, by Country/Sub-region, 2022 and 2031

Figure 54: Asia Pacific Life Science Instrumentation Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 55: Asia Pacific Life Science Instrumentation Market Value Share, by Technique, 2022 and 2031

Figure 56: Asia Pacific Life Science Instrumentation Market Attractiveness Analysis, by Technique, 2021–2031

Figure 57: Asia Pacific Life Science Instrumentation Market Value Share, by Application, 2022 and 2031

Figure 58: Asia Pacific Life Science Instrumentation Market Attractiveness Analysis, by Application, 2021–2031

Figure 59: Asia Pacific Life Science Instrumentation Market Value Share, by End-user, 2022 and 2031

Figure 60: Asia Pacific Life Science Instrumentation Market Attractiveness Analysis, by End-user, 2021–2031

Figure 61: Latin America Life Science Instrumentation Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2031

Figure 62: Latin America Life Science Instrumentation Market Attractiveness Analysis, by Country/Sub-region, 2021 and 2031

Figure 63: Latin America Life Science Instrumentation Market Value Share, by Country/Sub-region, 2022 and 2031

Figure 64: Latin America Life Science Instrumentation Market Value Share, by Technique, 2022 and 2031

Figure 65: Latin America Life Science Instrumentation Market Attractiveness Analysis, by Technique, 2021 and 2031

Figure 66: Latin America Life Science Instrumentation Market Value Share, by Application, 2022 and 2031

Figure 67: Latin America Life Science Instrumentation Market Attractiveness Analysis, by Application, 2021 and 2031

Figure 68: Latin America Life Science Instrumentation Market Value Share, by End-user, 2022 and 2031

Figure 69: Latin America Life Science Instrumentation Market Attractiveness Analysis, by End-user, 2021 and 2031

Figure 70: Middle East & Africa Life Science Instrumentation Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2031

Figure 71: Middle East & Africa Life Science Instrumentation Market Attractiveness Analysis, by Country/Sub-region, 2021 and 2031

Figure 72: Middle East & Africa Life Science Instrumentation Market Value Share, by Country/Sub-region, 2022 and 2031

Figure 73: Middle East & Africa Life Science Instrumentation Market Value Share, by Technique, 2022 and 2031

Figure 74: Middle East & Africa Life Science Instrumentation Market Attractiveness Analysis, by Technique, 2021 and 2031

Figure 75: Middle East & Africa Life Science Instrumentation Market Value Share, by Application, 2022 and 2031

Figure 76: Middle East & Africa Life Science Instrumentation Market Attractiveness Analysis, by Application, 2021 and 2031

Figure 77: Middle East & Africa Life Science Instrumentation Market Value Share, by End-user, 2022 and 2031

Figure 78: Middle East & Africa Life Science Instrumentation Market Attractiveness Analysis, by End-user, 2021 and 2031