Analysts’ Viewpoint on Life Care Solution Services Market Scenario

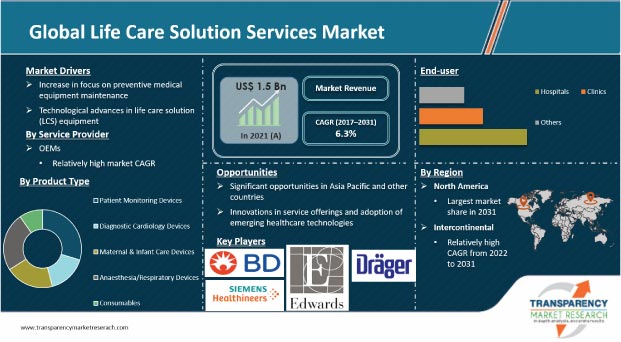

Life care solution services help improve the level of care in community hospitals and clinics, thus allowing patients across the world to receive enhanced care. The global market for life care solution services is experiencing significant changes in the competitive landscape and patient base due to the quick shift toward value-added service offerings. Automated artificial manual-breathing unit (AMBU) bags are gaining traction among clinicians, researchers, and policymakers due to fast production, cost-effective deployment, and easy access to a larger portion of the population across the globe. Technological developments in life care and surgical solutions are likely to drive the global life care solution services market during the forecast period.

The global life care solution services market is projected to grow due to technological advancements in health care solutions & services, surge in R&D funding, increase in demand for surgeries, and rise in prevalence of chronic diseases. Prominent companies are inventing technologically advanced devices in order to cater to the increasing patient demand. For instance, in February 2022, Mindray Medical International Co., Ltd. expanded its A-Series Advantage – Anesthesia Machine platform. The platform improves clinical care and enhances user satisfaction with multiple choices in ventilation modes.

Focus on the maintenance of medical equipment has increased in the past few years. This primarily involves a designed program, where maintenance tasks are performed in a scheduled manner in order to avoid expensive and larger repairs down the line. It also helps reduce equipment downtime. The preventive maintenance approach is gaining traction, as planned inspections and medical equipment maintenance services help avoid medical device-related adverse accidents. Regular maintenance services confirm the efficient, safe, and long-lasting utilization of life care solutions. Thorough maintenance combined with proper use of life care medical solutions ensures increased availability and maximum efficiency of equipment at reasonable costs and under satisfactory conditions of safety, quality, and environmental protection.

Manufacturers of ventilators and other medical equipment are maintaining tight control on hospitals to service and repair their products. Modern ventilators are generally serviced after every six months of use and can last for 10 years if maintained well.

Emerging economies, including China, India, South Korea, Brazil, Russia, South Africa, and Turkey, provide significant opportunities for life care solution services companies. Large population base, specifically in China and India, offers a lucrative market for life care solution services. More than half of the global population lives in India and China; hence, these countries have a significant patient base. Among the 18.6 million CVD deaths across the globe in 2019, 58% occurred in countries in Asia.

Companies operating in developing countries engage in business expansion to strengthen their footprint across the globe. For instance, in March 2019, Nihon Kohden Corporation, a Japan-based prominent manufacturer, developer, and distributor of medical electronic equipment, announced the official launch of ‘Performance Care’, a comprehensive service and support program. ‘Performance Care’ provides two levels of care, with additional services including award-winning customer support, free software upgrades and updates, and a five-year warranty. Rise in number of research institutions is augmenting the life sciences research industry in emerging countries. This, in turn, is increasing the demand for multiple innovative medical imaging modalities in Asia Pacific.

In terms of service provider, the global life care solution services market has been bifurcated into original equipment manufacturers (OEMs) and independent service providers (ISOs). The OEMs segment held major share of the global market in 2021. The segment is expected to grow at a moderate pace during the forecast period. Prominent manufacturers, such as Becton, Dickinson and Company, Getinge AB, and Atom Medical, are investing substantially in the expansion of their service offerings. Moreover, technological innovations leading to rapid processing and shorter test time are expected to augment the segment during the forecast period.

In terms of application, life care solution services are classified into diagnostic cardiology devices, patient monitoring devices, anesthesia/respiratory devices, maternal & infant care devices, and consumables. The anesthesia/respiratory devices segment is projected to grow at a CAGR of 7.2% during the forecast period. Surge in number of surgeries, technological advancements in anesthesia monitoring, and rise in prevalence of airway and other lung diseases across the world are likely to drive the segment during the forecast period. Additionally, strategic collaborations between key companies are projected to propel the segment. For instance, in January 2022, Senzime, a Sweden-based medical device company that manufactures and markets FDA- and CE-approved monitoring systems for anesthesia patients, announced a service partnership with Mercury Medical, a dedicated firm that delivers clinically differentiated critical care technology. Mercury Medical is an exclusive provider of biomedical repair and maintenance services in the U.S. Mercury Medical and Senzime will extend sales distribution in the U.S. through the service partnership.

In terms of end-user, the global life care solution services market has been divided into hospitals, clinics, and others. The hospitals segment dominated the global life care solution services market in 2021. According to the American Hospital Association (AHA), the U.S. has 6,093 hospitals presently. Increase in number of hospitals across the globe and comparatively higher performance & adoption of equipment maintenance services in these settings augment the hospitals segment.

North America accounted for the largest share of around 60% of the global market in terms of volume in 2021. The market in the region is driven by factors such as increase in investment in research & innovations and rise in number of patients with chronic diseases, specifically across Canada and the U.S. Additionally, a strong base of healthcare facilities, especially specialty clinics and hospitals, and presence of several prominent medical equipment manufacturers is enabling North America dominate the global market. For instance, in September 2021, Teladoc Health, the U.S.-based multinational telemedicine and virtual healthcare company, announced that it will provide remote patient monitoring solutions across multiple provinces, serving nearly 60% of Canada’s population.

EMEA and Intercontinental countries are also large users of life care solution services, and held the second and third largest share of the global market, respectively, in 2021. The life care solution services market in Intercontinental countries is highly influenced by the growth of the medical tourism industry. Favorable regulatory policies and presence of leading players such as GE Healthcare, Koninklijke Philips N.V., and Medtronic plc are also projected to drive the market in the region.

The global life care solution services market is consolidated, with the presence of large-scale and small-scale vendors. Majority of the companies are investing significantly in research & development activities, primarily to introduce innovative devices. Key players are entering into strategic alliances to increase revenue and market share in the global life care solution services market. Furthermore, diversification of product portfolios and mergers & acquisitions are the major strategies adopted by the leading players.

Abbott Laboratories, Atom Medical Corporation, Becton, Dickinson and Company (BD), Drägerwerk AG & Co. KGaA, Nihon Kohden Corporation, Edwards Lifesciences Corporation, GE Healthcare (General Electric Company), Getinge AB, Hill-Rom Services, Inc., Koninklijke Philips N.V., Masimo Corporation, Natus Medical Incorporated, Medtronic plc, and Shenzhen Mindray Bio-Medical Electronics Co., Ltd. are the prominent companies operating in the global life care solution services market.

Each of these players has been profiled in the life care solution services market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 1.5 Bn |

|

Market Forecast Value in 2031 |

More than US$ 2.7 Bn |

|

Growth Rate (CAGR) |

6.3% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global life care solution services market was valued at US$ 1.5 Bn in 2021

The global life care solution services market grew at a CAGR of 4.1% from 2017 to 2021

The global life care solution services market is anticipated to grow at a CAGR of 6.3% from 2022 to 2031

Increase in technological advances in life care solutions, rise in burden of chronic diseases due to lifestyle changes, and surge in preference for advanced patient monitoring devices, biosensors, and ease of use of portable devices are expected to drive the global life care solution services market

The patient monitoring devices segment held over 25% share of the global life care solution services market in 2021

Prominent players in the global life care solution services market include Abbott Laboratories, Atom Medical Corporation, Becton, Dickinson and Company (BD), and Drägerwerk AG & Co. KGaA

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Life Care Solution Services Market

4. Market Overview

4.1. Overview

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

5. Key Insights

5.1. Key Industry Events

5.2. Technological Advancements

5.3. COVID-19 Impact Analysis

6. Global Life Care Solution Services Market Analysis and Forecast, by Product Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product Type, 2017–2031

6.3.1. Patient Monitoring Devices

6.3.2. Diagnostic Cardiology Devices

6.3.3. Maternal & Infant Care Devices

6.3.4. Anesthesia/Respiratory Devices

6.3.5. Consumables

6.4. Market Attractiveness Analysis, by Product Type

7. Global Life Care Solution Services Market Analysis and Forecast, by Service Provider

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Service Provider, 2017–2031

7.3.1. Original Equipment Manufacturers

7.3.2. Independent Service Providers

7.4. Market Attractiveness Analysis, by Service Provider

8. Global Life Care Solution Services Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by End-user, 2017–2031

8.3.1. Hospitals

8.3.2. Diagnostic Centers

8.3.3. Others

8.4. Market Attractiveness Analysis, by End-user

9. Global Life Care Solution Services Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. EMEA

9.2.3. China

9.2.4. Intercontinental

9.3. Market Attractiveness Analysis, by Country/Region

10. North America Life Care Solution Services Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product Type, 2017–2031

10.2.1. Patient Monitoring Devices

10.2.2. Diagnostic Cardiology Devices

10.2.3. Maternal & Infant Care Devices

10.2.4. Anesthesia/Respiratory Devices

10.2.5. Consumables

10.3. Market Value Forecast, by Service Provider, 2017–2031

10.3.1. Original Equipment Manufacturers

10.3.2. Independent Service Providers

10.4. Market Value Forecast, by End-user, 2017–2031

10.4.1. Hospitals

10.4.2. Diagnostic Centers

10.4.3. Others

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product Type

10.6.2. By Service Provider

10.6.3. By End-user

10.6.4. By Country

11. EMEA Life Care Solution Services Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product Type, 2017–2031

11.2.1. Patient Monitoring Devices

11.2.2. Diagnostic Cardiology Devices

11.2.3. Maternal & Infant Care Devices

11.2.4. Anesthesia/Respiratory Devices

11.2.5. Consumables

11.3. Market Value Forecast, by Service Provider, 2017–2031

11.3.1. Original Equipment Manufacturers

11.3.2. Independent Service Providers

11.4. Market Value Forecast, by End-user, 2017–2031

11.4.1. Hospitals

11.4.2. Diagnostic Centers

11.4.3. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Europe

11.5.2. Middle East

11.5.3. Africa

11.5.4. Russia/CIS

11.6. Market Attractiveness Analysis

11.6.1. By Product Type

11.6.2. By Service Provider

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. China Life Care Solution Services Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product Type, 2017–2031

12.2.1. Patient Monitoring Devices

12.2.2. Diagnostic Cardiology Devices

12.2.3. Maternal & Infant Care Devices

12.2.4. Anesthesia/Respiratory Devices

12.2.5. Consumables

12.3. Market Value Forecast, by Service Provider, 2017–2031

12.3.1. Original Equipment Manufacturers

12.3.2. Independent Service Providers

12.4. Market Value Forecast, by End-user, 2017–2031

12.4.1. Hospitals

12.4.2. Diagnostic Centers

12.4.3. Others

12.5. Market Attractiveness Analysis

12.5.1. By Product Type

12.5.2. By Service Provider

12.5.3. By End-user

13. Intercontinental Life Care Solution Services Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product Type, 2017–2031

13.2.1. Patient Monitoring Devices

13.2.2. Diagnostic Cardiology Devices

13.2.3. Maternal & Infant Care Devices

13.2.4. Anesthesia/Respiratory Devices

13.2.5. Consumables

13.3. Market Value Forecast, by Service Provider, 2017–2031

13.3.1. Original Equipment Manufacturers

13.3.2. Independent Service Providers

13.4. Market Value Forecast, by End-user, 2017–2031

13.4.1. Hospitals

13.4.2. Diagnostic Centers

13.4.3. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Latin America

13.5.2. Japan

13.5.3. Australia & New Zealand

13.5.4. South Korea

13.5.5. Indonesia

13.5.6. Vietnam

13.5.7. Thailand

13.5.8. Philippines

13.5.9. Singapore

13.5.10. Malaysia

13.5.11. Cambodia

13.5.12. Laos

13.5.13. Myanmar

13.5.14. India

13.5.15. South Asia

13.6. Market Attractiveness Analysis

13.6.1. By Product Type

13.6.2. By Service Provider

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Competition Landscape

14.1. Market Player - Competition Matrix (by tier and size of companies)

14.2. Market Share Analysis, by Company, 2021

14.3. Company Profiles

14.3.1. Abbott Laboratories

14.3.1.1. Company Overview

14.3.1.2. Product Portfolio

14.3.1.3. SWOT Analysis

14.3.1.4. Strategic Overview

14.3.2. Atom Medical USA, LLC

14.3.2.1. Company Overview

14.3.2.2. Product Portfolio

14.3.2.3. SWOT Analysis

14.3.2.4. Strategic Overview

14.3.3. BD

14.3.3.1. Company Overview

14.3.3.2. Product Portfolio

14.3.3.3. SWOT Analysis

14.3.3.4. Strategic Overview

14.3.4. Drägerwerk AG & Co. KGaA

14.3.4.1. Company Overview

14.3.4.2. Product Portfolio

14.3.4.3. SWOT Analysis

14.3.4.4. Strategic Overview

14.3.5. Edwards Lifesciences Corporation

14.3.5.1. Company Overview

14.3.5.2. Product Portfolio

14.3.5.3. SWOT Analysis

14.3.5.4. Strategic Overview

14.3.6. GE Healthcare (General Electric Company)

14.3.6.1. Company Overview

14.3.6.2. Product Portfolio

14.3.6.3. SWOT Analysis

14.3.6.4. Strategic Overview

14.3.7. Getinge AB

14.3.7.1. Company Overview

14.3.7.2. Product Portfolio

14.3.7.3. SWOT Analysis

14.3.7.4. Strategic Overview

14.3.8. Hill-Rom Services, Inc.

14.3.8.1. Company Overview

14.3.8.2. Product Portfolio

14.3.8.3. SWOT Analysis

14.3.8.4. Strategic Overview

14.3.9. Koninklijke Philips N.V.

14.3.9.1. Company Overview

14.3.9.2. Product Portfolio

14.3.9.3. SWOT Analysis

14.3.9.4. Strategic Overview

14.3.10. Masimo Corporation

14.3.10.1. Company Overview

14.3.10.2. Product Portfolio

14.3.10.3. SWOT Analysis

14.3.10.4. Strategic Overview

14.3.11. Medtronic plc

14.3.11.1. Company Overview

14.3.11.2. Product Portfolio

14.3.11.3. SWOT Analysis

14.3.11.4. Strategic Overview

14.3.12. Natus Medical Incorporated

14.3.12.1. Company Overview

14.3.12.2. Product Portfolio

14.3.12.3. SWOT Analysis

14.3.12.4. Strategic Overview

14.3.13. Nihon Kohden Corporation

14.3.13.1. Company Overview

14.3.13.2. Product Portfolio

14.3.13.3. SWOT Analysis

14.3.13.4. Strategic Overview

14.3.14. Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

14.3.14.1. Company Overview

14.3.14.2. Product Portfolio

14.3.14.3. SWOT Analysis

14.3.14.4. Strategic Overview

List of Tables

Table 01: Global Life Care Solution Services Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 02: Global Life Care Solution Services Market Value (US$ Mn) Forecast, by Service Provider, 2017–2031

Table 03: Global Life Care Solution Services Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 04: Global Life Care Solution Services Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Life Care Solution Services Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 06: North America Life Care Solution Services Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 07: North America Life Care Solution Services Market Value (US$ Mn) Forecast, by Service Provider, 2017–2031

Table 08: North America Life Care Solution Services Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 09: EMEA Life Care Solution Services Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 10: EMEA Life Care Solution Services Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 11: EMEA Life Care Solution Services Market Value (US$ Mn) Forecast, by Service Provider, 2017–2031

Table 12: EMEA Life Care Solution Services Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 13: China Life Care Solution Services Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 14: China Life Care Solution Services Market Value (US$ Mn) Forecast, by Service Provider, 2017–2031

Table 15: China Life Care Solution Services Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 16: Intercontinental Life Care Solution Services Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 17: Intercontinental Life Care Solution Services Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 18: Intercontinental Life Care Solution Services Market Value (US$ Mn) Forecast, by Service Provider, 2017–2031

Table 19: Intercontinental Life Care Solution Services Market Value (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Life Care Solution Services Market, by Product Type, 2021 and 2031

Figure 02: Global Life Care Solution Services Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 03: Global Life Care Solution Services Market (US$ Mn), by Patient Monitoring Devices, 2017–2031

Figure 04: Global Life Care Solution Services Market (US$ Mn), by Diagnostic Cardiology Devices, 2017–2031

Figure 05: Global Life Care Solution Services Market (US$ Mn), by Maternal & Infant Care Devices, 2017–2031

Figure 06: Global Life Care Solution Services Market (US$ Mn), by Anesthesia/Respiratory Devices, 2017–2031

Figure 07: Global Life Care Solution Services Market (US$ Mn), by Consumables, 2017–2031

Figure 08: Global Life Care Solution Services Market, by Service Provider, 2021 and 2031

Figure 09: Global Life Care Solution Services Market Attractiveness Analysis, by Service Provider, 2022–2031

Figure 10: Global Life Care Solution Services Market (US$ Mn), by Patient Monitoring Devices, 2017–2031

Figure 11: Global Life Care Solution Services Market (US$ Mn), by Diagnostic Cardiology Devices, 2017–2031

Figure 12: Global Life Care Solution Services Market, by End-user, 2021 and 2031

Figure 13: Global Life Care Solution Services Market Attractiveness Analysis, by End-user, 2022–2031

Figure 14: Global Life Care Solution Services Market (US$ Mn), by Hospitals, 2017–2031

Figure 15: Global Life Care Solution Services Market (US$ Mn), by Clinics, 2017–2031

Figure 16: Global Life Care Solution Services Market (US$ Mn), by Others, 2017–2031

Figure 17: Global Life Care Solution Services Market, by Region, 2021 and 2031

Figure 18: Global Life Care Solution Services Market Attractiveness Analysis, by Region, 2022–2031

Figure 19: North America Life Care Solution Services Market Value (US$ Mn) Forecast, 2017–2031

Figure 20: North America Life Care Solution Services Market, by Country, 2021 and 2031

Figure 21: North America Life Care Solution Services Market Attractiveness Analysis, by Country, 2022–2031

Figure 22: North America Life Care Solution Services Market, by Product Type, 2021 and 2031

Figure 23: North America Life Care Solution Services Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 24: North America Life Care Solution Services Market, by Service Provider, 2021 and 2031

Figure 25: North America Life Care Solution Services Market Attractiveness Analysis, by Service Provider, 2022–2031

Figure 26: North America Life Care Solution Services Market, by End-user, 2021 and 2031

Figure 27: North America Life Care Solution Services Market Attractiveness Analysis, by End-user, 2022–2031

Figure 28: EMEA Life Care Solution Services Market Value (US$ Mn) Forecast, 2017–2031

Figure 29: EMEA Life Care Solution Services Market, by Country/Region, 2021 and 2031

Figure 30: EMEA Life Care Solution Services Market Attractiveness Analysis, by Country/Region, 2022–2031

Figure 31: EMEA Life Care Solution Services Market, by Product Type, 2021 and 2031

Figure 32: EMEA Life Care Solution Services Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 33: EMEA Life Care Solution Services Market, by Service Provider, 2021 and 2031

Figure 34: EMEA Life Care Solution Services Market Attractiveness Analysis, by Service Provider, 2022–2031

Figure 35: EMEA Life Care Solution Services Market, by End-user, 2021 and 2031

Figure 36: EMEA Life Care Solution Services Market Attractiveness Analysis, by End-user, 2022–2031

Figure 37: China Life Care Solution Services Market Value (US$ Mn) Forecast, 2017–2031

Figure 38: China Life Care Solution Services Market, by Product Type, 2021 and 2031

Figure 39: China Life Care Solution Services Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 40: China Life Care Solution Services Market, by Service Provider, 2021 and 2031

Figure 41: China Life Care Solution Services Market Attractiveness Analysis, by Service Provider, 2022–2031

Figure 42: China Life Care Solution Services Market, by End-user, 2021 and 2031

Figure 43: China Life Care Solution Services Market Attractiveness Analysis, by End-user, 2022–2031

Figure 44: Intercontinental Life Care Solution Services Market Value (US$ Mn) Forecast, 2017–2031

Figure 45: Intercontinental Life Care Solution Services Market, by Country/Sub-region, 2021 and 2031

Figure 46: Intercontinental Life Care Solution Services Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 47: Intercontinental Life Care Solution Services Market, by Product Type, 2021 and 2031

Figure 48: Intercontinental Life Care Solution Services Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 49: Intercontinental Life Care Solution Services Market, by Service Provider, 2021 and 2031

Figure 50: Intercontinental Life Care Solution Services Market Attractiveness Analysis, by Service Provider, 2022–2031

Figure 51: Intercontinental Life Care Solution Services Market, by End-user, 2021 and 2031

Figure 52: Intercontinental Life Care Solution Services Market Attractiveness Analysis, by End-user, 2022–2031

Figure 53: Global Life Care Solution Services Market Share Analysis/Ranking, by Company, 2021