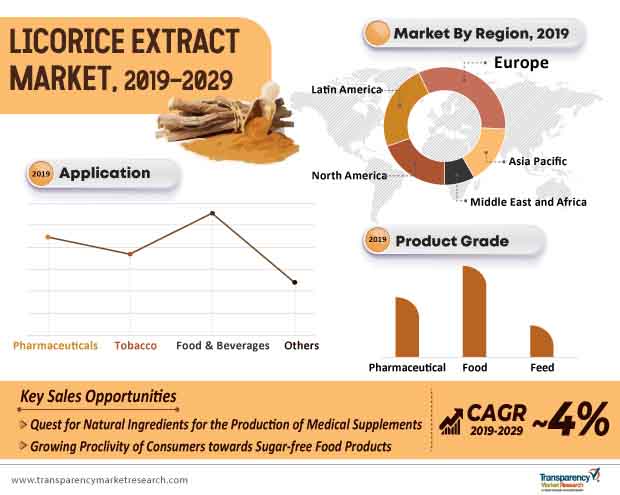

Once popular as a weed, then as a concoction, and now being a legit natural sweetener, licorice extract has been making a prominent mark for itself in numerous industries. According to an exclusive study published by Transparency Market Research (TMR), the licorice extract market will remain relevant in pharmaceutical, tobacco, and food & beverage industries with its steady gait, and is anticipated to record a value of ~US$ 2.9 Bn by 2029, up from ~US$ 1.9 Bn in 2019.

Insights from the study show that, individuals with medical conditions such as obesity, diabetes, and high cholesterol account for a substantial share of the demand for licorice extract, with popular consumables being in the form of toothpastes, chewing gums, or sweeteners. As the once covert health benefits of licorice extract come to light, pharmaceutical and nutraceutical industries find an attractive market for penetrating nutritional products and dietary supplements to consumers seeking natural products to maintain their health.

Gaining a sense of enormous sales potential of licorice extract, companies are devising numerous product-level strategies to scale up their businesses. Among them, increasing the effectiveness of extraction technology remains a coveted strategy in the licorice extract market.

Given the health implications regarding obesity and diabetes, medical personnel recommend individuals to control their sugar intake, which augurs well for low-calorie sweeteners. Being at the lower end of the price scale, the penetration of synthetic sweeteners has been growing, while the shift to natural sweeteners is currently only in its infancy stage.

Despite the switch of consumers toward organic products, end-use industries continue their high-scale adoption of artificial sweeteners. Take for instance the food and beverage industry. As the industry continues to experiment with unique flavors, the use of artificial sweeteners remains constant. The wide availability of artificial sweeteners in various forms such as cubes, granules, paste, liquid, and powder, alongside their cost-effectiveness, is likely to exert a negative influence on the sales of licorice extract.

In order to match the pace of the ever-evolving preferences of consumers, manufacturers find themselves hard-pressed to bring innovative products to the table, and microencapsulation has lately acquired a significant amount of traction. Manufacturers are investing in microencapsulation technologies to protect the sweet sensation promoted by licorice extract. This technology especially finds huge prominence in the production of sugar-free chewing gums and chewable confections to prolong their sweet flavor during chewing.

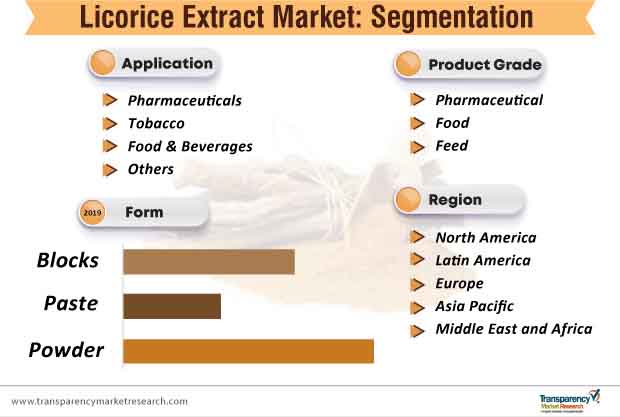

As per the consumption trend, the powdered form of licorice extract will remain preferable over cubes and paste, given the ease of shipment and long shelf life. However, the preference for licorice extract in the semi-fluid form is likely to grow at an exponential rate, as end-use industries show a marked proclivity for readily-soluble forms.

Another striking feature of the market that players need to focus on is the large-scale adoption of licorice extract in the tobacco industry. The potential of licorice extract as a de-bittering agent is likely to drive sales in the tobacco industry. However, the food and beverage industry will continue to account for a leading share in the licorice extract market during the forecast period.

Analysts’ Take on the Future of the Licorice Extract Market

Authors of the study maintain an optimistic outlook on the future growth of the licorice extract market. Growing cognizance regarding the benefits of licorice extract will remain a key success factor to achieve high revenue influx. Moving beyond the traditional scope of application, licorice extract remains sought-after in the cosmetics and personal care industry, which will catalyze revenue from consumers seeking skincare and hair care products that are developed using natural ingredients. Though the high popularity and deep penetration of synthetic sweeteners could dim the revenue prospects of the landscape, running awareness campaigns that stress on the benefits of natural sweeteners over their synthetic counterparts could help manufacturers in diverging demand towards their products.

North America Stands Out in Licorice Extract Market in Terms of Sales and Growth

Food & Beverage Industry Main Driving Force for Licorice Extract Market Growth

Health Attributes of Licorice Extract Influencing Purchase Decisions of Consumers

Manufacturers Re-branding Licorice Extract Products to Attract More Consumers

High Prices Restraining Licorice Extract Market in Developing Countries

Licorice Extract Market: Competitive Landscape

Licorice Extract Market is expected to reach US$ 2.9 Bn By 2029

Licorice Extract Market is estimated to rise at a CAGR of 4% during forecast period

Increase Pharmaceuticals, tobacco, and food and beverages activities are driving the growth of the Licorice Extract Market

Europe is more attractive for vendors in the Licorice Extract Market

Key players of Licorice Extract Market are Norevo GmbH, F&C Licorice Ltd, Mafco Worldwide LLC, Zagros Licorice Co., VPL Chemicals PVT Ltd., SepidanOsareh Co., ASEH Licorice MFG & Exp. Co., Maruzen, Pharmaceuticals Co. Ltd, Zelang Group, Ransom Naturals Ltd

1. Licorice Extract Market - Executive Summary

1.1. Global Licorice Extract Market Country Analysis

1.2. Vertical Specific Market Penetration

1.3. Application – Product Mapping

1.4. Proprietary Wheel of Fortune

1.5. Opportunity Assessment-Winning and Losing Components

1.6. TMR Analysis and Recommendations

2. Market Introduction

2.1. Market Introduction

2.2. Market Definition

2.3. Market Taxonomy

3. Market Dynamics

3.1. Macro-economic Factors

3.1.1. Rise in Consumption of Food Items across Globe

3.1.2. Global and Regional Per Capita Food Consumption (kcal per capita per day)

3.1.3. Change in Consumer Price Indexes (Percentage Change) 2018 (Forecast)

3.1.4. Population of Key Countries

3.1.5. Food and Beverage Industry Overview

3.1.6. Global Retail Dynamics

3.1.7. Per Capita Disposable Income

3.1.8. Organized Retail Penetration

3.1.9. Global GDP Growth Outlook

3.2. Drivers

3.2.1. Economic Drivers

3.2.2. Supply Side Drivers

3.2.3. Demand Side Drivers

3.3. Restraints

3.4. Opportunity

3.5. Forecast Factors – Relevance and Impact

3.6. Trade Data

3.7. Key Regulation & Certifications

4. Key Success Factors

4.1. Powerful Portfolio of Brands

4.2. Nuanced Marketing Campaigns

4.3. Exploiting Economies of Scale

4.4. Establishing Flexible Supply Chain to Optimize on Miracle Ingredients/ Products

4.5. Working in Close Vicinity of Policy

4.6. Strategic Promotional Activity

5. Risk and Opportunities

5.1. Associated Risk

5.1.1. Regulatory Landscape Associated Risk

5.1.2. Standard and Certification Risk

5.1.3. Risk of Alternatives and advanced Technology

5.2. Opportunities

5.2.1. Niche within the existing product line

5.2.2. Opportunities in new product categories

5.2.3. Latent opportunities in established market

6. Global Licorice Extract Market Analysis Scenario 2019-2029

6.1. Market Size and Forecast

6.1.1. Market Size (Volume in MT and Value in US$ Mn) and Y-o-Y Growth

6.1.2. Absolute $ Opportunity

6.1.3. Industry Value and Supply Chain Analysis

6.1.4. Value Chain

6.1.5. Profitability Margins

6.1.6. List of Key Participants

6.1.6.1. Manufacturers

6.1.6.2. Distributors/Retailers

6.1.6.3. End users

7. Global Licorice Extract Market Analysis, By Form 2019-2029

7.1. Introduction

7.1.1. Y-o-Y Growth Comparison, By Form

7.1.2. Basis Point Share (BPS) Analysis, By Form

7.2. Market Size ( Value in US$ Mn) and Forecast By Form 2019-2029

7.2.1. Powder

7.2.2. Semi-Fluid/Paste

7.2.3. Block

7.3. Market Attractiveness Analysis, By Form

7.4. Prominent Trends

8. Global Licorice Extract Market Analysis, By Grade 2019-2029

8.1. Introduction

8.1.1. Y-o-Y Growth Comparison, By Grade

8.1.2. Basis Point Share (BPS) Analysis, By Grade

8.2. Market Size (Value in US$ Mn) and Forecast By Grade 2019-2029

8.2.1. Pharmaceutical grade

8.2.2. Food grade

8.2.3. Feed grade

8.3. Market Attractiveness Analysis, By Grade 2019-2029

8.4. Prominent Trends

9. Global Licorice Extract Market Analysis, By Application 2019-2029

9.1. Introduction

9.1.1. Y-o-Y Growth Comparison, By Application

9.1.2. Basis Point Share (BPS) Analysis, By Application

9.2. Market Size (Value in US$ Mn) and Forecast By Application 2019-2029

9.2.1. Pharmaceutical

9.2.2. Tobacco Industry

9.2.3. Food and Beverage Industry

9.2.4. Others

9.3. Market Attractiveness Analysis, By Application 2019-2029

9.4. Prominent Trends

10. Global Licorice Extract Market Analysis and Forecast, By Region 2019-2029

10.1. Introduction

10.1.1. Basis Point Share (BPS) Analysis By Region

10.1.2. Y-o-Y Growth Projections By Region

10.2. Market Size ( Value in US$ Mn) and Forecast By Region

10.2.1. North America

10.2.2. Europe

10.2.3. APAC

10.2.4. Latin America

10.2.5. Middle East and Africa

10.3. Market Attractiveness Analysis By Region 2019-2029

11. North America Licorice Extract Market Analysis and Forecast,2019-2029

11.1. Introduction

11.1.1. Basis Point Share (BPS) Analysis By Country

11.1.2. Y-o-Y Growth Projections By Country

11.2. Market Size (Value in US$ Mn) and Forecast By Country 2019-2029

11.2.1. U.S.

11.2.2. Canada

11.3. Market Size (Value in US$ Mn) and Forecast By Form 2019-2029

11.3.1. Powder

11.3.2. Semi-Fluid/Paste

11.3.3. Block

11.4. Market Size (Value in US$ Mn) and Forecast By Grade 2019-2029

11.4.1. Pharmaceutical grade

11.4.2. Food grade

11.4.3. Feed grade

11.5. Market Size (Value in US$ Mn) and Forecast By Application 2019-2029

11.5.1. Pharmaceutical

11.5.2. Tobacco Industry

11.5.3. Food and Beverage Industry

11.5.4. Others

11.6. Market Attractiveness Analysis 2019-2029

11.6.1. By Country

11.6.2. By Grade

11.6.3. By Form

11.6.4. By Application

11.7. Prominent Trends

11.8. Drivers and Restraints: Impact Analysis

12. Latin America Licorice Extract Market Analysis and Forecast

12.1. Introduction

12.1.1. Basis Point Share (BPS) Analysis By Country

12.1.2. Y-o-Y Growth Projections By Country

12.2. Market Size (Value in US$ Mn) and Forecast By Country 2019-2029

12.2.1. Brazil

12.2.2. Mexico

12.2.3. Argentina

12.2.4. Rest of Latin America

12.3. Market Size (Value in US$ Mn) and Forecast By Form 2019-2029

12.3.1. Powder

12.3.2. Semi-Fluid/Paste

12.3.3. Block

12.4. Market Size (Value in US$ Mn) and Forecast By Grade 2019-2029

12.4.1. Pharmaceutical grade

12.4.2. Food grade

12.4.3. Feed grade

12.5. Market Size (Value in US$ Mn) and Forecast By Application 2019-2029

12.5.1. Pharmaceutical

12.5.2. Tobacco Industry

12.5.3. Food and Beverage Industry

12.5.4. Others

12.6. Market Attractiveness Analysis 2019-2029

12.6.1. By Country

12.6.2. By Grade

12.6.3. By Form

12.6.4. By Applications

12.7. Prominent Trends

13. Europe Licorice extract Market Analysis and Forecast

13.1. Introduction

13.1.1. Basis Point Share (BPS) Analysis By Country

13.1.2. Y-o-Y Growth Projections By Country

13.2. Market Size (Value in US$ Mn) and Forecast By Country 2019-2029

13.2.1. EU5

13.2.2. Nordic

13.2.3. Russia

13.2.4. Poland

13.2.5. Rest of Europe

13.3. Market Size (Value in US$ Mn) and Forecast By Form 2019-2029

13.3.1. Powder

13.3.2. Semi-Fluid/Paste

13.3.3. Block

13.4. Market Size (Value in US$ Mn) and Forecast By Grade 2019-2029

13.4.1. Pharmaceutical grade

13.4.2. Food grade

13.4.3. Feed grade

13.5. Market Size (Value in US$ Mn) and Forecast By Application 2019-2029

13.5.1. Pharmaceutical Industry

13.5.2. Tobacco Industry

13.5.3. Food and Beverage Industry

13.5.4. Others

13.6. Market Attractiveness Analysis 2019-2029

13.6.1. By Country

13.6.2. By Form

13.6.3. By Grade

13.6.4. By Applications

13.7. Prominent Trends

13.8. Drivers and Restraints: Impact Analysis

14. APAC Licorice Extract Market Analysis and Forecast

14.1. Introduction

14.1.1. Basis Point Share (BPS) Analysis By Country

14.1.2. Y-o-Y Growth Projections By Country

14.2. Market Size (Value in US$ Mn) and Forecast By Country 2019-2029

14.2.1. China

14.2.2. India

14.2.3. Japan

14.2.4. Australia and New Zealand

14.2.5. Rest of APAC

14.3. Market Size (Value in US$ Mn) and Forecast By Form 2019-2029

14.3.1. Powder

14.3.2. Semi-Fluid/Paste

14.3.3. Block

14.4. Market Size (Value in US$ Mn) and Forecast By Grade 2019-2029

14.4.1. Pharmaceutical grade

14.4.2. Food grade

14.4.3. Feed grade

14.5. Market Size (Value in US$ Mn) and Forecast By Application

14.5.1. Pharmaceutical

14.5.2. Tobacco Industry

14.5.3. Food and Beverage Industry

14.5.4. Others

14.6. Market Attractiveness Analysis

14.6.1. By Country

14.6.2. By Form

14.6.3. By Grade

14.6.4. By Applications

14.7. Prominent Trends

14.8. Drivers and Restraints: Impact Analysis

15. Middle East and Africa Licorice Extract Market Analysis and Forecast 2019-2029

15.1. Introduction

15.1.1. Basis Point Share (BPS) Analysis By Country

15.1.2. Y-o-Y Growth Projections By Country 2019-2029

15.2. Market Size (Value in US$ Mn) and Forecast By Country 2019-2029

15.2.1. GCC

15.2.2. North Africa

15.2.3. South Africa

15.2.4. Rest of MEA

15.3. Market Size (Value in US$ Mn) and Forecast By Form 2019-2029

15.3.1. Powder

15.3.2. Semi-Fluid/Paste

15.3.3. Block

15.4. Market Size (Value in US$ Mn) and Forecast By Grade 2019-2029

15.4.1. Pharmaceutical grade

15.4.2. Food grade

15.4.3. Feed grade

15.5. Market Size (Value in US$ Mn) and Forecast By Application 2019-2029

15.5.1. Pharmaceutical

15.5.2. Tobacco Industry

15.5.3. Food and Beverage Industry

15.5.4. Others

15.6. Market Attractiveness Analysis 2019-2029

15.6.1. By Country

15.6.2. By Form

15.6.3. By Grade

15.6.4. By Applications

15.7. Prominent Trends

15.8. Drivers and Restraints: Impact Analysis

16. Competition Landscape (Manufacturer/Supplier)

16.1. Competition Dashboard

16.2. Market Structure

16.3. Company Profiles (Details–Overview, Financials, Products, Strategy, Recent Developments) (Tentative list)

16.3.1. Norevo GmbH

16.3.1.1. Overview

16.3.1.2. Product Portfolio

16.3.1.3. Sales Footprint

16.3.1.4. Strategy Overview

16.3.1.4.1. Marketing Strategy

16.3.1.4.2. Product Strategy

16.3.1.4.3. Channel Strategy

16.3.2. Mafco Worldwide LLC

16.3.2.1. Overview

16.3.2.2. Product Portfolio

16.3.2.3. Sales Footprint

16.3.2.4. Strategy Overview

16.3.2.4.1. Marketing Strategy

16.3.2.4.2. Product Strategy

16.3.2.4.3. Channel Strategy

16.3.3. F&C Licorice Ltd.

16.3.3.1. Overview

16.3.3.2. Product Portfolio

16.3.3.3. Sales Footprint

16.3.3.4. Strategy Overview

16.3.3.4.1. Marketing Strategy

16.3.3.4.2. Product Strategy

16.3.3.4.3. Channel Strategy

16.3.4. ASEH Licorice MFG & EXP Co.

16.3.4.1. Overview

16.3.4.2. Product Portfolio

16.3.4.3. Sales Footprint

16.3.4.4. Strategy Overview

16.3.4.4.1. Marketing Strategy

16.3.4.4.2. Product Strategy

16.3.4.4.3. Channel Strategy

16.3.5. Zagros Licorice Co

16.3.5.1. Overview

16.3.5.2. Product Portfolio

16.3.5.3. Sales Footprint

16.3.5.4. Strategy Overview

16.3.5.4.1. Marketing Strategy

16.3.5.4.2. Product Strategy

16.3.5.4.3. Channel Strategy

16.3.6. Iran Licorice

16.3.6.1. Overview

16.3.6.2. Product Portfolio

16.3.6.3. Sales Footprint

16.3.6.4. Strategy Overview

16.3.6.4.1. Marketing Strategy

16.3.6.4.2. Product Strategy

16.3.6.4.3. Channel Strategy

16.3.7. Sepidan Osareh Co.

16.3.7.1. Overview

16.3.7.2. Product Portfolio

16.3.7.3. Sales Footprint

16.3.7.4. Strategy Overview

16.3.7.4.1. Marketing Strategy

16.3.7.4.2. Product Strategy

16.3.7.4.3. Channel Strategy

16.3.8. Ransom Naturals Ltd

16.3.8.1. Overview

16.3.8.2. Product Portfolio

16.3.8.3. Sales Footprint

16.3.8.4. Strategy Overview

16.3.8.4.1. Marketing Strategy

16.3.8.4.2. Product Strategy

16.3.8.4.3. Channel Strategy

16.3.9. MARUZEN PHARMACEUTICALS CO., LTD

16.3.9.1. Overview

16.3.9.2. Product Portfolio

16.3.9.3. Sales Footprint

16.3.9.4. Strategy Overview

16.3.9.4.1. Marketing Strategy

16.3.9.4.2. Product Strategy

16.3.9.4.3. Channel Strategy

16.3.10. Zelang Group

16.3.10.1. Overview

16.3.10.2. Product Portfolio

16.3.10.3. Sales Footprint

16.3.10.4. Strategy Overview

16.3.10.4.1. Marketing Strategy

16.3.10.4.2. Product Strategy

16.3.10.4.3. Channel Strategy

17. Assumptions & Acronyms Used

18. Research Methodology

List of Table

Table 01: Global Licorice Extract Market Revenue (USD Mn) Forecast, by Region, 2019 - 2029

Table 02: North America Licorice Extract Market Revenue (US$ Mn) Forecast, by Form, 2019 - 2029

Table 03: North America Licorice Extract Market Revenue (US$ Mn) Forecast, by Grade, 2019 - 2029

Table 04: North America Licorice Extract Market Revenue (US$ Mn) Forecast, by Application, 2019 - 2029

Table 05: North America Licorice Extract Market Revenue (US$ Mn) Forecast, by Country, 2019 - 2029

Table 06: Europe Licorice Extract Market Revenue (US$ Mn) Forecast, by Form, 2019 - 2029

Table 07: Europe Licorice Extract Market Revenue (US$ Mn) Forecast, by Grade, 2019 - 2029

Table 08: Europe Licorice Extract Market Revenue (US$ Mn) Forecast, by Application, 2019 - 2029

Table 09: Europe Licorice Extract Market Revenue (US$ Mn) Forecast, by Country, 2019 - 2029

Table 10: Asia Pacific Licorice Extract Market Revenue (US$ Mn) Forecast, by Form, 2019 - 2029

Table 11: Asia Pacific Licorice Extract Market Revenue (US$ Mn) Forecast, by Grade, 2019 - 2029

Table 12: Asia Pacific Licorice Extract Market Revenue (US$ Mn) Forecast, by Application, 2019 - 2029

Table 13: Asia Pacific Licorice Extract Market Revenue (US$ Mn) Forecast, by Country, 2019 - 2029

Table 14: Middle East and Africa Licorice Extract Market Revenue (US$ Mn) Forecast, by Form, 2019 - 2029

Table 15: Middle East and Africa Licorice Extract Market Revenue (US$ Mn) Forecast, by Grade, 2019 - 2029

Table 16: Middle East and Africa Licorice Extract Market Revenue (US$ Mn) Forecast, by Application, 2019 - 2029

Table 17: Middle East and Africa Licorice Extract Market Revenue (US$ Mn) Forecast, by Country, 2019 - 2029

Table 18: Latin America Licorice Extract Market Revenue (US$ Mn) Forecast, by Form, 2019 - 2029

Table 19: Latin America Licorice Extract Market Revenue (US$ Mn) Forecast, by Grade, 2019 - 2029

Table 20: Latin America Licorice Extract Market Revenue (US$ Mn) Forecast, by Application, 2019 - 2029

Table 21: Latin America Licorice Extract Market Revenue (US$ Mn) Forecast, by Country, 2019 - 2029

List of Figure

Figure 01: Market Snapshot

Figure 02: Global Licorice Extract Market Revenue Analysis, and Forecasts, 2019-2029

Figure 03: Global Licorice Extract Market Attractiveness Analysis (2016) by Application

Figure 04: Global Licorice Extract Market Revenue Share Analysis, by Form, 2019 & 2029

Figure 05: Global Licorice Extracts Powder Market, Revenue (USD Mn), 2019 - 2029

Figure 06: Global Licorice Extracts Semi-Fluid/Paste Market, Revenue (USD Mn), 2019 - 2029

Figure 07: Global Licorice Extracts Block Market, Revenue (USD Mn ),2019 - 2029

Figure 08: Global Licorice Extract Market Revenue Share Analysis, by Grade, 2019 & 2029

Figure 09: Global Licorice Extract Market Revenue (USD Mn), by Pharmaceutical Grade, 2019 - 2029

Figure 10: Global Licorice Extract Market Revenue (USD Mn), by Food Grade, 2019 - 2029

Figure 11: Global Licorice Extract Market Revenue (USD Mn), by Feed Grade, 2019 - 2029

Figure 12: Global Licorice Extract Market Revenue Share Analysis, by Application, 2019 & 2029

Figure 13: Global Licorice Extract Market Revenue (USD Mn), by Pharmaceutical, 2019 - 2029

Figure 14: Global Licorice Extract Market Revenue (USD Mn), by Tobacco, 2019 - 2029

Figure 15: Global Licorice Extract Market Revenue (USD Mn), by Food and Beverage, 2019 - 2029

Figure 16: Global Licorice Extract Market Revenue (USD Mn), by Others, 2019 - 2029

Figure 17: Global Licorice Extract Market Revenue Share Analysis, by Region, 2019 & 2029

Figure 18: North America Licorice Extracts Revenue Analysis, and Forecasts, 2019-2029

Figure 19: North America Licorice Extract Market Revenue Share Analysis, by Form, 2019 & 2029

Figure 20: North America Licorice Extract Market Revenue Share Analysis, by Grade, 2019 & 2029

Figure 21: North America Licorice Extract Market Revenue Share Analysis, by Application, 2019 & 2029

Figure 22: North America Licorice Extract Market Revenue Share Analysis, by Country, 2019 & 2029

Figure 23: Europe Licorice Extracts Revenue Analysis, and Forecasts, 2019-2029

Figure 24: Europe Licorice Extract Market Revenue Share Analysis, by Form, 2019 & 2029

Figure 25: Europe Licorice Extract Market Revenue Share Analysis, by Grade, 2019 & 2029

Figure 26: Europe Licorice Extract Market Revenue Share Analysis, by Application, 2019 & 2029

Figure 27: Europe Licorice Extract Market Revenue Share Analysis, by Country, 2019 & 2029

Figure 28: Asia Pacific Licorice Extracts Revenue Analysis, and Forecasts, 2019-2029

Figure 29: Asia Pacific Licorice Extract Market Revenue Share Analysis, by Form, 2019 & 2029

Figure 30: Asia Pacific Licorice Extract Market Revenue Share Analysis, by Grade, 2019 & 2029

Figure 31: Asia Pacific Licorice Extract Market Revenue Share Analysis, by Application, 2019 & 2029

Figure 32: Asia Pacific Licorice Extract Market Revenue Share Analysis, by Country, 2019 & 2029

Figure 33: Middle East and Africa Licorice Extracts Revenue Analysis, and Forecasts, 2019-2029

Figure 34: Middle East and Africa Licorice Extract Market Revenue Share Analysis, by Form, 2019 & 2029

Figure 35: Middle East and Africa Licorice Extract Market Revenue Share Analysis, by Grade, 2019 & 2029

Figure 36: Middle East and Africa Licorice Extract Market Revenue Share Analysis, by Application, 2019 & 2029

Figure 37: Middle East and Africa Licorice Extract Market Revenue Share Analysis, by Country, 2019 & 2029

Figure 38: Latin America Licorice Extracts Revenue Analysis, and Forecasts, 2019-2029

Figure 39: Latin America Licorice Extract Market Revenue Share Analysis, by Form, 2019 & 2029

Figure 40: Latin America Licorice Extract Market Revenue Share Analysis, by Grade, 2019 & 2029

Figure 41: Latin America Licorice Extract Market Revenue Share Analysis, by Application, 2019 & 2029

Figure 42: Latin America Licorice Extract Market Revenue Share Analysis, by Country, 2019 & 2029