Legalized Cannabis Market – Multi-Purposed & Multi-Faceted Product Developments Favor Growth

As cannabis is getting gradually legalized across the US, doors are opening wide for investors and businesses to expand in the pot space, with companies scrambling to capitalize on surging marijuana demand with new lines of hemp-infused products. Transparency Market Research (TMR) compiled a study on ‘Legalized Cannabis Market’, which, according to the study, is witnessing colossal changes. Several industries have noticed the ravenous appetite of consumers that exists inside the cannabis culture, and thus, it is highly likely that the prospects remain promising for legalized cannabis manufacturers. Nevertheless, the cannabis economy is riddled with several hindrances to success, and tapping into this lucrative landscape is not going to be an easy task.

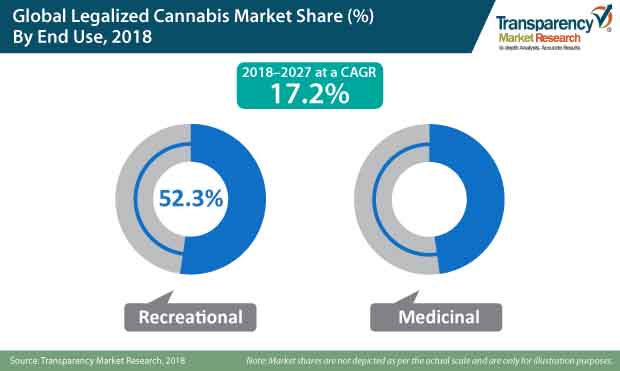

The complex yet multi-faceted and purposeful nature of legalized cannabis has enabled myriad segments of the consumer products industry to exploit its opportune potential. The surge in the demand for legitimate marijuana is evident, with the value of legalized cannabis market in 2018 estimated at nearly US$ 20.0 Bn, according to the study. The legalized cannabis market is projected to grow over 4X between 2018 and 2027. Established companies in every consumer industry are taking a close peek into methods and formulations for infusing THC, CBD, or both in an array of products.

What are Key Trends in the Legalized Cannabis Market?

The legalized cannabis industry is closing in on a more sophisticated customer base that seeks variety in products with different potency levels, effects, and prices. Increasing demand for luxury skincare products, such as edibles, and organic options, continues to create opportunities in both wellness-focused CBD variants and larger-than-ever adult-use space. In response to these opportunities, the manufacturers in legalized cannabis market focusing more on branding activities. Meanwhile, as the market grows vis-a-vis product diversity, legalized cannabis will gain a notable traction alongside demand from enthusiasts for various flavored products. Terpenes are one of the key ingredients of legalized cannabis, which have gained utter popularity in the recent past, with their ability to enhance the effect of ‘high’, and give weed an appealing flavor and essence.

The evident legitimacy and regulation-approved safety mark associated with legalized cannabis has led its adoption among new mothers. Post-federal legalization of marijuana in Canada, mothers have started consuming pot and its various incarnations to deal with everyday pressures, stresses of motherhood, postpartum depression and anxiety. Sublingual spray is one such convenient, THC-infused ingestible liquid that is spreading fast in mom circles.

Growing awareness pertaining to convenience of ingestion modes and doses of legalized cannabis is complementing the infiltration of low-dose products and variants other than flower in the legalized cannabis landscape. Significant number of ready-to-consume edibles, beverages and vapes are likely to show up for both recreational and medicinal applications of legalized cannabis in the upcoming years, with a specific focus on highly versatile and potent distillate oils.

Legalized Cannabis Market: Product Variety & Branding Remain Key Winning Strategies

The CBD-dominant legalized cannabis infused products are witnessing significant traction, with demand from canna-curious novice users, who want discreet, convenient, and controlled dose of legalized cannabis. Growing interest of first-time consumers in discreet forms of consumption, and their increased inclination towards edible products first before jumping to inhalables, will continue to drive demand for CBD-based legalized cannabis infused drinks. Following the legalization of marijuana in Canada, beverage companies have increased the production of legalized cannabis infused drinks in different flavors, to tap growing demand from enthusiasts. Technological advancements and developments in processing and production processes are key strategies adopted by leaders in the legalized cannabis landscape to maintain a competitive edge.

Legalized Cannabis Market Remains Consolidated among Established Brands

The market for legalized cannabis market continues to remain clustered among leading brands, which collectively accounting for over 80% shares, according to the study. Leading companies that process and manufacture legalized cannabis continue to consolidate their position in developed markets - North America and Europe - attributed to the obvious aspect of favorable regulatory approvals for medicinal and recreational use of legalized cannabis in these region. However, the legalized cannabis market, due to its volatile nature could witness a palpable bifurcation between established players and entrepreneurs. Up until now, legalized cannabis has been a ‘rising tide lifts all the boats’ sort of space, however the tables are expected to turn around anytime soon.

Legalized Cannabis Market - Analyst Point of View

The legalized cannabis market will continue to remain highly lucrative for businesses, with novel product launches, new capital investments, and the ceaseless entry of canna-curious novices in the marijuana space.

Established legalized cannabis manufacturers, with their potent business plans, are likely to witness a colossal lift, as more consumers are willing to spend on processed cannabis. This, coupled with shifting consumer preference for convenience in pot consumption, will continue to favor the legalized cannabis industry. The legalized cannabis market will also witness a remarkable penetration of large non-weed-related corporations, which eye exploiting the opportunities in the legalized cannabis market through product design, strategic partnerships and collaborations with producers.

1. Global Legalized Cannabis Market - Executive Summary

1.1. Global Legalized Cannabis Market Country Analysis

1.2. Vertical Specific Market Penetration

1.3. Application – Product Mapping

1.4. Competition Blueprint

1.5. Technology Time Line Mapping

1.6. TMR Analysis and Recommendations

2. Market Overview

2.1. Market Introduction

2.2. Market Definition

2.3. Market Taxonomy

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Outlook: Psychoactive drugs

3.3. Active Participants for the Market

3.4. Drivers

3.4.1. Economic Drivers

3.4.2. Supply Side Drivers

3.4.3. Demand Side Drivers

3.5. Market Restraints

3.5.1. Regulatory concerns

3.5.2. Supply chain issues

3.5.3. Others

3.6. Market Trends

3.7. Trend Analysis- Impact on Time Line (2018-2027)

3.8. Forecast Factors – Relevance and Impact

3.9. Key Regulations By Regions

4. Associated Industry and Key Indicator Assessment

4.1. Psychoactive Drug Industry Overview

4.1.1. Market Size and Forecast

4.1.2. Market Size and Y-o-Y Growth

4.1.3. Absolute $ Opportunity

5. Supply Chain Analysis

5.1. Profitability and Gross Margin Analysis By Competition

5.2. List of Active Participants- By Region

5.2.1. Legalized Cannabis Machinery Manufacturers

5.2.2. Private Label/Contract Manufacturers

5.2.3. Wholesaler/Distributor/Retailers

5.2.4. End Use Industry

6. Global Legalized Cannabis Market Pricing Analysis

6.1. Price Point Assessment by End Use

6.2. Regional Average Pricing Analysis

6.2.1. North America

6.2.2. Latin America

6.2.3. Europe

6.2.4. Asia Pacific

6.2.5. Middle East and Africa

6.3. Price Forecast till 2027

6.4. Factors Influencing Pricing

7. Global Legalized Cannabis Market Analysis and Forecast

7.1. Market Size Analysis (2013-2017) and Forecast (2018-2027)

7.1.1. Market Value (US$ Mn) and Volume (Tons) and Y-o-Y Growth

7.1.2. Absolute $ Opportunity

7.2. Global Legalized Cannabis Market Scenario Forecast (Optimistic, Likely and Conservative Market Conditions)

7.2.1. Forecast Factors and Relevance of Impact

7.2.2. Regional Legalized Cannabis Market Business Performance Summary

8. Global Legalized Cannabis Market Analysis By End Use

8.1. Introduction

8.1.1. Y-o-Y Growth Comparison By End Use

8.1.2. Basis Point Share (BPS) Analysis By End Use

8.2. Legalized Cannabis Market Size (US$ Mn) and Volume (MT) Analysis (2013-2017) & Forecast (2018-2027) By End Use

8.2.1. Recreational

8.2.2. Medicinal

8.3. Market Attractiveness Analysis By End Use

9. Global Legalized Cannabis Market Analysis By Product Type

9.1. Introduction

9.1.1. Y-o-Y Growth Comparison By Product Type

9.1.2. Basis Point Share (BPS) Analysis By Product Type

9.2. Legalized Cannabis Market Size (US$ Mn) and Volume (MT) Analysis (2013-2017) & Forecast (2018-2027) By Product Type

9.2.1. Cannabis Herb

9.2.2. Cannabis Resin

9.3. Market Attractiveness Analysis By Product Type

10. Global Legalized Cannabis Market Analysis By Form

10.1. Introduction

10.1.1. Y-o-Y Growth Comparison By Form

10.1.2. Basis Point Share (BPS) Analysis By Form

10.2. Legalized Cannabis Market Size (US$ Mn) and Volume (MT) Analysis (2013-2017) & Forecast (2018-2027) By Form

10.2.1. Raw

10.2.2. Processed

10.3. Market Attractiveness Analysis By Form

11. Global Legalized Cannabis Market Analysis By Compound

11.1. Introduction

11.1.1. Y-o-Y Growth Comparison By Compound

11.1.2. Basis Point Share (BPS) Analysis By Compound

11.2. Legalized Cannabis Market Size (US$ Mn) and Volume (MT) Analysis (2013-2017) & Forecast (2018-2027) By Compound

11.2.1. THC-Dominant

11.2.2. CBD-Dominant

11.2.3. Balanced THC & CBD

11.3. Market Attractiveness Analysis By Compound

12. Global Legalized Cannabis Market Analysis and Forecast, By Region

12.1. Introduction

12.1.1. Basis Point Share (BPS) Analysis By Region

12.1.2. Y-o-Y Growth Projections By Region

12.2. Legalized Cannabis Market Size (US$ Mn) and Volume (MT) & Forecast (2018-2027) Analysis By Region

12.2.1. North America

12.2.2. Europe

12.2.3. APAC

12.2.4. Latin America

12.2.5. Middle East and Africa

12.3. Market Attractiveness Analysis By Region

13. North America Legalized Cannabis Market Analysis and Forecast

13.1. Introduction

13.1.1. Basis Point Share (BPS) Analysis By Country

13.1.2. Y-o-Y Growth Projections By Country

13.2. Legalized Cannabis Market Size (Value (US$) and Volume (MT) Analysis (2013-2018) and Forecast (2018-2027)

13.2.1. Market Attractiveness By Country

13.2.1.1. U.S.

13.2.1.2. Canada

13.2.2. By End Use

13.2.3. By Product Type

13.2.4. By Form

13.2.5. By Compound

13.3. Market Attractiveness Analysis

13.3.1. By Country

13.3.2. By End Use

13.3.3. By Product Type

13.3.4. By Form

13.3.5. By Compound

13.4. Drivers and Restraints: Impact Analysis

14. Latin America Legalized Cannabis Market Analysis and Forecast

14.1. Introduction

14.1.1. Basis Point Share (BPS) Analysis By Country

14.1.2. Y-o-Y Growth Projections By Country

14.1.3. Key Regulations

14.2. Legalized Cannabis Market Size (Value (US$) and Volume (MT) Analysis (2013-2018) and Forecast (2018-2027)

14.2.1. By Country

14.2.1.1. Argentina

14.2.1.2. Mexico

14.2.1.3. Uruguay

14.2.1.4. Brazil

14.2.1.5. Rest of LATAM

14.2.2. By End Use

14.2.3. By Product Type

14.2.4. By Form

14.2.5. By Compound

14.3. Market Attractiveness Analysis

14.3.1. By Country

14.3.2. By End Use

14.3.3. By Product Type

14.3.4. By Form

14.3.5. By Compound

14.4. Drivers and Restraints: Impact Analysis

15. Europe Legalized Cannabis Market Analysis and Forecast

15.1. Introduction

15.1.1. Basis Point Share (BPS) Analysis By Country

15.1.2. Y-o-Y Growth Projections By Country

15.1.3. Key Regulations

15.2. Legalized Cannabis Market Size (Value (US$) and Volume (MT) Analysis (2013-2018) and Forecast (2018-2027)

15.2.1. By Country

15.2.1.1. UK

15.2.1.2. Germany

15.2.1.3. France

15.2.1.4. Italty

15.2.1.5. Netherlands

15.2.1.6. Spain

15.2.1.7. Poland

15.2.1.8. Nordic

15.2.1.9. Rest of Europe

15.2.2. By End Use

15.2.3. By Product Type

15.2.4. By Form

15.2.5. By Compound

15.3. Market Attractiveness Analysis

15.3.1. By Country

15.3.2. By End Use

15.3.3. By Product Type

15.3.4. By Form

15.3.5. By Compound

15.4. Drivers and Restraints: Impact Analysis

16. APAC Legalized Cannabis Market Analysis and Forecast

16.1. Introduction

16.1.1. Basis Point Share (BPS) Analysis By Country

16.1.2. Y-o-Y Growth Projections By Country

16.1.3. Key Regulations

16.2. Legalized Cannabis Market Size (Value (US$) and Volume (MT) Analysis (2013-2018) and Forecast (2018-2027)

16.2.1. By Country

16.2.1.1. China

16.2.1.2. India

16.2.1.3. Japan

16.2.1.4. Australia & New Zealand

16.2.1.5. Rest of APAC

16.2.2. By End Use

16.2.3. By Product Type

16.2.4. By Form

16.2.5. By Compound

16.3. Market Attractiveness Analysis

16.3.1. By Country

16.3.2. By End Use

16.3.3. By Product Type

16.3.4. By Form

16.3.5. By Compound

16.4. Drivers and Restraints: Impact Analysis

17. Middle East and Africa (MEA) Legalized Cannabis Market Analysis and Forecast

17.1. Introduction

17.1.1. Basis Point Share (BPS) Analysis By Country

17.1.2. Y-o-Y Growth Projections By Country

17.1.3. Key Regulations

17.2. Legalized Cannabis Market Size (Value (US$) and Volume (MT) Analysis (2013-2018) and Forecast (2018-2027)

17.2.1. By Country

17.2.1.1. GCC Countries

17.2.1.2. Turkey

17.2.1.3. North Africa

17.2.1.4. South Africa

17.2.1.5. Ghana

17.2.1.6. Nigeria

17.2.1.7. Uganda

17.2.1.8. Rest of Middle East & Africa

17.2.2. By End Use

17.2.3. By Product Type

17.2.4. By Form

17.2.5. By Compound

17.3. Market Attractiveness Analysis

17.3.1. By Country

17.3.2. By End Use

17.3.3. By Product Type

17.3.4. By Form

17.3.5. By Compound

17.4. Drivers and Restraints: Impact Analysis

18. Competition Assessment

18.1. Global Legalized Cannabis Market Competition - a Dashboard View

18.2. Global Legalized Cannabis Market Structure Analysis

18.3. Global Legalized Cannabis Market Company Share Analysis

18.3.1. For Tier 1 Market Players, 2017

18.3.2. Company Market Share Analysis of Top 10 Players, By Region

18.4. Key Participants Market Presence (Intensity Mapping) by Region

19. Competition Deep-dive (Manufacturers/Suppliers)

19.1. Tilray, Inc.

19.1.1. Overview

19.1.2. Product Portfolio

19.1.3. Sales Footprint

19.1.4. Channel Footprint

19.1.4.1. Distributors List

19.1.4.2. Form (Clients)

19.1.5. Strategy Overview

19.1.5.1. Marketing Strategy

19.1.5.2. Culture Strategy

19.1.5.3. Channel Strategy

19.1.6. SWOT Analysis

19.1.7. Financial Analysis

19.1.8. Revenue Share

19.1.8.1. By Nature

19.1.8.2. By Region

19.1.9. Key Clients

19.1.10. Analyst Comments

19.2. Aphria, Inc.

19.3. The Supreme Cannabis Company, Inc.

19.4. CannTrust Holdings, Inc.

19.5. Terra Tech Corp.

19.6. Cronos Group Inc.

19.7. STENOCARE

19.8. Cannabis Science Inc.

19.9. Medical Marijuana Inc.

19.10. VIVO Cannabis Inc.

19.11. OrganiGram Holdings Inc

19.12. Wayland Group Corp.

19.13. Aurora Cannabis Inc

19.14. Canopy Growth Corporation

20. Recommendation- Critical Success Factors

21. Research Methodology

22. Assumptions & Acronyms Used

Table 01: Global Legalized Cannabis Market Value (US$ Mn) Forecast by End Use , 2018–2027

Table 02: Global Legalized Cannabis Market Volume (MT) Forecast by End Use , 2018–2027

Table 03: Global Legalized Cannabis Market Value (US$ Mn) Forecast by Product Type, 2018–2027

Table 04: Global Legalized Cannabis Market Volume (MT) Forecast by Product Type, 2018–2027

Table 05: Global Legalized Cannabis Market Value (US$ Mn) Forecast by Form, 2018–2027

Table 06: Global Legalized Cannabis Market Volume (MT) Forecast by Form, 2018–2027

Table 07: Global Legalized Cannabis Market Value (US$ Mn) Forecast by Compound, 2018–2027

Table 08: Global Legalized Cannabis Market Volume (MT) Forecast by Compound, 2018–2027

Table 09: Global Legalized Cannabis Market Value (US$ Mn) Forecast by Region, 2018–2027

Table 10: Global Legalized Cannabis Market Volume (MT) Forecast by Region, 2018–2027

Table 11: North America Legalized Cannabis Market Value (US$ Mn) Forecast by End Use , 2018–2027

Table 12: North America Legalized Cannabis Market Volume (MT) Forecast by End Use , 2018–2027

Table 13: North America Legalized Cannabis Market Value (US$ Mn) Forecast by Product Type, 2018–2027

Table 14: North America Legalized Cannabis Market Volume (MT) Forecast by Product Type, 2018–2027

Table 15: North America Legalized Cannabis Market Value (US$ Mn) Forecast by Form, 2018–2027

Table 16: North America Legalized Cannabis Market Volume (MT) Forecast by Form, 2018–2027

Table 17: North America Legalized Cannabis Market Value (US$ Mn) Forecast by Compound, 2018–2027

Table 18: North America Legalized Cannabis Market Volume (MT) Forecast by Compound, 2018–2027

Table 19: North America Legalized Cannabis Market Value (US$ Mn) Forecast by Country, 2018–2027

Table 20: North America Legalized Cannabis Market Volume (MT) Forecast by Region, 2018–2027

Table 21: Latin America Legalized Cannabis Market Value (US$ Mn) Forecast by End Use , 2018–2027

Table 22: Latin America Legalized Cannabis Market Volume (MT) Forecast by End Use , 2018–2027

Table 23: Latin America Legalized Cannabis Market Value (US$ Mn) Forecast by Product Type, 2018–2027

Table 24: Latin America Legalized Cannabis Market Volume (MT) Forecast by Product Type, 2018–2027

Table 25: Latin America Legalized Cannabis Market Value (US$ Mn) Forecast by Form, 2018–2027

Table 26: Latin America Legalized Cannabis Market Volume (MT) Forecast by Form, 2018–2027

Table 27: Latin America Legalized Cannabis Market Value (US$ Mn) Forecast by Compound, 2018–2027

Table 28: Latin America Legalized Cannabis Market Volume (MT) Forecast by Compound, 2018–2027

Table 29: Latin America Legalized Cannabis Market Value (US$ Mn) Forecast by Country, 2018–2027

Table 30: Latin America Legalized Cannabis Market Volume (MT) Forecast by Country, 2018–2027

Table 31: Europe Legalized Cannabis Market Value (US$ Mn) Forecast by End Use , 2018–2027

Table 32: Europe Legalized Cannabis Market Volume (MT) Forecast by End Use , 2018–2027

Table 33: Europe Legalized Cannabis Market Value (US$ Mn) Forecast by Product Type, 2018–2027

Table 34: Europe Legalized Cannabis Market Volume (MT) Forecast by Product Type, 2018–2027

Table 35: Europe Legalized Cannabis Market Value (US$ Mn) Forecast by Form, 2018–2027

Table 36: Europe Legalized Cannabis Market Volume (MT) Forecast by Form, 2018–2027

Table 37: Europe America Legalized Cannabis Market Value (US$ Mn) Forecast by Compound, 2018–2027

Table 38: Eurpe America Legalized Cannabis Market Volume (MT) Forecast by Compound, 2018–2027

Table 39: Europe Legalized Cannabis Market Value (US$ Mn) Forecast by Country, 2018–2027

Table 40: Europe Legalized Cannabis Market Volume (MT) Forecast by Country, 2018–2027

Table 41: APAC Legalized Cannabis Market Value (US$ Mn) Forecast by End Use , 2018–2027

Table 42: APAC Legalized Cannabis Market Volume (MT) Forecast by End Use , 2018–2027

Table 43: APAC Legalized Cannabis Market Value (US$ Mn) Forecast by Product Type, 2018–2027

Table 44: APAC Legalized Cannabis Market Volume (MT) Forecast by Product Type, 2018–2027

Table 45: APAC Legalized Cannabis Market Value (US$ Mn) Forecast by Form, 2018–2027

Table 46: APAC Legalized Cannabis Market Volume (MT) Forecast by Form, 2018–2027

Table 47: APAC Legalized Cannabis Market Value (US$ Mn) Forecast by Compound, 2018–2027

Table 48: APAC Legalized Cannabis Market Volume (MT) Forecast by Compound, 2018–2027

Table 49: APAC Legalized Cannabis Market Value (US$ Mn) Forecast by Country, 2018–2027

Table 50: APAC Legalized Cannabis Market Volume (MT) Forecast by Country, 2018–2027

Table 51: MEA Legalized Cannabis Market Value (US$ Mn) Forecast by End Use , 2018–2027

Table 52: MEA Legalized Cannabis Market Volume (MT) Forecast by End Use , 2018–2027

Table 53: MEA Legalized Cannabis Market Value (US$ Mn) Forecast by Product Type, 2018–2027

Table 54: MEA Legalized Cannabis Market Volume (MT) Forecast by Product Type, 2018–2027

Table 55: MEA Legalized Cannabis Market Value (US$ Mn) Forecast by Form, 2018–2027

Table 56: MEA Legalized Cannabis Market Volume (MT) Forecast by Form, 2018–2027

Table 57: MEA Legalized Cannabis Market Value (US$ Mn) Forecast by Compound, 2018–2027

Table 58: MEA Legalized Cannabis Market Volume (MT) Forecast by Compound, 2018–2027

Table 59: MEA Legalized Cannabis Market Value (US$ Mn) Forecast by Country, 2018–2027

Table 60: MEA Legalized Cannabis Market Volume (MT) Forecast by Country, 2018–2027

Figure 1: Global Legalized Cannabis Market Volume (MT) Analysis by End Use , 2018 & 2027

Figure 2: Global Legalized Cannabis Market Value (US$ Mn) Analysis by End Use , 2018 & 2027

Figure 3: Global Legalized Cannabis Market Value Share (%) and BPS Analysis by End Use , 2018 & 2027

Figure 4: Global Legalized Cannabis Market Y-o-Y Growth (%) Projections by End Use , 2018-2027

Figure 5: Global Legalized Cannabis Market Volume (MT) Analysis by Product Type, 2018 & 2027

Figure 6: Global Legalized Cannabis Market Value (US$ Mn) Analysis by Product Type, 2018 & 2027

Figure 7: Global Legalized Cannabis Market Value Share (%) and BPS Analysis by Product Type, 2018 & 2027

Figure 8: Global Legalized Cannabis Market Y-o-Y Growth (%) Projections by Product Type, 2018-2027

Figure 9: Global Legalized Cannabis Market Volume (MT) Analysis by Form, 2018 & 2027

Figure 10: Global Legalized Cannabis Market Value (US$ Mn) Analysis by Form, 2018 & 2027

Figure 11: Global Legalized Cannabis Market Value Share (%) and BPS Analysis by Form, 2018 & 2027

Figure 12: Global Legalized Cannabis Market Y-o-Y Growth (%) Projections by Form, 2018-2027

Figure 13: Global Legalized Cannabis Market Volume (MT) Analysis by Compound, 2018 & 2027

Figure 14: Global Legalized Cannabis Market Value (US$ Mn) Analysis by Compound, 2018 & 2027

Figure 15: Global Legalized Cannabis Market Value Share (%) and BPS Analysis by Compound, 2018 & 2027

Figure 16: Global Legalized Cannabis Market Y-o-Y Growth (%) Projections by Compound, 2018-2027

Figure 17: Global Legalized Cannabis Market Volume (MT) Analysis by Region, 2018 & 2027

Figure 18: Global Legalized Cannabis Market Value (US$ Mn) Analysis by Region, 2018 & 2027

Figure 19: Global Legalized Cannabis Market Value Share (%) and BPS Analysis by Region, 2018 & 2027

Figure 20: Global Legalized Cannabis Market Y-o-Y Growth (%) Projections by Region, 2018-2027

Figure 21: Global Legalized Cannabis Market Attractiveness Analysis, by End Use, 2018 & 2027

Figure 22: Global Legalized Cannabis Market Attractiveness Analysis, by Product Type, 2018 & 2027

Figure 23: Global Legalized Cannabis Market Attractiveness Analysis, by Form

Figure 24: Global Legalized Cannabis Market Attractiveness Analysis, by Compound

Figure 25: Global Legalized Cannabis Market Attractiveness Analysis, by Region

Figure 26: North America Legalized Cannabis Market Volume (MT) Analysis by End Use , 2018 & 2027

Figure 27: North America Legalized Cannabis Market Value (US$ Mn) Analysis by End Use , 2018 & 2027

Figure 28: North America Legalized Cannabis Market Value Share (%) and BPS Analysis by End Use, 2018 & 2027

Figure 29: North America Legalized Cannabis Market Y-o-Y Growth (%) Projections by End Use , 2018-2027

Figure 30: North America Legalized Cannabis Market Volume (MT) Analysis by Product Type, 2018 & 2027

Figure 31: North America Legalized Cannabis Market Value (US$ Mn) Analysis by Product Type, 2018 & 2027

Figure 32: North America Legalized Cannabis Market Value Share (%) and BPS Analysis by Product Type, 2018 & 2027

Figure 33: North America Legalized Cannabis Market Y-o-Y Growth (%) Projections by Product Type, 2018-2027

Figure 34: North America Legalized Cannabis Market Volume (MT) Analysis by Form, 2018 & 2027

Figure 35: North America Legalized Cannabis Market Value (US$ Mn) Analysis by Form, 2018 & 2027

Figure 36: North America Legalized Cannabis Market Value Share (%) and BPS Analysis by Form, 2018 & 2027

Figure 37: North America Legalized Cannabis Market Y-o-Y Growth (%) Projections by Form, 2018-2027

Figure 38: North America Legalized Cannabis Market Volume (MT) Analysis by Compound, 2018 & 2027

Figure 39: North America Herbs Market Value (US$ Mn) Analysis by Compound, 2018 & 2027

Figure 40: North America Legalized Cannabis Market Value Share (%) and BPS Analysis by Compound, 2018 & 2027

Figure 41: North America Legalized Cannabis Market Y-o-Y Growth (%) Projections by Compound, 2018-2027

Figure 42: North America Legalized Cannabis Market Volume (MT) Analysis by Country, 2018 & 2027

Figure 43: North America Legalized Cannabis Market Value (US$ Mn) Analysis by Country, 2018 & 2027

Figure 44: North America Legalized Cannabis Market Value Share (%) and BPS Analysis by Country, 2018 & 2027

Figure 45: North America Legalized Cannabis Market Y-o-Y Growth (%) Projections by Country, 2018-2027

Figure 46: North America Legalized Cannabis Market Attractiveness Analysis, by End Use, 2018 & 2027

Figure 47: North America Legalized Cannabis Market Attractiveness Analysis, by Product Type, 2018 & 2027

Figure 48: North America Legalized Cannabis Market Attractiveness Analysis, by Form

Figure 49: North America Legalized Cannabis Market Attractiveness Analysis, by Compound

Figure 50: North America Legalized Cannabis Market Attractiveness Analysis, by Country

Figure 51: Latin America Legalized Cannabis Market Volume (MT) Analysis by End Use , 2018 & 2027

Figure 52: Latin America Legalized Cannabis Market Value (US$ Mn) Analysis by End Use , 2018 & 2027

Figure 53: Latin America Legalized Cannabis Market Value Share (%) and BPS Analysis by End Use, 2018 & 2027

Figure 54: Latin America Legalized Cannabis Market Y-o-Y Growth (%) Projections by End Use , 2018-2027

Figure 55: Latin America Legalized Cannabis Market Volume (MT) Analysis by Product Type, 2018 & 2027

Figure 56: Latin America Legalized Cannabis Market Value (US$ Mn) Analysis by Product Type, 2018 & 2027

Figure 57: Latin America Legalized Cannabis Market Value Share (%) and BPS Analysis by Product Type, 2018 & 2027

Figure 58: Latin America Legalized Cannabis Market Y-o-Y Growth (%) Projections by Product Type, 2018-2027

Figure 59: Latin America Legalized Cannabis Market Volume (MT) Analysis by Form, 2018 & 2027

Figure 60: Latin America Legalized Cannabis Market Value (US$ Mn) Analysis by Form, 2018 & 2027

Figure 61: Latin America Legalized Cannabis Market Value Share (%) and BPS Analysis by Form, 2018 & 2027

Figure 62: Latin America Legalized Cannabis Market Y-o-Y Growth (%) Projections by Form, 2018-2027

Figure 63: Latin America Legalized Cannabis Market Volume (MT) Analysis by Compound, 2018 & 2027

Figure 64: Latin America Legalized Cannabis Market Value (US$ Mn) Analysis by Compound, 2018 & 2027

Figure 65: Latin America Legalized Cannabis Market Value Share (%) and BPS Analysis by Compound, 2018 & 2027

Figure 66: Latin America Legalized Cannabis Market Y-o-Y Growth (%) Projections by Compound, 2018-2027

Figure 67: Latin America Legalized Cannabis Market Volume (MT) Analysis by Country, 2018 & 2027

Figure 68: Latin America Legalized Cannabis Market Value (US$ Mn) Analysis by Country, 2018 & 2027

Figure 69: Latin America Legalized Cannabis Market Value Share (%) and BPS Analysis by Country, 2018 & 2027

Figure 70: Latin America Legalized Cannabis Market Y-o-Y Growth (%) Projections by Country, 2018-2027

Figure 71: Latin America Legalized Cannabis Market Attractiveness Analysis, by End Use, 2018 & 2027

Figure 72: Latin America Legalized Cannabis Market Attractiveness Analysis, by Product Type, 2018 & 2027

Figure 73: Latin America Legalized Cannabis Market Attractiveness Analysis, by Form

Figure 74: Latin America Legalized Cannabis Market Attractiveness Analysis, by Compound

Figure 75: Latin America Legalized Cannabis Market Attractiveness Analysis, by Country

Figure 76: Europe Legalized Cannabis Market Volume (MT) Analysis by End Use , 2018 & 2027

Figure 77: Europe Legalized Cannabis Market Value (US$ Mn) Analysis by End Use , 2018 & 2027

Figure 78: Europe Legalized Cannabis Market Value Share (%) and BPS Analysis by End Use, 2018 & 2027

Figure 79: Europe Legalized Cannabis Market Y-o-Y Growth (%) Projections by End Use , 2018-2027

Figure 80: Europe Legalized Cannabis Market Volume (MT) Analysis by Product Type, 2018 & 2027

Figure 81: Europe Legalized Cannabis Market Value (US$ Mn) Analysis by Product Type, 2018 & 2027

Figure 82: Europe Legalized Cannabis Market Value Share (%) and BPS Analysis by Product Type, 2018 & 2027

Figure 83: Europe Legalized Cannabis Market Y-o-Y Growth (%) Projections by Product Type, 2018-2027

Figure 84: Europe Legalized Cannabis Market Volume (MT) Analysis by Form, 2018 & 2027

Figure 85: Europe Legalized Cannabis Market Value (US$ Mn) Analysis by Form, 2018 & 2027

Figure 86: Europe Legalized Cannabis Market Value Share (%) and BPS Analysis by Form, 2018 & 2027

Figure 87: Europe Legalized Cannabis Market Y-o-Y Growth (%) Projections by Form, 2018-2027

Figure 88: Europe Legalized Cannabis Market Volume (MT) Analysis by Compound, 2018 & 2027

Figure 89: Europe Legalized Cannabis Market Value (US$ Mn) Analysis by Compound, 2018 & 2027

Figure 90: Europe Legalized Cannabis Market Value Share (%) and BPS Analysis by Compound, 2018 & 2027

Figure 91: Europe Legalized Cannabis Market Y-o-Y Growth (%) Projections by Compound, 2018-2027

Figure 92: Europe Legalized Cannabis Market Volume (MT) Analysis by Country, 2018 & 2027

Figure 93: Europe Legalized Cannabis Market Value (US$ Mn) Analysis by Country, 2018 & 2027

Figure 94: Europe Legalized Cannabis Market Value Share (%) and BPS Analysis by Country, 2018 & 2027

Figure 95: Europe Legalized Cannabis Market Y-o-Y Growth (%) Projections by Country, 2018-2027

Figure 96: Europe Legalized Cannabis Market Attractiveness Analysis, by End Use, 2018 & 2027

Figure 97: Europe Legalized Cannabis Market Attractiveness Analysis, by Product Type, 2018 & 2027

Figure 98: Europe Legalized Cannabis Market Attractiveness Analysis, by Form

Figure 99: Europe Legalized Cannabis Market Attractiveness Analysis, by Compound

Figure 100: Europe Legalized Cannabis Market Attractiveness Analysis, by Country

Figure 101: APAC Legalized Cannabis Market Volume (MT) Analysis by End Use , 2018 & 2027

Figure 102: APAC Legalized Cannabis Market Value (US$ Mn) Analysis by End Use , 2018 & 2027

Figure 103: APAC Legalized Cannabis Market Value Share (%) and BPS Analysis by End Use, 2018 & 2027

Figure 104: APAC Legalized Cannabis Market Y-o-Y Growth (%) Projections by End Use , 2018-2027

Figure 105: APAC Legalized Cannabis Market Volume (MT) Analysis by Product Type, 2018 & 2027

Figure 106: APAC Legalized Cannabis Market Value (US$ Mn) Analysis by Product Type, 2018 & 2027

Figure 107: APAC Legalized Cannabis Market Value Share (%) and BPS Analysis by Product Type, 2018 & 2027

Figure 108: APAC Legalized Cannabis Market Y-o-Y Growth (%) Projections by Product Type, 2018-2027

Figure 109: APAC Legalized Cannabis Market Volume (MT) Analysis by Form, 2018 & 2027

Figure 110: APAC Legalized Cannabis Market Value (US$ Mn) Analysis by Form, 2018 & 2027

Figure 111: APAC Legalized Cannabis Market Value Share (%) and BPS Analysis by Form, 2018 & 2027

Figure 112: APAC Legalized Cannabis Market Y-o-Y Growth (%) Projections by Form, 2018-2027

Figure 113: APAC Legalized Cannabis Market Volume (MT) Analysis by Compound, 2018 & 2027

Figure 114: APAC Legalized Cannabis Market Value (US$ Mn) Analysis by Compound, 2018 & 2027

Figure 115: APAC Legalized Cannabis Market Value Share (%) and BPS Analysis by Compound, 2018 & 2027

Figure 116: APAC Legalized Cannabis Market Y-o-Y Growth (%) Projections by Compound, 2018-2027

Figure 117: APAC Legalized Cannabis Market Volume (MT) Analysis by Country, 2018 & 2027

Figure 118: APAC Legalized Cannabis Market Value (US$ Mn) Analysis by Country, 2018 & 2027

Figure 119: APAC Legalized Cannabis Market Value Share (%) and BPS Analysis by Country, 2018 & 2027

Figure 120: APAC Legalized Cannabis Market Y-o-Y Growth (%) Projections by Country, 2018-2027

Figure 121: APAC Legalized Cannabis Market Attractiveness Analysis, by End Use, 2018 & 2027

Figure 122: APAC Legalized Cannabis Market Attractiveness Analysis, by Product Type, 2018 & 2027

Figure 123: APAC Legalized Cannabis Market Attractiveness Analysis, by Form

Figure 124: APAC Legalized Cannabis Market Attractiveness Analysis, by Dryig Method

Figure 125: APAC Legalized Cannabis Market Attractiveness Analysis, by Country

Figure 126: MEA Legalized Cannabis Market Volume (MT) Analysis by End Use , 2018 & 2027

Figure 127: MEA Legalized Cannabis Market Value (US$ Mn) Analysis by End Use , 2018 & 2027

Figure 128: MEA Legalized Cannabis Market Value Share (%) and BPS Analysis by End Use, 2018 & 2027

Figure 129: MEA Legalized Cannabis Market Y-o-Y Growth (%) Projections by End Use , 2018-2027

Figure 130: MEA Legalized Cannabis Market Volume (MT) Analysis by Product Type, 2018 & 2027

Figure 131: MEA Legalized Cannabis Market Value (US$ Mn) Analysis by Product Type, 2018 & 2027

Figure 132: MEA Legalized Cannabis Market Value Share (%) and BPS Analysis by Product Type, 2018 & 2027

Figure 133: MEA Legalized Cannabis Market Y-o-Y Growth (%) Projections by Product Type, 2018-2027

Figure 134: MEA Legalized Cannabis Market Volume (MT) Analysis by Form, 2018 & 2027

Figure 135: MEA Legalized Cannabis Market Value (US$ Mn) Analysis by Form, 2018 & 2027

Figure 136: MEA Legalized Cannabis Market Value Share (%) and BPS Analysis by Form, 2018 & 2027

Figure 137: MEA Legalized Cannabis Market Y-o-Y Growth (%) Projections by Form, 2018-2027

Figure 138: MEA Legalized Cannabis Market Volume (MT) Analysis by Compound, 2018 & 2027

Figure 139: MEA Legalized Cannabis Market Value (US$ Mn) Analysis by Compound, 2018 & 2027

Figure 140: MEA Legalized Cannabis Market Value Share (%) and BPS Analysis by Compound, 2018 & 2027

Figure 141: MEA Legalized Cannabis Market Y-o-Y Growth (%) Projections by Compound, 2018-2027

Figure 142: MEA Legalized Cannabis Market Volume (MT) Analysis by Country, 2018 & 2027

Figure 143: MEA Legalized Cannabis Market Value (US$ Mn) Analysis by Country, 2018 & 2027

Figure 144: MEA Legalized Cannabis Market Value Share (%) and BPS Analysis by Country, 2018 & 2027

Figure 145: MEA Legalized Cannabis Market Y-o-Y Growth (%) Projections by Country, 2018-2027

Figure 146: MEA Legalized Cannabis Market Attractiveness Analysis, by End Use, 2018 & 2027

Figure 147: MEA Legalized Cannabis Market Attractiveness Analysis, by Product Type, 2018 & 2027

Figure 148: MEA Legalized Cannabis Market Attractiveness Analysis, by Form

Figure 149: MEA Legalized Cannabis Market Attractiveness Analysis, by Compound

Figure 150: MEA Legalized Cannabis Market Attractiveness Analysis, by Country