Deployment in Multiple Applications Rise on Back of Attractive Performance Characteristics and Favorable Economics

The lead acid battery market has made continuous strides, fueled by the constantly rising deployment in multiple applications. The adoption of the battery system in energy management applications has grown tremendously over the past several decades. Businesses across the globe are fervently betting big on lead-acid battery as a cost-effective and high-performance energy storage solution. The use in a number of stationary applications such as smart-grid frequency regulation facilities and other critical backup applications is proliferating.

Ease of Transportation and Relative low Costs Makes Lead Acid Batteries Competitive with Other Battery Systems

The versatile use of lead acid battery is one of the major propositions behind the deployment of the technologies in the market. The choice of alloy and design advancements have been shaped by the changing energy requirements in these industries.

Players in the lead acid battery market have conducted extensive R&D on extending the life of these batteries and enhance their dynamic charge-acceptance. The launch of products with longer lifetimes and higher efficiencies has been invigorating interest in new materials and electrolytes as novel chemistries.

Proliferating Demand in Renewable Energy Storage Application Enriched Future Lead Acid Battery Market Outlook

The renewable energy sector has made some massive advancements, given the need to reduce the greenhouse gas emissions and the recurrent drive to meet lower carbon emissions. The trend has received a massive thrust in developing economies, and has nudged developed countries to extend financial support to make the transition. In all these, cost-effective secondary storage solutions attract groundswell of attention.

Lead acid battery technologies prove to be promising for smart energy storage solutions for smart grids. The ease of recyclability, simplicity of charging, and ease of transportation are propelling the revenue generation from the adoption of these in renewable energy storage applications.

Lead Acid Battery Likely to be Prominent Choice for Energy-Intensive Data Centers

The global lead acid battery market is projected to reach worth of US$ 79 Bn by 2025-end.

The demand has risen in data center infrastructures. The trend has created new revenue streams in emerging markets. Africa and ASEAN have been attractive markets. The explosion of internet-of-things (IoT) applications has led to spurt in demand for data centers to store volumes of data for use in various end-use industries. As a result, the prospects for the lead acid battery market in data centers is anticipated to rise at a promising growth rate during the forecast period.

Data centers are becoming power-hungry more than ever. Hence, the development of cost-efficient energy storage applications is expected to impart significant headwinds. This will open new frontiers for players in the lead acid battery market.

Automotive Sector Keeps Demand in Asia Pacific Market Buoyant

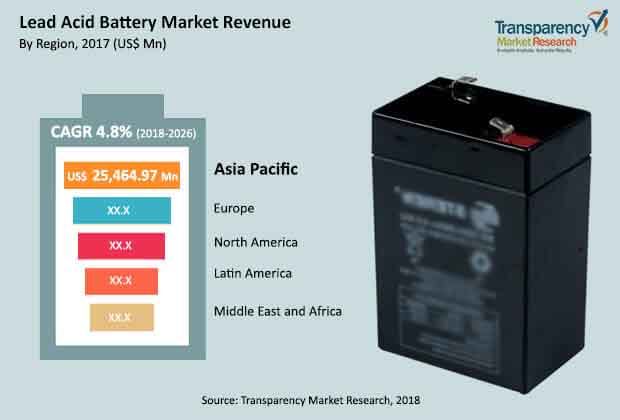

Asia Pacific held the major share of the global lead acid battery market in 2016. This was trailed by Europe and North America.

The strides made in automotive sector has played a large role in spurring the commercialization prospects of the Asia Pacific lead acid battery market. There has been substantial deployment of lead acid batteries in SLI (Starting, Lighting, and Ignition) batteries in automobiles.

New Designs & Safety Features to Chalk Future of Automotive Lead–Acid Battery Market

Advent of new lead acid battery designs has helped manufacturers in the lead acid battery market meet the evolving requirements in relation to maintenance, endurance, charge-acceptance, and cold crankability. Advanced designs have bolstered the use of lead acid battery in high-rate operation in the automotive applications. Lead acid battery for automotive sector will continue to make exciting strides ahead. This will be stridently fueled by the commercialization of maintenance-free lead acid batteries.

Manufacturers Commit Sizable Funds on Novel Energy Storage Materials

Various approaches have been tested and several of them are the key themes in ongoing research in energy storage applications. One of the key approaches is promoting the negative-plate charge and discharge processes. Another objective of manufacturers is reducing the degradation of positive electrode due to corrosion. Stridently, the lead acid battery market has witnessed the advent of new chemistries with longer lifetimes, essentially more charge/discharge cycles, and cycle life under 100% depth of discharge condition.

New Materials Enhance Cycle Life of Lead-acid Battery Find Applications in Electric Vehicles

A number of additives and alloys are being tested for developing and commercializing new chemistries in the lead acid battery market.

The relevant body of R&D activities has opened up new applications, particularly to meet the standards of new-age automotive. A prominent case in point is the need for battery technologies to meet various technical requirements for electric vehicles. Several studies have demonstrated activated carbon, carbon black, graphite, and carbon nanotubes to the negative active material (NAM) of the lead acid batteries to decrease premature failure of sulfation. This has resulted in prolonging the cycle life of batteries.

Graphene-enhanced Lead-Acid Batteries Attract Attention of Researchers

Use of graphene as an additive in the active mass of negative electrode in valve-regulated lead–acid batteries is attracting growing attention. At least three companies in China have tested the potential of this novel technology, leading to launch of graphene-enhanced lead-acid batteries.

Such product developments and launches in the lead acid battery market make the products competitive with respect to popular contemporary battery technologies. This is particularly with respect to lead acid batteries. The result was noticeable in performance of e-bike motive power VRLA batteries with respect to 100% depth-of-discharge cycle, notably in low ambient temperature.

Application of PV Cells Shows Game-changing Potential in Energy Storage Systems

In numerous countries, the demand in the lead acid battery market has been burgeoning on the back of production new solar photovoltaic systems. These are slated to attract industry investments from countries looking to modernize their energy storage systems and incorporate more renewables in the energy mix. Thus, the application of lead acid battery in PV cells has been growing at a rapid pace, adding momentum to the lead acid battery market.

Over the past few years, a number of new solar photovoltaic systems have been incorporated in renewables. One major motivation for this focus of utility companies and energy companies in reducing variability of renewable electricity sources. China and the U.S. have been at the forefront of these trends.

Industry Players Focus on Circumventing Environmental and Health Hazards

There are a few glaring challenges in the commercialization of lead acid battery market. Technological challenges are the primary bottlenecks, but not severe. This is because the market has been witnessing tailwinds due to advent of new battery chemistries. Significant loss in energy and power density at low ambient temperatures especially below 10 °C is creating hurdles. New electrochemical materials and other chemistries will help players circumvent these challenges.

But, perhaps a more serious problem is the environmental and health hazards posed by lead and lead oxides. Various international health and environmental standards have classified these as hazardous heavy metal materials. In particular, human skin is vulnerable to ill effects when it comes into contact with theses, and are especially sensitive to mucous membranes.

On the other hand, producers are keenly complying with better workplace standards to keep their workers safe in battery manufacturing plants.

Yet another contentious concern that has impeded the swift growth of the lead acid battery market is the absence of an adequate recycling infrastructure. Hence, policy makers in key markets such as in North America are taking efforts to close the loop between lead from recycled lead–acid batteries and the utilization of lead in manufacturing of these. New recycling concepts have emerged, thereby enriching the prospects of the lead acid battery market.

Some of the key players in the lead acid battery market are Trojan battery Company, Crown Battery Manufacturing Co., FIAMM Energy Technology S.p.A., East Penn Manufacturing Co., C&D Technologies, Inc., and HBL Power Systems Limited.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Lead Acid Battery Market

3.1. Global Lead Acid Battery Market Size, US$ Mn, Thousand Units, 2017-2026

4. Market Overview

4.1. Introduction

4.1.1. Lead Acid Battery Market Definition

4.1.2. Industry Developments

4.2. Key Market Indicators

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunity

4.4. Porter’s Five Force Analysis

4.5. Value Chain Analysis

4.5.1. List of Key Raw Material Suppliers

4.5.2. List of Key Manufacturers

4.5.3. List of Potential Customers

4.5.4. Level of Integration

4.6. Regulatory Scenario

4.7. SWOT Analysis

5. Global Lead Acid Battery Price Trend Analysis by Application, 2017-2026

6. Global Lead Acid Battery – Supply Demand Scenario, 2016

6.1. Overview

6.2. Global Import/Export Scenario (HS Code 850710)

7. Global Lead Acid Battery Market Analysis and Forecasts, by Product Type Segment

7.1. Introduction & Definition

7.2. Key Findings

7.3. Market Size (Thousand Units) (US$ Mn) Forecast by Product Type Segment, 2018-2026

7.3.1. Flooded

7.3.2. Sealed

7.3.2.1.AGM

7.3.2.2.Gel

7.4. Market Attractiveness By Product Type Segment

8. Global Lead Acid Battery Market Analysis and Forecasts, by Application Segment

8.1. Introduction & Definition

8.2. Key Findings

8.3. Market Size (Thousand Units) (US$ Mn) Forecast by Application Segment, 2018-2026

8.3.1. Automotive

8.3.2. Motor Cycles

8.3.3. Motive Power

8.3.4. Renewable Power

8.3.5. UPS & Telecom

8.3.6. Others (Wheel chair, etc.)

8.4. Market Attractiveness By Application Segment

9. Global Lead Acid Battery Market Analysis and Forecasts, by Region

9.1. Key Findings

9.2. Market Size (Thousand Units) (US$ Mn) Forecast by Region, 2018-2026

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness By Region

10. North America Lead Acid Battery Market Size and Forecast (Thousand Units) (US$ Mn), 2018-2026

10.1. Key Findings

10.2. North America Market, by Product Type Segment

10.2.1. Flooded

10.2.2. Sealed

10.2.2.1.AGM

10.2.2.2.Gel

10.3. North America Market, by Application Segment

10.3.1. Automotive

10.3.2. Motor Cycles

10.3.3. Motive Power

10.3.4. Renewable Power

10.3.5. UPS & Telecom

10.3.6. Others (Wheel chair, etc.)

10.4. U.S. Market Size & Forecast by Product Type Segment

10.4.1. Flooded

10.4.2. Sealed

10.4.2.1.AGM

10.4.2.2.Gel

10.5. U.S. Market Size & Forecast by Application Segment

10.5.1. Automotive

10.5.2. Motor Cycles

10.5.3. Motive Power

10.5.4. Renewable Power

10.5.5. UPS & Telecom

10.5.6. Others (Wheel chair, etc.)

10.6. Canada Market Size & Forecast by Product Type Segment

10.6.1. Flooded

10.6.2. Sealed

10.6.2.1.AGM

10.6.2.2.Gel

10.7. Canada Market Size & Forecast by Application Segment

10.7.1. Automotive

10.7.2. Motor Cycles

10.7.3. Motive Power

10.7.4. Renewable Power

10.7.5. UPS & Telecom

10.7.6. Others (Wheel chair, etc.)

11.Europe Lead Acid Battery Market Size and Forecast (Thousand Units) (US$ Mn), 2018-2026

11.1. Key Findings

11.2. Europe Market, by Product Type Segment

11.2.1. Flooded

11.2.2. Sealed

11.2.2.1.AGM

11.2.2.2.Gel

11.3. Europe Market, by Application Segment

11.3.1. Automotive

11.3.2. Motor Cycles

11.3.3. Motive Power

11.3.4. Renewable Power

11.3.5. UPS & Telecom

11.3.6. Others (Wheel chair, etc.)

11.4. Germany Market Size & Forecast by Product Type Segment

11.4.1. Flooded

11.4.2. Sealed

11.4.2.1. AGM

11.4.2.2. Gel

11.5. Germany Market Size & Forecast by Application Segment

11.5.1. Automotive

11.5.2. Motor Cycles

11.5.3. Motive Power

11.5.4. Renewable Power

11.5.5. UPS & Telecom

11.5.6. Others (Wheel chair, etc.)

11.6. France Market Size & Forecast by Product Type Segment

11.6.1. Flooded

11.6.2. Sealed

11.6.2.1.AGM

11.6.2.2.Gel

11.7. France Market Size & Forecast by Application Segment

11.7.1. Automotive

11.7.2. Motor Cycles

11.7.3. Motive Power

11.7.4. Renewable Power

11.7.5. UPS & Telecom

11.7.6. Others (Wheel chair, etc.)

11.8. U.K. Market Size & Forecast by Product Type Segment

11.8.1. Flooded

11.8.2. Sealed

11.8.2.1. AGM

11.8.2.2. Gel

11.9. U.K. Market Size & Forecast by Application Segment

11.9.1. Automotive

11.9.2. Motor Cycles

11.9.3. Motive Power

11.9.4. Renewable Power

11.9.5. UPS & Telecom

11.9.6. Others (Wheel chair, etc.)

11.10. Spain Market Size & Forecast by Product Type Segment

11.10.1. Flooded

11.10.2. Sealed

11.10.2.1. AGM

11.10.2.2. Gel

11.11. Spain Market Size & Forecast by Application Segment

11.11.1. Automotive

11.11.2. Motor Cycles

11.11.3. Motive Power

11.11.4. Renewable Power

11.11.5. UPS & Telecom

11.11.6. Others (Wheel chair, etc.)

11.12. Italy Market Size & Forecast by Product Type Segment

11.12.1. Flooded

11.12.2. Sealed

11.12.2.1. AGM

11.12.2.2. Gel

11.13. Italy Market Size & Forecast by Application Segment

11.13.1. Automotive

11.13.2. Motor Cycles

11.13.3. Motive Power

11.13.4. Renewable Power

11.13.5. UPS & Telecom

11.13.6. Others (Wheel chair, etc.)

11.14. Russia & CIS Market Size & Forecast by Product Type Segment

11.14.1. Flooded

11.14.2. Sealed

11.14.2.1.AGM

11.14.2.2.Gel

11.15. Russia & CIS Market Size & Forecast by Application Segment

11.15.1. Automotive

11.15.2. Motor Cycles

11.15.3. Motive Power

11.15.4. Renewable Power

11.15.5. UPS & Telecom

11.15.6. Others (Wheel chair, etc.)

11.16. Rest of Europe Market Size & Forecast by Product Type Segment

11.16.1. Flooded

11.16.2. Sealed

11.16.2.1.AGM

11.16.2.2.Gel

11.17. Rest of Europe Market Size & Forecast by Application Segment

11.17.1. Automotive

11.17.2. Motor Cycles

11.17.3. Motive Power

11.17.4. Renewable Power

11.17.5. UPS & Telecom

11.17.6. Others (Wheel chair, etc.)

12. Asia Pacific Lead Acid Battery Market Size and Forecast (Thousand Units) (US$ Mn), 2018-2026

12.1. Key Findings

12.2. Asia Pacific Market, by Product Type Segment

12.2.1. Flooded

12.2.2. Sealed

12.2.2.1. AGM

12.2.2.2. Gel

12.3. Asia Pacific Market, by Application Segment

12.3.1. Automotive

12.3.2. Motor Cycles

12.3.3. Motive Power

12.3.4. Renewable Power

12.3.5. UPS & Telecom

12.3.6. Others (Wheel chair, etc.)

12.4. China Market Size & Forecast by Product Type Segment

12.4.1. Flooded

12.4.2. Sealed

12.4.2.1. AGM

12.4.2.2. Gel

12.5. China Market Size & Forecast by Application Segment

12.5.1. Automotive

12.5.2. Motor Cycles

12.5.3. Motive Power

12.5.4. Renewable Power

12.5.5. UPS & Telecom

12.5.6. Others (Wheel chair, etc.)

12.6. India Market Size & Forecast by Product Type Segment

12.6.1. Flooded

12.6.2. Sealed

12.6.2.1.AGM

12.6.2.2.Gel

12.7. India Market Size & Forecast by Application Segment

12.7.1. Automotive

12.7.2. Motor Cycles

12.7.3. Motive Power

12.7.4. Renewable Power

12.7.5. UPS & Telecom

12.7.6. Others (Wheel chair, etc.)

12.8. Japan Market Size & Forecast by Product Type Segment

12.8.1. Flooded

12.8.2. Sealed

12.8.2.1.AGM

12.8.2.2.Gel

12.9. Japan Market Size & Forecast by Application Segment

12.9.1. Automotive

12.9.2. Motor Cycles

12.9.3. Motive Power

12.9.4. Renewable Power

12.9.5. UPS & Telecom

12.9.6. Others (Wheel chair, etc.)

12.10. ASEAN Market Size & Forecast by Product Type Segment

12.10.1. Flooded

12.10.2. Sealed

12.10.2.1.AGM

12.10.2.2.Gel

12.11. ASEAN Market Size & Forecast by Application Segment

12.11.1. Automotive

12.11.2. Motor Cycles

12.11.3. Motive Power

12.11.4. Renewable Power

12.11.5. UPS & Telecom

12.11.6. Others (Wheel chair, etc.)

12.12. Rest of Asia Pacific Market Size & Forecast by Product Type Segment

12.12.1. Flooded

12.12.2. Sealed

12.12.2.1.AGM

12.12.2.2.Gel

12.13. Rest of Asia Pacific Market Size & Forecast by Application Segment

12.13.1. Automotive

12.13.2. Motor Cycles

12.13.3. Motive Power

12.13.4. Renewable Power

12.13.5. UPS & Telecom

12.13.6. Others (Wheel chair, etc.)

13. Latin America Lead Acid Battery Market Size and Forecast (Thousand Units) (US$ Mn), 2018-2026

13.1. Key Findings

13.2. Latin America Market, by Product Type Segment

13.2.1. Flooded

13.2.2. Sealed

13.2.2.1.AGM

13.2.2.2.Gel

13.3. Latin America Market, by Application Segment

13.3.1. Automotive

13.3.2. Motor Cycles

13.3.3. Motive Power

13.3.4. Renewable Power

13.3.5. UPS & Telecom

13.3.6. Others (Wheel chair, etc.)

13.4. Brazil Market Size & Forecast by Product Type Segment

13.4.1. Flooded

13.4.2. Sealed

13.4.2.1.AGM

13.4.2.2.Gel

13.5. Brazil Market Size & Forecast by Application Segment

13.5.1. Automotive

13.5.2. Motor Cycles

13.5.3. Motive Power

13.5.4. Renewable Power

13.5.5. UPS & Telecom

13.5.6. Others (Wheel chair, etc.)

13.6. Mexico Market Size & Forecast by Product Type Segment

13.6.1. Flooded

13.6.2. Sealed

13.6.2.1.AGM

13.6.2.2.Gel

13.7. Mexico Market Size & Forecast by Application Segment

13.7.1. Automotive

13.7.2. Motor Cycles

13.7.3. Motive Power

13.7.4. Renewable Power

13.7.5. UPS & Telecom

13.7.6. Others (Wheel chair, etc.)

13.8. Argentina Market Size & Forecast by Product Type Segment

13.8.1. Flooded

13.8.2. Sealed

13.8.2.1.AGM

13.8.2.2.Gel

13.9.Argentina Market Size & Forecast by Application Segment

13.9.1. Automotive

13.9.2. Motor Cycles

13.9.3. Motive Power

13.9.4. Renewable Power

13.9.5. UPS & Telecom

13.9.6. Others (Wheel chair, etc.)

13.10. Rest of Latin America Market Size & Forecast by Product Type Segment

13.10.1. Flooded

13.10.2. Sealed

13.10.2.1. AGM

13.10.2.2. Gel

13.12. Rest of Latin America Market Size & Forecast by Application Segment

13.12.1. Automotive

13.12.2. Motor Cycles

13.12.3. Motive Power

13.12.4. Renewable Power

13.12.5. UPS & Telecom

13.12.6. Others (Wheel chair, etc.)

14. Middle East & Africa Lead Acid Battery Market Size and Forecast (Thousand Units) (US$ Mn), 2018-2026

14.1. Key Findings

14.2. Middle East & Africa Market, by Product Type Segment

14.2.1. Flooded

14.2.2. Sealed

14.2.2.1.AGM

14.2.2.2.Gel

14.3. Middle East & Africa Market, by Application Segment

14.3.1. Automotive

14.3.2. Motor Cycles

14.3.3. Motive Power

14.3.4. Renewable Power

14.3.5. UPS & Telecom

14.3.6. Others (Wheel chair, etc.)

14.4. GCC Market Size & Forecast by Product Type Segment

14.4.1. Flooded

14.4.2. Sealed

14.4.2.1.AGM

14.4.2.2.Gel

14.5. GCC Market Size & Forecast by Application Segment

14.5.1. Automotive

14.5.2. Motor Cycles

14.5.3. Motive Power

14.5.4. Renewable Power

14.5.5. UPS & Telecom

14.5.6. Others (Wheel chair, etc.)

14.6. South Africa Market Size & Forecast by Product Type Segment

14.6.1. Flooded

14.6.2. Sealed

14.6.2.1.AGM

14.6.2.2.Gel

14.7. South Africa Market Size & Forecast by Application Segment

14.7.1. Automotive

14.7.2. Motor Cycles

14.7.3. Motive Power

14.7.4. Renewable Power

14.7.5. UPS & Telecom

14.7.6. Others (Wheel chair, etc.)

14.8. Rest of Middle East & Africa Market Size & Forecast by Product Type Segment

14.8.1. Flooded

14.8.2. Sealed

14.8.2.1.AGM

14.8.2.2.Gel

14.9. Rest of Middle East & Africa Market Size & Forecast by Application Segment

14.9.1. Automotive

14.9.2. Motor Cycles

14.9.3. Motive Power

14.9.4. Renewable Power

14.9.5. UPS & Telecom

14.9.6. Others (Wheel chair, etc.)

15. Competition Landscape

15.1. Competition Matrix (By Tier and Size of companies)

15.2. Company Profiles

15.2.1. JOHNSON CONTROLS INTERNATIONAL PLC

15.2.1.1. Company Details (Headquarters’, Established year, Revenue, Employee Strength, Key Management)

15.2.1.2. Business Overview

15.2.1.3. Product Segments & Applications

15.2.1.4. Financial Overview

15.2.1.5. Strategic Overview

15.2.1.5.1. Key Developments

15.2.1.5.2. Partnerships

15.2.2. ENERSYS

15.2.2.1. Company Details (Headquarters’, Established year, Revenue, Employee Strength, Key Management)

15.2.2.2. Business Overview

15.2.2.3. Product Segments & Applications

15.2.2.4. Financial Overview

15.2.2.5. Strategic Overview

15.2.2.5.1. Intellectual Property

15.2.2.5.2. Acquisitions

15.2.2.5.3. Key Developments

15.2.3. Exide Technologies

15.2.3.1. Company Details (Headquarters’, Established year, Revenue, Employee Strength, Key Management)

15.2.3.2. Business Overview

15.2.3.3. Product Segments & Applications

15.2.3.4. Financial Overview

15.2.3.5. Strategic Overview

15.2.3.5.1. Research & Development

15.2.3.5.2. Key Developments

15.2.4. GS Yuasa Corporation

15.2.4.1. Company Details (Headquarters’, Established year, Revenue, Employee Strength, Key Management)

15.2.4.2. Business Overview

15.2.4.3. Product Segments & Industries Served

15.2.4.4. Financial Overview

15.2.4.5. Strategic Overview

15.2.4.5.1. Acquisitions

15.2.5. Amara Raja Batteries Limited

15.2.5.1. Company Details (Headquarters’, Established year, Revenue, Employee Strength, Key Management)

15.2.5.2. Business Overview

15.2.5.3. Product Segments & Applications

15.2.5.4. Financial Overview

15.2.5.5. Strategic Overview

15.2.5.5.1. Expansions

15.2.6. EXIDE INDUSTRIES LIMITED

15.2.6.1. Company Details (Headquarters’, Established year, Revenue, Employee Strength, Key Management)

15.2.6.2. Business Overview

15.2.6.3. Product Segments & Applications

15.2.6.4. Financial Overview

15.2.6.5. Strategic Overview

15.2.6.5.1. Research & Development

15.2.6.5.2. Exports

15.2.7. HBL Power Systems Limited

15.2.7.1. Company Details (Headquarters’, Established year, Revenue, Employee Strength, Key Management)

15.2.7.2. Business Overview

15.2.7.3. Product Segments & Applications

15.2.7.4. Financial Overview

15.2.7.5. Strategic Overview

15.2.7.5.1. Reverse Merger

15.2.8. C&D TECHNOLOGIES, INC

15.2.8.1. Company Details (Headquarters’, Established year, Revenue, Employee Strength, Key Management)

15.2.8.2. Business Overview

15.2.8.3. Product Segments & Applications

15.2.8.4. Strategic Overview

15.2.8.4.1. Key Developments

15.2.8.4.2. Divestiture

15.2.8.4.3. Acquisitions

15.2.8.4.4. Expansions

15.2.9. NorthStar.

15.2.9.1. Company Details (Headquarters’, Established year, Revenue, Employee Strength, Key Management)

15.2.9.2. Business Overview

15.2.9.3. Product Segments & Applications

15.2.9.4. Strategic Overview

15.2.9.4.1. Key Developments

15.2.9.4.2. Technology

15.2.10. First National Battery.

15.2.10.1. Company Details (Headquarters’, Established year, Revenue, Employee Strength, Key Management)

15.2.10.2. Business Overview

15.2.10.3. Product Segments & Applications

15.2.10.4. Strategic Overview

15.2.10.4.1. Key Developments

15.2.10.4.2. Production Plants

15.2.11. East Penn Manufacturing Co.

15.2.11.1. Company Details (Headquarters’, Established year, Revenue, Employee Strength, Key Management)

15.2.11.2. Business Overview

15.2.11.3. Product Segments & Applications

15.2.11.4. Strategic Overview

15.2.11.4.1. Expansion

15.2.11.4.2. Facilities

15.2.12. FIAMM Energy Technology S.p.A.

15.2.12.1. Company Details (Headquarters’, Established year, Revenue, Employee Strength, Key Management)

15.2.12.2. Business Overview

15.2.12.3. Product Segments & Applications

15.2.12.4. Strategic Overview

15.2.12.4.1. Joint Venture

15.2.12.4.2. Partnerships

15.2.13. HOPPECKE Batterien GmbH & Co. KG

15.2.13.1. Company Details (Headquarters’, Established year, Revenue, Employee Strength, Key Management)

15.2.13.2. Business Overview

15.2.13.3. Product Segments & Applications

15.2.13.4. Strategic Overview

15.2.13.4.1. Key Developments

15.2.14. Crown Battery Manufacturing Company

15.2.14.1. Company Details (Headquarters’, Established year, Revenue, Employee Strength, Key Management)

15.2.14.2. Business Overview

15.2.14.3. Product Segments & Applications

15.2.15. Trojan Battery Company

15.2.15.1. Company Details (Headquarters’, Established year, Revenue, Employee Strength, Key Management)

15.2.15.2. Business Overview

15.2.15.3. Product Segments & Applications

15.2.15.4. Strategic Overview

15.2.15.4.1. Key Developments

List of Tables

Table 01: Global Lead-acid Batteries Market size (US$ Mn) (Thousand Units) Forecast, by Product Type, 2017–2026

Table 02: Global Lead-acid Batteries Market Size (US$ Mn) Forecast, by Application, 2017–2026

Table 03: Global Lead-acid Batteries Market Volume (Thousand Units) Forecast, by Application, 2017–2026

Table 04: Global Lead-acid Batteries Market Revenue (US$ Mn) and Forecast, by Country/Sub-region, 2017–2026

Table 05: Global Lead-acid Batteries Market Volume (Thousand Units) and Forecast, by Country/Sub-region, 2017–2026

Table 06: North America Lead-acid Batteries Market Size (US$ Mn) (Thousand Units) Forecast, by Product, 2017–2026

Table 07: North America Lead-acid Batteries Market Size (US$ Mn) Forecast, by Application, 2017–2026

Table 08: North America Lead-acid Batteries Market Volume (Thousand Units) Forecast, by Application, 2017–2026

Table 09: North America Lead-acid Batteries Market Revenue (US$ Mn) Volume ( Thousand Units) Forecast, by Country/Sub-region, 2017–2026

Table 10: U.S. Lead-acid Batteries Market Size (US$ Mn) (Thousand Units) Forecast, by Product, 2017–2026

Table 11: U.S. Lead-acid Batteries Market Size (US$ Mn) Forecast, by Application, 2017–2026

Table 12: U.S. Lead-acid Batteries Market Volume (Thousand Units) Forecast, by Application, 2017–2026

Table 13: Canada Lead-acid Batteries Market Size (US$ Mn) (Thousand Units) Forecast, by Product, 2017–2026

Table 14: Canada Lead-acid Batteries Market Size (US$ Mn) Forecast, by Application, 2017–2026

Table 15: Canada Lead-acid Batteries Market Volume (Thousand Units) Forecast, by Application, 2017–2026

Table 16: Europe Lead-acid Batteries Market size (US$ Mn) (Thousand Units) Forecast, by Product, 2017–2026

Table 17: Europe Lead-acid Batteries Market Size (US$ Mn) Forecast, by Application, 2017–2026

Table 18: Europe Lead-acid Batteries Market Volume (Thousand Units) Forecast, by Application, 2017–2026

Table 19: Europe Lead-acid Batteries Market Revenue (US$ Mn) and Forecast, by Country/Sub region, 2017–2026

Table 20: Europe Lead-acid Batteries Market Volume (Thousand Units) and Forecast, by Country Region, 2017–2026

Table 21: Germany Lead-acid Batteries Market size (US$ Mn) (Thousand Units) Forecast, by Product, 2017–2026

Table 22: Germany Lead-acid Batteries Market Size (US$ Mn) Forecast, by Application, 2017–2026

Table 23: Germany Lead-acid Batteries Market Volume (Thousand Units) Forecast, by Application, 2017–2026

Table 24: France Lead-acid Batteries Market size (US$ Mn) (Thousand Units) Forecast, by Product, 2017–2026

Table 25: France Lead-acid Batteries Market Size (US$ Mn) Forecast, by Application, 2017–2026

Table 26: France Lead-acid Batteries Market Volume (Thousand Units) Forecast, by Application, 2017–2026

Table 27: U.K. Lead-acid Batteries Market size (US$ Mn) (Thousand Units) Forecast, by Product, 2017–2026

Table 28: U.K. Lead-acid Batteries Market Size (US$ Mn) Forecast, by Application, 2017–2026

Table 29: U.K. Lead-acid Batteries Market Volume (Thousand Units) Forecast, by Application, 2017–2026

Table 30: Spain Lead-acid Batteries Market size (US$ Mn) (Thousand Units) Forecast, by Product, 2017–2026

Table 31: Spain Lead-acid Batteries Market Size (US$ Mn) Forecast, by Application, 2017–2026

Table 32: Spain Lead-acid Batteries Market Volume (Thousand Units) Forecast, by Application, 2017–2026

Table 33: Italy Lead-acid Batteries Market size (US$ Mn) (Thousand Units) Forecast, by Product, 2017–2026

Table 34: Italy Lead-acid Batteries Market Size (US$ Mn) Forecast, by Application, 2017–2026

Table 35: Italy Lead-acid Batteries Market Volume (Thousand Units) Forecast, by Application, 2017–2026

Table 36: Russia & CIS Lead-acid Batteries Market size (US$ Mn) (Thousand Units) Forecast, by Product, 2017–2026

Table 37: Russia & CIS Lead-acid Batteries Market Size (US$ Mn) Forecast, by Application, 2017–2026

Table 38: Russia & CIS Lead-acid Batteries Market Volume (Thousand Units) Forecast, by Application, 2017–2026

Table 39: Rest of Europe Lead-acid Batteries Market size (US$ Mn) (Thousand Units) Forecast, by Product, 2017–2026

Table 40: Rest of Europe Lead-acid Batteries Market Size (US$ Mn) Forecast, by Application, 2017–2026

Table 41: Rest of Europe Lead-acid Batteries Market Volume (Thousand Units) Forecast, by Application, 2017–2026

Table 42: Asia Pacific Lead-acid Batteries Market size (US$ Mn) (Thousand Units) Forecast, by Product Type, 2017–2026

Table 43: Asia Pacific Lead-acid Batteries Market Size (US$ Mn) Forecast, by Application, 2017–2026

Table 44: Asia Pacific Lead-acid Batteries Market Volume (Thousand Units) Forecast, by Application, 2017–2026

Table 45: Asia Pacific Lead-acid Batteries Market Revenue (US$ Mn) and Forecast, by Country/Sub-region, 2017–2026

Table 46: Asia Pacific Lead-acid Batteries Market Volume (Thousand Units) and Forecast, by Country/Sub-region, 2017–2026

Table 47: China Lead-acid Batteries Market size (US$ Mn) (Thousand Units) Forecast, by Product Type, 2017–2026

Table 48: China Lead-acid Batteries Market Size (US$ Mn) Forecast, by Application, 2017–2026

Table 49: China Lead-acid Batteries Market Volume (Thousand Units) Forecast, by Application, 2017–2026

Table 50: India Lead-acid Batteries Market size (US$ Mn) (Thousand Units) Forecast, by Product Type, 2017–2026

Table 51: India Lead-acid Batteries Market Size (US$ Mn) Forecast, by Application, 2017–2026

Table 52: India Lead-acid Batteries Market Volume (Thousand Units) Forecast, by Application, 2017–2026

Table 53: Japan Lead-acid Batteries Market size (US$ Mn) (Thousand Units) Forecast, by Product Type, 2017–2026

Table 54: Japan Lead-acid Batteries Market Size (US$ Mn) Forecast, by Application, 2017–2026

Table 55: Japan Lead-acid Batteries Market Volume (Thousand Units) Forecast, by Application, 2017–2026

Table 56: ASEAN Lead-acid Batteries Market size (US$ Mn) (Thousand Units) Forecast, by Product Type, 2017–2026

Table 57: ASEAN Lead-acid Batteries Market Size (US$ Mn) Forecast, by Application, 2017–2026

Table 58: ASEAN Lead-acid Batteries Market Volume (Thousand Units) Forecast, by Application, 2017–2026

Table 59: Rest of Asia Pacific Lead-acid Batteries Market size (US$ Mn) (Thousand Units) Forecast, by Product Type, 2017–2026

Table 60: Rest of Asia Pacific Lead-acid Batteries Market Size (US$ Mn) Forecast, by Application, 2017–2026

Table 61: Rest of Asia Pacific Lead-acid Batteries Market Volume (Thousand Units) Forecast, by Application, 2017–2026

Table 62: Latin America Lead-acid Batteries Market size (US$ Mn) (Thousand Units) Forecast, by Product Type, 2017–2026

Table 63: Latin America Lead-acid Batteries Market Size (US$ Mn) Forecast, by Application, 2017–2026

Table 64: Latin America Lead-acid Batteries Market Volume (Thousand Units) Forecast, by Application, 2017–2026

Table 65: Latin America Lead-acid Batteries Market Revenue (US$ Mn) and Forecast, by Country/Sub-region, 2017–2026

Table 66: Latin America Lead-acid Batteries Market Volume (Thousand Units) and Forecast, by Country Country/Sub-region, 2017–2026

Table 67: Brazil Lead-acid Batteries Market size (US$ Mn) (Thousand Units) Forecast, by Product Type, 2017–2026

Table 68: Brazil Lead-acid Batteries Market Size (US$ Mn) Forecast, by Application, 2017–2026

Table 69: Brazil Lead-acid Batteries Market Volume (Thousand Units) Forecast, by Application, 2017–2026

Table 70: Mexico Lead-acid Batteries Market size (US$ Mn) (Thousand Units) Forecast, by Product Type, 2017–2026

Table 71: Mexico Lead-acid Batteries Market Size (US$ Mn) Forecast, by Application, 2017–2026

Table 72: Mexico Lead-acid Batteries Market Volume (Thousand Units) Forecast, by Application, 2017–2026

Table 73: Argentina Lead-acid Batteries Market size (US$ Mn) (Thousand Units) Forecast, by Product Type, 2017–2026

Table 74: Argentina Lead-acid Batteries Market Size (US$ Mn) Forecast, by Application, 2017–2026

Table 75: Argentina Lead-acid Batteries Market Volume (Thousand Units) Forecast, by Application, 2017–2026

Table 76: Rest of Latin America Lead-acid Batteries Market size (US$ Mn) (Thousand Units) Forecast, by Product Type, 2017–2026

Table 77: Rest of Latin America Lead-acid Batteries Market Size (US$ Mn) Forecast, by Application, 2017–2026

Table 78: Rest of Latin America Lead-acid Batteries Market Volume (Thousand Units) Forecast, by Application, 2017–2026

Table 79: Middle East & Africa Lead-acid Batteries Market Size (US$ Mn) (Thousand Units) Forecast, by Product Type, 2017–2026

Table 80: Middle East & Africa Lead-acid Batteries Market Size (US$ Mn) Forecast, by Application, 2017–2026

Table 81: Middle East & Africa Lead-acid Batteries Market Volume (Thousand Units) Forecast, by Application, 2017–2026

Table 82: Middle East & Africa Lead-acid Batteries Market Revenue (US$ Mn) and Forecast, by Country/Sub-region, 2017–2026

Table 83: Middle East & Africa Lead-acid Batteries Market Volume (Thousand Units) and Forecast, by Country/Sub-region, 2017–2026

Table 84: GCC Lead-acid Batteries Market size (US$ Mn) (Thousand Units) Forecast, by Product Type, 2017–2026

Table 85: GCC Lead-acid Batteries Market Size (US$ Mn) Forecast, by Application, 2017–2026

Table 86: GCC Lead-acid Batteries Market Volume (Thousand Units) Forecast, by Application, 2017–2026

Table 87: South Africa Lead-acid Batteries Market size (US$ Mn) (Thousand Units) Forecast, by Product Type, 2017–2026

Table 88: South Africa Lead-acid Batteries Market Size (US$ Mn) Forecast, by Application, 2017–2026

Table 89: South Africa Lead-acid Batteries Market Volume (Thousand Units) Forecast, by Application, 2017–2026

Table 90: Rest of Middle East & Africa Lead-acid Batteries Market size (US$ Mn) (Thousand Units) Forecast, by Product Type, 2017–2026

Table 91: Rest of Middle East & Africa Lead-acid Batteries Market Size (US$ Mn) Forecast, by Application, 2017–2026

Table 92: Rest of Middle East & Africa Lead-acid Batteries Market Volume (Thousand Units) Forecast, by Application, 2017–2026

List of Figures

Figure 01: Summary: Global Lead-acid Batteries Market value (US$ Mn) & Volume (Thousand Units), 2017–2026

Figure 02: Schematic of Lead Acid Batteries

Figure 03: Lead acid-Batteries Recycling Supply chain

Figure 04: Breakup of Percentage Split of Imports - HS 850710, by Country/Sub-region, 2016

Figure 05: Breakup of Percentage Split of Exports- HS 850710, by Country/Sub-region, 2016

Figure 06: Lead Acid Battery Price Trend for Automotive (US$/Unit), 2017-2026

Figure 07: Lead Acid Battery Price Trend for Motorcycle (US$/Unit), 2017-2026

Figure 08: Lead Acid Battery Price Trend for Motive Power (US$/Unit), 2017-2026

Figure 09: Lead Acid Battery Price Trend for Renewable Power (US$/Unit), 2017-2026

Figure 10: Lead Acid Battery Price Trend for UPS & Telecom (US$/Unit), 2017-2026

Figure 11: Lead Acid Battery Price Trend for Others (US$/Unit), 2017-2026

Figure 12: Global Lead-acid Batteries Market Value Share Analysis, by Product Type, 2017 and 2026

Figure 13: Global Lead-acid Batteries Market Value Share Analysis, by Sealed Product Type, 2017 and 2026

Figure 14: Global Lead Acid Market Size, Value (US$ Mn), Volume (Thousand Units), by Flooded Product Type

Figure 15: Global Lead Acid Market Size, Value (US$ Mn), Volume (Thousand Units), by Sealed Product Type

Figure 16: Global Lead Acid Market Size, Value (US$ Mn), Volume (Thousand Units), by AGM Product Type

Figure 17: Global Lead Acid Market Size, Value (US$ Mn), Volume (Thousand Units), by Gel Product Type

Figure18: Global Lead-acid Batteries Market Attractiveness Analysis, by Product Type

Figure 19: Global Lead-acid Batteries Market Attractiveness Analysis, by Sealed Product Type

Figure 20: Global Lead-acid Batteries Market Value Share Analysis, by Application, 2017 and 2026

Figure 21: Global Lead Acid Market Size, Value (US$ Mn), Volume (Thousand Units), by Automotive Application

Figure 22: Global Lead Acid Market Size, Value (US$ Mn), Volume (Thousand Units), by Motorcycles Application

Figure 23: Global Lead Acid Market Size, Value (US$ Mn), Volume (Thousand Units), by Motive Power Application

Figure 24: Global Lead Acid Market Size, Value (US$ Mn), Volume (Thousand Units), by Renewable Power Application

Figure 25: Global Lead Acid Market Size, Value (US$ Mn), Volume (Thousand Units), by UPS & Telecom Application

Figure 26: Global Lead Acid Market Size, Value (US$ Mn), Volume (Thousand Units), by Other Application

Figure 27: Global Lead-acid Batteries Market Attractiveness Analysis, by Application

Figure 28: Global Lead-acid Batteries Market Value Share Analysis, by Country/Sub-region, 2017 and 2026

Figure 29: Global Lead-acid Batteries Market Attractiveness Analysis, by Country/Sub-region

Figure 30: North America Lead-acid Batteries Market Value Share Analysis, by Product, 2017 and 2026

Figure 31: North America Lead-acid Batteries Market Value Share Analysis, by Sealed Product Type, 2017 and 2026

Figure 32: North America Lead-acid Batteries Market Attractiveness Analysis, by Product

Figure 33: North America Lead-acid Batteries Market Attractiveness Analysis, by Sealed Product Type

Figure 34: North America Lead-acid Batteries Market Value Share Analysis, by Application, 2017 and 2026

Figure 35: North America Lead-acid Batteries Market Attractiveness Analysis, by Application

Figure 36: North America Lead-acid Batteries Market Value Share Analysis, by Country/Sub-region, 2017 and 2026

Figure 37: North America Lead-acid Batteries Market Attractiveness Analysis by Country/Sub-region 2017

Figure 38: Europe Lead-acid Batteries Market Value Share Analysis, by Product, 2017 and 2026

Figure 39: Europe Lead-acid Batteries Market Value Share Analysis, by Sealed Battery, 2017 and 2026

Figure 40: Europe Lead-acid Batteries Market Attractiveness Analysis, by Product

Figure 41: Europe Lead-acid Batteries Market Attractiveness Analysis, by Sealed Battery

Figure 42: Europe Lead-acid Batteries Market Value Share Analysis, by Application, 2017 and 2026

Figure 43: Europe Lead-acid Batteries Market Attractiveness Analysis, by Application

Figure 44: Europe Lead-acid Batteries Market Value Share Analysis, by Country/Sub-region, 2017 and 2026

Figure 45: Europe Lead-acid Battery Market Attractiveness Analysis by Country/Sub region, 2017

Figure 46: Asia Pacific Lead-acid Batteries Market Value Share Analysis, by Product Type, 2017 and 2026

Figure 47: Asia Pacific Lead-acid Batteries Market Value Share Analysis, by Sealed Product Type, 2017 and 2026

Figure 48: Asia Pacific Lead-acid Batteries Market Attractiveness Analysis, by Product Type

Figure 49: Asia Pacific Lead-acid Batteries Market Attractiveness Analysis, by Sealed Product Type

Figure 50: Asia Pacific Lead-acid Batteries Market Value Share Analysis, by Application, 2017 and 2026

Figure 51: Asia Pacific Lead-acid Batteries Market Attractiveness Analysis, by Application

Figure 52: Asia Pacific Lead-acid Batteries Market Value Share Analysis, by Country/Sub-region, 2017 and 2026

Figure 53: Asia Pacific Lead-acid Batteries Market Attractiveness Analysis, by Country/Sub-region

Figure 54: Latin America Lead-acid Batteries Market Value Share Analysis, by Product Type, 2017 and 2026

Figure 55: Latin America Lead-acid Batteries Market Value Share Analysis, by Sealed Product Type, 2017 and 2026

Figure 56: Latin America Lead-acid Batteries Market Attractiveness Analysis, by Product Type

Figure 57: Latin America Lead-acid Batteries Market Attractiveness Analysis, by Sealed Product Type

Figure 58: Latin America Lead-acid Batteries Market Value Share Analysis, by Application, 2017 and 2026

Figure 59: Latin America Lead-acid Batteries Market Attractiveness Analysis, by Application

Figure 60: Latin America Lead-acid Batteries Market Value Share Analysis, by Country/Sub-region, 2017 and 2026

Figure 61: Latin America Lead-acid Batteries Market Attractiveness Analysis, by Country/Sub-region

Figure 62: Middle East & Africa Lead-acid Batteries Market Value Share Analysis, by Product Type, 2017 and 2026

Figure 63: Middle East & Africa Lead-acid Batteries Market Value Share Analysis, by Sealed Product Type, 2017 and 2026

Figure 64: Middle East & Africa Lead-acid Batteries Market Attractiveness Analysis, by Product Type

Figure 65: Middle East & Africa Lead-acid Batteries Market Attractiveness Analysis, by Sealed Product Type

Figure 66: Middle East & Africa Lead-acid Batteries Market Value Share Analysis, by Application, 2017 and 2026

Figure 67: Middle East & Africa Lead-acid Batteries Market Attractiveness Analysis, by Application

Figure 68: Middle East & Africa Lead-acid Batteries Market Value Share Analysis, by Country/Sub-region, 2017 and 2026

Figure 69: Middle East & Africa Lead-acid Batteries Market Attractiveness Analysis, by Country/Sub-region